Automotive Power Discrete Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429184 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Power Discrete Market Size

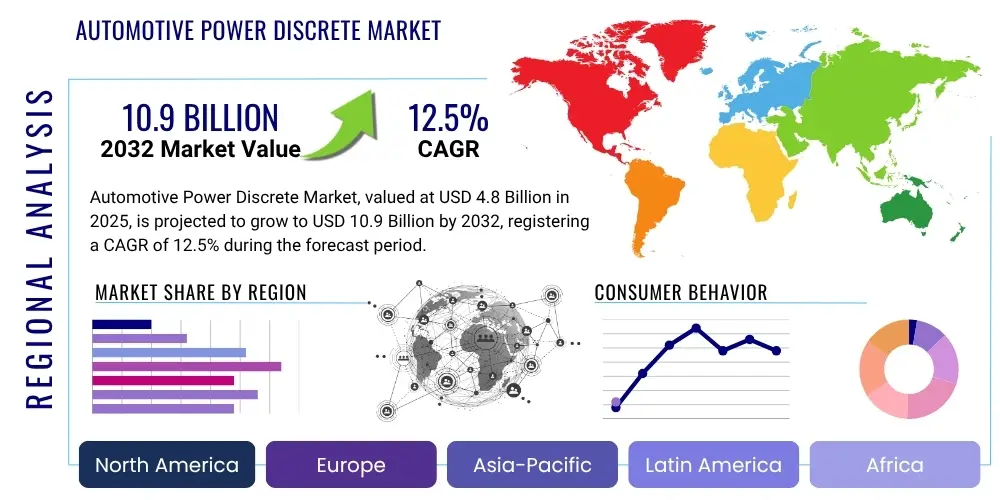

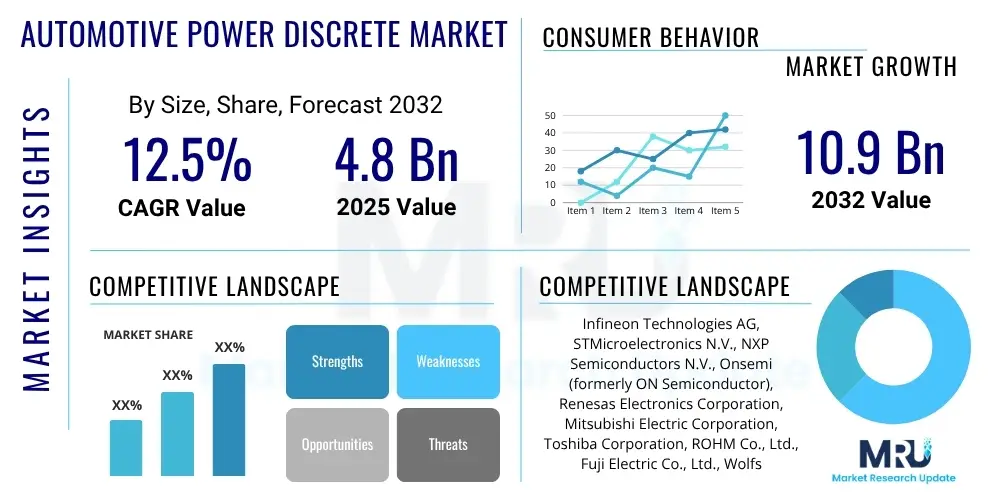

The Automotive Power Discrete Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at $4.8 Billion in 2025 and is projected to reach $10.9 Billion by the end of the forecast period in 2032.

Automotive Power Discrete Market introduction

The Automotive Power Discrete Market encompasses a wide range of semiconductor devices crucial for power conversion, control, and management within modern vehicles. These components, including MOSFETs, IGBTs, diodes, and advanced wide-bandgap (WBG) devices like Silicon Carbide (SiC) and Gallium Nitride (GaN), are fundamental to the efficient operation of various automotive systems. They enable precise power delivery to critical applications, ranging from engine control units in traditional internal combustion engine (ICE) vehicles to the complex battery management and traction inverters in electric vehicles (EVs).

The primary applications of automotive power discretes span across powertrain systems, safety and security features, body electronics, infotainment, and increasingly, sophisticated Advanced Driver Assistance Systems (ADAS) and autonomous driving platforms. The benefits derived from these components include enhanced energy efficiency, reduced power loss, improved thermal performance, and a smaller form factor, all of which are vital for optimizing vehicle performance, extending battery range in EVs, and complying with stringent emission regulations. The market's robust growth is significantly driven by the accelerating global shift towards vehicle electrification, the continuous innovation in ADAS technologies, and the increasing integration of smart and connected car features, all demanding more powerful and efficient semiconductor solutions.

Key driving factors for the automotive power discrete market include the rapid adoption of hybrid and battery electric vehicles, which require a significantly higher number of power semiconductors compared to conventional vehicles. Furthermore, advancements in autonomous driving systems and advanced safety features necessitate precise power management for sensors, cameras, and processing units. The ongoing development of wide-bandgap materials like SiC and GaN is also a major catalyst, offering superior performance characteristics that are essential for high-voltage and high-frequency automotive applications, thereby enabling higher power density and efficiency in next-generation vehicle architectures.

Automotive Power Discrete Market Executive Summary

The Automotive Power Discrete Market is experiencing transformative growth, primarily fueled by the accelerating global transition to electric vehicles (EVs) and the increasing sophistication of Advanced Driver Assistance Systems (ADAS). Business trends indicate a strong focus on strategic collaborations, mergers, and acquisitions among semiconductor manufacturers to enhance technological capabilities, broaden product portfolios, and secure supply chains amid rising demand. Key players are heavily investing in research and development to innovate in wide-bandgap materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN), which offer superior efficiency and performance over traditional silicon-based devices, thereby positioning them as critical enablers for future automotive applications.

Regional trends highlight Asia Pacific as the leading market, driven by its robust automotive manufacturing base, particularly in China, Japan, and South Korea, which are at the forefront of EV production and adoption. Europe and North America also demonstrate significant growth, supported by stringent emission regulations and increasing consumer demand for electric and autonomous vehicles. These regions are characterized by substantial investments in charging infrastructure and government incentives promoting EV sales, further stimulating the demand for power discretes. The Middle East and Africa, along with Latin America, are emerging markets showing promising growth prospects as their automotive industries evolve and embrace electrification.

In terms of segment trends, the wide-bandgap (WBG) devices segment, particularly SiC and GaN, is projected to witness the most rapid expansion due to their indispensable role in high-voltage EV powertrains and fast-charging systems. The Battery Electric Vehicle (BEV) segment under vehicle types is set to dominate, reflecting the growing consumer preference and regulatory push towards fully electric transportation. Application-wise, the Powertrain and Chassis segment, encompassing traction inverters, on-board chargers, and DC-DC converters, will remain the largest segment, given the fundamental requirement for efficient power management in electrified vehicles. Overall, the market's trajectory is defined by a continuous push for higher power density, improved thermal performance, and enhanced reliability in automotive electronic components.

AI Impact Analysis on Automotive Power Discrete Market

User questions about AI's impact on the Automotive Power Discrete Market often revolve around how artificial intelligence will influence device design, manufacturing processes, and the performance requirements of power semiconductors within AI-enabled automotive systems. Users frequently inquire about the role of AI in optimizing power consumption for autonomous driving platforms, managing thermal loads in advanced electronic control units, and improving the reliability and predictive maintenance of power discrete components. There is also significant interest in how AI algorithms can contribute to smarter energy management strategies within electric vehicles, potentially leading to more efficient utilization of power discretes. Overall, the key themes are efficiency optimization, predictive capabilities, and enhanced integration within complex AI-driven architectures, alongside concerns about the increased computational demands and power density challenges that AI poses for existing discrete technologies.

- AI optimizes power discrete design for efficiency and thermal management.

- Predictive maintenance for power components becomes feasible through AI analytics.

- AI-driven algorithms enable smarter energy management in EVs, utilizing power discretes optimally.

- Autonomous driving systems, heavily reliant on AI, demand robust and high-performance power discretes.

- AI in manufacturing processes enhances yield and quality of power discrete production.

- Data from power discretes can feed AI systems for performance monitoring and fault detection.

DRO & Impact Forces Of Automotive Power Discrete Market

The Automotive Power Discrete Market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the exponential growth in electric vehicle (EV) production and adoption globally, as EVs require a substantially higher number of power semiconductors for their powertrains and charging systems. Concurrently, the increasing demand for Advanced Driver Assistance Systems (ADAS) and the progression towards autonomous driving also fuel market expansion, as these sophisticated systems rely heavily on robust power management solutions. Stringent global automotive emission regulations are compelling manufacturers to electrify their fleets, thereby directly boosting the demand for efficient power discretes. Furthermore, continuous advancements in wide-bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) are opening new avenues for higher performance and efficiency, acting as a crucial technological driver.

Despite the strong growth drivers, the market faces several restraints. The high cost associated with manufacturing and integrating advanced SiC and GaN devices, although decreasing, remains a barrier to broader adoption, particularly in cost-sensitive segments. Complexities within the global supply chain, exacerbated by geopolitical factors and raw material availability concerns, pose significant challenges to consistent production and delivery. Design complexity and integration hurdles for high-power applications, requiring specialized thermal management and packaging, also present technical restraints. Additionally, intense market competition among a large number of global and regional players leads to pricing pressure, which can impact profit margins for manufacturers.

Opportunities within the market are abundant. The emergence of new automotive applications, beyond traditional powertrain and body electronics, such as vehicle-to-grid (V2G) systems and advanced sensor fusion platforms, creates fresh demand for power discretes. The rapid expansion into the fast-growing EV charging infrastructure sector, including both residential and public fast-charging stations, presents a lucrative market segment. Furthermore, ongoing development of innovative packaging technologies aimed at enhancing thermal management and power density will unlock new performance levels. Strategic collaborations, partnerships, and joint ventures between semiconductor companies, Tier 1 suppliers, and automotive OEMs are crucial for accelerating technology development, ensuring supply security, and effectively addressing evolving market demands. These impact forces collectively shape the market's trajectory, requiring continuous innovation and strategic adaptation from all stakeholders.

Segmentation Analysis

The Automotive Power Discrete Market is extensively segmented to provide a detailed understanding of its diverse components and applications. These segments offer insights into various device types, their specific uses within different vehicle systems, and their deployment across the evolving landscape of vehicle electrification. The segmentation highlights the shift from traditional silicon-based devices to advanced wide-bandgap materials, reflecting technological progress and market demand.

- By Type

- MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistor)

- IGBT (Insulated Gate Bipolar Transistor)

- SiC (Silicon Carbide) Devices

- GaN (Gallium Nitride) Devices

- Diodes

- Thyristors

- Other Discrete Components

- By Application

- Powertrain and Chassis

- Safety and Security

- Body Electronics

- Infotainment and Telematics

- Advanced Driver Assistance Systems (ADAS)

- By Vehicle Type

- Internal Combustion Engine (ICE) Vehicles

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Battery Electric Vehicles (BEV)

Value Chain Analysis For Automotive Power Discrete Market

The value chain for the Automotive Power Discrete Market is a complex ecosystem involving multiple stages, from raw material extraction to end-product integration within vehicles. Upstream activities commence with the sourcing of raw materials such as silicon, silicon carbide substrates, and gallium nitride substrates. This is followed by critical wafer fabrication processes, including crystal growth, slicing, polishing, and epitaxy, which are essential for creating the foundational semiconductor material. Semiconductor design houses and foundries then convert these wafers into discrete power components through advanced manufacturing steps like lithography, etching, and doping, before assembly and packaging into finished devices. Key players in the upstream segment include specialized material suppliers, wafer manufacturers, and integrated device manufacturers (IDMs) that handle both design and fabrication.

Downstream in the value chain, the packaged power discrete components are supplied to Tier 1 automotive suppliers. These Tier 1 companies integrate the discretes into modules and sub-systems, such as traction inverters, on-board chargers, DC-DC converters, electronic control units (ECUs), and various ADAS modules. These integrated systems are then supplied to automotive Original Equipment Manufacturers (OEMs), who incorporate them into the final vehicle assembly. The distribution channel plays a crucial role in connecting semiconductor manufacturers with their customers. Direct sales are common for large volume orders to major Tier 1 suppliers and OEMs, often involving direct technical support and long-term contracts. Indirect channels involve distributors and authorized resellers who serve smaller manufacturers, provide localized support, manage inventory, and offer value-added services. The efficiency and resilience of this value chain are paramount for the automotive industry, especially with the increasing demand for advanced power discretes driven by vehicle electrification.

The dynamic nature of the automotive industry, coupled with the rapid technological advancements in power electronics, necessitates close collaboration and integration across all stages of the value chain. Ensuring a robust and secure supply of raw materials and fabricated wafers is a continuous challenge, often impacted by global economic and geopolitical factors. The shift towards wide-bandgap materials like SiC and GaN further intensifies the need for specialized material sourcing and fabrication capabilities. Effective management of direct and indirect distribution channels, including strong relationships with global and regional distributors, is essential for market penetration and timely delivery of components to a geographically diverse customer base. Ultimately, the successful delivery of high-performance and reliable power discretes hinges on the seamless coordination and innovation across this intricate value chain.

Automotive Power Discrete Market Potential Customers

The primary potential customers and end-users for products within the Automotive Power Discrete Market are predominantly found within the automotive manufacturing ecosystem. This includes major automotive Original Equipment Manufacturers (OEMs) who are directly responsible for the design, assembly, and marketing of vehicles, ranging from internal combustion engine vehicles to sophisticated hybrid and battery electric vehicles. These OEMs are increasingly engaging directly with semiconductor suppliers to secure critical components and influence future technology roadmaps, particularly for high-volume and strategically important power discrete devices that underpin EV performance and efficiency.

Another significant customer segment comprises Tier 1 automotive suppliers. These companies specialize in designing and manufacturing complex automotive modules and sub-systems, such as traction inverters, on-board chargers, DC-DC converters, electronic power steering systems, electronic braking systems, and various electronic control units for ADAS. Tier 1 suppliers procure power discretes in large quantities and integrate them into their specialized modules, which are then sold to automotive OEMs. Their demand is driven by OEM specifications, volume requirements, and the need for reliable, high-performance components that meet stringent automotive quality and safety standards. The growing complexity of automotive electronics and the accelerated pace of vehicle electrification mean that both OEMs and Tier 1 suppliers are continuously seeking innovative and efficient power discrete solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.8 Billion |

| Market Forecast in 2032 | $10.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Onsemi (formerly ON Semiconductor), Renesas Electronics Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, ROHM Co., Ltd., Fuji Electric Co., Ltd., Wolfspeed (A Cree Company), Littelfuse, Inc., Vishay Intertechnology, Inc., Microchip Technology Inc., Allegro MicroSystems, LLC, Texas Instruments Incorporated, Diodes Incorporated, WeEn Semiconductors, Semikron Danfoss, IXYS Corporation (now part of Littelfuse), Power Integrations, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Power Discrete Market Key Technology Landscape

The automotive power discrete market is characterized by a rapidly evolving technological landscape, driven primarily by the stringent demands of vehicle electrification, enhanced safety features, and the pursuit of greater energy efficiency. Traditional silicon (Si) based power discretes, such as MOSFETs and IGBTs, continue to form the backbone of many automotive applications due to their maturity, cost-effectiveness, and established manufacturing processes. However, their limitations in terms of switching speed, power density, and high-temperature operation are increasingly apparent with the advent of higher voltage and current requirements in modern electric vehicles and fast-charging systems.

A significant technological shift is the widespread adoption and continuous development of wide-bandgap (WBG) semiconductor materials, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC devices are particularly favored for high-voltage (600V and above) and high-power applications, such as main traction inverters, on-board chargers, and DC-DC converters in electric vehicles, owing to their superior breakdown voltage, thermal conductivity, and ability to operate at higher temperatures and switching frequencies. GaN devices, while typically suited for lower to medium voltage applications (up to 650V), offer even faster switching speeds and higher efficiency than SiC, making them ideal for specialized applications like lidar systems, high-frequency DC-DC converters, and advanced power management in autonomous driving modules.

Beyond the fundamental semiconductor materials, advancements in packaging technologies are also crucial. Innovations like advanced module packaging, sintering, and robust interconnection methods are essential for managing the high thermal loads and achieving higher power densities required by automotive applications. These packaging improvements enhance reliability, extend component lifespan, and enable smaller, more efficient system designs. Furthermore, the integration of intelligent control features and sensor capabilities within power discrete modules, along with the development of sophisticated gate drivers and power management integrated circuits (PMICs), are vital for optimizing performance, providing diagnostic capabilities, and ensuring the overall safety and reliability of automotive power electronics. The synergy between material science, device physics, and advanced packaging is key to meeting the future demands of the automotive industry.

Regional Highlights

- North America: A significant market driven by increasing EV adoption, government incentives, and the presence of major automotive OEMs and technology innovators. Demand is particularly strong for high-performance SiC and GaN devices for EV powertrains and charging infrastructure.

- Europe: Characterized by stringent emission regulations and ambitious electrification targets, leading to robust growth in the automotive power discrete market. Germany, France, and the UK are key contributors, focusing on advanced vehicle technologies and EV battery production.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily led by China, Japan, and South Korea. This region boasts a strong automotive manufacturing base, substantial investments in EV production, and rapid development of ADAS and autonomous driving technologies, making it a hub for power discrete demand.

- Latin America: An emerging market with growing automotive production and increasing interest in vehicle electrification. Brazil and Mexico are leading the adoption of advanced automotive electronics, though at a slower pace compared to developed regions.

- Middle East and Africa (MEA): Showing nascent growth in the automotive sector, with a gradual shift towards electrification. Investments in smart city initiatives and renewable energy projects in some countries are expected to drive future demand for power discretes in specialized applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Power Discrete Market.- Infineon Technologies AG

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Onsemi (formerly ON Semiconductor)

- Renesas Electronics Corporation

- Mitsubishi Electric Corporation

- Toshiba Corporation

- ROHM Co., Ltd.

- Fuji Electric Co., Ltd.

- Wolfspeed (A Cree Company)

- Littelfuse, Inc.

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Allegro MicroSystems, LLC

- Texas Instruments Incorporated

- Diodes Incorporated

- WeEn Semiconductors

- Semikron Danfoss

- IXYS Corporation (now part of Littelfuse)

- Power Integrations, Inc.

Frequently Asked Questions

What are the primary drivers of growth in the Automotive Power Discrete Market?

The market's growth is predominantly driven by the accelerating global adoption of electric vehicles (EVs), the increasing integration of Advanced Driver Assistance Systems (ADAS), and stringent governmental regulations pushing for vehicle electrification and improved fuel efficiency.

How do wide-bandgap (WBG) materials like SiC and GaN impact the market?

SiC and GaN devices are revolutionizing the market by offering superior performance over traditional silicon, enabling higher power density, increased efficiency, faster switching speeds, and better thermal management, which are crucial for EV powertrains and fast-charging systems.

Which vehicle types contribute most to the demand for automotive power discretes?

Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) are the largest contributors to demand, as they require a significantly higher number of sophisticated power discrete components for their electric powertrains, battery management systems, and charging infrastructure compared to conventional vehicles.

What are the main challenges faced by manufacturers in this market?

Key challenges include the high cost of advanced SiC and GaN devices, complexities in the global supply chain for raw materials and components, intense market competition leading to pricing pressures, and the increasing design complexity for high-power, high-reliability automotive applications.

What is the role of power discretes in autonomous driving systems?

Power discretes are fundamental in autonomous driving systems for efficiently managing power to various sensors (radar, lidar, cameras), high-performance computing units, and communication modules, ensuring reliable and precise operation of critical safety and navigation functions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager