Automotive Power Electronics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430084 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Power Electronics Market Size

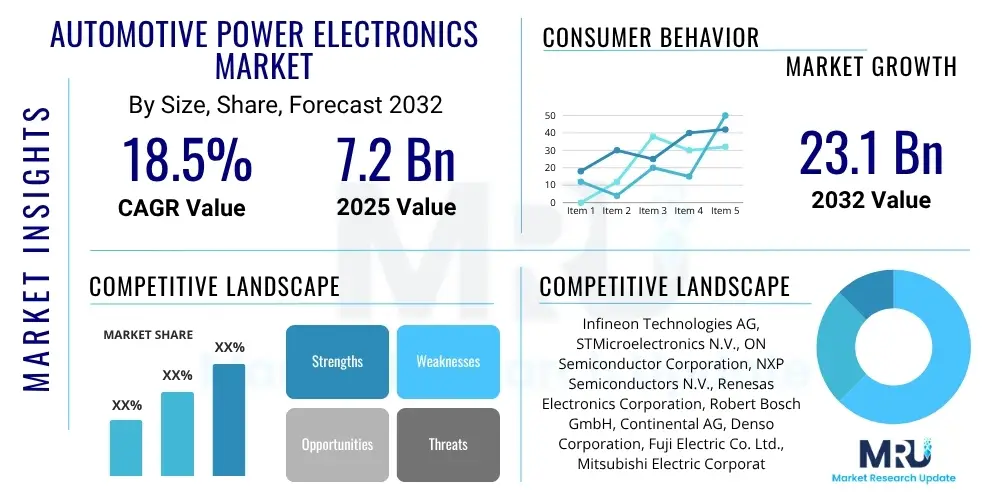

The Automotive Power Electronics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 7.2 Billion in 2025 and is projected to reach USD 23.1 Billion by the end of the forecast period in 2032.

Automotive Power Electronics Market introduction

The Automotive Power Electronics Market encompasses the design, development, and integration of electronic components and systems essential for efficient power management and conversion within vehicles. These sophisticated components are crucial for managing electrical power from various sources, such as batteries and alternators, and distributing it to numerous automotive systems including powertrain, safety, comfort, and infotainment. The rise of electric vehicles (EVs), hybrid electric vehicles (HEVs), and autonomous driving technologies has significantly amplified the demand for advanced power electronics, driving innovation in material science, device architecture, and packaging techniques to meet stringent performance and reliability requirements.

Products within this market range from power integrated circuits (ICs), such as insulated gate bipolar transistors (IGBTs) and metal-oxide-semiconductor field-effect transistors (MOSFETs), to diodes, rectifiers, and microcontrollers, often based on advanced semiconductor materials like silicon carbide (SiC) and gallium nitride (GaN). Major applications span across vehicle electrification systems, advanced driver-assistance systems (ADAS), in-car connectivity, and various body electronics. These components are fundamental to the operation of battery management systems, DC-DC converters, on-board chargers, inverters, and motor drive systems, ensuring optimal energy utilization and system functionality across all vehicle types.

The primary benefits derived from modern automotive power electronics include enhanced energy efficiency, reduced emissions in conventional and hybrid vehicles, improved power density, and superior thermal management capabilities. These advancements directly contribute to extended range in EVs, faster charging times, and the enablement of complex autonomous driving functions. The market is primarily driven by global governmental regulations promoting vehicle electrification, increasing consumer demand for fuel-efficient and high-performance vehicles, rapid technological advancements in semiconductor materials, and the pervasive integration of advanced safety and connectivity features into modern automobiles. These factors collectively propel the market forward, fostering continuous research and development efforts.

Automotive Power Electronics Market Executive Summary

The Automotive Power Electronics Market is experiencing robust growth, primarily fueled by the accelerating global transition towards electric mobility and autonomous driving technologies. Business trends indicate a strong emphasis on strategic collaborations, mergers, and acquisitions among semiconductor manufacturers, Tier 1 suppliers, and automotive OEMs to consolidate expertise and streamline supply chains. There is a discernible shift towards the adoption of wide-bandgap (WBG) semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), due to their superior performance characteristics, including higher efficiency, increased power density, and better thermal management, which are critical for high-voltage and high-frequency applications in EVs. Furthermore, companies are investing heavily in advanced packaging technologies to improve component reliability and reduce system footprints, addressing the spatial constraints within modern vehicles. This competitive landscape is driving innovation in power module design and manufacturing processes to meet escalating performance demands.

From a regional perspective, Asia Pacific, particularly China, Japan, and South Korea, dominates the market due to its robust automotive manufacturing base, significant investments in EV infrastructure, and supportive government policies. Europe also represents a substantial market, driven by stringent emission regulations and a strong commitment to electrification, especially in Germany and Scandinavia. North America is experiencing steady growth, propelled by increasing EV adoption rates, substantial government incentives for electric vehicles, and significant R&D activities in autonomous driving technologies. Emerging markets in Latin America, the Middle East, and Africa are showing nascent but promising growth, as governments and consumers in these regions begin to embrace vehicle electrification, albeit at a slower pace compared to developed economies, with infrastructure development posing a significant factor for future expansion.

Segment trends highlight the dominance of power ICs, particularly IGBTs and MOSFETs, as foundational components across various applications. The electric vehicle and hybrid electric vehicle (EV/HEV) segment continues to be the largest and fastest-growing application area, driven by the increasing integration of inverters, DC-DC converters, and on-board chargers. Within materials, SiC and GaN are projected to capture a larger market share, gradually supplanting traditional silicon-based components in high-power applications due to their inherent advantages. Passenger vehicles constitute the primary vehicle type segment, though commercial electric vehicles are also gaining traction, necessitating tailored power electronics solutions. These trends underscore a market in constant evolution, where technological differentiation and strategic positioning are paramount for success.

AI Impact Analysis on Automotive Power Electronics Market

User questions regarding AI's impact on automotive power electronics frequently revolve around how artificial intelligence can optimize energy management, enhance system efficiency, and improve reliability in increasingly complex vehicle architectures. Users are particularly keen on understanding AI's role in predictive maintenance for power modules, its potential to enable more sophisticated control algorithms for electric powertrains, and its contribution to the development of safer and more efficient autonomous driving systems. There is also significant interest in how AI can accelerate the design and testing phases of new power electronics components, leading to faster market introduction and cost reductions. Concerns often include the computational overhead, data privacy implications, and the robustness of AI algorithms in safety-critical automotive applications, highlighting the need for highly reliable and certifiable AI solutions within the power electronics domain.

- AI optimizes power conversion efficiency: Utilizes machine learning algorithms to dynamically adjust power delivery and conversion processes, minimizing energy losses in inverters and DC-DC converters.

- Predictive maintenance for power modules: AI analyzes real-time operational data to predict potential failures in power electronic components, enabling proactive maintenance and enhancing vehicle reliability.

- Enables intelligent thermal management: AI algorithms control cooling systems to maintain optimal operating temperatures for power electronics, preventing overheating and extending component lifespan.

- Advanced control for electric powertrains: AI-driven control units fine-tune motor operation and battery discharge, improving performance, responsiveness, and energy utilization in EVs.

- Accelerates design and testing processes: Machine learning models simulate component behavior under various conditions, reducing development cycles and identifying design flaws early.

- Facilitates autonomous driving power distribution: AI manages the complex power demands of ADAS sensors, LiDAR, radar, and high-performance computing units, ensuring stable and reliable operation.

- Enhances battery management systems (BMS): AI optimizes charging and discharging cycles, estimates state of charge (SoC) and state of health (SoH) more accurately, and balances cell voltage for extended battery life.

DRO & Impact Forces Of Automotive Power Electronics Market

The Automotive Power Electronics Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its growth trajectory. Key drivers include the aggressive global push for vehicle electrification, driven by environmental concerns and government incentives, which necessitates high-performance and efficient power conversion solutions for electric vehicle powertrains, charging infrastructure, and auxiliary systems. Furthermore, the rapid advancements in autonomous driving technologies and connected car systems significantly increase the demand for reliable and compact power electronics to manage the extensive computational power, sensor arrays, and communication modules within these vehicles. The continuous evolution of semiconductor materials, particularly wide-bandgap materials like SiC and GaN, offers enhanced efficiency and power density, further fueling market expansion by enabling superior performance in demanding automotive applications. Strict regulatory standards for emissions and fuel economy across major automotive markets also compel manufacturers to adopt advanced power electronics to meet compliance requirements and enhance overall vehicle efficiency.

Despite these strong growth drivers, the market faces several notable restraints. The high initial cost associated with advanced power electronic components, especially those utilizing SiC and GaN, can be a deterrent for mass-market adoption, particularly in cost-sensitive vehicle segments. Furthermore, the complex thermal management challenges posed by high-power-density modules require sophisticated cooling solutions, adding to the system complexity and cost. Supply chain vulnerabilities, exacerbated by geopolitical tensions and raw material scarcity, present significant risks, leading to potential production delays and increased manufacturing costs. The intricate design and integration challenges involved in developing robust and reliable power electronics for safety-critical automotive applications also represent a substantial hurdle, requiring extensive testing and validation processes to ensure compliance with stringent automotive industry standards.

Opportunities within this dynamic market are abundant and varied. The increasing adoption of 48V mild hybrid systems provides a significant growth avenue, as these systems bridge the gap between conventional internal combustion engines and full EVs, requiring a new class of efficient power electronics. The development of advanced wireless charging technologies for EVs represents another promising opportunity, demanding innovative power conversion and control systems. The expansion into vehicle-to-everything (V2X) communication and smart grid integration capabilities also opens new markets for intelligent power electronics that can manage bidirectional power flow and communication. Moreover, the continuous development of novel packaging technologies and module integration techniques promises to enhance component performance, reduce size, and improve cost-effectiveness, paving the way for wider market penetration and new application areas. Strategic partnerships and investments in R&D focusing on next-generation materials and topologies are crucial for capitalizing on these emerging opportunities.

The impact forces influencing the automotive power electronics market are multifaceted, encompassing technological, regulatory, economic, and environmental factors. Technological advancements in semiconductor manufacturing, materials science, and power converter topologies continually drive innovation, leading to more efficient, compact, and reliable components. Regulatory pressures, primarily driven by global climate goals and urban air quality concerns, push for greater electrification and stricter efficiency standards, directly impacting power electronics design requirements. Economic factors such as raw material costs, manufacturing scale, and consumer purchasing power influence pricing strategies and market accessibility. Environmental considerations, particularly the push for sustainability and reduction of carbon footprints, necessitate power electronics that enable lower energy consumption and support the integration of renewable energy sources within vehicles. Geopolitical developments and trade policies can also exert significant pressure on global supply chains and market access, making robust and diversified sourcing strategies critical for market resilience.

Segmentation Analysis

The Automotive Power Electronics Market is comprehensively segmented across various dimensions to provide a granular understanding of its diverse landscape and growth drivers. These segments include breakdowns by component type, application area, material utilized, vehicle type, and specific electric vehicle configurations. This multifaceted segmentation helps in identifying key market trends, competitive advantages, and investment opportunities within different niches of the automotive power electronics ecosystem. The growing complexity of vehicle electronics, coupled with the rapid evolution of electric and autonomous vehicle technologies, necessitates a detailed analytical approach to capture the full scope of market dynamics across these categories. Understanding these segmentations is critical for stakeholders to tailor their product development, marketing strategies, and operational focus effectively.

- By Component

- Power ICs

- IGBTs (Insulated Gate Bipolar Transistors)

- MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors)

- Power Diodes

- Thyristors

- Other Power Management ICs

- Sensors

- Current Sensors

- Temperature Sensors

- Voltage Sensors

- Capacitors

- Film Capacitors

- Ceramic Capacitors

- Electrolytic Capacitors

- Diodes and Rectifiers

- Schottky Diodes

- Zener Diodes

- Standard Rectifiers

- Microcontrollers and Microprocessors

- Other Components (e.g., Inductors, Resistors)

- Power ICs

- By Application

- Electric Vehicle and Hybrid Electric Vehicle (EV/HEV)

- Inverters (Traction Inverters)

- DC-DC Converters

- On-Board Chargers (OBC)

- Battery Management Systems (BMS)

- Electric Power Steering (EPS)

- Advanced Driver-Assistance Systems (ADAS)

- Radar Systems

- LiDAR Systems

- Camera Systems

- Ultrasonic Sensors

- Infotainment and Telematics

- Navigation Systems

- Communication Modules

- Display Systems

- Chassis and Safety

- Anti-lock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Airbag Control Units

- Body Electronics

- Lighting Systems

- Power Window Modules

- HVAC Control

- Electric Vehicle and Hybrid Electric Vehicle (EV/HEV)

- By Material

- Silicon (Si)

- Standard Silicon

- Silicon Carbide (SiC)

- SiC MOSFETs

- SiC Diodes

- Gallium Nitride (GaN)

- GaN HEMTs

- Silicon (Si)

- By Vehicle Type

- Passenger Vehicle

- Sedans

- SUVs

- Hatchbacks

- Commercial Vehicle

- Buses

- Trucks

- Vans

- Passenger Vehicle

- By Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Value Chain Analysis For Automotive Power Electronics Market

The value chain for the Automotive Power Electronics Market is a complex ecosystem, starting from raw material extraction and culminating in the end-use of sophisticated electronic modules within vehicles. The upstream segment primarily involves suppliers of fundamental raw materials such as silicon wafers, gallium nitride, silicon carbide, and various metals required for semiconductor manufacturing and component fabrication. This also includes providers of highly specialized chemicals and gases essential for advanced semiconductor processing. These foundational materials are then processed by integrated device manufacturers (IDMs) or outsourced to semiconductor foundries, which specialize in designing and producing the core power electronic chips and discrete components like IGBTs, MOSFETs, and diodes. The quality and availability of these raw materials and initial fabrication services significantly impact the cost, performance, and reliability of the final power electronic products, establishing a critical dependency throughout the chain. Innovation at this stage, particularly in material purity and wafer processing, is a key differentiator.

Moving downstream, the fabricated semiconductor components are then acquired by various Tier 2 and Tier 1 automotive suppliers. Tier 2 suppliers often specialize in producing sub-modules or specific components such as power modules, sensors, and capacitors, integrating multiple discrete power electronic devices into a single package. These sub-modules are then supplied to Tier 1 suppliers, which are responsible for designing, assembling, and testing complete power electronic systems and modules, such as inverters, DC-DC converters, on-board chargers, and advanced driver assistance system (ADAS) control units. Tier 1 suppliers possess deep expertise in automotive system integration and adhere to stringent automotive quality and safety standards. Their role is pivotal in transforming individual electronic components into robust, automotive-grade systems that meet the precise specifications and performance requirements demanded by vehicle manufacturers. The collaboration between Tier 2 and Tier 1 suppliers is crucial for ensuring compatibility, efficiency, and reliability across the entire power electronics system.

The distribution channel primarily involves direct sales from Tier 1 suppliers to Original Equipment Manufacturers (OEMs), which are the automotive manufacturers. Given the highly customized and integrated nature of automotive power electronics, direct engagement ensures close collaboration on design, specification, and testing. Indirect channels may also exist where smaller component manufacturers supply through distributors to reach a broader base of Tier 2 or Tier 1 suppliers. Aftermarket service providers also form part of the downstream segment, offering repair and replacement parts. The market is characterized by a strong emphasis on long-term relationships and strategic partnerships between automotive OEMs and their key Tier 1 power electronics suppliers, driven by the need for high reliability, safety, and consistent supply. The intricate nature of automotive design cycles means that suppliers are often involved from the very early stages of vehicle development, necessitating deep technical expertise and strong collaborative capabilities to navigate complex integration challenges and ensure seamless product deployment into mass production vehicles.

Automotive Power Electronics Market Potential Customers

The primary potential customers for the Automotive Power Electronics Market are diverse, reflecting the broad application spectrum of these critical components within the automotive industry. Automotive Original Equipment Manufacturers (OEMs) stand as the most significant direct customers, requiring a vast array of power electronic modules and systems for their vehicle production lines. This includes manufacturers of conventional internal combustion engine (ICE) vehicles, hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs). OEMs source these components for powertrain electrification, chassis and safety systems, body electronics, infotainment, and ADAS functionalities, making them central to the market's demand. Their needs range from high-power inverters for traction motors to compact control units for various in-cabin systems, with a strong emphasis on reliability, cost-effectiveness, and compliance with stringent automotive standards.

Beyond the direct OEMs, Tier 1 automotive suppliers represent another crucial segment of potential customers. These companies procure power electronic components and sub-assemblies from semiconductor manufacturers and specialized component providers to integrate them into complete systems, which are then supplied to the OEMs. Examples include companies specializing in braking systems, infotainment units, engine control units, or full EV powertrain modules. Tier 1 suppliers often leverage their expertise in specific automotive domains to combine power electronics with software and mechanical components, delivering fully validated and integrated solutions. Additionally, emerging players in the electric vehicle manufacturing sector, including startups focused solely on EVs, constitute a rapidly growing customer base, often seeking innovative, highly efficient, and compact power electronic solutions to gain a competitive edge in the burgeoning EV market. The continuous push for advanced vehicle features, ranging from enhanced fuel efficiency to full autonomy, ensures a sustained and expanding demand from these critical customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2032 | USD 23.1 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, STMicroelectronics N.V., ON Semiconductor Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Robert Bosch GmbH, Continental AG, Denso Corporation, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Toshiba Corporation, Vishay Intertechnology Inc., Littelfuse Inc., Texas Instruments Incorporated, Allegro MicroSystems Inc., ROHM Semiconductor, Wolfspeed Inc., SemiQ, Inc., Qorvo, Inc., Magna International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Power Electronics Market Key Technology Landscape

The key technology landscape of the Automotive Power Electronics Market is rapidly evolving, driven by the relentless pursuit of higher efficiency, increased power density, and enhanced reliability in vehicle systems. A central focus is on wide-bandgap (WBG) semiconductors, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC devices, such as MOSFETs and diodes, are becoming indispensable for high-voltage and high-power applications in electric vehicle inverters, on-board chargers, and DC-DC converters due to their superior breakdown voltage, lower switching losses, and better thermal conductivity compared to traditional silicon. GaN, while primarily used in lower to medium power applications currently, offers even higher switching frequencies and smaller form factors, making it attractive for compact and efficient power conversion modules in various automotive auxiliary systems and potentially for future higher voltage applications as the technology matures. These WBG materials enable designers to create more compact, lighter, and more efficient power electronics, directly contributing to extended EV range and faster charging times.

Beyond advanced materials, significant technological advancements are occurring in power module packaging and integration. Traditional discrete components are increasingly being replaced by integrated power modules that combine multiple semiconductor dies, gate drivers, and passive components into a single, compact unit. This integration reduces parasitic inductance, improves thermal performance, and enhances reliability by minimizing interconnections. Technologies like wire bonding replacement with advanced sintering, copper clip, or solder-free interconnects are gaining traction to withstand harsh automotive environments and improve power cycling capabilities. Furthermore, the development of intelligent power modules (IPMs) that incorporate embedded control and protection features, often with AI-driven diagnostics, is enhancing system functionality and fault tolerance. Efficient thermal management solutions, including advanced liquid cooling systems and innovative heat sink designs, are also critical for dissipating the heat generated by high-power components, ensuring optimal performance and longevity. These technological strides are fundamentally reshaping how power is managed and converted within modern vehicles, paving the way for more sophisticated and efficient automotive systems.

Regional Highlights

- North America: This region is characterized by significant investments in electric vehicle infrastructure and manufacturing, coupled with robust research and development activities in autonomous driving. Government incentives and increasing consumer acceptance of EVs are driving the demand for advanced power electronics. Key players and startups in the automotive and technology sectors are fostering innovation in power management solutions, particularly for high-power charging and ADAS applications.

- Europe: Driven by stringent emission regulations and a strong commitment to sustainable mobility, Europe exhibits a mature and rapidly expanding market for automotive power electronics. Countries like Germany, France, and the Nordics are at the forefront of EV adoption and battery technology development, necessitating high-performance SiC and GaN-based power solutions. The presence of major automotive OEMs and Tier 1 suppliers contributes to a competitive and innovation-driven landscape.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily led by China, Japan, and South Korea. China's dominance stems from its massive EV production and market penetration, coupled with significant governmental support for electric mobility and local semiconductor manufacturing. Japan and South Korea are key players in advanced automotive electronics, including components for HEVs, BEVs, and sophisticated ADAS systems, driving demand for innovative power semiconductor technologies and module integration. The region also serves as a critical manufacturing hub for global automotive supply chains.

- Latin America: This region is an emerging market for automotive power electronics, with growing interest in vehicle electrification but at a comparatively slower pace. Market growth is influenced by improving economic conditions, increasing awareness of environmental benefits, and gradual development of charging infrastructure in key countries like Brazil and Mexico. Local manufacturing and policy support for electric vehicles are nascent but showing potential for future expansion.

- Middle East and Africa (MEA): The MEA region is at an early stage of adoption, though there is increasing strategic interest in EV adoption, particularly in countries aiming for economic diversification away from fossil fuels, such as the UAE and Saudi Arabia. Infrastructure development for EVs and favorable government policies are crucial for future market growth. The demand for power electronics is expected to rise with the progressive shift towards electrification in regional transportation sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Power Electronics Market.- Infineon Technologies AG

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Vishay Intertechnology Inc.

- Littelfuse Inc.

- Texas Instruments Incorporated

- Allegro MicroSystems Inc.

- ROHM Semiconductor

- Wolfspeed Inc.

- SemiQ, Inc.

- Qorvo, Inc.

- Magna International Inc.

Frequently Asked Questions

What is driving the growth of the Automotive Power Electronics Market?

The market's growth is primarily driven by the global shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs), stringent government regulations for emissions reduction, and increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. These factors necessitate highly efficient and reliable power management solutions.

Which semiconductor materials are prominent in automotive power electronics?

Traditional silicon (Si) remains widely used, but wide-bandgap (WBG) semiconductors such as Silicon Carbide (SiC) and Gallium Nitride (GaN) are gaining significant prominence. SiC is preferred for high-voltage, high-power EV applications due to its superior efficiency, while GaN is emerging for high-frequency, compact power conversion solutions.

How does AI impact the Automotive Power Electronics Market?

AI plays a crucial role in optimizing energy management, improving power conversion efficiency, enabling predictive maintenance for power modules, and enhancing thermal management. It also supports advanced control algorithms for electric powertrains and accelerates the design and testing phases of new components, contributing to overall system reliability and performance.

What are the key challenges facing the Automotive Power Electronics Market?

Key challenges include the high initial cost of advanced materials like SiC and GaN, complex thermal management requirements for high-power density modules, and vulnerabilities within global supply chains. Ensuring robust reliability and compliance with stringent automotive safety standards also presents significant design and integration hurdles.

Which application segment holds the largest share in the market?

The Electric Vehicle and Hybrid Electric Vehicle (EV/HEV) application segment currently holds the largest share in the Automotive Power Electronics Market. This dominance is due to the increasing integration of essential components like inverters, DC-DC converters, on-board chargers, and battery management systems critical for electrified powertrains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager