Automotive Radar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430936 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Radar Market Size

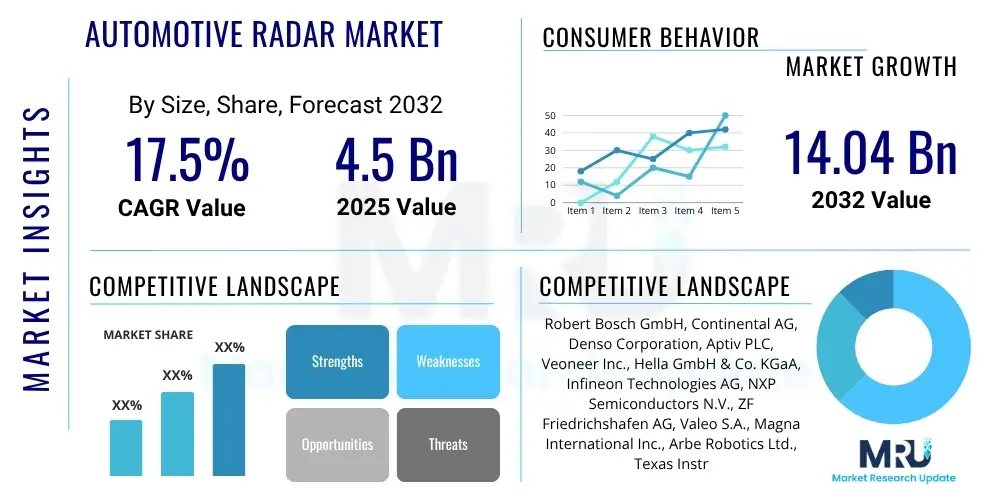

The Automotive Radar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2025 and 2032. The market is estimated at $4.5 Billion in 2025 and is projected to reach $14.04 Billion by the end of the forecast period in 2032.

Automotive Radar Market introduction

The Automotive Radar Market encompasses the development, production, and integration of radar systems into vehicles for enhanced safety, driver assistance, and autonomous driving capabilities. Automotive radar systems emit radio waves to detect objects, measure their distance, speed, and angle, providing crucial environmental perception data. These systems are fundamental components of Advanced Driver Assistance Systems (ADAS) such as Adaptive Cruise Control (ACC), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Change Assist (LCA), and Rear Cross-Traffic Alert (RCTA).

The primary benefits of automotive radar include improved road safety by reducing accidents, increased driver comfort through automation, and enablement of higher levels of autonomous driving. They offer robust performance in various weather conditions, unlike camera-based systems, and provide precise distance and velocity measurements. Key driving factors for market expansion include the increasingly stringent global automotive safety regulations mandating ADAS features, the rapid advancements in autonomous vehicle technology, and growing consumer demand for safer and more convenient driving experiences. Furthermore, cost reduction initiatives and the continuous improvement in radar sensor capabilities, such as higher resolution and wider fields of view, are significantly propelling market growth.

Automotive Radar Market Executive Summary

The Automotive Radar Market is experiencing robust expansion driven by significant technological advancements and a global push for enhanced vehicle safety. Business trends indicate a strong focus on miniaturization, cost-effectiveness, and the development of higher-resolution imaging radar systems, allowing for more precise object detection and classification. Mergers, acquisitions, and strategic partnerships among technology providers and automotive OEMs are common, aimed at accelerating innovation and solidifying market positions in the competitive landscape of autonomous driving solutions.

Regionally, Asia Pacific is emerging as a dominant market due to high vehicle production volumes, rapid adoption of ADAS technologies in China, Japan, and South Korea, and supportive government policies. Europe leads in regulatory mandates for safety features, fostering a strong market for premium vehicles equipped with advanced radar systems. North America continues to be a hub for autonomous vehicle research and development, driving demand for sophisticated radar solutions. Segment-wise, the 77 GHz radar segment is expected to maintain its leadership due to its superior performance in long-range detection and higher resolution, while applications in ADAS continue to be the largest contributor, with autonomous driving anticipated to be the fastest-growing segment.

AI Impact Analysis on Automotive Radar Market

User inquiries regarding the impact of Artificial intelligence (AI) on the Automotive Radar Market frequently revolve around how AI enhances radar's capabilities, its role in sensor fusion, implications for autonomous driving safety, and the challenges associated with integrating complex AI algorithms into real-time automotive systems. Concerns often surface about the reliability of AI in diverse driving scenarios, data processing demands, and the potential for AI-driven systems to reduce false positives and negatives, which are critical for robust performance. Users are keen to understand how AI contributes to improving object classification, prediction, and overall system robustness, moving beyond traditional radar signal processing limits.

- AI significantly enhances radar's ability to classify objects more accurately, distinguishing between pedestrians, cyclists, and other vehicles, which is crucial for decision-making in ADAS and autonomous driving.

- Integration of AI algorithms allows for advanced sensor fusion, combining data from radar, cameras, lidar, and ultrasonic sensors to create a comprehensive and redundant perception of the vehicle's surroundings, overcoming individual sensor limitations.

- Machine learning models enable predictive analysis, allowing radar systems to anticipate the movement of other road users, thereby improving adaptive cruise control, automatic emergency braking, and path planning for autonomous vehicles.

- AI assists in filtering out clutter and noise from radar signals, leading to clearer detection in challenging environmental conditions such as heavy rain, fog, or snow, where traditional radar might struggle.

- Deep learning techniques are being applied to develop "imaging radar" which can provide much higher resolution and detailed environmental mapping, approaching the capabilities of lidar but with superior performance in adverse weather.

- AI-powered radar systems contribute to the continuous improvement of autonomous driving by facilitating more intelligent decision-making, reducing human intervention, and increasing overall system safety and reliability.

- The use of AI enables software-defined radar, allowing for over-the-air updates and adaptive performance optimization, extending the lifespan and capabilities of radar hardware.

DRO & Impact Forces Of Automotive Radar Market

The Automotive Radar Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all contributing to its evolving impact forces. Key drivers include the global mandate for enhanced vehicle safety features, particularly the widespread adoption of Advanced Driver Assistance Systems (ADAS) in new vehicles. Government regulations, such as those promoting AEB and pedestrian detection systems, compel automakers to integrate sophisticated radar technologies. Furthermore, the relentless pursuit of fully autonomous driving capabilities is a powerful catalyst, as radar provides essential long-range detection and velocity measurement crucial for Level 3 and above automation. Continuous technological advancements leading to smaller, more powerful, and cost-effective radar sensors also fuel market expansion.

However, several restraints challenge market growth. The relatively high cost of advanced radar systems, particularly imaging radar, can be a barrier to broader adoption in entry-level and mid-range vehicle segments. The complexity of integrating multiple sensors and managing the vast amounts of data generated, especially in sensor fusion architectures, poses significant technical hurdles. While radar performs well in adverse weather, its resolution can still be limited compared to lidar, and it can sometimes suffer from interference from other radar systems. Additionally, the regulatory landscape for autonomous vehicles remains fragmented and evolving, creating uncertainty for manufacturers investing heavily in these technologies.

Opportunities abound with the emergence of new frequency bands, such as 79 GHz, offering higher resolution and better performance. The development of 4D imaging radar promises to bridge the gap between traditional radar and lidar by providing precise height information in addition to range, azimuth, and velocity. The increasing emphasis on V2X (Vehicle-to-Everything) communication and enhanced cybersecurity for connected cars also presents new avenues for radar integration and data sharing. Moreover, the aftermarket segment and the growth of commercial autonomous vehicles like robotaxis and autonomous trucks offer fertile ground for market expansion. Impact forces are primarily shaped by technological innovation, stringent safety regulations, shifting consumer expectations towards safer and more convenient vehicles, and the intense competition among market players to offer superior, cost-efficient solutions.

Segmentation Analysis

The Automotive Radar Market is comprehensively segmented based on various critical parameters, including frequency band, application, range, and vehicle type. This granular segmentation provides valuable insights into market dynamics, growth trajectories, and competitive landscapes across different product categories and end-user applications. Understanding these segments is crucial for stakeholders to tailor their product development, marketing strategies, and investment decisions, ensuring they address specific market needs and capitalize on emerging trends. The market's complexity and rapid evolution necessitate a detailed analysis of each segment's contribution and potential growth.

- By Frequency Band:

- 24 GHz (Short-Range Radar - SRR): Primarily used for blind spot detection, parking assist, and rear cross-traffic alerts due to its shorter range and lower cost.

- 77 GHz (Long-Range Radar - LRR, Medium-Range Radar - MRR): Dominant for adaptive cruise control, automatic emergency braking, forward collision warning, and advanced autonomous driving functions, offering higher resolution and penetration capabilities.

- 79 GHz: Emerging band offering even higher resolution and bandwidth, promising enhanced imaging radar capabilities and better object differentiation for future ADAS and autonomous driving applications.

- By Application:

- Adaptive Cruise Control (ACC): Maintains a safe distance from preceding vehicles.

- Autonomous Emergency Braking (AEB): Automatically applies brakes to prevent or mitigate collisions.

- Blind Spot Detection (BSD): Alerts drivers to vehicles in their blind spots.

- Forward Collision Warning (FCW): Warns drivers of potential frontal collisions.

- Lane Change Assist (LCA): Aids drivers during lane changes by detecting nearby vehicles.

- Parking Assist (PA): Assists in parking maneuvers.

- Cross-Traffic Alert (CTA): Detects vehicles approaching from the side, often when reversing.

- Autonomous Driving: Radar systems are foundational for Level 3 and above autonomous vehicles, providing comprehensive environmental perception.

- By Range:

- Short-Range Radar (SRR): Typically up to 30 meters, used for close-proximity detection.

- Medium-Range Radar (MRR): Ranges from 30 to 80 meters, used for applications like lane change assist.

- Long-Range Radar (LRR): Exceeds 80 meters, crucial for ACC and AEB, detecting objects far ahead.

- By Vehicle Type:

- Passenger Cars: The largest segment, driven by mass adoption of ADAS features in consumer vehicles.

- Commercial Vehicles: Growing segment due to increasing demand for safety and efficiency in trucks, buses, and logistics vehicles.

Value Chain Analysis For Automotive Radar Market

The value chain for the Automotive Radar Market is a complex ecosystem involving multiple layers of specialized companies, from raw material suppliers to automotive manufacturers and end-users. The upstream segment is dominated by semiconductor companies and component manufacturers that provide the fundamental building blocks for radar systems. These include suppliers of radio frequency (RF) integrated circuits (ICs), microcontrollers, digital signal processors (DSPs), and specialized antennas. Innovation at this stage is critical for achieving miniaturization, higher performance, and cost reduction. The intense research and development in semiconductor technologies directly impacts the capabilities and efficiency of the final radar modules.

Midstream in the value chain are the Tier 1 suppliers and specialized radar module manufacturers. These companies integrate the components from upstream suppliers into complete radar sensor units. They are responsible for the sophisticated engineering, software development, calibration, and testing of the radar modules, ensuring they meet rigorous automotive standards for reliability and performance. This stage often involves proprietary signal processing algorithms, embedded software, and advanced packaging techniques. These Tier 1 suppliers then deliver the integrated radar modules to the original equipment manufacturers (OEMs) who assemble the final vehicles.

The downstream segment primarily consists of automotive OEMs, which are the direct and indirect purchasers of radar modules. OEMs integrate these systems into their vehicles as part of ADAS packages or for autonomous driving platforms. Distribution channels are predominantly direct from Tier 1 suppliers to OEMs for new vehicle production. However, an indirect channel exists in the aftermarket, where standalone radar systems or ADAS upgrades might be installed by specialized workshops or through authorized distributors. The after-sales service and maintenance network also forms part of the downstream value chain, providing support for the installed radar systems. The entire value chain is characterized by strong partnerships and collaboration, given the highly technical and safety-critical nature of automotive radar technology.

Automotive Radar Market Potential Customers

Potential customers for automotive radar systems primarily consist of entities involved in the design, manufacturing, and operation of vehicles and autonomous platforms. The largest segment of end-users are the global automotive Original Equipment Manufacturers (OEMs). These include major passenger car manufacturers such as Volkswagen, Toyota, General Motors, Ford, Mercedes-Benz, BMW, and Tesla, who integrate radar systems directly into their new vehicles during the production phase to offer ADAS features and increasingly, autonomous driving capabilities. OEMs are driven by safety regulations, consumer demand for advanced features, and the strategic imperative to lead in autonomous technology.

Another significant customer group comprises Tier 1 automotive suppliers, such as Bosch, Continental, Denso, Aptiv, and ZF, who not only manufacture radar modules but also integrate them into more complex ADAS sub-systems before supplying them to OEMs. These suppliers often engage in extensive research and development to produce cutting-edge radar solutions. Beyond traditional passenger vehicle manufacturers, commercial vehicle manufacturers, including producers of trucks, buses, and specialized utility vehicles, are increasingly adopting radar for fleet safety, logistics optimization, and eventual autonomous operation of commercial transport. Emerging players in the autonomous mobility space, such as robotaxi operators and autonomous truck developers, also represent a critical and rapidly growing customer base, demanding high-performance and reliable radar solutions for their self-driving fleets. Furthermore, the aftermarket segment for vehicle upgrades and specialized applications, alongside research institutions and defense contractors exploring advanced ground vehicle technologies, also constitute potential customers for radar technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.5 Billion |

| Market Forecast in 2032 | $14.04 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Veoneer Inc., Hella GmbH & Co. KGaA, Infineon Technologies AG, NXP Semiconductors N.V., ZF Friedrichshafen AG, Valeo S.A., Magna International Inc., Arbe Robotics Ltd., Texas Instruments Incorporated, Analog Devices Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Ainstein Inc., Echodyne Corp., Metawave Corporation, Vayyar Imaging Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Radar Market Key Technology Landscape

The Automotive Radar Market is characterized by a rapidly evolving technological landscape, with innovations continuously pushing the boundaries of what radar systems can achieve in terms of performance, cost-efficiency, and integration. At the core, millimeter-wave (mmWave) technology forms the foundation, operating primarily in the 24 GHz and 77/79 GHz frequency bands. The transition from 24 GHz to higher frequencies like 77 GHz and the emerging 79 GHz band is driven by the need for higher resolution, wider bandwidths, and smaller antenna sizes, enabling more compact and precise sensors. This shift allows for enhanced object detection, classification, and differentiation, which are paramount for advanced ADAS and autonomous driving systems.

Recent advancements include the widespread adoption of Multiple-Input Multiple-Output (MIMO) radar, which utilizes multiple transmit and receive antennas to simulate a much larger antenna array. This significantly improves angular resolution without increasing the physical size of the sensor, allowing for better separation of closely spaced objects. Another critical innovation is the development of 4D imaging radar, which, in addition to providing range, azimuth, and velocity, also adds height information. This capability helps in distinguishing between objects on the road surface versus overhead structures, providing a much richer environmental understanding, and bringing radar closer to the perception capabilities of lidar, especially in adverse weather conditions. Furthermore, the integration of Artificial Intelligence and Machine Learning algorithms into radar signal processing is transforming how radar data is interpreted. AI models enhance object classification, track prediction, and reduce false positives by learning patterns from vast datasets.

Software-defined radar (SDR) is another key technological trend, offering increased flexibility and adaptability. SDR allows for dynamic reconfiguration of radar parameters such as waveform, frequency, and bandwidth through software updates, enabling continuous performance improvements and customization for specific applications without hardware changes. The push towards system-on-chip (SoC) radar solutions, integrating radar transceivers, processors, and memory onto a single chip, is driving miniaturization and cost reduction, making radar more accessible for mass-market vehicles. Sensor fusion, the intelligent combination of data from radar, camera, lidar, and ultrasonic sensors, is also a critical technological area. Advanced fusion algorithms leverage the strengths of each sensor type to compensate for individual weaknesses, creating a robust and redundant perception system vital for highly automated and autonomous vehicles. The relentless pursuit of higher resolution, better interference mitigation, and robust performance in all weather conditions continues to define the key technology landscape in automotive radar.

Regional Highlights

- North America: This region is a significant hub for automotive innovation and autonomous vehicle research. Stringent safety regulations and a strong consumer demand for advanced driver assistance systems (ADAS) drive market growth. The presence of leading technology companies and a robust ecosystem for autonomous vehicle testing contribute to its dominance. Companies like Tesla are pushing the boundaries of automotive radar integration.

- Europe: European countries are at the forefront of implementing strict vehicle safety standards, such as those from Euro NCAP, which mandate advanced safety features like automatic emergency braking. This regulatory environment fuels the adoption of automotive radar in premium and mid-range vehicle segments. Germany, in particular, with its strong automotive manufacturing base, is a key market.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market for automotive radar, driven by high vehicle production volumes, particularly in China, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and growing awareness regarding vehicle safety are boosting ADAS penetration. Government initiatives to promote smart and connected vehicles further accelerate market expansion in this region.

- Latin America: While currently a smaller market compared to developed regions, Latin America shows nascent growth in automotive radar adoption. Increasing vehicle sales and a growing emphasis on road safety regulations are expected to drive demand, albeit at a slower pace. Brazil and Mexico are key countries contributing to regional market development.

- Middle East and Africa (MEA): The MEA region is characterized by emerging markets with increasing investments in automotive infrastructure and manufacturing. The adoption of automotive radar is primarily driven by luxury vehicle sales and government initiatives aiming to modernize transportation systems, although overall market penetration remains relatively low.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Radar Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv PLC

- Veoneer Inc.

- Hella GmbH & Co. KGaA

- Infineon Technologies AG

- NXP Semiconductors N.V.

- ZF Friedrichshafen AG

- Valeo S.A.

- Magna International Inc.

- Arbe Robotics Ltd.

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Ainstein Inc.

- Echodyne Corp.

- Metawave Corporation

- Vayyar Imaging Ltd.

Frequently Asked Questions

What is automotive radar and how does it work?

Automotive radar is a sensor system used in vehicles that emits radio waves and analyzes the reflections to detect objects, measure their distance, speed, and angle. It works by sending out electromagnetic waves and then processing the echoes that bounce back from surrounding obstacles, providing critical data for safety and driver assistance features.

What are the main applications of automotive radar?

The primary applications include Advanced Driver Assistance Systems (ADAS) such as Adaptive Cruise Control (ACC), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Change Assist (LCA), and parking assistance. It is also a fundamental component for enabling various levels of autonomous driving by providing essential environmental perception.

How does 77 GHz radar differ from 24 GHz radar?

77 GHz radar offers higher resolution, wider bandwidth, and better penetration capabilities compared to 24 GHz radar. It is predominantly used for long-range applications like adaptive cruise control and automatic emergency braking, whereas 24 GHz radar is typically used for shorter-range functions like blind spot detection due to its lower cost and more limited range.

What is the role of AI in automotive radar technology?

AI significantly enhances automotive radar by improving object classification accuracy, enabling advanced sensor fusion with other sensors, facilitating predictive analysis for better decision-making, and filtering out noise. It is crucial for developing high-resolution imaging radar and for optimizing radar performance through software-defined approaches, especially in autonomous driving.

What are the key drivers for the growth of the automotive radar market?

Key drivers include stringent global automotive safety regulations mandating ADAS features, the rapid development and adoption of autonomous vehicle technologies, growing consumer demand for safer and more convenient driving experiences, and continuous technological advancements leading to more efficient and cost-effective radar systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager