Automotive Sintered Brake Pads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427890 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Sintered Brake Pads Market Size

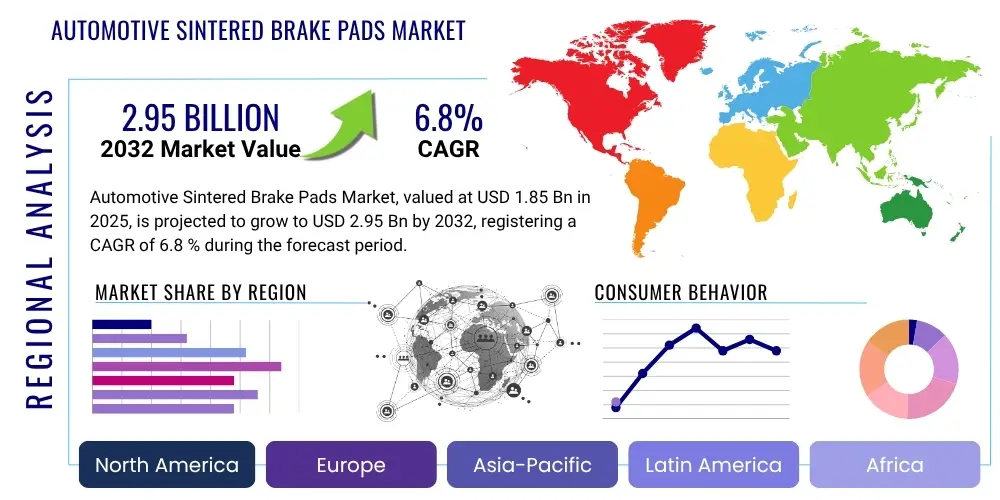

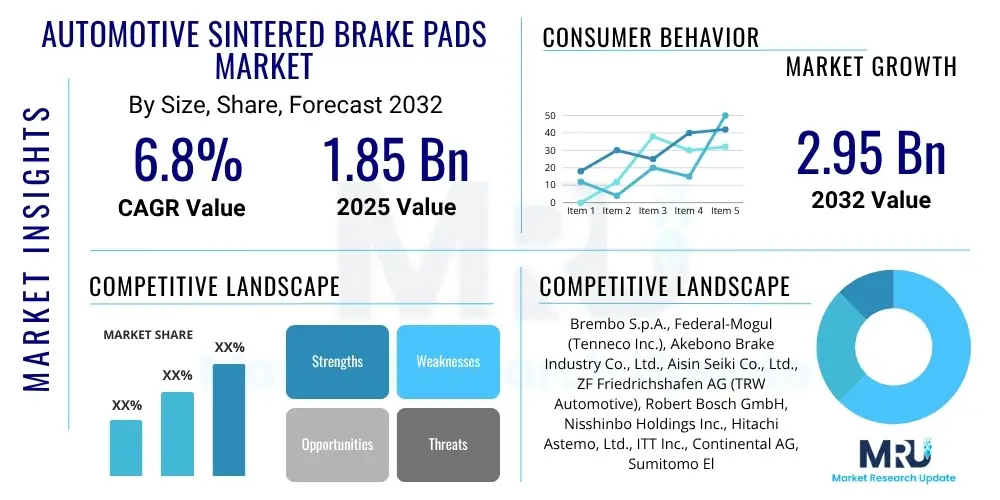

The Automotive Sintered Brake Pads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2032.

Automotive Sintered Brake Pads Market introduction

The automotive industry’s relentless pursuit of enhanced safety, durability, and performance has significantly bolstered the demand for advanced braking solutions. Sintered brake pads, characterized by their metallic composition and high-temperature processing, stand at the forefront of this evolution. These pads are manufactured through a complex powder metallurgy process where metallic particles, binders, and friction modifiers are compressed and heated to a high temperature, below their melting point, to form a solid, porous structure. This unique manufacturing method imparts superior thermal stability, wear resistance, and consistent friction characteristics across a wide range of operating conditions, making them ideal for demanding applications. Unlike conventional organic or ceramic brake pads, sintered pads excel in extreme conditions, offering unparalleled fade resistance and a prolonged lifespan.

Major applications for automotive sintered brake pads span across high-performance passenger vehicles, heavy-duty commercial vehicles, motorcycles, and specialized off-road machinery where braking force and heat dissipation are paramount. Their robust construction and ability to withstand aggressive braking cycles make them an indispensable component in environments demanding consistent and reliable stopping power. The primary benefits of sintered brake pads include their exceptional durability, significantly longer lifespan compared to non-sintered alternatives, superior braking performance at high temperatures, and excellent resistance to brake fade. These attributes contribute directly to enhanced vehicle safety and reduced maintenance frequency, which are critical factors for both original equipment manufacturers (OEMs) and the aftermarket.

The market for automotive sintered brake pads is predominantly driven by the escalating demand for high-performance vehicles, including sports cars, luxury SUVs, and powerful motorcycles, where owners expect uncompromising braking capabilities. Furthermore, stringent global safety regulations, which mandate higher braking efficiency and reliability standards, compel vehicle manufacturers to adopt advanced braking materials like sintered pads. The increasing production of heavy-duty trucks and buses, coupled with the growing trend of vehicle customization and aftermarket upgrades for enhanced performance, also significantly contributes to market expansion. Moreover, advancements in material science, focusing on developing new alloys and friction compounds that offer improved performance while addressing environmental concerns, are continuously propelling market growth and innovation.

Automotive Sintered Brake Pads Market Executive Summary

The Automotive Sintered Brake Pads Market is poised for substantial growth, driven by an intricate interplay of evolving business trends, regional dynamics, and segment-specific demands. A key business trend shaping this market is the intensified focus on material innovation, with manufacturers investing heavily in R&D to develop environmentally friendly, copper-free formulations and advanced composite materials that offer superior friction stability and extended wear life. The industry is also witnessing a trend towards consolidation, as major players acquire smaller, specialized firms to expand their product portfolios and technological capabilities. Furthermore, the burgeoning demand for high-performance braking systems in electric vehicles (EVs) presents a significant business opportunity, as EVs require robust braking solutions to manage their higher curb weight and regenerative braking integration, prompting manufacturers to adapt sintered pad characteristics for this emerging segment.

Regionally, the Asia Pacific (APAC) continues to dominate the market, largely due to rapid industrialization, burgeoning automotive manufacturing hubs in China and India, and a growing middle class with increasing purchasing power for both new vehicles and aftermarket upgrades. Europe, with its strong legacy in premium and performance automotive brands, maintains a significant market share, driven by stringent regulatory standards and a consumer preference for advanced vehicle components. North America also exhibits robust growth, fueled by a thriving aftermarket for performance modifications and a substantial heavy-duty vehicle sector that relies on durable braking solutions. Emerging economies in Latin America and the Middle East & Africa are showing promising growth trajectories as automotive production and infrastructure development advance, increasing the installed base of vehicles requiring quality brake components.

Segmentation trends reveal significant insights into market dynamics. By vehicle type, high-performance passenger cars and motorcycles represent a high-value segment due to the critical need for superior braking. The commercial vehicle segment, encompassing heavy-duty trucks and buses, drives volume, given the emphasis on durability and load-bearing capabilities. In terms of material composition, low-metallic and semi-metallic sintered pads remain prevalent, though there is a growing shift towards ceramic-metallic blends that offer improved noise reduction and cleaner operation. The sales channel segmentation highlights a balanced distribution, with the OEM segment being crucial for initial fitments and the aftermarket providing consistent demand for replacement parts, which is often influenced by consumer choices for performance upgrades and reliability. These trends collectively underscore a dynamic market landscape characterized by technological advancements and shifting consumer preferences.

AI Impact Analysis on Automotive Sintered Brake Pads Market

Common user questions regarding AI's impact on the Automotive Sintered Brake Pads Market often revolve around how artificial intelligence can enhance material development, optimize manufacturing processes, predict component lifespan, and contribute to overall vehicle safety systems. Users are keen to understand if AI can lead to more durable, efficient, and environmentally friendly brake pads. There is also significant interest in AI's role in predictive maintenance for braking systems, aiming to reduce unexpected failures and improve vehicle uptime, particularly in commercial fleets. Concerns frequently touch upon the cost implications of integrating AI into manufacturing and product development, as well as the potential for AI-driven design to truly revolutionize friction material science. Expectations are high for AI to deliver smarter, safer, and more sustainable braking solutions, driving innovation beyond conventional methodologies and contributing to autonomous driving safety.

- AI-driven material discovery accelerates the development of novel friction composites with enhanced thermal stability and wear resistance, allowing for predictive modeling of material performance without extensive physical testing.

- Predictive maintenance algorithms, powered by AI, monitor brake pad wear in real-time through sensor data, optimizing replacement schedules and reducing unexpected failures for fleets and individual vehicles.

- AI optimizes manufacturing processes by analyzing production data to identify inefficiencies, reduce waste, improve consistency in sintering, and enhance overall quality control, leading to cost savings and improved product reliability.

- Generative design tools leverage AI to create optimized brake pad geometries and internal structures for improved heat dissipation and stress distribution, leading to lighter yet more robust designs.

- AI contributes to advanced driver-assistance systems (ADAS) and autonomous driving by providing more accurate real-time data on brake system status, enhancing the decision-making capabilities of the vehicle's control unit for emergency braking scenarios.

- Supply chain optimization benefits from AI by forecasting demand more accurately, managing inventory levels efficiently, and identifying potential disruptions in the supply of raw materials, ensuring a steady production flow.

DRO & Impact Forces Of Automotive Sintered Brake Pads Market

The Automotive Sintered Brake Pads Market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that shape its growth trajectory. Key drivers include the escalating global demand for high-performance vehicles, where sintered pads are favored for their superior thermal resistance and consistent friction coefficients, crucial for safety and control. Furthermore, increasingly stringent global automotive safety regulations, particularly concerning braking efficiency and reliability, compel manufacturers to adopt advanced materials and technologies, thereby boosting the demand for high-quality sintered pads. The expansion of the automotive manufacturing sector, especially in developing economies, coupled with a growing consumer preference for durable and long-lasting vehicle components, also acts as a powerful market stimulant. The aftermarket segment further contributes to growth, driven by consumers seeking performance upgrades and reliable replacement parts for their vehicles.

Conversely, the market faces several notable restraints. The relatively high manufacturing cost of sintered brake pads compared to conventional organic or ceramic alternatives often presents a barrier, particularly in price-sensitive market segments. Environmental concerns surrounding the release of metallic brake dust, containing materials like copper, during braking have led to regulatory pressures and a push for copper-free formulations, necessitating significant R&D investment. Intense competition from alternative brake pad materials, such as advanced ceramics and low-metallic formulations, which offer different performance characteristics and price points, also limits market expansion. Furthermore, the complex manufacturing process involved in powder metallurgy requires specialized equipment and expertise, which can deter new entrants and increase production overheads for existing players. These factors collectively create challenges for market participants, requiring strategic adaptation and innovation.

Despite the restraints, the Automotive Sintered Brake Pads Market is rich with opportunities. The rapid global shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) presents a substantial avenue for growth. EVs, often heavier due to battery packs, require robust braking systems capable of handling higher loads and integrating effectively with regenerative braking mechanisms; sintered pads are well-suited to meet these demands. Advancements in material science and metallurgy continually open doors for developing next-generation sintered compounds that offer enhanced performance, reduced environmental impact, and improved cost-effectiveness. The expanding aftermarket segment, driven by vehicle customization trends and the desire for performance upgrades, provides a consistent revenue stream for manufacturers. Moreover, the growing focus on autonomous driving technologies necessitates highly reliable and consistent braking systems, creating new opportunities for sintered pads to play a critical role in future mobility solutions. External impact forces, such as fluctuating raw material prices (e.g., copper, iron, graphite), geopolitical instabilities affecting supply chains, and evolving trade policies, can significantly influence manufacturing costs and market accessibility, demanding agile strategic responses from industry players.

Segmentation Analysis

The Automotive Sintered Brake Pads Market is comprehensively segmented to provide a granular understanding of its diverse components, offering insights into varying demands and applications across different vehicle types, material compositions, and sales channels. This segmentation allows market participants to tailor their strategies, product development, and marketing efforts to specific niches. The market is primarily divided by the type of vehicle they serve, recognizing the distinct performance and durability requirements of each category. Further differentiation occurs based on the material composition of the pads, reflecting advancements in metallurgical science aimed at optimizing friction characteristics, noise reduction, and environmental impact. Lastly, the sales channel segmentation highlights the two major avenues through which these products reach their end-users, each with its own set of business dynamics and customer relationships, influencing distribution strategies and pricing models.

- By Vehicle Type

- Passenger Cars: Including sedans, SUVs, hatchbacks, and luxury vehicles, often emphasizing performance and comfort.

- Commercial Vehicles: Encompassing heavy-duty trucks, buses, and light commercial vehicles, where durability, load-bearing capacity, and consistent performance are paramount.

- High-Performance Vehicles: Sports cars, racing cars, and specialized off-road vehicles that demand extreme thermal stability and braking power.

- Motorcycles: Crucial for two-wheelers, where brake performance directly impacts rider safety and control, often in varied riding conditions.

- By Material Composition

- Low-Metallic Sintered Pads: Containing a lower percentage of metallic fibers, balancing performance with reduced brake dust and noise.

- Semi-Metallic Sintered Pads: A traditional blend of metallic fibers and other materials, offering good performance and durability, but can be noisy and produce more dust.

- Ceramic-Metallic Sintered Pads: Incorporating ceramic fibers alongside metallic components to improve quietness, reduce dust, and enhance overall smooth braking characteristics, often preferred for premium applications.

- Copper-Free Sintered Pads: Developed in response to environmental regulations, these formulations replace copper with alternative metallic or non-metallic friction modifiers to reduce environmental impact.

- By Sales Channel

- Original Equipment Manufacturer (OEM): Sales directly to vehicle manufacturers for initial installation in new vehicles.

- Aftermarket: Sales of replacement brake pads through distributors, retailers, and service centers for vehicles already in operation.

Value Chain Analysis For Automotive Sintered Brake Pads Market

The value chain for the Automotive Sintered Brake Pads Market is a complex network involving various stages, from raw material extraction to end-user distribution, each contributing to the final product's value and market availability. The upstream segment primarily involves the sourcing and processing of essential raw materials. This includes metallic powders such as iron, copper, brass, and bronze, along with non-metallic components like graphite, ceramics (e.g., alumina, silicon carbide), and various binders and friction modifiers. Suppliers in this stage focus on delivering high-purity, consistent-quality powders and additives that meet stringent specifications for subsequent manufacturing processes. The quality of these raw materials directly impacts the final performance characteristics of the sintered brake pads, necessitating robust quality control and long-term relationships with reliable suppliers. Technological advancements in powder metallurgy and material science at this stage are crucial for innovation in friction material development, aiming for improved performance and environmental compliance.

The midstream of the value chain involves the manufacturing and assembly of the brake pads. This stage is dominated by specialized brake pad manufacturers who employ sophisticated powder metallurgy techniques, including pressing, sintering at high temperatures, and subsequent grinding and finishing operations. These manufacturers often invest heavily in R&D to optimize their proprietary formulations and manufacturing processes, ensuring consistent quality, durability, and performance under diverse operating conditions. Integration of advanced automation and quality assurance systems is critical to producing pads that meet global safety standards and OEM specifications. Downstream activities involve the distribution and sales of the finished products. This segment caters to two primary channels: direct sales to Original Equipment Manufacturers (OEMs) for factory installation in new vehicles, and indirect sales to the aftermarket through a network of distributors, wholesalers, retailers, and independent repair shops. The OEM channel demands close collaboration with vehicle manufacturers, often involving co-development and rigorous testing to integrate brake pads seamlessly into new vehicle designs.

The distribution channels for automotive sintered brake pads are bifurcated into direct and indirect routes. Direct distribution primarily serves OEMs, where manufacturers deliver brake pads directly to vehicle assembly plants as per just-in-time inventory systems. This relationship is characterized by long-term contracts, strict quality audits, and often exclusive supply agreements. The indirect distribution channel is vital for the aftermarket, reaching vehicle owners who require replacement pads. This involves a multi-tiered network starting from master distributors, who then supply regional wholesalers, who in turn distribute to smaller retailers, auto parts stores, and service garages. E-commerce platforms are also increasingly becoming a significant indirect channel, allowing consumers and workshops to purchase brake pads directly from online vendors. Effective supply chain management, robust logistics, and strong relationships across all these channels are critical for ensuring timely delivery, broad market reach, and customer satisfaction, ultimately enhancing brand loyalty and market share.

Automotive Sintered Brake Pads Market Potential Customers

The potential customers for Automotive Sintered Brake Pads encompass a broad spectrum of entities within the automotive ecosystem, each driven by distinct needs and purchasing criteria. At the forefront are Original Equipment Manufacturers (OEMs), who constitute a primary segment of buyers. These include global automotive giants producing passenger cars, commercial vehicles, and motorcycles, seeking high-quality, durable, and performance-driven braking components for integration into their new vehicle models. OEMs prioritize reliability, safety compliance, long-term performance consistency, and cost-effectiveness in large-scale procurement. Their decision-making process involves extensive testing, validation, and adherence to stringent industry standards, making them demanding but high-volume clients. The growing adoption of sintered pads in luxury, sports, and heavy-duty vehicles by OEMs is a testament to their performance advantages, establishing a critical foundational demand for the market.

Another significant segment of potential customers resides within the automotive aftermarket, comprising a diverse group of end-users and intermediaries. This includes independent repair shops and garages, which service a vast installed base of vehicles and require reliable replacement parts that meet or exceed original equipment specifications. Auto parts retailers, both brick-and-mortar and online, also serve as crucial direct channels to consumers and professional installers, stocking a wide range of sintered pads for various vehicle makes and models. Individual vehicle owners, particularly those who drive performance-oriented cars, heavy-duty trucks, or motorcycles, often seek sintered brake pads for performance upgrades, increased durability, or improved safety over standard options. These consumers are typically informed and willing to invest in premium braking solutions for enhanced driving experience and reduced maintenance frequency. Furthermore, fleet operators of commercial vehicles, public transport, and logistics companies represent a key customer group in the aftermarket. For them, the extended lifespan and consistent performance of sintered pads translate directly into reduced downtime, lower operational costs, and improved safety for their vehicle fleets, making long-term value a critical purchasing factor. These diverse customer bases underscore the pervasive utility and demand for advanced braking solutions in the automotive sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brembo S.p.A., Federal-Mogul (Tenneco Inc.), Akebono Brake Industry Co., Ltd., Aisin Seiki Co., Ltd., ZF Friedrichshafen AG (TRW Automotive), Robert Bosch GmbH, Nisshinbo Holdings Inc., Hitachi Astemo, Ltd., ITT Inc., Continental AG, Sumitomo Electric Industries, Ltd., Bendix (Knorr-Bremse AG), MAT Holdings Inc., Fras-le S.A., Miba AG, SGL Carbon, R.H. Sheppard Co. Inc., Carlisle Brake & Friction, Shandong Gold Phoenix Co., Ltd., TMD Friction Holdings GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Sintered Brake Pads Market Key Technology Landscape

The Automotive Sintered Brake Pads Market is characterized by a dynamic and evolving technological landscape, driven by continuous innovation in material science, manufacturing processes, and product design aimed at enhancing performance, durability, and environmental sustainability. At the core of sintered brake pad technology is powder metallurgy, a sophisticated manufacturing process that involves the precise blending of metallic powders (such as iron, copper, brass), ceramic particles, graphite, and various binders and friction modifiers. This mixture is then compressed under high pressure and heated in a controlled atmosphere to a temperature below its melting point, a process known as sintering. Advanced sintering techniques, including hot pressing and spark plasma sintering, are being developed to achieve denser, more homogeneous material structures, which directly translate to improved mechanical properties and superior friction stability across extreme temperatures and loads. Research efforts are focused on optimizing particle size distribution, porosity, and the bonding characteristics between different constituents to create superior friction materials.

Beyond the fundamental manufacturing process, significant technological advancements are occurring in the realm of material composition and formulation. There is an intensive push towards developing copper-free formulations, driven by environmental regulations that aim to reduce the ecological impact of brake dust. This involves extensive research into alternative metallic and non-metallic friction modifiers that can replicate or even surpass the performance of copper, focusing on materials like steel fibers, mineral fibers, and various ceramic compounds. Furthermore, manufacturers are exploring advanced composites and nanostructured materials to enhance wear resistance, reduce noise and vibration, and improve overall braking feel. The integration of advanced simulation and modeling tools, such as Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), is also becoming crucial. These tools enable engineers to predict brake pad performance, thermal behavior, stress distribution, and wear patterns virtually, significantly reducing development cycles and costs associated with physical prototyping and testing. This predictive capability allows for faster iteration and optimization of designs and material compositions.

Another emerging technological trend is the application of additive manufacturing (3D printing) for prototyping and potentially for specialized, low-volume production of complex brake pad geometries or internal structures. While not yet mainstream for mass production, 3D printing offers unparalleled design freedom, allowing for intricate cooling channels or weight-optimized structures that could further enhance performance. Sensor integration into brake pads is also gaining traction, particularly for predictive maintenance and real-time wear monitoring. These smart brake pads can transmit data on wear levels, temperature, and even friction characteristics to the vehicle’s control unit or a cloud-based analytics platform. This technology, often coupled with AI and machine learning, enables proactive maintenance scheduling, prevents critical failures, and supports the evolution of autonomous driving systems by providing accurate, continuous data on brake system health. Such advancements underscore a future where brake pads are not just mechanical components but intelligent parts of a larger, interconnected vehicle system, contributing to enhanced safety, efficiency, and sustainability.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to its large and growing automotive manufacturing base, particularly in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and a rising demand for both passenger cars and commercial vehicles drive significant OEM and aftermarket sales. The region is also a hub for two-wheeler production, further boosting demand for sintered brake pads in motorcycles.

- Europe: A significant market driven by stringent safety regulations, a strong presence of premium and high-performance vehicle manufacturers, and a mature aftermarket. Countries like Germany, France, and Italy are key contributors, known for their focus on advanced automotive technologies and high-quality components. The region is at the forefront of adopting copper-free formulations due to environmental mandates.

- North America: Characterized by a robust demand for heavy-duty commercial vehicles and a strong aftermarket for performance upgrades. The United States and Canada are key markets, with consumers often seeking enhanced durability and braking power for their trucks, SUVs, and performance cars. The region also shows increasing adoption of sintered pads in its growing electric vehicle segment.

- Latin America: An emerging market with growing automotive production and an expanding vehicle parc. Countries such as Brazil and Mexico are witnessing increased demand for reliable and durable brake pads as their automotive industries mature and vehicle ownership rises. The aftermarket segment is particularly dynamic, driven by a need for cost-effective yet robust replacement solutions.

- Middle East & Africa (MEA): This region is experiencing steady growth, fueled by infrastructure development, increasing vehicle imports, and a rising demand for commercial and off-road vehicles. Countries like Saudi Arabia, UAE, and South Africa are key markets, where extreme operating conditions often necessitate high-performance and durable braking solutions like sintered pads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Sintered Brake Pads Market.- Brembo S.p.A.

- Federal-Mogul (Tenneco Inc.)

- Akebono Brake Industry Co., Ltd.

- Aisin Seiki Co., Ltd.

- ZF Friedrichshafen AG (TRW Automotive)

- Robert Bosch GmbH

- Nisshinbo Holdings Inc.

- Hitachi Astemo, Ltd.

- ITT Inc.

- Continental AG

- Sumitomo Electric Industries, Ltd.

- Bendix (Knorr-Bremse AG)

- MAT Holdings Inc.

- Fras-le S.A.

- Miba AG

- SGL Carbon

- R.H. Sheppard Co. Inc.

- Carlisle Brake & Friction

- Shandong Gold Phoenix Co., Ltd.

- TMD Friction Holdings GmbH

Frequently Asked Questions

What are the primary advantages of automotive sintered brake pads over traditional options?

Automotive sintered brake pads offer superior advantages, including exceptional durability, significantly longer lifespan, and consistent high-performance braking, especially under extreme temperatures and heavy loads. Their metallic composition provides excellent heat dissipation and fade resistance, making them ideal for high-performance vehicles, heavy-duty applications, and motorcycles where reliable stopping power is critical for safety and control.

How do sintered brake pads contribute to vehicle safety in demanding conditions?

Sintered brake pads significantly enhance vehicle safety in demanding conditions by maintaining a stable friction coefficient even at very high operating temperatures, which is crucial for preventing brake fade during aggressive or prolonged braking. Their robust construction ensures consistent braking performance, enabling shorter stopping distances and improved control, particularly in high-speed maneuvers, mountainous terrain, or when carrying heavy loads, thus reducing the risk of accidents.

Are sintered brake pads suitable for electric vehicles (EVs), and what role do they play?

Yes, sintered brake pads are highly suitable for electric vehicles (EVs) and play a crucial role. EVs often have a higher curb weight due to battery packs, requiring more robust braking systems. Sintered pads offer the durability and performance needed to manage this increased mass. While EVs primarily use regenerative braking, sintered pads provide essential mechanical braking for emergency stops, low-speed maneuvers, and when the battery is fully charged, ensuring consistent and reliable stopping power as a critical backup.

What environmental considerations are associated with sintered brake pads, and how is the industry addressing them?

A primary environmental consideration for sintered brake pads is the release of metallic brake dust, particularly copper, which can be harmful to aquatic ecosystems. The industry is actively addressing this through extensive research and development into copper-free and low-copper formulations. Manufacturers are investing in alternative friction materials and binders to maintain performance standards while complying with stringent environmental regulations and promoting a more sustainable automotive ecosystem, aligning with global green initiatives.

What is the typical lifespan of sintered brake pads compared to other types, and what factors influence it?

Sintered brake pads generally offer a significantly longer lifespan compared to organic or semi-metallic alternatives, often lasting 20-50% longer due to their superior wear resistance and durability. Key factors influencing their lifespan include driving style (aggressive vs. moderate), vehicle type and weight, operating temperatures, road conditions, and the specific material formulation. While their initial cost might be higher, their extended service life often provides a better long-term value and reduced maintenance frequency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager