Automotive Speaker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430302 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Speaker Market Size

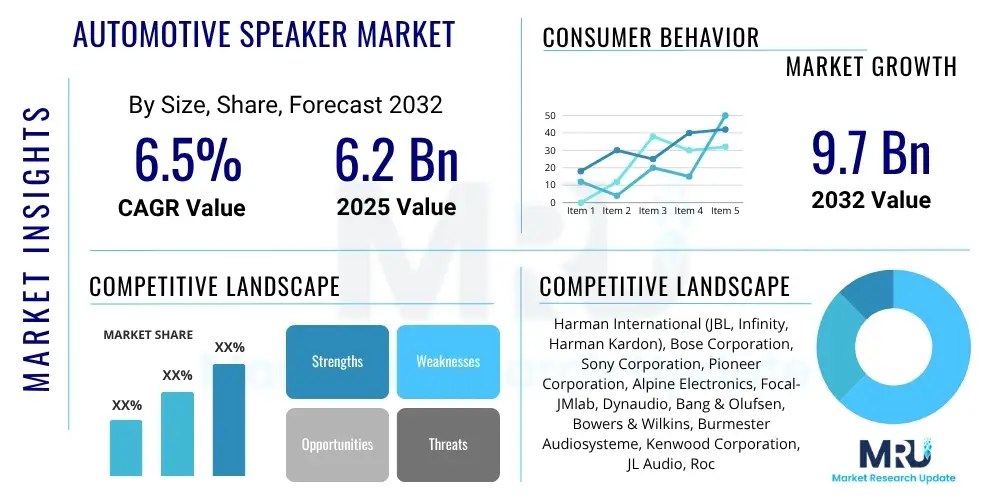

The Automotive Speaker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2032.

Automotive Speaker Market introduction

The automotive speaker market represents a vital segment within the broader automotive electronics industry, dedicated to the development, manufacturing, and distribution of audio transducers specifically engineered for in-vehicle environments. These sophisticated sound systems are far more than simple components; they are integral to the overall driving and passenger experience, transforming the vehicle cabin into an immersive audio space. The product portfolio ranges extensively from fundamental full-range coaxial speakers and dedicated component sets—comprising separate woofers, tweeters, and crossovers—to powerful subwoofers for deep bass reproduction, and specialized mid-range drivers. Each type is meticulously designed to meet specific acoustic requirements and installation constraints inherent to diverse vehicle architectures, ensuring optimal sound dispersion and tonal accuracy.

Major applications of automotive speakers span beyond pure entertainment, encompassing critical functionalities within modern vehicles. They are central to infotainment systems, delivering crystal-clear music, podcasts, and digital radio. Furthermore, they facilitate hands-free communication, enabling safe and clear calls. Increasingly, speakers play a role in safety and alert systems, providing audible warnings for navigation instructions, parking assistance, and advanced driver-assistance systems (ADAS) warnings, thereby enhancing situational awareness. The multifaceted benefits of advanced automotive speakers include superior sound fidelity, personalized audio settings, robust durability to withstand harsh automotive conditions, seamless integration with vehicle electronics, and overall enhancement of the in-cabin comfort and luxury perception. These systems cater to an escalating consumer demand for premium experiences, positioning them as a key differentiator in vehicle sales.

The market's dynamic growth is primarily propelled by several significant driving factors. A paramount driver is the continuous evolution of consumer expectations, where high-quality in-car audio is no longer a luxury but a sought-after standard. This trend is amplified by the proliferation of digital music streaming services and personal audio devices. Concurrently, technological advancements in audio processing, materials science, and digital signal processing (DSP) are enabling manufacturers to offer more sophisticated and energy-efficient speaker solutions. The global surge in automotive production, particularly the accelerated adoption and manufacturing of electric vehicles (EVs), presents a unique catalyst, as EVs necessitate lightweight, efficient, and acoustically optimized audio systems to compensate for the absence of engine noise and to maximize battery range. These factors collectively underscore the market's trajectory towards innovation and expansion, continually pushing the boundaries of in-car acoustic engineering to deliver unparalleled audio experiences.

Automotive Speaker Market Executive Summary

The automotive speaker market is currently undergoing a transformative phase, characterized by significant shifts in business trends, regional growth patterns, and segment-specific demands. A predominant business trend is the automotive industry's pervasive focus on integrating advanced infotainment systems as a core selling proposition for new vehicles. This has led to heightened collaboration between major automotive Original Equipment Manufacturers (OEMs) and leading audio technology specialists, resulting in bespoke, factory-installed premium audio packages. Furthermore, there is an increasing emphasis on smart audio features, including voice control integration, personalized soundscapes, and connectivity with external devices, reflecting the broader trend towards connected and intelligent vehicles. Manufacturers are also prioritizing sustainable materials and energy-efficient designs, particularly in response to the rapid expansion of the electric vehicle market, where minimizing weight and power consumption is paramount. The competitive landscape is intensely dynamic, with companies innovating in areas such as active noise cancellation and immersive audio technologies to differentiate their offerings.

From a regional perspective, the market exhibits varied growth trajectories and maturity levels. The Asia Pacific (APAC) region stands out as a primary growth engine, propelled by burgeoning automotive production volumes in countries like China, India, and Southeast Asian nations, alongside a rising disposable income that fuels demand for feature-rich vehicles. This region is witnessing substantial investments in manufacturing capabilities and a rapid adoption of modern automotive technologies. Conversely, established markets in North America and Europe continue to hold significant shares, predominantly driven by a robust aftermarket segment, a strong preference for luxury and high-performance audio systems, and a consistent demand for vehicle upgrades and customization. Latin America and the Middle East and Africa (MEA) are emerging as promising markets, showing gradual but steady growth, influenced by improving economic conditions and increasing vehicle penetration.

Segmentation trends reveal distinct dynamics. The OEM segment's trajectory is intrinsically linked to global new vehicle sales, with a growing trend towards offering higher-tier audio systems as standard or desirable options across vehicle categories, from compact cars to high-end luxury models. The aftermarket segment, on the other hand, thrives on consumer desires for personalization, superior sound quality beyond factory installations, and the replacement of older or damaged components. This segment is characterized by a wide array of products, from basic upgrades to sophisticated multi-channel audio setups, often catering to audiophiles and car enthusiasts. Technology-wise, there is a clear trend towards digital signal processing (DSP) enabled speakers, multi-channel configurations, and active noise reduction solutions, all contributing to a more refined and adaptable in-car audio environment. The interplay of these trends highlights a complex yet opportunity-rich market poised for continuous evolution.

AI Impact Analysis on Automotive Speaker Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the automotive speaker market frequently explore how AI can revolutionize the in-car audio experience, moving beyond static sound reproduction to dynamic, intelligent, and personalized soundscapes. A common theme is the expectation that AI will enable audio systems to adapt autonomously to various real-time conditions, such as cabin occupancy, external road noise, vehicle speed, and even the emotional state of occupants, thereby optimizing sound delivery. Concerns often arise regarding data privacy and the ethical implications of AI collecting and processing personal audio preferences and behavioral patterns. Users are keen to understand the extent to which AI can enhance voice command accuracy for infotainment and navigation, ensuring seamless interaction without compromising audio quality. There is also significant anticipation for AI to facilitate entirely novel forms of interactive audio experiences, integrating seamlessly with smart assistants and enabling predictive maintenance for audio components through acoustic analysis. The overarching expectation is for AI to usher in an era where in-car audio is not just heard, but intelligently experienced, dynamically responding to the environment and its occupants.

- AI-powered adaptive equalization, adjusting sound profiles in real-time based on cabin acoustics, road conditions, and ambient noise levels for optimal clarity and immersion.

- Enhanced voice recognition and natural language processing capabilities, enabling more intuitive and precise control over infotainment systems and vehicle functions through voice commands.

- Development of personalized sound zones within the vehicle, utilizing AI algorithms to direct distinct audio streams to individual passengers without disturbing others.

- Predictive analytics for audio system maintenance, where AI monitors speaker performance and identifies potential issues before they lead to failure, ensuring reliability.

- Integration of AI with advanced driver-assistance systems (ADAS) to provide clear, directional, and contextual audio alerts, improving driver awareness and safety.

- AI-driven content recommendations based on user listening habits, mood, and travel patterns, enhancing the infotainment experience.

- Optimization of audio compression and streaming algorithms to deliver high-fidelity sound efficiently, reducing data consumption and latency.

- Real-time sound staging and 3D audio rendering, leveraging AI to create a more spatial and immersive listening experience across all seating positions.

DRO & Impact Forces Of Automotive Speaker Market

The automotive speaker market's trajectory is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A significant driver is the escalating consumer demand for superior in-car audio systems, which has transformed from a mere utility into a critical component of the overall driving experience. This demand is further amplified by increasing disposable incomes in emerging economies and a global trend towards premiumization in vehicle offerings. The rapid advancements in infotainment technologies, including larger touchscreens, seamless smartphone integration, and sophisticated operating systems, necessitate high-quality audio outputs. Furthermore, the burgeoning market for electric vehicles (EVs) acts as a powerful catalyst, as the quietness of EV cabins accentuates the need for refined audio solutions and their unique power management requirements drive innovation in efficiency and weight reduction. Connected car technologies, enabling seamless access to streaming services and cloud-based applications, also significantly bolster demand for advanced speaker systems.

Despite these growth drivers, the market faces notable restraints. The inherently high cost associated with manufacturing premium audio components, especially those utilizing exotic materials or advanced digital processing, can limit their penetration into mass-market segments. Intense competition among a multitude of global and regional players often leads to aggressive pricing strategies, impacting profit margins for manufacturers. The increasing complexity of integrating sophisticated audio systems with diverse vehicle electronic architectures, coupled with space constraints within modern dashboards and door panels, presents significant design and engineering challenges. Moreover, global supply chain volatility, exacerbated by geopolitical tensions and raw material shortages (e.g., for rare-earth magnets or semiconductors), introduces risks to production schedules and costs, thereby acting as a substantial restraint on market expansion and stability.

Opportunities within the automotive speaker market are abundant and diverse. The most prominent opportunity lies in the continued growth of the electric vehicle sector, which demands innovative, lightweight, and energy-efficient audio solutions. This encourages research and development into new materials and compact designs. The concept of personalized in-car audio experiences, enabled by software-defined vehicles and advanced AI algorithms, presents another lucrative avenue, allowing for dynamic sound tuning based on individual preferences or cabin conditions. Emerging markets, with their expanding middle-class populations and increasing first-time vehicle ownership, offer untapped potential for both OEM and aftermarket segments. Furthermore, the potential for advanced audio systems to integrate with future autonomous vehicle interiors, transforming the cabin into a versatile multi-functional space, opens up entirely new design paradigms and usage scenarios. Impact forces such as evolving automotive safety regulations, mandating clear audio alerts for ADAS, continuously influence speaker design and placement. Fluctuations in raw material prices, global economic downturns affecting consumer spending, and the rapid pace of technological obsolescence, which constantly pushes for new product cycles, all exert significant pressure on market participants to adapt and innovate swiftly.

Segmentation Analysis

The automotive speaker market is meticulously segmented across various crucial dimensions, offering a granular understanding of its structure, operational dynamics, and underlying consumer behaviors. This comprehensive segmentation provides a strategic framework for market participants to identify lucrative niches, tailor product development, and refine marketing strategies to address specific demands effectively. By dissecting the market based on speaker type, vehicle type, underlying technology, sales channel, and application, stakeholders gain invaluable insights into purchasing patterns, technological preferences, and regional disparities. This analytical approach facilitates a more accurate assessment of market potential, competitive intensity, and potential areas for innovation, ensuring that product offerings are precisely aligned with market needs, from foundational audio components to highly integrated, immersive sound systems that enhance the driving experience across all vehicle categories.

Understanding these segments is paramount for strategic planning. For instance, the distinction between coaxial and component speakers directly relates to consumer demands for sound quality and customization, influencing product development pipelines. Similarly, segmenting by vehicle type highlights the unique requirements of passenger cars versus commercial vehicles, and critically, the evolving demands of electric vehicles for lightweight and energy-efficient audio solutions. The sales channel segmentation, differentiating between OEM and aftermarket, informs distribution strategies and partnership opportunities. Moreover, breaking down the market by application allows for a clear view of how speakers serve diverse purposes, from core infotainment to critical safety alerts, showcasing the multifaceted role of audio within the modern automobile. This detailed analysis ensures that all facets of the market are understood, enabling businesses to navigate complexities and capitalize on growth opportunities with precision.

- By Speaker Type: These categories delineate the fundamental design and function of individual speakers within an automotive audio system, catering to different acoustic needs and performance levels.

- Coaxial Speakers: Integrate multiple audio drivers (e.g., woofer, tweeter) into a single unit, offering a compact and cost-effective solution for full-range sound reproduction.

- Component Speakers: Separate drivers (woofer, tweeter, crossover) for superior sound staging, imaging, and fidelity, allowing for more precise installation and acoustic tuning.

- Subwoofers: Dedicated speakers designed to reproduce very low-frequency sounds (bass), adding depth and impact to the audio experience.

- Tweeters: Small speakers specialized in reproducing high-frequency sounds, contributing to crispness and detail in music.

- Mid-range Speakers: Designed to reproduce the crucial vocal and instrumental frequencies between bass and treble, ensuring clarity and presence.

- By Vehicle Type: This segmentation reflects how speaker system requirements vary across different automotive platforms due to differences in cabin size, power availability, and consumer expectations.

- Passenger Cars: The largest segment, including sedans, SUVs, hatchbacks, and coupes, demanding a wide range of audio solutions from basic to premium.

- Commercial Vehicles:

- Light Commercial Vehicles (LCVs): Vans, pickups, and small trucks requiring durable and often simpler audio systems for functional communication and basic entertainment.

- Heavy Commercial Vehicles (HCVs): Large trucks, buses, and coaches needing robust audio for long-haul comfort, communication, and driver alerts.

- Electric Vehicles (EVs):

- Battery Electric Vehicles (BEVs): Fully electric vehicles requiring highly energy-efficient and lightweight audio systems to maximize range.

- Plug-in Hybrid Electric Vehicles (PHEVs): Combine electric and internal combustion engines, needing balanced audio solutions.

- Hybrid Electric Vehicles (HEVs): Primarily rely on internal combustion with electric assistance, similar audio needs to traditional cars but with efficiency considerations.

- By Technology: Refers to the underlying principles of sound production, influencing performance characteristics, power requirements, and cost.

- Dynamic Speakers: Most common type, using a magnetic coil and cone to produce sound; known for versatility and robustness.

- Electrostatic Speakers: Utilize an electrostatic field to vibrate a thin membrane, offering exceptional clarity and detailed sound, typically found in high-end systems.

- Planar Magnetic Speakers: Employ a flat diaphragm with conductors, offering a blend of dynamic and electrostatic speaker characteristics with good transient response.

- Piezoelectric Speakers: Utilize piezoelectric effect, often used for tweeters or small, robust applications due to their efficiency and resistance to environmental factors.

- By Sales Channel: Distinguishes between direct supply to vehicle manufacturers and sales to end-consumers or installers.

- Original Equipment Manufacturer (OEM): Speakers supplied directly to car manufacturers for factory installation in new vehicles.

- Aftermarket: Speakers sold separately to consumers for upgrading, customizing, or replacing existing audio systems in their vehicles.

- By Application: Categorizes speakers based on their primary function within the vehicle's ecosystem.

- Infotainment Systems: For music, radio, podcasts, and other entertainment content.

- Communication Systems: For hands-free calls, intercoms in commercial vehicles, and voice assistance.

- Safety and Alert Systems: For navigation prompts, parking sensor warnings, ADAS alerts, and vehicle status notifications.

Value Chain Analysis For Automotive Speaker Market

The value chain for the automotive speaker market is an intricate network of activities spanning from raw material acquisition to end-user delivery, each stage adding significant value to the final product. Upstream activities are centered on the sourcing and processing of essential raw materials and components. This critical initial phase involves the procurement of high-grade metals such as steel and neodymium for magnets and speaker frames, various polymers like polypropylene and kevlar for cones and surrounds, and specialized textiles such as silk or aluminum for tweeters. Additionally, complex electronic components like voice coils, capacitors, resistors, and printed circuit boards are acquired from specialized suppliers. These raw material and component suppliers are vital, as the quality and performance of their inputs directly impact the acoustic output and durability of the finished speaker units. Research and development activities, including material science innovation and acoustic modeling, are also deeply integrated into this upstream segment, driving advancements in speaker efficiency and sound reproduction.

Midstream activities primarily encompass the manufacturing and assembly processes. This stage involves the precise fabrication of speaker drivers, including cone molding, voice coil winding, magnet assembly, and diaphragm attachment. Advanced manufacturing techniques, such as automated assembly lines and stringent quality control protocols, are employed to ensure consistent performance and reliability, meeting the rigorous standards required by the automotive industry. Following individual speaker production, these units are often integrated into more comprehensive audio systems, which might include amplifiers, digital signal processors (DSPs), and vehicle-specific enclosures. This integration phase frequently involves close collaboration between speaker manufacturers and automotive audio system integrators or directly with vehicle OEMs, ensuring seamless compatibility and optimized acoustic performance within diverse vehicle cabins. Rigorous testing for environmental resilience, including temperature extremes, humidity, and vibration, is also a critical midstream activity to guarantee longevity and consistent performance in automotive environments.

Downstream analysis focuses on the distribution and sales channels, which primarily bifurcate into the Original Equipment Manufacturer (OEM) segment and the Aftermarket segment. The OEM channel involves direct supply of speakers and complete audio systems to vehicle manufacturers for integration during vehicle assembly. This requires robust logistics, just-in-time delivery systems, and deep contractual relationships, often involving co-development and long-term supply agreements. The aftermarket channel, conversely, targets individual consumers and independent installers seeking to upgrade, customize, or replace their vehicle's audio system. This channel utilizes a broad network of distributors, specialized car audio retailers, independent garages, and increasingly, e-commerce platforms. Both direct sales, particularly to major automotive clients, and indirect sales through a widespread retail and online network are crucial for market penetration. Effective marketing, after-sales support, and robust inventory management are paramount in the downstream segment to ensure product availability and customer satisfaction across a diverse global consumer base, influencing brand perception and market share significantly.

Automotive Speaker Market Potential Customers

The potential customer base for the automotive speaker market is expansive and segmented, reflecting the diverse applications and end-user requirements for in-vehicle audio solutions. The most substantial segment comprises Original Equipment Manufacturers (OEMs), which are global automotive brands responsible for the design, manufacturing, and assembly of new vehicles. These OEMs, including established players across luxury, premium, and mass-market segments, as well as burgeoning electric vehicle (EV) manufacturers, represent critical buyers. They integrate speakers as standard features or optional upgrades into their vehicle models, often seeking sophisticated, customized audio systems that align with their brand identity and vehicle acoustics. OEMs prioritize reliability, seamless integration with vehicle electronics, energy efficiency (especially for EVs), and adherence to strict automotive quality and safety standards, driving demand for innovative and high-performance speaker solutions from their suppliers.

The aftermarket segment constitutes another vital customer group, comprising individual vehicle owners who seek to enhance, customize, or replace their existing factory-installed audio systems. This segment is driven by a strong desire for superior sound quality, greater power output, personalized aesthetics, or specific functionalities that may not have been available in their original vehicle purchase. Aftermarket consumers range from dedicated audiophiles pursuing high-fidelity sound reproduction to casual listeners desiring a more robust bass response or clearer vocals. Additionally, this segment includes car enthusiasts who engage in vehicle customization, independent automotive repair shops, and specialized car audio installation centers that procure speaker components and systems for their clients. These buyers often value product versatility, ease of installation, and a wide range of options to suit diverse budgets and performance expectations, influencing the product offerings and distribution strategies of aftermarket manufacturers.

Beyond individual consumers and mainstream automotive manufacturers, other significant buyers include fleet operators and commercial vehicle manufacturers. Fleet operators, managing large numbers of commercial trucks, buses, or rental cars, require durable, reliable, and cost-effective audio systems primarily for communication and basic entertainment purposes. These buyers emphasize product longevity, ease of maintenance, and compliance with commercial vehicle regulations. Similarly, manufacturers of specialized vehicles, such as emergency vehicles, public transport, or heavy machinery, also represent a niche but important customer segment, often requiring highly robust and functional audio solutions tailored for specific operational environments. The diversity of these potential customers underscores the need for automotive speaker manufacturers to offer a broad portfolio of products, catering to varying levels of performance, integration complexity, and cost considerations, ensuring comprehensive market coverage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2032 | USD 9.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harman International (JBL, Infinity, Harman Kardon), Bose Corporation, Sony Corporation, Pioneer Corporation, Alpine Electronics, Focal-JMlab, Dynaudio, Bang & Olufsen, Bowers & Wilkins, Burmester Audiosysteme, Kenwood Corporation, JL Audio, Rockford Fosgate, Hertz (Elettromedia S.p.A.), Brax (Audiotec Fischer), McIntosh Laboratory, Panasonic Corporation, Klipsch Group, Inc., Denon (Sound United LLC), Philips (TP Vision) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Speaker Market Key Technology Landscape

The automotive speaker market is continually shaped by a dynamic and evolving technology landscape, with innovations focused on enhancing sound quality, ensuring durability under challenging automotive conditions, and facilitating seamless integration into sophisticated vehicle electronics. A foundational area of advancement lies in speaker materials science, where manufacturers are increasingly utilizing lightweight yet rigid cone materials such such as polypropylene, woven fiberglass, carbon fiber, Kevlar, and exotic composite blends. These materials reduce moving mass, improve transient response, and minimize distortion, contributing to clearer and more accurate sound reproduction. Concurrently, advancements in magnet technology, particularly the widespread adoption of high-energy neodymium magnets, allow for more powerful and compact speaker designs, crucial for optimizing space within vehicle doors and dashboards while maintaining high efficiency.

Beyond physical components, the digital realm plays a pivotal role. Digital Signal Processing (DSP) is a cornerstone technology, enabling sophisticated audio tuning, active crossovers, time alignment, and equalization that can compensate for the acoustically challenging environment of a car cabin. DSP allows for precise control over frequency response and sound staging, ensuring an optimized listening experience regardless of speaker placement or cabin geometry. Amplifier technologies have also seen significant progression, with Class D amplifiers gaining prominence due to their superior energy efficiency, reduced heat generation, and compact size—benefits that are particularly crucial for electric vehicles to conserve battery power and minimize weight. These amplifiers deliver high power output with minimal energy loss, providing robust sound even in demanding conditions. The integration of advanced power management systems further ensures consistent performance across varying electrical loads within the vehicle.

Emerging technologies are continually pushing the boundaries of in-car audio, focusing on creating truly immersive and personalized experiences. Multi-channel surround sound systems, incorporating numerous speakers strategically positioned throughout the cabin, deliver a rich, three-dimensional audio landscape. Active Noise Cancellation (ANC) technology, often integrated with the audio system, leverages microphones to detect and analyze ambient cabin noise (e.g., road noise, engine hum) and then generates precisely inverted sound waves through the speakers to neutralize these unwanted sounds, significantly improving clarity and passenger comfort. This technology relies on complex algorithms and precise speaker control to be effective. Furthermore, the development of lightweight and compact micro-speakers, alongside specialized drivers optimized for specific frequency ranges (e.g., ultra-thin subwoofers), allows for greater design flexibility and the creation of more sophisticated audio architectures. Wireless connectivity solutions like advanced Bluetooth codecs and Wi-Fi integration also play a crucial role, enabling seamless high-resolution audio streaming from personal devices and robust integration with modern infotainment platforms, ensuring future-proof audio capabilities. The convergence of these technological innovations is driving the automotive speaker market towards highly intelligent, adaptable, and emotionally engaging audio solutions.

Regional Highlights

- North America: This region represents a mature and highly developed market for automotive speakers, characterized by a significant consumer base that places high value on premium audio systems and advanced in-car entertainment. The strong presence of luxury vehicle manufacturers, coupled with a robust and active aftermarket segment, drives continuous innovation and high sales volumes. Consumers here often prioritize high-fidelity sound, powerful amplification, and seamless integration with connected car technologies. Early adoption of cutting-edge infotainment features and a culture of vehicle customization contribute significantly to the market's sustained growth and demand for high-end audio solutions.

- Europe: Europe is another key region with a strong emphasis on acoustic performance, sophisticated engineering, and adherence to stringent quality and environmental standards. Countries like Germany, the United Kingdom, and France are major contributors, driven by a rich automotive manufacturing heritage, particularly in luxury and performance vehicle segments. The accelerating growth of the electric vehicle market across Europe is a significant driver, pushing demand for lightweight, energy-efficient speaker solutions that do not compromise on sound quality. There is a strong focus on advanced sound processing technologies and integration with sophisticated vehicle safety systems.

- Asia Pacific (APAC): The Asia Pacific region stands out as the fastest-growing and most dynamic market for automotive speakers globally. This rapid expansion is primarily fueled by booming vehicle production, particularly in economic powerhouses like China, India, Japan, and South Korea, coupled with rapidly increasing disposable incomes and accelerating urbanization. The region is a significant hub for automotive manufacturing and technological innovation, experiencing high demand for both OEM-installed systems in new vehicles and a thriving aftermarket for upgrades and customization. The market here is characterized by a blend of demand for feature-rich, high-value audio solutions across all price points.

- Latin America: This region is an emerging market for automotive speakers, exhibiting steady growth influenced by increasing vehicle sales, improving economic conditions, and an expanding middle class. Brazil and Mexico are leading markets within the region, driven by both domestic automotive production and a growing appetite for imported vehicles equipped with better audio systems. Consumers in Latin America are increasingly seeking value-for-money products that offer enhanced sound quality and reliability. The aftermarket segment plays a crucial role in this region, catering to consumers looking to upgrade their vehicle's audio beyond factory specifications, with a strong focus on durability and performance in varying environmental conditions.

- Middle East and Africa (MEA): The MEA region represents a gradually expanding market for automotive speakers. Growth is primarily influenced by increasing sales of luxury vehicles, ongoing infrastructure development, and a rising interest in advanced vehicle technologies. The United Arab Emirates and Saudi Arabia are prominent markets within the MEA, showing a strong preference for high-performance and premium audio systems that complement the luxury vehicle segment. Opportunities exist in both the OEM and aftermarket sectors, with a growing demand for robust and sophisticated audio solutions tailored to regional consumer preferences and challenging climatic conditions. The market is also seeing increased penetration of connected car technologies, further driving demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Speaker Market.- Harman International (JBL, Infinity, Harman Kardon, Revel, Lexicon, Mark Levinson)

- Bose Corporation

- Sony Corporation

- Pioneer Corporation

- Alpine Electronics

- Focal-JMlab (Verve Acoustic SAS)

- Dynaudio A/S

- Bang & Olufsen A/S

- Bowers & Wilkins (Sound United LLC)

- Burmester Audiosysteme GmbH

- Kenwood Corporation (JVCKENWOOD Corporation)

- JL Audio, Inc.

- Rockford Corporation (Rockford Fosgate)

- Hertz (Elettromedia S.p.A.)

- Brax (Audiotec Fischer GmbH)

- McIntosh Laboratory, Inc.

- Panasonic Corporation

- Klipsch Group, Inc. (Voxx International)

- Denon (Sound United LLC)

- Philips (TP Vision)

Frequently Asked Questions

What is the projected growth rate for the Automotive Speaker Market?

The Automotive Speaker Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. This growth is primarily fueled by increasing consumer demand for advanced in-car audio systems, the rapid expansion of the electric vehicle segment, and continuous technological innovations in audio processing and connectivity.

What are the primary factors driving the Automotive Speaker Market?

Key drivers include the escalating consumer preference for premium sound quality and advanced infotainment features in vehicles, rising disposable incomes globally, the significant surge in global vehicle production, especially electric vehicles, and ongoing technological advancements in areas like Digital Signal Processing (DSP) and smart audio integration.

How does Artificial Intelligence (AI) influence the Automotive Speaker Market?

AI significantly impacts the market by enabling highly adaptive and personalized audio experiences. It facilitates real-time sound optimization based on cabin conditions, enhances voice command recognition for seamless infotainment control, allows for personalized sound zones, and integrates with ADAS for crucial safety alerts, ultimately creating a more intelligent and responsive in-car acoustic environment.

Which geographical regions are crucial for the Automotive Speaker Market's growth?

The Asia Pacific (APAC) region is a leading growth engine due to robust vehicle production and increasing consumer wealth. North America and Europe remain key contributors, driven by strong aftermarket demand and premium segment adoption. Latin America and MEA are also emerging with steady growth as vehicle ownership and upgrade desires increase.

What are the main segmentation categories within the Automotive Speaker Market?

The market is broadly segmented by speaker type (e.g., coaxial, component, subwoofers), vehicle type (passenger cars, commercial vehicles, electric vehicles), technology employed (e.g., dynamic, electrostatic), sales channel (Original Equipment Manufacturer OEM, aftermarket), and application (infotainment systems, communication systems, safety and alert systems).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager