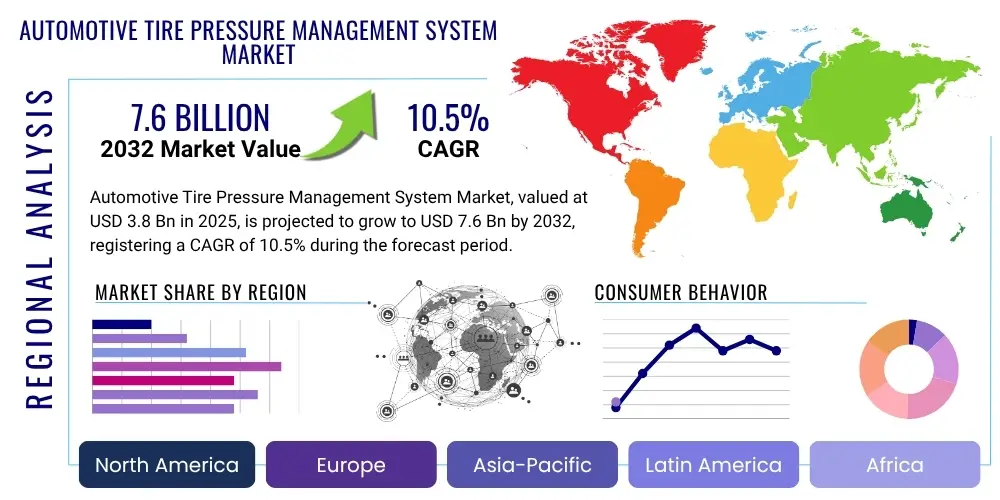

Automotive Tire Pressure Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431313 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Tire Pressure Management System Market Size

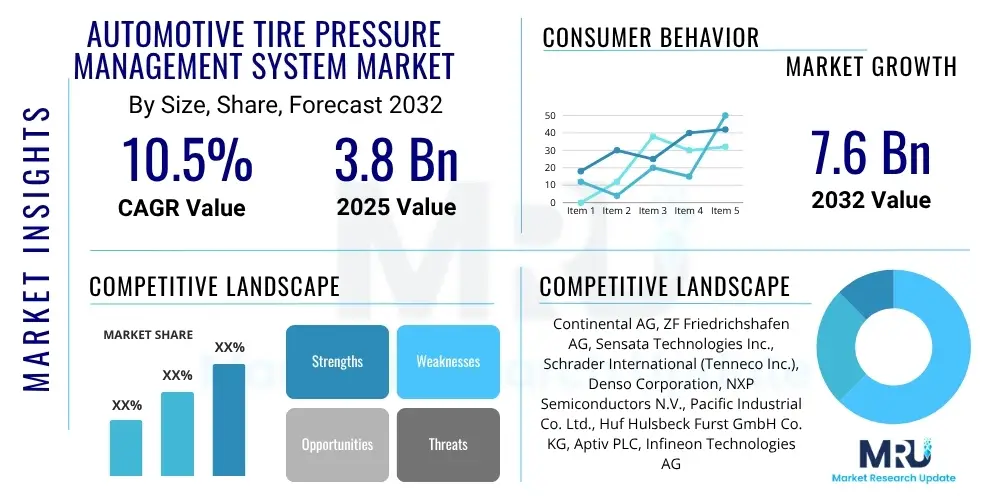

The Automotive Tire Pressure Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at $3.8 Billion in 2025 and is projected to reach $7.6 Billion by the end of the forecast period in 2032.

Automotive Tire Pressure Management System Market introduction

The Automotive Tire Pressure Management System (TPMS) market encompasses technologies designed to monitor the air pressure inside pneumatic tires on various vehicle types, alerting the driver when tire pressure falls below a predetermined threshold or when temperatures become abnormal. TPMS solutions are crucial for enhancing vehicle safety, improving fuel efficiency, and extending tire longevity. These systems primarily consist of direct and indirect variants. Direct TPMS utilizes sensors mounted inside each tire to directly measure pressure and temperature, transmitting this data wirelessly to the vehicle's onboard computer. Indirect TPMS, conversely, uses the vehicle's Anti-lock Braking System (ABS) and Electronic Stability Control (ESC) systems to monitor tire rotation speeds, inferring low pressure from deviations in rotational speed.

The core product offerings within this market include specialized sensors, electronic control units (ECUs), display units, and associated software and communication modules. Major applications span a wide range of automotive segments, from passenger cars and light commercial vehicles to heavy-duty trucks and buses, with increasing adoption in motorcycles. The fundamental benefits of TPMS are multi-faceted: it significantly reduces the risk of tire-related accidents by ensuring optimal tire inflation, contributes to better fuel economy by preventing underinflation, and minimizes tire wear, leading to reduced maintenance costs and environmental impact through prolonged tire life. Furthermore, properly inflated tires ensure consistent vehicle handling and braking performance, augmenting overall driving safety and control.

Key driving factors propelling the growth of the Automotive Tire Pressure Management System market include stringent safety regulations and mandates imposed by governments worldwide, such as the TREAD Act in the United States and similar legislation in the European Union, which make TPMS a mandatory feature in new vehicles. Beyond regulatory compliance, rising consumer awareness regarding vehicle safety, the growing emphasis on fuel efficiency to mitigate environmental concerns and operating costs, and continuous advancements in sensor technology and wireless communication are further accelerating market expansion. The increasing global production of automobiles, particularly in emerging economies, also provides a substantial foundation for market growth, as a higher volume of vehicles naturally translates to increased demand for essential safety features like TPMS.

Automotive Tire Pressure Management System Market Executive Summary

The Automotive Tire Pressure Management System market is experiencing robust growth driven by a confluence of evolving business trends, distinct regional developments, and dynamic segment shifts. Business trends indicate a strong move towards integrated vehicle safety systems, with TPMS becoming a critical component of broader ADAS (Advanced Driver Assistance Systems) packages. There is an increasing focus on developing smarter, more connected tire solutions that can provide predictive maintenance insights and integrate seamlessly with vehicle telematics. Electrification of the automotive industry is also influencing TPMS design, requiring energy-efficient sensors and systems that do not significantly impact battery range. The aftermarket segment continues to present lucrative opportunities for sensor replacement and upgrade, while OEM installations remain a dominant revenue stream.

Regionally, mature markets in North America and Europe are characterized by widespread adoption due to long-standing regulatory mandates, with growth primarily stemming from technological upgrades and integration. The Asia Pacific region stands out as the fastest-growing market, propelled by escalating vehicle production, rising disposable incomes, and the gradual implementation of new safety regulations in countries like China, India, and Japan. Latin America and the Middle East & Africa are emerging markets, showing increasing awareness and adoption, often influenced by global automotive safety standards and the influx of vehicles equipped with TPMS. Each region presents unique challenges and opportunities, from infrastructure readiness to consumer education levels, shaping the deployment and uptake of TPMS technologies.

Segmentation trends highlight the continued dominance of direct TPMS systems due to their superior accuracy and real-time data capabilities, although indirect TPMS maintains a niche for its cost-effectiveness and simpler integration. In terms of vehicle types, passenger vehicles remain the largest segment, but commercial vehicles are rapidly adopting TPMS for fleet management, fuel efficiency, and safety compliance, particularly in long-haul transport. The sales channel segmentation shows OEMs as the primary market for initial installations, while the aftermarket segment thrives on replacement sensors, calibration tools, and upgrades. Technology-wise, wheel-mounted sensors are prevalent, but advancements are exploring more integrated solutions, including valve-mounted and tread-mounted designs for enhanced data collection and durability. These trends collectively underscore a market moving towards greater sophistication, integration, and expanded application.

AI Impact Analysis on Automotive Tire Pressure Management System Market

Users frequently inquire about AI's potential to revolutionize TPMS by moving beyond basic pressure alerts to predictive maintenance and enhanced safety. Common questions revolve around how AI can improve the accuracy of tire health diagnostics, its role in predicting tire failures before they occur, the cybersecurity implications of connected AI-enabled TPMS, and how AI-driven TPMS will integrate with the evolving landscape of autonomous vehicles. There's also significant interest in the cost-benefit analysis of AI integration and the data requirements for effective AI implementation. Users are keen to understand if AI can make TPMS smarter, more proactive, and an integral part of a holistic vehicle health monitoring system, while also considering the challenges related to data privacy and the complexity of these advanced systems.

Based on these user concerns, the key themes indicate a strong expectation for AI to transform TPMS from a reactive warning system into a proactive, intelligent tire management solution. Users anticipate that AI will leverage sensor data more effectively, providing deeper insights into tire performance, wear patterns, and potential hazards. They envision a system capable of learning from driving conditions and user behavior to offer personalized tire maintenance recommendations. However, there are inherent concerns about the reliability and security of AI algorithms processing sensitive vehicle data, as well as the need for seamless interoperability with other vehicle systems. The drive for greater vehicle autonomy further amplifies the desire for TPMS that can contribute robustly to overall vehicle intelligence and decision-making.

The integration of AI into Automotive Tire Pressure Management Systems is poised to bring significant advancements, transitioning the technology from a basic alert mechanism to a sophisticated predictive and analytical tool. AI algorithms can process vast amounts of data from TPMS sensors, vehicle dynamics, and external environmental factors to offer unprecedented insights into tire condition and performance. This capability extends beyond simply detecting low pressure to identifying subtle anomalies that might indicate premature wear, structural damage, or impending failure, thereby enhancing proactive safety measures and optimizing tire life. Such intelligent systems will be critical for the next generation of smart and autonomous vehicles, providing essential data for informed decision-making and ensuring consistent vehicle stability and control.

- AI-enhanced predictive analytics for tire wear and structural integrity, moving beyond simple pressure monitoring.

- Improved anomaly detection, identifying subtle tire performance deviations indicative of potential issues.

- Seamless integration with Advanced Driver Assistance Systems (ADAS) and autonomous driving platforms for holistic vehicle intelligence.

- Optimization of tire performance and fuel efficiency through real-time, adaptive pressure recommendations.

- Development of self-calibrating and self-diagnosing TPMS units, reducing maintenance complexity.

- Enhanced cybersecurity measures required to protect sensitive data transmitted by AI-enabled connected TPMS.

- Data-driven insights for fleet management, enabling optimized maintenance schedules and reduced operational costs.

DRO & Impact Forces Of Automotive Tire Pressure Management System Market

The Automotive Tire Pressure Management System market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. Key drivers include stringent global safety regulations making TPMS mandatory, a rising focus on enhancing vehicle safety and reducing road accidents, and the imperative to improve fuel efficiency and minimize carbon emissions. Rapid technological advancements in sensor design, wireless communication, and battery life further stimulate market growth, alongside increasing consumer awareness regarding the benefits of proper tire maintenance. These drivers create a compelling demand for advanced TPMS solutions across various vehicle segments, pushing manufacturers to innovate and expand their product portfolios to meet regulatory and consumer expectations.

However, several restraints impede the market's full potential. The relatively high initial cost of direct TPMS systems, particularly in cost-sensitive markets, can deter adoption, especially in aftermarket scenarios. Maintenance and replacement costs for sensors, including battery replacement and recalibration after tire servicing, also pose challenges for consumers and service providers. Issues related to sensor compatibility across different vehicle models and aftermarket brands can create complexities. Moreover, in some developing regions, a lack of awareness about the long-term benefits of TPMS, combined with limited technical infrastructure for servicing and repairs, continues to act as a significant barrier to widespread market penetration and adoption.

Despite these restraints, significant opportunities exist for market expansion and innovation. The growing trend of vehicle connectivity and telematics offers a pathway for integrating TPMS data into broader vehicle health monitoring and remote diagnostic systems. The development of 'smart tires' equipped with embedded sensors that communicate directly with vehicle systems presents a future growth avenue. Furthermore, the burgeoning market for autonomous and electric vehicles requires highly reliable and precise tire data for optimal performance and safety, creating new demand for advanced TPMS solutions. The aftermarket segment also offers substantial opportunities for growth through the sale of replacement sensors, upgrade kits, and specialized diagnostic tools, particularly as the installed base of TPMS-equipped vehicles continues to expand globally.

Segmentation Analysis

The Automotive Tire Pressure Management System market is intricately segmented across various dimensions, including product type, vehicle type, sales channel, and underlying technology. This detailed segmentation provides a granular view of market dynamics, revealing specific growth avenues and competitive landscapes within each category. Understanding these segments is crucial for stakeholders to tailor their product development, marketing strategies, and distribution efforts effectively. Each segment contributes uniquely to the overall market valuation and growth trajectory, driven by distinct consumer needs, regulatory environments, and technological capabilities.

The differentiation between direct and indirect TPMS systems forms a primary segmentation axis, reflecting varying levels of accuracy, cost, and complexity. Direct TPMS, with its individual tire sensors, offers precise, real-time data, while indirect TPMS leverages existing vehicle systems for a more cost-effective solution. Vehicle type segmentation highlights the differing requirements and adoption rates across passenger cars, light commercial vehicles, and heavy commercial vehicles, each segment having unique operational demands influencing TPMS design and features. The sales channel delineates between OEM installations during vehicle manufacturing and the aftermarket segment, which caters to replacements, upgrades, and vehicles not initially equipped with TPMS, showcasing diverse market access strategies.

Furthermore, technology-based segmentation categorizes TPMS solutions by sensor mounting methods, such as wheel-mounted, valve-mounted, and increasingly, tread-mounted systems. These technological distinctions often dictate performance characteristics, durability, and ease of maintenance. The multifaceted nature of these segments underscores the diverse landscape of the Automotive Tire Pressure Management System market, necessitating a comprehensive approach to analysis and strategic planning. Recognizing the nuances within each segment allows businesses to identify unmet needs, capitalize on emerging trends, and navigate the competitive environment more successfully.

- By Type:

- Direct TPMS

- Indirect TPMS

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Sales Channel:

- OEM

- Aftermarket

- By Technology:

- Wheel mounted

- Valve mounted

- Tread mounted

Value Chain Analysis For Automotive Tire Pressure Management System Market

The value chain for the Automotive Tire Pressure Management System market encompasses a series of interconnected activities, starting from raw material procurement and component manufacturing, extending through assembly and vehicle integration, and culminating in distribution, sales, and aftermarket services. This complex chain involves various stakeholders, each adding value at different stages. Upstream activities are critical, involving the sourcing of highly specialized materials and the production of intricate electronic components that form the core of TPMS devices. This foundational stage dictates the quality, reliability, and cost-effectiveness of the final product, with significant reliance on semiconductor manufacturers and precision engineering firms.

Further along the chain, component manufacturers play a pivotal role, transforming raw materials and electronic parts into finished TPMS sensors, modules, and displays. These specialized manufacturers often engage in extensive research and development to enhance sensor accuracy, battery life, and communication protocols. The midstream of the value chain sees these components supplied to automotive original equipment manufacturers (OEMs) for integration into new vehicles during the assembly process. This OEM channel represents a significant portion of the market, driven by mandatory installation requirements and the push for integrated vehicle safety systems. The direct nature of these relationships often involves long-term contracts and rigorous quality control.

Downstream activities focus on reaching the end-user. For new vehicles, distribution occurs through the OEMs' extensive dealership networks. For the aftermarket, the distribution channel is more diverse, involving independent distributors, wholesale retailers, online e-commerce platforms, and a vast network of service centers and garages. Aftermarket sales are crucial for replacement sensors, diagnostic tools, and TPMS service kits. Both direct and indirect distribution strategies are employed; direct sales are predominant for OEM partnerships, while indirect channels leverage multiple intermediaries to ensure broad availability and accessibility for the aftermarket. This extensive network ensures that TPMS products and services are available throughout the vehicle's lifecycle, from initial purchase to ongoing maintenance and repair.

Automotive Tire Pressure Management System Market Potential Customers

The primary potential customers for the Automotive Tire Pressure Management System market are multifaceted, spanning across various sectors of the automotive industry. At the forefront are Automotive Original Equipment Manufacturers (OEMs), including global manufacturers of passenger cars, light commercial vehicles, heavy commercial vehicles, and increasingly, motorcycles. These OEMs represent the largest segment of the customer base, as TPMS is a mandatory installation in new vehicles in many key markets. Their demand is driven by regulatory compliance, brand reputation for safety, and the integration of TPMS into broader vehicle electronic architectures, requiring reliable, high-volume supply partnerships with TPMS manufacturers. The shift towards electric and autonomous vehicles also creates a specific demand for advanced, highly accurate, and energy-efficient TPMS solutions.

Another significant customer segment comprises fleet operators, including logistics companies, public transportation services, and ride-sharing providers. For these entities, the benefits of TPMS extend beyond individual vehicle safety to operational efficiency, cost management, and minimizing downtime. Properly maintained tires through TPMS contribute to optimized fuel consumption, reduced tire replacement costs, and improved overall fleet safety and reliability. Fleet managers are increasingly seeking integrated TPMS solutions that can feed data into their telematics and fleet management systems, enabling proactive maintenance scheduling and real-time monitoring of tire health across their entire vehicle pool, thus ensuring maximum uptime and profitability.

Finally, individual vehicle owners constitute a crucial segment within the aftermarket. While new vehicles come equipped with TPMS, there is a continuous demand for replacement sensors due to battery life expiration, damage during tire service, or wear and tear. Moreover, owners of older vehicles that were not originally equipped with TPMS may seek aftermarket solutions to enhance safety and fuel efficiency. This segment is reached through independent workshops, tire shops, automotive parts retailers, and online platforms. Tire manufacturers also represent an emerging customer base as they develop 'smart tires' that integrate TPMS functionality directly into the tire construction, aiming to offer a holistic tire-as-a-service solution with advanced monitoring capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $3.8 Billion |

| Market Forecast in 2032 | $7.6 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, ZF Friedrichshafen AG, Sensata Technologies Inc., Schrader International (Tenneco Inc.), Denso Corporation, NXP Semiconductors N.V., Pacific Industrial Co. Ltd., Huf Hulsbeck Furst GmbH Co. KG, Aptiv PLC, Infineon Technologies AG, Bartec USA LLC, Steelmate International Holdings Ltd., Stoneridge Inc., Lear Corporation, BorgWarner Inc., Allegro MicroSystems LLC, TE Connectivity Ltd., Standard Motor Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Tire Pressure Management System Market Key Technology Landscape

The Automotive Tire Pressure Management System market is characterized by a dynamic and evolving technology landscape, driven by the continuous pursuit of enhanced accuracy, reliability, and integration with broader vehicle systems. At the core are highly precise Micro-Electro-Mechanical Systems (MEMS) sensors, which are fundamental for accurately measuring tire pressure and temperature. These tiny, robust sensors enable the miniaturization and cost-effectiveness required for mass automotive deployment. Advances in low-power wireless communication protocols, primarily Radio Frequency (RF) and increasingly Bluetooth Low Energy (BLE), are crucial for efficiently transmitting real-time tire data from the sensors within the tires to the vehicle's Electronic Control Unit (ECU) without significant power drain, which is particularly important for battery life of the tire sensors.

Another critical technological area involves sophisticated battery technology, specifically miniaturized, long-lasting batteries that can power the in-tire sensors for the lifespan of the tire or vehicle. Innovations in energy harvesting, though still nascent for in-tire applications, present a promising future for eliminating battery replacement needs. Furthermore, the embedded software and firmware running on the TPMS ECU are becoming increasingly complex, enabling advanced functionalities such as auto-location, auto-learn, and more refined pressure threshold management. Integration capabilities are also paramount, with TPMS systems designed to seamlessly interface with vehicle data buses (like CAN bus), infotainment systems, and other safety features such as ABS, ESC, and increasingly, ADAS, to provide a holistic view of vehicle health and safety.

The broader technological trends impacting TPMS include the advent of the Internet of Things (IoT) and vehicle connectivity. Future TPMS solutions are leveraging IoT principles to enable cloud-based data analytics, allowing for predictive maintenance, remote diagnostics, and over-the-air updates. Sensor fusion techniques, combining TPMS data with information from other vehicle sensors, are enhancing the intelligence and reliability of tire health monitoring. The development of 'smart tires' with integrated sensors that monitor not just pressure and temperature but also tread depth, load, and road conditions, represents the cutting edge of this technological evolution, paving the way for more sophisticated tire management systems that contribute significantly to the safety and efficiency of next-generation vehicles, including autonomous platforms.

Regional Highlights

- North America: This region is a mature market for Automotive Tire Pressure Management Systems, primarily driven by the stringent TREAD Act in the United States, which mandated TPMS in all new passenger vehicles since 2007. The market is characterized by high adoption rates, a strong focus on advanced TPMS technologies, and a significant aftermarket for replacement sensors and diagnostic tools. Consumers in North America also show a high awareness of vehicle safety features, further sustaining demand.

- Europe: Similar to North America, Europe boasts a high penetration of TPMS due to EU regulations (e.g., EU 661/2009) that made TPMS mandatory for all new car models since 2012 and all new cars sold since 2014. The European market emphasizes both direct and indirect systems, with a strong inclination towards integrated vehicle safety and efficiency solutions. Germany, France, and the UK are key contributors, with robust automotive industries and a focus on premium vehicle segments.

- Asia Pacific (APAC): APAC is the fastest-growing market for Automotive Tire Pressure Management Systems, fueled by burgeoning automotive production, increasing disposable incomes, and evolving safety regulations in countries like China, India, Japan, and South Korea. While regulations are not as uniformly stringent as in Western markets, there is a clear trend towards adoption due to rising consumer awareness and the influence of global automotive standards. China, in particular, represents a massive growth opportunity due to its sheer market size and recent regulatory push for TPMS.

- Latin America: This region is an emerging market for TPMS, showing gradual but consistent growth. Countries like Brazil and Mexico are leading the adoption, driven by increasing vehicle sales, improving road safety initiatives, and the influence of international automotive manufacturers. While regulatory mandates are not as widespread, the benefits of TPMS in terms of safety and fuel efficiency are increasingly recognized by consumers and fleet operators.

- Middle East and Africa (MEA): The MEA region is experiencing nascent growth in the TPMS market. Adoption is primarily influenced by the import of TPMS-equipped vehicles from other regions and a growing awareness of vehicle safety standards. The commercial vehicle sector, particularly in countries with significant logistics and transportation activities, shows promising potential for TPMS integration to improve fleet management and operational efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Tire Pressure Management System Market.- Continental AG

- ZF Friedrichshafen AG

- Sensata Technologies Inc.

- Schrader International (Tenneco Inc.)

- Denso Corporation

- NXP Semiconductors N.V.

- Pacific Industrial Co. Ltd.

- Huf Hulsbeck Furst GmbH Co. KG

- Aptiv PLC

- Infineon Technologies AG

- Bartec USA LLC

- Steelmate International Holdings Ltd.

- Stoneridge Inc.

- Lear Corporation

- BorgWarner Inc.

- Allegro MicroSystems LLC

- TE Connectivity Ltd.

- Standard Motor Products Inc.

Frequently Asked Questions

What is the primary purpose of an Automotive Tire Pressure Management System?

The primary purpose of an Automotive Tire Pressure Management System (TPMS) is to continuously monitor the air pressure within vehicle tires and alert the driver if pressure drops to an unsafe level, thereby enhancing vehicle safety, fuel efficiency, and tire longevity.

What is the difference between direct and indirect TPMS?

Direct TPMS uses individual sensors inside each tire to directly measure pressure and temperature, providing highly accurate, real-time data. Indirect TPMS, conversely, utilizes the vehicle's ABS/ESC systems to monitor tire rotation speeds and infer low pressure based on rotational deviations, offering a more cost-effective solution.

Are TPMS systems mandatory in new vehicles?

Yes, TPMS systems are mandatory in new passenger vehicles in many major markets, including the United States (under the TREAD Act) and the European Union (EU 661/2009), due to regulations aimed at improving road safety and fuel economy.

How does AI impact the future of TPMS?

AI is expected to transform TPMS into a predictive maintenance tool, enabling advanced analytics for tire wear, early anomaly detection, and integration with autonomous driving systems for optimized performance and enhanced safety, moving beyond basic pressure alerts to proactive tire health management.

What are the main benefits of using TPMS?

The main benefits of using TPMS include significantly improved vehicle safety by preventing tire-related accidents, enhanced fuel efficiency due to proper tire inflation, extended tire lifespan reducing replacement costs, and better vehicle handling and braking performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager