Automotive Tires E-Retailing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429736 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Tires E-Retailing Market Size

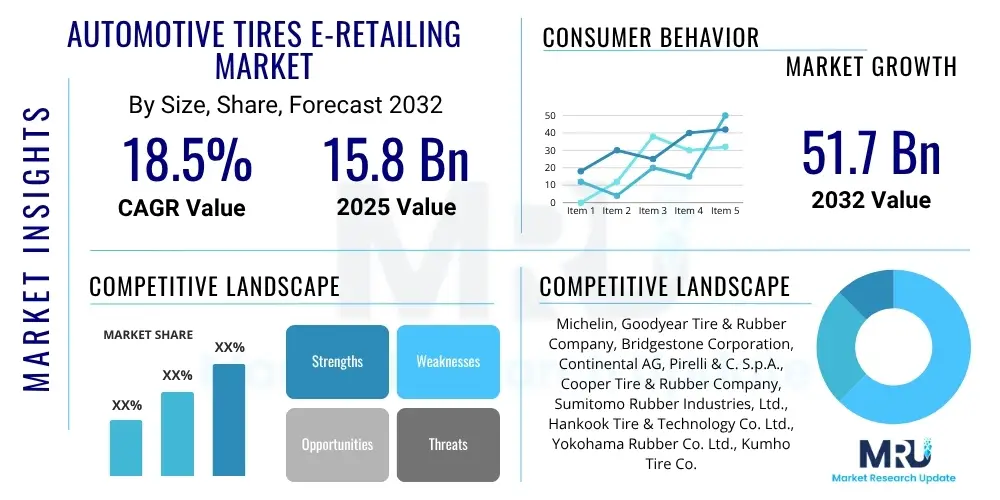

The Automotive Tires E-Retailing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 15.8 billion in 2025 and is projected to reach USD 51.7 billion by the end of the forecast period in 2032.

Automotive Tires E-Retailing Market introduction

The Automotive Tires E-Retailing Market encompasses the online sale of vehicle tires to end-users through various digital platforms, including manufacturer websites, third-party e-commerce sites, and specialized online tire retailers. This market leverages the widespread adoption of e-commerce and digital payment solutions to offer consumers a convenient and often more competitive alternative to traditional brick-and-mortar tire shops. The product description for this market primarily focuses on a vast array of tire types, sizes, and brands suitable for various vehicle categories, ranging from passenger cars and light trucks to commercial vehicles and motorcycles.

Major applications for automotive tires sold online include replacement tires for existing vehicles, performance upgrades, and specialized tires for specific driving conditions such as winter, all-season, or off-road use. The convenience of browsing extensive catalogs, comparing prices, reading reviews, and scheduling installation at a preferred location directly online constitutes significant benefits for consumers. This digital transformation simplifies the traditionally complex and time-consuming process of tire purchasing, offering unparalleled access to a global inventory.

Key driving factors propelling the growth of the Automotive Tires E-Retailing Market include the increasing internet penetration and smartphone usage globally, rising consumer preference for online shopping due to convenience and price transparency, and advancements in logistics and supply chain management making tire delivery and installation more seamless. Furthermore, the growing awareness among consumers about the importance of timely tire replacement for vehicle safety and performance, coupled with the competitive pricing often found online, further stimulates market expansion.

Automotive Tires E-Retailing Market Executive Summary

The Automotive Tires E-Retailing Market is currently undergoing a significant transformation driven by evolving consumer purchasing habits and technological advancements. Business trends indicate a strong shift towards digital channels for tire sales, with traditional tire manufacturers and retailers investing heavily in their online presence and direct-to-consumer models. This includes developing user-friendly e-commerce platforms, integrating virtual try-on tools, and offering comprehensive installation services through partnerships or owned service centers. The focus is increasingly on providing a holistic online buying experience that rivals or surpasses the convenience of physical stores, encompassing everything from selection to post-purchase support.

Regional trends reveal varying paces of adoption and growth across different geographies. North America and Europe are mature markets with high internet penetration and established e-commerce infrastructure, showing steady growth driven by convenience and wider product availability. The Asia Pacific region, particularly countries like China and India, is emerging as a high-growth market, propelled by a rapidly expanding middle class, increasing vehicle ownership, and burgeoning e-commerce ecosystem. Latin America and the Middle East and Africa also present significant opportunities, albeit with market development at earlier stages, influenced by improving digital infrastructure and evolving consumer trust in online transactions.

Segment trends highlight strong performance in the passenger vehicle tire segment, which constitutes the largest share due to high consumer volumes. However, specialized tire segments, such as those for electric vehicles (EVs) and high-performance vehicles, are demonstrating accelerated growth as vehicle technology advances and consumer demands diversify. The distribution channel segment is seeing an intense battle between third-party online retailers, who offer extensive choices and competitive pricing, and manufacturer-owned online stores, which capitalize on brand loyalty and integrated service networks. This competitive landscape is fostering innovation in delivery, installation, and customer service models, ensuring continued market dynamism.

AI Impact Analysis on Automotive Tires E-Retailing Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize the online tire purchasing experience, questioning its role in personalization, predictive maintenance, and operational efficiency. Common concerns revolve around the accuracy of AI recommendations for tire selection, the security of personal data used for customization, and the potential for AI to streamline the complex logistics of tire delivery and installation. Expectations are high for AI to provide more intuitive browsing, smarter fitting tools, and proactive customer support, ultimately simplifying the decision-making process for consumers and enhancing the profitability for retailers by reducing returns and improving inventory management.

- AI-driven personalized product recommendations based on vehicle type, driving habits, and past purchases.

- Predictive analytics for inventory management, optimizing stock levels and reducing warehousing costs.

- Enhanced customer support through AI-powered chatbots and virtual assistants for instant query resolution.

- Virtual try-on tools leveraging augmented reality (AR) and AI for realistic visualization of tires on vehicles.

- Optimization of supply chain and logistics, including route planning and delivery scheduling, using AI algorithms.

- Fraud detection and cybersecurity enhancements to protect online transactions and customer data.

- Analysis of user reviews and feedback to identify trends, improve product offerings, and refine marketing strategies.

- Automated pricing adjustments based on real-time market demand, competitor pricing, and inventory levels.

- Development of smart tire sensors that communicate data to AI systems for proactive maintenance suggestions.

- Improved search engine results and website navigation through natural language processing (NLP) and machine learning.

- Personalized marketing campaigns and dynamic content delivery to specific customer segments.

- Quality control and defect detection in manufacturing processes, indirectly impacting online sales through product reliability.

- Efficient processing of warranty claims and returns through automated AI systems.

- Integration with smart vehicle platforms for seamless tire monitoring and replacement alerts.

- Demand forecasting for regional markets, aiding in strategic expansion and localized inventory.

DRO & Impact Forces Of Automotive Tires E-Retailing Market

The Automotive Tires E-Retailing Market is significantly shaped by a confluence of driving factors, restrictive elements, emerging opportunities, and pervasive impact forces. Key drivers include the ever-expanding global e-commerce infrastructure, offering unparalleled convenience and accessibility for consumers to purchase tires from anywhere, at any time. The increasing digital literacy of populations, combined with a preference for transparent pricing and a wider selection often unavailable in physical stores, further propels market growth. Advancements in logistics and installation services, making the online tire buying experience seamless from purchase to fitting, also act as a strong impetus.

Conversely, the market faces several restraints. One major challenge is the inherent requirement for physical installation, which necessitates partnerships with local service centers or the establishment of proprietary installation networks, adding complexity to the online model. Consumer skepticism regarding the fitment accuracy of online purchases, lack of immediate expert advice compared to in-store interactions, and potential cybersecurity concerns related to online payments and data privacy also hinder growth. High shipping costs for bulky items like tires and the environmental impact of increased transportation further represent significant hurdles.

Opportunities for market expansion are abundant, particularly in emerging economies with rapidly growing internet penetration and vehicle ownership. The rise of electric vehicles (EVs) presents a niche for specialized EV tire e-retailing, offering performance-optimized and quieter options. The integration of augmented reality (AR) for virtual tire fitting, personalized recommendations through artificial intelligence (AI), and the development of subscription-based tire services could unlock new revenue streams. Moreover, partnerships between online retailers and vehicle manufacturers, along with expanded offerings of ancillary services like roadside assistance or tire maintenance plans, provide fertile ground for innovation. These opportunities, coupled with the overarching impact forces of digital transformation, shifting consumer behaviors towards online channels, and continuous technological advancements in tire manufacturing and e-commerce platforms, collectively dictate the trajectory and competitive dynamics of the Automotive Tires E-Retailing Market.

Segmentation Analysis

The Automotive Tires E-Retailing Market is comprehensively segmented to provide a detailed understanding of its diverse components and consumer bases. These segmentations allow for targeted marketing strategies, specialized product development, and precise competitive analysis within specific niches, reflecting the varied needs and preferences of different vehicle owners and operational requirements.

- By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers (Motorcycles, Scooters)

- Off-road Vehicles

- By Tire Type

- Radial Tires

- Bias-ply Tires

- Run-flat Tires

- Winter Tires

- All-season Tires

- Summer Tires

- Specialty Tires (e.g., EV specific, Off-road)

- By Rim Size

- Up to 15 inches

- 16 to 18 inches

- 19 to 21 inches

- Above 21 inches

- By End-Use

- Replacement Market

- Original Equipment Manufacturer (OEM) Market

- By Distribution Channel

- Third-party Online Retailers (e.g., Amazon, eBay, dedicated tire sites)

- Manufacturer-owned Online Stores (e.g., Goodyear.com, MichelinMan.com)

- Direct-to-Consumer (DTC) Brands

- Online Marketplaces specializing in automotive parts

Value Chain Analysis For Automotive Tires E-Retailing Market

The value chain for the Automotive Tires E-Retailing Market is a complex network of activities that spans from raw material sourcing to final tire installation, with a strong emphasis on digital integration. Upstream analysis begins with raw material suppliers providing natural rubber, synthetic rubber, carbon black, steel, and textiles to tire manufacturers. These manufacturers, such as Michelin, Goodyear, and Bridgestone, then engage in the design, development, and production of a wide array of tires. This initial stage is crucial for ensuring product quality, performance characteristics, and adherence to safety standards, which are foundational for consumer trust in online purchases.

The midstream segment of the value chain is where e-retailing primarily operates. Tire manufacturers can distribute directly through their own online platforms, serving as a direct channel from producer to consumer. Alternatively, they supply tires to large third-party online retailers like Amazon or dedicated online tire stores such as Tire Rack and SimpleTire. These online platforms handle digital storefront management, inventory display, pricing, order processing, and secure payment gateways. They also play a critical role in providing comprehensive product information, customer reviews, and virtual tools to assist buyers in making informed decisions. The efficiency of these online platforms directly impacts the user experience and sales volume.

Downstream analysis focuses on the logistics, delivery, and installation services that complete the transaction for the end-user. Once an order is placed online, effective supply chain management ensures the tires are transported from warehouses to the customer's specified location. This can be direct delivery to a consumer's home or, more commonly, to a network of affiliated or partner installation centers. The distribution channel encompasses both direct methods, where manufacturers sell directly to consumers via their websites, and indirect methods, involving third-party online retailers and marketplaces that act as intermediaries. The success of the e-retailing model hinges on the seamless integration of these logistics and installation partners, ensuring convenience and customer satisfaction from the virtual cart to the physical road.

Automotive Tires E-Retailing Market Potential Customers

The primary potential customers for the Automotive Tires E-Retailing Market are diverse, encompassing a wide range of end-users who own or manage vehicles and seek convenient, transparent, and often cost-effective solutions for tire procurement. Individual vehicle owners, including passenger car drivers, light truck owners, and motorcycle enthusiasts, represent the largest segment. These buyers are typically looking for replacement tires due to wear and tear, seeking upgrades for performance or specific seasonal conditions, or needing new tires for a recently acquired vehicle. Their purchasing decisions are often influenced by brand reputation, price comparisons, convenience of online browsing, and the availability of trusted installation services.

Another significant customer segment includes fleet managers and small to medium-sized businesses that operate multiple vehicles, such as delivery services, taxi companies, or local utility providers. For these buyers, efficiency in purchasing, bulk discounts, standardized billing, and reliable supply chain management are crucial. E-retailing platforms offer the advantage of streamlined procurement processes, enabling managers to manage tire inventory and replacement schedules more effectively across their fleet, often with tailored business accounts and dedicated support.

Furthermore, automotive workshops, independent mechanics, and small dealerships also represent potential customers, using e-retailing as a sourcing channel for tires they install for their own clients. While some may have direct supplier relationships, online platforms provide access to a broader range of brands and tire types that might not be readily available through their traditional distributors, allowing them to better serve diverse customer needs and vehicle models. The overall appeal for all these customer groups lies in the efficiency, extensive selection, competitive pricing, and increasingly sophisticated integrated services that the Automotive Tires E-Retailing Market provides, moving beyond just a product transaction to a complete solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 billion |

| Market Forecast in 2032 | USD 51.7 billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Goodyear Tire & Rubber Company, Bridgestone Corporation, Continental AG, Pirelli & C. S.p.A., Cooper Tire & Rubber Company, Sumitomo Rubber Industries, Ltd., Hankook Tire & Technology Co. Ltd., Yokohama Rubber Co. Ltd., Kumho Tire Co. Inc., Toyo Tire Corporation, Apollo Tyres Ltd., MRF Tyres, CEAT Ltd., Nexen Tire Corporation, Tire Rack, SimpleTire, Discount Tire Direct, Amazon.com, eBay Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Tires E-Retailing Market Key Technology Landscape

The Automotive Tires E-Retailing Market relies heavily on a sophisticated array of technologies to deliver a seamless and efficient customer experience. Central to this landscape are robust e-commerce platforms that provide intuitive user interfaces, comprehensive product catalogs, secure payment gateways, and efficient order management systems. These platforms often integrate advanced search functionalities, filtering options, and comparison tools, allowing consumers to easily navigate through thousands of tire options. The underlying architecture frequently leverages cloud computing for scalability and reliability, ensuring consistent performance even during peak demand periods.

Beyond core e-commerce infrastructure, Artificial Intelligence (AI) and Machine Learning (ML) play a crucial role in personalizing the shopping experience. AI algorithms analyze browsing history, vehicle specifications, driving habits, and regional weather patterns to offer tailored tire recommendations, optimizing fitment and performance. Furthermore, AI-powered chatbots and virtual assistants provide instant customer support, answering queries about tire compatibility, installation, and delivery statuses, thereby enhancing customer satisfaction and reducing call center loads. Data analytics tools are also paramount, enabling retailers to gain insights into consumer behavior, market trends, and inventory performance for strategic decision-making.

Augmented Reality (AR) and Virtual Reality (VR) technologies are emerging as powerful tools, allowing customers to virtually "try on" tires on their own vehicles before purchase, which significantly reduces uncertainty and improves confidence in selection. Advanced logistics and supply chain management software, including warehouse management systems (WMS) and transportation management systems (TMS), are essential for optimizing inventory, tracking shipments, and coordinating with installation partners. This technological ecosystem collectively enables the Automotive Tires E-Retailing Market to offer a dynamic, data-driven, and highly convenient purchasing journey, continuously evolving to meet consumer expectations for speed, accuracy, and personalized service.

Regional Highlights

- North America: This region is a mature and leading market for automotive tires e-retailing, characterized by high internet penetration, a strong e-commerce culture, and advanced logistics infrastructure. The United States, in particular, showcases significant market activity due to a large vehicle parc and consumer readiness to purchase automotive components online. Canada also demonstrates steady growth.

- Europe: The European market is robust, with countries like Germany, the UK, and France showing high adoption rates for online tire purchases. Regulatory frameworks concerning tire labeling and environmental standards also influence consumer choices, often leading them to online platforms for detailed information and compliant options.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, increasing disposable incomes, a burgeoning middle class, and surging vehicle ownership in countries like China, India, and Japan. The widespread use of mobile internet and the development of local e-commerce giants contribute significantly to market expansion.

- Latin America: This region presents an emerging market with substantial growth potential, albeit from a smaller base. Countries such as Brazil and Mexico are witnessing increasing internet penetration and improvements in digital payment systems, gradually shifting consumer preferences towards online automotive purchases.

- Middle East and Africa (MEA): The MEA market is evolving, with growth concentrated in wealthier Gulf Cooperation Council (GCC) countries where digital infrastructure is more developed. Expanding internet access and increasing vehicle sales are fostering the adoption of e-retailing for tires, though logistics and payment infrastructure are still developing in many parts of Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Tires E-Retailing Market.- Michelin

- Goodyear Tire & Rubber Company

- Bridgestone Corporation

- Continental AG

- Pirelli & C. S.p.A.

- Cooper Tire & Rubber Company

- Sumitomo Rubber Industries, Ltd.

- Hankook Tire & Technology Co. Ltd.

- Yokohama Rubber Co. Ltd.

- Kumho Tire Co. Inc.

- Toyo Tire Corporation

- Apollo Tyres Ltd.

- MRF Tyres

- CEAT Ltd.

- Nexen Tire Corporation

- Tire Rack

- SimpleTire

- Discount Tire Direct

- Amazon.com

- eBay Inc.

Frequently Asked Questions

Is it safe to buy automotive tires online?

Yes, buying automotive tires online from reputable retailers is generally safe and secure. Established e-retailers offer extensive product details, secure payment gateways, clear return policies, and often partnerships with local installers, ensuring a reliable purchase and fitting process.

How do I choose the correct tire size online?

To choose the correct tire size online, you should refer to your vehicle's owner's manual, the tire information placard on the driver's side door jamb, or the sidewall of your existing tires. Most online retailers also offer vehicle fitment tools where you input your car's make, model, and year to find compatible tires.

What is the process for online tire installation?

The online tire installation process typically involves purchasing tires from an e-retailer who then ships them directly to a local, affiliated installation center. You schedule an appointment with the center, and they install the tires upon arrival. Some retailers also offer mobile installation services at your home or workplace.

Are online tire prices generally cheaper than in-store?

Online tire prices can often be more competitive than in-store prices due to lower overheads for e-retailers and the ease of comparing multiple vendors. However, it's essential to factor in shipping costs and potential installation fees when comparing total costs, as these can vary.

What should I do if my online-purchased tires are damaged or incorrect?

If your online-purchased tires are damaged or incorrect, contact the e-retailer's customer service immediately. Reputable retailers have clear return and exchange policies for such situations. Ensure you inspect the tires upon delivery and before installation to identify any issues promptly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager