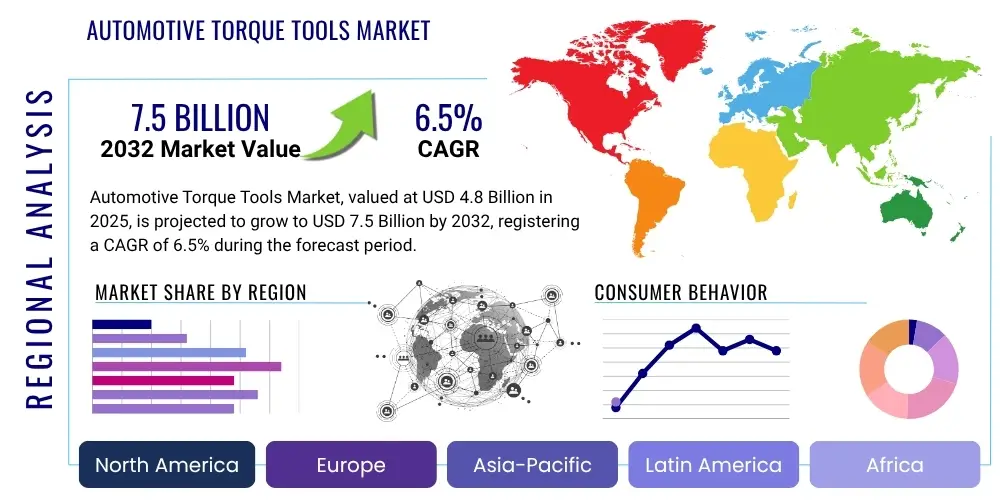

Automotive Torque Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429098 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Torque Tools Market Size

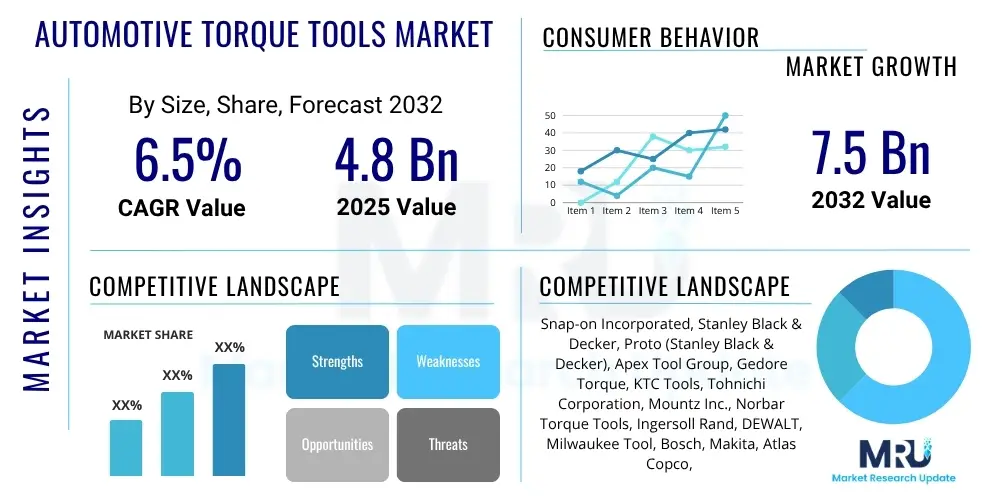

The Automotive Torque Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at $4.8 Billion in 2025 and is projected to reach $7.5 Billion by the end of the forecast period in 2032.

Automotive Torque Tools Market introduction

The Automotive Torque Tools Market encompasses a wide range of specialized instruments designed to apply and measure torque to fasteners in various automotive applications. These tools are indispensable across the entire automotive lifecycle, from original equipment manufacturing (OEM) assembly lines to aftermarket maintenance and repair services. Products within this market segment include manual torque wrenches, pneumatic and electric torque screwdrivers, hydraulic torque multipliers, and advanced digital torque analysis systems, all crucial for ensuring the structural integrity, safety, and performance of vehicles. The core function of these tools is to ensure that bolts, nuts, and other fasteners are tightened to precise specifications, preventing both under-tightening, which can lead to component failure, and over-tightening, which can damage parts or lead to material fatigue.

Major applications for automotive torque tools span engine assembly, chassis construction, wheel fastening, interior component installation, and critical safety systems. The benefits derived from the accurate use of these tools are multifaceted, including enhanced vehicle safety, improved operational efficiency, prolonged component lifespan, and compliance with stringent industry standards and regulatory requirements. Precise torque application is paramount in preventing accidents, optimizing vehicle performance, and reducing warranty claims. The automotive industry's continuous evolution, marked by increasing complexity in vehicle design, the advent of electric vehicles (EVs), and stricter quality control mandates, significantly drives the demand for sophisticated and reliable torque tools.

Driving factors for market expansion include the global increase in vehicle production and sales, particularly in emerging economies, alongside the growing emphasis on vehicle safety and reliability. Furthermore, the rising complexity of modern vehicles, which incorporate a multitude of electronic components and lightweight materials, necessitates increasingly precise fastening techniques. The shift towards automated and semi-automated assembly lines also fuels the demand for smart and integrated torque solutions that offer data logging, traceability, and enhanced ergonomics for operators. These factors collectively underscore the critical role of advanced torque tools in maintaining high standards across the automotive value chain.

Automotive Torque Tools Market Executive Summary

The Automotive Torque Tools Market is experiencing robust growth, driven by a confluence of evolving business trends, significant regional expansion, and dynamic segment developments. Key business trends include the accelerating adoption of automation and digitalization in manufacturing processes, leading to an increased demand for smart torque tools capable of data collection, precision control, and seamless integration into Industry 4.0 ecosystems. Original equipment manufacturers (OEMs) are prioritizing advanced torque solutions to meet stringent quality control standards and enhance assembly line efficiency, while the aftermarket segment focuses on durable, user-friendly tools for a wide array of repair and maintenance tasks. Companies are also investing in research and development to introduce ergonomic designs and advanced materials that improve tool performance and operator comfort.

Regionally, the market exhibits diverse growth patterns. Asia Pacific, particularly countries like China, India, and Japan, is emerging as a dominant force due to its burgeoning automotive manufacturing base, rising vehicle sales, and increasing investments in advanced production technologies. North America and Europe continue to be significant markets, characterized by stringent safety regulations, a strong focus on premium vehicle segments, and high adoption rates of sophisticated, technologically advanced torque tools. Latin America, the Middle East, and Africa are showing promising growth, attributed to industrialization initiatives, expanding automotive fleets, and a growing emphasis on professional automotive services. Each region presents unique opportunities and challenges influenced by local economic conditions, regulatory landscapes, and consumer preferences.

Segment trends highlight a noticeable shift towards digital and electric torque tools, which offer superior accuracy, repeatability, and data logging capabilities compared to traditional manual and pneumatic options. The electric vehicle (EV) segment is a significant growth catalyst, as EV manufacturing requires extremely precise torque specifications for battery assembly, motor components, and lightweight chassis structures. Manual torque tools continue to hold a substantial market share due to their cost-effectiveness and versatility, especially in smaller workshops and for specific repair tasks. However, the overall trajectory points towards intelligent, connected torque solutions that contribute to predictive maintenance, enhanced quality assurance, and greater operational transparency throughout the automotive industry value chain.

AI Impact Analysis on Automotive Torque Tools Market

User questions related to the impact of AI on the Automotive Torque Tools Market frequently revolve around how artificial intelligence can enhance precision, automate processes, predict maintenance needs, and integrate with smart factory ecosystems. Users are keen to understand if AI will lead to fully autonomous torque application, improve defect detection, or provide real-time feedback for operators. There is significant interest in AI's potential to analyze torque data for quality control, identify trends in fastening failures, and optimize tool calibration schedules, thereby reducing downtime and ensuring consistent performance. Concerns often include the cost of implementing AI-powered systems, the need for specialized training, and data security implications, balanced by expectations of significant gains in efficiency, accuracy, and overall product quality.

The integration of AI in automotive torque tools is poised to revolutionize precision fastening, moving beyond mere mechanical application to intelligent, adaptive systems. AI algorithms can analyze vast datasets from torque applications, including environmental conditions, operator performance, and fastener characteristics, to predict optimal torque settings and identify potential issues before they escalate. This predictive capability extends to tool maintenance, where AI can forecast when a tool requires calibration or service, minimizing unscheduled downtime and extending equipment lifespan. Furthermore, AI-powered vision systems can inspect fastener quality and placement, ensuring adherence to design specifications with unparalleled accuracy, significantly enhancing quality control throughout the assembly process.

Expectations for AI's influence are high, focusing on achieving zero-defect fastening, enabling highly customized torque application for diverse materials and components, and creating a more proactive and data-driven approach to automotive manufacturing and maintenance. The ability of AI to learn from past operations and adapt to changing conditions offers a path towards more resilient and efficient production systems. While initial investment and the need for new skill sets present challenges, the long-term benefits in terms of enhanced safety, reduced waste, and improved vehicle performance are driving sustained interest and adoption of AI-enabled solutions within the automotive torque tools sector.

- Enhanced precision and repeatability through adaptive torque application.

- Predictive maintenance for torque tools, reducing downtime and costs.

- Real-time quality control and anomaly detection in fastening processes.

- Automated data analysis for process optimization and traceability.

- Integration with smart factory systems for seamless communication and control.

- Augmented reality guidance for operators, improving accuracy and training.

- Optimized tool calibration schedules based on usage patterns and performance data.

- Improved defect detection in fastener assembly.

DRO & Impact Forces Of Automotive Torque Tools Market

The Automotive Torque Tools Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces. Key drivers include the consistent growth in global automotive production and sales, particularly fueled by expanding middle-class populations in emerging economies and the increasing demand for personal mobility. Stringent safety regulations and quality standards imposed by regulatory bodies worldwide compel automotive manufacturers and service providers to adopt high-precision torque tools to ensure vehicle integrity and reduce warranty claims. Moreover, the rapid technological advancements in vehicle design, such as the widespread adoption of lightweight materials, complex electronic systems, and advanced driver-assistance systems (ADAS), necessitate even finer control over fastening processes, thereby boosting the demand for sophisticated torque solutions. The burgeoning electric vehicle (EV) market further acts as a powerful driver, as EV battery packs and motors require extremely precise and consistent torque application for optimal performance and safety, creating new niches for specialized tools.

Conversely, several restraints impede the market's full potential. The high initial investment required for advanced digital, hydraulic, and automated torque tools can be a significant barrier for smaller workshops and independent service providers, particularly in cost-sensitive markets. Furthermore, the operational and maintenance costs associated with calibration, software updates, and repairs for these complex tools can add to the total cost of ownership. A prevalent challenge is the lack of a highly skilled workforce capable of operating, calibrating, and troubleshooting advanced torque systems, which can hinder the seamless adoption of newer technologies. Market fragmentation, with numerous local and international players offering a wide range of products, can also lead to intense price competition, impacting profit margins for manufacturers. Economic slowdowns and geopolitical uncertainties, which often lead to fluctuations in automotive sales and manufacturing output, pose additional risks to market stability.

Opportunities for growth are abundant within the Automotive Torque Tools Market. The rapid expansion of the electric vehicle (EV) segment globally presents a substantial growth avenue, as EV components demand specialized and ultra-precise torque applications. The increasing demand for IoT-enabled and smart torque tools that can communicate data, integrate with manufacturing execution systems (MES), and offer real-time feedback presents significant innovation potential. Expansion into emerging economies with growing automotive industries and increasing vehicle parc offers new market penetration strategies. Furthermore, the integration of torque tools with Industry 4.0 initiatives, promoting smart factories and connected ecosystems, opens doors for advanced automation and data-driven process optimization. Customization of tools for specific automotive applications and the development of value-added services such as remote diagnostics, calibration, and training programs also represent compelling growth opportunities. The overarching impact forces include ongoing technological advancements that continually redefine precision and efficiency, evolving regulatory pressures that mandate higher safety and quality standards, the cyclical nature of economic growth affecting consumer spending and industrial investment, a highly competitive landscape fostering innovation, and potential supply chain disruptions that can influence production and distribution capabilities.

Segmentation Analysis

The Automotive Torque Tools Market is comprehensively segmented based on various critical parameters, providing a detailed understanding of its diverse landscape and market dynamics. These segmentations allow for a granular analysis of product types, operational mechanisms, primary end-users, and specific automotive applications, enabling stakeholders to identify key growth areas and formulate targeted strategies. The market can be broadly categorized by the type of tool, the method of operation, the specific industry end-users, and the particular automotive applications where these tools are predominantly utilized. This multi-dimensional approach to segmentation reflects the intricate requirements and varied demands across the entire automotive value chain, from initial manufacturing to long-term maintenance and repair.

Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, regulatory mandates, and market preferences. For instance, the segmentation by tool type distinguishes between traditional manual tools and more advanced digital, pneumatic, electric, and hydraulic solutions, each catering to different levels of precision, power, and automation needs. Operational segmentation further refines this by differentiating between manually operated tools and power-driven alternatives, highlighting the industry's shift towards increased efficiency and reduced operator fatigue. The end-user analysis provides insights into the demand patterns from OEMs, aftermarket service providers, and independent workshops, revealing market concentration and purchasing behaviors. Finally, application-based segmentation identifies high-growth areas within vehicle assembly and maintenance, such as engine, chassis, and increasingly, electric vehicle battery assembly, underscoring the specialized nature of torque requirements in modern automotive engineering.

- By Type

- Manual Torque Tools

- Hydraulic Torque Tools

- Pneumatic Torque Tools

- Electric Torque Tools

- Digital Torque Tools

- By Operation

- Manual

- Power

- By End-User

- OEMs (Original Equipment Manufacturers)

- Aftermarket Service Providers

- Independent Repair Shops

- Tire Shops

- Car Dealerships

- By Application

- Engine Assembly

- Chassis Assembly

- Wheel Fastening

- Interior Assembly

- Bodywork

- Battery Assembly (EVs)

Value Chain Analysis For Automotive Torque Tools Market

The value chain for the Automotive Torque Tools Market is a complex network involving multiple stages, from raw material sourcing to end-user consumption, with each stage adding significant value to the final product. The upstream analysis begins with the procurement of essential raw materials such as high-grade steel alloys, aluminum, plastics, and electronic components like sensors, microcontrollers, and displays. These materials are processed by component manufacturers to create specialized parts like gears, springs, handles, and digital interfaces. Suppliers of these components play a crucial role in ensuring the quality, durability, and technological sophistication of the torque tools. Research and development activities, including material science and software engineering, are integral at this stage to innovate new tool designs and functionalities, enhancing precision and ergonomics.

Further down the chain, manufacturers assemble these components into finished torque tools, often incorporating proprietary technologies for enhanced accuracy, calibration, and data logging. This manufacturing process involves stringent quality control measures to meet industry standards and specific automotive requirements. Once manufactured, the tools are then distributed through various channels to reach the end-users. The distribution channels are predominantly categorized into direct and indirect methods. Direct distribution typically involves manufacturers selling directly to large automotive OEMs or major industrial clients through their own sales teams, offering customized solutions, technical support, and training. This approach ensures a close relationship with key customers and allows for tailored product offerings and service contracts.

Indirect distribution involves leveraging a network of third-party intermediaries. This includes wholesalers, distributors, industrial supply retailers, and online e-commerce platforms. These partners play a vital role in reaching a broader customer base, particularly small to medium-sized repair shops, independent mechanics, and individual consumers. They often provide localized inventory, expedited shipping, and accessible customer service. Aftermarket service providers and car dealerships also act as significant downstream players, purchasing tools for their own maintenance and repair operations. The entire value chain is characterized by a strong emphasis on after-sales support, including calibration services, repair, and parts replacement, which are critical for maintaining tool accuracy and longevity, thereby ensuring sustained customer satisfaction and brand loyalty. The efficiency and reliability of these distribution channels are paramount for market penetration and customer retention.

Automotive Torque Tools Market Potential Customers

The potential customers for the Automotive Torque Tools Market are diverse, encompassing a wide range of entities within the automotive ecosystem, all of whom share a critical need for precise and reliable fastening solutions. Original Equipment Manufacturers (OEMs) represent a primary segment, utilizing these tools extensively in their assembly plants for vehicle production, from engine and chassis assembly to interior and exterior component installation. OEMs demand high-volume, automated, and often custom-designed torque tools that integrate seamlessly into their production lines, emphasizing repeatability, accuracy, and data traceability to meet stringent quality and safety standards. Their purchasing decisions are driven by production efficiency, defect reduction, and compliance with global automotive industry regulations, including ISO/TS 16949.

The aftermarket sector forms another substantial customer base, comprising independent repair shops, authorized service centers, tire shops, and car dealerships. These end-users require versatile, durable, and user-friendly torque tools for routine maintenance, diagnostics, and complex repairs. Their purchasing motivations often center on tool reliability, ergonomic design for operator comfort, and the ability to handle a wide variety of vehicle makes and models. The growing complexity of modern vehicles, including electric and hybrid powertrains, further drives demand in this segment for specialized torque tools capable of addressing new fastening challenges. Additionally, vocational training centers and technical schools are also potential customers, equipping future automotive technicians with the necessary tools and knowledge.

Beyond traditional automotive applications, specialized vehicle manufacturers, such as those producing heavy-duty trucks, buses, agricultural machinery, and construction equipment, also represent significant potential customers. These industries often have even higher torque requirements and specific fastening protocols, necessitating robust and specialized torque tools. The military and defense sectors, with their strict maintenance and repair schedules for vehicle fleets, also constitute a niche but important customer segment. The increasing focus on vehicle longevity, safety recalls, and consumer expectations for flawless performance across all vehicle types continually reinforces the broad and enduring demand for high-quality automotive torque tools among this extensive spectrum of end-users and buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.8 Billion |

| Market Forecast in 2032 | $7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Snap-on Incorporated, Stanley Black & Decker, Proto (Stanley Black & Decker), Apex Tool Group, Gedore Torque, KTC Tools, Tohnichi Corporation, Mountz Inc., Norbar Torque Tools, Ingersoll Rand, DEWALT, Milwaukee Tool, Bosch, Makita, Atlas Copco, SPX FLOW, Enerpac, Craftsman, Wright Tool, Tecalemit, CDI Torque Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Torque Tools Market Key Technology Landscape

The Automotive Torque Tools Market is undergoing significant technological transformation, driven by the need for enhanced precision, efficiency, and data integration in modern automotive manufacturing and maintenance. A pivotal technological shift involves the widespread adoption of digitalization across various tool types. Digital torque tools, equipped with LCD screens and advanced sensors, offer highly accurate readings, real-time data display, and often integrate memory functions for storing torque values. This digitalization extends to providing audit trails and simplifying compliance with quality assurance standards. Sensor integration is fundamental, allowing tools to not only measure torque but also angle, ensuring that fasteners are tightened to specific yield points, which is crucial for critical applications and advanced materials.

The advent of the Internet of Things (IoT) is profoundly impacting the market, enabling torque tools to become "smart" and connected. IoT-enabled tools can wirelessly transmit torque application data to central databases or cloud platforms, facilitating real-time monitoring, analysis, and process optimization. This connectivity supports proactive maintenance, allows for remote calibration checks, and enables seamless integration with Manufacturing Execution Systems (MES) in smart factories. Data analytics plays a crucial role in leveraging this collected information to identify trends, predict potential fastening failures, and continuously improve assembly processes. The insights derived from such data are invaluable for maintaining product quality, reducing rework, and optimizing production throughput.

Furthermore, advancements in ergonomics and material science are enhancing tool design, making them lighter, more balanced, and reducing operator fatigue, which is particularly important in high-volume production environments. Battery technology improvements are also driving the performance of electric torque tools, offering longer run times and faster charging capabilities. Automated and robotic torque systems are gaining traction, especially in large-scale OEM facilities, where they contribute to higher precision, consistency, and speed. These systems often incorporate sophisticated software for programming tightening sequences and provide advanced diagnostics. The continuous evolution of these technologies is not only improving the performance of torque tools but also transforming the entire fastening process into a more intelligent, integrated, and data-driven operation, crucial for the future of automotive manufacturing and repair.

Regional Highlights

- North America: A mature market characterized by stringent safety regulations, high adoption of advanced digital and smart torque tools, and significant investment in automotive R&D. The presence of major OEMs and a strong aftermarket segment drives demand for high-quality, precise tools. The transition to electric vehicles (EVs) is a key growth area, requiring specialized torque solutions.

- Europe: Similar to North America, Europe exhibits a strong focus on quality, precision, and adherence to ISO standards. Germany, France, and the UK are leading markets, with a high concentration of premium automotive manufacturers. Emphasis on automation, Industry 4.0 integration, and sustainability drives demand for technologically advanced and energy-efficient torque tools.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily due to robust automotive production in China, India, Japan, South Korea, and Southeast Asian nations. Rising disposable incomes, increasing vehicle sales, and significant investments in manufacturing infrastructure contribute to market expansion. The region is a hub for both OEM and aftermarket demand, with a growing appetite for smart and automated torque solutions.

- Latin America: An emerging market experiencing steady growth driven by expanding automotive manufacturing capabilities in countries like Brazil and Mexico. The demand is fueled by increasing vehicle ownership and the need for reliable repair and maintenance services. Cost-effectiveness and durability are key purchasing factors for torque tools in this region.

- Middle East and Africa (MEA): A developing market with potential growth influenced by industrialization initiatives, increasing vehicle parc, and investments in automotive assembly plants in countries like South Africa and Saudi Arabia. The demand for torque tools is rising alongside the development of local automotive ecosystems and a greater emphasis on professional vehicle servicing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Torque Tools Market.- Snap-on Incorporated

- Stanley Black & Decker

- Proto (Stanley Black & Decker)

- Apex Tool Group

- Gedore Torque

- KTC Tools

- Tohnichi Corporation

- Mountz Inc.

- Norbar Torque Tools

- Ingersoll Rand

- DEWALT

- Milwaukee Tool

- Bosch

- Makita

- Atlas Copco

- SPX FLOW

- Enerpac

- Craftsman

- Wright Tool

- Tecalemit

- CDI Torque Products

Frequently Asked Questions

What are automotive torque tools and why are they essential?

Automotive torque tools are specialized instruments used to apply and measure precise rotational force (torque) to fasteners in vehicles. They are essential for ensuring the structural integrity, safety, and performance of automotive components by preventing under-tightening (which can lead to failure) and over-tightening (which can cause damage).

How is the electric vehicle (EV) market impacting the demand for torque tools?

The EV market i

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager