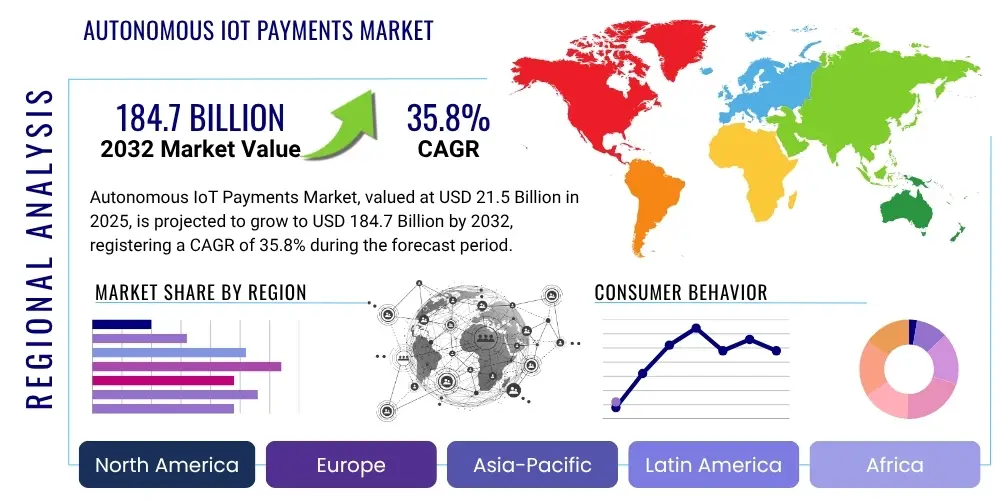

Autonomous IoT Payments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429069 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Autonomous IoT Payments Market Size

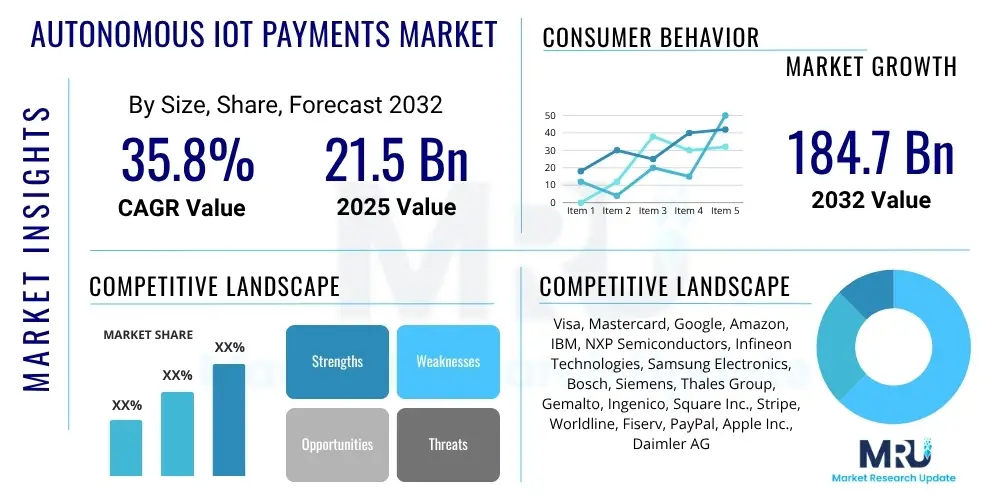

The Autonomous IoT Payments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.8% between 2025 and 2032. The market is estimated at $21.5 Billion in 2025 and is projected to reach $184.7 Billion by the end of the forecast period in 2032.

Autonomous IoT Payments Market introduction

The Autonomous IoT Payments Market represents a transformative paradigm where connected devices initiate and complete financial transactions without direct human intervention. This innovative market encompasses a broad range of products and services, from embedded payment modules in smart appliances to advanced software platforms that facilitate secure, real-time value exchange. It leverages the Internet of Things (IoT) infrastructure, artificial intelligence (AI), and secure payment protocols to enable machines to act as independent economic agents, fundamentally altering traditional commerce and operational models.

Products within this market typically include specialized hardware components such as secure payment chips, embedded sensors, and communication modules integrated into IoT devices, alongside sophisticated software solutions covering payment gateways, authentication systems, data analytics, and blockchain-based ledger technologies. Major applications span across diverse sectors, including connected cars paying for fuel or parking, smart homes ordering consumables, industrial machines purchasing parts or services, and smart retail systems automating inventory replenishment and billing. The core benefit derived from this evolution is unparalleled operational efficiency, enhanced convenience for consumers and businesses, reduction in human error, and the creation of entirely new service and revenue models.

Key driving factors for the proliferation of autonomous IoT payments include the exponential growth in the number of internet-connected devices, the increasing consumer and business demand for seamless and frictionless transaction experiences, the advancements in AI and machine learning for predictive payment decisions and fraud detection, and the continuous evolution of secure digital payment infrastructures. These elements collectively foster an environment conducive to the adoption of autonomous payment systems, pushing the boundaries of what is possible in automated economic interactions.

Autonomous IoT Payments Market Executive Summary

The Autonomous IoT Payments Market is undergoing rapid expansion, driven by the convergence of IoT, AI, and digital payment technologies. Current business trends indicate a strong focus on strategic partnerships between IoT device manufacturers, payment service providers, and blockchain technology firms to develop robust and scalable solutions. There is an increasing emphasis on creating standardized protocols and interoperable platforms to ensure seamless transactions across diverse ecosystems. Furthermore, the market is witnessing significant investments in security infrastructure and data privacy solutions to build trust and mitigate potential risks associated with machine-to-machine transactions. Businesses are exploring subscription models and pay-per-use services enabled by autonomous payments, opening new revenue streams and optimizing operational costs across various industries.

Geographically, North America and Europe currently lead the market in terms of technological adoption and infrastructure development, benefiting from established digital economies and a strong regulatory framework. However, the Asia Pacific region is poised for substantial growth, fueled by rapid digitalization, a large manufacturing base for IoT devices, and an expanding consumer base with high mobile payment penetration. Latin America, the Middle East, and Africa are emerging as significant markets, driven by smart city initiatives, increasing internet penetration, and a growing push towards digital transformation, though these regions still face challenges related to infrastructure and regulatory maturity. Regional trends also show a localized approach to payment solutions, adapting to specific consumer behaviors and regulatory landscapes.

Segmentation trends highlight the automotive sector as a key early adopter, with connected vehicles enabling automated payments for tolls, parking, and in-car services. The smart home segment is also experiencing significant traction as appliances become capable of ordering supplies independently. Industrial IoT applications are gaining momentum, optimizing supply chain payments and maintenance operations through automated transactions. The retail sector is exploring innovative checkout-free experiences and automated inventory management. Across all segments, the demand for enhanced security, real-time processing, and robust authentication mechanisms remains paramount, propelling innovation in biometric authentication and cryptographic techniques. The market is increasingly segmenting by the level of autonomy and the complexity of transactions involved.

AI Impact Analysis on Autonomous IoT Payments Market

User inquiries concerning AI's impact on Autonomous IoT Payments frequently revolve around its role in decision-making, security enhancements, fraud prevention, and the overall efficiency of transactions. Key themes include how AI facilitates smart payment routing, whether it can autonomously manage financial thresholds, and its capability to detect and respond to anomalous transaction patterns. Users are keen to understand if AI can personalize payment experiences for devices, optimize transaction costs, and how it contributes to the trustworthiness of machine-to-machine financial exchanges. Concerns often touch upon the transparency of AI-driven decisions, the potential for algorithmic bias, and the implications for data privacy and regulatory compliance.

Artificial intelligence is an indispensable component of the Autonomous IoT Payments Market, acting as the intelligent core that enables devices to make informed and secure payment decisions independently. AI algorithms analyze vast datasets, including transaction history, user preferences, sensor data, and market conditions, to predict optimal payment methods, authorize transactions within defined parameters, and proactively identify potential fraud. This analytical capability transforms devices from simple data collectors into intelligent economic actors, enhancing operational efficiency, minimizing human intervention, and providing a seamless, context-aware payment experience. Furthermore, AI contributes significantly to risk management by continuously learning and adapting to new threats, making autonomous payment systems more resilient and reliable.

- Enhanced Decision Making: AI algorithms process real-time data to authorize, decline, or optimize payment methods without human intervention, ensuring efficient and context-aware transactions.

- Predictive Analytics: AI forecasts future needs, enabling proactive payments for services or supplies, such as a smart refrigerator ordering groceries or a connected car initiating maintenance payments.

- Advanced Fraud Detection: Machine learning models identify anomalous transaction patterns and potential fraudulent activities with higher accuracy and speed than traditional rule-based systems, bolstering security.

- Personalized Payment Experiences: AI customizes payment options and thresholds based on device usage patterns, user preferences, and historical data, optimizing convenience and user satisfaction.

- Operational Optimization: AI manages transaction routing, currency conversions, and fee minimization, leading to more cost-effective and efficient payment processing for businesses.

- Anomaly Detection: Real-time monitoring by AI systems identifies unusual behavior or malfunctions in IoT devices that might impact payment integrity, triggering alerts or corrective actions.

- Dynamic Pricing and Billing: AI enables devices to adapt to fluctuating prices or usage-based billing models, supporting flexible and fair payment structures in shared economies.

DRO & Impact Forces Of Autonomous IoT Payments Market

The Autonomous IoT Payments Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its trajectory. The primary drivers include the pervasive proliferation of IoT devices across consumer and industrial sectors, generating an unprecedented volume of data and a need for automated actions. This is coupled with a surging demand for frictionless, convenient, and highly efficient transaction experiences, reducing human touchpoints and speeding up processes. The continuous innovation in artificial intelligence, machine learning, and blockchain technologies provides the necessary intelligence and security infrastructure for autonomous payment systems to function reliably and securely. Furthermore, the global shift towards digital and contactless payments, accelerated by recent events, reinforces the adoption of automated transaction methods, making machines economic agents in their own right.

However, the market faces significant restraints that challenge its widespread adoption. Foremost among these are pressing concerns regarding security and data privacy. The potential for cyberattacks, data breaches, and unauthorized transactions involving autonomous devices necessitates robust, continuously evolving security protocols, which can be costly and complex to implement. The lack of universal standardization across IoT platforms and payment protocols creates interoperability issues, hindering seamless integration and broad market acceptance. High initial investment costs for developing and deploying these advanced systems, along with the absence of clear regulatory frameworks in many jurisdictions, further impede growth. Building and maintaining consumer and business trust in machines handling financial transactions is another critical hurdle that requires comprehensive solutions and transparent operations.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The development of new service models, such as pay-per-use devices (e.g., smart washing machines billing per cycle) and micro-transactions for digital content or services, opens untapped revenue streams. Cross-industry collaborations between technology providers, financial institutions, and IoT manufacturers are fostering comprehensive solutions and accelerating market development. The potential for integrating autonomous payments with emerging technologies like the metaverse and Web3 offers futuristic avenues for digital asset exchange and virtual economies. Furthermore, enhancing transparency and efficiency in supply chain management through automated payments presents a significant opportunity for industrial applications. The ability to streamline operations and create new value propositions positions this market for considerable long-term growth.

Segmentation Analysis

The Autonomous IoT Payments Market is segmented across various dimensions to provide a comprehensive understanding of its structure, growth drivers, and diverse applications. These segmentations typically include components, technology, application, and end-user, each revealing unique market dynamics and growth potentials. Analyzing these segments helps stakeholders identify key areas of investment, target specific customer groups, and develop tailored solutions that address the distinct needs of different market verticals. The intrinsic complexity of integrating IoT devices with payment infrastructures means that each segment requires specialized approaches in terms of hardware, software, and service delivery, reflecting the fragmented yet interconnected nature of the market.

- By Component:

- Hardware (Sensors, Payment Modules, Secure Elements, Gateways, Terminals)

- Software (Payment Gateways, Operating Systems, AI/ML Algorithms, Security & Authentication Solutions, Data Analytics Platforms)

- Services (Integration & Deployment, Consulting, Maintenance & Support, Managed Services)

- By Technology:

- Near Field Communication (NFC)

- Bluetooth Low Energy (BLE)

- Blockchain

- Artificial Intelligence (AI) & Machine Learning (ML)

- Biometrics (Fingerprint, Facial Recognition, Iris Scan)

- QR Codes

- Cloud Computing

- By Application:

- Connected Cars (Tolls, Parking, Fuel, In-car Services)

- Smart Homes (Utility Payments, Appliance Consumables, Subscription Services)

- Smart Retail (Checkout-Free Stores, Automated Inventory, Vending Machines)

- Industrial IoT (Supply Chain Payments, Predictive Maintenance, Asset Tracking)

- Smart Cities (Public Transport, Parking, Waste Management, Utilities)

- Wearables & Smart Devices (Fitness Subscriptions, Micropayments)

- Healthcare (Automated Billing, Medical Supply Orders)

- By End User:

- Commercial Enterprises

- Residential Consumers

- Industrial Sector

- Public Sector

Value Chain Analysis For Autonomous IoT Payments Market

The value chain for the Autonomous IoT Payments Market is intricate, spanning from the foundational hardware and software development to the final deployment and service delivery. At the upstream level, it involves a multitude of providers specializing in critical components and foundational technologies. This includes semiconductor manufacturers producing secure elements and processors, sensor manufacturers offering environmental and proximity sensing capabilities, and connectivity providers (e.g., 5G, LPWAN) ensuring reliable machine-to-machine communication. Software developers contribute operating systems, payment APIs, AI/ML algorithms, and blockchain frameworks that form the intelligence and security layers of autonomous payment systems. These upstream activities are crucial for building the robust and reliable infrastructure necessary for devices to operate autonomously.

Moving downstream, the value chain involves system integrators and solution providers who specialize in combining various hardware and software components into functional autonomous payment systems tailored for specific applications or industries. Payment service providers (PSPs) and financial institutions play a pivotal role, offering the financial infrastructure, gateway services, and regulatory compliance necessary for processing transactions. End-user industries, such as automotive, retail, and manufacturing, integrate these solutions into their products and operations, becoming the ultimate beneficiaries. The distribution channel is multifaceted, comprising direct sales to large enterprises and original equipment manufacturers (OEMs) for custom solutions, as well as indirect channels through partnerships with telecommunication companies, IoT platform providers, and specialized value-added resellers that offer comprehensive service bundles.

The market primarily utilizes a hybrid distribution model. Direct channels involve technology providers and payment companies engaging directly with large enterprise clients or IoT device manufacturers to embed autonomous payment capabilities into their product lines, offering highly customized solutions and direct support. Indirect channels are equally significant, where solution integrators, resellers, and strategic partners aggregate various technologies to offer complete packages to a wider range of smaller and medium-sized businesses or specific vertical markets. Furthermore, digital marketplaces and cloud platforms are increasingly serving as indirect channels, enabling easier access to autonomous payment APIs and services for developers and businesses looking to integrate these capabilities into their applications. This blend of direct and indirect approaches facilitates broad market penetration while addressing diverse customer needs.

Autonomous IoT Payments Market Potential Customers

Potential customers for autonomous IoT payment solutions are broadly diverse, reflecting the technology's applicability across numerous sectors. The primary end-users and buyers are enterprises and organizations seeking to enhance operational efficiency, reduce labor costs, and introduce innovative service models through automation. This includes, but is not limited to, major automotive original equipment manufacturers (OEMs) looking to integrate in-car payment capabilities for fuel, parking, and subscription services, making vehicles active economic entities. Smart home device manufacturers and platform providers are also key customers, aiming to enable appliances to autonomously manage consumables, utility payments, and maintenance requests, creating a truly connected and self-managing home environment.

Beyond consumer-facing applications, the industrial sector represents a substantial customer base. Manufacturing plants and logistics companies are increasingly investing in autonomous IoT payments for supply chain management, enabling machinery to automatically order spare parts, pay for maintenance services, or manage inventory replenishment based on real-time operational data. Smart city developers and municipal authorities are potential buyers, seeking to implement automated payment systems for public utilities, transportation networks, parking facilities, and waste management, contributing to more efficient urban living. Furthermore, retail businesses are exploring checkout-free stores and intelligent vending machines that leverage autonomous payments to offer seamless customer experiences and optimize stock management. These varied customer groups are united by the desire for enhanced automation, efficiency, and novel revenue generation possibilities offered by machine-to-machine transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $21.5 Billion |

| Market Forecast in 2032 | $184.7 Billion |

| Growth Rate | 35.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Visa, Mastercard, Google, Amazon, IBM, NXP Semiconductors, Infineon Technologies, Samsung Electronics, Bosch, Siemens, Thales Group, Gemalto, Ingenico, Square Inc., Stripe, Worldline, Fiserv, PayPal, Apple Inc., Daimler AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous IoT Payments Market Key Technology Landscape

The Autonomous IoT Payments Market is fundamentally enabled by a sophisticated array of interconnected technologies that ensure seamless, secure, and intelligent transactions without human intervention. At its core, it relies on highly specialized IoT sensors and embedded hardware, which include secure element chips, microcontrollers, and communication modules (e.g., NFC, Bluetooth, Wi-Fi, 5G) integrated directly into devices. These components are responsible for identifying payment triggers, authenticating devices, and securely transmitting transactional data. The physical security of these embedded systems is paramount, often employing tamper-resistant hardware and cryptographic accelerators to protect sensitive information at the edge.

Beyond hardware, advanced software and network technologies form the intelligent backbone of autonomous payments. Artificial Intelligence and Machine Learning algorithms are critical for enabling devices to make smart payment decisions, detect fraud in real-time, predict maintenance needs, and optimize transaction routing. Blockchain technology is increasingly being adopted for creating immutable ledgers of transactions, enhancing transparency, security, and trust in machine-to-machine economic interactions, particularly for micro-transactions and supply chain payments. Cloud computing platforms provide the necessary scalability and processing power for managing vast amounts of IoT data and payment processing requests, while secure communication protocols and robust encryption ensure data integrity and confidentiality during transmission. Biometric authentication methods are also emerging as a key technology, providing enhanced security layers for authorizing higher-value or sensitive autonomous transactions, particularly in scenarios where human verification is still desired for specific actions.

Regional Highlights

- North America: This region is a frontrunner in the Autonomous IoT Payments Market, characterized by early adoption of advanced technologies, substantial investments in R&D, and a robust digital payment infrastructure. The presence of major technology innovators and financial institutions, coupled with a high consumer readiness for digital and automated services, drives market growth. Key growth sectors include connected automotive, smart homes, and industrial IoT applications, supported by supportive regulatory environments and significant venture capital funding.

- Europe: Europe showcases a strong commitment to smart city initiatives and a well-developed regulatory framework (e.g., GDPR, PSD2) that, while posing compliance challenges, also fosters trust and structured growth in the autonomous payments sector. Countries like Germany, the UK, and the Nordics are at the forefront, driven by a focus on industrial automation, sustainable smart infrastructure, and a growing emphasis on data privacy and security in IoT applications. Collaborations between automotive manufacturers, utility providers, and payment firms are particularly strong.

- Asia Pacific (APAC): The APAC region is experiencing the fastest growth in the Autonomous IoT Payments Market, propelled by rapid digitalization, a vast manufacturing base for IoT devices, and an expanding consumer market with high mobile payment penetration. Countries such as China, Japan, South Korea, and India are investing heavily in smart infrastructure, 5G deployment, and AI research. This region benefits from a dynamic ecosystem of startups and established tech giants, leading to innovative applications in smart retail, logistics, and interconnected consumer electronics, although varying regulatory landscapes can present complexities.

- Latin America: As an emerging market, Latin America is witnessing increasing interest and investment in digital transformation and smart city projects, creating significant opportunities for autonomous IoT payments. Economic reforms and initiatives to improve digital inclusion are driving the adoption of IoT solutions across various sectors, particularly in transportation and utilities. Challenges include infrastructure disparities and economic volatility, but the region holds strong potential for growth as digital payment ecosystems mature and government support for technological innovation expands.

- Middle East and Africa (MEA): The MEA region is characterized by ambitious smart city visions, particularly in the Gulf Cooperation Council (GCC) countries, and substantial government investments in technological infrastructure. These initiatives are creating fertile ground for the deployment of autonomous IoT payment solutions in areas like smart parking, intelligent transportation systems, and integrated public services. While adoption rates vary across the diverse countries, the region's focus on diversification from traditional industries and a youthful, tech-savvy population are key drivers for future growth in autonomous payment technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous IoT Payments Market.- Visa

- Mastercard

- Amazon

- IBM

- NXP Semiconductors

- Infineon Technologies

- Samsung Electronics

- Bosch

- Siemens

- Thales Group

- Gemalto (now part of Thales)

- Ingenico (now part of Worldline)

- Square Inc. (now Block, Inc.)

- Stripe

- Worldline

- Fiserv

- PayPal

- Apple Inc.

- Daimler AG

Frequently Asked Questions

What are autonomous IoT payments?

Autonomous IoT payments are financial transactions initiated and completed by connected devices, such as smart cars or home appliances, without direct human intervention. These systems leverage IoT, AI, and secure payment protocols to enable machines to act as independent economic agents, facilitating automated purchases and service payments.

How secure are autonomous IoT payments?

Security in autonomous IoT payments is paramount and is maintained through multi-layered approaches. This includes embedded secure elements in hardware, advanced encryption protocols, AI-powered fraud detection systems, and often blockchain technology for immutable transaction records. Continuous monitoring and updates are crucial to mitigating evolving cyber threats.

What industries benefit most from autonomous IoT payments?

Industries poised to benefit most include automotive (for tolls, parking, fuel), smart homes (for utility payments, consumable reordering), smart retail (for checkout-free experiences), and industrial IoT (for supply chain automation and predictive maintenance). These sectors gain significant efficiencies, cost reductions, and new service opportunities.

What is the role of AI in autonomous IoT payments?

AI plays a critical role by enabling devices to make intelligent payment decisions, detect fraudulent activities in real-time, optimize transaction routes, and personalize payment experiences based on context and past behavior. It acts as the "brain" for autonomous financial interactions, enhancing both efficiency and security.

What are the main challenges to widespread adoption of autonomous IoT payments?

Key challenges include ensuring robust security and privacy, developing universal standards for interoperability across diverse IoT ecosystems, navigating complex and evolving regulatory landscapes, overcoming high initial investment costs, and building strong consumer and business trust in machine-to-machine financial transactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager