Autonomous Marine Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428142 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Autonomous Marine Vehicle Market Size

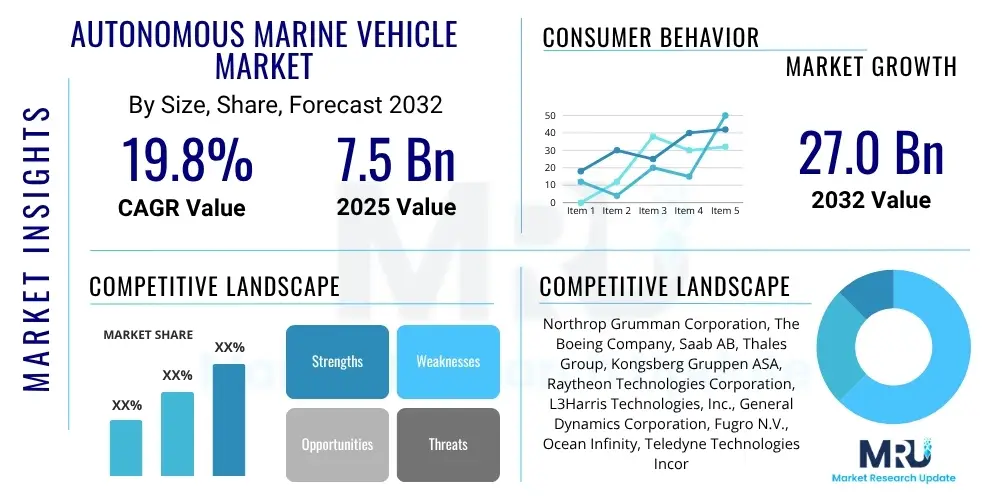

The Autonomous Marine Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.8% between 2025 and 2032. The market is estimated at USD 7.5 Billion in 2025 and is projected to reach USD 27.0 Billion by the end of the forecast period in 2032.

Autonomous Marine Vehicle Market introduction

The Autonomous Marine Vehicle (AMV) Market encompasses a diverse range of uncrewed vessels designed to operate on or under the water surface without direct human intervention. These sophisticated systems leverage advanced robotics, artificial intelligence, and communication technologies to execute missions autonomously, offering significant advantages across various applications. The market is defined by continuous innovation in sensor technology, propulsion systems, and navigation capabilities, enabling AMVs to perform complex tasks with enhanced precision and endurance, often in environments too hazardous or costly for human-crewed vessels.

Products within this domain include Unmanned Surface Vehicles (USVs) and Unmanned Underwater Vehicles (UUVs), each tailored for specific operational requirements. USVs are utilized for tasks such as hydrographic surveying, maritime security, environmental monitoring, and anti-submarine warfare, operating on the ocean's surface. UUVs, conversely, are designed for subsea exploration, pipeline inspection, seabed mapping, intelligence gathering, and scientific research, operating entirely submerged. Both categories are equipped with various payloads, including sonars, cameras, environmental sensors, and communication systems, making them highly versatile platforms.

Major applications of AMVs span defense and security, commercial operations, scientific research, and offshore energy exploration. Benefits include reduced operational costs, enhanced safety by removing humans from dangerous environments, increased efficiency through prolonged endurance, and the ability to access remote or hazardous locations. The market is primarily driven by escalating defense spending on naval modernization, the growing demand for oceanographic data, the expansion of offshore oil and gas activities requiring inspection and maintenance, and a rising focus on environmental monitoring and resource management. These factors collectively propel the development and adoption of AMV technologies globally, reshaping traditional maritime operations.

Autonomous Marine Vehicle Market Executive Summary

The Autonomous Marine Vehicle (AMV) market is experiencing robust expansion, propelled by significant technological advancements and a burgeoning range of applications across both defense and commercial sectors. Key business trends indicate a strategic pivot towards modular designs, enhancing the adaptability and versatility of AMVs for diverse missions. There is also a notable increase in collaborations between defense contractors, technology startups, and academic institutions, fostering innovation and accelerating product development cycles. Furthermore, significant investment in R&D, particularly in artificial intelligence, sensor fusion, and advanced power systems, underscores the industry's commitment to pushing the boundaries of autonomous maritime capabilities. The market is characterized by a drive for greater endurance, deeper operational depths, and enhanced data processing at the edge, aiming to maximize mission effectiveness and reduce human intervention.

Regional trends highlight North America and Europe as dominant forces, primarily due to substantial defense budgets, established maritime industries, and leading technological innovation hubs. North America benefits from significant investments in naval modernization and advanced research programs, particularly in autonomous capabilities for surveillance and anti-submarine warfare. Europe, with its extensive coastline and strong emphasis on marine research and offshore energy, is a key adopter of AMVs for environmental monitoring, hydrography, and infrastructure inspection. The Asia Pacific region is rapidly emerging as a high-growth market, driven by increasing maritime security concerns, expanding offshore exploration activities, and significant government investments in developing indigenous autonomous technologies, particularly from countries like China, Japan, and South Korea.

Segmentation trends indicate a strong growth trajectory for Unmanned Underwater Vehicles (UUVs) due to their critical role in subsea inspection, mapping, and defense applications. Within UUVs, remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) are seeing specialized advancements, with AUVs gaining prominence for their true autonomy and long-duration missions. Unmanned Surface Vehicles (USVs) are also experiencing significant adoption, particularly for maritime surveillance, border patrol, and scientific data collection, benefiting from improved communication ranges and payload capacities. The defense and security segment continues to be the largest application area, driven by persistent threats and the need for enhanced intelligence, surveillance, and reconnaissance (ISR) capabilities. However, the commercial segment, including offshore oil and gas, oceanography, and environmental monitoring, is projected to witness the highest growth rate as AMVs offer cost-effective and safer alternatives to traditional methods.

AI Impact Analysis on Autonomous Marine Vehicle Market

Common user questions regarding the impact of AI on the Autonomous Marine Vehicle market frequently revolve around the extent of true autonomy, the reliability and safety of AI-driven decision-making in complex marine environments, and the ethical implications of autonomous systems, especially in defense contexts. Users are keen to understand how AI enhances mission efficiency, reduces operational costs, and improves data processing capabilities, while also raising concerns about cybersecurity vulnerabilities and the regulatory framework required for widespread AI integration. The overarching themes reflect a blend of excitement for the transformative potential of AI in achieving fully autonomous operations and apprehension regarding the associated risks and governance challenges.

- Enhanced situational awareness through advanced sensor fusion and intelligent data interpretation.

- Improved autonomous navigation and collision avoidance in dynamic marine environments.

- Optimized mission planning and dynamic re-tasking based on real-time data and changing conditions.

- Automated anomaly detection and predictive maintenance for onboard systems, increasing reliability.

- Faster and more accurate processing of vast amounts of collected data (e.g., sonar, video, environmental).

- Development of sophisticated decision-making capabilities, reducing the need for human intervention.

- Facilitation of swarming capabilities and collaborative multi-AMV operations.

- Adaptive learning algorithms that improve performance over time and across diverse scenarios.

DRO & Impact Forces Of Autonomous Marine Vehicle Market

The Autonomous Marine Vehicle (AMV) market is shaped by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. A primary driver is the accelerating pace of technological advancements in artificial intelligence, sensor technology, and communication systems, which are continually enhancing AMV capabilities, making them more efficient, reliable, and versatile. Concurrently, increasing global defense expenditures, particularly in naval modernization and anti-submarine warfare, fuel demand for AMVs due to their strategic advantages in surveillance, reconnaissance, and mine countermeasures. The growing need for comprehensive oceanographic data for climate research, resource management, and environmental monitoring further stimulates market growth, as AMVs offer a cost-effective and persistent platform for data collection. Moreover, the expansion of the offshore oil and gas industry necessitates advanced inspection and maintenance solutions for subsea infrastructure, for which AMVs are ideally suited, providing safer alternatives to human divers.

However, significant restraints temper this growth. The high initial capital investment required for the development and acquisition of sophisticated AMV systems remains a barrier for many potential adopters. Regulatory complexities and the absence of harmonized international legal frameworks for autonomous operations pose considerable challenges, particularly concerning collision regulations, liability, and operating permits in international waters. Technical challenges, such as limited battery endurance for long-duration missions, the complexities of operating in harsh and unpredictable marine environments, and ensuring robust cybersecurity against evolving threats, also act as significant impediments. Furthermore, public perception and ethical concerns, particularly surrounding autonomous weapon systems and potential job displacement, can influence policy decisions and slow adoption.

Despite these challenges, substantial opportunities abound. The emergence of new application areas beyond traditional defense and research, such as marine logistics, port security, aquaculture management, and search and rescue operations, presents untapped market potential. Developing economies, particularly in Asia Pacific and Latin America, offer burgeoning markets as their maritime interests expand and they seek cost-effective solutions for coastal surveillance and resource exploration. Strategic partnerships, mergers, and acquisitions among technology firms, defense contractors, and specialized service providers are fostering innovation and enabling market participants to pool resources and expertise, accelerating development and market penetration. Furthermore, advancements in hybrid propulsion systems and renewable energy integration for AMVs promise to overcome current endurance limitations, opening avenues for ultra-long-duration missions and unlocking new applications, thereby strengthening the market's long-term growth prospects.

Segmentation Analysis

The Autonomous Marine Vehicle market is intricately segmented across various dimensions to reflect its diverse applications, technological specifications, and operational modalities. These segmentations provide a granular view of the market's composition, highlighting areas of concentrated growth and specific technological requirements. The primary segmentation criteria typically include vehicle type, application, endurance, payload capacity, and propulsion system, each offering unique insights into market dynamics and user preferences. Understanding these segments is crucial for stakeholders to identify niche opportunities, tailor product development, and formulate targeted market entry strategies. The market's complexity demands a multifaceted analytical approach to capture the full scope of its evolving landscape.

- By Type:

- Unmanned Surface Vehicles (USVs)

- Unmanned Underwater Vehicles (UUVs)

- Remotely Operated Vehicles (ROVs)

- Autonomous Underwater Vehicles (AUVs)

- By Application:

- Defense & Security

- Surveillance & Reconnaissance

- Mine Countermeasures (MCM)

- Anti-Submarine Warfare (ASW)

- Patrol & Interdiction

- Commercial

- Oil & Gas (Inspection, Maintenance, Repair)

- Hydrography & Oceanography

- Environmental Monitoring

- Marine Logistics & Transport

- Port & Harbor Security

- Aquaculture

- Scientific Research & Exploration

- Defense & Security

- By Endurance:

- Short-Range (less than 24 hours)

- Medium-Range (24 hours to 7 days)

- Long-Range (more than 7 days)

- By Payload:

- Sensors (Sonar, Lidar, Cameras, Environmental Sensors)

- Communication Systems

- Navigation Systems

- Weapons

- Other Payloads (Manipulators, Sampling Tools)

- By Propulsion System:

- Electric

- Hybrid

- Mechanical

- Sail/Solar-Powered

Value Chain Analysis For Autonomous Marine Vehicle Market

The value chain for the Autonomous Marine Vehicle (AMV) market is a sophisticated network encompassing various stages from raw material sourcing and component manufacturing to final deployment and post-sales support. Upstream analysis focuses on the foundational elements, including the development and supply of critical components such as advanced sensors (e.g., sonar, lidar, INS, GPS), high-performance computing units for AI and data processing, robust communication systems (acoustic, satellite, radio), propulsion systems (electric motors, thrusters), energy storage solutions (lithium-ion batteries, fuel cells), and specialized materials for hull construction. This stage also includes the development of core software platforms for autonomy, navigation, mission planning, and data analytics, often provided by specialized technology firms or in-house R&D departments. The quality and innovation at this stage directly influence the capabilities and cost-effectiveness of the final AMV product.

Midstream activities involve the design, integration, and manufacturing of the AMVs themselves. This includes system engineering, integrating various hardware and software components into a cohesive platform, rigorous testing, and assembly. Major defense contractors and specialized marine technology companies typically lead this stage, leveraging expertise in naval architecture, robotics, and systems integration. Downstream analysis centers on the deployment, operation, and maintenance of AMVs. This involves end-users such as naval forces, offshore energy companies, research institutions, and environmental agencies that operate these vehicles for their specific missions. Service providers, often working in conjunction with manufacturers or independently, play a crucial role in providing operational support, data analysis, maintenance, and training, ensuring the optimal performance and longevity of AMV systems in challenging marine environments.

Distribution channels for AMVs are primarily direct, especially for large-scale defense contracts or highly specialized commercial applications, involving direct sales from manufacturers to end-user organizations. This direct approach facilitates customization, technical support, and long-term partnership development. Indirect channels, though less common for high-value AMV platforms, can include distributors or value-added resellers for specific components or smaller, more standardized AMV models. Partnerships and collaborations are also vital distribution mechanisms, particularly for accessing new markets or integrating AMVs into broader maritime solutions. The direct and indirect distribution strategies are influenced by the complexity of the product, the target customer segment, and the regulatory environment, with a strong emphasis on direct engagement to ensure comprehensive support and tailored solutions for sophisticated autonomous systems.

Autonomous Marine Vehicle Market Potential Customers

The potential customers for Autonomous Marine Vehicles (AMVs) are diverse, spanning governmental, commercial, and scientific sectors, all seeking to leverage the unique advantages offered by uncrewed operations in marine environments. The largest and most established customer segment is military and defense organizations worldwide. Navies and coast guards are increasingly adopting AMVs for critical missions such as intelligence, surveillance, and reconnaissance (ISR), mine countermeasures (MCM), anti-submarine warfare (ASW), maritime security patrols, and force protection, driven by the need to enhance capabilities while reducing risks to personnel. These agencies represent a sustained demand for sophisticated, high-end AMV systems capable of operating in contested or hazardous zones. The evolving geopolitical landscape and ongoing naval modernization initiatives globally underscore the significance of this customer base.

Beyond defense, the commercial sector represents a rapidly expanding customer base. The offshore oil and gas industry is a significant consumer, utilizing AMVs for critical infrastructure inspection, maintenance, and repair (IMR) of pipelines, subsea structures, and platforms, as well as for site surveys and environmental monitoring around operational areas. These applications benefit from the cost-effectiveness and enhanced safety offered by autonomous operations, mitigating the risks associated with human diving operations. Furthermore, the burgeoning renewable energy sector, particularly offshore wind farms, is increasingly deploying AMVs for cable inspection, foundation maintenance, and environmental impact assessments, demonstrating a growing market need for specialized subsea and surface autonomous capabilities.

Scientific research institutions, oceanographic agencies, and environmental monitoring bodies also constitute a vital segment of potential customers. These organizations utilize AMVs for seabed mapping, ocean current profiling, water quality analysis, marine life observation, and climate change studies. AMVs provide unprecedented access to remote and deep-sea environments, enabling long-duration data collection and reducing the cost of traditional research expeditions. Emerging customer segments include port authorities and marine logistics companies, which are exploring AMVs for port security, harbor management, and even autonomous cargo delivery in certain scenarios. The versatility, efficiency, and safety benefits of AMVs make them an attractive solution across a broad spectrum of end-users, underscoring the market's significant growth potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.5 Billion |

| Market Forecast in 2032 | USD 27.0 Billion |

| Growth Rate | CAGR of 19.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman Corporation, The Boeing Company, Saab AB, Thales Group, Kongsberg Gruppen ASA, Raytheon Technologies Corporation, L3Harris Technologies, Inc., General Dynamics Corporation, Fugro N.V., Ocean Infinity, Teledyne Technologies Incorporated, BAE Systems plc, ECA Group (part of Exail), ASV Global (part of L3Harris), Elbit Systems Ltd., Atlas Elektronik GmbH (part of thyssenkrupp Marine Systems), Lockheed Martin Corporation, QinetiQ Group plc, Hydroid, Inc. (part of Kongsberg), iXblue (part of Exail) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous Marine Vehicle Market Key Technology Landscape

The Autonomous Marine Vehicle (AMV) market is underpinned by a dynamic and rapidly evolving technology landscape, integrating cutting-edge innovations from various disciplines to achieve robust autonomous capabilities. At its core, advanced artificial intelligence (AI) and machine learning (ML) algorithms are pivotal, enabling sophisticated decision-making, adaptive navigation, and complex data analysis without human intervention. These AI systems facilitate real-time object detection, classification, and tracking, crucial for collision avoidance and situational awareness in cluttered marine environments. Furthermore, AI-driven mission planning and dynamic re-tasking capabilities allow AMVs to adapt to changing operational parameters and unexpected events, optimizing efficiency and mission success rates. The continuous advancement in AI learning models, particularly deep learning for perception and reinforcement learning for control, is pushing the boundaries of true autonomy.

Sensor fusion technology is another critical enabler, combining data from multiple disparate sensors to create a more comprehensive and accurate perception of the AMV's surroundings. This includes integration of sonar (multibeam, side-scan, synthetic aperture), lidar, high-resolution cameras, inertial navigation systems (INS), global positioning systems (GPS), and various environmental sensors (temperature, salinity, pressure). By fusing data from these different modalities, AMVs can overcome the limitations of individual sensors, ensuring reliable navigation, obstacle detection, and data collection even in challenging conditions such as turbid waters or GPS-denied environments. Advances in miniaturization and processing power are allowing for more complex sensor suites on smaller platforms, expanding their operational versatility and reducing SWaP (Size, Weight, and Power) requirements.

Communication systems are vital for command and control, data exfiltration, and collaborative operations among multiple AMVs. This landscape includes satellite communication for long-range surface operations, acoustic modems for subsea data transfer, radio frequency (RF) links for near-surface and line-of-sight communication, and emerging optical communication technologies for high-bandwidth underwater data transfer. Cybersecurity measures are increasingly integrated into these communication and control systems to protect against jamming, spoofing, and unauthorized access, ensuring the integrity and security of autonomous missions. Beyond these, advanced power and propulsion systems, including high-density batteries, fuel cells, hybrid electric configurations, and even solar or wave energy harvesting, are crucial for extending AMV endurance. Moreover, specialized materials science contributes to robust hull designs capable of withstanding extreme pressures and corrosive marine environments, further enhancing the reliability and longevity of these sophisticated autonomous platforms.

Regional Highlights

- North America: A dominant market, driven by substantial defense budgets, extensive naval modernization programs, and a robust ecosystem of technology innovation. The U.S. Navy is a primary driver, investing heavily in USVs and UUVs for anti-submarine warfare, mine countermeasures, and intelligence, surveillance, and reconnaissance (ISR). Canada also contributes through Arctic research and coastal surveillance initiatives.

- Europe: A significant market fueled by strong maritime industries, a focus on marine research, and growing demand for offshore energy and environmental monitoring. Countries like the UK, France, Germany, Norway, and Sweden are key players, with investments in both defense and commercial AMV applications, including hydrographic surveying, pipeline inspection, and naval defense.

- Asia Pacific (APAC): Emerging as the fastest-growing region due to increasing maritime security concerns, territorial disputes, expanding offshore exploration, and significant government investments in indigenous AMV development. China, Japan, South Korea, and India are leading this growth, rapidly expanding their naval capabilities and commercial marine operations using autonomous platforms.

- Latin America: A nascent but growing market, primarily driven by coastal security needs, illegal fishing surveillance, and potential for offshore resource exploration. Brazil, with its extensive coastline and oil & gas interests, is a key potential growth area for AMV adoption.

- Middle East and Africa (MEA): This region is showing increasing interest in AMVs for maritime security, critical infrastructure protection (e.g., oil & gas platforms, shipping lanes), and border control. The Arabian Gulf, in particular, is a hotbed for AMV deployment due to strategic choke points and a high volume of maritime traffic.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Marine Vehicle Market.- Northrop Grumman Corporation

- The Boeing Company

- Saab AB

- Thales Group

- Kongsberg Gruppen ASA

- Raytheon Technologies Corporation

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Fugro N.V.

- Ocean Infinity

- Teledyne Technologies Incorporated

- BAE Systems plc

- ECA Group (part of Exail)

- ASV Global (part of L3Harris)

- Elbit Systems Ltd.

- Atlas Elektronik GmbH (part of thyssenkrupp Marine Systems)

- Lockheed Martin Corporation

- QinetiQ Group plc

- Hydroid, Inc. (part of Kongsberg)

- iXblue (part of Exail)

Frequently Asked Questions

What is an Autonomous Marine Vehicle (AMV)?

An AMV is a vessel designed to operate on or under the water surface without continuous direct human control. It uses advanced technologies like AI, sensors, and communication systems to navigate, make decisions, and complete missions autonomously.

What are the main types of Autonomous Marine Vehicles?

The main types are Unmanned Surface Vehicles (USVs), which operate on the water's surface, and Unmanned Underwater Vehicles (UUVs), which operate submerged. UUVs further segment into Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs).

What are the primary applications of AMVs?

AMVs are primarily used in defense and security (surveillance, mine countermeasures), commercial operations (offshore oil & gas inspection, hydrography), and scientific research (oceanography, environmental monitoring).

What challenges does the AMV market face?

Key challenges include high development and acquisition costs, complex regulatory frameworks, technical hurdles in harsh marine environments, cybersecurity risks, and ethical considerations surrounding autonomous decision-making.

How does AI impact the AMV market?

AI significantly enhances AMVs by improving autonomous navigation, mission planning, data processing, situational awareness through sensor fusion, and enabling sophisticated decision-making, leading to greater efficiency and mission capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager