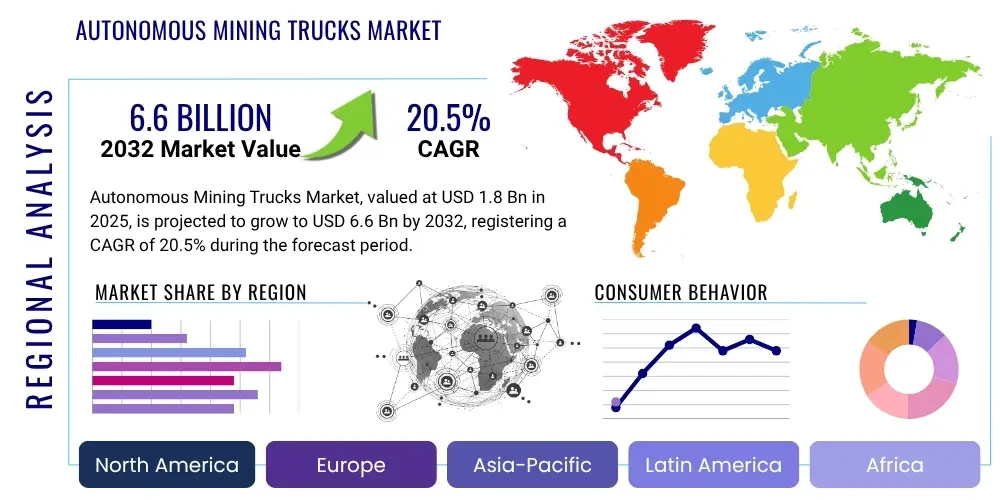

Autonomous Mining Trucks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431294 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Autonomous Mining Trucks Market Size

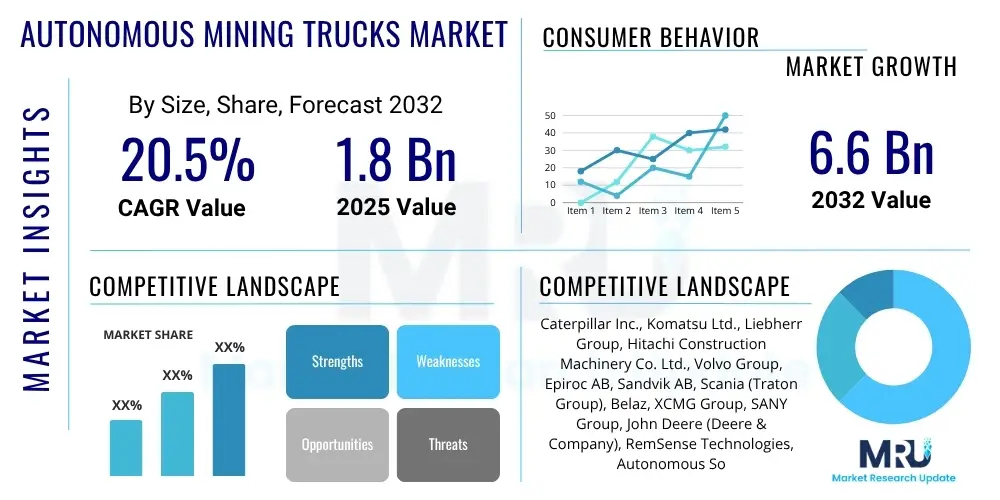

The Autonomous Mining Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2032. The market is estimated at USD 1.8 Billion in 2025 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2032.

Autonomous Mining Trucks Market introduction

The autonomous mining trucks market represents a pivotal shift in the global mining industry, characterized by the adoption of heavy-duty vehicles capable of operating without human intervention for transporting ore and overburden. These advanced systems integrate sophisticated technologies such as GPS, LiDAR, radar, cameras, and real-time communication protocols, all governed by complex software algorithms. The primary product in this market consists of self-driving haul trucks ranging in capacity from under 100 tons to over 400 tons, designed for the demanding environments of large-scale open-pit mines. These trucks perform routine haulage cycles, navigating predefined routes, detecting and avoiding obstacles, and interfacing seamlessly with loading equipment like excavators and shovels, as well as dumping facilities.

Major applications for autonomous mining trucks span a wide spectrum of mineral extraction, including but not limited to iron ore, copper, coal, gold, diamonds, and oil sands operations. Their deployment is predominantly observed in remote and expansive mining sites where the logistical challenges and inherent risks of human-operated vehicles are amplified. The core benefits driving their adoption are multifaceted, encompassing significant enhancements in worker safety by removing personnel from hazardous zones, substantial improvements in operational efficiency through consistent performance and reduced idle times, and considerable cost reductions attributed to optimized fuel consumption, lower labor expenses, and decreased wear and tear due to precise operation. These benefits collectively contribute to a more predictable and economically viable mining process.

The market's robust growth is propelled by several key driving factors. Foremost among these is the escalating global demand for minerals and raw materials, necessitating more efficient and productive mining operations. Concurrently, increasing labor costs, particularly in developed mining regions, and a persistent shortage of skilled operators further incentivize automation. Furthermore, stringent environmental regulations are pushing mining companies towards solutions that can reduce carbon footprints and optimize resource utilization, where autonomous trucks, especially electric and hybrid variants, offer a compelling answer. The continuous technological advancements in sensor fusion, artificial intelligence, and communication infrastructure also serve as strong enablers for broader and more reliable deployment of these autonomous systems.

Autonomous Mining Trucks Market Executive Summary

The Autonomous Mining Trucks Market is undergoing transformative growth, largely propelled by a convergence of business trends focused on optimizing operational expenditures and enhancing safety standards across the global mining landscape. A significant business trend involves the increasing strategic partnerships between major mining equipment manufacturers and technology providers, aiming to deliver integrated, end-to-end automation solutions. Mining companies are increasingly investing in digital transformation initiatives, seeing autonomous haulage systems as a foundational element for achieving smart mine objectives, which include real-time data analytics, predictive maintenance, and centralized fleet management. The shift towards electrification and sustainable mining practices is also a predominant trend, with manufacturers developing electric and hybrid autonomous trucks to meet environmental targets and reduce reliance on fossil fuels, aligning with broader ESG (Environmental, Social, and Governance) commitments.

Regional trends indicate a strong leadership position held by Australia, particularly in its iron ore mining regions, which has pioneered large-scale autonomous deployments, demonstrating significant operational gains and setting benchmarks for efficiency. North America, driven by robust coal, copper, and precious metal mining sectors, is rapidly accelerating its adoption, supported by advancements in local technology and infrastructure. Latin America, especially Chile with its vast copper reserves, is emerging as a critical growth region, as mining companies there seek to leverage automation for competitive advantage in a highly cost-sensitive market. Asia Pacific, beyond Australia, shows burgeoning interest from countries like China and India, focusing on domestic technology development and deployment in coal and metal mines, while Europe and Africa present nascent but promising opportunities, particularly in remote and large-scale projects where safety and efficiency gains are paramount.

Segment trends within the market highlight the dominance of trucks with haulage capacities above 250 tons, primarily due to their suitability for ultra-large open-pit operations where the scale of efficiency gains is maximized. However, there is a growing interest in mid-capacity autonomous trucks (101-250 tons) for smaller to medium-sized mines or specific applications, broadening the market's applicability. Propulsion-wise, diesel remains the prevalent type due to existing infrastructure and power requirements, yet the electric and hybrid autonomous truck segment is poised for significant acceleration, driven by sustainability mandates and advancements in battery technology and charging infrastructure. Furthermore, while fully autonomous (Level 5) systems are the ultimate goal, semi-autonomous (Level 4) solutions, offering supervised autonomy, continue to find strong traction as an interim step for many companies embarking on their automation journey, allowing for gradual integration and workforce adaptation.

AI Impact Analysis on Autonomous Mining Trucks Market

User inquiries regarding the impact of Artificial Intelligence on the Autonomous Mining Trucks Market frequently revolve around concerns about job displacement, the reliability and safety of AI-driven systems in complex environments, data security implications, the capacity for AI to handle unforeseen scenarios, and the economic viability of AI integration. There are also significant expectations concerning AI's potential to unlock unprecedented levels of efficiency, optimize resource utilization, and enable a truly smart and interconnected mining ecosystem. These questions underscore a blend of apprehension regarding the societal and operational shifts brought by AI, alongside an optimistic outlook on its transformative capabilities for enhanced productivity and safety.

- AI-powered predictive maintenance algorithms analyze sensor data from trucks to forecast equipment failures, minimizing unplanned downtime and extending asset lifespan, leading to substantial operational cost savings and improved fleet availability.

- Advanced AI systems optimize truck routes and traffic flow in real time, considering factors like road conditions, gradient, payload, and congestion, thereby reducing cycle times, fuel consumption, and overall operational inefficiencies.

- Machine learning capabilities enhance obstacle detection and avoidance, allowing autonomous trucks to distinguish between various objects, pedestrians, and dynamic hazards with greater accuracy and react appropriately, significantly bolstering safety protocols.

- AI algorithms enable sophisticated fleet coordination, synchronizing the movements of multiple autonomous trucks, loaders, and other equipment to ensure seamless integration and maximize productivity across the entire mining operation.

- Computer vision and deep learning techniques empower trucks to interpret complex environmental data from cameras and LiDAR, improving perception in challenging conditions such as dust, fog, or low light, which are common in mining environments.

- AI facilitates adaptive decision-making for autonomous trucks, allowing them to learn from past operational data and adjust their behavior to optimize performance in varying geological, weather, and operational contexts.

- The integration of AI contributes to enhanced cybersecurity by enabling anomaly detection and threat identification within the truck's operational software and communication networks, safeguarding against potential malicious attacks or system breaches.

DRO & Impact Forces Of Autonomous Mining Trucks Market

The Autonomous Mining Trucks Market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces influencing its trajectory. Key drivers include an imperative to enhance safety by removing human operators from hazardous mining environments, the pursuit of substantial productivity gains through continuous, optimized operations, and a critical need to reduce operational costs by minimizing labor expenses, fuel consumption, and equipment wear. Additionally, global labor shortages in skilled mining roles and increasing environmental mandates for lower emissions and sustainable practices significantly propel market adoption. However, the market faces notable restraints such as the exceedingly high initial capital investment required for autonomous fleet deployment and associated infrastructure, complex regulatory frameworks that vary by region and often lag technological advancements, and the inherent cybersecurity risks associated with networked, autonomous systems. The integration challenges with existing mining infrastructure and the need for a highly skilled technical workforce for maintenance and supervision also pose significant hurdles. Opportunities abound in the expansion of autonomous solutions into underground mining operations, the development of subscription-based or 'Robotics as a Service' models to lower entry barriers, and the integration of these systems with advanced IoT and predictive analytics platforms for truly smart mining. Impact forces therefore include continuous technological advancements in AI, sensor technology, and connectivity, which drive system reliability and intelligence; evolving regulatory landscapes that can either accelerate or impede deployment; the economic viability and demonstrable return on investment (ROI) that convince mining companies to adopt; and increasing societal and corporate pressures for enhanced safety and environmental sustainability within the mining sector, which are increasingly non-negotiable considerations.

Segmentation Analysis

The Autonomous Mining Trucks Market is comprehensively segmented to provide granular insights into its diverse applications, technological specifications, and operational characteristics. This segmentation allows for a detailed analysis of market dynamics across various dimensions, including the capacity of the trucks, their propulsion mechanisms, the level of autonomy offered, and the specific types of mining operations where they are deployed. Understanding these segments is crucial for stakeholders to identify growth areas, tailor product development, and formulate targeted market entry strategies, reflecting the nuanced needs and adoption patterns within the global mining industry.

- By Haulage Capacity:

- Up to 100 Tons: Typically used for smaller operations, specific material handling, or in mines with tighter access constraints.

- 101-250 Tons: A growing segment for medium to large-scale open-pit mines, balancing capacity with operational flexibility.

- Above 250 Tons: Dominant segment, primarily deployed in ultra-large open-pit mines for high-volume, continuous haulage, maximizing efficiency and scale.

- By Propulsion Type:

- Diesel: Currently the most widespread, leveraging existing fuel infrastructure and proven power for heavy loads.

- Electric: Gaining traction due to environmental benefits, lower operating costs, and advancements in battery and charging technology, especially for 'trolley assist' systems.

- Hybrid: Combining diesel engines with electric motors for improved fuel efficiency and reduced emissions, offering a transitional solution.

- By Autonomy Level:

- Semi-Autonomous (Level 4): Trucks operate autonomously under specific conditions, with human supervision or remote intervention capabilities, allowing for phased adoption.

- Fully Autonomous (Level 5): Trucks operate entirely without human intervention under all conditions, representing the ultimate goal of full automation.

- By Application:

- Metal Mining: Includes iron ore, copper, gold, platinum, and other metal extraction, often in large open-pit environments.

- Coal Mining: Utilization in both surface coal mines for overburden removal and coal haulage.

- Other Mining: Encompasses operations such as diamond mining, oil sands extraction, and industrial minerals where bulk material handling is critical.

Value Chain Analysis For Autonomous Mining Trucks Market

The value chain for the Autonomous Mining Trucks Market is complex and highly integrated, spanning from foundational technology development to end-user deployment and ongoing support, involving numerous specialized entities. Upstream analysis reveals a critical reliance on advanced component manufacturers for sensors such as LiDAR, radar, ultrasonic sensors, and high-resolution cameras, alongside developers of sophisticated AI and machine learning software for navigation, perception, and decision-making. Communication system providers, specializing in high-bandwidth, low-latency solutions like 5G, Wi-Fi 6, and satellite communication, are also integral upstream partners, ensuring robust data exchange. The midstream segment is dominated by original equipment manufacturers (OEMs) like Caterpillar, Komatsu, and Liebherr, who integrate these components into robust autonomous haulage systems, often working in conjunction with specialized system integrators to customize solutions for specific mine sites. This phase also includes infrastructure development for vehicle-to-infrastructure (V2I) communication, high-precision GPS (RTK), and charging stations for electric variants. Downstream analysis focuses on the end-users, primarily large-scale mining corporations such as Rio Tinto, BHP, and Fortescue Metals Group, who purchase and operate these systems. Distribution channels are typically direct sales from OEMs to mining companies, often accompanied by long-term service contracts, training, and ongoing technical support. Indirect channels may involve specialized integrators or robotics solution providers who bundle various technologies for comprehensive deployment. The value chain emphasizes close collaboration and strategic partnerships across all stages to ensure seamless integration, reliable operation, and optimal performance of autonomous mining truck fleets.

Autonomous Mining Trucks Market Potential Customers

The primary potential customers for autonomous mining trucks are large-scale mining corporations and operators with extensive open-pit operations that involve significant haulage distances and volumes, where the benefits of automation can be fully realized and justify the substantial initial investment. These include global diversified mining giants operating across multiple commodities like iron ore, copper, coal, and gold, which continuously seek efficiency gains and safety improvements. Companies engaged in capital-intensive, long-life assets are particularly attractive targets, as they possess the financial capacity and long-term strategic vision to invest in transformative technologies. Additionally, contract mining companies that manage operations for resource owners represent a growing segment of potential customers, as they can leverage autonomous fleets to offer more competitive and efficient services. Government-owned mining enterprises, especially in regions with supportive industrial policies and a focus on modernization, also present significant opportunities. The ideal customer profile often involves mines in remote locations, experiencing labor shortages, operating under stringent safety and environmental regulations, and facing intense competitive pressures to reduce operating costs. As technology advances and costs potentially decrease, the market for mid-sized mining operations is also emerging as a viable segment, seeking to scale their operations with automated solutions without necessarily requiring ultra-large fleets. The ability to demonstrate a clear return on investment through reduced operational expenses, enhanced safety, and increased productivity is paramount in converting these potential customers into adopters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2032 | USD 6.6 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Liebherr Group, Hitachi Construction Machinery Co. Ltd., Volvo Group, Epiroc AB, Sandvik AB, Scania (Traton Group), Belaz, XCMG Group, SANY Group, John Deere (Deere & Company), RemSense Technologies, Autonomous Solutions Inc. (ASI), Wenco International Mining Systems (Hitachi subsidiary), Hexagon AB (Leica Geosystems), Oxbotica, SafeAI Inc., Phantom Auto, RCT Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous Mining Trucks Market Key Technology Landscape

The autonomous mining trucks market is underpinned by a sophisticated array of interconnected technologies that enable safe, efficient, and reliable operation without human intervention. At the core of navigation and positioning are high-precision Global Positioning Systems (GPS) augmented by Real-Time Kinematic (RTK) technology, providing centimeter-level accuracy essential for dynamic path planning and precise maneuvering in open-pit environments. Environmental perception relies heavily on a sensor fusion approach, integrating LiDAR (Light Detection and Ranging) for 3D mapping and obstacle detection, radar for all-weather object sensing and distance measurement, and high-resolution cameras utilizing machine vision for detailed object classification and situational awareness. Inertial Measurement Units (IMUs) complement these sensors by providing data on the truck's orientation, velocity, and gravitational forces. Communication between autonomous trucks, central control systems, and other mine equipment is facilitated by robust wireless networks, including dedicated short-range communication (DSRC), Wi-Fi, 4G LTE, and increasingly 5G networks, ensuring low-latency data exchange crucial for real-time coordination and safety. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are paramount for processing sensor data, enabling predictive maintenance, optimizing routes, facilitating adaptive decision-making, and enhancing obstacle avoidance capabilities. Robotics Operating Systems (ROS) or similar industrial automation platforms provide the framework for integrating these diverse hardware and software components. Furthermore, advanced teleoperation systems allow remote operators to supervise and intervene when necessary, serving as a crucial safety and operational backup. The integration of cloud computing platforms for data storage, analysis, and simulation also plays a significant role in continually refining the performance and safety protocols of autonomous mining fleets, driving continuous improvement through data-driven insights.

Regional Highlights

- North America: This region is a significant adopter, driven by a strong focus on enhancing worker safety, mitigating labor shortages, and optimizing operational costs across large-scale mining operations in the US and Canada. Companies are actively investing in retrofitting existing fleets and deploying new autonomous systems, particularly in copper, coal, and oil sands mines. The presence of leading technology developers and supportive regulatory environments further fuels market expansion.

- Europe: While having fewer vast open-pit mines compared to other regions, Europe is a hub for innovation and R&D in mining automation. Scandinavian countries are particularly advanced in exploring autonomous solutions for challenging environments, including underground mining. The region's stringent environmental regulations are also driving demand for electric and hybrid autonomous trucks, positioning it as a key market for sustainable mining solutions and advanced prototyping.

- Asia Pacific (APAC): Leading the global market in terms of deployed autonomous trucks, primarily due to Australia's extensive iron ore mining operations. Australia has set a global benchmark for large-scale autonomous deployments, demonstrating significant efficiency and safety gains. Beyond Australia, countries like China and India are increasingly investing in autonomous technology for their vast coal and metal mining sectors, focusing on domestically developed solutions and efficiency improvements to meet escalating raw material demand.

- Latin America: This region presents immense growth potential, particularly in countries like Chile, Peru, and Brazil, which possess vast mineral resources, especially copper and iron ore. Mining companies in Latin America are actively exploring and implementing autonomous solutions to combat rising operational costs, address safety concerns in remote locations, and increase productivity to remain competitive in global markets. Investments in infrastructure and local expertise are steadily growing.

- Middle East and Africa (MEA): An emerging market for autonomous mining trucks, with substantial potential in regions rich in strategic minerals and precious metals. Countries with large-scale mining projects are evaluating and gradually adopting autonomous solutions to overcome operational challenges such as extreme temperatures, remote locations, and the need for enhanced safety. The region is poised for increased adoption as infrastructure develops and the economic benefits become more widely recognized.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Mining Trucks Market.- Caterpillar Inc.

- Komatsu Ltd.

- Liebherr Group

- Hitachi Construction Machinery Co. Ltd.

- Volvo Group

- Epiroc AB

- Sandvik AB

- Scania (Traton Group)

- Belaz

- XCMG Group

- SANY Group

- John Deere (Deere & Company)

- RemSense Technologies

- Autonomous Solutions Inc. (ASI)

- Wenco International Mining Systems (Hitachi subsidiary)

- Hexagon AB (Leica Geosystems)

- Oxbotica

- SafeAI Inc.

- Phantom Auto

- RCT Global

Frequently Asked Questions

What are autonomous mining trucks?

Autonomous mining trucks are self-driving, heavy-duty vehicles designed for transporting ore and overburden in mining operations without human operators. They utilize advanced sensor technology, AI software, and communication systems to navigate, detect obstacles, and perform haulage tasks autonomously, significantly enhancing safety and operational efficiency in large-scale open-pit mines.

What are the primary benefits of implementing autonomous mining trucks?

The main benefits include a dramatic improvement in worker safety by removing personnel from hazardous environments, substantial increases in operational efficiency through consistent performance and optimized routes, and significant reductions in operational costs due to lower fuel consumption, minimized labor expenses, and decreased equipment wear and tear from precise, controlled movements.

What are the key challenges hindering the widespread adoption of autonomous mining trucks?

Key challenges involve the high initial capital investment required for purchasing trucks and upgrading mine infrastructure, complex and often inconsistent regulatory frameworks across different jurisdictions, potential cybersecurity risks associated with networked systems, the need for advanced technical skills for maintenance, and the integration complexities with existing mining equipment and operational processes.

How does AI contribute to the functionality and performance of autonomous mining trucks?

AI is fundamental to autonomous mining trucks, enabling advanced capabilities such as real-time route optimization, predictive maintenance for critical components, enhanced obstacle detection and classification through machine learning, sophisticated fleet coordination for maximum throughput, and adaptive decision-making in varying operational conditions, all contributing to safer and more efficient operations.

Which regions are leading the global adoption of autonomous mining trucks?

Australia is a global leader in the adoption of autonomous mining trucks, particularly in its iron ore sector, setting benchmarks for large-scale deployments. North America, driven by strong safety and efficiency mandates in its copper, coal, and oil sands mines, is also a significant adopter. Latin America, especially Chile, is rapidly increasing its investments in automation, emerging as a key growth region for these advanced systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager