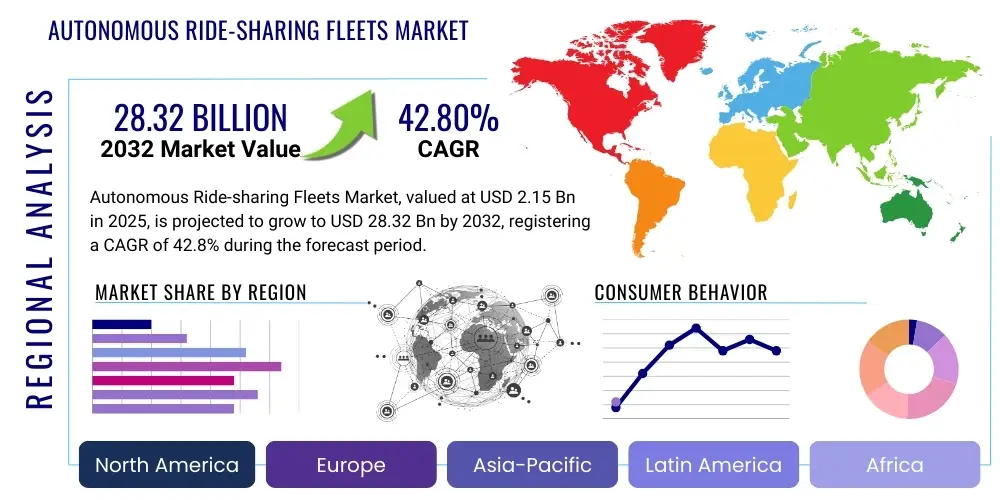

Autonomous Ride-sharing Fleets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427438 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Autonomous Ride-sharing Fleets Market Size

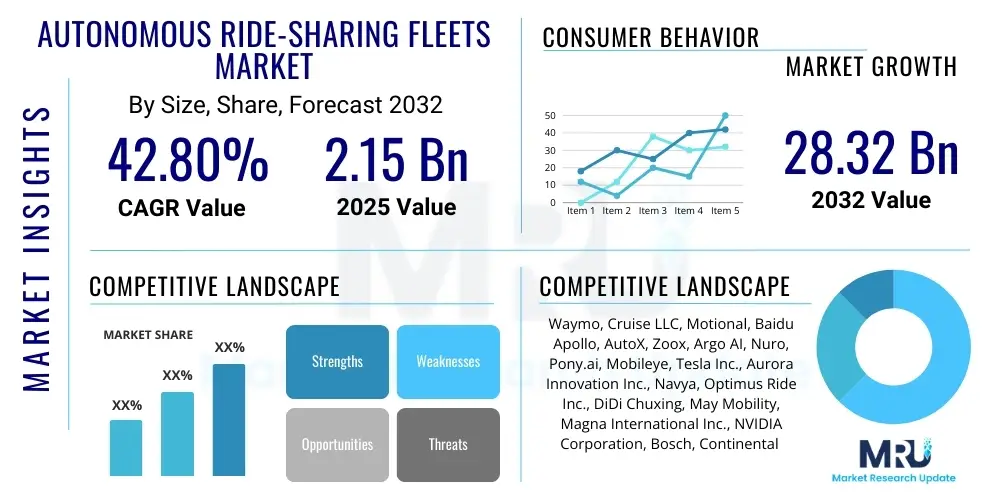

The Autonomous Ride-sharing Fleets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 42.8% between 2025 and 2032. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 28.32 Billion by the end of the forecast period in 2032.

Autonomous Ride-sharing Fleets Market introduction

The Autonomous Ride-sharing Fleets Market represents a transformative paradigm in urban transportation, characterized by the deployment of self-driving vehicles for on-demand passenger and, increasingly, goods transportation. These fleets leverage advanced artificial intelligence, sensor fusion, and sophisticated mapping technologies to operate without human intervention, promising a future of enhanced safety, efficiency, and accessibility. The product at the core of this market includes Level 4 (L4) and Level 5 (L5) autonomous vehicles, ranging from compact robotaxis designed for individual or small-group travel to larger autonomous shuttles serving fixed routes or enterprise solutions.

Major applications of autonomous ride-sharing fleets span urban mobility services, last-mile logistics, public transportation augmentation, and corporate shuttle programs. These applications address critical urban challenges such as traffic congestion, parking scarcity, and environmental pollution. The benefits derived from these fleets are substantial, including significantly reduced traffic accidents, lower operational costs due to the absence of human drivers, decreased carbon emissions, and increased mobility options for diverse populations, including the elderly and those unable to drive. Furthermore, the advent of autonomous technology promises optimized route planning and fleet management, leading to more predictable and reliable service delivery.

Driving factors propelling the Autonomous Ride-sharing Fleets Market include rapid advancements in AI and sensor technology, substantial investments from both technology giants and automotive OEMs, growing global urbanization leading to increased demand for efficient transit solutions, and evolving consumer preferences favoring convenient, on-demand services over private car ownership. Regulatory frameworks, while nascent, are slowly adapting to accommodate these innovations, fostering an environment where pilot programs can transition into widespread commercial deployment, marking a pivotal shift in how societies envision and utilize transportation infrastructure.

Autonomous Ride-sharing Fleets Market Executive Summary

The Autonomous Ride-sharing Fleets Market is experiencing profound growth driven by significant technological breakthroughs and strategic investments from global leaders. Business trends highlight a strong emphasis on partnerships between traditional automotive manufacturers, innovative tech companies, and ride-hailing platforms to accelerate development and deployment of L4 and L5 autonomous vehicles. There is a clear trend towards expanding test beds and pilot programs in designated urban areas, with a focus on refining perception systems, improving safety protocols, and optimizing operational efficiency. Companies are increasingly exploring diverse business models, including direct consumer services (robotaxis), business-to-business logistics, and public transit integration, reflecting a versatile approach to market penetration and revenue generation as the technology matures and regulatory landscapes evolve globally.

Regionally, North America, particularly the United States, stands as a primary innovation hub and early adopter market, characterized by extensive testing and commercial launches in cities like Phoenix, San Francisco, and Austin. Asia-Pacific, led by China and increasingly by Japan and South Korea, demonstrates immense potential due to robust government support, dense urban populations, and a tech-savvy consumer base. Europe, while progressing with stricter regulatory oversight, is catching up with several cities participating in autonomous shuttle pilot projects, indicating a measured yet determined approach towards integrating these advanced mobility solutions. Each region presents unique opportunities and challenges, influencing deployment strategies and market growth trajectories, with localized regulatory frameworks playing a crucial role in the pace of adoption.

Segmentation trends reveal that robotaxi services continue to dominate the market in terms of early commercialization and investment, addressing the immediate need for flexible, on-demand personal transportation. Autonomous shuttles are gaining traction in specific niches such as campus transportation, airport transfers, and last-mile connectivity for public transit, offering fixed-route or geofenced solutions. The market is also seeing emerging segments focusing on autonomous delivery vehicles and specialized logistics fleets, particularly for urban freight and e-commerce fulfillment. This diversification of applications underscores the adaptability of autonomous technology beyond just passenger transport, pointing towards a future where various types of autonomous fleets contribute to a comprehensive, interconnected mobility ecosystem that enhances efficiency across multiple sectors.

AI Impact Analysis on Autonomous Ride-sharing Fleets Market

User inquiries about AIs impact on Autonomous Ride-sharing Fleets frequently revolve around the fundamental questions of safety, reliability, and the ethical implications of machine decision-making. Users are keenly interested in how AI addresses complex real-world scenarios, navigates unpredictable human behavior, and ensures robust performance in adverse weather conditions. Concerns about cybersecurity vulnerabilities and the potential for system failures due to AI limitations are also prevalent. Conversely, there is significant curiosity regarding AIs potential to revolutionize urban mobility, enhance efficiency through optimized routing and fleet management, and personalize the user experience, underscoring a dual perspective of caution and anticipation regarding this transformative technology.

- AI forms the core of autonomous driving systems, enabling perception through sensor fusion (LiDAR, radar, cameras), object detection, classification, and tracking in real-time.

- It powers decision-making algorithms, predicting pedestrian and vehicle behavior, planning optimal trajectories, and executing control commands for steering, acceleration, and braking.

- Machine learning algorithms continuously improve system performance by learning from vast datasets of driving scenarios, reducing errors and enhancing safety over time.

- AI-driven predictive analytics optimize fleet operations, including vehicle dispatch, maintenance scheduling, and dynamic routing, leading to increased efficiency and reduced operational costs.

- Natural Language Processing (NLP) and computer vision enhance human-vehicle interaction, enabling voice commands and personalized passenger experiences within the autonomous fleet.

- Reinforcement learning is increasingly used to train autonomous systems to adapt to novel and complex driving situations, improving their ability to handle edge cases safely.

- AI contributes significantly to cybersecurity defenses, detecting anomalies and potential threats within the vehicles software and communication networks, safeguarding against external attacks.

DRO & Impact Forces Of Autonomous Ride-sharing Fleets Market

The Autonomous Ride-sharing Fleets Market is shaped by a dynamic interplay of driving forces, significant restraints, and emerging opportunities, all collectively defining its trajectory. Rapid technological advancements, particularly in artificial intelligence, sensor technology (LiDAR, radar, cameras), and high-definition mapping, serve as primary drivers, continually enhancing the capabilities and safety of autonomous vehicles. The growing global urbanization, leading to increased traffic congestion and demand for efficient, sustainable transportation solutions, further propels market expansion. Moreover, the inherent potential for reduced operational costs through the elimination of human drivers, coupled with the promise of enhanced safety by minimizing human error, makes autonomous fleets an attractive investment for mobility providers and urban planners alike, fostering a compelling case for widespread adoption.

However, the market faces considerable restraints that temper its growth. Regulatory hurdles represent a significant impediment, with a fragmented and evolving legal framework across different jurisdictions creating uncertainty for deployment and operations. Public acceptance and trust remain critical challenges, stemming from safety concerns following high-profile incidents, alongside ethical considerations regarding AI decision-making in accident scenarios. The substantial upfront research and development costs required for achieving L4 and L5 autonomy, coupled with the complexity of integrating these sophisticated technologies into existing infrastructure, pose significant financial and technical barriers. Furthermore, the persistent threat of cybersecurity breaches and the logistical complexities of maintaining and managing large fleets of highly advanced vehicles add layers of operational difficulty.

Despite these challenges, numerous opportunities are emerging that could unlock the markets full potential. The expansion into untapped geographical markets, particularly in developing urban centers, presents vast growth avenues. The integration of autonomous fleets into various logistics and last-mile delivery services offers a novel and efficient solution for the rapidly growing e-commerce sector, creating new revenue streams beyond traditional passenger transport. The monetization of data generated by autonomous vehicles, through analytics on traffic patterns, consumer behavior, and urban infrastructure needs, offers significant value for urban planning and smart city initiatives. Furthermore, the development of innovative business models, such as subscription services for autonomous mobility or specialized fleet-as-a-service offerings, could democratize access to this technology and accelerate its commercial viability, transforming the future of urban and suburban transportation.

Segmentation Analysis

The Autonomous Ride-sharing Fleets Market is segmented across several critical dimensions, allowing for a detailed understanding of its complex structure and diverse applications. These segments typically include the level of autonomy (e.g., L4, L5), the type of vehicle used (e.g., robotaxis, shuttles, specialized delivery vehicles), the service model offered (e.g., B2B, B2C, government contracts), and the application area (e.g., passenger transport, goods delivery, public transit support). This granular segmentation helps stakeholders analyze specific market niches, identify key growth areas, and tailor technological developments and business strategies to meet the unique demands of each sub-market, ultimately driving targeted innovation and efficient resource allocation across the evolving autonomous mobility landscape.

- By Level of Autonomy:

- Level 4 (High Automation)

- Level 5 (Full Automation)

- By Vehicle Type:

- Robotaxis (Passenger Cars)

- Autonomous Shuttles/Buses

- Autonomous Delivery Pods/Vans

- Specialized Autonomous Vehicles (e.g., for logistics hubs)

- By Service Model:

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Business-to-Government (B2G)

- By Application:

- Passenger Mobility

- Last-Mile Delivery

- Public Transit Enhancement

- Corporate & Campus Shuttles

- By Component:

- Hardware (Sensors, Cameras, LiDAR, Radar, Computing Units)

- Software (AI Algorithms, Mapping, V2X Communication, Cloud Platform)

- Services (Fleet Management, Maintenance, Data Monetization)

Autonomous Ride-sharing Fleets Market Value Chain Analysis

The value chain for the Autonomous Ride-sharing Fleets Market is highly intricate, involving a complex ecosystem of technology providers, vehicle manufacturers, service operators, and infrastructure developers. Upstream activities are dominated by specialized component suppliers who provide the foundational hardware and software. This includes manufacturers of advanced sensors like LiDAR, radar, and high-resolution cameras, which are critical for environmental perception. It also encompasses developers of high-performance computing platforms, specialized AI chips, and robust mapping and localization software, along with telecommunication providers enabling V2X (Vehicle-to-Everything) communication. These suppliers form the technological bedrock upon which autonomous capabilities are built, demanding significant R&D investment and continuous innovation to meet evolving performance and safety standards for the fleets.

Midstream in the value chain, vehicle manufacturers and system integrators play a pivotal role. This segment involves traditional automotive OEMs adapting their vehicle platforms for autonomous operation, as well as new entrants focused solely on autonomous vehicle design and production. System integrators are responsible for combining the diverse hardware components and software layers into a cohesive, functional autonomous driving system. This includes rigorous testing, validation, and calibration of sensors, algorithms, and vehicle control systems to ensure reliability and safety under various driving conditions. Collaborations between traditional automakers and tech companies are increasingly common at this stage, pooling expertise to accelerate the development and commercialization of robust autonomous vehicle platforms suitable for fleet deployment.

Downstream activities center around the operation and maintenance of autonomous fleets, directly interacting with the end-users. This segment includes autonomous ride-sharing service providers who manage and deploy the fleets, handle dispatching, customer support, and real-time monitoring. Maintenance and servicing are critical, requiring specialized diagnostics and technicians capable of handling complex autonomous systems. Furthermore, distribution channels for these services can be direct, with companies like Waymo and Cruise operating their own fleets and engaging directly with consumers through dedicated apps. Indirect channels may involve partnerships with existing ride-hailing platforms or public transit authorities, where autonomous vehicles are integrated into broader mobility networks. This ecosystem extends to data analytics providers who leverage the vast amounts of operational data for fleet optimization, predictive maintenance, and urban planning insights, creating additional value streams.

Autonomous Ride-sharing Fleets Market Potential Customers

The Autonomous Ride-sharing Fleets Market serves a diverse range of potential customers, each with distinct needs and motivations for adopting these advanced mobility solutions. Individual urban commuters represent a significant end-user segment, seeking convenient, affordable, and flexible transportation alternatives to personal car ownership or traditional ride-hailing services. The promise of reduced travel time, enhanced safety, and the ability to utilize transit time productively makes autonomous ride-sharing an attractive option for daily commutes and occasional travel, particularly as vehicle availability and service reliability improve in dense metropolitan areas, addressing the persistent challenges of parking and traffic congestion that plague modern cities globally.

Beyond individual consumers, corporate clients and municipal governments constitute a growing base of potential customers. Businesses are exploring autonomous fleets for employee shuttles, inter-campus transport, and optimizing last-mile delivery operations for goods and services, aiming to reduce operational costs, improve efficiency, and enhance employee mobility programs. Municipalities and public transit agencies view autonomous ride-sharing fleets as a valuable extension of their existing public transportation networks, offering solutions for first-mile/last-mile connectivity, serving underserved areas, and providing on-demand transit options that can reduce traffic and pollution. These entities are keen on leveraging autonomous technology to build smarter, more sustainable, and accessible urban environments for their residents, integrating these services into broader urban development strategies.

Furthermore, specialized industries such as logistics and e-commerce companies are emerging as crucial potential customers for autonomous fleets, particularly for goods delivery and inter-depot transportation. Autonomous delivery vehicles offer the potential to significantly reduce labor costs, improve delivery speed and reliability, and operate 24/7, transforming urban logistics. Event organizers, tourist destinations, and campus environments also represent niche markets for autonomous shuttles, seeking efficient and novel ways to move people within controlled environments. The appeal to these diverse customer segments stems from the technologys promise of enhanced efficiency, safety, sustainability, and the potential for substantial cost savings and service improvements across various operational contexts, indicating a broad and expanding adoption landscape.

Autonomous Ride-sharing Fleets Market Key Technology Landscape

The Autonomous Ride-sharing Fleets Market is underpinned by an advanced and rapidly evolving technology landscape, with each component playing a critical role in enabling the safe and efficient operation of self-driving vehicles. At the forefront is Artificial Intelligence (AI) and Machine Learning (ML), which serve as the brain of autonomous systems, processing vast amounts of sensory data, predicting behaviors of other road users, and making real-time driving decisions. These AI algorithms drive perception, planning, and control modules, continuously learning from new data to enhance system performance, object recognition, and navigation capabilities. Sophisticated deep learning networks allow vehicles to interpret complex road situations and adapt to unpredictable environments, which is crucial for achieving high levels of autonomy in dynamic urban settings.

Sensor technologies are equally foundational, providing the autonomous vehicle with a comprehensive understanding of its surroundings. LiDAR (Light Detection and Ranging) systems generate highly detailed 3D maps of the environment, essential for precise localization and obstacle detection. Radar sensors excel in adverse weather conditions, detecting objects and their velocities, while an array of high-resolution cameras provides visual data, crucial for traffic sign recognition, lane keeping, and identifying intricate details. Ultrasonic sensors assist with close-range object detection and parking maneuvers. The fusion of data from these diverse sensors is critical to creating a robust and redundant perception system that can operate reliably under various conditions, overcoming the limitations of any single sensor type and ensuring a holistic environmental awareness.

Beyond perception, the technology landscape includes high-definition (HD) mapping and Global Positioning System (GPS) for accurate localization and navigation, allowing vehicles to precisely know their position on the road. V2X (Vehicle-to-Everything) communication technologies enable vehicles to communicate with each other (V2V), with infrastructure (V2I), and with pedestrians (V2P), enhancing safety and traffic flow by sharing real-time information about road conditions, hazards, and traffic signals. Cloud computing infrastructure provides the necessary processing power for AI training, data storage, and over-the-air (OTA) software updates, ensuring that fleets remain up-to-date and continuously improve. Cybersecurity measures are also paramount, protecting these interconnected systems from potential hacks and ensuring the integrity and privacy of operational data, which is essential for maintaining trust and reliability in autonomous ride-sharing services globally.

Regional Highlights

- North America: This region is a global leader in the development and deployment of autonomous ride-sharing fleets, primarily driven by significant investments from tech giants and automotive OEMs in the United States. Cities like Phoenix, San Francisco, and Austin have served as key testing grounds and early commercial launch sites for robotaxi services. The robust regulatory sandboxes, high levels of technological adoption, and a strong venture capital ecosystem foster innovation. Canada also shows promise with ongoing pilot projects, contributing to the regional leadership in autonomous mobility.

- Europe: European markets are progressing with a more cautious and regulatory-driven approach, focusing on autonomous shuttles for public transport integration and controlled urban environments. Countries like Germany, France, and the UK are actively engaged in pilot programs, emphasizing safety standards and public acceptance. While full-scale robotaxi deployments are slower compared to North America, the regions strong automotive manufacturing base and commitment to smart city initiatives suggest a steady, long-term growth trajectory for autonomous fleets.

- Asia-Pacific: This region is projected to be one of the fastest-growing markets, led by China, Japan, and South Korea. China, in particular, benefits from strong government support, massive urban populations, and a highly competitive tech landscape, with companies rapidly expanding their autonomous testing and commercial operations. Japan is focusing on autonomous mobility for addressing labor shortages and enhancing services for its aging population, while South Korea is investing heavily in V2X infrastructure and smart city integration, positioning the region as a significant force in the global market.

- Rest of the World (RoW): The RoW, encompassing Latin America, the Middle East, and Africa, represents an emerging market with substantial long-term potential. Countries in the Middle East, such as the UAE and Saudi Arabia, are making significant investments in smart city infrastructure and autonomous technology as part of their national visions for futuristic urban development. Latin America and Africa are still in nascent stages, primarily focusing on feasibility studies and initial pilot projects, with potential for growth driven by urbanization and the need for efficient public transport solutions, particularly in megacities, as infrastructure and regulatory frameworks evolve over time.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Ride-sharing Fleets Market.- Waymo (Alphabet Inc.)

- Cruise LLC (General Motors)

- Motional (Hyundai Motor Group & Aptiv)

- Baidu Apollo

- AutoX

- Zoox (Amazon)

- Argo AI (Ford & Volkswagen)

- Nuro

- Pony.ai

- Mobileye (Intel Corporation)

- Tesla Inc.

- Aurora Innovation Inc.

- Navya

- Optimus Ride Inc.

- DiDi Chuxing

- May Mobility

- Magna International Inc.

- NVIDIA Corporation

- Bosch (Robert Bosch GmbH)

- Continental AG

Frequently Asked Questions

Analyze common user questions about the Autonomous Ride-sharing Fleets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an autonomous ride-sharing fleet?

An autonomous ride-sharing fleet comprises self-driving vehicles (Level 4 or 5 autonomy) deployed for on-demand passenger transport or goods delivery without human drivers. These fleets are managed centrally and accessed via mobile applications, offering a convenient, often more efficient alternative to traditional transportation services, leveraging advanced AI, sensors, and connectivity to operate safely and intelligently within designated operational domains.

How safe are autonomous ride-sharing fleets?

Autonomous ride-sharing fleets are designed with multiple layers of redundancy and advanced safety systems, including sophisticated AI algorithms, high-resolution sensors, and rigorous testing protocols, aiming to significantly reduce accidents caused by human error. While incidents can occur, continuous learning from vast operational data and stringent safety validations are constantly improving their reliability and safety performance, striving for a safety record superior to human-driven vehicles, with industry bodies and regulators setting increasingly robust standards for deployment.

What are the main benefits of autonomous ride-sharing fleets?

The primary benefits include enhanced safety due to reduced human error, lower operational costs by eliminating driver salaries, decreased traffic congestion and parking demand, reduced carbon emissions contributing to environmental sustainability, and increased mobility access for individuals unable to drive. These fleets also offer improved efficiency through optimized routing and fleet management, providing a more reliable and personalized transportation experience for urban and suburban environments.

What are the key challenges facing the widespread adoption of autonomous ride-sharing fleets?

Key challenges involve navigating complex and fragmented regulatory landscapes across different regions, overcoming public apprehension and building trust in self-driving technology, managing the substantial upfront capital investment required for research, development, and infrastructure, and addressing cybersecurity risks. Technical hurdles related to operating in diverse weather conditions and unpredictable urban environments also persist, along with ethical considerations surrounding AI decision-making in critical scenarios.

How will autonomous ride-sharing fleets impact urban infrastructure and employment?

Autonomous fleets are expected to significantly reshape urban infrastructure by reducing the need for extensive parking facilities and potentially optimizing road utilization, leading to smarter traffic management systems. In terms of employment, there will likely be a shift from traditional driving roles to new jobs in fleet management, maintenance, software development, data analytics, and regulatory oversight. While some job displacement is anticipated for drivers, new opportunities will emerge in the autonomous mobility ecosystem, requiring a workforce with specialized technical skills.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager