Autonomous Tractors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427336 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Autonomous Tractors Market Size

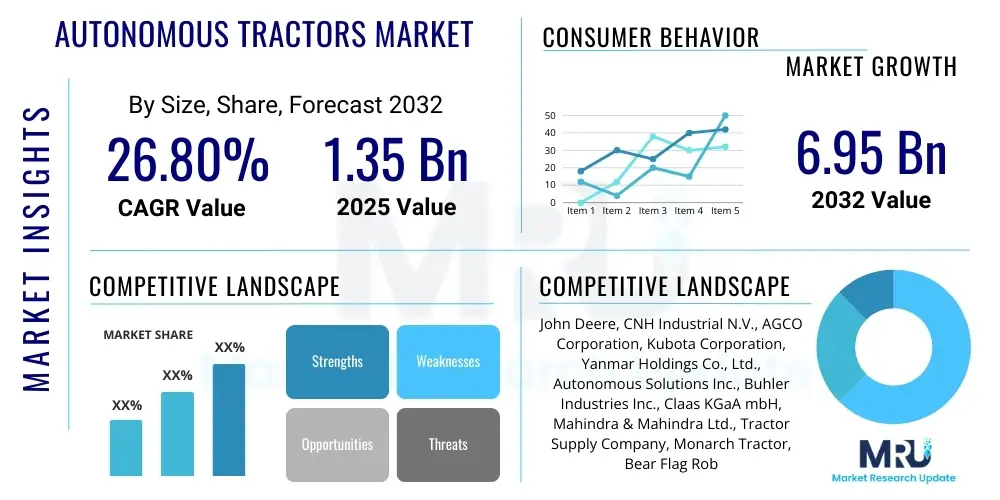

The Autonomous Tractors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.8% between 2025 and 2032. The market is estimated at USD 1.35 billion in 2025 and is projected to reach USD 6.95 billion by the end of the forecast period in 2032.

Autonomous Tractors Market introduction

The autonomous tractors market represents a significant paradigm shift in modern agriculture, leveraging advanced technologies to automate farming operations. These sophisticated machines are designed to operate without direct human intervention, performing tasks such as plowing, planting, spraying, and harvesting with enhanced precision and efficiency. They integrate a complex array of sensors, GPS navigation, artificial intelligence, and robust software systems to navigate fields, detect obstacles, and execute predefined tasks, thereby minimizing labor requirements and optimizing resource utilization. The evolution of autonomous tractors is driven by the pressing need for increased agricultural productivity, especially in the face of global food demand and dwindling labor availability.

Autonomous tractors offer a transformative solution to various challenges plaguing the agricultural sector. Their primary benefits include a substantial reduction in operational costs through optimized fuel consumption and labor savings, improved crop yields due to precise application of inputs, and enhanced worker safety by removing personnel from potentially hazardous environments. These systems are integral to the broader movement of precision agriculture, enabling farmers to make data-driven decisions that lead to sustainable farming practices. The markets growth is primarily propelled by significant advancements in sensor technology, satellite navigation systems, and sophisticated AI algorithms that enable increasingly complex autonomous capabilities, making these machines indispensable for future agricultural landscapes.

Autonomous Tractors Market Executive Summary

The Autonomous Tractors Market is experiencing robust growth, fueled by several overarching business trends. Key among these are the increasing investments in research and development by major agricultural machinery manufacturers, alongside strategic partnerships with technology firms specializing in AI, robotics, and connectivity solutions. There is a discernible trend towards offering autonomous capabilities as part of integrated farm management systems, moving beyond standalone machinery to comprehensive, data-driven agricultural ecosystems. Business models are also evolving, with a growing emphasis on subscription-based services for software and support, which lowers the initial capital expenditure for farmers and promotes wider adoption. The market is witnessing a consolidation phase as established players acquire smaller tech innovators to enhance their autonomous product portfolios and intellectual property.

Regionally, North America and Europe currently dominate the autonomous tractors market, attributed to early adoption of precision agriculture technologies, significant agricultural infrastructure, and favorable government policies supporting technological innovation in farming. These regions benefit from a high degree of technological readiness among farmers and substantial investment capacities. However, the Asia-Pacific region is emerging as a critical growth hub, driven by the need to improve food security for large populations, increasing governmental support for agricultural modernization, and the rising awareness of precision farming benefits. Countries like China and India, with vast agricultural lands and a growing focus on efficiency, are expected to contribute significantly to market expansion in the coming years. South America, particularly Brazil, is also showing promising growth as large-scale commercial farms seek to optimize operations and counter labor shortages.

Segment-wise, the market is characterized by trends towards higher horsepower autonomous tractors, reflecting the demand from large commercial farming operations for powerful and efficient machinery. Advancements in sensor fusion technology, integrating data from multiple sensor types (Lidar, Radar, Cameras, GPS) for superior environmental perception, are a prominent trend. The software segment, particularly AI and machine learning algorithms for route optimization, real-time decision-making, and predictive analytics, is witnessing rapid innovation and is becoming a critical differentiator for manufacturers. Furthermore, there is a strong inclination towards fully autonomous solutions over semi-autonomous ones, as the technology matures and regulatory frameworks adapt to allow for complete driverless operation, promising greater efficiencies and reduced human error in field tasks.

AI Impact Analysis on Autonomous Tractors Market

Artificial intelligence is fundamentally reshaping the autonomous tractors market by addressing critical user questions regarding operational precision, safety, real-time adaptability, and yield optimization. Users are keen to understand how AI can ensure maximum efficiency in planting and harvesting, minimize input waste, and navigate complex field conditions without human intervention. The core concerns revolve around AIs capability to accurately detect and classify obstacles, make instantaneous decisions in dynamic environments, and continuously learn from operational data to improve performance. AIs influence extends to enabling predictive maintenance, optimizing fuel consumption, and integrating seamlessly with broader farm management systems, thereby elevating the overall intelligence and reliability of autonomous agricultural machinery. This technological integration is pivotal for unlocking the full potential of driverless farming, promising unprecedented levels of productivity and sustainability.

The integration of artificial intelligence empowers autonomous tractors with advanced perception, cognitive, and decision-making capabilities that mimic, and often surpass, human abilities in repetitive agricultural tasks. AI algorithms process vast amounts of data from onboard sensors, satellite imagery, and weather forecasts to make highly informed decisions regarding planting density, fertilizer application rates, pest detection, and harvesting schedules. This data-driven approach not only enhances precision but also significantly reduces the environmental impact of farming by optimizing the use of water, pesticides, and fertilizers. Furthermore, machine learning models continuously refine these processes, learning from every operation to improve efficiency and adapt to varying field conditions and crop types, making autonomous tractors more intelligent and adaptable over time.

- Enhanced Precision Agriculture: AI optimizes seeding, spraying, and fertilizing based on real-time data, leading to precise input application.

- Real-time Obstacle Detection and Avoidance: Machine learning algorithms analyze sensor data to identify and circumvent objects or people in the field, ensuring safety.

- Route Optimization and Efficiency: AI develops the most efficient paths for field operations, minimizing fuel consumption and operational time.

- Predictive Analytics for Maintenance: AI monitors system health, predicting potential failures and enabling proactive maintenance to reduce downtime.

- Adaptive Learning for Varied Conditions: AI models learn from diverse environmental and crop data to adjust operations for optimal performance in different scenarios.

- Yield Optimization: AI analyzes crop health and growth patterns to suggest optimal harvesting times and strategies, maximizing output.

- Automated Data Collection and Analysis: AI facilitates the systematic collection and interpretation of field data, providing actionable insights for farm management.

DRO & Impact Forces Of Autonomous Tractors Market

The autonomous tractors market is shaped by a complex interplay of driving forces, significant restraints, and emerging opportunities, all influenced by various impact forces. Key drivers include the escalating global demand for food, which necessitates increased agricultural productivity and efficiency. This is coupled with severe labor shortages in the agricultural sector across many developed and developing nations, making automation an attractive and often essential solution. Advances in sensor technology, artificial intelligence, and GPS/GNSS systems have made autonomous operations increasingly feasible and reliable. Furthermore, the growing adoption of precision agriculture techniques, aimed at optimizing resource use and reducing environmental impact, inherently aligns with the capabilities offered by autonomous machinery, providing significant impetus for market expansion.

Despite these strong drivers, the market faces notable restraints. The high initial capital investment required for autonomous tractors remains a significant barrier for many farmers, particularly small and medium-sized enterprises. Regulatory hurdles and a lack of standardized frameworks for autonomous agricultural machinery pose challenges, as governments navigate safety protocols, operational guidelines, and legal liabilities. Connectivity issues in remote agricultural areas can hinder the performance of data-intensive autonomous systems, which rely on robust real-time communication. Technical complexities, including the integration of diverse sensor data and ensuring fail-safe operations, also present development and deployment challenges. Additionally, farmer skepticism and resistance to adopting new, complex technologies, along with the need for specialized training, can slow market penetration.

Opportunities within this market are substantial and multifaceted. Emerging markets, particularly in Asia-Pacific and South America, represent vast untapped potential as these regions look to modernize their agricultural practices. The increasing integration of autonomous tractors with the Internet of Things (IoT) and advanced data analytics platforms offers new avenues for enhanced efficiency and comprehensive farm management. The development of more cost-effective and scalable autonomous solutions, potentially through modular retrofitting kits for existing tractors or innovative ownership models like machinery-as-a-service, could significantly broaden market accessibility. Niche applications, such as autonomous vineyard or orchard management, also present specific growth opportunities where precision and labor savings are critically valued, extending beyond traditional broadacre farming.

Segmentation Analysis

The Autonomous Tractors Market is comprehensively segmented to provide a detailed understanding of its diverse components, end-users, and technological applications. This segmentation allows for targeted analysis of market dynamics, competitive landscapes, and growth opportunities across various dimensions, including horsepower, level of autonomy, specific applications, core components, and the primary end-user base. Understanding these segments is crucial for manufacturers to tailor their product offerings, for investors to identify high-growth areas, and for policymakers to formulate supportive regulations. The markets structure reflects the evolving needs of the agricultural sector, from small-scale precise tasks to large-scale, high-power operations, indicating a flexible and adaptable technological landscape.

- By Horsepower:

- Less than 30 HP

- 30-100 HP

- More than 100 HP

- By Autonomy Level:

- Semi-Autonomous Tractors

- Fully Autonomous Tractors

- By Application:

- Planting and Seeding

- Harvesting

- Spraying and Fertilizing

- Tillage

- Plowing

- Crop Monitoring

- Others (e.g., Mowing, Baling)

- By Component:

- Hardware (GPS/GNSS, Sensors, Actuators, Cameras, Lidar, Radar)

- Software (AI/ML Algorithms, Navigation Systems, Farm Management Software)

- Services (Consulting, Integration, Maintenance, Support)

- By End-Use:

- Commercial Farms (Large, Medium)

- Research and Development Institutions

- Others (e.g., Agricultural Cooperatives, Government Projects)

Autonomous Tractors Market Value Chain Analysis

The value chain for autonomous tractors is intricate, encompassing various stages from raw material sourcing to end-user deployment and ongoing support, highlighting the interconnectedness of specialized industries. The upstream segment involves the foundational elements: raw material suppliers providing metals, plastics, and electronic components, followed by manufacturers of advanced sensors (Lidar, Radar, ultrasonic), high-precision GPS/GNSS modules, embedded AI processors, and specialized software development kits. These components are critical for the perception, navigation, and intelligence of autonomous systems. This phase also includes research and development efforts that continuously innovate the core technologies, such as advanced robotics, machine vision, and machine learning algorithms, which form the brain of these smart machines.

Midstream activities involve the design, assembly, and integration of these complex components into the final autonomous tractor unit. This stage is dominated by major agricultural machinery manufacturers who combine their traditional engineering expertise with cutting-edge autonomous technology. Rigorous testing and calibration are essential here to ensure the reliability, safety, and performance of the autonomous systems in diverse agricultural environments. Downstream activities focus on reaching the end-user and providing post-purchase support. This includes direct sales channels where manufacturers sell directly to large commercial farms, offering customized solutions and integration services. Indirect channels involve extensive dealer networks, which provide local sales, financing, installation, training, and critical after-sales services, including maintenance, repairs, and software updates, ensuring the long-term operational efficiency of the tractors.

The distribution channel typically involves a hybrid model of direct and indirect engagement. Major manufacturers often maintain direct sales teams for strategic clients and large agricultural enterprises, allowing for direct feedback and customized solutions. However, the pervasive network of authorized dealerships and distributors plays a vital role in market penetration, especially for small and medium-sized farms. These partners not only facilitate sales but also provide crucial local support, which is paramount for complex machinery requiring specialized technical assistance. The effective management of these distribution channels, coupled with robust customer service and technical support, is critical for establishing trust, fostering adoption, and sustaining market growth in the autonomous tractors sector.

Autonomous Tractors Market Potential Customers

The primary potential customers for autonomous tractors are large commercial farms, which operate on extensive land areas and can derive significant economic benefits from automation due to their scale. These farms often face substantial labor costs and shortages, making the investment in autonomous machinery a strategic decision to enhance efficiency, reduce operational expenditures, and achieve higher yields through precision agriculture. Their substantial capital expenditure budgets and a readiness to adopt advanced technologies position them as early and consistent adopters of autonomous tractor solutions. For these enterprises, the value proposition extends beyond mere automation to include comprehensive data collection, predictive analytics, and seamless integration with existing farm management systems, leading to optimized resource allocation and improved profitability.

Beyond large-scale operations, small and medium-sized farms also represent a growing segment of potential customers, particularly as autonomous tractor technology becomes more accessible and cost-effective. While their immediate adoption might be slower due to financial constraints and a perceived higher barrier to entry, the development of modular retrofitting kits, smaller autonomous units, and subscription-based service models is making this technology more viable for them. These farms are increasingly recognizing the benefits of precision farming in improving sustainability and competitiveness, driving their interest in solutions that can automate labor-intensive tasks and optimize input usage even on a smaller scale. Agricultural cooperatives, by pooling resources, can also collectively invest in autonomous tractor fleets, sharing the benefits among their members and making the technology accessible to a broader farmer base.

Additionally, research and development institutions, government agricultural departments, and educational bodies form another crucial segment of potential customers. These entities acquire autonomous tractors for various purposes, including testing new agricultural techniques, evaluating machine performance, developing future generations of autonomous systems, and training the next generation of agricultural professionals. Their procurement is often driven by the need for innovation, scientific research, and policy development related to sustainable and efficient farming. The insights and data gathered by these institutions not only advance the technology itself but also contribute to establishing best practices and regulatory frameworks that further support wider commercial adoption of autonomous tractors.

Autonomous Tractors Market Key Technology Landscape

The autonomous tractors market is defined by a sophisticated and rapidly evolving technology landscape, drawing from advancements in several critical fields. At its core, high-precision Global Positioning System (GPS) and Global Navigation Satellite Systems (GNSS) are fundamental for accurate navigation and mapping, often augmented by Real-Time Kinematic (RTK) technology for centimeter-level positioning accuracy. This allows tractors to follow precise paths, ensuring minimal overlap and optimal coverage during field operations. Complementary to navigation, a suite of advanced sensors provides the machine with a comprehensive understanding of its environment. This includes Lidar (Light Detection and Ranging) for 3D mapping and obstacle detection, Radar for all-weather object detection, and high-resolution cameras for visual recognition and analysis of crop health, soil conditions, and potential hazards.

The intelligence of autonomous tractors is primarily driven by Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies process the vast streams of data collected by sensors, enabling the tractor to make real-time decisions, detect anomalies, classify objects, and adapt its operations to changing conditions. Sensor fusion, a critical AI application, integrates data from multiple sensor types to create a more robust and reliable environmental model, overcoming the limitations of individual sensors. Furthermore, telematics and the Internet of Things (IoT) play a pivotal role, allowing remote monitoring, control, and data exchange between the autonomous tractor, farm management systems, and cloud-based platforms. This connectivity facilitates predictive maintenance, performance optimization, and seamless integration into broader smart farming ecosystems.

Beyond core navigation and perception, other key technologies include advanced robotics for precision implements, sophisticated software platforms for mission planning and fleet management, and secure communication systems for reliable data transfer and remote diagnostics. Cloud computing provides the necessary infrastructure for processing and storing large datasets, enabling complex analytics and AI model training. The development of robust power systems and electric drivetrains is also becoming increasingly important, aligning with sustainability goals and reducing operational noise and emissions. The continuous convergence and refinement of these diverse technologies are central to enhancing the capabilities, safety, and economic viability of autonomous tractors, pushing the boundaries of what is achievable in modern agriculture.

Regional Highlights

- North America: A leading market driven by extensive agricultural lands, high adoption rates of precision agriculture, severe labor shortages, and strong government support for agricultural technology. The United States and Canada are at the forefront of innovation and deployment.

- Europe: Characterized by significant R&D investments, stringent environmental regulations pushing for sustainable farming, and increasing automation to counter rising labor costs. Countries like Germany, France, and the UK are key markets with strong technological infrastructure.

- Asia-Pacific: Emerging as a high-growth region, propelled by large agricultural populations, increasing government initiatives for agricultural modernization, and growing awareness of precision farming benefits. China, India, and Japan are pivotal markets.

- South America: Experiencing substantial growth due to the presence of large commercial farms, particularly in Brazil and Argentina, focused on optimizing vast cultivable areas and improving crop yields.

- Middle East and Africa (MEA): A nascent but promising market, driven by the need for food security, water scarcity issues promoting efficient irrigation and farming, and increasing investments in agricultural technology, notably in South Africa and parts of the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Tractors Market.- John Deere (Deere & Company)

- CNH Industrial N.V. (Case IH, New Holland Agriculture)

- AGCO Corporation (Fendt, Massey Ferguson, Valtra)

- Kubota Corporation

- Yanmar Holdings Co., Ltd.

- Autonomous Solutions Inc. (ASI)

- Buhler Industries Inc. (Versatile)

- Claas KGaA mbH

- Mahindra & Mahindra Ltd.

- Tractor Supply Company (TSCO)

- Monarch Tractor

- Bear Flag Robotics (acquired by John Deere)

- Saga Robotics AS

- Perkins Engines Company Limited (a Caterpillar company, focused on engines for autonomous machinery)

Frequently Asked Questions

What are the primary benefits of autonomous tractors in modern agriculture?

Autonomous tractors offer significant benefits including increased operational efficiency, reduced labor costs due to automation, enhanced precision in planting, spraying, and harvesting, and optimized resource utilization for fuel, water, and fertilizers. These advantages lead to improved crop yields and contribute to more sustainable farming practices.

How much do autonomous tractors typically cost, and are they financially viable for small farms?

The initial cost of fully autonomous tractors can range from hundreds of thousands to over a million US dollars, making them a substantial investment. While large commercial farms benefit significantly, the financial viability for small farms is improving with the introduction of semi-autonomous options, retrofitting kits, and subscription-based service models, which aim to lower the entry barrier.

What are the main challenges hindering the widespread adoption of autonomous tractors?

Key challenges include the high initial capital investment, complex regulatory frameworks that vary by region, ensuring reliable connectivity in remote agricultural areas, technical complexities in integrating diverse sensor and software systems, and overcoming farmer resistance or skepticism towards new technologies. Safety concerns and liability issues also present significant hurdles to broader adoption.

Are autonomous tractors safe to operate, and how do they handle unexpected obstacles?

Autonomous tractors are designed with multiple layers of safety features, including advanced sensors (Lidar, Radar, cameras) and AI algorithms for real-time obstacle detection and avoidance. They are programmed to identify and react to unexpected objects, people, or animals by either stopping, slowing down, or maneuvering around them, often requiring human oversight or intervention in complex scenarios.

What is the future outlook for the autonomous tractors market, and what technological advancements are expected?

The future outlook for autonomous tractors is highly positive, with significant growth projected due to ongoing technological advancements and increasing demand for agricultural automation. Expected advancements include more sophisticated AI for adaptive learning, enhanced sensor fusion for superior environmental perception, improved battery and electric powertrain technologies, and greater integration with IoT and cloud-based farm management systems for fully connected and optimized operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager