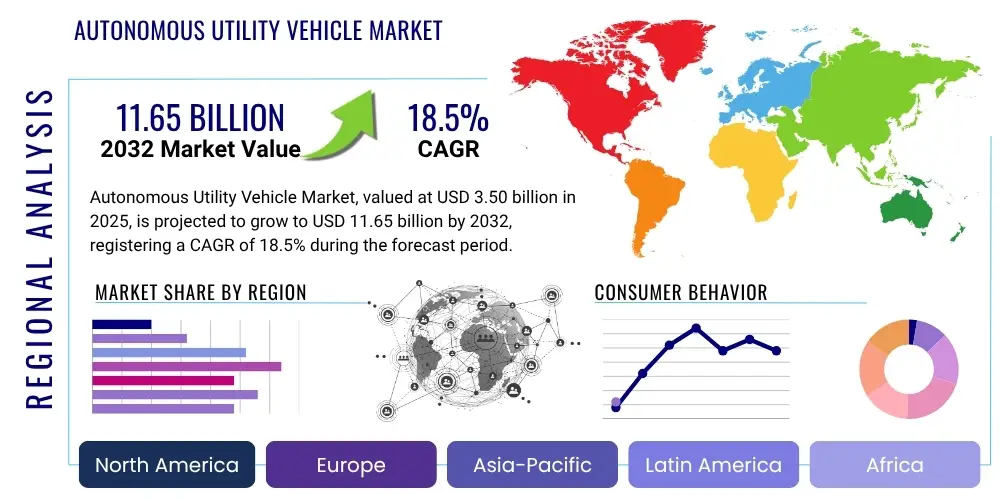

Autonomous Utility Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429131 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Autonomous Utility Vehicle Market Size

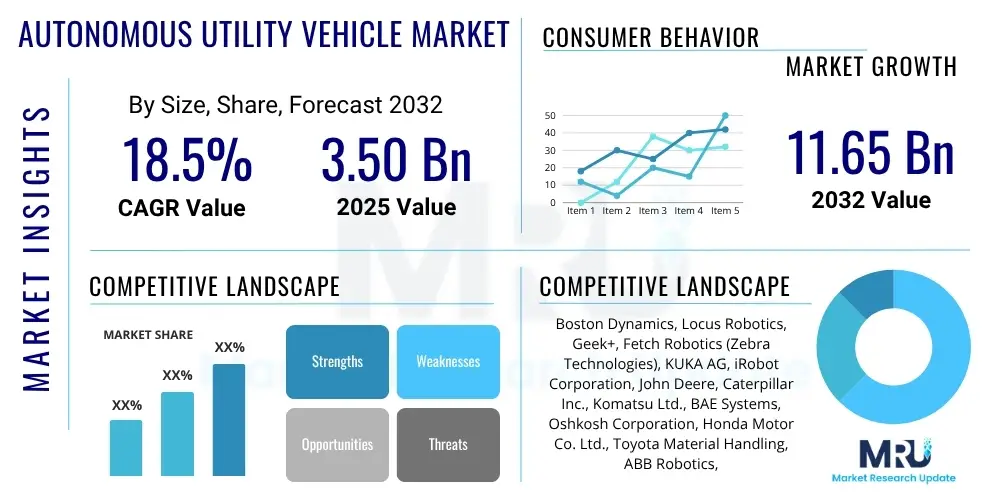

The Autonomous Utility Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 3.50 billion in 2025 and is projected to reach USD 11.65 billion by the end of the forecast period in 2032.

Autonomous Utility Vehicle Market introduction

The Autonomous Utility Vehicle (AUV) market encompasses a wide array of self-operating vehicles designed for various industrial, commercial, and service applications, moving beyond traditional automotive uses. These vehicles integrate advanced technologies such as artificial intelligence, robotics, sensors, and sophisticated navigation systems to perform tasks without direct human intervention, enhancing efficiency, safety, and productivity across diverse sectors. They are characterized by their ability to operate autonomously in defined environments, adapting to changing conditions and executing complex functions.

Product descriptions for AUVs vary significantly based on their intended use, ranging from compact robotic platforms for indoor logistics and surveillance to larger, heavy-duty vehicles for agriculture, mining, construction, and last-mile delivery. Common features include GPS and LiDAR for mapping, vision systems for object detection, and robust computing units for real-time decision-making. Major applications span industries requiring repetitive tasks, hazardous environment operations, or precise material handling, offering substantial operational advantages.

The primary benefits of adopting AUVs include significant labor cost reduction, improved operational safety by removing humans from dangerous tasks, enhanced precision and consistency in operations, and the ability to operate continuously without human fatigue. Key driving factors for market expansion include the escalating demand for automation in logistics and manufacturing, a growing focus on worker safety, advancements in AI and sensor technologies, and increasing investments in smart infrastructure across urban and industrial landscapes.

Autonomous Utility Vehicle Market Executive Summary

The Autonomous Utility Vehicle market is poised for robust expansion, driven by an accelerating shift towards automation in critical industrial and service sectors. Current business trends indicate a strong emphasis on integrating AUVs into existing operational frameworks to optimize workflows, reduce operational expenditures, and address labor shortages. Companies are increasingly investing in research and development to enhance vehicle autonomy, expand application versatility, and improve cost-effectiveness, leading to a competitive landscape characterized by innovation and strategic partnerships.

Regionally, North America and Europe are leading the market in terms of adoption and technological advancements, supported by favorable regulatory environments and substantial industrial infrastructure. However, the Asia Pacific region is rapidly emerging as a significant growth hub, propelled by rapid industrialization, burgeoning e-commerce sectors, and government initiatives promoting smart cities and advanced manufacturing. Latin America, the Middle East, and Africa are also expected to demonstrate steady growth as awareness and investment in automation solutions increase.

Segmentation trends highlight the dominance of autonomous guided vehicles (AGVs) and autonomous mobile robots (AMRs) in the indoor logistics and manufacturing segments, while larger autonomous platforms are gaining traction in outdoor applications like agriculture and mining. The market is also seeing a rise in demand for specialized AUVs tailored for niche applications, underscoring a trend towards customized, highly efficient autonomous solutions. The convergence of hardware advancements with sophisticated AI software is further enabling more complex and adaptable AUV deployments across all segments.

AI Impact Analysis on Autonomous Utility Vehicle Market

Users frequently inquire about how artificial intelligence enhances the capabilities of Autonomous Utility Vehicles, particularly concerning their decision-making accuracy, adaptability to dynamic environments, and overall operational safety. Common concerns revolve around the reliability of AI algorithms in unforeseen circumstances, the cybersecurity risks associated with networked autonomous systems, and the ethical implications of machines operating without direct human oversight. Expectations generally lean towards AI enabling AUVs to perform more complex tasks, learn from experience, and seamlessly integrate into diverse operational ecosystems, offering a path to greater efficiency and precision while requiring robust validation and regulation.

- AI enables advanced perception through sensor fusion, combining data from LiDAR, radar, cameras, and ultrasonic sensors for comprehensive environmental understanding.

- Predictive analytics powered by AI allows AUVs to anticipate future scenarios, optimize routes, and manage tasks more efficiently, reducing energy consumption and operational time.

- Reinforcement learning algorithms facilitate AUVs in adapting to changing operational conditions and learning from new data, continuously improving their performance over time.

- AI-driven decision-making systems allow AUVs to navigate complex environments, avoid obstacles, and execute intricate maneuvers with high precision, even in challenging terrains or congested areas.

- Enhanced fault detection and self-diagnosis capabilities, leveraging AI, help AUVs identify potential issues, schedule proactive maintenance, and minimize downtime.

- AI supports collaborative autonomy, enabling multiple AUVs to communicate and coordinate their actions to achieve shared objectives, particularly useful in large-scale logistics and construction.

- Natural Language Processing (NLP) integration in some advanced AUVs allows for intuitive human-machine interaction, simplifying programming and task assignment.

- Improved safety protocols are implemented through AI by predicting potential hazards and taking evasive actions, significantly reducing accident rates.

- AI facilitates deep learning for object recognition and classification, allowing AUVs to differentiate between various objects and react appropriately, crucial for mixed-traffic environments.

- Cybersecurity enhancements through AI can detect and mitigate potential threats to AUV systems, protecting sensitive data and operational integrity.

DRO & Impact Forces Of Autonomous Utility Vehicle Market

The Autonomous Utility Vehicle market is significantly influenced by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities that collectively shape its growth trajectory. Key drivers include the global push for industrial automation to enhance productivity and reduce labor costs, the increasing demand for improved safety in hazardous work environments, and the rapid advancements in AI, robotics, and sensor technologies which make autonomous operation more viable and reliable. The ongoing development of 5G infrastructure also facilitates real-time data exchange critical for sophisticated AUV operations, further propelling market expansion. These forces create a compelling case for industries to integrate autonomous solutions into their daily operations.

Conversely, the market faces several significant restraints that could impede its growth. High initial capital investment required for AUV acquisition and infrastructure setup can be a barrier for smaller enterprises. Regulatory complexities and the absence of standardized guidelines for autonomous vehicles across different regions pose challenges for widespread deployment and market penetration. Public acceptance and trust issues, particularly regarding safety and job displacement concerns, also present hurdles. Furthermore, the need for specialized technical expertise for maintenance and operation, coupled with cybersecurity vulnerabilities, adds layers of operational complexity and cost.

Despite these challenges, the AUV market is brimming with opportunities. The expansion into new application areas such as smart cities for waste management and public safety, precision agriculture for optimized crop yields, and advanced healthcare logistics presents substantial avenues for growth. The development of more cost-effective and versatile AUV platforms, coupled with the rising trend of Robot-as-a-Service (RaaS) models, can lower entry barriers and accelerate adoption. Furthermore, strategic collaborations between technology providers, manufacturers, and end-users are fostering innovation and creating integrated solutions, unlocking new market potential and addressing specific industry needs.

Segmentation Analysis

The Autonomous Utility Vehicle market is extensively segmented to reflect the diverse applications, technological advancements, and operational requirements across various industries. This segmentation provides a granular view of the market's structure, allowing for a detailed analysis of growth drivers, competitive landscapes, and emerging opportunities within specific niches. Understanding these segments is crucial for stakeholders to tailor products, develop targeted strategies, and address the specific needs of end-users effectively. The market can be broadly categorized by autonomy level, component, type, application, and end-use industry, each representing distinct characteristics and growth potential.

- By Autonomy Level:

- Fully Autonomous

- Semi-Autonomous (Remote Operated with autonomous features)

- By Component:

- Hardware (Sensors, Cameras, LiDAR, Radar, Actuators, GPS, etc.)

- Software (AI Algorithms, Navigation Software, Control Systems, Operating Systems, etc.)

- Services (Consulting, Integration, Maintenance, Support)

- By Type:

- Autonomous Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Autonomous Forklifts

- Autonomous Tractors

- Autonomous Shuttles/Tuggers

- Unmanned Ground Vehicles (UGVs)

- Other Autonomous Platforms

- By Application:

- Material Handling and Logistics

- Surveillance and Security

- Inspection and Maintenance

- Agriculture

- Mining

- Construction

- Environmental Monitoring

- Last-Mile Delivery

- Public Transport

- Healthcare

- By End-Use Industry:

- Manufacturing

- Automotive

- Logistics and E-commerce

- Agriculture

- Mining and Construction

- Defense and Security

- Healthcare and Pharmaceuticals

- Oil and Gas

- Forestry

- Municipal and Public Services

Value Chain Analysis For Autonomous Utility Vehicle Market

The value chain for the Autonomous Utility Vehicle market is complex and highly integrated, involving multiple stages from initial research and development to final deployment and maintenance. At the upstream level, it begins with raw material suppliers providing components such as specialized metals, plastics, and advanced semiconductors essential for manufacturing AUV hardware. This stage also includes suppliers of crucial technological elements like high-precision sensors (LiDAR, radar, cameras), robust computing units, advanced battery systems, and communication modules, forming the fundamental building blocks of autonomous capabilities. Research institutions and software developers contribute significantly here by creating the core AI algorithms, navigation systems, and control software that power these vehicles, making the upstream highly reliant on innovation and specialized technological inputs.

Moving downstream, the value chain encompasses the AUV manufacturers who assemble these components and integrate the software to produce the final autonomous vehicles. This stage involves sophisticated manufacturing processes, rigorous testing, and quality assurance to ensure the reliability and safety of the AUVs. Following manufacturing, the distribution channel plays a critical role. This can involve direct sales from manufacturers to large enterprises, or indirect channels through distributors, integrators, and value-added resellers (VARs) who often customize solutions for specific client needs. Direct channels are common for large, complex deployments requiring significant consultation and post-sales support, while indirect channels cater to a broader market, offering specialized solutions and local support.

The final stages of the value chain involve the end-users who deploy and operate the AUVs, and the after-sales service providers who offer maintenance, upgrades, and technical support. These services are crucial for ensuring optimal performance and longevity of the autonomous fleet. The increasing trend of Robot-as-a-Service (RaaS) models further highlights the importance of service providers in the downstream, shifting the focus from outright purchase to subscription-based operational solutions. The entire value chain emphasizes collaboration and technological synergy, from semiconductor foundries to end-user support teams, ensuring efficient operation and continuous innovation in the AUV ecosystem.

Autonomous Utility Vehicle Market Potential Customers

Potential customers for Autonomous Utility Vehicles span a broad spectrum of industries and organizations that stand to gain significant operational efficiencies, safety improvements, and cost reductions through automation. The primary end-users are typically large enterprises and industrial entities grappling with labor shortages, seeking to streamline repetitive tasks, or operating in hazardous environments where human presence poses risks. These include manufacturing facilities, particularly those involved in automotive, electronics, and heavy machinery production, where AUVs can manage internal logistics, material handling, and assembly line support with high precision and consistency.

Another significant segment of potential customers includes the logistics and e-commerce sectors, which are under constant pressure to optimize supply chains, accelerate last-mile delivery, and manage vast warehouse operations more efficiently. AUVs in these areas can automate sorting, transportation, and inventory management, significantly reducing operational bottlenecks and improving delivery times. Furthermore, the agricultural industry represents a rapidly growing customer base, with farmers adopting autonomous tractors and specialized field robots for precision farming, planting, harvesting, and crop monitoring to enhance yields and conserve resources.

Beyond traditional industrial applications, there is emerging potential in sectors such as mining and construction, where large autonomous vehicles can perform drilling, hauling, and excavation tasks in dangerous conditions. Municipal and public service entities are also potential buyers for AUVs used in waste collection, street cleaning, surveillance, and emergency response. Healthcare facilities are exploring AUVs for transporting medical supplies, laboratory samples, and even assisting patients, highlighting the diverse and expanding scope of potential customers across virtually all sectors requiring efficient and safe utility operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.50 billion |

| Market Forecast in 2032 | USD 11.65 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Dynamics, Locus Robotics, Geek+, Fetch Robotics (Zebra Technologies), KUKA AG, iRobot Corporation, John Deere, Caterpillar Inc., Komatsu Ltd., BAE Systems, Oshkosh Corporation, Honda Motor Co. Ltd., Toyota Material Handling, ABB Robotics, Clearpath Robotics, Mobile Industrial Robots (MiR), KION Group, Rockwell Automation, NVIDIA Corporation, Velodyne Lidar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autonomous Utility Vehicle Market Key Technology Landscape

The Autonomous Utility Vehicle market is underpinned by a sophisticated and rapidly evolving technological landscape, characterized by the convergence of several cutting-edge innovations. Central to AUV operation are advanced sensing technologies, which include LiDAR (Light Detection and Ranging) for 3D mapping and obstacle detection, radar for all-weather perception, high-resolution cameras for visual recognition and analysis, and ultrasonic sensors for proximity detection. These sensors provide AUVs with a comprehensive understanding of their environment, enabling safe and accurate navigation, even in complex or dynamic settings. The continuous improvement in sensor miniaturization, cost-effectiveness, and data processing capabilities is a critical enabler for wider AUV adoption.

Another fundamental aspect is the development of robust artificial intelligence and machine learning algorithms. These algorithms are crucial for processing vast amounts of sensor data in real-time, facilitating complex decision-making, object classification, predictive analytics, and adaptive learning. AI-powered navigation systems employ techniques such as Simultaneous Localization and Mapping (SLAM) to build maps of unknown environments while simultaneously tracking the vehicle's position within them. Furthermore, deep learning models are used for enhanced perception, allowing AUVs to distinguish between various objects, pedestrians, and potential hazards with increasing accuracy, contributing significantly to operational safety and efficiency.

Beyond sensing and AI, the technology landscape includes powerful onboard computing platforms designed to handle intensive data processing, advanced robotic actuators and motors for precise movement and manipulation, and secure communication systems. The integration of 5G connectivity is becoming increasingly important for enabling real-time data exchange, remote monitoring, and collaborative autonomous operations, especially in large-scale deployments. Battery technology advancements are also pivotal, providing longer operational times and faster charging cycles, which are essential for continuous industrial applications. The synergy of these technologies allows AUVs to operate effectively, adapt to unforeseen conditions, and perform a wide array of utility tasks with minimal human intervention.

Regional Highlights

- North America: This region is a leading market for AUVs, driven by high adoption rates in manufacturing, logistics, and agriculture. Significant investments in robotics and AI research, coupled with a robust industrial infrastructure and supportive regulatory frameworks, contribute to its dominance. Key countries include the United States and Canada, which are home to major technology developers and early adopters.

- Europe: Europe represents another key market, propelled by strong automation trends in automotive, warehousing, and defense sectors. Countries like Germany, the UK, and Scandinavia are at the forefront of AUV development and deployment, benefiting from government initiatives for Industry 4.0 and advanced robotics.

- Asia Pacific (APAC): APAC is experiencing the fastest growth, primarily due to rapid industrialization, burgeoning e-commerce, and increasing labor costs in countries like China, Japan, South Korea, and India. Governments in these nations are actively promoting automation and smart technologies, creating a massive potential market for AUVs, particularly in manufacturing and logistics.

- Latin America: This region is an emerging market, with increasing interest in AUVs for mining, agriculture, and warehousing, particularly in Brazil and Mexico. While adoption is slower due to economic factors and infrastructure development, strategic investments are gradually opening up new opportunities.

- Middle East and Africa (MEA): The MEA region is witnessing gradual adoption, driven by investments in smart city projects, oil and gas, and logistics in countries such as UAE, Saudi Arabia, and South Africa. AUVs are being explored for infrastructure development, surveillance, and hazardous environment operations, presenting future growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autonomous Utility Vehicle Market.- Boston Dynamics

- Locus Robotics

- Geek+

- Fetch Robotics (Zebra Technologies)

- KUKA AG

- iRobot Corporation

- John Deere

- Caterpillar Inc.

- Komatsu Ltd.

- BAE Systems

- Oshkosh Corporation

- Honda Motor Co. Ltd.

- Toyota Material Handling

- ABB Robotics

- Clearpath Robotics

- Mobile Industrial Robots (MiR)

- KION Group

- Rockwell Automation

- NVIDIA Corporation

- Velodyne Lidar

Frequently Asked Questions

What is an Autonomous Utility Vehicle (AUV)?

An Autonomous Utility Vehicle (AUV) is a self-operating machine equipped with AI, sensors, and robotics to perform tasks in various environments without direct human control, commonly used in industrial, agricultural, and logistics applications.

What are the primary benefits of using AUVs?

AUVs offer significant benefits including reduced labor costs, enhanced operational safety, improved precision and consistency in tasks, and the ability to operate continuously, thereby increasing productivity and efficiency across diverse sectors.

Which industries are major adopters of Autonomous Utility Vehicles?

Key industries adopting AUVs include manufacturing, logistics and e-commerce, agriculture, mining, construction, defense, and municipal services, all seeking to automate repetitive, dangerous, or precise tasks.

What technological components are essential for AUV functionality?

Essential AUV technologies include advanced sensors (LiDAR, radar, cameras), artificial intelligence and machine learning algorithms for decision-making, robust onboard computing platforms, and secure communication systems like 5G connectivity.

What are the main challenges hindering the growth of the AUV market?

Major challenges include high initial investment costs, the complexity of regulatory frameworks, public acceptance concerns regarding safety and job displacement, and the need for specialized technical expertise for maintenance and operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager