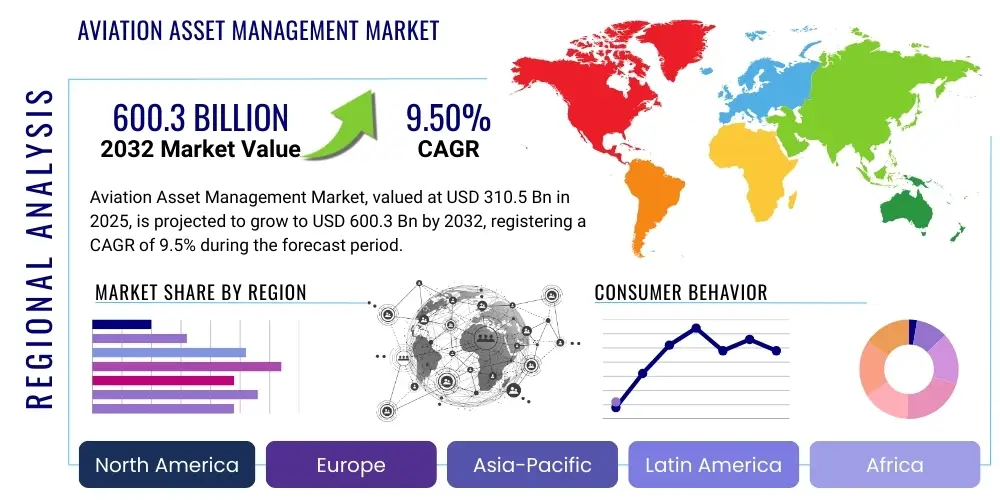

Aviation Asset Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427781 | Date : Oct, 2025 | Pages : 239 | Region : Global | Publisher : MRU

Aviation Asset Management Market Size

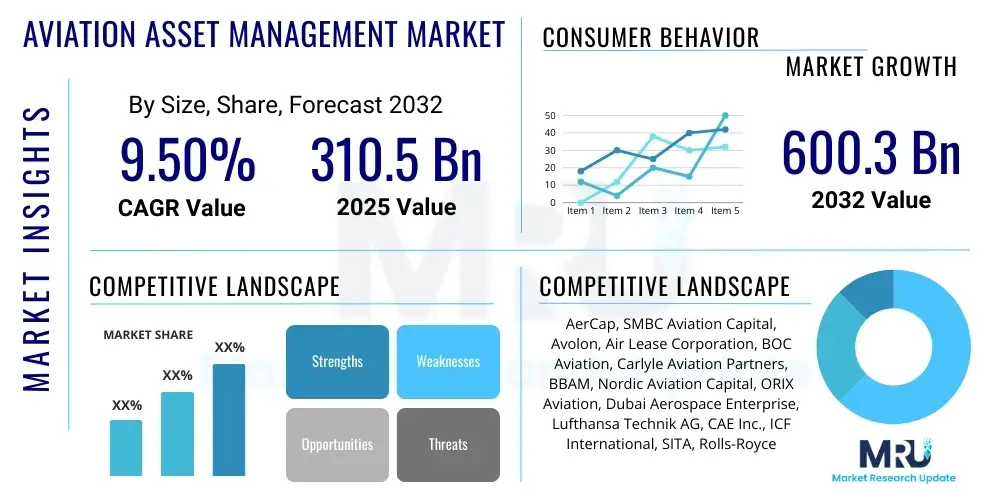

The Aviation Asset Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 310.5 Billion in 2025 and is projected to reach USD 600.3 Billion by the end of the forecast period in 2032. This significant expansion is driven by increasing global air traffic, the growth of aircraft leasing, and the rising complexity of managing a diverse fleet of assets across various regulatory environments. The markets robust growth trajectory reflects the critical role of specialized management services in optimizing asset lifecycles and ensuring operational efficiency for airlines and lessors worldwide, coupled with the ongoing digital transformation within the industry.

Aviation Asset Management Market introduction

Aviation Asset Management encompasses the comprehensive oversight and strategic handling of aircraft, engines, and related components throughout their entire lifecycle, from acquisition and financing to operation, maintenance, and eventual disposal. This specialized field is critical for maximizing the economic value and operational efficiency of aviation assets. It involves a broad spectrum of services designed to ensure regulatory compliance, optimize maintenance schedules, manage technical documentation, and mitigate financial risks associated with these high-value assets. The discipline supports the intricate needs of airlines, lessors, and financial institutions by providing structured frameworks for asset tracking, performance monitoring, and strategic planning.

The core products and services within this market primarily include aircraft leasing (both operating and finance leases), asset financing, technical management (ensuring airworthiness and maintenance compliance), regulatory compliance oversight, and end-of-life solutions such as part-out and recycling. Major applications span commercial airlines, business aviation operators, and military aviation, all of whom leverage these services to maintain competitive advantage, reduce operational costs, and enhance fleet reliability. The growing global demand for air travel continues to fuel fleet expansion, necessitating sophisticated asset management solutions to handle diverse aircraft types and evolving technological landscapes.

Key benefits derived from effective aviation asset management include enhanced operational efficiency through optimized maintenance programs, significant cost reduction by extending asset life and minimizing downtime, improved regulatory compliance across multiple jurisdictions, and better risk mitigation against market fluctuations or technical failures. Driving factors for this markets expansion include the escalating global demand for new and used aircraft, the increasing preference for operating leases over direct purchases due to capital intensity, the aging global aircraft fleet requiring intensive maintenance and remarketing strategies, and the continuous evolution of aviation regulations demanding meticulous oversight. Furthermore, technological advancements in data analytics, artificial intelligence, and predictive maintenance are transforming how assets are managed, contributing significantly to market growth.

Aviation Asset Management Market Executive Summary

The Aviation Asset Management market is experiencing substantial growth, underpinned by dynamic business trends, evolving regional demands, and significant segmental shifts. A dominant business trend is the accelerated digital transformation across the industry, with companies adopting advanced analytics, IoT, and AI to enhance decision-making, optimize maintenance, and improve operational workflows. There is also a notable consolidation among lessors and service providers, aiming for greater economies of scale and comprehensive service offerings. Sustainability is emerging as a critical driver, with a growing focus on eco-friendly asset management practices, including optimized fuel efficiency programs, sustainable disposal methods, and tracking of environmental performance metrics, influencing investment decisions and operational strategies.

Regionally, the Asia Pacific market is demonstrating the fastest growth, primarily due to expanding air travel, burgeoning middle-class populations, and significant investments in new airline operations and infrastructure, leading to a surge in aircraft fleet size and associated asset management needs. North America and Europe, while mature, remain crucial hubs for innovation, technology adoption, and financial services related to aviation asset management, continuously driving demand for advanced solutions. The Middle East and Africa are also showing strategic growth, with new airlines and expanding regional connectivity contributing to a rising demand for comprehensive asset lifecycle management services, including leasing and MRO support for a diverse range of aircraft types.

Segment-wise, the operating lease segment continues to dominate, offering airlines greater flexibility and reduced capital expenditure, driving demand for specialized lessor services. The technical management and CAMO (Continuing Airworthiness Management Organization) services segments are expanding rapidly due to increasing regulatory complexities and the need for meticulous record-keeping and maintenance oversight. Furthermore, the market for engine and component management is gaining traction as these high-value assets require specialized tracking and maintenance protocols. The increasing sophistication of aircraft systems and the push for predictive maintenance are leading to greater investment in specialized software and analytics solutions, enhancing efficiency across all segments and supporting the move towards a more proactive asset management approach.

AI Impact Analysis on Aviation Asset Management Market

User inquiries concerning AIs influence on Aviation Asset Management frequently center on its capacity to revolutionize efficiency, cost reduction, and predictive capabilities, while also posing questions about data security, integration challenges, and the potential displacement of human expertise. Key themes include how AI can enhance predictive maintenance to minimize unscheduled downtime, optimize flight operations for fuel efficiency, and streamline the complex process of asset valuation and risk assessment. There is also significant interest in AI’s role in automating compliance checks and improving the accuracy of documentation management, addressing the vast quantities of data generated by modern aircraft. Users seek to understand tangible benefits such as improved fleet utilization and extended asset life, alongside the practical implications for technology adoption and workforce upskilling required for successful AI implementation.

- Predictive Maintenance Optimization: AI algorithms analyze vast datasets from aircraft sensors, maintenance logs, and operational flight data to predict component failures before they occur, enabling proactive maintenance scheduling, reducing unscheduled downtime, and improving aircraft availability. This shifts the paradigm from reactive to predictive maintenance, optimizing MRO costs.

- Enhanced Asset Valuation and Risk Assessment: AI processes market data, historical performance, and economic indicators to provide more accurate and dynamic valuations of aircraft and engines. It also identifies potential risks related to asset depreciation, market volatility, and operational issues, supporting informed decision-making for acquisitions, disposals, and financing.

- Streamlined Compliance and Regulatory Adherence: AI automates the monitoring and verification of regulatory compliance documentation, maintenance records, and airworthiness directives. This reduces manual effort, minimizes human error, and ensures that all assets consistently meet stringent aviation standards across various global jurisdictions.

- Optimized Fleet Management and Route Planning: AI analyzes operational data to optimize flight schedules, minimize fuel consumption, and improve aircraft utilization. It helps in dynamic allocation of assets, considering factors like maintenance cycles, passenger demand, and weather conditions, leading to greater operational efficiency.

- Supply Chain and Inventory Optimization: AI-driven analytics can forecast demand for spare parts, optimize inventory levels, and manage supply chain logistics more efficiently. This reduces holding costs, ensures part availability when needed, and minimizes AOG (Aircraft on Ground) situations due to parts shortages.

- Automated Data Analysis and Reporting: AI tools can rapidly process and interpret complex technical and financial data from multiple sources, generating comprehensive reports and actionable insights that would otherwise take significant human effort and time. This supports strategic planning and performance monitoring.

- Digital Twin Development: AI supports the creation and maintenance of digital twins for aircraft and components, providing real-time insights into their condition, performance, and remaining useful life, allowing for precise lifecycle management and maintenance forecasting.

DRO & Impact Forces Of Aviation Asset Management Market

The Aviation Asset Management Market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and competitive forces that dictate its growth trajectory and operational landscape. Key drivers include the consistent growth in global air passenger traffic, which necessitates continuous fleet expansion and renewal, and the increasing reliance on aircraft leasing models by airlines to manage capital expenditures and maintain operational flexibility. Furthermore, the aging global aircraft fleet requires sophisticated maintenance, repair, and overhaul (MRO) strategies, driving demand for advanced technical asset management services. The intricate and evolving regulatory landscape across different jurisdictions also mandates specialized expertise in compliance, bolstering the market for comprehensive asset management solutions.

Conversely, the market faces significant restraints. High capital investment requirements for asset acquisition and the development of sophisticated management technologies pose barriers to entry and expansion. Geopolitical uncertainties, such as trade disputes, regional conflicts, and fluctuating oil prices, can directly impact airline profitability and investment decisions in new assets or management solutions. The shortage of skilled aviation professionals, particularly in technical and maintenance roles, remains a persistent challenge, affecting the efficiency and quality of asset management operations. Moreover, economic downturns and global health crises, as evidenced recently, can drastically reduce air travel demand, leading to fleet groundings and deferral of asset management investments, thereby dampening market growth.

Opportunities within the market primarily revolve around digital transformation, with the adoption of advanced technologies like AI, blockchain, and IoT for predictive maintenance, smart contracts, and enhanced data analytics to optimize asset performance and streamline operations. Emerging markets, particularly in Asia Pacific and parts of Africa and Latin America, present vast untapped potential for fleet expansion and the establishment of new leasing and MRO hubs. The growing emphasis on sustainable aviation also opens avenues for innovative asset management practices focused on fuel efficiency, green MRO, and environmentally responsible end-of-life solutions. Strategic partnerships and consolidation among lessors, MROs, and technology providers are also key opportunities to create integrated service offerings and improve market reach.

The impact forces influencing the Aviation Asset Management market include the bargaining power of buyers (airlines), who often seek competitive leasing rates and comprehensive service packages, and the bargaining power of suppliers (aircraft and engine manufacturers, MRO providers), whose specialized products and services are essential. The threat of new entrants is relatively low due to the high capital intensity, complex regulatory requirements, and established industry relationships, though specialized tech start-ups could disrupt specific niches. The threat of substitute products or services is minimal, as physical aircraft assets are indispensable for air travel. Finally, competitive rivalry among existing lessors, MROs, and asset management service providers is high, driven by the desire to secure long-term contracts and offer differentiated value propositions.

Segmentation Analysis

The Aviation Asset Management market is highly diverse, segmented across various dimensions to cater to the distinct needs of its stakeholders. Understanding these segments is crucial for market participants to tailor their offerings and strategy effectively. This segmentation helps in identifying specific demand patterns, technological requirements, and regulatory considerations that define sub-markets within the broader aviation asset management landscape. This granular view allows for a more precise analysis of market trends, competitive intensity, and growth opportunities, reflecting the multifaceted nature of managing high-value aviation assets through their complex lifecycles.

- By Service:

- Aircraft Leasing (Operating Lease, Finance Lease)

- Asset Financing and Structuring

- Technical Asset Management (Airworthiness Management, Maintenance Program Optimization)

- Regulatory Compliance and Auditing

- Continuing Airworthiness Management Organization (CAMO) Services

- MRO Oversight and Management

- Records Management and Digital Archiving

- Asset Trading and Remarketing

- End-of-Life Solutions (Part-out, Recycling, Storage)

- By Asset Type:

- Aircraft (Commercial, Business, Regional Jets)

- Engines (Turbofan, Turboprop)

- Components and Spare Parts

- By End-User:

- Airlines (Flag Carriers, Low-Cost Carriers, Regional Airlines, Cargo Airlines)

- Aircraft Lessors

- Maintenance, Repair, and Overhaul (MRO) Organizations

- Financial Institutions and Investors

- Business Jet Operators

- Government and Defense Organizations

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets

- Turboprops

- By Application:

- Fleet Planning and Acquisition

- Maintenance and Engineering Management

- Financial Management and Reporting

- Compliance and Safety Management

Aviation Asset Management Market Value Chain Analysis

The value chain of the Aviation Asset Management market is an intricate network of interconnected stages, each contributing to the lifecycle and value optimization of aviation assets. It begins with upstream activities involving the manufacturing and supply of the core assets themselves, progresses through various midstream processes of financing and specialized management services, and culminates in downstream operations focused on the assets utilization and eventual disposition. Understanding this chain is essential for identifying value creation points, optimizing efficiencies, and pinpointing areas for strategic collaboration or competitive differentiation. The flow of value is largely driven by specialized knowledge, capital intensity, and adherence to stringent industry standards.

Upstream analysis primarily focuses on aircraft and engine manufacturers (e.g., Boeing, Airbus, GE Aerospace, Rolls-Royce, Pratt & Whitney) and their component suppliers. These entities are responsible for the design, production, and initial delivery of the aviation assets, setting the foundational technical specifications and airworthiness standards. Their ability to deliver high-quality, fuel-efficient, and technologically advanced aircraft directly impacts the long-term value and manageability of these assets. The relationships between manufacturers and lessors/airlines at this stage are crucial for large-scale fleet orders and the initial structuring of asset ownership or leasing arrangements. Financing entities, including commercial banks and specialized aviation finance houses, also play a significant upstream role in funding new aircraft acquisitions.

Midstream activities encompass the core of aviation asset management services. This includes aircraft lessors who acquire assets from manufacturers and lease them to airlines, often providing comprehensive technical and financial management. Specialized asset management companies offer services such as continuing airworthiness management, maintenance program development and oversight, regulatory compliance, and digital record-keeping. MRO organizations also form a vital part of this segment, conducting scheduled and unscheduled maintenance, repairs, and overhauls that preserve asset value and airworthiness. Technology providers, offering software for fleet management, predictive maintenance, and data analytics, support these midstream players by enhancing operational efficiency and decision-making capabilities.

Downstream analysis centers on the end-users of the aviation assets, primarily airlines (commercial, cargo, business aviation) that utilize the aircraft for revenue-generating operations. Their operational efficiency, route networks, and financial performance directly impact the utilization and return on investment for the asset owners/lessors. The distribution channels for aviation asset management services are largely direct, involving direct contracts between lessors and airlines, or between airlines and MRO providers. However, indirect channels also exist through brokers, consultants, and financial advisors who facilitate transactions, remarketing, or specialized financing structures. The value chain concludes with end-of-life solutions, where assets are either remarketed, stored, or undergo part-out for component salvage and recycling, managed by specialized dismantling and asset recovery firms, thus completing the assets lifecycle and potentially feeding components back into the supply chain.

Aviation Asset Management Market Potential Customers

The Aviation Asset Management market serves a diverse array of potential customers, all of whom share the common need to optimize the financial and operational performance of their high-value aviation assets. These customers are primarily entities that own, operate, or finance aircraft, engines, and related components, requiring specialized expertise to navigate the complex technical, regulatory, and financial landscapes of the aviation industry. Identifying and understanding the specific needs of each customer segment is crucial for service providers to develop targeted solutions and foster long-term partnerships. The underlying demand from these customers is driven by the imperative to maintain airworthiness, ensure operational efficiency, maximize asset utilization, and comply with evolving global standards.

The primary customers include commercial airlines, ranging from large flag carriers and legacy airlines to low-cost carriers and regional operators. These airlines often prefer operating leases to preserve capital, requiring comprehensive asset management services that span technical oversight, maintenance planning, and regulatory compliance throughout the lease term. Cargo airlines, another significant segment, operate specialized fleets and have distinct requirements for asset utilization and maintenance schedules, particularly for heavy-lift aircraft. Business jet operators also represent a niche but important customer group, seeking tailored management solutions for their often smaller, yet equally complex and high-value, private and corporate aircraft fleets, emphasizing reliability and dispatch readiness.

Beyond the operators, aircraft lessors themselves are major customers, as they require sophisticated management services to oversee their vast portfolios of aircraft leased to multiple airlines globally. This includes due diligence during acquisition, ongoing technical management, lease management, remarketing services for lease transitions, and eventual asset disposition. Maintenance, Repair, and Overhaul (MRO) organizations are both service providers and customers, often engaging in asset management to optimize their own component pools or to manage assets on behalf of smaller operators. Additionally, banks, financial institutions, and private equity firms investing in aviation assets are key customers, relying on expert asset managers for valuations, risk assessments, and portfolio management to ensure the profitability and compliance of their aviation investments. Government and defense entities also represent a segment seeking specialized management for their diverse fleets, often with unique security and operational requirements.

Aviation Asset Management Market Key Technology Landscape

The Aviation Asset Management market is increasingly defined by its sophisticated technology landscape, where innovation plays a pivotal role in enhancing efficiency, accuracy, and strategic decision-making. The integration of advanced digital solutions is transforming traditional manual processes into automated, data-driven workflows, enabling stakeholders to achieve higher levels of operational performance and financial optimization. This technological evolution is not merely about incremental improvements but represents a fundamental shift in how aviation assets are monitored, maintained, and managed across their entire lifecycle, driven by the need for greater transparency, predictability, and cost-effectiveness in a highly competitive industry.

Central to this landscape is the widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML). These technologies power predictive maintenance solutions, analyzing vast quantities of sensor data from aircraft and engines to forecast potential failures, thereby reducing unscheduled downtime and optimizing MRO schedules. AI also enhances asset valuation, risk modeling, and anomaly detection in operational data. Big Data Analytics is another foundational technology, enabling the processing and interpretation of immense datasets generated by modern aircraft and operational systems, providing actionable insights into fleet performance, fuel efficiency, and maintenance trends. Cloud computing provides the scalable infrastructure necessary to store and process this data, facilitating remote access and collaborative platforms for global asset management teams.

The Internet of Things (IoT) contributes by providing real-time data collection from various aircraft components, ground support equipment, and MRO operations, feeding into analytical systems for continuous monitoring and performance optimization. Digital Twin technology creates virtual replicas of physical aircraft and engines, allowing for simulated testing, condition monitoring, and predictive analysis throughout the assets lifespan. Blockchain technology is emerging as a critical tool for ensuring the immutability and transparency of maintenance records, ownership transfers, and compliance documentation, significantly enhancing trust and reducing fraud within the value chain. Furthermore, enterprise resource planning (ERP) systems specifically tailored for aviation, coupled with specialized asset management software (AMS) and MRO software, provide integrated platforms for managing complex operational, financial, and technical data, streamlining workflows, and ensuring regulatory adherence. These technologies collectively enable a more proactive, efficient, and resilient approach to aviation asset management.

Regional Highlights

- North America: A mature market characterized by early adoption of advanced asset management technologies, a strong presence of major lessors and MRO providers, and a high demand for sophisticated data analytics and AI-driven solutions to manage large, diverse fleets. The region benefits from a robust financial ecosystem supporting aviation investments.

- Europe: A key hub for aircraft leasing and financing, with a strong regulatory framework (EASA) driving demand for stringent technical asset management and compliance services. The region also hosts leading MRO organizations and is a significant market for both new and used aircraft, with an increasing focus on sustainable aviation practices.

- Asia Pacific: The fastest-growing market globally, fueled by rapidly expanding air travel demand, significant fleet modernization and expansion programs, and the emergence of new airlines. This region presents substantial opportunities for lessors and asset management service providers, particularly for narrow-body aircraft, alongside growing investment in regional MRO capabilities.

- Middle East & Africa: Experiencing strategic growth with significant investments in new airlines, airport infrastructure, and the development of regional MRO hubs. The Middle East, in particular, boasts large flag carriers operating modern wide-body fleets, driving demand for advanced asset management and technical support services, while Africas potential lies in fleet renewal and regional connectivity.

- Latin America: A developing market with increasing air traffic and fleet expansion, albeit with economic volatility impacting growth. There is a rising demand for cost-effective leasing solutions and robust MRO services, as airlines look to optimize operational costs and enhance efficiency. The region is gradually adopting digital asset management tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aviation Asset Management Market.- AerCap

- SMBC Aviation Capital

- Avolon

- Air Lease Corporation (ALC)

- BOC Aviation

- Carlyle Aviation Partners

- BBAM

- Nordic Aviation Capital (NAC)

- ORIX Aviation

- Dubai Aerospace Enterprise (DAE)

- Lufthansa Technik AG

- CAE Inc.

- ICF International

- SITA

- Rolls-Royce plc (through Power by the Hour services)

Frequently Asked Questions

What is Aviation Asset Management?

Aviation Asset Management involves the comprehensive oversight and strategic handling of aircraft, engines, and components throughout their entire lifecycle. This includes acquisition, financing, technical management, maintenance optimization, regulatory compliance, and eventual disposal, all aimed at maximizing asset value and operational efficiency for airlines and lessors.

Why is aircraft leasing increasingly popular in aviation asset management?

Aircraft leasing is popular because it offers airlines greater financial flexibility, reduces large upfront capital expenditures, and mitigates risks associated with aircraft ownership, such as depreciation and remarketing. Lessors provide access to modern fleets without requiring significant balance sheet commitment, enabling airlines to scale operations efficiently.

How does AI impact the Aviation Asset Management market?

AI significantly impacts the market by enabling predictive maintenance, optimizing fleet operations, enhancing asset valuation and risk assessment, and automating compliance checks. It processes vast data to provide actionable insights, leading to reduced downtime, improved efficiency, and more informed decision-making across the asset lifecycle.

What are the primary challenges faced by the Aviation Asset Management market?

Primary challenges include high capital investment requirements, geopolitical uncertainties impacting air travel demand, a persistent shortage of skilled aviation professionals, and the increasing complexity of global regulatory compliance. Economic downturns and technological integration hurdles also pose significant restraints.

Which regions are driving the growth of the Aviation Asset Management market?

The Asia Pacific region is the fastest-growing market, driven by expanding air travel and fleet modernization. North America and Europe remain crucial for advanced technology adoption and financial services. The Middle East and Africa are also showing strategic growth with new investments in airline operations and infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager