Aviation Carbon Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428395 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aviation Carbon Fiber Market Size

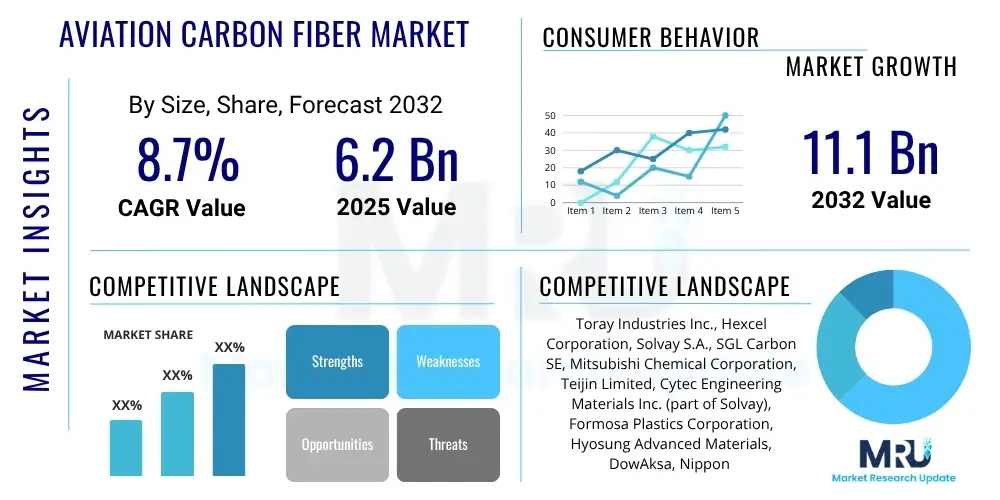

The Aviation Carbon Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2032.

Aviation Carbon Fiber Market introduction

The Aviation Carbon Fiber Market encompasses the production, supply, and application of advanced composite materials primarily composed of carbon fibers embedded in a polymer matrix, specifically designed for aerospace applications. These materials are highly valued for their exceptional strength-to-weight ratio, stiffness, and fatigue resistance, making them indispensable in modern aircraft construction. The market is characterized by stringent quality and performance requirements driven by aviation safety standards and the critical need for reliable, lightweight components.

Carbon fiber composites are utilized across a wide spectrum of aircraft components, from primary structures like wings, fuselage, and empennage to secondary structures such as control surfaces, interior panels, and engine components. Their lightweight nature directly translates into significant fuel savings, reduced carbon emissions, and enhanced operational performance for aircraft. The continuous innovation in material science and manufacturing processes aims to further optimize these composites for improved durability, repairability, and cost-effectiveness, thereby expanding their adoption in both commercial and military aviation sectors.

Key drivers for this market include the escalating demand for new, fuel-efficient aircraft globally, spurred by increasing air travel and fleet modernization initiatives by airlines. Additionally, the growing focus on environmental sustainability mandates lighter aircraft, directly favoring carbon fiber adoption. The inherent benefits of these materials, such as reduced maintenance costs over the aircraft lifespan and superior aerodynamic performance, further solidify their position as a critical element in the future of aviation manufacturing.

Aviation Carbon Fiber Market Executive Summary

The Aviation Carbon Fiber Market is experiencing robust growth, primarily fueled by the aerospace industry's unwavering commitment to lightweighting, fuel efficiency, and performance enhancement. Business trends indicate a strong emphasis on supply chain integration and strategic partnerships between material suppliers and aerospace manufacturers to secure stable raw material sourcing and optimize production processes. There is a discernible shift towards developing advanced manufacturing techniques and more cost-effective carbon fiber production methods to address the traditionally high cost associated with these materials. Furthermore, investments in research and development are continuously targeting improvements in material properties, process automation, and composite repair solutions, signaling a dynamic and evolving landscape.

Regionally, North America and Europe continue to dominate the market due to the presence of major aircraft original equipment manufacturers (OEMs), strong defense spending, and advanced R&D infrastructure. However, the Asia Pacific region is rapidly emerging as a significant growth hub, driven by increasing air travel demand, a burgeoning middle class, and substantial investments in developing indigenous aerospace manufacturing capabilities in countries like China and India. Latin America, the Middle East, and Africa are also showing potential, albeit at a slower pace, as their aviation infrastructure develops and fleet modernization efforts gain momentum.

In terms of segmentation, the market is seeing increased adoption of carbon fiber prepregs due to their ease of handling and consistent quality in manufacturing. The commercial aircraft segment remains the largest end-user, propelled by large fleet orders and the introduction of next-generation aircraft featuring a higher percentage of composite materials. There is also growing interest in thermoset resin-based composites, particularly epoxy systems, owing to their proven performance, though thermoplastic composites are gaining traction for their faster processing times and improved recyclability, indicating future diversification in material choices and application techniques across the industry.

AI Impact Analysis on Aviation Carbon Fiber Market

User inquiries regarding AI's impact on the Aviation Carbon Fiber Market frequently revolve around how artificial intelligence can enhance design, optimize manufacturing processes, improve quality control, and streamline the supply chain. Common themes include expectations for AI to reduce production costs, accelerate material development, enable predictive maintenance for composite components, and contribute to the overall sustainability of aviation. There is significant interest in how AI algorithms can predict material performance under various stress conditions, automate complex layup procedures, and detect microscopic flaws in composite structures, ultimately leading to safer and more efficient aircraft manufacturing and operation.

- AI-driven Generative Design: Optimizes composite structures for strength, weight, and aerodynamics.

- Predictive Analytics for Manufacturing: Enhances process control, reduces waste, and predicts equipment failures in carbon fiber production and component fabrication.

- Automated Quality Inspection: Utilizes machine vision and AI to detect defects in composite layups and finished parts with high precision.

- Supply Chain Optimization: Forecasts demand, manages inventory, and optimizes logistics for raw materials and finished components.

- Material Characterization and Development: Accelerates R&D for new carbon fiber formulations and composite systems by simulating performance.

- Robotics and Automation: Integrates AI with robotic systems for automated fiber placement (AFP) and automated tape laying (ATL), increasing manufacturing speed and accuracy.

- Predictive Maintenance for Aircraft: Analyzes sensor data from composite structures to predict potential failures and schedule proactive maintenance.

- Enhanced Data Management: Processes vast datasets from design, manufacturing, and in-service performance to inform future innovations and improvements.

- Digital Twin Creation: Develops virtual replicas of composite components to simulate performance, predict lifespan, and optimize maintenance schedules.

- Cost Reduction: Through efficiency gains in design, manufacturing, and quality control, AI contributes to lowering the overall cost of carbon fiber components.

DRO & Impact Forces Of Aviation Carbon Fiber Market

The Aviation Carbon Fiber Market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that shape its growth trajectory. Key drivers include the relentless global demand for fuel-efficient and high-performance aircraft, pushing manufacturers towards lightweight composite materials. The expansion of air travel, particularly in emerging economies, coupled with increasing military expenditure on advanced aircraft platforms, further stimulates market demand. However, substantial restraints such as the high initial cost of carbon fiber materials, complex manufacturing processes requiring specialized equipment and skilled labor, and challenges associated with composite repair and recycling, temper this growth. These factors necessitate continuous innovation to overcome cost barriers and improve material lifecycle management.

Opportunities within the market are abundant, especially with the advent of urban air mobility (UAM) and electric vertical takeoff and landing (eVTOL) aircraft, which heavily rely on lightweight composites for structural integrity and energy efficiency. The development of advanced thermoplastic composites, offering faster processing and improved recyclability, presents another significant avenue for growth. Furthermore, the increasing focus on sustainable aviation and stringent environmental regulations compel the industry to adopt materials that reduce carbon footprint, thereby bolstering the demand for carbon fiber solutions. Exploration into novel applications, such as internal components and non-structural elements, also offers future expansion potential.

Impact forces on the market are diverse, ranging from technological advancements that improve material properties and manufacturing efficiency to fluctuating raw material prices, particularly for precursors like polyacrylonitrile (PAN). Regulatory pressures regarding aircraft emissions and safety standards continuously drive innovation and material choice. Global economic conditions directly affect airline profitability and new aircraft orders, subsequently impacting carbon fiber demand. Geopolitical stability, trade policies, and supply chain vulnerabilities also play a crucial role in shaping market dynamics and the strategic decisions of key players within the aviation carbon fiber ecosystem.

Segmentation Analysis

The Aviation Carbon Fiber Market is extensively segmented based on various attributes, including fiber type, resin type, manufacturing process, aircraft type, application, and geographical region. This detailed segmentation provides a comprehensive understanding of market dynamics, revealing specific growth opportunities and challenges within each category. The differing performance requirements and cost considerations for various aircraft components and platforms necessitate a diverse range of carbon fiber materials and processing techniques. Understanding these segments is crucial for stakeholders to tailor product offerings, optimize market strategies, and identify emerging trends across the aerospace industry value chain.

- By Fiber Type:

- Standard Modulus Carbon Fiber

- Intermediate Modulus Carbon Fiber

- High Modulus Carbon Fiber

- Ultra-High Modulus Carbon Fiber

- By Resin Type:

- Epoxy

- BMI (Bismaleimide)

- Phenolic

- Thermoplastic (PEEK, PEKK, PPS, PA)

- Others

- By Manufacturing Process:

- Prepreg Lay-up (Autoclave, Out-of-Autoclave - OoA)

- Filament Winding

- Pultrusion

- Resin Transfer Molding (RTM)

- Vacuum Assisted Resin Transfer Molding (VARTM)

- Automated Fiber Placement (AFP) / Automated Tape Laying (ATL)

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighter Jets, Transport Aircraft, Helicopters)

- General Aviation

- Helicopters

- Unmanned Aerial Vehicles (UAVs) / Drones

- Urban Air Mobility (UAM) / eVTOL

- By Application:

- Primary Structural Components (Wings, Fuselage, Empennage, Tail)

- Secondary Structural Components (Flight Control Surfaces, Doors, Landing Gear)

- Interior Components (Floor Panels, Galleys, Seating)

- Engine Components (Fan Blades, Nacelles, Ducts)

- Brakes

- Radomes

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Aviation Carbon Fiber Market

The value chain for the Aviation Carbon Fiber Market is complex and multi-layered, beginning with the production of precursor materials and extending to the final integration of composite components into aircraft structures. Upstream activities involve the manufacturing of polyacrylonitrile (PAN) or pitch-based fibers, which are then carbonized to produce carbon fibers. Key players in this stage focus on optimizing fiber properties such as tensile strength and modulus, along with ensuring cost-effective production methods to maintain competitiveness. The quality and availability of these raw materials directly impact the subsequent stages of the value chain, making robust supply agreements crucial.

Midstream activities primarily encompass the conversion of raw carbon fibers into intermediate products, most notably prepregs, which are sheets of carbon fibers pre-impregnated with a resin system. This stage also includes the fabrication of composite parts through various advanced manufacturing processes like automated fiber placement (AFP), automated tape laying (ATL), filament winding, and resin transfer molding (RTM). Companies at this stage specialize in sophisticated engineering and manufacturing capabilities, converting raw materials into highly specialized components that meet the stringent specifications of the aerospace industry. The efficiency and precision of these manufacturing steps are critical for producing lightweight, high-performance aircraft parts.

Downstream, the value chain culminates with aircraft manufacturers (OEMs) who integrate these composite components into complete aircraft structures. This phase involves extensive design, assembly, and rigorous testing to ensure airworthiness and performance. Distribution channels typically involve direct sales and long-term contracts between carbon fiber and prepreg suppliers and large aerospace OEMs or their Tier 1 suppliers. Indirect channels may involve specialized distributors for smaller manufacturers or MRO (Maintenance, Repair, and Overhaul) facilities requiring composite materials for repairs. The entire value chain is characterized by strong vertical integration and collaborative efforts to ensure material traceability, quality control, and timely delivery for aerospace production cycles.

Aviation Carbon Fiber Market Potential Customers

The primary customers in the Aviation Carbon Fiber Market are entities within the aerospace and defense sectors that design, manufacture, or maintain aircraft. Aircraft Original Equipment Manufacturers (OEMs) such as Airbus, Boeing, Lockheed Martin, Embraer, and Bombardier represent the largest segment of end-users, requiring vast quantities of carbon fiber composites for their commercial and military aircraft programs. These OEMs procure materials and components directly from carbon fiber manufacturers and their Tier 1 suppliers, driving demand for specific grades and forms of carbon fiber optimized for various structural applications, including fuselages, wings, and empennages.

Beyond the major aircraft integrators, Tier 1 and Tier 2 aerospace suppliers constitute another significant customer base. Companies like Spirit AeroSystems, Premium Aerotec, and Safran, which specialize in manufacturing large subassemblies and critical aircraft systems, heavily rely on carbon fiber composites. These suppliers work closely with OEMs to develop and produce components that meet precise specifications, often acting as intermediaries in the procurement of raw carbon fiber materials or prepregs. Their demand is directly correlated with new aircraft orders and production rates from the main OEMs, forming a vital part of the supply chain.

Additionally, defense contractors and government aerospace agencies are crucial customers for carbon fiber composites, particularly for advanced military aircraft, missiles, and unmanned aerial vehicles (UAVs) where stealth, speed, and extreme performance are paramount. Maintenance, Repair, and Overhaul (MRO) facilities also represent a growing segment, requiring carbon fiber materials for structural repairs and component replacements on existing aircraft fleets. The emerging urban air mobility (UAM) and eVTOL aircraft manufacturers are new but rapidly expanding customer segments, driving demand for innovative, lightweight composite solutions tailored for electric propulsion systems and compact airframes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2032 | USD 11.1 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries Inc., Hexcel Corporation, Solvay S.A., SGL Carbon SE, Mitsubishi Chemical Corporation, Teijin Limited, Cytec Engineering Materials Inc. (part of Solvay), Formosa Plastics Corporation, Hyosung Advanced Materials, DowAksa, Nippon Graphite Fiber Corporation, Kemrock Industries and Exports Limited, Kureha Corporation, Sumitomo Corporation, Plasan Carbon Composites, TenCate Advanced Composites (part of Toray), Barracuda Advanced Composites, Gurit Holding AG, ACP Composites, Vectorply Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aviation Carbon Fiber Market Key Technology Landscape

The Aviation Carbon Fiber Market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of lighter, stronger, and more cost-effective materials and manufacturing processes. Advanced manufacturing techniques are at the forefront, including Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), which utilize robotics to precisely lay carbon fiber prepregs, significantly reducing manual labor, improving consistency, and enabling the fabrication of complex geometries with superior speed and accuracy. Out-of-Autoclave (OoA) processing methods are also gaining traction, offering reduced energy consumption and production cycle times compared to traditional autoclave curing, making composite part manufacturing more economical and scalable.

Innovations in material science play a pivotal role, with a strong focus on developing new resin systems and fiber types. The development of thermoplastic composites, such as those using PEEK (Polyetheretherketone) and PEKK (Polyetherketoneketone), is a key area of research. These materials offer advantages like increased toughness, faster processing times (via thermoforming), unlimited shelf life, and improved recyclability compared to traditional thermoset composites, addressing some of the long-standing challenges in composite manufacturing and sustainability. High-modulus and ultra-high-modulus carbon fibers are also being developed to meet the demanding structural requirements of next-generation aircraft, allowing for thinner, lighter components without compromising strength.

Furthermore, digital technologies, including advanced simulation software and digital twins, are transforming the design and engineering phases of carbon fiber components. These tools enable engineers to virtually test and optimize composite layups, predict material behavior under various loads, and identify potential failure points before physical prototyping, thereby accelerating the development cycle and reducing costs. Non-destructive testing (NDT) techniques, often augmented with AI and machine learning, are also becoming more sophisticated, allowing for precise defect detection and quality assurance throughout the manufacturing process and during in-service inspection, ensuring the integrity and safety of carbon fiber aircraft structures.

Regional Highlights

- North America: This region stands as a dominant force in the Aviation Carbon Fiber Market, driven by the presence of major aerospace OEMs like Boeing and Lockheed Martin, substantial defense spending, and a robust ecosystem of research institutions and composite manufacturers. The U.S. is at the forefront of adopting advanced composite materials for both commercial and military aircraft, emphasizing lightweighting and fuel efficiency.

- Europe: Europe represents another significant market, largely propelled by Airbus and other prominent aerospace companies across countries like France, Germany, and the UK. Strong governmental support for aerospace R&D, a focus on sustainable aviation, and stringent environmental regulations are key factors driving the demand for carbon fiber in this region.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth, primarily due to the rapid expansion of air travel, increasing demand for new aircraft, and significant investments in developing domestic aerospace manufacturing capabilities in countries such as China, India, and Japan. The burgeoning middle class and urbanization trends are fueling the need for both commercial and regional aircraft.

- Latin America: This region presents a developing market for aviation carbon fiber, with Embraer in Brazil being a key aerospace player. Growth is anticipated as airlines modernize their fleets and regional air connectivity improves, leading to a gradual increase in the adoption of composite materials in aircraft manufacturing and maintenance.

- Middle East and Africa (MEA): While currently a smaller market, the MEA region shows considerable potential. Strategic investments in expanding airport infrastructure, growing tourism, and the establishment of new airlines are expected to drive demand for modern aircraft, consequently boosting the adoption of carbon fiber composites in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aviation Carbon Fiber Market.- Toray Industries Inc.

- Hexcel Corporation

- Solvay S.A.

- SGL Carbon SE

- Mitsubishi Chemical Corporation

- Teijin Limited

- Cytec Engineering Materials Inc. (part of Solvay)

- Formosa Plastics Corporation

- Hyosung Advanced Materials

- DowAksa

- Nippon Graphite Fiber Corporation

- Kemrock Industries and Exports Limited

- Kureha Corporation

- Sumitomo Corporation

- Plasan Carbon Composites

- TenCate Advanced Composites (part of Toray)

- Barracuda Advanced Composites

- Gurit Holding AG

- ACP Composites

- Vectorply Corporation

Frequently Asked Questions

What are the primary benefits of using carbon fiber in aviation?

Carbon fiber offers significant benefits including superior strength-to-weight ratio, high stiffness, excellent fatigue resistance, and corrosion immunity. These properties contribute to lighter aircraft, which leads to improved fuel efficiency, reduced emissions, extended range, and enhanced overall performance and payload capacity.

Why is carbon fiber an expensive material for aircraft manufacturing?

The high cost of carbon fiber stems from several factors: the complex and energy-intensive manufacturing process of converting precursor materials (like PAN) into carbon fibers, the specialized equipment required for composite fabrication, the high cost of raw materials, and the stringent quality control standards demanded by the aerospace industry.

Which aircraft parts primarily utilize carbon fiber composites?

Carbon fiber composites are extensively used in primary structural components such as wings, fuselage sections, and empennage (tail assemblies). They are also found in secondary structures like control surfaces, doors, landing gear components, interior panels, and engine nacelles, due to their lightweight and durable properties.

How does the use of carbon fiber impact aircraft maintenance?

While carbon fiber composites generally require less frequent maintenance due to their durability and corrosion resistance, their repair processes can be more complex and require specialized techniques and skilled technicians compared to traditional metallic structures. However, advancements in repair technologies are continuously improving.

What are the future trends in the Aviation Carbon Fiber Market?

Future trends include increased adoption of thermoplastic composites for faster processing and recyclability, further integration of AI and automation in manufacturing, development of more sustainable and cost-effective production methods, and expanded applications in emerging sectors like Urban Air Mobility (UAM) and eVTOL aircraft.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager