Aviation MRO Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429347 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Aviation MRO Software Market Size

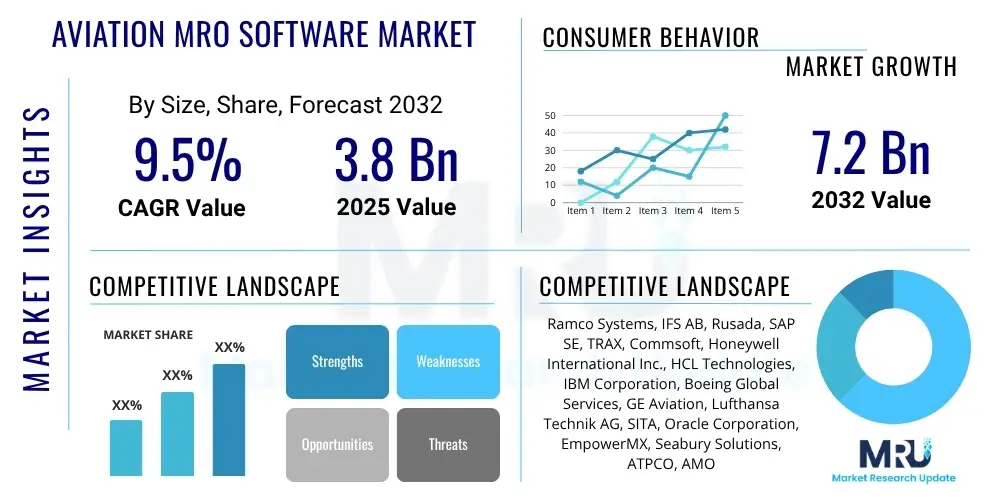

The Aviation MRO Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 3.8 Billion in 2025 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2032.

Aviation MRO Software Market introduction

Aviation Maintenance, Repair, and Overhaul (MRO) software encompasses a sophisticated suite of digital tools designed to manage and optimize the complex processes involved in maintaining aircraft components and systems. This critical software solution helps aviation organizations, including airlines, MRO service providers, and military aviation units, streamline operational workflows, enhance safety compliance, and reduce overall operational costs. The product typically includes robust modules for comprehensive line maintenance, detailed base maintenance, specialized component repair, intricate supply chain management, efficient logistics, advanced engineering support, and rigorous quality assurance. Its major applications span across the entire aviation spectrum, covering commercial aviation, general aviation, dedicated cargo airlines, and defense sectors, facilitating a broad range of tasks from routine checks to heavy structural overhauls and complex engine repairs.

The primary benefits derived from the adoption of Aviation MRO Software are extensive, including significantly improved operational efficiency through automation, real-time data visibility across all maintenance operations, advanced predictive maintenance capabilities to minimize unscheduled events, stringent adherence to global regulatory frameworks, and enhanced asset utilization leading to extended operational lifespans for aircraft components. Key driving factors propelling this market's growth include the continuous expansion of the global aircraft fleet, necessitating more sophisticated maintenance solutions, increasingly stringent regulatory requirements for airworthiness and safety, the growing industry-wide adoption of digital solutions to optimize complex MRO processes, and the rising demand for predictive maintenance technologies that promise to drastically reduce aircraft downtime and extend valuable asset lifespans. This technological shift is pivotal for maintaining a competitive edge and ensuring long-term operational sustainability.

Furthermore, modern MRO software solutions are pivotal in integrating various functional departments, providing a unified and holistic view of all maintenance activities and inventory levels. By centralizing critical data and automating numerous administrative and technical workflows, these systems empower aviation professionals to make proactive decisions and allocate resources more efficiently. Airlines and independent MROs leverage these comprehensive systems to manage work orders seamlessly, track thousands of parts, precisely schedule maintenance events, and rigorously ensure that all operations are in strict adherence to international aviation standards set by leading bodies such such as EASA (European Union Aviation Safety Agency) and the FAA (Federal Aviation Administration). The robust capabilities offered by Aviation MRO software contribute substantially to maintaining fleet airworthiness, enhancing operational safety, and underpinning the reliability of air travel globally. Moreover, the detailed analytics provided by these platforms support continuous improvement initiatives and strategic planning for future maintenance budgets and fleet modernization efforts.

Aviation MRO Software Market Executive Summary

The Aviation MRO Software Market is currently experiencing a period of robust expansion, primarily driven by an increasing global emphasis on operational efficiency, unyielding regulatory compliance requirements, and an imperative for enhanced safety standards within the dynamic aviation industry. Business trends highlight a significant industry-wide migration towards sophisticated cloud-based solutions and fully integrated platforms that offer comprehensive functionalities, moving away from fragmented and often inefficient legacy systems. There is a palpable surge in strategic partnerships, collaborations, and mergers among leading software providers, aimed at developing and delivering more specialized and complete solutions that can cater to the diverse and evolving needs of airlines, third-party MRO service providers, and military aviation organizations. Customization and scalability have emerged as critical differentiators, with end-users actively seeking flexible systems that can seamlessly adapt to fluctuating fleet sizes, integrate with new aircraft technologies, and accommodate advancements in operational paradigms.

Regionally, North America and Europe continue to maintain their dominant positions in the market, primarily attributable to the presence of an extensive number of aircraft operators, well-established MRO infrastructure, and historically high adoption rates of advanced digital technologies. These regions benefit from mature aviation ecosystems and significant investment in maintenance capabilities. However, the Asia Pacific (APAC) region is rapidly ascending as the fastest-growing market segment, propelled by substantial investments in new aircraft procurement, aggressive expansion of existing airline fleets, and the rapid development of advanced MRO capabilities, particularly in economic powerhouses like China and India. Latin America, the Middle East, and Africa (MEA) are also demonstrating promising growth trajectories, albeit from a relatively smaller base, driven by increasing air travel demand, a burgeoning focus on modernizing existing MRO operations, and a strategic intent to enhance their competitive standing on the global aviation stage through digital transformation.

From a segmentation perspective, the market is broadly categorized by deployment type (on-premise versus cloud-based), solution type (e.g., Enterprise Resource Planning (ERP), Maintenance Execution Systems (MES), Supply Chain Management (SCM)), and end-user (airlines, independent MROs, defense organizations). Cloud-based solutions are currently witnessing a significantly higher adoption rate, primarily due to their inherent flexibility, unparalleled scalability, and notably reduced infrastructure costs, making them particularly attractive to small and medium-sized MROs seeking agile and cost-effective solutions. The demand for integrated ERP solutions remains consistently strong among larger airlines and comprehensive MRO providers who require end-to-end operational visibility, stringent control, and seamless integration across all business functions. Furthermore, the increasing complexity of modern aircraft and the critical imperative for proactive, rather than reactive, maintenance are significantly fueling the demand for advanced analytics and predictive maintenance modules, which are rapidly becoming integral components of contemporary MRO software suites, leading to specialized growth within these segments.

AI Impact Analysis on Aviation MRO Software Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally revolutionize various aspects of the Aviation MRO Software market, particularly concerning maintenance scheduling, diagnostics, and inventory management. Common questions consistently revolve around AI's projected capabilities to accurately predict component failures, dynamically optimize maintenance windows, and significantly enhance decision-making processes through sophisticated data analysis. Accompanying these expectations are critical concerns regarding data security protocols, the inherent challenges of integrating complex AI systems with existing MRO infrastructure, and the potential impact of automation on human employment within the maintenance workforce. Key overarching themes emerging from user inquiries include the strong expectation of a substantial reduction in unscheduled maintenance events, a marked increase in overall operational efficiency, and a transformative shift towards advanced condition-based maintenance strategies. Concerns often focus intently on the reliability and trustworthiness of AI algorithms when applied to safety-critical aviation applications, the ethical considerations surrounding increasingly autonomous decision-making processes, and the potentially substantial investment required for the initial implementation and ongoing management of these advanced systems, alongside the crucial need for a highly skilled and adaptable workforce to manage these sophisticated AI-powered MRO tools.

The integration of Artificial Intelligence into Aviation MRO software promises to usher in a new era of significant advancements, moving the industry far beyond traditional reactive and even current preventive maintenance models, towards highly sophisticated predictive and prescriptive approaches. AI algorithms possess the unparalleled ability to analyze vast and complex datasets derived from a multitude of sources, including real-time aircraft sensor data, comprehensive flight operations information, and extensive historical maintenance records. This analytical power allows AI to identify subtle, often imperceptible, patterns and anomalies that are indicative of impending component failures. This groundbreaking capability empowers MRO providers to schedule maintenance precisely at the optimal moment, thereby proactively preventing costly and disruptive aircraft-on-ground (AOG) situations and effectively extending the operational lifespans of critical components. The direct result of such integration is a substantial reduction in operational costs, optimized spare parts inventory management, and a significant improvement in overall aircraft availability. Moreover, AI-driven insights can inform and refine more effective maintenance strategies, allowing for highly tailored approaches specific to different aircraft types, varied operational environments, and unique usage patterns, ultimately enhancing overall fleet performance, reliability, and paramount safety standards.

- Enhanced Predictive Maintenance: AI algorithms analyze vast sensor data and historical records to forecast component failures, significantly reducing unscheduled downtime and improving operational predictability.

- Optimized Maintenance Scheduling: AI-driven insights enable more efficient and dynamic scheduling of maintenance tasks, minimizing aircraft ground time and maximizing fleet utilization rates.

- Automated Diagnostics and Troubleshooting: AI assists in rapid identification of root causes for malfunctions and faults, thereby accelerating the repair process and reducing diagnostic labor.

- Intelligent Inventory Management: AI predicts the precise demand for spare parts, optimizing stock levels, reducing carrying costs, and preventing parts shortages or excesses.

- Improved Workforce Efficiency: AI tools can significantly augment human capabilities, providing real-time data, intelligent recommendations, and step-by-step guidance to maintenance technicians.

- Data-Driven Decision Making: AI offers deep, actionable insights for strategic planning, optimized resource allocation, continuous process improvement, and long-term asset management in MRO operations.

- Integration with Augmented Reality (AR) and Virtual Reality (VR): AI enhances AR/VR solutions, creating immersive and highly effective platforms for technician training and real-time maintenance guidance.

- Natural Language Processing (NLP) for Documentation: AI processes and summarizes complex maintenance manuals, service bulletins, and inspection reports, improving accessibility and compliance.

- Enhanced Quality and Compliance: AI monitors maintenance processes for deviations, ensuring strict adherence to regulatory standards and internal quality protocols.

DRO & Impact Forces Of Aviation MRO Software Market

The Aviation MRO Software Market is primarily driven by several compelling factors, most notably the continuous growth in global air traffic and the subsequent rapid expansion of commercial aircraft fleets, which inherently necessitates increasingly robust and sophisticated maintenance solutions. The escalating complexity of modern aircraft, incorporating advanced avionics, sophisticated systems, and lightweight composite materials, demands highly specialized software for accurate diagnostics, precise repair procedures, and comprehensive overhaul processes. Furthermore, stringent regulatory mandates imposed by leading aviation authorities such as EASA and the FAA compel aircraft operators to adopt advanced MRO software to ensure meticulous compliance, accurately track all maintenance activities, and meticulously maintain airworthiness records. The pervasive industry-wide drive for enhanced operational efficiency and significant cost reduction across airlines and MRO providers also serves as a potent market driver, as software automation demonstrably reduces manual errors, optimizes resource allocation, and critically minimizes aircraft downtime, thereby directly impacting profitability and maximizing valuable asset utilization. The increasing adoption of predictive maintenance strategies, largely enabled by the Internet of Things (IoT) and advanced big data analytics, further fuels demand for these intelligent software solutions.

Despite the strong drivers, several notable restraints pose challenges to the market's accelerated growth. A significant barrier is the high initial investment costs associated with implementing and seamlessly integrating sophisticated MRO software, particularly for smaller MROs and airlines that often operate with fragmented legacy systems. The inherent complexity involved in integrating new MRO software solutions with existing disparate IT systems frequently leads to protracted implementation cycles, potential data migration hurdles, and compatibility issues. Additionally, growing concerns regarding data security, especially with the increasing reliance on cloud-based solutions that handle sensitive operational and proprietary data, represent a substantial restraint, necessitating robust cybersecurity measures. The persistent shortage of highly skilled personnel capable of effectively operating, maintaining, and fully leveraging these advanced software systems, coupled with a natural resistance to change from entrenched traditional maintenance practices, also significantly hinders widespread adoption and optimal utilization of new platforms. Furthermore, the inherent economic volatility affecting the broader aviation industry, such as unpredictable fuel price fluctuations or unforeseen global events like pandemics, can directly impact MRO budgets and consequently influence software investment decisions.

Significant opportunities for market expansion are emerging, particularly in the growing demand for specialized MRO software solutions meticulously tailored for specific aircraft types, such as regional jets, business aviation fleets, or for rapidly emerging technologies like unmanned aerial vehicles (UAVs). The increasing global trend of outsourcing MRO services to dedicated third-party providers creates a fertile ground for software vendors to offer comprehensive, scalable solutions to these specialized MRO facilities, expanding their customer base. The widespread proliferation of IoT devices and advanced sensors on modern aircraft presents a vast and untapped opportunity for enhanced real-time data collection and continuous monitoring, which can significantly boost the capabilities of predictive maintenance modules embedded within MRO software. Moreover, the development of flexible, subscription-based, or Software-as-a-Service (SaaS) business models can substantially lower the entry barrier for smaller industry players, thereby broadening the potential customer base. These opportunities are further bolstered by the overarching digital transformation initiatives currently sweeping across the aviation industry, which prioritize technology adoption as a critical pathway to achieving operational excellence, improving competitive advantage, and ensuring long-term resilience.

Collectively, these drivers and restraints exert profound impact forces that continuously shape the trajectory and evolution of the Aviation MRO Software market. The unwavering imperative for maintaining absolute safety and ensuring stringent regulatory compliance remains a foundational force, compelling continuous investment in robust, reliable, and compliant MRO systems. Concurrent economic pressures experienced by airlines and MROs drive relentless innovation towards the development of more cost-effective and highly efficient software solutions. Accelerating technological advancements, particularly in areas such as Artificial Intelligence, Machine Learning, and advanced cloud computing, act as powerful catalysts, profoundly transforming MRO operations from predominantly reactive paradigms to highly proactive, data-driven approaches. Human factors, encompassing the critical need for a highly skilled workforce, effective change management, and addressing potential resistance to new technologies, remain a significant impact force influencing both the pace and the ultimate success of MRO software adoption across the industry. Finally, geopolitical stability and the sustained demand for global air travel also play a pivotal role, directly influencing fleet sizes, maintenance requirements, and consequently, the overall growth trajectory of the Aviation MRO Software market.

Segmentation Analysis

The Aviation MRO Software market is meticulously segmented to accurately reflect the diverse operational requirements and technological preferences prevalent across the extensive aviation industry. These granular segmentations provide a profound understanding of underlying market dynamics, enabling all stakeholders to precisely identify specific growth areas and strategically tailor their solutions to particular client demands. Key segmentation criteria comprehensively include deployment type, offering type, specific function, distinct end-user categories, and various aircraft types, each revealing unique adoption patterns, investment trends, and emerging market opportunities. The in-depth analysis of these segments is instrumental in discerning which technological approaches, service models, or application areas are experiencing the most significant growth and attracting substantial investment, thereby providing invaluable guidance for strategic business decisions for software providers, MRO companies, and prospective investors alike within this highly dynamic sector.

The inherent complexity of the aviation MRO landscape necessitates a comprehensive and multi-faceted segmentation approach to fully capture its intricate nuances and varied demands. For instance, the critical distinction between cloud-based and on-premise solutions meticulously highlights the varying levels of IT infrastructure maturity, budgetary considerations, and paramount security concerns among different market participants, ranging from small regional operators to large international airlines. Similarly, segmenting the market by specific function, such as specialized maintenance execution, sophisticated supply chain management, or rigorous quality assurance, allows for a precise examination of demand for particular operational tools and functionalities. Understanding the diverse end-user segments, which range from major global airlines and independent third-party MRO facilities to defense organizations and smaller business jet operators, provides crucial insights into the requirement for highly tailored software feature sets, specialized functionalities, and bespoke service level agreements. This structured and analytical approach to segmentation ensures a thorough, actionable, and commercially relevant market overview, which is essential for informed strategic planning, effective competitive positioning, and sustained growth within the continuously evolving Aviation MRO Software market landscape.

- By Deployment Type

- On-Premise: Software installed and operated from computing infrastructure located on the customer's premises.

- Cloud-Based: Software hosted on external servers and accessed over the internet, typically offered as Software-as-a-Service (SaaS).

- By Offering Type

- Solutions: The core MRO software platforms and modules.

- Services: Implementation, customization, training, maintenance, and support services related to the software.

- By Function

- Maintenance Planning and Scheduling: Tools for creating, optimizing, and managing maintenance schedules and work packages.

- Line Maintenance: Software support for routine inspections and minor repairs performed at airports.

- Base Maintenance: Solutions for heavy maintenance checks, structural repairs, and major modifications at MRO facilities.

- Engine MRO: Specialized modules for the maintenance, repair, and overhaul of aircraft engines.

- Component MRO: Tools for managing the repair and overhaul of individual aircraft components.

- Supply Chain Management and Logistics: Functions for managing the flow of parts, materials, and services.

- Inventory Management: Systems for tracking, controlling, and optimizing spare parts and consumables inventory.

- Technical Records and Documentation: Digital management of aircraft logs, maintenance manuals, and compliance documentation.

- Quality and Compliance Management: Modules ensuring adherence to regulatory standards and internal quality processes.

- Human Resources and Training: Tools for managing technician qualifications, training records, and workforce planning.

- Financial Management: Integration with accounting and billing for MRO operations.

- Reporting and Analytics: Capabilities for generating performance reports and deriving operational insights.

- By End-User

- Airlines: Commercial and cargo airlines operating passenger and freight aircraft.

- Third-Party MROs: Independent organizations providing maintenance services to multiple aircraft operators.

- OEMs (Original Equipment Manufacturers): Aircraft and component manufacturers offering MRO services for their products.

- Defense and Government Aviation: Military branches and government agencies maintaining their air fleets.

- Business Aviation Operators: Companies or individuals managing private and corporate jets.

- General Aviation Operators: Operators of smaller aircraft, including flight schools and charter services.

- By Aircraft Type

- Fixed-Wing Aircraft

- Commercial Aviation (Narrow-body, Wide-body): Software tailored for large passenger and cargo jets.

- General Aviation: Solutions for smaller private and light commercial aircraft.

- Military Aircraft: Software designed for specialized defense aircraft maintenance.

- Rotary-Wing Aircraft (Helicopters): MRO software specifically adapted for helicopter maintenance requirements.

- Fixed-Wing Aircraft

Value Chain Analysis For Aviation MRO Software Market

The value chain for the Aviation MRO Software market commences with upstream activities involving a diverse ecosystem of software developers, core technology providers, and specialized data analytics firms that collectively supply the foundational technologies, programming languages, and advanced AI/ML (Artificial Intelligence/Machine Learning) frameworks. These crucial entities are primarily responsible for conceiving, developing, and refining the core software modules, robust database solutions, and essential integration tools that are indispensable for efficient MRO operations. Upstream contributions also encompass hardware manufacturers who provide the critical infrastructure, including high-performance servers, sophisticated networking equipment, and advanced IoT (Internet of Things) sensors, which are vital for collecting vast amounts of critical aircraft operational data subsequently processed by the MRO software. Furthermore, strategic partnerships with leading cybersecurity firms are absolutely crucial at this foundational stage to ensure the unwavering integrity, confidentiality, and robust protection of highly sensitive aviation data. These foundational elements directly and significantly influence the overall quality, scalability, security, and long-term reliability of the final software product, thereby forming the bedrock upon which world-class MRO software solutions are meticulously built and deployed.

Downstream activities within the value chain are primarily concentrated on the efficient distribution, meticulous implementation, and effective utilization of the Aviation MRO software by the ultimate end-users. The distribution channel is multifaceted, involving direct sales teams from software vendors who maintain close relationships with key strategic accounts, alongside a network of value-added resellers (VARs) and experienced system integrators who specialize in customizing and deploying complex software solutions. Direct distribution allows vendors to cultivate profound relationships with large, strategic accounts such as major airlines or national defense organizations, enabling them to offer highly tailored solutions, personalized support, and comprehensive long-term partnerships. Conversely, indirect channels, facilitated through channel partners, significantly extend market reach, particularly to smaller MROs or into international markets where localized expertise and cultural understanding are invaluable. Following the successful deployment, continuous support, in-depth training programs, ongoing maintenance, and regular software updates are critical downstream services, all meticulously designed to ensure optimal performance, sustained user satisfaction, and long-term operational excellence for the end-users. The diverse end-users, encompassing airlines, independent MRO service providers, and military aviation units, leverage this powerful software to perform their core maintenance, repair, and overhaul functions, realizing substantial benefits in terms of enhanced efficiency, stringent compliance, and significant cost savings.

The entire Aviation MRO Software value chain is characterized by an exceptionally high degree of integration and collaborative effort, particularly between the innovative software developers and the discerning end-users, ensuring that the delivered solutions consistently meet the rapidly evolving industry demands and stringent regulatory requirements. Continuous and robust feedback loops originating from downstream users directly inform and influence upstream product development, fostering a cycle of perpetual innovation and ensuring the ongoing relevance and efficacy of the software. The accelerating shift towards sophisticated cloud-based solutions has further streamlined distribution processes and notably reduced the necessity for extensive on-premise infrastructure investments, thereby impacting both the upstream supply chain for hardware components and the downstream deployment strategies. Both direct and indirect distribution models coexist strategically within the market; direct sales are often preferred for highly complex, enterprise-level deployments that demand deep customization and intensive consultation, while indirect channels effectively facilitate broader market penetration for more standardized or Software-as-a-Service (SaaS) offerings. This dynamic demonstrates the market’s adaptable and sophisticated approach to effectively reaching its diverse and expanding customer base, ensuring widespread accessibility and tailored solutions.

Aviation MRO Software Market Potential Customers

The primary end-users and discerning buyers of Aviation MRO Software are a diverse array of entities strategically positioned within the expansive global aviation ecosystem, each possessing unique operational scales, specialized maintenance requirements, and varying levels of technological integration. This broad customer base includes major commercial airlines operating extensive fleets of passenger and cargo aircraft across global networks, for whom MRO software is an absolutely indispensable tool for meticulously managing vast and complex maintenance schedules, optimizing critical inventory, and ensuring unwavering regulatory compliance across multiple operational hubs worldwide. Independent third-party MRO service providers, who specialize in offering comprehensive maintenance and repair services to a multitude of airlines and aircraft owners, represent another critically significant customer segment, relying heavily on these advanced software solutions to efficiently manage intricate multi-client operations, diverse aircraft types, and highly variable customer specifications. These specialized MROs often require highly scalable and extensively customizable software platforms to effectively handle a wide range of different aircraft types and unique customer specifications, thereby highlighting their pivotal role in shaping the market's demand landscape and driving innovation.

Beyond the extensive realm of commercial aviation, defense and government aviation agencies also constitute an exceptionally crucial segment, demanding robust and highly secure MRO software to meticulously maintain military aircraft, specialized helicopters, and other mission-critical fleets, where achieving absolute operational readiness, ensuring uncompromised mission success, and guaranteeing unwavering reliability are paramount considerations. Original Equipment Manufacturers (OEMs) who actively offer comprehensive MRO services for their own manufactured aircraft or proprietary components also extensively utilize these sophisticated software solutions to efficiently support and expand their lucrative aftermarket service business, ensuring long-term customer satisfaction and brand loyalty. Furthermore, business aviation operators, who typically manage smaller but high-value fleets of private jets and corporate aircraft, alongside general aviation operators, including specialized flight schools, regional charter services, and private aircraft owners, are increasingly adopting Aviation MRO software to professionalize their maintenance operations, significantly enhance safety protocols, and meticulously ensure compliance with less stringent, yet vitally important, aviation regulations, thereby elevating their operational standards and efficiency.

The inherent diversity of these varied customer groups unequivocally underscores the critical necessity for software vendors to offer highly flexible, modular, and exceptionally scalable solutions that can be precisely adapted to specific operational environments, unique aircraft configurations, and varying budgetary constraints across the entire aviation spectrum. From large-scale, enterprise-grade deployments designed for global airlines requiring extensive customization and integration, to more streamlined, accessible, and often cloud-based offerings tailored for smaller independent MROs or individual business jet operators, the market effectively caters to a broad and nuanced spectrum of needs. The fundamental commonality uniting all these potential customers is the absolutely critical requirement for efficient, meticulously compliant, and highly cost-effective maintenance management. This shared imperative makes Aviation MRO software an essential and irreplaceable tool for rigorously ensuring the safety, paramount airworthiness, and long-term operational longevity of aircraft across all segments and sectors of the global aviation industry, solidifying its indispensable role in modern air travel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.8 Billion |

| Market Forecast in 2032 | USD 7.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ramco Systems, IFS AB, Rusada, SAP SE, TRAX, Commsoft, Honeywell International Inc., HCL Technologies, IBM Corporation, Boeing Global Services, GE Aviation, Lufthansa Technik AG, SITA, Oracle Corporation, EmpowerMX, Seabury Solutions, ATPCO, AMOS (Swiss-AS), Quantum Control (Component Control), MRO Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aviation MRO Software Market Key Technology Landscape

The Aviation MRO Software market is undergoing a rapid and transformative evolution, primarily driven by the strategic integration of cutting-edge technologies aimed at substantially enhancing efficiency, accuracy, and predictability across all maintenance operations. A foundational technological pillar in this landscape is the widespread adoption of Enterprise Resource Planning (ERP) systems, which serve as the indispensable backbone, seamlessly integrating diverse MRO functions such as meticulous maintenance planning, optimized inventory management, efficient supply chain logistics, human resources administration, and comprehensive financial management into a unified, coherent platform. Modern ERP solutions distinguish themselves through their highly modular architectures, allowing for bespoke, tailored implementations and unparalleled scalability to meet evolving organizational needs. Beyond core ERP functionalities, the pervasive adoption of cloud computing, particularly through Software-as-a-Service (SaaS) models, represents a significant and accelerating trend, offering unprecedented flexibility, substantially reduced infrastructure costs, and effortless access to continuous software updates. Cloud-based solutions facilitate real-time, seamless collaboration across geographically dispersed MRO teams and provide robust, resilient data backup and rapid recovery capabilities, which are absolutely critical for ensuring business continuity in the safety-sensitive aviation industry.

Another pivotal technological advancement profoundly transforming the MRO software landscape is the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities. These sophisticated technologies are being progressively embedded within MRO software to power advanced predictive maintenance analytics, enabling the precise forecasting of potential component failures based on continuous sensor data streams and extensive historical trends. AI/ML algorithms meticulously optimize maintenance schedules, accurately identify the root causes of faults with greater speed, and manage complex spare parts inventory more efficiently, thereby minimizing wastage and ensuring timely availability. Furthermore, the Internet of Things (IoT) plays an absolutely crucial role by enabling the ubiquitous collection of vast amounts of real-time operational data from a myriad of aircraft sensors and systems. This torrent of data, when meticulously fed into AI/ML-powered MRO software, allows for highly accurate condition-based monitoring, marking a transformative shift away from traditional time-based or cycle-based maintenance paradigms, ultimately maximizing asset utilization and dramatically minimizing unscheduled aircraft downtime, which is a major cost driver for operators.

Complementary technologies are also essential for realizing the full potential of Aviation MRO software. Big Data analytics capabilities are indispensable for processing and deriving actionable, strategic insights from the immense volumes of MRO-related data generated daily, facilitating informed decision-making. Blockchain technology is also gaining considerable traction for significantly enhancing traceability, transparency, and security across the complex aviation supply chain, particularly for meticulously tracking the provenance and maintenance records of parts, thereby improving trust, mitigating risks, and substantially reducing fraud. Augmented Reality (AR) and Virtual Reality (VR) solutions are being innovatively utilized for highly immersive technician training and on-the-job maintenance guidance, offering interactive experiences that profoundly improve skill transfer, reduce human errors, and enhance overall efficiency. Finally, sophisticated mobile applications for MRO software allow maintenance technicians to instantaneously access critical information, efficiently complete work orders, and meticulously document tasks directly from the hangar floor or flight line, significantly enhancing mobility, responsiveness, and data accuracy. These advanced technologies collectively represent the dynamic future of Aviation MRO software, continuously driving innovation and delivering significant improvements in operational outcomes and overall safety across the global aviation industry.

Regional Highlights

- North America: This region consistently holds a substantial and leading share of the Aviation MRO Software market. It is characterized by an exceptionally large installed base of both commercial and military aircraft, a highly mature and well-established MRO infrastructure, and historically high adoption rates of advanced digital technologies. The pervasive presence of major airlines, a multitude of leading MRO providers, and a stringent regulatory environment collectively drive continuous and significant investment in sophisticated software solutions essential for ensuring comprehensive compliance, optimizing efficiency, and enhancing safety. The United States, in particular, stands as a dominant force due leveraging its expansive aviation industry and pioneering contributions to technological advancements in the sector.

- Europe: Europe represents another critically important market for Aviation MRO Software, distinguished by a dense network of air traffic, a substantial and diverse fleet of aircraft, and robust MRO capabilities, particularly concentrated in highly developed aviation hubs such as Germany, France, and the United Kingdom. The region significantly benefits from the stringent and comprehensive EASA regulations, which meticulously mandate comprehensive maintenance tracking, detailed record-keeping, and proactive safety management, thereby consistently boosting the demand for advanced, compliant MRO software solutions. Strategic investments in pervasive digital transformation initiatives and a strong focus on sustainable aviation practices further fuel the market's robust growth trajectory within the European continent.

- Asia Pacific (APAC): The APAC region is unequivocally projected to be the fastest-growing market for Aviation MRO Software globally. This rapid expansion is primarily driven by the aggressive and continuous growth of airline fleets, a dramatic increase in passenger traffic, and substantial investments in the strategic development and modernization of MRO infrastructure, particularly notable in fast-growing economies such as China, India, and various Southeast Asian countries. The region's concerted focus on modernizing and optimizing MRO operations, coupled with an accelerating adoption of scalable cloud-based solutions to enhance overall efficiency and reduce operational overheads, significantly contributes to its exceptionally strong and dynamic market trajectory.

- Latin America: This region is currently experiencing steady and incremental growth in the Aviation MRO Software market, primarily influenced by an increasing demand for air travel and ongoing fleet modernization initiatives across its rapidly developing economies. While comparatively smaller in overall market size when juxtaposed against North America or Europe, the compelling need to significantly improve operational efficiency, enhance safety standards, and rigorously comply with international aviation standards is actively propelling the adoption of advanced MRO software among local airlines and burgeoning MRO service providers. Brazil and Mexico are notably leading these crucial adoption efforts, demonstrating significant investment and strategic foresight in digitalizing their MRO operations.

- Middle East and Africa (MEA): The MEA region is witnessing considerable and consistent growth in the Aviation MRO Software market, predominantly driven by significant strategic investments in new, state-of-the-art aircraft by major Gulf carriers and the parallel development of cutting-edge MRO facilities designed to support ambitious expansion plans. The region's strategic focus on becoming global aviation hubs and the rapid expansion of vital air cargo operations are powerfully stimulating demand for advanced MRO software to efficiently manage increasingly complex maintenance schedules, optimize intricate supply chains, and ensure seamless logistics. Modernization efforts across various African countries also play a crucial role in contributing to this dynamic regional market expansion, as nations strive to enhance their aviation infrastructure and operational capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aviation MRO Software Market.- Ramco Systems

- IFS AB

- Rusada

- SAP SE

- TRAX

- Commsoft

- Honeywell International Inc.

- HCL Technologies

- IBM Corporation

- Boeing Global Services

- GE Aviation

- Lufthansa Technik AG

- SITA

- Oracle Corporation

- EmpowerMX

- Seabury Solutions

- ATPCO

- AMOS (Swiss-AS)

- Quantum Control (Component Control)

- MRO Holdings Inc.

Frequently Asked Questions

What is Aviation MRO Software and its primary function in the industry?

Aviation MRO Software is a specialized suite of digital tools designed to manage and optimize all aspects of aircraft maintenance, repair, and overhaul operations. Its primary function is to streamline workflows, ensure stringent regulatory compliance, significantly reduce aircraft downtime, and enhance the overall safety and efficiency of aviation assets by integrating crucial processes like maintenance planning, scheduling, inventory management, and technical record-keeping into a unified platform.

How is Artificial Intelligence (AI) specifically impacting the Aviation MRO Software market?

AI is profoundly impacting the Aviation MRO Software market by enabling highly advanced predictive maintenance capabilities, dynamically optimizing maintenance schedules, significantly enhancing diagnostic accuracy through data analysis, and intelligently improving inventory management. This leads to substantial reductions in operational costs, increased aircraft availability, and a transformative shift towards more proactive, condition-based maintenance strategies across the aviation sector.

What are the key driving factors propelling the growth of the Aviation MRO Software market?

Key driving factors include the continuously expanding global aircraft fleet, stringent and evolving aviation regulations mandating robust maintenance practices, the pervasive industry demand for enhanced operational efficiency and cost reduction strategies by airlines and MROs, and the accelerating adoption of advanced technologies like IoT and predictive analytics to optimize critical MRO processes and asset management.

Which geographical regions are currently leading the adoption of Aviation MRO Software solutions?

North America and Europe currently hold the largest market shares due to their mature aviation industries, extensive existing MRO infrastructure, and high technology adoption rates. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, primarily driven by aggressive fleet expansion plans and significant strategic investments in MRO infrastructure modernization across its developing economies.

What are the main challenges faced by the Aviation MRO Software market today?

The market primarily faces significant challenges such as high initial investment costs for comprehensive software implementation, inherent complexities in seamlessly integrating new solutions with diverse existing legacy IT systems, critical concerns regarding data security and privacy protocols, and a persistent, industry-wide shortage of highly skilled technical personnel capable of effectively operating and maintaining these sophisticated software solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager