B2B Laptop & PC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428306 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

B2B Laptop & PC Market Size

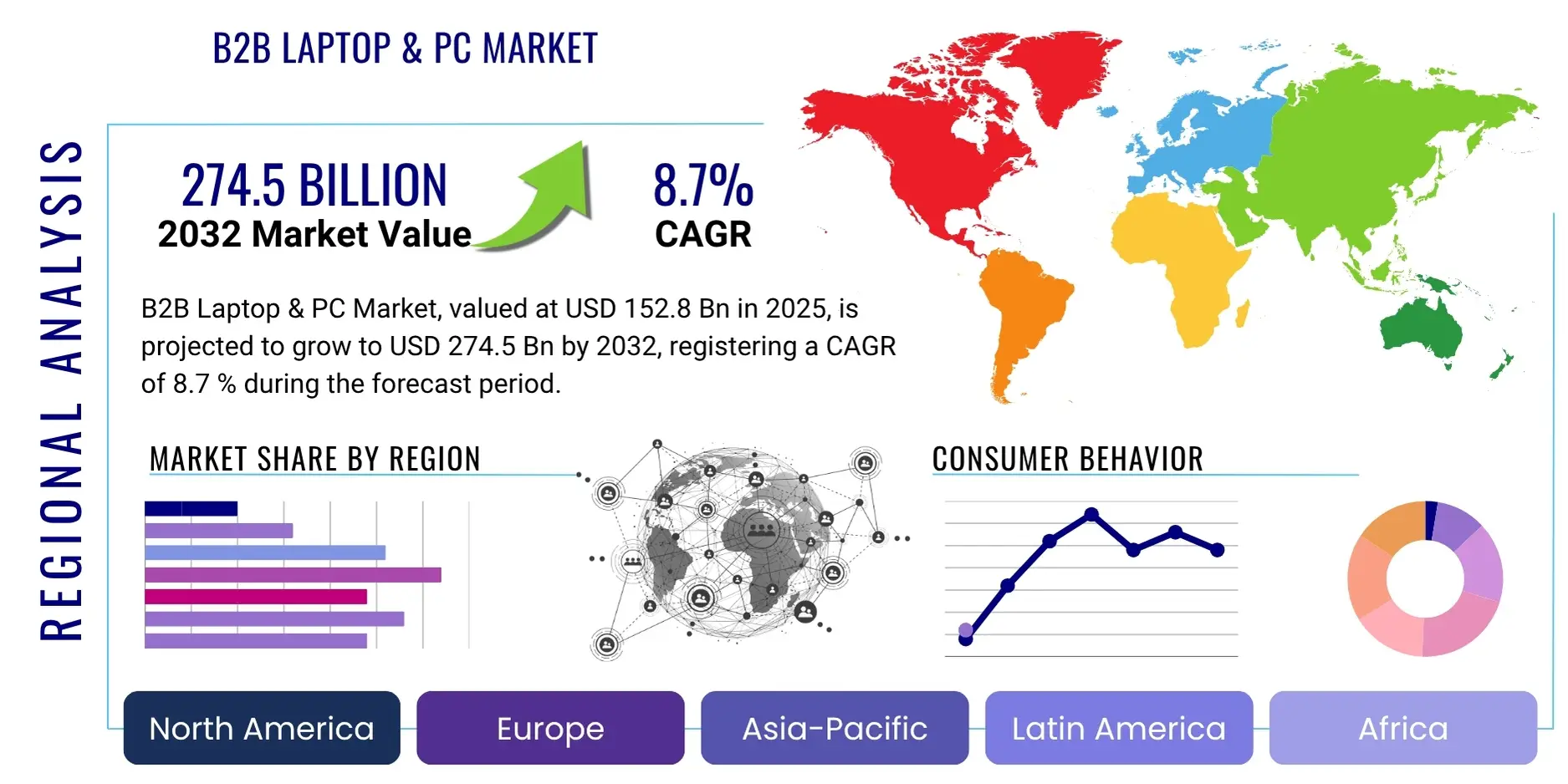

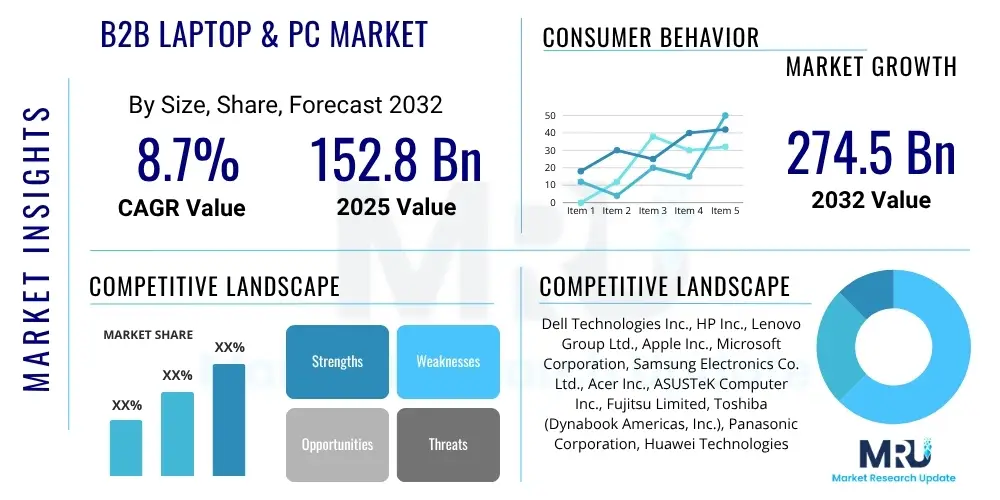

The B2B Laptop & PC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 152.8 billion in 2025 and is projected to reach USD 274.5 billion by the end of the forecast period in 2032.

B2B Laptop & PC Market introduction

The B2B Laptop & PC market encompasses the sale of desktop computers, notebooks, workstations, and thin clients specifically designed and marketed for business use across various industries. These devices are optimized for productivity, security, manageability, and durability, catering to the unique demands of corporate environments, small and medium-sized enterprises (SMEs), and public sector organizations. The product offerings range from high-performance workstations for intensive tasks like graphic design and data analytics to robust, secure laptops for mobile professionals and cost-effective desktops for general office use. Key features often include enhanced security protocols, long-term stability, centralized management capabilities, and enterprise-grade support, distinguishing them from consumer-grade counterparts.

Major applications for B2B laptops and PCs span a wide array of business functions, including general office administration, advanced data processing, software development, financial modeling, content creation, engineering design, and remote collaboration. These devices serve as the foundational tools enabling digital transformation initiatives, supporting hybrid work models, and facilitating access to enterprise applications and cloud services. The benefits derived by businesses from investing in these professional-grade devices include improved employee productivity, enhanced data security, reduced total cost of ownership through extended lifecycles and easier management, and seamless integration into existing IT infrastructures. Their robust build quality and specialized features ensure operational continuity and compliance with industry standards.

The market is primarily driven by several critical factors, including the ongoing global digital transformation, which necessitates modern computing hardware to support evolving software and cloud services. The pervasive shift towards hybrid and remote work models has amplified demand for portable, secure, and powerful laptops. Additionally, the regular refresh cycles for enterprise hardware, driven by technological obsolescence, security concerns, and performance requirements for demanding applications, consistently fuel market expansion. The integration of advanced features such as AI-enabled processors, enhanced connectivity options (e.g., Wi-Fi 6E, 5G), and improved battery life further propels businesses to upgrade their device fleets, seeking greater efficiency and competitive advantage.

B2B Laptop & PC Market Executive Summary

The B2B Laptop & PC market is currently experiencing dynamic shifts driven by accelerated digital transformation and the widespread adoption of hybrid work models. Business trends indicate a strong emphasis on device-as-a-service (DaaS) offerings, providing companies with flexible procurement and management solutions, reducing upfront capital expenditure, and ensuring up-to-date technology. Cybersecurity remains a top priority, leading to increased demand for devices with integrated hardware-level security features and robust endpoint protection. Sustainability is also emerging as a significant purchasing criterion, with businesses increasingly favoring manufacturers that offer energy-efficient products and demonstrate responsible supply chain practices. Moreover, the demand for powerful, AI-ready hardware capable of handling increasingly complex software and data workloads is on the rise, pushing innovation in processor and memory technologies.

Regionally, North America and Europe continue to represent mature markets, characterized by high adoption rates of advanced technology and a strong focus on cloud integration and cybersecurity. These regions are seeing significant investments in refreshing existing IT infrastructure and embracing DaaS models. Asia Pacific, particularly countries like China, India, and Japan, is emerging as a high-growth region, propelled by rapid industrialization, expanding digitalization initiatives across SMEs, and a growing professional workforce. Latin America and the Middle East & Africa are also witnessing steady growth, albeit from a lower base, as businesses in these regions gradually transition from traditional IT setups to more modern, cloud-centric computing environments, driven by favorable government policies and increased foreign investment. Each region presents unique opportunities and challenges influenced by local economic conditions, regulatory landscapes, and digital maturity levels.

Segmentation trends within the B2B Laptop & PC market highlight a clear bifurcation between high-performance, specialized workstations and ultra-portable, secure business laptops. Large enterprises continue to invest in a mix of both, prioritizing manageability, scalability, and robust security suites. The SMB segment shows increasing interest in versatile, cost-effective laptops and DaaS solutions that offer enterprise-grade features without requiring extensive in-house IT support. By end-user, the corporate sector remains dominant, but education and government sectors are also significant consumers, driven by digitalization of learning and public services. Furthermore, the market is seeing a rise in demand for custom-configured devices tailored to specific industry needs, underscoring a move away from one-size-fits-all solutions towards more personalized and optimized computing experiences. The shift towards powerful, yet energy-efficient components is another prominent trend influencing product development and procurement decisions across all segments.

AI Impact Analysis on B2B Laptop & PC Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the B2B Laptop & PC market frequently revolve around several key themes: the necessity of new hardware for AI workloads, the integration of AI capabilities into operating systems and applications, the role of AI in enhancing device security and manageability, and the potential for AI to drive accelerated hardware refresh cycles. Businesses are keen to understand how AI will influence productivity gains, what new features they can expect, and whether their existing IT infrastructure is adequate for emerging AI demands. There's also significant interest in how AI will transform the overall user experience, particularly in areas like intelligent automation, personalized workflows, and advanced data processing at the edge. The common thread is a desire to leverage AI for competitive advantage while navigating the associated hardware and software requirements.

- AI-dedicated neural processing units (NPUs) are becoming standard in new B2B laptops and PCs, enabling on-device AI acceleration for tasks like voice commands, real-time language translation, and image processing without relying solely on cloud resources, thus improving privacy and latency.

- Enhanced productivity software, integrated with AI, offers features like intelligent meeting summaries, predictive text, advanced search capabilities, and automated data analysis directly on the device, significantly streamlining workflows for business users.

- AI-powered security features are being embedded at the hardware level, providing proactive threat detection, behavioral analytics for anomaly detection, and more robust biometric authentication, offering superior protection against sophisticated cyber threats compared to software-only solutions.

- The demand for AI-ready hardware is driving accelerated refresh cycles as businesses seek to equip their workforce with devices capable of efficiently running next-generation AI-intensive applications and operating systems.

- AI assists in device management and IT support through predictive maintenance, automated troubleshooting, and intelligent resource allocation, leading to reduced downtime and lower IT operational costs for enterprises.

- Edge AI capabilities on B2B devices enable real-time data processing and decision-making closer to the source, crucial for industries like manufacturing, retail, and healthcare, reducing reliance on constant cloud connectivity and improving data privacy.

DRO & Impact Forces Of B2B Laptop & PC Market

The B2B Laptop & PC market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, shaped by broader technological and economic trends. Key drivers include the relentless pace of digital transformation across all industry verticals, compelling businesses to continuously upgrade their computing infrastructure to support advanced software, cloud services, and big data analytics. The global shift towards hybrid and remote work models has profoundly increased demand for portable, high-performance, and secure laptops that facilitate seamless collaboration and productivity regardless of location. Furthermore, the constant evolution of operating systems and business applications, which require more robust hardware, along with a consistent enterprise refresh cycle typically every 3-5 years, ensures a steady baseline demand for new devices. Additionally, the increasing emphasis on data security and compliance drives organizations to invest in devices with integrated hardware-level security features and advanced management capabilities.

However, the market also faces considerable restraints. High initial procurement costs, especially for premium business-grade devices and workstations, can be a significant barrier for smaller businesses or those with limited IT budgets. Supply chain disruptions, as evidenced in recent years, can lead to component shortages and increased manufacturing costs, ultimately impacting product availability and pricing. The cyclical nature of hardware demand and the increasing lifespan of existing devices due to incremental performance gains can occasionally lead to slower market growth. Furthermore, the growing concerns around e-waste and the environmental impact of device manufacturing and disposal present a challenge, pushing manufacturers to innovate in sustainable practices, which can sometimes add to production costs. The rising threat of cyberattacks also necessitates continuous investment in security, which adds complexity and cost to device development and deployment.

Despite these challenges, numerous opportunities exist for market expansion and innovation. The integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities directly into device hardware, such as dedicated neural processing units (NPUs), presents a significant opportunity to drive new sales cycles as businesses seek to leverage AI for enhanced productivity and competitive advantage. The expansion of Device-as-a-Service (DaaS) models offers a flexible, subscription-based approach to hardware procurement, making advanced technology more accessible to a broader range of businesses and improving total cost of ownership. The burgeoning demand for sustainable and energy-efficient computing solutions provides a pathway for manufacturers to differentiate their offerings and appeal to environmentally conscious enterprises. Moreover, the continuous development of ultra-portable, powerful, and always-connected devices caters to the evolving needs of highly mobile professionals, opening new avenues for growth in niche markets. The ongoing development of robust 5G and Wi-Fi 6E connectivity also presents an opportunity for seamless, high-speed remote work capabilities, further solidifying the necessity for advanced B2B computing solutions.

Segmentation Analysis

The B2B Laptop & PC market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation helps identify key customer groups, product preferences, and geographical concentrations, enabling manufacturers and vendors to tailor their strategies effectively. The market is primarily segmented by product type, end-user industry, and organization size, reflecting the varied requirements across the business landscape. Each segment is characterized by distinct purchasing behaviors, technical specifications, and budgetary considerations, necessitating customized marketing and sales approaches. Understanding these segments is crucial for accurate market sizing, competitive analysis, and strategic planning within the B2B computing ecosystem.

- By Product Type:

- Laptops (Notebooks, Ultrabooks, 2-in-1 Laptops)

- Desktops (Tower PCs, All-in-One PCs, Small Form Factor PCs)

- Workstations (Fixed Workstations, Mobile Workstations)

- Thin Clients (Hardware Thin Clients, Software Thin Clients)

- By End-User Industry:

- IT & Telecommunications

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Education

- Government & Public Sector

- Manufacturing

- Retail & E-commerce

- Media & Entertainment

- Other Industries (Legal, Consulting, Transportation, etc.)

- By Organization Size:

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Distribution Channel:

- Direct Sales (Manufacturer to Business)

- Indirect Sales (Distributors, Value-Added Resellers, System Integrators, Online Retailers)

Value Chain Analysis For B2B Laptop & PC Market

The value chain for the B2B Laptop & PC market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user deployment and post-sales support. It begins with upstream activities, where various component suppliers play a critical role. This includes semiconductor manufacturers providing processors (CPUs, GPUs, NPUs), memory modules (RAM), and storage devices (SSDs, HDDs). Other essential components like display panels, batteries, chipsets, power management units, and casing materials are also sourced from a global network of specialized suppliers. The quality, cost, and availability of these components directly impact the final product's performance, pricing, and time-to-market. Strong relationships with these upstream suppliers are vital for ensuring supply chain resilience and competitive advantage, as disruptions in this stage can have widespread repercussions throughout the entire chain. Innovation at the component level, especially in areas like AI acceleration and power efficiency, drives the evolution of the end product.

Midstream activities involve the design, manufacturing, and assembly of the laptops and PCs. Leading original equipment manufacturers (OEMs) like Dell, HP, Lenovo, and Apple design their products, often collaborating with component suppliers for optimization. Manufacturing processes involve intricate assembly lines, quality control, and testing to ensure device reliability and performance meet stringent business standards. This stage also includes the integration of operating systems, security software, and specialized business applications. After assembly, devices are packaged and prepared for distribution. The efficiency of manufacturing, coupled with economies of scale, is crucial for cost-effectiveness and meeting large-volume enterprise orders. Customization and configuration services, often performed at this stage, add significant value by tailoring products to specific client requirements, such as pre-installed software images or custom asset tags.

Downstream activities focus on the distribution, sales, and post-sales support, connecting the manufactured products with the end-users. Distribution channels are varied, encompassing both direct and indirect models. Direct sales involve manufacturers selling directly to large enterprises or government agencies through dedicated sales teams, offering personalized service, bulk discounts, and custom solutions. This approach allows for direct feedback and stronger customer relationships. Indirect channels are more prevalent and include a network of distributors, value-added resellers (VARs), system integrators (SIs), and increasingly, business-focused online retailers. Distributors act as intermediaries, managing inventory and logistics for a wide range of products. VARs add significant value by bundling hardware with software, services, and specialized IT solutions tailored to specific industry needs. System integrators provide comprehensive IT infrastructure solutions, often incorporating B2B laptops and PCs as part of a larger project. Post-sales support, including warranty services, technical assistance, and repair, is a critical component of the value chain, ensuring customer satisfaction and fostering long-term business relationships. Effective management of these downstream activities is essential for market penetration, customer retention, and overall brand reputation in the competitive B2B landscape.

B2B Laptop & PC Market Potential Customers

Potential customers for B2B laptops and PCs span a broad spectrum of organizations, from nascent startups and growing small and medium-sized enterprises (SMEs) to expansive multinational corporations, governmental bodies, and educational institutions. Each segment possesses unique purchasing motivations, budgetary constraints, and technical requirements. SMEs, for instance, often seek cost-effective yet reliable and secure devices that can scale with their growth, frequently favoring robust, versatile laptops that support general office productivity, cloud-based applications, and essential business operations. Their purchasing decisions are often influenced by the total cost of ownership, ease of management, and readily available technical support, sometimes gravitating towards subscription-based Device-as-a-Service (DaaS) models to minimize upfront investment and IT overhead.

Large enterprises, on the other hand, prioritize advanced security features, centralized manageability, high performance, and compatibility with their complex IT infrastructures. These organizations often require a diverse fleet of devices, including high-performance workstations for specialized departments (e.g., engineering, finance, R&D) and secure, ultra-portable laptops for their mobile workforce and executives. Bulk purchasing, custom configurations, and comprehensive service level agreements (SLAs) are common requirements. Government and public sector entities focus heavily on procurement regulations, data security, compliance with national standards, and long-term reliability, often having extensive refresh cycles and requiring robust supply chain guarantees. Educational institutions, from K-12 to universities, seek durable, user-friendly devices for students and faculty, emphasizing collaborative features, network manageability, and cost-effectiveness for large deployments, often driven by digital learning initiatives and funding cycles.

Beyond these broad categories, vertical-specific industries present distinct customer profiles. The IT & Telecommunications sector requires powerful machines for software development, network management, and data centers. The Banking, Financial Services, and Insurance (BFSI) industry demands devices with uncompromised security, reliability, and performance for sensitive data handling and transactional operations. Healthcare providers need portable and sanitary devices for patient care, data entry, and medical imaging, often with strict regulatory compliance. Manufacturing companies utilize B2B PCs for CAD/CAM, production line management, and industrial control systems, requiring ruggedized and high-performance workstations. Retail and e-commerce businesses deploy devices for point-of-sale systems, inventory management, and back-office operations, valuing reliability and integration with existing retail software. Each of these end-users represents a significant market segment for B2B laptop and PC manufacturers, requiring a deep understanding of their operational needs and technological preferences to effectively serve them.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 152.8 billion |

| Market Forecast in 2032 | USD 274.5 billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies Inc., HP Inc., Lenovo Group Ltd., Apple Inc., Microsoft Corporation, Samsung Electronics Co. Ltd., Acer Inc., ASUSTeK Computer Inc., Fujitsu Limited, Toshiba (Dynabook Americas, Inc.), Panasonic Corporation, Huawei Technologies Co. Ltd., LG Electronics Inc., Google LLC (Chromebooks), Razer Inc. (Business Solutions), MSI (Micro-Star International Co., Ltd.), VAIO Corporation, Getac Technology Corporation, System76, Star Labs Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B Laptop & PC Market Key Technology Landscape

The B2B Laptop & PC market's technology landscape is characterized by continuous innovation aimed at enhancing performance, security, connectivity, and user experience for business applications. Central to this evolution are advancements in processor technology, with Intel and AMD consistently releasing new generations of CPUs that integrate more cores, higher clock speeds, and improved power efficiency. A significant recent development is the inclusion of dedicated Neural Processing Units (NPUs) or AI accelerators within these processors, specifically designed to handle AI and machine learning workloads locally on the device. This enables features like enhanced video conferencing, intelligent automation, and personalized computing without constant reliance on cloud services, addressing concerns around data privacy and latency. These AI-enabled chips are becoming a standard expectation for future-proof business devices, driving a new wave of hardware refresh cycles.

Security remains a paramount concern in the B2B sector, leading to a strong focus on hardware-level security technologies. Trusted Platform Modules (TPMs) are standard, providing hardware-based cryptographic functions and secure boot capabilities. Beyond TPMs, manufacturers are integrating advanced biometric authentication systems, such as facial recognition and fingerprint scanners, to enhance user verification. BIOS-level security, self-healing firmware, and integration with enterprise endpoint security platforms are also critical. Developments in secure element technology and memory encryption further bolster data protection against sophisticated cyber threats. The move towards Zero Trust Architecture principles is influencing device design, ensuring that every access request is verified, regardless of whether it originates inside or outside the corporate network, making devices more resilient against evolving security landscapes.

Connectivity and manageability are also undergoing significant technological transformation. The adoption of Wi-Fi 6E and the nascent integration of 5G cellular modems in business laptops ensure ubiquitous, high-speed, and reliable network access, crucial for remote and hybrid work models. Thunderbolt and USB4 ports offer versatile, high-bandwidth connectivity for external displays, storage, and docking solutions. For IT departments, advancements in remote management technologies, such as Intel vPro and AMD PRO technologies, provide enhanced out-of-band management capabilities, allowing for remote diagnostics, repairs, and updates even when a device is powered off or offline. Furthermore, cloud-based device management platforms are becoming increasingly sophisticated, enabling centralized deployment, configuration, and security policy enforcement across large fleets of B2B laptops and PCs, streamlining IT operations and reducing the total cost of ownership. The emphasis is on creating a seamlessly connected, secure, and easily manageable ecosystem for business users.

Regional Highlights

- North America: This region stands as a mature and highly innovative market for B2B Laptops & PCs, characterized by early adoption of advanced technologies, a strong emphasis on cybersecurity, and robust digital transformation initiatives across large enterprises and growing startups. The presence of major tech companies, a significant professional workforce, and pervasive hybrid work models drive consistent demand for high-performance, secure, and cloud-integrated devices. The U.S. and Canada lead in DaaS adoption and refresh cycles, with a strong focus on devices offering advanced manageability features and AI capabilities. Regulatory frameworks, such as NIST guidelines and CMMC, also influence purchasing decisions, favoring devices with enhanced security protocols.

- Europe: The European B2B Laptop & PC market is dynamic, reflecting diverse economic conditions and varying levels of digital maturity across countries. Western European nations (e.g., Germany, UK, France) are characterized by strong enterprise demand, a focus on sustainability, and adherence to strict data protection regulations like GDPR, driving preferences for secure, energy-efficient, and ethically sourced devices. Central and Eastern European countries show steady growth as businesses modernize their IT infrastructure. The region is embracing hybrid work models, leading to increased demand for portable and collaborative computing solutions, alongside a growing interest in Device-as-a-Service models to optimize IT budgets.

- Asia Pacific (APAC): APAC is projected as the fastest-growing region, fueled by rapid industrialization, expanding digitalization across SMEs, and a burgeoning professional and remote workforce in countries like China, India, Japan, Australia, and Southeast Asian nations. Government initiatives supporting digital economies, coupled with significant foreign investments, are accelerating IT infrastructure development. There is strong demand for both cost-effective solutions for emerging businesses and high-performance workstations for specialized industries such as manufacturing, IT, and R&D. The region also exhibits a high propensity for adopting new technologies, including AI-enabled devices and advanced connectivity solutions.

- Latin America: The B2B Laptop & PC market in Latin America is experiencing steady growth, driven by increasing digitalization efforts, investment in infrastructure, and the expansion of small and medium-sized businesses across countries like Brazil, Mexico, and Argentina. Economic stability and improving internet penetration are enabling more businesses to adopt modern computing solutions. While cost-effectiveness remains a key purchasing factor, there is a growing recognition of the importance of robust security features and reliable performance. The region shows potential for increased cloud adoption and the gradual integration of device-as-a-service models, especially among organizations looking to modernize their IT without significant upfront capital expenditure.

- Middle East and Africa (MEA): The MEA region presents a developing yet promising market for B2B Laptops & PCs. Growth is primarily propelled by economic diversification initiatives, large-scale infrastructure projects (e.g., in UAE, Saudi Arabia), and increasing governmental investment in digital transformation and smart city projects. The expanding private sector, particularly in sectors like finance, oil & gas, and tourism, is driving demand for modern, secure, and scalable computing solutions. African nations are witnessing gradual adoption, driven by improved connectivity and the need for basic computing infrastructure in growing enterprises. Cybersecurity concerns are also paramount, influencing the selection of devices with integrated security features, especially in critical national infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B Laptop & PC Market.- Dell Technologies Inc.

- HP Inc.

- Lenovo Group Ltd.

- Apple Inc.

- Microsoft Corporation

- Samsung Electronics Co. Ltd.

- Acer Inc.

- ASUSTeK Computer Inc.

- Fujitsu Limited

- Toshiba (Dynabook Americas, Inc.)

- Panasonic Corporation

- Huawei Technologies Co. Ltd.

- LG Electronics Inc.

- Google LLC (Chromebooks)

- Razer Inc. (Business Solutions)

- MSI (Micro-Star International Co., Ltd.)

- VAIO Corporation

- Getac Technology Corporation

- System76

- Star Labs Ltd.

Frequently Asked Questions

What is the projected growth rate for the B2B Laptop & PC market?

The B2B Laptop & PC market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. This growth is driven by ongoing digital transformation, the widespread adoption of hybrid work models, and continuous technological advancements in hardware and software.

How is AI impacting B2B laptops and PCs?

AI is significantly impacting the B2B market by integrating dedicated Neural Processing Units (NPUs) into devices, enabling on-device AI acceleration for enhanced productivity, security, and real-time processing. This fosters new features in operating systems and applications, drives faster refresh cycles, and improves device manageability through intelligent automation.

What are the primary drivers for the B2B Laptop & PC market?

Key drivers include the accelerating pace of digital transformation across industries, the global shift towards hybrid and remote work models, regular enterprise hardware refresh cycles, and the increasing demand for advanced data security features. The need for robust computing infrastructure to support evolving software and cloud services also significantly propels market growth.

Which regions are leading or showing high growth in the B2B Laptop & PC market?

North America and Europe represent mature markets with high adoption rates of advanced technology and strong focus on security and cloud integration. Asia Pacific, particularly China and India, is emerging as the fastest-growing region due to rapid industrialization, expanding digitalization across SMEs, and a burgeoning professional workforce.

What types of businesses are considered potential customers for B2B laptops and PCs?

Potential customers encompass a broad range including Small & Medium-sized Enterprises (SMEs), large enterprises across various sectors (IT, BFSI, Healthcare, Manufacturing, Retail), government organizations, and educational institutions. Each segment has distinct requirements regarding performance, security, manageability, and budget, influencing their purchasing decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager