Banking as a Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429343 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Banking as a Service Market Size

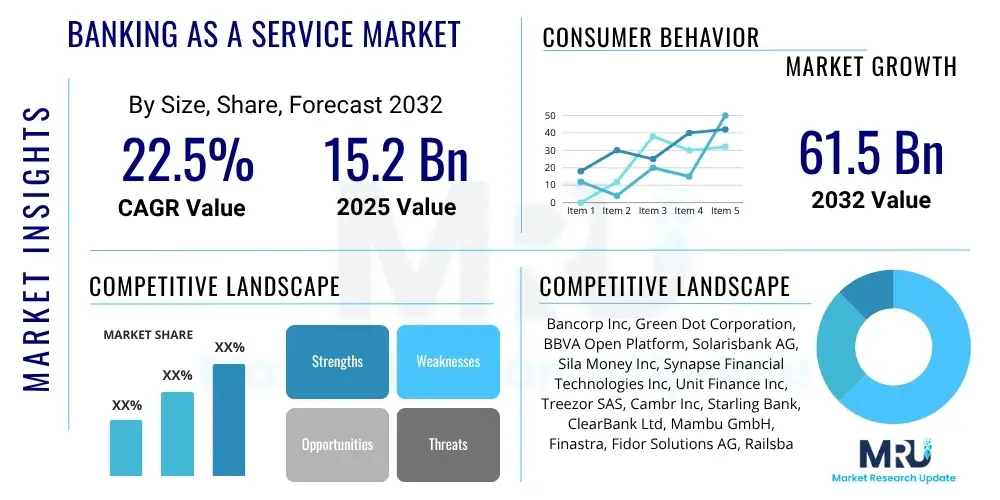

The Banking as a Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2025 and 2032. The market is estimated at USD 15.2 Billion in 2025 and is projected to reach USD 61.5 Billion by the end of the forecast period in 2032.

Banking as a Service Market introduction

The Banking as a Service BaaS market represents a transformative shift in the financial services industry, enabling non-bank entities and fintechs to offer integrated financial products and services without acquiring a full banking license. This innovative model leverages the existing regulatory framework and technological infrastructure of licensed banks, allowing third parties to embed banking functionalities directly into their own applications and customer journeys. BaaS platforms provide a suite of modular banking services, including accounts, payments, lending, and card issuance, accessible via Application Programming Interfaces APIs. This strategic unbundling of banking services facilitates rapid innovation, reduces time to market for new financial products, and lowers operational costs for both traditional financial institutions and new market entrants.

Major applications of Banking as a Service extend across a broad spectrum of industries. Fintech startups utilize BaaS to launch challenger banks, personalized lending platforms, and innovative payment solutions. E-commerce platforms integrate BaaS to offer embedded finance options like buy now, pay later BNPL schemes or merchant accounts. Retailers, automotive companies, and even healthcare providers are exploring BaaS to provide branded financial services, enhance customer loyalty, and create new revenue streams. The inherent flexibility and scalability of the BaaS model are key benefits, empowering businesses to tailor financial offerings that precisely meet their customers' evolving needs, while banks can expand their reach and monetize their core capabilities.

The market is primarily driven by several powerful forces, including the accelerating pace of digital transformation across all sectors, the increasing adoption of open banking regulations, and a growing consumer demand for seamless, personalized, and convenient financial experiences. Furthermore, the rising cost of traditional banking infrastructure and the desire for greater operational efficiency are compelling both incumbent banks and new players to embrace BaaS. Regulatory support for open banking initiatives in various regions further catalyzes market expansion, creating a fertile ground for collaboration and innovation within the financial ecosystem. These combined factors are establishing BaaS as a pivotal component of the future financial landscape.

Banking as a Service Market Executive Summary

The Banking as a Service BaaS market is experiencing robust growth, propelled by the widespread adoption of digital technologies and the increasing demand for integrated financial solutions across diverse industries. Key business trends indicate a strong move towards collaborative ecosystems, where traditional banks partner with fintechs and non-financial brands to deliver embedded finance offerings. This shift is redefining competitive landscapes, encouraging incumbents to evolve beyond their traditional roles and embrace platform-based business models. The market is characterized by a surge in API driven financial product innovation, enabling businesses to swiftly launch new services and respond to dynamic consumer expectations, leading to enhanced customer engagement and diversified revenue streams for all participants in the value chain.

Regionally, North America and Europe continue to dominate the BaaS market, largely due to supportive regulatory frameworks, a mature digital infrastructure, and a high concentration of fintech innovation. The Asia Pacific APAC region is emerging as a significant growth hub, driven by rapid digitalization, a vast unbanked and underbanked population, and increasing smartphone penetration that fuels demand for mobile-first financial services. Latin America and the Middle East and Africa MEA regions are also witnessing substantial growth, albeit from a lower base, as local fintech ecosystems mature and governments promote financial inclusion through digital initiatives. These regional dynamics highlight a global trend towards accessible and embedded financial services, tailored to local market needs and regulatory environments.

Segmentation trends reveal a strong emphasis on platform-centric solutions and a growing demand for specialized BaaS offerings across various end user segments. The API based segment is expected to maintain its lead, offering granular control and flexibility for developers. Payments, accounts, and lending are the most sought after services, forming the foundational pillars of many embedded finance propositions. Furthermore, the market is seeing an uptick in adoption among large enterprises looking to modernize their offerings, alongside continued strong uptake from small and medium sized enterprises SMEs and fintech startups seeking agile and cost effective solutions. The evolution of these segments points towards a future where financial services are increasingly modular, customizable, and seamlessly integrated into everyday consumer and business activities.

AI Impact Analysis on Banking as a Service Market

Users frequently inquire about how Artificial Intelligence AI is transforming Banking as a Service BaaS, focusing on its potential to revolutionize customer experience, operational efficiency, and risk management. Common questions explore AI's role in personalizing financial products, enhancing fraud detection capabilities, automating compliance processes, and driving predictive analytics for better decision-making. There is significant interest in understanding how AI can optimize the onboarding process, provide intelligent insights to end users, and create more seamless, contextually relevant financial interactions within BaaS ecosystems. Concerns often revolve around data privacy, ethical AI deployment, and the challenge of integrating complex AI solutions into existing BaaS infrastructure, alongside the expectation that AI will unlock hyper-personalization and proactive service delivery, profoundly shaping the future of embedded finance.

- Enhanced customer personalization through AI driven insights into user behavior and financial needs.

- Automated fraud detection and prevention, utilizing machine learning algorithms to identify suspicious patterns in real time.

- Streamlined compliance and regulatory reporting with AI powered tools for transaction monitoring and data analysis.

- Optimized credit scoring and lending decisions via advanced predictive analytics models.

- Improved operational efficiency through intelligent automation of back office tasks and customer support chatbots.

- Proactive financial advice and intelligent recommendations for end users of BaaS products.

- Dynamic pricing models and adaptive product offerings based on market conditions and customer segments.

- Advanced cybersecurity measures, leveraging AI to detect and mitigate evolving threats within BaaS platforms.

- Faster and more accurate data processing, enabling real time financial insights for businesses.

DRO & Impact Forces Of Banking as a Service Market

The Banking as a Service BaaS market is primarily driven by the accelerated pace of digital transformation across industries and the increasing consumer demand for integrated, convenient, and personalized financial services. Open banking initiatives and supportive regulatory frameworks worldwide are acting as significant catalysts, fostering a collaborative ecosystem where fintechs and non-financial brands can seamlessly embed financial products. This convergence enables businesses to rapidly innovate, reduce operational overheads associated with traditional banking infrastructure, and extend their market reach, ultimately driving market expansion and adoption. The flexibility and scalability offered by BaaS platforms are critical in enabling diverse businesses to adapt to dynamic market conditions and deliver bespoke financial solutions, making them a powerful force for market growth.

However, the market faces several notable restraints, predominantly related to complex regulatory landscapes and data security concerns. Navigating varied international and local financial regulations poses a significant challenge for BaaS providers and their partners, demanding robust compliance frameworks and constant vigilance. Furthermore, the handling of sensitive financial data across multiple entities within a BaaS ecosystem raises inherent cybersecurity and privacy risks, requiring stringent data protection measures and sophisticated threat mitigation strategies. Integration complexities with legacy systems of traditional banks, the need for high levels of technical expertise, and potential brand dilution for traditional banks are additional factors that can impede market growth. Addressing these challenges effectively is crucial for sustained development and broader market penetration.

Significant opportunities abound for the BaaS market, particularly in expanding into untapped non-financial sectors such as retail, e-commerce, automotive, and healthcare, where embedded finance can create entirely new value propositions. The integration of emerging technologies like blockchain for enhanced transparency and security, and further advancements in AI and machine learning for hyper personalization and predictive analytics, represent substantial avenues for innovation and differentiation. Global expansion into emerging economies with rapidly digitizing populations and growing financial inclusion needs also presents a fertile ground for BaaS providers. The continuous evolution of consumer expectations for seamless digital experiences will further fuel the demand for BaaS, creating a virtuous cycle of innovation and adoption. These opportunities position BaaS at the forefront of financial innovation, poised for substantial future growth.

Segmentation Analysis

The Banking as a Service BaaS market is meticulously segmented to provide a granular understanding of its diverse offerings and applications, categorizing solutions based on various attributes such as type, component, enterprise size, and end user. This segmentation helps identify key growth areas, competitive landscapes, and specific market demands across different client profiles. The modular nature of BaaS allows for a wide array of customized services, catering to both nascent fintech startups and established large enterprises seeking to integrate sophisticated financial functionalities into their operations. Analyzing these segments is critical for stakeholders to pinpoint strategic opportunities and tailor their product development and market entry strategies effectively.

- Type

- API Based BaaS

- Cloud Based BaaS

- Component

- Platform Solutions

- Services

- Consulting Services

- Integration Services

- Support Services

- Enterprise Size

- Small and Medium sized Enterprises SMEs

- Large Enterprises

- End User

- Fintech Companies

- Digital Banks Challenger Banks

- Traditional Banks

- Non Financial Brands Retailers, E-commerce, Automotive, Healthcare, etc.

Value Chain Analysis For Banking as a Service Market

The Banking as a Service BaaS value chain is a collaborative ecosystem involving multiple layers, starting from the foundational infrastructure and extending to the end user. At the upstream level, the value chain involves core banking system providers, cloud infrastructure providers, and specialized technology vendors that supply the essential software and hardware components for BaaS platforms. These entities are responsible for developing and maintaining the secure, scalable, and compliant technological backbone upon which BaaS offerings are built, ensuring robust performance and regulatory adherence. Strategic partnerships with these upstream providers are crucial for BaaS platforms to deliver high-quality, reliable, and innovative financial services to their clients, allowing for modularity and flexibility in service design.

The midstream of the value chain is dominated by the BaaS providers themselves, typically licensed banks or specialized technology companies acting as orchestrators. These providers leverage their regulatory licenses, core banking systems, and API layers to create a comprehensive suite of financial products and services. They manage the technical integration, compliance, and operational aspects, abstracting the complexities of banking for their downstream partners. Their role is to package these services into easy to consume APIs, fostering an environment where fintechs and non-financial brands can quickly integrate banking functionalities without the burden of developing and maintaining their own regulated infrastructure. This segment focuses heavily on API management, security, and continuous innovation in product offerings.

Downstream, the BaaS value chain culminates with the distribution channels and the end users of these embedded financial services. Distribution primarily occurs through direct channels, where BaaS platforms directly onboard fintechs and non financial brands, providing them access to APIs and development tools. Indirect channels involve partnerships with system integrators, consulting firms, or digital agencies that help businesses implement BaaS solutions. The ultimate end users are the customers of these fintechs and non financial brands, who benefit from seamless, integrated financial experiences within their preferred applications and platforms. This collaborative model ensures that financial services are delivered efficiently and effectively, broadening financial access and enriching customer journeys across various industries.

Banking as a Service Market Potential Customers

The Banking as a Service BaaS market caters to a diverse and rapidly expanding base of potential customers, spanning both financial and non financial sectors seeking to integrate banking functionalities without the complexities of traditional licensing and infrastructure. Foremost among these are fintech companies and challenger banks, which rely on BaaS to rapidly launch innovative financial products, such as mobile banking apps, specialized lending platforms, and digital payment solutions, allowing them to focus on user experience and market differentiation rather than regulatory hurdles. These agile players find immense value in the modular, API driven services offered by BaaS providers, enabling faster time to market and greater scalability for their offerings, driving continuous innovation within the financial landscape.

Beyond traditional financial innovators, a significant portion of the potential customer base comes from non financial brands across various industries. E-commerce platforms, for instance, can embed payment processing, credit facilities like buy now, pay later BNPL, or even branded debit cards directly into their checkout flows, enhancing customer loyalty and creating new revenue streams. Retailers, automotive manufacturers, and telecommunications companies are exploring BaaS to offer tailored financial products to their customer base, from loyalty programs with integrated payment features to vehicle financing solutions and mobile wallets. This embedded finance trend allows these brands to deepen customer relationships, gather richer data insights, and extend their service offerings beyond their core business, positioning them as comprehensive lifestyle providers.

Traditional banks also represent a growing segment of potential customers for BaaS, albeit in a different capacity. Many incumbent banks are leveraging BaaS platforms to modernize their own services, enhance their digital capabilities, and expand their reach into new customer segments or geographies without significant capital expenditure. By adopting a BaaS model internally, or partnering with specialized BaaS providers, traditional banks can streamline their operations, foster innovation, and unbundle their services to attract fintech partners, creating new revenue opportunities through collaboration. The overarching appeal of BaaS lies in its ability to enable any business with a customer base to become a provider of financial services, transforming numerous industries into potential buyers of these versatile banking solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.2 Billion |

| Market Forecast in 2032 | USD 61.5 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bancorp Inc, Green Dot Corporation, BBVA Open Platform, Solarisbank AG, Sila Money Inc, Synapse Financial Technologies Inc, Unit Finance Inc, Treezor SAS, Cambr Inc, Starling Bank, ClearBank Ltd, Mambu GmbH, Finastra, Fidor Solutions AG, Railsbank, Contis Financial Services Ltd, Stripe, Bond Financial Technologies Inc, Aion Bank, Goldman Sachs Group Inc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banking as a Service Market Key Technology Landscape

The technological foundation of the Banking as a Service BaaS market is built upon a sophisticated stack of interconnected innovations designed to facilitate seamless, secure, and scalable financial operations. Central to this landscape are Application Programming Interfaces APIs, which serve as the primary conduits for integrating banking functionalities into third party applications. These APIs enable modular access to core banking services such as accounts, payments, and lending, allowing developers to embed these features with minimal effort. Complementing APIs is a robust reliance on cloud computing infrastructure, offering the scalability, flexibility, and cost efficiency necessary to support the dynamic demands of digital banking, ensuring high availability and global reach for BaaS platforms and their partners.

Microservices architecture represents another critical technological pillar, decomposing complex banking functionalities into smaller, independent services. This approach enhances agility, facilitates independent development and deployment, and improves system resilience, allowing BaaS providers to update or add specific features without affecting the entire platform. Cybersecurity technologies are paramount, encompassing advanced encryption protocols, multi factor authentication, intrusion detection systems, and regulatory compliance tools to protect sensitive financial data and ensure the integrity of transactions across the ecosystem. Given the nature of financial services, robust data privacy frameworks and adherence to global standards like GDPR and CCPA are also foundational.

Emerging technologies like Artificial Intelligence AI and Machine Learning ML are increasingly integrated into BaaS platforms to drive intelligence and automation. AI/ML algorithms are employed for enhanced fraud detection, personalized financial recommendations, automated customer support via chatbots, and advanced credit risk assessment, improving both operational efficiency and customer experience. Furthermore, blockchain technology is gaining traction for its potential to enhance transparency, security, and efficiency in areas like cross border payments and identity verification. Big data analytics tools are utilized to extract actionable insights from vast datasets, enabling BaaS providers and their partners to understand customer behavior better, optimize product offerings, and identify new market opportunities. These technologies collectively empower the BaaS market to deliver highly innovative, secure, and customer centric financial solutions.

Regional Highlights

- North America: This region holds a dominant share in the BaaS market, driven by a mature fintech ecosystem, high digital adoption rates, and a supportive regulatory environment. The United States, in particular, showcases a high concentration of BaaS providers and adopters, with strong investment in financial technology and a culture of innovation. Canada also contributes significantly with a growing number of challenger banks and embedded finance initiatives.

- Europe: Europe is a leading market for BaaS, largely propelled by proactive open banking regulations such as the PSD2 Payment Services Directive 2. This has fostered intense competition and innovation, with countries like the UK, Germany, and the Nordic nations at the forefront. The region emphasizes seamless cross-border payments, digital identities, and a strong focus on data privacy and security, leading to robust BaaS adoption by both fintechs and traditional banks.

- Asia Pacific APAC: The APAC region is experiencing the fastest growth in the BaaS market, fueled by rapid digitalization, a large unbanked population seeking digital financial solutions, and increasing smartphone penetration. Countries like Singapore, India, Australia, and China are significant players, with government initiatives promoting fintech innovation and financial inclusion. The region sees strong demand for mobile first banking, digital payments, and embedded finance solutions tailored for diverse economic landscapes.

- Latin America: Latin America is emerging as a dynamic market for BaaS, driven by a burgeoning fintech sector, increasing internet penetration, and efforts to address financial inclusion. Brazil and Mexico are key markets, witnessing substantial investment in digital banks and payment solutions. BaaS platforms are enabling local businesses to offer financial services to a population that has historically been underserved by traditional banking.

- Middle East and Africa MEA: While a nascent market, the MEA region is showing promising growth in BaaS, supported by government initiatives to diversify economies and accelerate digital transformation. Countries like UAE, Saudi Arabia, and South Africa are leading the charge, with a focus on smart city initiatives, digital payment infrastructure, and attracting foreign investment in fintech. The demand for modern, accessible financial services is a key growth driver, with BaaS helping bridge gaps in financial service provision.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banking as a Service Market.- Bancorp Inc

- Green Dot Corporation

- BBVA Open Platform

- Solarisbank AG

- Sila Money Inc

- Synapse Financial Technologies Inc

- Unit Finance Inc

- Treezor SAS

- Cambr Inc

- Starling Bank

- ClearBank Ltd

- Mambu GmbH

- Finastra

- Fidor Solutions AG

- Railsbank

- Contis Financial Services Ltd

- Stripe

- Bond Financial Technologies Inc

- Aion Bank

- Goldman Sachs Group Inc

Frequently Asked Questions

What is Banking as a Service BaaS?

Banking as a Service BaaS is a model where licensed banks open up their regulated infrastructure and core banking capabilities via APIs to third party businesses, enabling them to embed financial products and services directly into their own applications without needing a banking license. This allows non-financial companies, fintechs, and other organizations to offer services such as accounts, payments, and lending under their own brand.

Why is BaaS gaining traction in the financial industry?

BaaS is gaining traction due to the accelerating digital transformation, increased demand for embedded finance, and the rise of open banking regulations. It enables rapid innovation, reduces time to market for new financial products, lowers operational costs, and allows businesses to create more personalized and seamless customer experiences by integrating banking functionalities directly into their existing platforms.

What are the primary benefits of BaaS for businesses?

Businesses benefit from BaaS by achieving faster time to market for financial products, reducing the regulatory burden and operational costs associated with traditional banking, and gaining access to modular banking services via APIs. This allows them to enhance customer loyalty, create new revenue streams, and differentiate their offerings by providing relevant, branded financial services directly within their customer journeys.

What challenges does the Banking as a Service market face?

The BaaS market faces challenges including navigating complex and evolving regulatory landscapes, ensuring robust data security and privacy across multiple entities, and overcoming technical integration complexities with legacy systems. Building trust and maintaining strong partnerships between BaaS providers and their clients is also crucial for successful long-term adoption and growth.

How does BaaS impact traditional banking institutions?

BaaS significantly impacts traditional banks by encouraging them to evolve from product centric models to platform centric ones. It enables banks to monetize their core infrastructure and regulatory licenses by partnering with fintechs and non financial brands, expanding their reach beyond traditional channels. It also drives internal modernization, fostering innovation and enhancing their competitive position in the rapidly changing financial landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager