Barium Nitrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427826 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Barium Nitrate Market Size

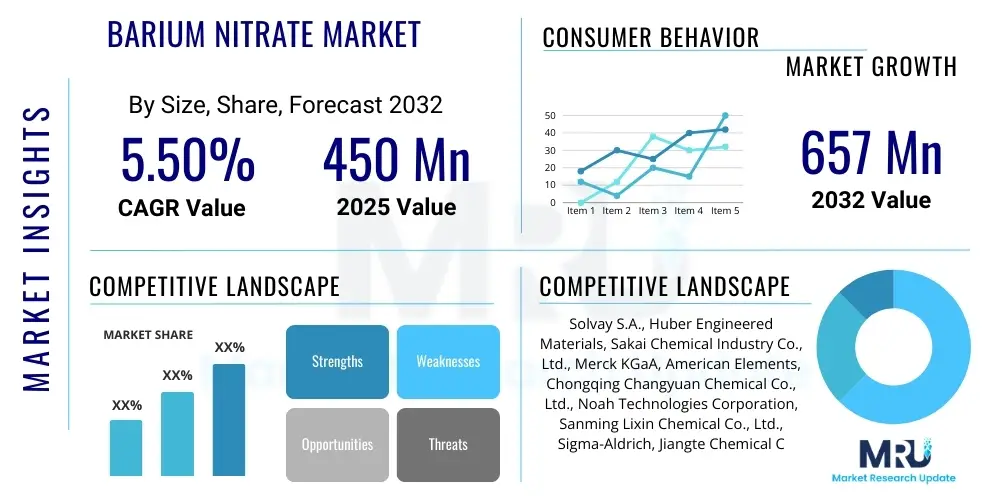

The Barium Nitrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2032. The market is estimated at USD 450 Million in 2025 and is projected to reach USD 657 Million by the end of the forecast period in 2032. This growth is primarily driven by increasing demand from the pyrotechnics, ceramics, and specialty glass industries, coupled with ongoing advancements in material science that expand its applicability in new high-performance formulations. The markets expansion is also underpinned by robust industrialization trends in emerging economies, which are fueling the consumption of barium nitrate in various manufacturing processes.

Barium Nitrate Market introduction

The Barium Nitrate market encompasses the production, distribution, and consumption of barium nitrate, an inorganic chemical compound with the formula Ba(NO3)2. This salt is notable for its excellent oxidizing properties and its ability to produce a vivid green flame when heated, making it indispensable in specific industrial applications. As a white crystalline solid, barium nitrate is highly soluble in water and is typically produced through the reaction of barium carbonate or barium sulfide with nitric acid, followed by crystallization. Its unique chemical characteristics contribute to its critical role across several sectors, where it acts as a key component for specialized functions rather than a high-volume commodity.

Major applications of barium nitrate span a diverse range of industries, including pyrotechnics, where it is extensively used as an oxidizer and a green colorant in fireworks, flares, and signal lights due to its characteristic spectral emission. In the ceramics and glass industries, it serves as an additive to improve the optical properties, density, and refractive index of certain specialty glass formulations, particularly those used in optical fibers and cathode ray tubes. Furthermore, it finds applications in the production of other barium compounds, as a precursor in the manufacturing of high-purity barium oxide and barium carbonate, and to a lesser extent, in the pharmaceutical sector for diagnostic imaging agents or in the production of specific pharmaceutical intermediates, albeit with strict regulatory oversight due to its toxicity.

The market benefits significantly from its irreplaceable role in producing vibrant green pyrotechnic effects, a feature difficult to replicate with other compounds without compromising safety or performance. Its utility as an oxidizer in various energetic compositions and as a densifier in specialized glass formulations further solidifies its market position. Key driving factors for the barium nitrate market include the consistent demand from the global pyrotechnics industry, particularly during festive seasons and public events, the continuous growth in specialty glass manufacturing for advanced technological applications, and the ongoing demand for high-performance ceramic materials. Additionally, research and development into new applications for barium compounds contribute to sustained market interest, despite inherent challenges related to its handling and regulatory environment.

Barium Nitrate Market Executive Summary

The Barium Nitrate market is characterized by steady demand primarily from the pyrotechnics and specialty glass sectors, demonstrating resilience amidst evolving regulatory landscapes. Current business trends indicate a concentrated market with key players focusing on optimizing production efficiencies, ensuring supply chain robustness, and adhering to increasingly stringent environmental and safety regulations. Innovation in material science and the development of new high-performance applications for barium compounds are opening niche opportunities, while raw material price volatility and the search for safer alternatives continue to present challenges. Strategic collaborations and investments in advanced manufacturing processes are becoming pivotal for maintaining competitive advantages within this specialized chemical market.

Regional trends reveal Asia-Pacific as the dominant market, driven by its robust manufacturing base, significant pyrotechnics production, and expanding industrial infrastructure, particularly in countries like China and India. North America and Europe also maintain substantial market shares, characterized by advanced glass and ceramic industries, coupled with strict regulatory frameworks that necessitate high-purity and compliant products. Emerging economies in Latin America and the Middle East & Africa are showing promising growth, albeit from a smaller base, as industrialization efforts and increased disposable incomes fuel demand for pyrotechnics and specialty materials. Geopolitical stability and trade policies significantly influence regional supply dynamics and market access, impacting both production and distribution networks globally.

Segmentation trends highlight the continued dominance of the pyrotechnics application segment, which accounts for the largest share of barium nitrate consumption due to its unique color-producing properties. The specialty glass and ceramics segment is witnessing consistent, albeit more moderate, growth, driven by technological advancements requiring high-performance materials. In terms of grade, the technical grade barium nitrate commands the largest volume, while high-purity and pharmaceutical grades, though smaller in volume, achieve premium pricing due to their stringent quality requirements and specialized applications. The shift towards more sustainable manufacturing processes and the exploration of novel applications in areas such as defense and electronics are influencing market dynamics across all segments, pushing manufacturers to innovate and adapt their product offerings.

AI Impact Analysis on Barium Nitrate Market

The integration of Artificial intelligence (AI) within the Barium Nitrate market is primarily anticipated to revolutionize operational efficiencies, supply chain management, and research and development initiatives rather than directly influencing product formulation. Common user questions related to AIs impact often revolve around how it can enhance safety protocols in handling a hazardous substance, optimize complex chemical synthesis processes, predict market demand fluctuations more accurately, and identify new application areas or substitute materials. Users are keen to understand how AI can mitigate risks associated with chemical manufacturing, reduce production costs, and accelerate the development cycle for advanced barium-based materials, thereby ensuring competitive advantages in a highly specialized market. The overarching expectation is that AI will introduce a new era of data-driven decision-making, leading to smarter, more sustainable, and more responsive industrial practices across the entire value chain of barium nitrate.

AIs role in optimizing the Barium Nitrate market extends to predictive maintenance for manufacturing equipment, which minimizes downtime and improves operational reliability. By analyzing vast datasets from sensors and production lines, AI algorithms can foresee potential machinery failures, allowing for proactive interventions that reduce maintenance costs and ensure continuous production. Furthermore, AI-powered systems can meticulously monitor and control reaction parameters during barium nitrate synthesis, leading to enhanced product purity, consistency, and yield. This level of precision is crucial for meeting the stringent quality requirements of end-user industries, particularly in specialty glass and defense applications, where even minor variations can have significant implications for product performance.

Beyond operational improvements, AI also holds transformative potential for market intelligence and strategic planning within the Barium Nitrate sector. Advanced analytics driven by AI can process global economic indicators, regulatory changes, and competitive landscape data to generate highly accurate demand forecasts, enabling manufacturers to optimize inventory levels and adjust production schedules efficiently. Moreover, AI algorithms can be employed to screen vast chemical databases and simulate molecular interactions, potentially accelerating the discovery of novel applications for barium nitrate or identifying safer, more environmentally friendly alternatives. This capability could be instrumental in addressing long-standing challenges related to the toxicity of barium compounds and fostering innovation in product development. Overall, AI is poised to enhance decision-making across all facets of the market, making processes more intelligent, robust, and adaptable to future challenges.

- Enhanced predictive maintenance and operational efficiency in manufacturing facilities.

- Optimized chemical synthesis processes leading to improved product purity and yield.

- Advanced demand forecasting and supply chain optimization through data analytics.

- Accelerated research and development for new applications and safer alternatives.

- Improved safety monitoring and risk assessment in handling hazardous materials.

- Facilitation of data-driven strategic planning and market intelligence.

DRO & Impact Forces Of Barium Nitrate Market

The Barium Nitrate market is shaped by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces that dictate its trajectory. Primary drivers include the robust and consistent demand from the global pyrotechnics industry, where barium nitrate is an essential component for producing vibrant green colors and acting as an oxidizer in various energetic formulations for fireworks, flares, and signal lights. The continuous expansion of the specialty glass and ceramics sectors, particularly for applications requiring enhanced optical properties, increased density, and improved refractive indices, also significantly boosts consumption. Furthermore, the use of barium nitrate as a precursor in the production of other high-purity barium compounds for diverse industrial uses contributes to its sustained market growth. Technological advancements leading to improved manufacturing processes and the development of new niche applications further act as potent market drivers, ensuring a steady demand for this specialized chemical compound.

However, the market faces considerable restraints, primarily stemming from the inherent toxicity of barium nitrate, which necessitates stringent environmental regulations and safety protocols throughout its production, handling, storage, and disposal. These regulations often translate into higher operational costs for manufacturers and end-users, potentially hindering market expansion in certain regions. The availability of substitute materials, particularly in less demanding applications or where environmental concerns are paramount, also poses a long-term threat to market share. Additionally, fluctuations in raw material prices, especially for barium carbonate and nitric acid, along with energy costs, can impact production profitability and overall market stability. Public perception regarding the environmental and health impacts of chemical industries further adds to the restrictive forces, pushing for more sustainable and safer alternatives.

Despite these challenges, significant opportunities exist for market players to capitalize on. Research and development efforts aimed at discovering novel applications for barium nitrate or developing more sustainable and less hazardous production methods present promising avenues for growth. The increasing demand for advanced materials in sectors like defense, aerospace, and electronics, where high-performance and specialized chemical inputs are crucial, offers potential new market segments. Moreover, strategic investments in emerging economies, particularly in Asia-Pacific where industrialization and consumer demand for pyrotechnics are on the rise, can unlock substantial market potential. Collaborations for technology transfer and capacity expansion, coupled with adherence to global best practices in safety and environmental management, are key to leveraging these opportunities and fostering resilient market growth in the long term.

Segmentation Analysis

The Barium Nitrate market is meticulously segmented to provide a comprehensive understanding of its diverse applications, grades, and end-user industries, offering granular insights into specific market dynamics. This segmentation facilitates a deeper analysis of market trends, growth drivers, and challenges across various product types and end-use sectors, enabling stakeholders to identify lucrative opportunities and formulate targeted strategies. The market is primarily categorized based on the grade of barium nitrate produced, which dictates its purity and suitability for specific applications, and by the diverse industries that utilize this chemical compound, reflecting the broad utility of its unique properties. Understanding these distinct segments is crucial for navigating the complexities of the market, from raw material sourcing to final product consumption.

Segmentation by grade typically differentiates between technical grade and high-purity/pharmaceutical grade barium nitrate. Technical grade, characterized by a lower purity level, is predominantly used in large-volume applications such as pyrotechnics and certain industrial processes where ultra-high purity is not a critical requirement. High-purity grade, on the other hand, undergoes extensive purification processes to meet stringent quality standards, making it suitable for specialty glass manufacturing, optical applications, and research and development activities. Pharmaceutical grade barium nitrate, though a niche segment, adheres to the most rigorous purity and quality control standards, essential for its limited use in pharmaceutical intermediates or diagnostic agents, despite its inherent toxicity requiring careful handling and regulatory compliance.

Further segmentation by application provides a detailed view of the primary end-use industries driving demand. The pyrotechnics sector remains the largest consumer, leveraging barium nitrate for its green flame colorant and oxidizing properties in fireworks, signal flares, and tracer ammunition. The glass and ceramics industry represents another significant segment, utilizing barium nitrate to enhance optical clarity, density, and refractive index in specialty glass products like optical fibers, display panels, and high-performance ceramic glazes. Other applications, though smaller, include its use in the production of other barium chemicals, as a mordant in dyeing, in the manufacturing of vacuum tubes, and in niche defense applications. Each application segment is influenced by its own set of market dynamics, technological advancements, and regulatory environments, collectively contributing to the overall market landscape of barium nitrate.

- By Grade:

- Technical Grade

- High Purity/Pharmaceutical Grade

- By Application:

- Pyrotechnics (Fireworks, Flares, Signal Lights, Tracer Ammunition)

- Glass and Ceramics (Specialty Glass, Optical Glass, Ceramic Glazes)

- Production of Other Barium Chemicals

- Other Industrial Applications (e.g., Mordant in Dyeing, Vacuum Tubes, Defense)

- By End-Use Industry:

- Chemical Industry

- Consumer Goods (Pyrotechnics)

- Construction (Specialty Ceramics)

- Electronics (Display Panels, Optical Fibers)

- Defense

- By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Barium Nitrate Market Value Chain Analysis

The value chain for the Barium Nitrate market begins with upstream analysis, focusing on the sourcing and processing of essential raw materials. The primary raw materials for barium nitrate production are barium carbonate (BaCO3) or barium sulfide (BaS) and nitric acid (HNO3). Barium carbonate is typically mined as barite (barium sulfate, BaSO4) and then converted through a chemical process. Nitric acid is a common industrial chemical derived from ammonia synthesis. The availability, quality, and price stability of these upstream inputs significantly impact the overall cost structure and production efficiency of barium nitrate manufacturers. Any disruptions in the supply of these critical raw materials, whether due to geopolitical factors, environmental regulations on mining, or production challenges, can reverberate throughout the entire value chain, affecting downstream industries.

Moving downstream, the value chain encompasses the manufacturing, purification, and distribution of barium nitrate to various end-user industries. Manufacturers typically employ a process involving the reaction of barium carbonate or barium sulfide with nitric acid, followed by filtration, crystallization, and drying to produce the desired grade of barium nitrate. Purification steps are critical, especially for high-purity and pharmaceutical grades, to remove impurities and meet specific quality specifications. After production, the finished product is then packaged and transported through established distribution channels. These channels are crucial for connecting manufacturers with diverse end-users, ensuring timely and efficient delivery, and maintaining product integrity during transit, which is particularly important given the hazardous nature of barium nitrate requiring specialized handling and transportation protocols.

Distribution channels for barium nitrate are typically a mix of direct and indirect methods. Direct sales involve manufacturers supplying directly to large industrial clients, such as major pyrotechnics companies or specialty glass manufacturers, often involving long-term contracts and customized delivery schedules. This approach allows for closer client relationships, better technical support, and direct feedback. Indirect channels primarily involve chemical distributors and agents who purchase barium nitrate from manufacturers and then supply it to smaller or geographically dispersed end-users. These distributors often provide value-added services such as inventory management, repackaging, and local delivery, reducing the logistical burden on both manufacturers and smaller buyers. The choice of distribution channel depends on factors like customer size, geographic reach, and the specific requirements for hazardous material transport, all of which contribute to the final cost and accessibility of barium nitrate in the global market.

Barium Nitrate Market Potential Customers

The potential customers for Barium Nitrate are diverse, primarily comprising end-user industries that rely on its unique chemical properties for specialized applications. The largest segment of buyers originates from the pyrotechnics industry, including manufacturers of consumer fireworks, theatrical pyrotechnics, signal flares for maritime and aviation use, and military applications like tracer ammunition. These companies are perpetual buyers due to barium nitrates indispensable role as a potent oxidizer and its ability to produce the iconic bright green coloration in pyrotechnic displays. Their demand is often seasonal, peaking before major holidays and public events, but consistent year-round for defense and signaling applications, driving a steady baseline for consumption.

Another significant group of potential customers includes manufacturers within the glass and ceramics industries. Specialty glass producers, particularly those involved in optical glass, cathode ray tubes, and certain types of display screens, utilize barium nitrate as an additive to achieve specific optical properties, increase density, and enhance refractive indices. Similarly, ceramic manufacturers incorporate it into glazes and high-performance ceramic formulations for its fluxing properties and to impart specific aesthetic or functional characteristics. These customers often require high-purity grades of barium nitrate and place a premium on product consistency and reliability, making long-term supply relationships critical for their specialized manufacturing processes.

Beyond these primary sectors, a range of other industries also represent potential customers, albeit often for smaller volumes or highly niche applications. This includes chemical companies that use barium nitrate as a precursor in the synthesis of other barium compounds, such as barium oxide or barium carbonate, which then find applications in diverse fields. Pharmaceutical companies may also be considered potential customers, albeit in strictly controlled and limited quantities, for specific diagnostic agents or as an intermediate in specialized drug synthesis, where extremely high purity and compliance with pharmaceutical standards are paramount. The defense sector, separate from pyrotechnics, may also procure barium nitrate for specialized energetic materials or other classified applications, further broadening the customer base for this versatile chemical compound.

Barium Nitrate Market Key Technology Landscape

The key technology landscape of the Barium Nitrate market primarily revolves around the manufacturing processes, purification techniques, and handling methodologies that ensure product quality, efficiency, and safety. The most prevalent manufacturing technology involves the reaction of barium carbonate, often sourced from natural barite, with nitric acid. This process, typically carried out in a reactor, results in the formation of barium nitrate solution, which then undergoes a series of steps including filtration to remove insoluble impurities, evaporation to concentrate the solution, and crystallization to obtain solid barium nitrate crystals. Advancements in these foundational chemical engineering processes focus on optimizing reaction conditions, improving energy efficiency, and reducing by-product formation to enhance economic viability and environmental sustainability.

Beyond the core synthesis, purification technologies play a critical role, especially for producing high-purity and pharmaceutical grades of barium nitrate. Techniques such as recrystallization, ion exchange, and membrane filtration are employed to remove trace impurities, heavy metals, and other contaminants, ensuring the product meets stringent quality specifications required for optical glass, electronic components, or even highly regulated pharmaceutical applications. Continuous innovation in purification methods aims to achieve higher purity levels more cost-effectively, reducing the overall environmental footprint of the production process. The development of advanced analytical instrumentation for real-time quality control during manufacturing is also a crucial aspect, allowing manufacturers to monitor and adjust processes dynamically to maintain product consistency and adherence to strict standards.

Furthermore, technologies related to the safe handling, storage, and transportation of barium nitrate are integral to the market landscape. Given its hazardous nature as an oxidizer and its toxicity, specialized packaging, robust material handling equipment, and secure storage facilities are essential. Innovations in protective coatings for storage vessels, inert atmosphere handling systems, and advanced safety monitoring equipment contribute to mitigating risks associated with its use. Moreover, the adoption of digital technologies for supply chain management, including tracking and tracing solutions, enhances transparency and accountability, ensuring compliance with global regulatory frameworks for hazardous materials. Sustainable manufacturing practices, such as waste reduction and recycling of by-products, represent another evolving area within the technological landscape, driven by increasing environmental consciousness and regulatory pressures.

Regional Highlights

- Asia-Pacific: This region stands as the dominant market for Barium Nitrate, primarily driven by rapid industrialization, burgeoning manufacturing sectors, and high demand from the pyrotechnics industry, particularly in countries like China and India. Robust economic growth, increasing disposable incomes, and the cultural significance of fireworks during festivals contribute to significant consumption. The region also boasts a large base of specialty glass and ceramics manufacturers, further fueling demand. Investment in chemical infrastructure and less stringent environmental regulations in some parts contribute to its production capabilities.

- North America: Characterized by a mature industrial base and advanced manufacturing capabilities, North America represents a significant market share. Demand is sustained by sophisticated specialty glass and ceramics industries, as well as controlled but consistent pyrotechnic applications. Stringent environmental and safety regulations drive a preference for high-purity grades and emphasize responsible sourcing and handling practices. Innovation in material science and defense applications also contributes to regional demand.

- Europe: The European market for Barium Nitrate is driven by established industrial sectors, including specialty glass, ceramics, and pyrotechnics, with a strong emphasis on high-quality and regulatory compliance. Countries like Germany, the UK, and France are key consumers. The regions stringent REACH regulations and other environmental directives necessitate advanced production technologies and robust supply chain management, leading to a focus on sustainable practices and product safety. Research and development activities for new applications also contribute to market stability.

- Latin America: This region is an emerging market for Barium Nitrate, experiencing growth spurred by industrial development and increasing demand in sectors like construction, automotive, and consumer goods. While pyrotechnics demand exists, particularly in countries with strong cultural traditions, the overall market is smaller compared to Asia-Pacific. Economic stability and infrastructure development will be key determinants of future market expansion in this region.

- Middle East & Africa: The Middle East & Africa region shows nascent growth in the Barium Nitrate market, with demand primarily influenced by infrastructure projects, expanding chemical industries, and modest pyrotechnics consumption in certain countries. Development in specialized manufacturing capacities is gradual, and the market is highly dependent on imports. Resource availability and industrialization efforts will shape its future trajectory, with potential for growth in specialized industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Barium Nitrate Market.- Solvay S.A.

- Huber Engineered Materials

- Sakai Chemical Industry Co., Ltd.

- Merck KGaA

- American Elements

- Chongqing Changyuan Chemical Co., Ltd.

- Noah Technologies Corporation

- Sanming Lixin Chemical Co., Ltd.

- Sigma-Aldrich (part of Merck KGaA)

- Jiangte Chemical Co., Ltd.

Frequently Asked Questions

What is Barium Nitrate used for?

Barium Nitrate is primarily used as an oxidizer and a green colorant in pyrotechnics, including fireworks, flares, and signal lights. It is also utilized in the glass and ceramics industries to enhance optical properties and density in specialty glass, and as a precursor for other barium compounds.

Is Barium Nitrate considered hazardous?

Yes, Barium Nitrate is considered hazardous. It is an oxidizer and is toxic if ingested or inhaled, necessitating strict safety protocols for handling, storage, and disposal. Its use is regulated by environmental and safety agencies globally to minimize risks.

What are the main drivers of the Barium Nitrate market?

The primary drivers include consistent demand from the global pyrotechnics industry, growth in specialty glass and ceramics manufacturing for advanced applications, and its use as a precursor in other barium chemical production. Technological advancements and industrialization in emerging economies also fuel demand.

What are the key challenges facing the Barium Nitrate market?

Key challenges include stringent environmental regulations and safety concerns due to its toxicity, volatility in raw material prices, and the ongoing search for safer and more sustainable substitute materials. Public perception and disposal complexities also pose significant hurdles.

How is the Barium Nitrate market segmented?

The Barium Nitrate market is typically segmented by grade (e.g., technical grade, high purity grade), by application (e.g., pyrotechnics, glass and ceramics, other barium chemicals), by end-use industry, and by geographic region, providing a comprehensive view of its diverse market landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager