Barrier Coatings for Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431169 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Barrier Coatings for Packaging Market Size

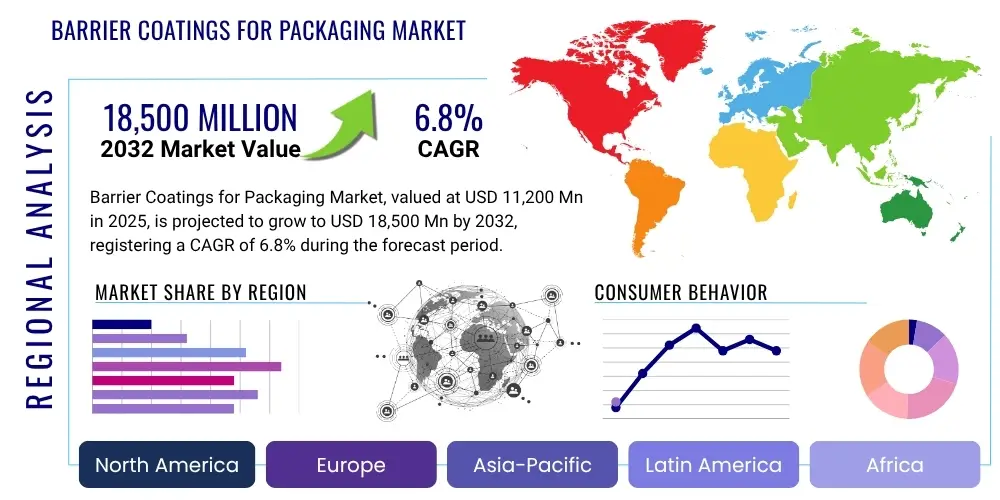

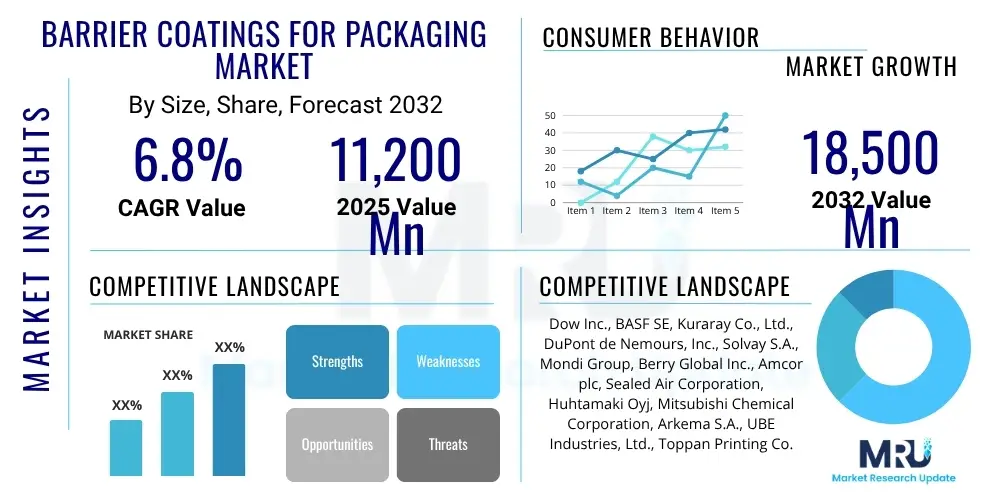

The Barrier Coatings for Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 11,200 million in 2025 and is projected to reach USD 18,500 million by the end of the forecast period in 2032.

Barrier Coatings for Packaging Market introduction

Barrier coatings for packaging represent a critical segment within the broader packaging industry, designed to enhance the protective properties of packaging materials. These specialized layers are applied to substrates such as plastics, paper, and metal foils to prevent the ingress or egress of gases (oxygen, carbon dioxide, nitrogen), moisture, aromas, and ultraviolet light, thereby extending the shelf life and maintaining the quality of packaged goods. The primary objective is to safeguard products from environmental degradation, microbial contamination, and flavor loss, making them indispensable across various sectors.

The product description encompasses a diverse range of materials, including Ethylene Vinyl Alcohol (EVOH), Polyvinylidene Chloride (PVDC), Silicon Oxide (SiOx), Aluminum Oxide (AlOx), and advanced biopolymer and nanocomposite coatings. Each material offers distinct barrier properties tailored to specific product requirements, from high oxygen barriers for sensitive foods to moisture barriers for pharmaceuticals. Major applications span the food and beverage industry, where they preserve freshness and nutritional value, to pharmaceuticals requiring sterile and stable environments, and cosmetics needing protection from oxidation and contamination. The benefits are multifaceted, including enhanced product safety, reduced food waste, compliance with stringent regulatory standards, and improved brand perception through prolonged product integrity.

Driving factors for the Barrier Coatings for Packaging Market are predominantly linked to evolving consumer preferences, stricter food safety regulations, and a growing emphasis on sustainability. The rising demand for convenience foods, extended shelf life, and fresh produce necessitates sophisticated barrier solutions. Furthermore, the expansion of e-commerce channels, which require robust packaging to withstand transit conditions, contributes significantly to market growth. Innovations in bio-based and recyclable barrier coatings are also playing a crucial role, addressing environmental concerns and promoting a circular economy within the packaging sector.

Barrier Coatings for Packaging Market Executive Summary

The Barrier Coatings for Packaging Market is currently undergoing significant transformation, driven by a confluence of evolving business trends, distinct regional dynamics, and innovative segment developments. Businesses are increasingly focused on integrating sustainable practices into their packaging solutions, leading to a surge in research and development for bio-based, biodegradable, and recyclable barrier materials. Strategic collaborations, mergers, and acquisitions are also prominent, as companies seek to expand their technological portfolios and market reach to meet the complex demands of various end-use industries. Furthermore, the emphasis on digital transformation within manufacturing processes, including AI-driven quality control and supply chain optimization, is reshaping operational efficiencies and product innovation cycles.

Regional trends indicate robust growth across Asia Pacific, propelled by rapid urbanization, increasing disposable incomes, and the burgeoning food and beverage industry, particularly in emerging economies like China and India. North America and Europe, while mature markets, are experiencing a shift towards advanced, high-performance barrier coatings, driven by stringent regulatory frameworks concerning food safety and environmental impact, along with a strong consumer inclination towards sustainable and premium packaged goods. Latin America, the Middle East, and Africa are showing steady growth, primarily influenced by expanding retail sectors and increasing awareness regarding product preservation and safety, albeit with varying levels of technological adoption and market maturity.

Segment trends highlight the enduring dominance of the food and beverage sector as the primary application area for barrier coatings, requiring diverse solutions for fresh produce, processed foods, and beverages. The pharmaceutical segment is witnessing accelerated demand for high-barrier films and coatings due to the sensitivity and value of medicinal products, necessitating uncompromising protection against moisture and oxygen. There is also a notable trend towards lightweighting packaging and reducing material usage, which barrier coatings facilitate by allowing thinner films to achieve superior protective qualities. The integration of intelligent barrier solutions that offer enhanced traceability and tamper evidence further underscores the dynamic evolution within specific market segments, reinforcing the market's trajectory towards innovative and specialized applications.

AI Impact Analysis on Barrier Coatings for Packaging Market

User questions related to the impact of AI on the Barrier Coatings for Packaging Market frequently revolve around optimizing material formulation, improving quality control, enhancing manufacturing efficiency, and predicting performance characteristics. Key themes reveal a strong interest in how AI can accelerate the discovery of novel barrier materials, particularly those with sustainable attributes, and how it can refine application processes to reduce waste and increase precision. Concerns often include the initial investment cost, data security, and the need for specialized expertise to implement AI solutions. Expectations are high regarding AI's potential to revolutionize R&D cycles, streamline production, and provide predictive insights into market demands and material longevity, ultimately leading to more effective, cost-efficient, and environmentally friendly packaging solutions.

- AI-driven material discovery and optimization for novel barrier coating formulations.

- Predictive analytics for quality control, reducing defects and improving consistency during manufacturing.

- Enhanced supply chain management and logistics for barrier coating raw materials and finished products.

- Real-time monitoring and adjustment of coating parameters for improved process efficiency and waste reduction.

- Simulation and modeling of coating performance under various environmental conditions, accelerating R&D cycles.

- Personalized packaging solutions enabled by AI, tailoring barrier properties to specific product requirements.

- Automated inspection systems for detecting microscopic flaws in barrier layers, ensuring product integrity.

DRO & Impact Forces Of Barrier Coatings for Packaging Market

The Barrier Coatings for Packaging Market is profoundly shaped by a combination of key drivers, significant restraints, and emerging opportunities, all influenced by various impact forces. A primary driver is the escalating global demand for packaged food and beverages, fueled by urbanization, evolving dietary habits, and the growth of convenience food culture. This demand directly translates into a need for advanced packaging solutions that extend shelf life and ensure product safety. Another potent driver is the rapid expansion of e-commerce, requiring robust and protective packaging to prevent damage during transit. Concurrently, stringent food safety regulations and pharmaceutical packaging standards compel manufacturers to adopt high-performance barrier coatings, further propelling market growth. The increasing consumer and regulatory emphasis on sustainable packaging also acts as a significant driver, pushing innovation towards recyclable, biodegradable, and bio-based barrier materials.

However, the market faces several notable restraints. The high cost associated with advanced barrier coating materials and the complex application processes can pose a significant barrier, especially for small and medium-sized enterprises. The intricate nature of multi-layered packaging, often incorporating barrier coatings, creates challenges for recycling and waste management, hindering efforts towards a circular economy. Furthermore, the regulatory landscape for new, innovative barrier materials can be slow and complex, delaying market entry for potentially superior solutions. These restraints necessitate ongoing investment in research and development to overcome technological and economic hurdles, while also navigating environmental and regulatory complexities to find viable solutions.

Despite these challenges, substantial opportunities exist within the market. The development and commercialization of bio-based and biodegradable barrier coatings present a significant avenue for growth, aligning with global sustainability goals. Nanotechnology offers promising advancements, allowing for thinner, more effective barrier layers with enhanced properties. The integration of smart packaging features, such as sensors and indicators, with barrier coatings can provide added value in terms of product traceability and freshness monitoring. Moreover, untapped potential in emerging economies, driven by rising disposable incomes and expanding retail sectors, represents a considerable opportunity for market expansion. The impact forces, such as the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of competitive rivalry, continuously shape market dynamics, pushing companies to innovate, differentiate, and strategically position themselves to capture these opportunities and mitigate restraints.

Segmentation Analysis

The Barrier Coatings for Packaging Market is segmented across various dimensions, including material type, substrate, application, and end-use industry, providing a comprehensive view of its intricate structure. This segmentation helps to understand the diverse demands and technological requirements across different sectors, reflecting the specialized nature of barrier protection in packaging. Each segment highlights specific market dynamics, growth drivers, and challenges, guiding strategic decisions for manufacturers and suppliers.

- By Type

- Ethylene Vinyl Alcohol (EVOH)

- Polyvinylidene Chloride (PVDC)

- Silicon Oxide (SiOx)

- Aluminum Oxide (AlOx)

- Polyethylene Naphthalate (PEN)

- Biodegradable & Bio-based Coatings (e.g., PLA, PHA, Starch-based)

- Nanocomposite Coatings

- Acrylic

- Waxes

- Others (e.g., Oleoresins, Protein-based)

- By Substrate

- Plastic (e.g., PET, PP, PE)

- Paper & Paperboard

- Metal

- Glass

- Flexible Packaging Films

- Rigid Packaging

- By Application

- Food & Beverage

- Meat, Poultry, & Seafood

- Dairy Products

- Fruits & Vegetables

- Bakery & Confectionery

- Snacks & Dry Food

- Beverages (Carbonated & Non-Carbonated)

- Ready-to-Eat Meals

- Pharmaceuticals & Healthcare

- Cosmetics & Personal Care

- Industrial Packaging

- Consumer Goods

- Electronics

- Others

- Food & Beverage

- By End-Use Industry

- Food Industry

- Beverage Industry

- Healthcare Industry

- Consumer Goods Industry

- Industrial Goods Industry

Value Chain Analysis For Barrier Coatings for Packaging Market

The value chain for the Barrier Coatings for Packaging Market commences with the upstream analysis, involving the sourcing and production of fundamental raw materials. This includes specialty polymers like EVOH, PVDC resins, and advanced biopolymers, along with various chemicals, additives, and nanoparticles required for coating formulation. Key suppliers in this stage are typically large chemical manufacturers and specialized material producers who provide these components to coating formulators and packaging converters. The quality and availability of these raw materials significantly impact the final performance and cost-effectiveness of the barrier coatings, making strong supplier relationships crucial for consistency and innovation.

Moving downstream, the value chain encompasses coating manufacturers who formulate and produce the barrier coating solutions, followed by packaging converters who apply these coatings onto various substrates like plastic films, paperboard, or metal containers. These converters leverage diverse technologies such as extrusion coating, lamination, vacuum deposition, and solution coating to integrate the barrier properties into the final packaging product. The downstream segment is highly competitive and technology-intensive, focusing on efficient application processes, quality assurance, and compliance with industry standards. Packaging converters then supply these finished barrier-coated packaging materials to a wide array of end-use industries, including food and beverage, pharmaceuticals, and cosmetics.

The distribution channel for barrier coatings and coated packaging materials involves both direct and indirect sales. Direct sales are common for large-volume contracts or highly specialized applications where coating manufacturers and packaging converters engage directly with major end-use clients to provide tailored solutions and technical support. Indirect distribution, on the other hand, involves a network of distributors, wholesalers, and specialized agents who facilitate market access for smaller clients or fragmented markets, offering logistical support and broader market reach. This multi-channel approach ensures that barrier coating solutions are accessible across the entire spectrum of potential customers, from global corporations to regional businesses, maintaining efficiency and responsiveness within the market.

Barrier Coatings for Packaging Market Potential Customers

The potential customers for barrier coatings in the packaging market are diverse and span across numerous industries, primarily driven by the universal need for product preservation, safety, and extended shelf life. The most significant end-users are within the food and beverage sector, which includes major food processing companies, beverage manufacturers, dairy product producers, and snack food brands. These entities require various barrier properties to protect against oxygen, moisture, and aroma migration, ensuring the freshness and integrity of perishable goods, from ready-to-eat meals to carbonated drinks. Their demand is constantly evolving with consumer trends towards healthier, convenient, and sustainably packaged products.

Beyond food and beverage, the pharmaceutical and healthcare industries represent another critical segment of potential customers. Pharmaceutical manufacturers, medical device companies, and healthcare providers necessitate packaging with stringent barrier properties to protect sensitive medicines, sterile equipment, and diagnostic tools from moisture, oxygen, and contamination. The high value and critical nature of these products mean that packaging integrity, enabled by advanced barrier coatings, is paramount for patient safety and efficacy. Compliance with regulatory standards like those set by the FDA and EMA further reinforces the demand for high-performance barrier solutions in this sector.

Furthermore, the cosmetics and personal care industry, along with various industrial sectors, also constitute significant potential customers. Cosmetic brands utilize barrier coatings to prevent oxidation of active ingredients and maintain the fragrance and texture of their products, enhancing consumer appeal and shelf presence. Industrial applications include packaging for chemicals, lubricants, and sensitive electronics, where barrier properties protect against environmental degradation and ensure product stability. This broad range of end-users underscores the essential role of barrier coatings in modern packaging, continuously driving innovation and market expansion across multiple commercial landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 11,200 million |

| Market Forecast in 2032 | USD 18,500 million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., BASF SE, Kuraray Co., Ltd., DuPont de Nemours, Inc., Solvay S.A., Mondi Group, Berry Global Inc., Amcor plc, Sealed Air Corporation, Huhtamaki Oyj, Mitsubishi Chemical Corporation, Arkema S.A., UBE Industries, Ltd., Toppan Printing Co., Ltd., Constantia Flexibles GmbH, Coveris Holdings S.A., Futamura Chemical Co., Ltd., Innovia Films, Sonoco Products Company, Novolex Holdings, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Barrier Coatings for Packaging Market Key Technology Landscape

The Barrier Coatings for Packaging Market is characterized by a dynamic and evolving technological landscape, continuously driven by the need for enhanced performance, cost-efficiency, and sustainability. Extrusion coating, a widely adopted technology, involves applying a molten polymer layer onto a substrate, offering high-speed production and versatility for various packaging types. Lamination techniques, where multiple layers of different materials are bonded together, are crucial for creating composite structures with synergistic barrier properties. These established methods continue to be refined for improved adhesion and barrier performance, often incorporating advanced polymer blends and adhesive systems to meet diverse application requirements.

Beyond traditional methods, vacuum deposition technologies such as plasma-enhanced chemical vapor deposition (PECVD) and physical vapor deposition (PVD) are gaining prominence for applying ultra-thin inorganic barrier layers like SiOx and AlOx. These technologies enable the creation of high-transparency, high-barrier films, particularly suitable for flexible packaging and electronics, by depositing uniform, pinhole-free inorganic films that significantly enhance barrier performance without adding substantial thickness. Solution coating and spray coating methods are also critical, particularly for applying specialized functional coatings, including those incorporating nanotechnology or bio-based materials, onto paper and board substrates or for creating specialty films, offering precision and adaptability in application.

The forefront of innovation in barrier coating technology includes the rapid advancements in nanotechnology and bio-based material science. Nanocomposite coatings, which integrate nanoparticles (e.g., nanoclays, cellulose nanocrystals) into polymer matrices, provide superior barrier properties at lower thicknesses, alongside improved mechanical strength and thermal stability. Simultaneously, the development of bio-based and biodegradable coating technologies, derived from sources like starch, cellulose, and proteins, represents a significant shift towards environmentally sustainable packaging. These emerging technologies are crucial for addressing environmental concerns, reducing fossil fuel dependence, and paving the way for a new generation of high-performance, eco-friendly barrier solutions that align with the principles of a circular economy.

Regional Highlights

- North America: This region is a mature market characterized by high consumer awareness regarding product quality and safety, leading to strong demand for high-performance barrier coatings. Innovation in sustainable packaging solutions, driven by corporate sustainability goals and consumer preferences, is a key trend. The market benefits from a robust food and beverage industry and advanced pharmaceutical manufacturing, pushing adoption of sophisticated barrier technologies, including bio-based and recyclable options.

- Europe: Europe is a leader in adopting stringent regulations for packaging, particularly concerning food contact materials and environmental impact. This drives significant investment in R&D for advanced, eco-friendly barrier coatings. The region shows strong growth in flexible packaging applications and a rapid shift towards monomaterial and recyclable barrier solutions. Germany, France, and the UK are key contributors, focusing on extending shelf life while minimizing environmental footprint.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for barrier coatings, primarily due to rapid industrialization, urbanization, and a burgeoning middle-class population. Countries like China, India, and Japan are experiencing a surge in demand for packaged food, beverages, and pharmaceuticals. This growth is supported by increasing investments in food processing and packaging infrastructure, alongside rising awareness about product safety and quality. The region is also becoming a hub for manufacturing and exporting barrier-coated packaging materials.

- Latin America: This region presents a growing market driven by increasing disposable incomes, expansion of organized retail, and rising consumption of packaged goods. Brazil and Mexico are leading the adoption of barrier coatings, particularly in the food and beverage sector. The market is influenced by the need to reduce food waste and extend the reach of perishable products to remote areas, fostering demand for effective barrier solutions.

- Middle East and Africa (MEA): The MEA market is an emerging region for barrier coatings, propelled by economic diversification, population growth, and increasing foreign investments in food processing and manufacturing. Saudi Arabia, UAE, and South Africa are key markets. The region's hot climate necessitates robust barrier properties to preserve perishable goods, while rising health consciousness is driving demand in the pharmaceutical and personal care sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Barrier Coatings for Packaging Market.- Dow Inc.

- BASF SE

- Kuraray Co., Ltd.

- DuPont de Nemours, Inc.

- Solvay S.A.

- Mondi Group

- Berry Global Inc.

- Amcor plc

- Sealed Air Corporation

- Huhtamaki Oyj

- Mitsubishi Chemical Corporation

- Arkema S.A.

- UBE Industries, Ltd.

- Toppan Printing Co., Ltd.

- Constantia Flexibles GmbH

- Coveris Holdings S.A.

- Futamura Chemical Co., Ltd.

- Innovia Films

- Sonoco Products Company

- Novolex Holdings, Inc.

Frequently Asked Questions

What are barrier coatings in packaging?

Barrier coatings are thin layers applied to packaging materials to prevent the exchange of gases, moisture, and aromas, thereby protecting the packaged product and extending its shelf life.

Why are barrier coatings essential for food and beverage packaging?

They are crucial for preserving freshness, preventing spoilage, maintaining nutritional value, and ensuring the safety of perishable food and beverage items by blocking oxygen, moisture, and contaminants.

What are the primary types of barrier coatings used today?

Key types include Ethylene Vinyl Alcohol (EVOH), Polyvinylidene Chloride (PVDC), Silicon Oxide (SiOx), Aluminum Oxide (AlOx), and various biodegradable or bio-based coatings like PLA and PHA.

How do barrier coatings contribute to sustainable packaging efforts?

By extending product shelf life, they reduce food waste. Innovations in bio-based, recyclable, and monomaterial barrier coatings also minimize environmental impact and promote circular economy principles.

What emerging technologies are influencing the barrier coatings market?

Nanotechnology for enhanced barrier properties, advanced bio-based materials for sustainability, and AI-driven optimization for formulation and quality control are key emerging trends shaping the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager