Beer Cans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431062 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Beer Cans Market Size

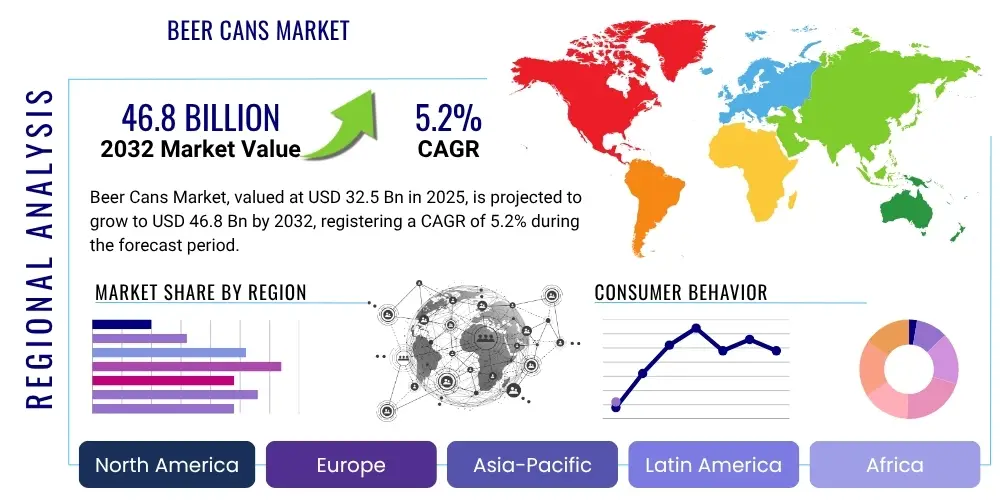

The Beer Cans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% between 2025 and 2032. The market is estimated at USD 32.5 billion in 2025 and is projected to reach USD 46.8 billion by the end of the forecast period in 2032.

Beer Cans Market introduction

The Beer Cans Market encompasses the global production and distribution of metal containers specifically designed for packaging beer. These containers, primarily made from aluminum and to a lesser extent steel, serve as a fundamental packaging solution for breweries worldwide. The market's growth is driven by a confluence of factors including evolving consumer preferences for convenience, sustainability, and product integrity. Beer cans offer superior protection against light and oxygen, which are critical for preserving beer quality and extending shelf life, making them an ideal choice for brewers looking to maintain the organoleptic properties of their products.

Product descriptions for beer cans include various sizes and shapes, such as standard 12oz (355ml), sleek 12oz, 16oz (473ml), and larger 24oz (710ml) or 500ml formats, catering to diverse market demands and consumer drinking occasions. These cans often feature advanced internal coatings to prevent metallic taste transfer and robust printing capabilities for brand differentiation and consumer engagement. Major applications span across the entire spectrum of the brewing industry, from mass-produced lagers and craft beers to increasingly popular hard seltzers, ready-to-drink cocktails, and non-alcoholic beer alternatives, reflecting the versatility and adaptability of can packaging. The rise of the craft beer segment, in particular, has fueled demand for cans due to their portability, aesthetic appeal, and lower shipping costs compared to glass bottles.

The inherent benefits of beer cans, such as their lightweight nature, excellent recyclability, and effective barrier properties, contribute significantly to their market prevalence. These advantages align with global sustainability trends and consumer demand for eco-friendly packaging. Key driving factors for the market include the continued expansion of the global beverage industry, technological advancements in canning and filling machinery, innovations in can design and printing, and growing environmental consciousness promoting aluminum recycling. Furthermore, the convenience offered by cans for outdoor activities, events, and easy storage at home continues to bolster their appeal among consumers, solidifying their position as a preferred packaging format for beer and other beverages.

Beer Cans Market Executive Summary

The Beer Cans Market Executive Summary highlights robust growth trajectories fueled by shifting consumer preferences and strategic industry innovations. Business trends indicate a strong emphasis on sustainable practices, with manufacturers investing heavily in lightweighting technologies and promoting closed-loop recycling systems. There is also a notable trend towards market consolidation among major can producers seeking economies of scale and enhanced geographical reach. Furthermore, the craft beverage segment continues to drive demand for diverse can formats and custom printing solutions, fostering innovation in design and manufacturing flexibility. The integration of advanced analytics and automation in production lines is becoming increasingly critical for optimizing operational efficiency and reducing waste.

Regionally, the Asia Pacific market is poised for significant expansion, driven by urbanization, rising disposable incomes, and the increasing adoption of Western consumption patterns. North America and Europe, while mature, demonstrate steady demand, primarily propelled by the craft beer boom and a strong consumer inclination towards convenient and environmentally friendly packaging. Latin America and the Middle East and Africa regions are emerging as high-growth markets, benefiting from infrastructural developments and a growing youthful population with increasing access to packaged beverages. Each region presents unique opportunities, from premiumization in developed markets to basic accessibility in developing economies, requiring tailored market strategies from packaging providers.

Segment trends underscore the dominance of aluminum cans due to their superior recyclability and lightweight properties, although steel cans maintain niche applications. Capacity-wise, the market is experiencing growth across various sizes, with smaller, single-serve cans gaining popularity alongside larger family packs, catering to different consumption occasions. The alcoholic beverages segment remains the primary application, but the proliferation of canned hard seltzers, ready-to-drink cocktails, and non-alcoholic beers signifies diversification in end-use. Innovation within these segments focuses on improving barrier coatings, enhancing decorative finishes, and developing more sustainable material sourcing, collectively shaping the competitive landscape and future direction of the Beer Cans Market.

AI Impact Analysis on Beer Cans Market

Common user questions regarding AI's impact on the Beer Cans Market frequently revolve around optimizing production efficiencies, enhancing supply chain resilience, and enabling more personalized or sustainable packaging solutions. Users are keen to understand how AI can streamline complex manufacturing processes, from raw material procurement to final product delivery, reducing costs and lead times. There is significant interest in AI's role in improving quality control, detecting defects more accurately, and predicting equipment failures before they occur. Furthermore, questions often arise about how AI can assist in demand forecasting, inventory management, and even designing innovative can aesthetics that resonate with target consumers, while also contributing to better material utilization and recycling efforts.

- AI-driven predictive maintenance optimizes machinery uptime, reducing production stoppages and costs.

- Enhanced demand forecasting capabilities improve inventory management and reduce waste across the supply chain.

- AI-powered quality control systems detect minute defects, ensuring consistent product integrity and reducing recalls.

- Generative AI tools assist in innovative can design and customization, accelerating product development cycles.

- Optimized logistics and distribution routes through AI algorithms lower transportation costs and carbon footprint.

- AI can analyze consumer behavior data to inform targeted marketing and packaging strategies.

- Intelligent sorting and recycling systems improve the efficiency and purity of aluminum recovery.

DRO & Impact Forces Of Beer Cans Market

The Beer Cans Market is shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively influenced by various impact forces. Key drivers include the escalating global demand for convenience-oriented packaging, particularly for on-the-go consumption and outdoor events, where cans offer superior portability and safety. The increasing consumer preference for sustainable and recyclable packaging solutions significantly boosts the demand for aluminum cans, which boast high recycling rates and a favorable environmental profile compared to other materials. Furthermore, the robust growth of the craft beer industry worldwide, which often favors cans for their protection against light and oxygen, expanded distribution reach, and innovative branding opportunities, continues to be a substantial market catalyst. Continuous product innovation, such as new can sizes, resealable options, and enhanced graphics, also plays a crucial role in maintaining market momentum and consumer engagement.

However, the market faces notable restraints that could temper its growth trajectory. The volatility of raw material prices, particularly for aluminum, poses a significant challenge, impacting production costs and ultimately influencing consumer prices. High energy consumption associated with aluminum smelting and can manufacturing processes can lead to increased operational expenditures, especially in regions with fluctuating energy markets. Additionally, intense competition from alternative packaging formats, such as glass bottles and PET containers, particularly in segments where cost is a primary decision factor or where traditional aesthetics are preferred, presents a continuous competitive pressure. Regulatory shifts concerning packaging materials and environmental standards, while often beneficial for aluminum in the long term, can impose initial compliance costs and necessitate production adjustments for manufacturers.

Despite these restraints, the Beer Cans Market is ripe with opportunities that promise future expansion. The untapped potential in emerging economies, driven by urbanization, rising disposable incomes, and the expansion of modern retail channels, offers significant avenues for market penetration. Innovations in lightweighting technologies and advanced material science present opportunities to further reduce the environmental footprint and cost of cans, making them even more competitive. The growing market for non-alcoholic beverages, including carbonated soft drinks, sparkling waters, and especially non-alcoholic beers, ciders, and ready-to-drink cocktails, provides a substantial diversification opportunity for can manufacturers. Moreover, advancements in digital printing and customization technologies allow brands to create highly personalized and limited-edition packaging, appealing to niche markets and enhancing consumer loyalty. Strategic partnerships and collaborations across the value chain, from material suppliers to brewers, can also unlock new growth synergies and foster market innovation.

Segmentation Analysis

The Beer Cans Market is comprehensively segmented by material, capacity, and end-use, providing a granular understanding of its dynamics and enabling targeted strategic planning. This segmentation allows for the analysis of specific market niches and the identification of growth drivers within each category. The material segment primarily distinguishes between aluminum and steel cans, reflecting differences in their prevalence, recyclability profiles, and manufacturing processes. Capacity segmentation addresses the diverse packaging needs of brewers and consumer preferences, ranging from small individual servings to larger multi-serve options. End-use segmentation categorizes the market based on the type of beverage being packaged, with alcoholic beer being the dominant application, alongside a growing presence in other beverage categories, thereby illustrating the versatility of can packaging.

- By Material:

- Aluminum Cans

- Steel Cans

- By Capacity:

- 150ml - 250ml

- 251ml - 330ml

- 331ml - 500ml

- 501ml - 750ml

- Above 750ml

- By End-Use:

- Alcoholic Beer

- Non-Alcoholic Beer

- Hard Seltzers and Ciders

- Ready-to-Drink (RTD) Cocktails

- By Type:

- Standard Cans

- Sleek Cans

- Slim Cans

- Specialty/Custom Cans

Value Chain Analysis For Beer Cans Market

The Value Chain Analysis for the Beer Cans Market encompasses several critical stages, beginning with the upstream sourcing of raw materials, progressing through the manufacturing and conversion processes, and culminating in distribution to end-users. The upstream segment is dominated by primary aluminum producers and, to a lesser extent, steel manufacturers, who supply the essential metal sheets to can makers. This stage also includes suppliers of specialized coatings, inks, and lacquers crucial for protecting the beer and for branding purposes. Relationships with these suppliers are often long-term and strategic, given the capital-intensive nature of raw material production and the importance of consistent quality and supply stability for can manufacturing.

The core of the value chain lies in the manufacturing and conversion process, where metal sheets are formed into cans through highly automated and efficient drawing and ironing processes. Can manufacturers operate large-scale facilities capable of producing billions of cans annually, emphasizing speed, precision, and cost-effectiveness. This stage involves significant investment in machinery, technology, and quality control systems to ensure the structural integrity and aesthetic appeal of the finished cans. Downstream, the manufactured cans are filled with beer by breweries and beverage companies. This is where the can integrates into the final product, directly impacting shelf life, consumer perception, and logistics.

Distribution channels for beer cans are multifaceted, involving both direct and indirect routes. Major can manufacturers often engage in direct sales and supply agreements with large, multinational breweries, ensuring high-volume, consistent deliveries. For smaller craft breweries or regional beverage companies, indirect distribution through packaging distributors and wholesalers is more common. These intermediaries aggregate demand, manage inventory, and provide logistical support, making cans accessible to a broader range of customers. The efficiency of these distribution networks is paramount, as cans are bulky and require optimized transportation to minimize costs and environmental impact, thus making strong logistical partnerships essential for market reach and customer satisfaction.

Beer Cans Market Potential Customers

The potential customers for the Beer Cans Market are diverse, primarily comprising various entities within the beverage industry who require robust, efficient, and appealing packaging solutions for their products. At the forefront are breweries of all sizes, ranging from global brewing giants like Anheuser-Busch InBev and Heineken to a burgeoning number of regional and local craft breweries. These brewers represent the core demand, utilizing cans for packaging a wide array of alcoholic beers, including lagers, ales, stouts, and IPAs, due to the protective qualities, portability, and strong branding potential offered by cans. The rapid expansion of the craft beer segment has significantly broadened the customer base, as many smaller brewers prefer cans for market entry and distribution efficiency.

Beyond traditional beer, the market extends to other alcoholic beverage producers, including manufacturers of hard seltzers, ciders, and ready-to-drink (RTD) cocktails. These segments have witnessed explosive growth, with cans becoming the preferred packaging format for their convenience, modern aesthetic, and suitability for active, on-the-go consumption occasions. The lightweight and unbreakable nature of cans makes them ideal for these categories, which often target younger demographics and outdoor activities. The shift towards non-alcoholic options further diversifies the customer base, with companies producing non-alcoholic beers, sparkling waters, and other non-carbonated beverages increasingly adopting cans for their sustainability and brand appeal.

Furthermore, packaging distributors and wholesalers act as crucial intermediaries, serving as customers who then supply cans to smaller beverage producers who may not have direct procurement relationships with large can manufacturers. These distributors provide logistical support, inventory management, and access to a variety of can sizes and specifications. Ultimately, the end-users of these packaged beverages, the consumers, indirectly drive demand for beer cans by expressing preferences for convenience, sustainability, and specific product types. Retailers, including supermarkets, convenience stores, and liquor shops, also represent a significant part of the customer ecosystem, as their stocking decisions and merchandising strategies influence which packaging formats are most visible and accessible to the final consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 32.5 Billion |

| Market Forecast in 2032 | USD 46.8 Billion |

| Growth Rate | 5.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ball Corporation, Crown Holdings Inc., Ardagh Group S.A., Canpack Group, Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., Envases Group, EXAL Corporation, Showa Aluminum Can Corporation, Tecnocap Group, Nampak Ltd., Orora Packaging Solutions, DS Smith Plc, Rexam (part of Ball Corporation), BWAY Corporation (part of Mauser Packaging Solutions), Kian Joo Can Factory Berhad, Hindustan Tin Works Ltd., Mahmood Saeed Can & Industrial Packaging Company, Al Ghurair Iron & Steel LLC, Guangzhou Pacific Can Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beer Cans Market Key Technology Landscape

The Beer Cans Market is continuously shaped by advancements in its key technology landscape, which focuses on enhancing production efficiency, improving product integrity, and bolstering sustainability. Can manufacturing itself relies on highly sophisticated drawing and ironing processes, where flat metal sheets are transformed into seamless cylindrical bodies. Innovations in these core forming technologies aim to achieve thinner can walls, leading to significant lightweighting without compromising strength, which reduces material usage and transportation costs. Coating technologies represent another critical area, with ongoing research into BPA-non-intent (BPA-NI) or BPA-free internal linings that ensure beer purity and consumer safety, while also extending shelf life. These advanced coatings must be chemically inert and resistant to acidic and alcoholic contents.

Printing and decoration technologies have evolved considerably, moving beyond traditional lithography to embrace advanced digital printing and high-definition graphics. This allows for greater design flexibility, faster changeovers for small batch productions (critical for craft brewers), and the ability to create highly intricate, vibrant, and tactile finishes that enhance brand appeal and consumer engagement. Digital printing facilitates mass customization, enabling brands to produce unique cans for marketing campaigns or limited editions, thereby offering a competitive edge. Furthermore, the integration of smart packaging features, such as QR codes, augmented reality (AR) elements, and temperature-sensitive inks, is beginning to emerge, offering interactive consumer experiences and enhanced product information.

Sustainability-focused technologies are paramount within the industry. This includes advancements in efficient recycling processes for aluminum, which significantly reduces the energy footprint compared to producing new aluminum. Innovations in recycling infrastructure, such as improved sorting and reprocessing techniques, aim to increase the purity and volume of recycled content used in new cans. Additionally, research into alternative materials or composite structures that maintain can performance while offering environmental benefits is ongoing, though aluminum remains dominant due to its established recycling loop. Automation and robotics throughout the manufacturing and quality control stages also play a pivotal role, not only in increasing throughput and consistency but also in minimizing human error and enhancing worker safety, thereby contributing to an overall more efficient and resilient production ecosystem.

Regional Highlights

- North America: A mature market characterized by high consumption rates and a strong emphasis on sustainability. The rapid growth of the craft beer segment, particularly in the United States and Canada, drives demand for diverse can formats and premium branding. Robust recycling infrastructure supports a high recycled content rate in can production.

- Europe: Exhibits consistent demand with a focus on environmental regulations and efficient recycling programs, especially in countries like Germany and the UK. The market benefits from diverse beer traditions and a growing preference for convenient, lightweight packaging, alongside a strong hard seltzer and RTD cocktail market.

- Asia Pacific (APAC): The fastest-growing region, driven by urbanization, rising disposable incomes, and changing consumer lifestyles in countries such as China, India, and Southeast Asian nations. Increased beer consumption and the adoption of modern retail formats are fueling substantial growth, with significant investment in new can manufacturing capacities.

- Latin America: An emerging market experiencing steady growth due to expanding middle-class populations, increased beer consumption, and improved distribution networks. Brazil and Mexico are key markets, showing a strong shift from traditional packaging to cans for convenience and brand appeal.

- Middle East and Africa (MEA): A nascent but rapidly developing market, influenced by urbanization, infrastructure development, and increasing brand availability. Demand is gradually increasing with a focus on convenience and accessible packaging solutions, though cultural factors may influence consumption patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beer Cans Market.- Ball Corporation

- Crown Holdings Inc.

- Ardagh Group S.A.

- Canpack Group

- Silgan Holdings Inc.

- Toyo Seikan Group Holdings Ltd.

- Envases Group

- EXAL Corporation

- Showa Aluminum Can Corporation

- Tecnocap Group

- Nampak Ltd.

- Orora Packaging Solutions

- DS Smith Plc

- Hindustan Tin Works Ltd.

- Kian Joo Can Factory Berhad

- Mahmood Saeed Can & Industrial Packaging Company

- Al Ghurair Iron & Steel LLC

- Guangzhou Pacific Can Co. Ltd.

Frequently Asked Questions

What are the primary benefits of packaging beer in cans?

Beer cans offer several key advantages, including superior protection against light and oxygen, which preserves the beer's freshness and flavor profile. They are also lightweight, unbreakable, and highly portable, making them ideal for outdoor activities and events. Furthermore, aluminum cans boast excellent recyclability, supporting environmental sustainability efforts, and provide a large surface area for creative branding and marketing.

How does the craft beer industry influence the Beer Cans Market?

The craft beer industry significantly influences the Beer Cans Market by driving demand for diverse can formats, smaller batch production capabilities, and innovative printing technologies. Craft brewers often prioritize cans for their protective qualities, reduced shipping costs, and their modern, artistic branding potential, leading to an increase in demand for specialty sizes and customizable designs.

What are the key sustainability aspects of beer cans?

The primary sustainability aspect of beer cans is their high recyclability. Aluminum cans can be endlessly recycled without loss of quality, and recycling aluminum requires significantly less energy than producing virgin aluminum. This closed-loop system reduces waste, conserves natural resources, and lowers greenhouse gas emissions, positioning cans as an environmentally preferred packaging choice.

What technological innovations are shaping the future of beer can packaging?

Technological innovations shaping the future of beer can packaging include lightweighting techniques for reduced material use, advanced internal coatings for enhanced product safety and flavor integrity, and sophisticated digital printing capabilities for greater customization and vibrant graphics. Additionally, smart packaging features like QR codes and AR elements are emerging to enhance consumer engagement and traceability.

What factors contribute to the growth of the Beer Cans Market in emerging regions?

The growth of the Beer Cans Market in emerging regions is primarily driven by urbanization, rising disposable incomes, and the expansion of modern retail channels. As consumer lifestyles evolve, there is an increasing demand for convenient, hygienically packaged beverages. Additionally, infrastructure development and the increasing adoption of global consumption trends further fuel the market's expansion in these regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager