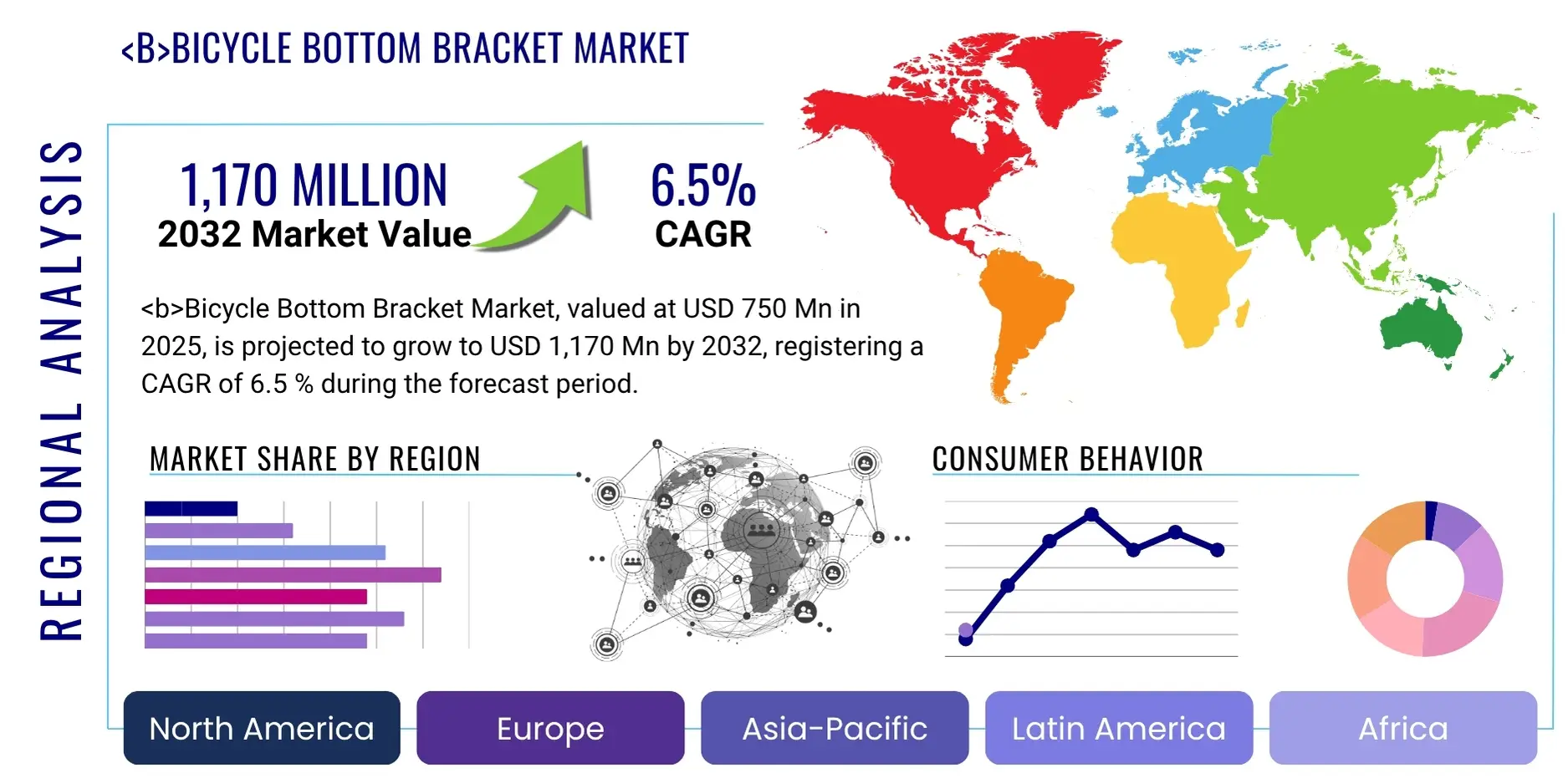

Bicycle Bottom Bracket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428149 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Bicycle Bottom Bracket Market Size

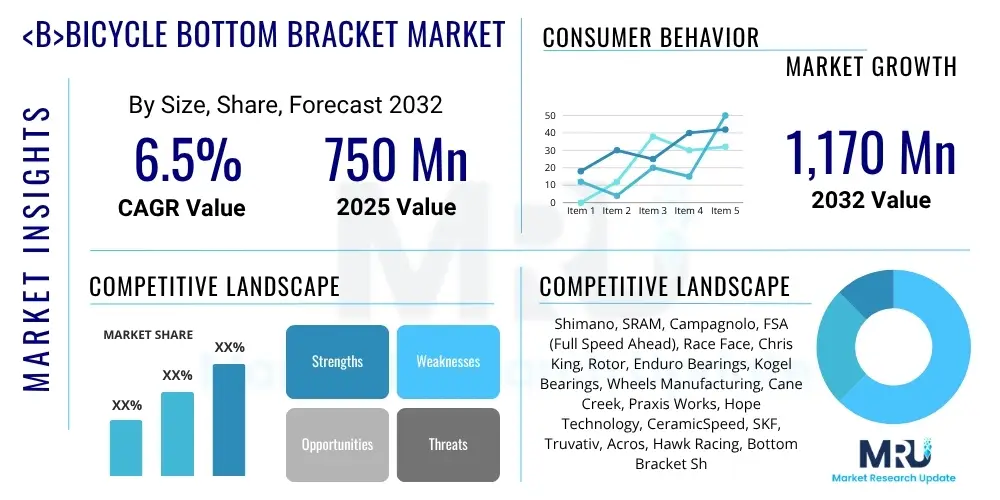

The Bicycle Bottom Bracket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 750 Million in 2025 and is projected to reach USD 1,170 Million by the end of the forecast period in 2032. This sustained growth is primarily fueled by increasing global interest in cycling for recreation, sport, and sustainable transportation. Significant technological advancements in bicycle component manufacturing, alongside the rising adoption of electric bicycles and high-performance road and mountain bikes, further contribute to this expansion, driving a continuous demand for durable, efficient, and lightweight bottom bracket solutions.

Bicycle Bottom Bracket Market introduction

The bicycle bottom bracket is a critical component within a bicycle's drivetrain, functioning as the central interface between the cranks and the bicycle frame. Its essential role is to house the bearings that facilitate the smooth rotation of the crankset, allowing for efficient power transfer from the pedals to the rear wheel. This component is fundamental to a bicycle’s overall performance, durability, and rider comfort, as it endures substantial forces during pedaling. The market for bottom brackets is characterized by a diverse array of types, materials, and designs, engineered to meet the specific demands of various cycling disciplines, from daily commutes to competitive racing and rigorous off-road cycling. A thorough understanding of the bottom bracket's integral function is vital for appreciating the dynamic forces shaping its market, where precision engineering and material science are constantly advancing product design and functionality.

Key applications for bicycle bottom brackets span across all bicycle categories, including road, mountain, gravel, hybrid, BMX, and the rapidly expanding e-bike sector. Each category necessitates particular bottom bracket attributes, such as enhanced resilience for mountain biking, lightweight construction for road racing, or superior sealing capabilities for all-weather urban commuting. The core benefits of a high-quality bottom bracket include optimized power transfer, minimal friction, extended component lifespan, and an improved rider experience through consistently smooth pedaling. Market growth is primarily driven by the global surge in cycling participation, motivated by increased health awareness and environmental concerns, significant public and private investments in cycling infrastructure, and ongoing innovation by manufacturers. These innovations aim to develop more efficient, lighter, and robust bottom bracket systems that align with evolving bicycle designs and performance expectations. The global shift towards sustainable transportation and the rising popularity of competitive cycling further stimulate demand across both the Original Equipment Manufacturer (OEM) and aftermarket segments.

Bicycle Bottom Bracket Market Executive Summary

The Bicycle Bottom Bracket Market is experiencing substantial growth, underpinned by a global cycling boom, continuous technological innovation, and an escalating consumer demand for high-performance and durable components. Business trends highlight a pronounced focus on research and development, as manufacturers strive to produce lighter, stiffer, and more reliable bottom bracket systems. The market is intensely competitive, offering a broad spectrum of products tailored to specific cycling disciplines and rider preferences. Furthermore, strategic consolidations, partnerships, and mergers are actively shaping the competitive landscape, as companies seek to broaden their product portfolios and geographical presence. The burgeoning e-bike segment represents a significant growth opportunity, driving the necessity for bottom brackets capable of managing higher torque and increased loads, thereby pushing the boundaries of material science and design. The aftermarket segment remains a crucial revenue stream, driven by replacement needs, performance upgrades, and customization trends among avid cyclists.

Regional trends reveal that North America and Europe continue to be mature markets with high adoption rates of premium bicycles and components, supported by deeply ingrained cycling cultures and extensive infrastructure. These regions demonstrate ongoing growth, particularly within the e-bike and gravel bike categories. Conversely, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by increasing disposable incomes, accelerated urbanization, and governmental initiatives promoting cycling in key countries such as China, India, and Japan. This region also functions as a primary manufacturing hub for bicycle components, significantly influencing global supply chains and pricing dynamics. Latin America, the Middle East, and Africa are showing initial signs of growth, with rising awareness about cycling's benefits and improving economic conditions fostering new market opportunities. Each region exhibits distinct consumer preferences and regulatory environments that exert influence on overall market dynamics.

Segmentation analysis underscores the prevailing dominance of specific bottom bracket types and materials. Press-fit and external bearing bottom brackets are increasingly gaining market traction due to their compatibility with contemporary frame designs and enhanced stiffness, while traditional threaded systems maintain a considerable market share, especially within the aftermarket. Material innovation indicates a growing preference for lightweight alloys, carbon fiber, and ceramic bearings, particularly in performance-oriented applications, offering benefits such as reduced friction and extended longevity. The market is further segmented by bicycle type, with specialized bottom brackets developed for road, mountain, and e-bikes, each engineered to meet particular performance requirements. The OEM segment benefits from high-volume production for new bicycle assemblies, whereas the aftermarket thrives on consumer-driven upgrades and replacements, often favoring premium components for superior performance and durability.

AI Impact Analysis on Bicycle Bottom Bracket Market

Common user questions regarding AI's influence on the Bicycle Bottom Bracket Market frequently explore how artificial intelligence could transform design, manufacturing, and maintenance processes. Inquiries often center on AI's potential to produce lighter or more durable designs, optimize production efficiency, or whether smart bottom brackets could provide real-time performance data and predictive maintenance alerts. Users express concerns about high integration costs and the possibility of AI leading to overly standardized designs, potentially limiting unique innovations. There is a strong interest in understanding if AI-driven analysis of riding data could enable personalized component recommendations or if manufacturing processes could become more adaptive and less prone to errors. The prevailing sentiment is one of keen curiosity regarding AI's capacity to significantly enhance both product performance and operational processes within this vital bicycle component sector.

- AI-driven generative design tools can optimize bottom bracket geometries for minimal weight and maximal stiffness through advanced simulation.

- Predictive maintenance analytics, powered by AI, can analyze sensor data to forecast potential failures, enabling proactive servicing and extending component lifespan.

- AI-enhanced quality control systems in manufacturing precisely detect micro-defects, reducing waste and ensuring consistent product quality.

- Supply chain optimization via AI algorithms enhances demand forecasting, inventory management, and logistics, reducing lead times and costs.

- Personalized product recommendations for consumers, based on AI analysis of riding data, guide buyers toward optimal bottom bracket choices.

- Automated robotic manufacturing integrated with AI improves production speed, precision, and consistency while minimizing human error.

DRO & Impact Forces Of Bicycle Bottom Bracket Market

The Bicycle Bottom Bracket Market is shaped by a dynamic interplay of drivers, restraints, and opportunities. Key drivers include the increasing global participation in cycling for sport, leisure, and commuting, fueled by growing health and environmental consciousness. The rapid expansion of the electric bicycle market is a substantial catalyst, as e-bikes impose higher demands on bottom bracket durability and performance. Furthermore, continuous technological advancements leading to lighter, more efficient, and robust designs, coupled with rising disposable incomes in emerging economies, are propelling market growth. Ongoing innovations in materials science and manufacturing processes are also critical, enabling the creation of components that offer superior power transfer and reduced friction, meeting the evolving needs of cyclists across various disciplines.

Conversely, several restraints hinder the market's full potential. The proliferation of counterfeit bicycle components, including bottom brackets, poses a significant challenge, eroding genuine manufacturers' sales and presenting safety risks to consumers. The complexity and wide array of bottom bracket standards (e.g., threaded vs. press-fit, various shell widths) can lead to confusion for consumers and present compatibility issues, complicating replacement and upgrade decisions. Additionally, the relatively high cost associated with premium, high-performance bottom brackets, particularly those utilizing advanced materials like ceramic bearings, can deter price-sensitive buyers. Macroeconomic downturns and fluctuations in raw material prices represent external restraints that directly impact production costs and market pricing strategies.

Opportunities for significant market growth are abundant. The surging demand for gravel bikes and adventure cycling equipment opens new avenues for specialized, highly durable bottom bracket designs. The development of 'smart' bottom brackets, equipped with sensors for integrated power measurement and predictive maintenance, offers a promising niche for technological innovation and premium product offerings. Expansion into underserved emerging markets, particularly in Asia Pacific and Latin America, presents substantial long-term growth potential as cycling infrastructure improves and disposable incomes rise. Strategic collaborations between bicycle frame manufacturers and component suppliers can foster seamless compatibility and integrated solutions, thereby unlocking new market opportunities and enhancing the overall user experience. The growing trend of customization and personalization in cycling further drives demand for a wider range of specialty bottom bracket options.

Segmentation Analysis

The Bicycle Bottom Bracket Market is meticulously segmented to address the diverse requirements of the cycling industry and its consumer base. These segmentations provide a detailed framework for understanding market dynamics, evolving consumer preferences, and critical technological advancements across different product types, materials, bicycle applications, and sales channels. Such granular analysis offers invaluable insights into specific growth pockets, competitive landscapes, and strategic opportunities for both manufacturers and retailers. The primary segmentation categories establish a clear structure for classifying the extensive range of bottom bracket designs and their particular applications, covering everything from basic commuter bicycles to high-performance professional racing machines.

- By Type

- Threaded (BSA, Italian, T47)

- Press-Fit (BB30, PF30, BB86, BB90, BB92)

- External Bearing (Hollowtech II, GXP)

- By Material

- Aluminum

- Steel

- Carbon Fiber

- Ceramic Bearings

- Other Alloys

- By Bicycle Type

- Road Bikes

- Mountain Bikes

- Gravel Bikes

- Hybrid/Commuter Bikes

- E-Bikes

- BMX Bikes

- Kids Bikes

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Specialty Retail Stores, Online Retail, Mass Merchandisers)

Value Chain Analysis For Bicycle Bottom Bracket Market

The value chain for the Bicycle Bottom Bracket Market commences with upstream activities focused on sourcing raw materials. These primarily include high-grade aluminum, steel, carbon fiber composites, and specialized ceramic materials. This initial stage also involves the meticulous manufacturing of precision bearings and seals, which are indispensable components of any bottom bracket assembly. Key participants in this segment are material suppliers, bearing manufacturers, and specialized component producers who furnish these raw or semi-finished goods to bottom bracket manufacturers. The quality and consistent availability of these materials are paramount, directly influencing the final product's performance, durability, and cost. Efficient procurement strategies and robust relationships with reliable suppliers are crucial for maintaining product quality standards and effectively managing production expenditures.

Midstream activities encompass the core processes of designing, engineering, and manufacturing the complete bottom bracket units. This phase involves highly specialized machining, precise assembly, and rigorous quality control protocols to ensure exact precision and seamless compatibility with the diverse array of bicycle frame standards and crankset designs. Leading bottom bracket manufacturers consistently invest significantly in research and development to innovate new designs, improve sealing mechanisms, minimize rotational friction, and enhance overall component durability. These manufacturers frequently develop proprietary technologies and engage in close collaborations with bicycle frame builders to ensure optimal integration and superior performance. Following manufacturing, the finished products transition into the distribution phase, connecting producers with both Original Equipment Manufacturers (OEMs) and the aftermarket retail channels.

Downstream activities involve the comprehensive distribution and sales channels. Direct channels primarily include sales to OEM bicycle manufacturers, where bottom brackets are integrated into new bicycle assemblies during the production phase. This segment is characterized by large-volume orders and often entails long-term contractual agreements. Indirect channels involve reaching the aftermarket through a vast network of specialized distributors, wholesalers, independent bicycle retail stores, and increasingly, robust online sales platforms. The aftermarket segment caters directly to individual cyclists seeking performance upgrades, necessary replacements, or personalized customization options. Establishing efficient distribution networks, fostering strong retail partnerships, and maintaining a compelling online presence are all critical for effectively reaching the end-consumer. Post-sales services, including comprehensive technical support, product warranties, and detailed repair guidance, also form an essential part of the downstream value chain, significantly enhancing customer satisfaction and reinforcing brand loyalty.

Bicycle Bottom Bracket Market Potential Customers

The Bicycle Bottom Bracket Market serves a diverse range of potential customers, spanning both business-to-business (B2B) and business-to-consumer (B2C) segments. In the B2B sector, Original Equipment Manufacturers (OEMs) of bicycles represent a foundational customer base. These include major global bicycle brands that source bottom brackets in substantial volumes for integration into their complete bicycle assemblies. Their purchasing decisions are primarily influenced by factors such as cost-effectiveness, proven reliability, compatibility with their specific frame designs, and performance characteristics that align with their targeted market segments, such as road, mountain, or e-bike categories. Cultivating strong, enduring relationships with these OEMs through consistent quality, competitive pricing, and dedicated technical support is paramount for bottom bracket manufacturers. Continuous innovation in bicycle frame designs consistently generates demand for novel and specialized bottom bracket solutions, making OEMs a dynamic and indispensable customer segment.

The B2C segment predominantly comprises individual cyclists, encompassing a broad spectrum from casual riders and daily commuters to dedicated enthusiasts and professional athletes. These end-users typically acquire bottom brackets through the aftermarket for purposes such as replacement due to wear, performance upgrades to enhance their riding experience, or customization to personalize their bicycle. Key factors influencing their purchasing decisions include brand reputation, perceived performance benefits (e.g., increased stiffness, reduced weight, lower friction), overall durability, ease of maintenance, and compatibility with their existing bicycle components. Specialty bicycle retail stores play a vital role in educating these customers and guiding their choices, while online retail platforms offer unparalleled convenience and a wider selection. The escalating popularity of cycling as both a hobby and a sport, combined with a growing awareness of component performance, continuously drives demand from this segment for a diverse array of bottom bracket options, including premium and high-performance models.

Beyond individual cyclists and OEMs, other significant potential customers include bicycle repair shops and service centers, which require a consistent supply of various bottom bracket types for their repair and maintenance services. Event organizers and professional cycling teams may also purchase bottom brackets in bulk for their extensive fleets and sponsored athletes, prioritizing components that offer superior performance and unwavering reliability under demanding conditions. Furthermore, component distributors and wholesalers act as crucial intermediaries, serving both the OEM and aftermarket segments by efficiently managing inventory and optimizing logistics across expansive geographical areas. These varied customer groups, each possessing distinct needs and purchasing behaviors, collectively define the extensive and dynamic market for bicycle bottom brackets, necessitating a comprehensive approach to product development, strategic marketing, and efficient distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 750 Million |

| Market Forecast in 2032 | USD 1,170 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano, SRAM, Campagnolo, FSA (Full Speed Ahead), Race Face, Chris King, Rotor, Enduro Bearings, Kogel Bearings, Wheels Manufacturing, Cane Creek, Praxis Works, Hope Technology, CeramicSpeed, SKF, Truvativ, Acros, Hawk Racing, Bottom Bracket Shop, Zipp |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Bottom Bracket Market Key Technology Landscape

The technology landscape of the Bicycle Bottom Bracket Market is defined by a relentless pursuit of innovation, specifically aimed at enhancing power transfer efficiency, reducing friction, boosting durability, and improving compatibility across the vast array of bicycle frame and crankset standards. Advances in bearing technology are a cornerstone, with ceramic bearings gaining considerable prominence due to their superior smoothness, lighter weight, and enhanced corrosion resistance when compared to conventional steel bearings. Manufacturers are also intensely focused on developing advanced sealing mechanisms to effectively protect bearings from contaminants such as water, dirt, and dust. This protection is critical for extending component lifespan, particularly in demanding riding conditions typical of mountain biking or gravel riding. Furthermore, the development of specialized lubricants and grease formulations plays a significant role in optimizing bearing performance and longevity, thereby minimizing the overall maintenance requirements for riders.

Material science is pivotal in the ongoing evolution of bottom bracket design. While aluminum and steel continue to be widely utilized for their cost-effectiveness and inherent robustness, there is an increasing adoption of lightweight materials, such as carbon fiber composites, for bottom bracket cups and shells. This trend is particularly evident in high-performance road and mountain bike applications, where these materials offer an exceptional stiffness-to-weight ratio, contributing significantly to overall bicycle lightness and improved power transfer. Additionally, proprietary manufacturing processes and sophisticated precision machining techniques are indispensable for producing components with extremely tight tolerances, ensuring perfect alignment and minimizing premature wear. Innovations in both press-fit and threaded standards, exemplified by the T47 standard which combines the advantages of larger bearing sizes with the reliability of threading, underscore the continuous efforts to address compatibility challenges and enhance user experience across the industry.

Beyond fundamental mechanical advancements, the integration of smart technologies is gradually emerging as a significant trend within the market. This includes bottom brackets equipped with integrated power meters that deliver real-time cycling data, enabling riders to precisely monitor their output and optimize training regimens. While still a niche segment, the potential for embedding advanced sensors for predictive maintenance, real-time temperature monitoring, or even basic health metrics could further expand the technological frontier of bottom brackets. The industry also sees ongoing efforts to standardize dimensions and interfaces, although the rapid proliferation of new bicycle frame designs continues to present ongoing compatibility challenges. Overall, the technological landscape remains dynamic, driven by the persistent demand for marginal gains in performance, enhanced durability, and improved integration within the broader ecosystem of bicycle components, ensuring that bottom brackets remain a key area for intensive research and development investment.

Regional Highlights

- North America: A mature market characterized by a robust cycling culture, high disposable incomes, and strong demand for performance-oriented and specialized bicycles. Growth is driven by the popularity of gravel cycling, mountain biking, and a surging interest in e-bikes. The United States and Canada are key contributors, with significant aftermarket sales for premium component upgrades.

- Europe: A leading market globally, propelled by extensive cycling infrastructure, strong environmental initiatives promoting cycling, and a significant presence of both established and innovative bicycle manufacturers. Major contributions come from Western European nations like Germany, France, and the UK. The e-bike segment is particularly vibrant, strongly influencing demand for durable bottom bracket solutions.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid urbanization, rising disposable incomes, and supportive government initiatives for cycling adoption. Key markets include China, India, Japan, and Australia. APAC is also a major manufacturing hub, impacting global supply chains. The region sees increasing adoption of both traditional and electric bicycles, leading to substantial market expansion.

- Latin America: An emerging market experiencing growing awareness of cycling's health and environmental benefits. Countries like Brazil, Mexico, and Colombia show increased cycling participation and improving economic conditions, fostering demand for entry-level to mid-range bicycles and components. Continued infrastructure development remains critical for sustained market growth.

- Middle East and Africa (MEA): A nascent market with growing interest in recreational cycling and sports events, particularly in urban areas. Though smaller in market size, increasing government investments in sports and leisure facilities, coupled with rising tourism, present long-term growth opportunities for bicycle components, including bottom brackets, as cycling culture develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Bottom Bracket Market.- Shimano

- SRAM

- Campagnolo

- FSA (Full Speed Ahead)

- Race Face

- Chris King

- Rotor

- Enduro Bearings

- Kogel Bearings

- Wheels Manufacturing

- Cane Creek

- Praxis Works

- Hope Technology

- CeramicSpeed

- SKF

- Truvativ

- Acros

- Hawk Racing

- Bottom Bracket Shop

- Zipp

Frequently Asked Questions

What is the primary function of a bicycle bottom bracket?

The primary function of a bicycle bottom bracket is to house bearings that enable the crankset (which includes pedals and chainrings) to rotate smoothly within the bike's frame. It serves as a vital pivot point for efficient power transfer from the rider's legs to the drivetrain, crucial for propulsion.

What are the main types of bicycle bottom brackets?

Main types include threaded (e.g., BSA, T47), which screw into the frame; press-fit (e.g., BB30, BB86), pressed into the frame without threads; and external bearing (e.g., Hollowtech II, GXP), where bearings sit outside the frame shell. Each type offers specific advantages in terms of weight, stiffness, and frame compatibility.

How do I choose the correct bottom bracket for my bike?

Choosing the correct bottom bracket depends on two key factors: your bicycle frame's bottom bracket shell standard (e.g., BSA, BB30, T47) and your crankset's spindle diameter and length. Precise matching of these specifications ensures compatibility, proper function, and optimal performance. Consulting your bike's manufacturer specs or a reputable mechanic is advised.

What are the benefits of upgrading to a ceramic bottom bracket?

Upgrading to a ceramic bottom bracket offers several benefits, including significantly reduced friction for smoother pedaling and improved power transfer, lighter weight compared to steel, and enhanced durability due to ceramic's hardness and corrosion resistance. These advantages are particularly valued by performance-oriented riders seeking marginal gains in efficiency.

What is the expected lifespan of a bicycle bottom bracket?

A bicycle bottom bracket's lifespan varies based on riding conditions (wet, dusty), usage frequency, maintenance, and component quality. Typically, a well-maintained, quality bottom bracket can last between 3,000 to 10,000+ miles. However, harsh conditions or neglect can considerably shorten its operational life, necessitating more frequent replacement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager