Bicycle Derailleur Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429212 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bicycle Derailleur Market Size

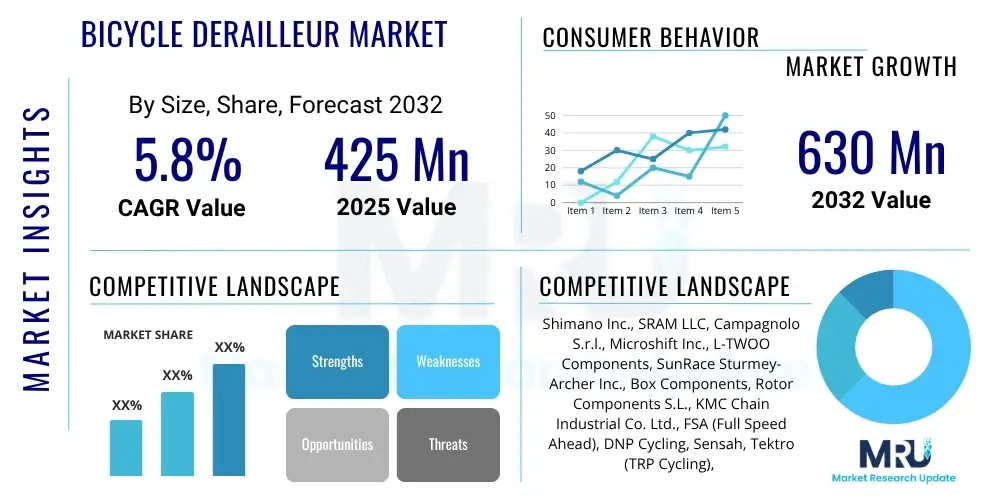

The Bicycle Derailleur Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $425 Million in 2025 and is projected to reach $630 Million by the end of the forecast period in 2032.

Bicycle Derailleur Market introduction

The bicycle derailleur market encompasses the global ecosystem involved in the design, manufacturing, distribution, and sales of mechanical devices critical for enabling multi-speed functionality in bicycles. Derailleurs, positioned at either the front (for chainrings) or rear (for the cassette), are fundamentally responsible for guiding the bicycle chain between different cogs. This action alters the gear ratio, allowing cyclists to optimize pedaling effort across diverse terrains and speeds. These sophisticated mechanisms are central to a cyclist's ability to adapt to uphill climbs, flat sprints, or technical descents, significantly enhancing both performance and comfort. The intricate product design typically involves a pivot mechanism, a cage to push the chain, and springs that provide tension, all controlled precisely by a rider's input via shifters. The market is driven by precision engineering, material science, and the continuous pursuit of lighter, more durable, and efficient shifting solutions, reflecting a deep integration of traditional craftsmanship with modern technological advancements.

Major applications for bicycle derailleurs span an incredibly diverse range of cycling disciplines, underscoring their universal importance in contemporary bicycle design. High-performance road bikes demand derailleurs offering exceptionally fast and accurate shifts for competitive racing and endurance riding, often prioritizing lightweight construction and aerodynamic profiles. Mountain bikes, conversely, require derailleurs engineered for extreme durability, resistance to mud and impacts, and reliable shifting under high torque in rugged off-road conditions. The rapidly expanding electric bicycle (e-bike) segment also relies heavily on robust derailleurs, which must effectively manage the increased power and torque generated by electric motors while maintaining smooth transitions. Furthermore, derailleurs are integral to gravel bikes, hybrid bikes, and even some advanced city bikes, where versatility and reliability are paramount for navigating mixed terrains and daily commutes. This broad applicability ensures consistent and growing demand across various consumer segments.

The market's sustained growth is underpinned by several compelling benefits offered by modern derailleur systems and key driving factors. Advanced derailleurs provide unparalleled shifting accuracy, allowing for seamless and instantaneous gear changes, which translates directly into improved rider control and efficiency. The relentless focus on reducing component weight through innovative materials like carbon fiber and aerospace-grade aluminum contributes to lighter, faster bicycles. Enhanced durability and reliability, especially crucial for performance-oriented cycling and the rigorous demands of e-bikes, ensure a longer product lifespan and reduced maintenance. The primary driving force behind this market expansion is the global surge in cycling's popularity, driven by increasing health consciousness, environmental concerns promoting sustainable transportation, and a renewed interest in outdoor recreational activities. Additionally, continuous innovation, particularly the evolution of electronic and wireless shifting systems, which offer superior performance and ease of use, acts as a powerful catalyst, encouraging upgrades and new bicycle purchases across all segments.

Bicycle Derailleur Market Executive Summary

The Bicycle Derailleur Market is currently experiencing a dynamic phase of growth, influenced significantly by several overarching business trends that are reshaping manufacturing, product development, and consumer engagement. A prominent trend is the pronounced shift towards premiumization and technological sophistication, with a growing consumer appetite for high-end, lightweight, and electronically controlled derailleur systems that offer superior performance and precision. This trend fosters intense research and development efforts among leading manufacturers to integrate advanced materials, smart sensors, and wireless communication capabilities into their product lines. Furthermore, the market is characterized by a strong focus on sustainability, with manufacturers exploring more eco-friendly production processes and materials, while also streamlining global supply chain operations to enhance efficiency and responsiveness to fluctuating demand patterns, especially in the context of recent global disruptions. The expansion of direct-to-consumer sales channels and localized assembly operations also represents a key business trend, enhancing market accessibility and reducing lead times.

Regionally, the market exhibits a variegated landscape of growth and development, with each major geographical segment contributing uniquely to the overall market trajectory. Asia Pacific stands as the undisputed global manufacturing hub for bicycle components, including derailleurs, benefiting from robust production infrastructure and cost efficiencies, particularly in countries like Taiwan, China, and Vietnam. Simultaneously, APAC is a burgeoning consumer market, driven by rapidly urbanizing populations, rising disposable incomes, and increasing adoption of cycling for both commuting and leisure, which fuels substantial demand for a wide range of derailleur products, from entry-level to high-performance. In contrast, Europe and North America represent mature markets characterized by a deeply ingrained cycling culture, substantial investment in cycling infrastructure, and a strong preference for advanced, high-technology derailleurs, with significant growth in the e-bike and gravel bike segments pushing innovation and demand for specialized components. Emerging markets in Latin America, the Middle East, and Africa are demonstrating promising growth potential, albeit from a lower base, as economic development and increasing awareness of cycling's benefits drive nascent but accelerating demand for bicycles and their essential components.

Segment-wise, the market is undergoing transformative shifts that reflect broader industry developments. The electronic derailleur segment is experiencing exponential growth, rapidly gaining market share over traditional mechanical systems due to its unparalleled shifting accuracy, ease of operation, and integration with smart cycling ecosystems. This segment is further subdivided into wired and increasingly popular wireless variants, which offer enhanced aesthetics and simpler installation. Derailleurs specifically designed for the burgeoning e-bike market are also demonstrating significant traction, as these components are engineered to withstand the unique stresses of electric power assistance while delivering seamless gear changes. Traditional segments such as mountain bike and road bike derailleurs remain foundational, but are continually innovating with enhanced durability, lighter weight, and refined ergonomics to meet the evolving demands of performance-driven riders. The aftermarket, comprising sales for replacement and upgrade purposes, continues to be a vital segment, driven by individual consumer desire for enhanced performance and personalized cycling experiences, often mirroring the technological advancements seen in OEM products.

AI Impact Analysis on Bicycle Derailleur Market

Common user questions concerning the influence of Artificial Intelligence on the Bicycle Derailleur Market frequently explore how this advanced technology could revolutionize various facets, ranging from product conception and manufacturing processes to post-sale maintenance and the overall user experience. Users are keen to understand the potential for AI-driven automation and robotics to enhance the precision and efficiency of derailleur production lines, thereby reducing manufacturing costs and improving product consistency. Significant interest is also directed towards how machine learning algorithms could be utilized in optimizing derailleur designs for superior performance, durability, and compatibility with diverse cycling environments. Furthermore, there's considerable anticipation regarding the integration of smart sensors and AI into derailleurs themselves, envisioning systems that can predict optimal gear changes, self-diagnose issues, and even adapt to individual rider profiles and real-time riding conditions, pointing towards a future of highly intelligent and adaptive shifting solutions. These inquiries collectively highlight a strong expectation for AI to bring disruptive innovation, leading to more efficient manufacturing, smarter products, and a more personalized cycling journey for end-users.

- AI-driven design optimization: Machine learning algorithms analyze data to refine derailleur designs for optimal strength-to-weight and performance, accelerating R&D.

- Precision manufacturing and quality control: AI-powered robotics and vision systems improve machining accuracy, assembly, and inspection, ensuring component consistency and reducing defects.

- Predictive maintenance: AI processes real-time usage data from smart derailleurs to forecast component wear, recommending proactive maintenance and extending product lifespan.

- Smart and adaptive shifting systems: AI integration with sensors enables derailleurs to autonomously anticipate and execute gear changes based on rider input and terrain, offering seamless experiences.

- Supply chain optimization: AI algorithms enhance forecasting, logistics, and inventory management for components, improving efficiency and mitigating disruption risks.

- Personalized product development: AI analyzes rider data to inform the creation of customized derailleur configurations and settings for unique performance demands.

- Autonomous testing: AI-driven simulations and robotic platforms rigorously test prototypes under various conditions, identifying weaknesses and validating performance faster.

- Enhanced diagnostics: AI-powered applications assist riders and mechanics in troubleshooting derailleur issues, simplifying maintenance and repair processes.

DRO & Impact Forces Of Bicycle Derailleur Market

The Bicycle Derailleur Market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces that collectively dictate its growth trajectory and competitive landscape. A primary driver fueling market expansion is the escalating global embrace of cycling, propelled by increasing health consciousness, environmental sustainability initiatives, and the growing recognition of cycling as a versatile mode of transportation for commuting and recreation. This surge in cycling participation directly translates into heightened demand for multi-speed bicycles, thereby boosting the requirement for sophisticated derailleur systems. Concurrently, the robust growth of the electric bicycle (e-bike) segment acts as a powerful catalyst; e-bikes, with their added torque and speed, necessitate more durable and precise derailleurs capable of handling greater stresses, driving innovation and increasing sales across diverse price points and application categories. Moreover, continuous advancements in derailleur technology, including the advent of electronic and wireless shifting, which offer superior accuracy, speed, and ease of use, further stimulate market growth by encouraging upgrades and new bike purchases among performance-oriented cyclists and enthusiasts.

However, the market's progression is tempered by several notable restraints. The relatively high acquisition cost associated with advanced derailleur systems, particularly the premium electronic variants, can present a significant barrier to entry for price-sensitive consumers or those in developing economies, thereby limiting broader market penetration. Intense competition from alternative gearing solutions, such as internal gear hubs (IGHs), often favored for their low maintenance, weather resistance, and cleaner aesthetics in urban and utilitarian cycling segments, poses a persistent challenge. Furthermore, the inherent mechanical complexity of derailleurs often requires specialized knowledge for installation, adjustment, and maintenance, potentially deterring novice cyclists or those without ready access to professional bicycle mechanics. Global supply chain vulnerabilities, including shortages of crucial raw materials and geopolitical disruptions, represent ongoing external restraints that can impact production schedules, lead times, and overall market stability, forcing manufacturers to diversify sourcing and increase inventory buffers.

Despite these challenges, the market is abundant with promising opportunities for innovation and strategic expansion. Extensive research and development efforts focused on integrating lightweight, high-strength materials such as advanced carbon fiber composites, aerospace-grade aluminum, and titanium alloys present significant potential to create derailleurs that offer unparalleled performance, reduced weight, and extended durability. The continued evolution of smart cycling technologies, including the incorporation of integrated sensors, IoT connectivity, and artificial intelligence into derailleurs, paves the way for adaptive shifting systems that can respond intelligently to real-time riding conditions and rider biometrics, delivering a truly personalized experience. Moreover, strategic expansion into burgeoning markets in Latin America, the Middle East, and parts of Asia, where rising disposable incomes and developing cycling infrastructure are fostering a new wave of cycling enthusiasm, offers substantial avenues for market penetration and long-term growth for manufacturers.

Segmentation Analysis

The Bicycle Derailleur Market is meticulously segmented to provide a granular understanding of its complex structure, enabling stakeholders to discern specific market niches, consumer needs, and competitive landscapes. This comprehensive segmentation allows for a precise analysis of demand patterns, technological preferences, and distribution strategies across the vast cycling ecosystem. By categorizing derailleurs based on their functional type, speed compatibility, intended application, material composition, and the channels through which they are sold, the market report offers critical insights into product differentiation and strategic positioning. This structured approach highlights the sophisticated evolution of bicycle gearing systems, where specialization caters to an increasingly diverse and discerning global cycling community, ranging from casual riders to elite athletes.

- By Type

- Front Derailleur: Shifts chain between chainrings on crankset for wider gear range.

- Rear Derailleur: Shifts chain across cassette cogs for fine-tuning gear ratios.

- By Speed/Gear

- 6-Speed and Below: Entry-level, kids', older bicycles.

- 7-Speed: Budget-friendly mountain and hybrid bikes.

- 8-Speed: Recreational and entry-level performance bikes.

- 9-Speed: Mid-range mountain and touring bikes.

- 10-Speed: Performance road and mountain biking.

- 11-Speed: High-performance road and mountain groupsets.

- 12-Speed: Dominant in modern MTB, growing in road/gravel.

- 13-Speed and Above: Emerging in specialized high-end systems.

- By Application/Bicycle Type

- Mountain Bikes (MTB): Durability, impact resistance, precise shifting in extreme conditions.

- Road Bikes: Lightweight, aerodynamic efficiency, rapid shifts on paved surfaces.

- Electric Bikes (E-Bikes): Withstand higher torque loads, seamless shifting with motor assistance.

- Gravel Bikes: Optimized for versatility across mixed terrains.

- City/Hybrid Bikes: Reliability, ease of use, low maintenance for urban commuting.

- Kids Bikes: Simplicity, robustness, ease of operation for young riders.

- By Material

- Aluminum Alloy: Balance of strength, weight, cost-effectiveness.

- Carbon Fiber: Exceptional strength-to-weight, dampening, aesthetic appeal in high-end.

- Steel: Durability and lower cost in robust or entry-level components.

- Titanium: Corrosion resistance, high strength, lightweight for premium components.

- Composites: Blend of materials for specific performance characteristics.

- By Distribution Channel

- Original Equipment Manufacturers (OEMs): Bulk sales for factory installation on new bikes.

- Aftermarket: Sales to consumers, bike shops, online for replacement, upgrade, custom builds.

- Online Retail: E-commerce platforms for broad access and convenience.

- Specialty Bicycle Retail Stores: Expert advice, professional installation, personalized service.

- Department Stores & Hypermarkets: Entry-to-mid-range derailleurs for broader consumer base.

- By Technology

- Mechanical Derailleurs: Traditional cable-actuated systems, reliable and straightforward.

- Electronic Derailleurs (Wired): Electric motors via wires, known for precision and low effort.

- Wireless Electronic Derailleurs: Radio signals between shifters and derailleurs for clean aesthetics, simplified installation.

Value Chain Analysis For Bicycle Derailleur Market

The value chain for the Bicycle Derailleur Market is a complex, globally interconnected network that meticulously tracks the journey of components from raw material sourcing to the final end-user, encompassing multiple stages of production, assembly, distribution, and retail. At the foundational upstream segment, the process commences with the procurement of diverse raw materials, which are crucial for the structural integrity and performance of derailleurs. These materials include high-grade aluminum alloys, various compositions of steel, sophisticated carbon fiber composites, specialized plastics, and occasionally titanium. Suppliers for these materials are often global entities, requiring stringent quality assurance protocols to meet the precise engineering specifications demanded by high-performance bicycle components. Following material acquisition, specialized sub-component manufacturers engage in precision processes such as forging, CNC machining, stamping, and injection molding to produce the intricate gears, cages, springs, bolts, and mounting hardware that constitute a derailleur. This initial phase is highly capital-intensive and demands advanced metallurgical and manufacturing expertise.

The midstream activities center on the intricate assembly of these disparate sub-components into complete, functional front and rear derailleur units. Leading derailleur manufacturers, such as Shimano, SRAM, and Campagnolo, perform this critical stage, integrating their proprietary technologies, patented designs, and advanced quality control measures. This often involves a blend of highly automated robotic assembly lines for speed and consistency, coupled with skilled manual labor for fine-tuning and complex installations, ensuring each unit meets stringent performance and reliability standards. Once assembled, these derailleurs are then supplied in two primary directions: a significant portion goes to Original Equipment Manufacturers (OEMs) for integration into new bicycle frames during mass production, while another substantial part is directed towards the aftermarket for individual sales and upgrades. The efficiency and quality control within this manufacturing and assembly stage are paramount, as derailleurs are precision instruments where even minor deviations can compromise performance.

The downstream segment of the value chain focuses on the comprehensive distribution and retail channels that bring finished derailleurs to the end-users. For OEM clients, derailleurs are typically shipped in bulk directly to bicycle factories worldwide, facilitating the assembly of new bicycles. The aftermarket, however, utilizes a multi-layered distribution network that includes large-scale wholesalers and regional distributors who manage logistics and inventory for a wide array of retailers. These retailers encompass dedicated specialty bicycle shops, which offer expert advice, professional installation services, and a curated selection of components, as well as broader online retail platforms that provide convenience, competitive pricing, and global reach to individual consumers. Additionally, some manufacturers operate direct-to-consumer online channels. The effectiveness of these distribution channels is crucial for market penetration, ensuring products are readily available to both industrial customers requiring components for new bike builds and individual cyclists seeking to replace or upgrade their existing gearing systems.

Bicycle Derailleur Market Potential Customers

The potential customer base for bicycle derailleurs is remarkably diverse, segmented broadly into Original Equipment Manufacturers (OEMs) and the expansive aftermarket, each with distinct needs and purchasing behaviors. OEMs represent the cornerstone of demand, comprising major global bicycle manufacturers and numerous smaller-scale assembly companies that integrate derailleurs into their new bicycle models. These customers purchase derailleurs in significant volumes to equip a vast array of bikes, including road, mountain, hybrid, and crucially, the rapidly growing electric bicycle segment. Their purchasing decisions are primarily driven by factors such as component reliability, performance specifications (e.g., speed compatibility, weight, shifting precision), cost-effectiveness, supply chain stability, and the ability to seamlessly integrate components into their proprietary frame designs. Establishing strong, long-term partnerships with leading OEM clients is a strategic imperative for derailleur manufacturers, as these relationships often involve collaborative design and exclusive supply agreements that secure substantial and consistent sales volumes.

Within the aftermarket, the customer spectrum widens considerably to include various entities and individual consumers focused on repairs, upgrades, and custom bicycle construction. A significant portion of this segment consists of independent bicycle retailers and specialized repair workshops globally, which procure derailleurs to service existing bicycles, replace worn-out parts, and build custom bikes for their clientele. These businesses value easy access to a broad inventory of components, technical support, and responsive supply chains to meet varied customer demands promptly. Additionally, online retailers and e-commerce platforms play an increasingly crucial role in the aftermarket, offering a convenient purchasing channel with extensive product selections and competitive pricing directly to consumers worldwide, enabling them to upgrade or replace components independently.

The ultimate end-users, individual cyclists, constitute the final layer of potential customers within the aftermarket. This group spans from casual riders seeking reliable and durable replacements for their everyday bikes to dedicated enthusiasts and professional athletes who continuously seek cutting-edge derailleurs to optimize their performance, reduce weight, or leverage the latest electronic shifting technologies. Their purchasing decisions are often influenced by brand reputation, peer reviews, compatibility with existing components, specific riding discipline requirements, and a willingness to invest in higher-performance parts for a superior cycling experience. The rapid evolution of cycling disciplines, such as gravel biking, and the continuous innovation in derailleur technology, ensure a persistent demand from this discerning group of customers, who are always looking for ways to enhance their ride.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $425 Million |

| Market Forecast in 2032 | $630 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., SRAM LLC, Campagnolo S.r.l., Microshift Inc., L-TWOO Components, SunRace Sturmey-Archer Inc., Box Components, Rotor Components S.L., KMC Chain Industrial Co. Ltd., FSA (Full Speed Ahead), DNP Cycling, Sensah, Tektro (TRP Cycling), Jagwire, Race Face, PROMAX Components, Clark's Cycle Systems, Origin8, Cane Creek Cycling Components, PYC Chain Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Derailleur Market Key Technology Landscape

The Bicycle Derailleur Market is characterized by a vibrant and rapidly advancing technology landscape, constantly driven by the imperative to enhance shifting precision, speed, durability, and overall rider experience. While conventional mechanical derailleurs continue to evolve with refinements in cable pull ratios, improved spring tension mechanisms, and more robust cage designs to deliver smoother and more reliable shifts, the most significant technological paradigm shift lies in the accelerating adoption and sophistication of electronic and wireless shifting systems. These innovations are revolutionizing how gears are changed, replacing traditional physical cables with digital signals or radio waves, which translates into unparalleled accuracy, minimal effort, and often, faster gear transitions. The technological forefront is marked by ongoing research into miniaturization, power efficiency, and seamless integration with other smart cycling components.

Electronic derailleurs, whether wired or wireless, represent the pinnacle of current technological achievement in this market. Wired electronic systems, pioneered by companies like Shimano (Di2) and Campagnolo (EPS), employ small, precise electric motors to move the chain, controlled by ergonomic electronic shifters. These systems offer robust, consistent performance, automatic trim functions for the front derailleur, and customizable shift patterns, drawing power from a rechargeable battery. The more advanced wireless electronic derailleurs, exemplified by SRAM (eTap/AXS), further simplify bicycle design by eliminating internal or external wiring, communicating via proprietary radio protocols. This offers a cleaner aesthetic, easier installation, and modularity, often integrating with mobile apps for personalization and firmware updates. These systems are also increasingly incorporating advanced sensor technologies to provide real-time data on gear usage, battery life, and even performance metrics.

Beyond electronic actuation, material science and manufacturing processes are critically important technological pillars. The widespread adoption of lightweight yet incredibly strong materials such as

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager