Bicycle Disc Brake Rotor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429592 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bicycle Disc Brake Rotor Market Size

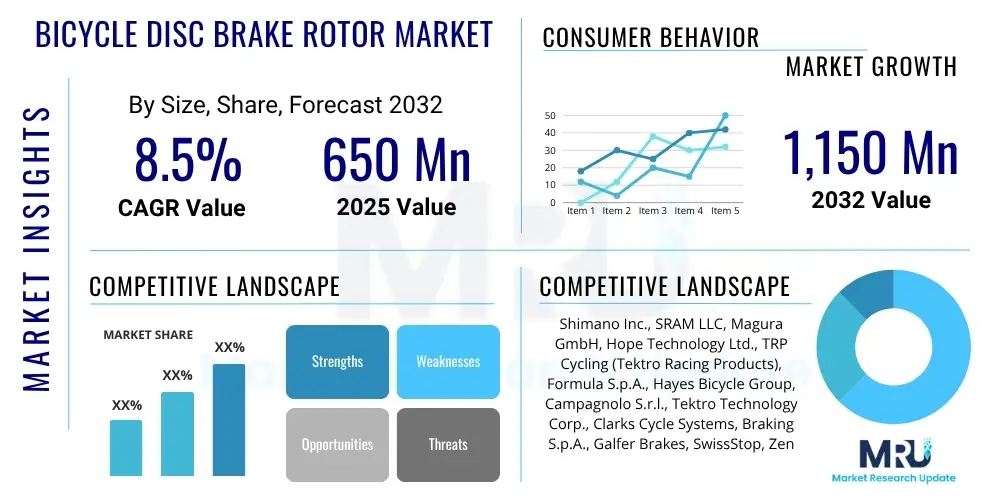

The Bicycle Disc Brake Rotor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $650 Million in 2025 and is projected to reach $1,150 Million by the end of the forecast period in 2032.

Bicycle Disc Brake Rotor Market introduction

The Bicycle Disc Brake Rotor Market is a critical segment within the broader cycling components industry, encompassing the design, manufacturing, and distribution of braking discs essential for modern bicycles. These rotors are precision-engineered components, typically circular metal plates, mounted to the wheel hubs and designed to be gripped by calipers to slow or stop the bicycle. Their fundamental purpose is to provide superior stopping power, enhanced modulation, and reliable performance across diverse riding conditions, representing a significant advancement over traditional rim braking systems.

Product description for bicycle disc brake rotors highlights their composition, often utilizing high-grade stainless steel for its durability, corrosion resistance, and heat dissipation properties, though lighter alloys and composite materials are also emerging for high-performance applications. These rotors come in various sizes, with diameters ranging from 140mm to over 203mm, catering to different bicycle types and braking requirements. Major applications span a wide array of cycling disciplines, including aggressive mountain biking where robust stopping power is paramount, increasingly popular road cycling for enhanced safety and control, gravel biking, and most notably, the rapidly expanding electric bicycle (e-bike) market, where the added weight and speed necessitate powerful and consistent braking.

The core benefits of disc brakes, and consequently their rotors, include significantly improved braking consistency in wet or muddy conditions, better heat management on long descents preventing brake fade, reduced hand fatigue due to lighter lever pull, and a longer lifespan for wheel rims as braking forces are applied directly to the rotor. The market's growth is predominantly driven by several interconnected factors: the accelerating global adoption of cycling for leisure, sport, and commuting; the exponential expansion of the e-bike segment which inherently demands powerful and reliable braking systems; continuous technological advancements leading to lighter, more durable, and better-performing rotors; and an increasing consumer emphasis on cycling safety and performance across all segments.

Bicycle Disc Brake Rotor Market Executive Summary

The Bicycle Disc Brake Rotor Market is poised for substantial growth, driven by a dynamic interplay of evolving business trends, significant regional expansion, and distinct segment shifts. Business trends are characterized by a pronounced focus on material science innovations, leading to the development of lighter and more efficient heat-dissipating rotor designs, crucial for maintaining optimal braking performance under extreme conditions. Furthermore, strategic partnerships between rotor manufacturers and bicycle brands are becoming commonplace, fostering integrated braking solutions that enhance overall bicycle safety and performance. Sustainability initiatives in manufacturing, including the use of recycled materials and energy-efficient production processes, are also gaining traction as companies respond to environmental concerns and consumer demand for eco-friendly products.

Regional trends indicate that the Asia Pacific (APAC) region is emerging as a primary growth engine, fueled by expanding manufacturing capabilities, rising disposable incomes, and a burgeoning interest in cycling across various countries. Europe continues to be a robust market, largely propelled by its deeply entrenched cycling culture, extensive cycling infrastructure, and the exceptionally high adoption rate of e-bikes, particularly in Western European nations. North America also maintains a strong market presence, driven by its large recreational cycling base, professional cycling events, and increasing consumer willingness to invest in premium bicycle components for enhanced performance and safety. Latin America and the Middle East and Africa (MEA) are showing promising, albeit nascent, growth as cycling infrastructure improves and awareness of cycling benefits spreads.

Segment-wise, the mountain bike (MTB) sector traditionally dominates the demand for disc brake rotors due to the rigorous demands of off-road riding, necessitating powerful and reliable braking. However, the road bike segment is experiencing rapid adoption of disc brakes, moving away from traditional rim brakes as riders prioritize all-weather performance and control. The electric bike (e-bike) segment is undeniably the fastest-growing application, with its heavier weight and higher speeds making disc brakes a necessity rather than an option, thus significantly boosting rotor demand. This comprehensive market landscape underscores a vibrant and competitive environment, where innovation, strategic market penetration, and adaptability to evolving consumer preferences are key to sustained success and market leadership.

AI Impact Analysis on Bicycle Disc Brake Rotor Market

Common user questions and industry discussions related to the impact of Artificial Intelligence (AI) on the Bicycle Disc Brake Rotor Market frequently center on its potential to revolutionize product design, manufacturing efficiency, and predictive maintenance. Users are keen to understand if AI can contribute to the creation of lighter yet stronger rotors, optimize their cooling characteristics, or even integrate with smart cycling systems for real-time performance adjustments. The overarching themes reflect expectations for AI to drive innovation, improve product quality, reduce costs, and offer enhanced safety features. There are also underlying concerns regarding the complexity and investment required for AI implementation, as well as the need for skilled personnel to leverage these advanced analytical capabilities effectively in a traditionally mechanical industry.

AI's influence is anticipated across multiple facets, from the initial conceptualization to the end-user experience. For instance, generative AI algorithms can explore thousands of design variations that human engineers might overlook, optimizing rotor geometry for maximum heat dissipation and minimal weight. In manufacturing, AI-powered systems can monitor production lines, detect anomalies, predict equipment failures, and ensure precision in machining processes, leading to fewer defects and higher output. Beyond production, AI could analyze vast datasets of rider behavior and environmental conditions to inform future product development, creating rotors that are more resilient to specific stresses encountered in real-world cycling scenarios, thereby leading to highly customized and optimized products.

- AI-driven generative design for optimal rotor geometries, reducing weight while maintaining structural integrity and heat dissipation efficiency.

- Predictive analytics and machine learning for material science, identifying optimal alloy compositions and surface treatments to enhance durability and performance.

- AI-powered manufacturing automation for increased precision in machining, laser cutting, and surface finishing, leading to higher quality and reduced production costs.

- Supply chain optimization using AI algorithms to forecast demand, manage inventory, and identify potential disruptions in raw material sourcing or component delivery.

- Integration of AI with smart braking systems to provide real-time performance feedback, anticipate wear patterns, and offer personalized maintenance recommendations to cyclists.

- Quality control enhancements through AI-driven visual inspection systems, detecting micro-fractures or manufacturing defects that might be missed by human inspection.

DRO & Impact Forces Of Bicycle Disc Brake Rotor Market

The Bicycle Disc Brake Rotor Market is fundamentally shaped by a dynamic interplay of distinct drivers, inherent restraints, and burgeoning opportunities, all operating under the influence of various impact forces. Key drivers include the significant global surge in cycling adoption, which is partly fueled by environmental consciousness and health trends, alongside the explosive growth of the electric bicycle (e-bike) market. E-bikes, due to their higher speeds and increased mass, critically depend on robust and reliable braking systems, thereby creating a non-negotiable demand for high-performance disc brake rotors. Furthermore, continuous technological advancements in material science and manufacturing processes are leading to lighter, more durable, and efficient rotors, attracting both manufacturers and consumers. Enhanced safety regulations and a growing consumer emphasis on braking performance across all cycling disciplines also act as potent market drivers, pushing for widespread adoption of disc brake technology over traditional rim brakes.

Despite the strong growth impetus, the market faces several notable restraints. The initial higher cost associated with disc brake systems, including the rotors themselves, compared to rim brake setups can be a deterrent for budget-conscious consumers or entry-level bicycle manufacturers. Additionally, the slightly increased weight of disc brake components, though continuously being minimized through technological innovation, can still be a concern for performance-oriented cyclists who prioritize every gram. Perceived complexities in maintenance, such as brake bleeding procedures and specific pad alignment, can also present a barrier, though advancements are simplifying these processes. Supply chain disruptions, particularly those exacerbated by geopolitical events or global health crises, can also impact production schedules and material costs, leading to price volatility and potential market instability. These factors collectively require strategic navigation by market participants to mitigate their adverse effects.

Opportunities within this market are extensive and diverse, promising future growth and innovation. The ongoing development of lightweight and advanced materials, such as carbon composites and specialized alloys, offers significant potential for enhancing rotor performance while reducing overall weight, appealing to high-end and competitive segments. The integration of smart braking technologies, potentially incorporating sensors for wear monitoring, temperature management, or even adaptive braking assistance, represents a frontier for innovation that could revolutionize rider safety and experience. Moreover, emerging markets in Asia Pacific, Latin America, and parts of Africa, with their rapidly growing middle classes and increasing interest in cycling for both utility and recreation, present substantial untapped market potential. Customization options, catering to specific rider preferences and bicycle types, along with aftermarket upgrade cycles, further expand the addressable market for specialized and premium rotor products. These opportunities highlight a fertile ground for product differentiation, market expansion, and sustained profitability for forward-thinking companies.

Segmentation Analysis

The Bicycle Disc Brake Rotor Market is meticulously segmented across various parameters, offering a granular view of market dynamics and enabling stakeholders to understand consumer preferences and technological demands within specific niches. This detailed segmentation is crucial for targeted product development, precise marketing strategies, and effective resource allocation, allowing companies to identify their core competencies and capitalize on emerging trends. Each segment reflects distinct characteristics in terms of material choice, size requirements, application, distribution channels, and end-user profiles, underscoring the diverse and evolving nature of the cycling industry.

Analyzing the market through these segmentations provides invaluable insights into where growth is most pronounced and where innovation is most required. For instance, understanding the demand split between Original Equipment Manufacturers (OEM) and the Aftermarket helps manufacturers tailor their production volumes and sales strategies. Similarly, segmenting by bicycle type, such as mountain bikes versus e-bikes, reveals differing needs for durability, heat dissipation, and overall braking power, directly influencing design specifications and material selection. This allows for specialized product lines that meet the unique demands of each cycling discipline, from the aggressive stopping power needed for downhill mountain biking to the consistent, high-endurance performance required for long-distance road cycling.

Furthermore, geographic segmentation complements these product and consumer-centric divisions by highlighting regional preferences, regulatory environments, and economic factors that influence market uptake. Companies can leverage this multi-dimensional analysis to forecast demand more accurately, optimize their supply chains, and establish competitive pricing strategies. The ability to dissect the market into these manageable components ultimately empowers businesses to respond agilely to market shifts, identify underserved segments, and cultivate strong brand loyalty by delivering products that precisely match specific customer requirements and market opportunities.

- By Material Type:

- Stainless Steel: Dominant for its balance of durability, heat resistance, and cost-effectiveness.

- Aluminum: Often used in spider designs for weight reduction, sometimes with a steel braking surface.

- Carbon Fiber: Niche, ultra-lightweight option for high-end, weight-conscious applications, primarily in racing.

- Others (e.g., Titanium Alloys, Composite Blends): Emerging materials offering specialized performance benefits like corrosion resistance or extreme heat handling.

- By Rotor Size:

- 140mm: Commonly used for road bikes and lighter riders, prioritizing weight and aerodynamics.

- 160mm: Standard size for many road, gravel, and light cross-country mountain bikes, offering a good balance of power and weight.

- 180mm: Popular for trail and all-mountain bikes, providing increased braking power and heat dissipation.

- 203mm and Above: Predominantly used for downhill mountain biking, e-bikes, and heavier riders, offering maximum stopping power and heat management.

- By Bicycle Type:

- Mountain Bikes (MTB): Highest demand for robust, heat-resistant rotors due to aggressive riding and steep descents.

- Road Bikes: Rapidly adopting disc brakes for all-weather performance, control, and reduced rim wear.

- E-Bikes: Critical segment requiring larger, more durable rotors to handle increased weight and speeds.

- Gravel Bikes: Demand for versatile rotors that perform well on varied terrains and in mixed conditions.

- Commuter/Urban Bikes: Growing segment prioritizing reliable braking for safety in urban environments.

- Hybrid Bikes: Requiring durable rotors for mixed-use riding.

- By Distribution Channel:

- Original Equipment Manufacturer (OEM): Sales directly to bicycle manufacturers for assembly into new bikes.

- Aftermarket: Sales to consumers, retailers, and repair shops for upgrades, replacements, or custom builds.

- By End-User:

- Recreational Cyclists: Focus on reliability, ease of maintenance, and value.

- Professional Cyclists: Demand for peak performance, minimal weight, and cutting-edge technology.

- Commuters: Prioritize durability, consistent performance, and safety in urban settings.

- Touring Cyclists: Require strong, consistent braking for heavily loaded bikes over long distances.

Value Chain Analysis For Bicycle Disc Brake Rotor Market

The value chain for the Bicycle Disc Brake Rotor Market is a complex and multi-faceted network, beginning with the sourcing of specialized raw materials and culminating in the delivery of finished products to diverse customer segments. Upstream analysis reveals a critical reliance on suppliers of high-grade metals such as various stainless steel alloys, aluminum, and in some specialized cases, advanced carbon composites. These raw material suppliers must meet stringent quality specifications concerning material purity, mechanical properties, and consistency, as these factors directly impact the rotor's performance, durability, and safety. Relationships with these suppliers are often strategic, involving long-term contracts and collaborative efforts to ensure a steady supply of quality inputs, which can be challenging given global commodity price fluctuations and supply chain vulnerabilities.

Midstream activities involve the intricate manufacturing processes undertaken by rotor producers. This stage encompasses precision engineering, including processes such as laser cutting, CNC machining, stamping, and specialized heat treatments to achieve the desired rotor geometry, flatness, and metallurgical properties that resist warping and enhance heat dissipation. Surface finishing, such as grinding and polishing, is also crucial for optimal brake pad contact and noise reduction. Quality control and testing are integral at this stage to ensure each rotor meets exacting industry standards for thickness, runout, and overall structural integrity. Manufacturers often invest heavily in advanced machinery and skilled labor to achieve the high tolerances required for reliable braking performance, continuously innovating to improve manufacturing efficiency and product characteristics.

Downstream analysis focuses on the distribution channels that connect manufacturers to end-users. The market operates through both direct and indirect channels. Direct sales predominantly occur to Original Equipment Manufacturers (OEMs), where rotor manufacturers supply components directly to bicycle brands for assembly into new bicycles. This channel typically involves large volume contracts and close collaboration on design and integration. Indirect channels cater to the aftermarket, comprising sales through wholesale distributors, independent bicycle dealers (IBDs), and a growing number of online retailers. The aftermarket is crucial for replacement parts, upgrades, and custom bicycle builds. Effective logistics, warehousing, and strong relationships with distributors and retailers are paramount for ensuring broad market reach and timely product availability, ultimately bridging the gap between sophisticated manufacturing and diverse consumer needs across the global cycling community.

Bicycle Disc Brake Rotor Market Potential Customers

The Bicycle Disc Brake Rotor Market serves a broad spectrum of potential customers, primarily segmented into Original Equipment Manufacturers (OEMs) and the vast aftermarket consumer base. OEMs represent a foundational segment, encompassing global bicycle manufacturers that integrate disc brake systems into their new bicycle models across all categories—from entry-level commuter bikes to high-performance road and mountain bikes. These manufacturers require consistent supply of high-quality, reliable, and cost-effective rotors that can be scaled for mass production. Their purchasing decisions are driven by factors such as performance specifications, compatibility with proprietary braking systems, supplier reputation, price efficiency, and the ability to meet production deadlines. Establishing strong, long-term relationships with OEMs is critical for rotor manufacturers, as these partnerships often involve collaborative design and exclusive supply agreements.

The aftermarket constitutes another significant customer segment, catering to individual cyclists, independent bicycle dealers (IBDs), and online specialty retailers. This segment involves sales of rotors for replacement, upgrades, or custom bicycle builds. Individual cyclists, ranging from recreational riders to professional athletes, purchase rotors based on factors such as brand preference, performance characteristics (e.g., weight, heat management, durability), compatibility with existing components, and aesthetic appeal. IBDs and online retailers serve as crucial intermediaries, providing product expertise, installation services, and a wide selection to end-users. This customer group often seeks premium, high-performance, or specialized rotors that can enhance their riding experience. Furthermore, niche customers such as custom bike builders and professional racing teams also contribute to the market, often demanding bespoke solutions or cutting-edge technology that pushes the boundaries of performance and innovation, influencing trends and technological advancements within the broader aftermarket landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $650 Million |

| Market Forecast in 2032 | $1,150 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., SRAM LLC, Magura GmbH, Hope Technology Ltd., TRP Cycling (Tektro Racing Products), Formula S.p.A., Hayes Bicycle Group, Campagnolo S.r.l., Tektro Technology Corp., Clarks Cycle Systems, Braking S.p.A., Galfer Brakes, SwissStop, Zeno (Changzhou) Cycle Parts Co., Ltd., Ashima Ltd., Jagwire, ProMax, DT Swiss AG, Giant Manufacturing Co. Ltd., Merida Industry Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Disc Brake Rotor Market Key Technology Landscape

The Bicycle Disc Brake Rotor Market is characterized by a dynamic and continuously evolving technology landscape, with innovations primarily centered on enhancing performance, durability, and weight reduction. A significant area of focus is material science, where manufacturers are constantly exploring and refining the use of various metal alloys, predominantly high-carbon stainless steels, to optimize properties such as heat resistance, stiffness, and wear longevity. Advanced heat treatment processes are employed to modify the material's microstructure, ensuring exceptional strength and stability under the extreme thermal stresses generated during heavy braking, which is crucial for preventing warping and maintaining consistent braking power over long descents or in demanding conditions.

Precision manufacturing techniques form another cornerstone of the technological landscape. Modern rotors are produced using highly accurate processes such as laser cutting and CNC (Computer Numerical Control) machining, which allow for intricate designs, tight tolerances, and superior flatness. These precise manufacturing methods are vital for minimizing brake rub, reducing noise, and ensuring a smooth, predictable braking feel. Furthermore, specialized surface treatments, including various coatings and finishes, are applied to enhance corrosion resistance, improve aesthetic appeal, and potentially reduce noise by optimizing the friction interface between the rotor and brake pads. These treatments also contribute to extending the lifespan of the rotor, even in harsh riding environments.

Beyond materials and manufacturing, design innovations play a critical role. Many rotors now feature multi-piece designs, often combining a lightweight aluminum spider with a steel braking track. This construction strategy effectively reduces overall weight while improving heat dissipation, as the aluminum core acts as a heat sink, preventing the braking surface from overheating and warping. The development of different mounting standards, such as the Center Lock system and the traditional 6-bolt pattern, further reflects the continuous drive for improved compatibility, easier installation, and optimized integration with various hub designs. These technological advancements collectively contribute to delivering the superior braking performance and reliability that modern cyclists demand across all disciplines, from competitive racing to daily commuting.

Regional Highlights

- North America: This region represents a mature and significant market for bicycle disc brake rotors, driven by a strong culture of recreational and performance cycling, particularly in mountain biking and road cycling. High disposable incomes enable consumers to invest in premium bicycle components, fostering demand for advanced and lightweight rotor systems. The rapid adoption of e-bikes across various states and provinces further amplifies the need for robust and reliable braking solutions, making North America a key hub for both consumption and technological advancements in the sector.

- Europe: Europe stands as a leading market for bicycle disc brake rotors, characterized by deeply entrenched cycling cultures and extensive cycling infrastructure in countries like Germany, the Netherlands, and Scandinavia. The region is at the forefront of the e-bike revolution, with high penetration rates driving substantial demand for high-performance and durable rotors capable of handling increased bike weights and speeds. Urban mobility initiatives and a strong emphasis on cycling for both commuting and leisure ensure a continuous and growing market, making Europe a critical area for innovation and sales.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for bicycle disc brake rotors, primarily due to expanding manufacturing capabilities, particularly in China and Taiwan, which are global production hubs for bicycle components. Rising disposable incomes, increasing urbanization, and a growing interest in cycling for fitness, recreation, and commuting are fueling consumer demand across countries like India, Southeast Asia, and Australia. The burgeoning e-bike market in China and other Asian economies further contributes to the region's significant market expansion, presenting immense opportunities for market players.

- Latin America: This region is an emerging market for bicycle disc brake rotors, experiencing gradual but consistent growth. Increasing interest in cycling as a sport and a sustainable mode of transportation, coupled with improving economic conditions and investments in cycling infrastructure in countries like Brazil, Colombia, and Mexico, are driving the adoption of modern bicycles equipped with disc brakes. While smaller than other established markets, Latin America represents a promising frontier for market expansion as cycling culture continues to develop and thrive.

- Middle East and Africa (MEA): The MEA region demonstrates nascent but growing potential in the bicycle disc brake rotor market. Initiatives promoting outdoor activities, sports tourism, and improvements in cycling infrastructure, particularly in the UAE and Saudi Arabia, are slowly fostering a cycling culture. Although the market size is currently smaller compared to more developed regions, increasing awareness of cycling benefits and government support for health and wellness programs are expected to stimulate demand for advanced bicycle components, including disc brake rotors, in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Disc Brake Rotor Market.- Shimano Inc.

- SRAM LLC

- Magura GmbH

- Hope Technology Ltd.

- TRP Cycling (Tektro Racing Products)

- Formula S.p.A.

- Hayes Bicycle Group

- Campagnolo S.r.l.

- Tektro Technology Corp.

- Clarks Cycle Systems

- Braking S.p.A.

- Galfer Brakes

- SwissStop

- Zeno (Changzhou) Cycle Parts Co., Ltd.

- Ashima Ltd.

- Jagwire

- ProMax

- DT Swiss AG

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd.

Frequently Asked Questions

What are the primary advantages of disc brakes over rim brakes for bicycles?

Bicycle disc brakes offer superior stopping power, better modulation, and significantly more consistent performance in all weather conditions, especially in wet or muddy environments. They also reduce wear on wheel rims, potentially extending wheel lifespan, and allow for wider tire clearances, which is beneficial for gravel and mountain bikes.

Which materials are commonly used for bicycle disc brake rotors and why?

The most common material is high-grade stainless steel, valued for its durability, excellent heat resistance, and consistent performance. Some high-performance rotors integrate aluminum spiders with steel braking tracks for weight reduction and improved heat dissipation. Carbon fiber is used in niche, ultra-lightweight applications for competitive cycling, offering unique braking characteristics.

How often should bicycle disc brake rotors be replaced?

Rotor replacement frequency depends on several factors, including riding style, terrain, weather conditions, and brake pad material. Rotors typically have a minimum thickness specified by the manufacturer (e.g., 1.5mm). They should be replaced when they wear below this threshold, show signs of warping, excessive scoring, cracking, or other damage that compromises braking integrity or safety.

What is the impact of e-bikes on the bicycle disc brake rotor market?

The rapid growth of the e-bike segment has a profound positive impact on the disc brake rotor market. E-bikes, being heavier and capable of higher speeds, necessitate more powerful, durable, and heat-resistant braking systems than traditional bicycles. This drives increased demand for larger rotors (e.g., 180mm, 203mm) and innovations in materials and designs to manage greater braking forces and thermal loads effectively.

What are the key technological trends shaping the future of bicycle disc brake rotor design?

Key trends include the development of lighter and more advanced materials for improved heat dissipation and weight reduction (e.g., multi-piece designs, specialized alloys). There is also a focus on enhanced surface treatments for increased durability and reduced noise, as well as improved manufacturing precision for tighter tolerances. Future innovations might also explore smart integration with cycling electronics for real-time performance monitoring and adaptive braking systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager