Bioanalytical Testing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429687 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Bioanalytical Testing Services Market Size

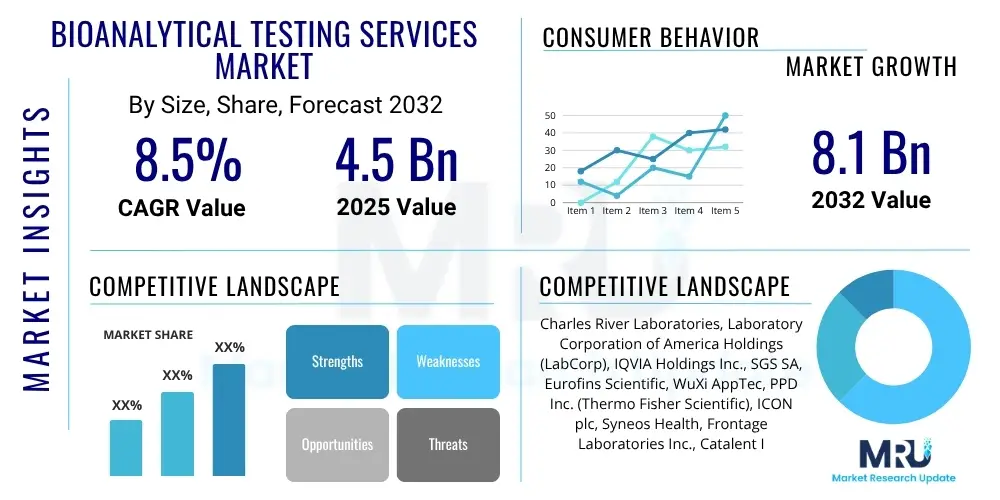

The Bioanalytical Testing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2032.

Bioanalytical Testing Services Market introduction

The Bioanalytical Testing Services Market encompasses a wide range of laboratory services critical for the discovery, development, and commercialization of pharmaceutical drugs and biologics. These services are essential for quantifying drugs, metabolites, and biomarkers in biological samples, assessing drug pharmacokinetics (PK) and pharmacodynamics (PD), evaluating immunogenicity, and supporting preclinical and clinical trials. The increasing complexity of drug molecules, especially biologics, and stringent regulatory requirements are primary drivers for the expansion of this market, which provides specialized expertise and advanced instrumentation to pharmaceutical and biotechnology companies globally.

The core product description within this market involves the precise measurement of analytes in complex biological matrices like blood, urine, or tissue. Major applications span from early-stage drug discovery, where compound screening and lead optimization are performed, through preclinical development for safety and efficacy assessment, to clinical trials for dose determination, patient monitoring, and regulatory submissions. The benefits derived from these services include accelerated drug development timelines, enhanced data accuracy and reliability, reduced in-house operational costs for drug developers, and ensuring compliance with global regulatory standards such as GLP (Good Laboratory Practice) and GCP (Good Clinical Practice).

Key driving factors for the Bioanalytical Testing Services Market include the robust growth in pharmaceutical research and development expenditure, particularly in oncology, rare diseases, and autoimmune disorders. The rising prevalence of chronic diseases necessitating novel therapeutic solutions, coupled with an increasing pipeline of biologics and biosimilars, further fuels demand. Additionally, the growing trend of outsourcing non-core activities by pharmaceutical companies to specialized Contract Research Organizations (CROs) for expertise and efficiency significantly contributes to market expansion. Technological advancements in analytical instrumentation, such as high-resolution mass spectrometry and automated immunoassay platforms, are also pivotal in enhancing the capabilities and scope of bioanalytical testing services.

Bioanalytical Testing Services Market Executive Summary

The Bioanalytical Testing Services Market is experiencing significant momentum driven by continuous innovation in drug development and a heightened focus on outsourcing specialized laboratory functions. Business trends indicate a strong inclination towards strategic partnerships and mergers and acquisitions among CROs to expand service portfolios, geographic reach, and technological capabilities. The increasing adoption of advanced analytical techniques, such as liquid chromatography-mass spectrometry (LC-MS/MS) for small molecules and ligand-binding assays (LBAs) for biologics, is a prominent trend enhancing the precision and efficiency of bioanalytical studies. Furthermore, the market is characterized by a shift towards personalized medicine and complex large molecule therapeutics, demanding more sophisticated and sensitive bioanalytical solutions.

Regional trends highlight North America and Europe as dominant markets due to well-established pharmaceutical industries, significant R&D investments, and stringent regulatory frameworks that mandate high-quality bioanalytical testing. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by increasing healthcare expenditure, a growing number of clinical trials, and the presence of cost-effective service providers. Latin America, the Middle East, and Africa are also showing promising growth, attracting investments due to their developing pharmaceutical sectors and expanding patient populations, although they currently hold smaller market shares.

In terms of segment trends, the market is primarily segmented by service type, molecule type, and end-user. Pharmacokinetic (PK) and pharmacodynamic (PD) studies consistently represent a large share of the service segment, given their critical role in drug safety and efficacy assessment. Immunogenicity testing, particularly for biologic drugs, is another rapidly expanding segment. The large molecule bioanalytical services segment is experiencing faster growth compared to small molecules, reflecting the global pharmaceutical industry's increasing focus on biologics. Contract Research Organizations (CROs) continue to be the dominant end-user segment, benefiting from the outsourcing trend and their specialized expertise. Academic and research institutes also contribute to market demand through early-stage research activities.

AI Impact Analysis on Bioanalytical Testing Services Market

User inquiries regarding AI's impact on the Bioanalytical Testing Services Market frequently revolve around its potential to revolutionize data analysis, accelerate drug development timelines, and enhance predictive modeling capabilities. Common themes include how AI can improve the accuracy and speed of biomarker identification, automate complex data interpretation, and reduce human error. Users are also concerned about the ethical implications of AI in clinical data, the need for robust validation protocols for AI-driven insights, and the potential for job displacement versus augmentation of human expertise. Expectations are high for AI to streamline workflows, identify novel therapeutic targets, and optimize experimental designs, ultimately leading to more efficient and cost-effective drug development processes, while also seeking clarification on implementation challenges and data integration complexities.

- Automated data analysis and interpretation, significantly reducing manual effort and processing time.

- Enhanced predictive modeling for drug efficacy, toxicity, and patient response, optimizing clinical trial design.

- Accelerated discovery of biomarkers and drug targets through advanced pattern recognition in large datasets.

- Improved quality control and error detection in bioanalytical assays, increasing reliability.

- Optimization of experimental protocols and resource allocation, leading to cost efficiencies.

- Facilitation of personalized medicine by analyzing individual patient data for tailored treatment strategies.

- Streamlined regulatory submissions through AI-powered data compilation and report generation.

- Development of intelligent laboratory information management systems (LIMS) for seamless data integration.

- Real-time monitoring and analysis of complex bioanalytical experiments.

- Augmentation of human analytical capabilities, allowing scientists to focus on higher-level problem-solving.

DRO & Impact Forces Of Bioanalytical Testing Services Market

The Bioanalytical Testing Services Market is significantly shaped by a confluence of driving forces, restraining factors, and emerging opportunities, all of which contribute to its dynamic impact landscape. Key drivers include the ever-increasing global pharmaceutical R&D expenditure, especially in the development of complex large molecule biologics and biosimilars, which require sophisticated and specialized bioanalytical support. The rising prevalence of chronic and infectious diseases globally necessitates continuous innovation in drug discovery, directly fueling the demand for comprehensive bioanalytical services. Furthermore, the growing trend of pharmaceutical and biotechnology companies outsourcing their non-core activities to specialized Contract Research Organizations (CROs) for cost-effectiveness, advanced expertise, and accelerated timelines is a major market catalyst.

Conversely, several restraints impede the market's full potential. The high cost associated with advanced bioanalytical instruments and the need for highly skilled personnel to operate them pose significant financial and operational challenges for service providers. Stringent regulatory guidelines, while ensuring quality and safety, also introduce complexities and delays in the drug development process, requiring extensive validation and documentation. Moreover, the shortage of qualified bioanalytical scientists and technicians globally can hinder the expansion capabilities of service providers, leading to recruitment challenges and increased operational costs. Data privacy and security concerns, especially with sensitive patient data in clinical trials, also represent a notable restraint that requires robust infrastructure and compliance.

Opportunities within the Bioanalytical Testing Services Market are abundant, primarily driven by technological advancements. The integration of artificial intelligence (AI) and machine learning (ML) for data analysis, predictive modeling, and automation presents significant avenues for enhancing efficiency, accuracy, and throughput. The expansion into emerging markets, particularly in the Asia Pacific region, offers lucrative growth prospects due to increasing healthcare investments, developing pharmaceutical industries, and a growing patient base. Furthermore, the rising demand for personalized medicine and biomarker-driven therapies creates new requirements for specialized bioanalytical assays and services, pushing the boundaries of current capabilities. Strategic collaborations and partnerships between CROs, pharmaceutical companies, and technology providers are also crucial opportunities for innovation and market penetration, enabling shared resources and expertise.

Segmentation Analysis

The Bioanalytical Testing Services Market is comprehensively segmented to address the diverse needs of the pharmaceutical and biotechnology industries. This segmentation provides a granular view of the market's structure, allowing for a deeper understanding of specific service demands, molecule types, and end-user applications. The primary categorization often includes services based on the analytical technique or study type, the nature of the drug molecule being analyzed, and the type of client or end-user leveraging these specialized laboratory functions. This multi-faceted approach ensures that all aspects of the market are covered, from early-stage research to late-stage clinical trials.

- By Service Type:

- ADME (Absorption, Distribution, Metabolism, Excretion) Studies

- Pharmacokinetics (PK) Studies

- Pharmacodynamics (PD) Studies

- Immunogenicity Testing

- Bioavailability and Bioequivalence Studies

- Cell-Based Assays

- Biomarker Analysis

- Method Development and Validation

- Other Bioanalytical Services

- By Molecule Type:

- Small Molecules

- Large Molecules (Biologics, Peptides, Vaccines, Gene Therapies)

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Medical Device Companies

- By Study Phase:

- Preclinical Studies

- Clinical Studies (Phase I, Phase II, Phase III, Phase IV)

- By Technology:

- Mass Spectrometry (LC-MS/MS, GC-MS)

- Immunoassays (ELISA, RIA, ECL)

- Chromatography (HPLC, UPLC)

- Flow Cytometry

- PCR-Based Assays

- Other Technologies

Value Chain Analysis For Bioanalytical Testing Services Market

The value chain for the Bioanalytical Testing Services Market is a complex ecosystem, starting with the upstream suppliers and extending to the downstream end-users, involving multiple critical stages and entities. Upstream analysis focuses on the providers of essential raw materials, reagents, consumables, and sophisticated analytical instruments necessary for bioanalytical testing laboratories. This includes manufacturers of mass spectrometers, HPLC systems, immunoassay kits, antibodies, and various laboratory chemicals. The quality and availability of these components directly impact the efficiency and accuracy of the bioanalytical services, making strong supplier relationships crucial for service providers.

At the core of the value chain are the bioanalytical testing service providers themselves, primarily Contract Research Organizations (CROs), and in-house pharmaceutical and biotechnology company laboratories. These entities perform the actual bioanalytical assays, method development, validation, sample analysis, and data interpretation. Their expertise, technological capabilities, and adherence to regulatory standards (GLP, GCP) are central to value creation. Downstream analysis involves the pharmaceutical and biotechnology companies that utilize these services to support their drug discovery, preclinical development, and clinical trial programs, ultimately leading to regulatory submissions and commercialization of new therapeutics. The efficiency of data transfer, reporting, and communication between service providers and drug developers is paramount in this stage.

Distribution channels in this market are predominantly direct and highly specialized. For CROs, the primary channel involves direct contracts and collaborations with pharmaceutical and biotech clients, often through dedicated business development teams and scientific liaison officers. These relationships are built on trust, demonstrated expertise, and successful project delivery. Indirect channels might include partnerships with other CROs for specific niche services or referral networks, though direct client engagement remains the dominant mode. The complexity and highly technical nature of bioanalytical testing necessitate a direct consultative approach to ensure alignment with client requirements and regulatory compliance throughout the drug development lifecycle.

Bioanalytical Testing Services Market Potential Customers

The primary potential customers and end-users of Bioanalytical Testing Services are entities heavily involved in the research, development, and manufacturing of pharmaceutical products, biologics, and medical devices. This includes a broad spectrum of organizations ranging from large multinational pharmaceutical corporations to emerging biotechnology startups. These customers require specialized analytical support for various stages of drug development, including early-stage discovery, preclinical safety and efficacy studies, and all phases of human clinical trials. Their demand is driven by the necessity to quantify drug concentrations, assess metabolism, evaluate immune responses, and identify biomarkers in biological matrices to ensure the safety and efficacy of novel therapeutic agents.

Contract Research Organizations (CROs) themselves can also be considered potential customers, particularly smaller CROs that may outsource highly specialized or niche bioanalytical assays to larger, more equipped CROs. This collaborative approach allows them to expand their service offerings without significant capital investment in specific technologies or expertise. Additionally, academic research institutions and government laboratories engaged in fundamental research and translational science are significant consumers of bioanalytical services, seeking to characterize novel compounds, understand disease mechanisms, and develop new diagnostic tools. Their requirements often focus on cutting-edge research and the analysis of complex biological samples for scientific publications and grant-funded projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles River Laboratories, Laboratory Corporation of America Holdings (LabCorp), IQVIA Holdings Inc., SGS SA, Eurofins Scientific, WuXi AppTec, PPD Inc. (Thermo Fisher Scientific), ICON plc, Syneos Health, Frontage Laboratories Inc., Catalent Inc., PRA Health Sciences (ICON plc), BioAgilytix Labs, QPS Holdings LLC, Celerion, Absorption Systems (Pharmaron), LGC Limited, Avance Biosciences, Intertek Group plc, Covance Inc. (LabCorp) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioanalytical Testing Services Market Key Technology Landscape

The Bioanalytical Testing Services Market is underpinned by a sophisticated and continuously evolving technology landscape, crucial for achieving high sensitivity, selectivity, and throughput in analyzing complex biological samples. Mass Spectrometry (MS) techniques, particularly Liquid Chromatography-Mass Spectrometry/Mass Spectrometry (LC-MS/MS), stand as a cornerstone for small molecule quantification due to their unparalleled sensitivity and specificity. Gas Chromatography-Mass Spectrometry (GC-MS) also plays a role for volatile analytes. These technologies enable precise measurement of drugs, metabolites, and endogenous compounds even at very low concentrations in diverse biological matrices, making them indispensable for pharmacokinetic and pharmacodynamic studies, as well as for drug metabolism investigations. The continuous development of higher resolution and faster MS platforms is a significant trend.

Immunoassay platforms, including Enzyme-Linked Immunosorbent Assays (ELISA), Radioimmunoassays (RIA), and Electrogenerated Chemiluminescence (ECL) assays, are critical for the quantification of large molecules such as proteins, peptides, and antibodies, as well as for immunogenicity testing. These methods leverage the specificity of antibody-antigen interactions to detect and quantify analytes, essential for biologic drug development and biomarker analysis. Advanced immunoassay systems offer automation, multiplexing capabilities, and enhanced sensitivity, allowing for the simultaneous measurement of multiple analytes from a single sample. The integration of robotics and automation in these platforms significantly increases throughput and reduces variability, thereby enhancing overall laboratory efficiency.

Beyond mass spectrometry and immunoassays, other vital technologies include High-Performance Liquid Chromatography (HPLC) and Ultra-Performance Liquid Chromatography (UPLC) for compound separation, Flow Cytometry for cell-based assays and immunophenotyping, and Polymerase Chain Reaction (PCR)-based assays for genetic and molecular analyses. High-throughput screening (HTS) systems enable rapid analysis of large numbers of samples, crucial for drug discovery and lead optimization. The adoption of Laboratory Information Management Systems (LIMS) and Electronic Lab Notebooks (ELN) for data management, integrity, and regulatory compliance is also a crucial aspect of the technological landscape, facilitating streamlined workflows, improved data traceability, and enhanced decision-making in bioanalytical laboratories. The synergy of these diverse technologies allows service providers to offer comprehensive and robust analytical solutions.

Regional Highlights

- North America: This region consistently holds the largest share of the Bioanalytical Testing Services Market, driven by the presence of a robust pharmaceutical and biotechnology industry, significant R&D investments, and a high concentration of leading CROs. Stringent regulatory frameworks by agencies like the FDA necessitate comprehensive and high-quality bioanalytical testing, further fueling market growth. The region benefits from strong government support for life sciences research and a highly skilled workforce, making it a hub for innovation and advanced drug development.

- Europe: Europe represents another substantial market for bioanalytical testing, characterized by a well-established pharmaceutical sector, increasing R&D activities, and supportive regulatory bodies such as the EMA. Countries like Germany, the UK, France, and Switzerland are at the forefront of pharmaceutical innovation, driving demand for specialized bioanalytical services. The region also benefits from a strong academic research base and a growing focus on personalized medicine and biologics.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, primarily due to increasing healthcare expenditure, a rising number of clinical trials, and the presence of a large patient pool. Countries like China, India, and Japan are becoming attractive destinations for drug development and outsourcing due to cost-effectiveness, growing scientific expertise, and supportive government initiatives. The expansion of domestic pharmaceutical and biotechnology companies further contributes to the robust growth in this region.

- Latin America: This region is an emerging market for bioanalytical testing services, experiencing growth driven by expanding pharmaceutical industries, improving healthcare infrastructure, and increasing foreign investments. Countries like Brazil and Mexico are witnessing a rise in clinical research activities and a growing demand for advanced analytical support, albeit from a smaller base compared to developed regions.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth in the bioanalytical testing market. This growth is primarily attributable to increasing government initiatives in healthcare, rising awareness about drug development, and a growing emphasis on pharmaceutical manufacturing. While still a nascent market, investments in healthcare infrastructure and R&D are expected to contribute to its future expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioanalytical Testing Services Market.- Charles River Laboratories

- Laboratory Corporation of America Holdings (LabCorp)

- IQVIA Holdings Inc.

- SGS SA

- Eurofins Scientific

- WuXi AppTec

- PPD Inc. (Thermo Fisher Scientific)

- ICON plc

- Syneos Health

- Frontage Laboratories Inc.

- Catalent Inc.

- BioAgilytix Labs

- QPS Holdings LLC

- Celerion

- Absorption Systems (Pharmaron)

- LGC Limited

- Avance Biosciences

- Intertek Group plc

- Covance Inc. (LabCorp)

Frequently Asked Questions

What is bioanalytical testing and why is it important?

Bioanalytical testing involves quantifying drugs, metabolites, and biomarkers in biological samples to support drug discovery, development, and clinical trials. It is crucial for assessing drug safety, efficacy, pharmacokinetics, and pharmacodynamics, ensuring regulatory compliance and accelerating new therapeutic approvals.

Which factors are driving the growth of the Bioanalytical Testing Services Market?

Key drivers include increasing R&D expenditure in pharmaceuticals, the rising prevalence of chronic diseases, a growing pipeline of biologics and biosimilars, and the increasing trend of outsourcing specialized analytical services to Contract Research Organizations (CROs) for efficiency and expertise.

What role does technology play in bioanalytical testing?

Advanced technologies like LC-MS/MS, immunoassays, and automated systems are fundamental for high sensitivity, specificity, and throughput in bioanalysis. They enable precise quantification of analytes, accelerate sample processing, reduce errors, and are vital for complex molecule analysis and regulatory compliance.

Which regions dominate the Bioanalytical Testing Services Market?

North America and Europe currently dominate the market due to robust pharmaceutical industries, significant R&D investments, and stringent regulatory environments. However, the Asia Pacific region is emerging as the fastest-growing market, driven by increasing healthcare expenditure and outsourcing trends.

What are the challenges faced by the Bioanalytical Testing Services Market?

Challenges include the high cost of advanced analytical instrumentation, the shortage of skilled bioanalytical scientists, the complexity of evolving regulatory guidelines, and the need for continuous investment in new technologies and talent to maintain competitive edge and meet diverse client demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager