Biocontrol Agents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428274 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Biocontrol Agents Market Size

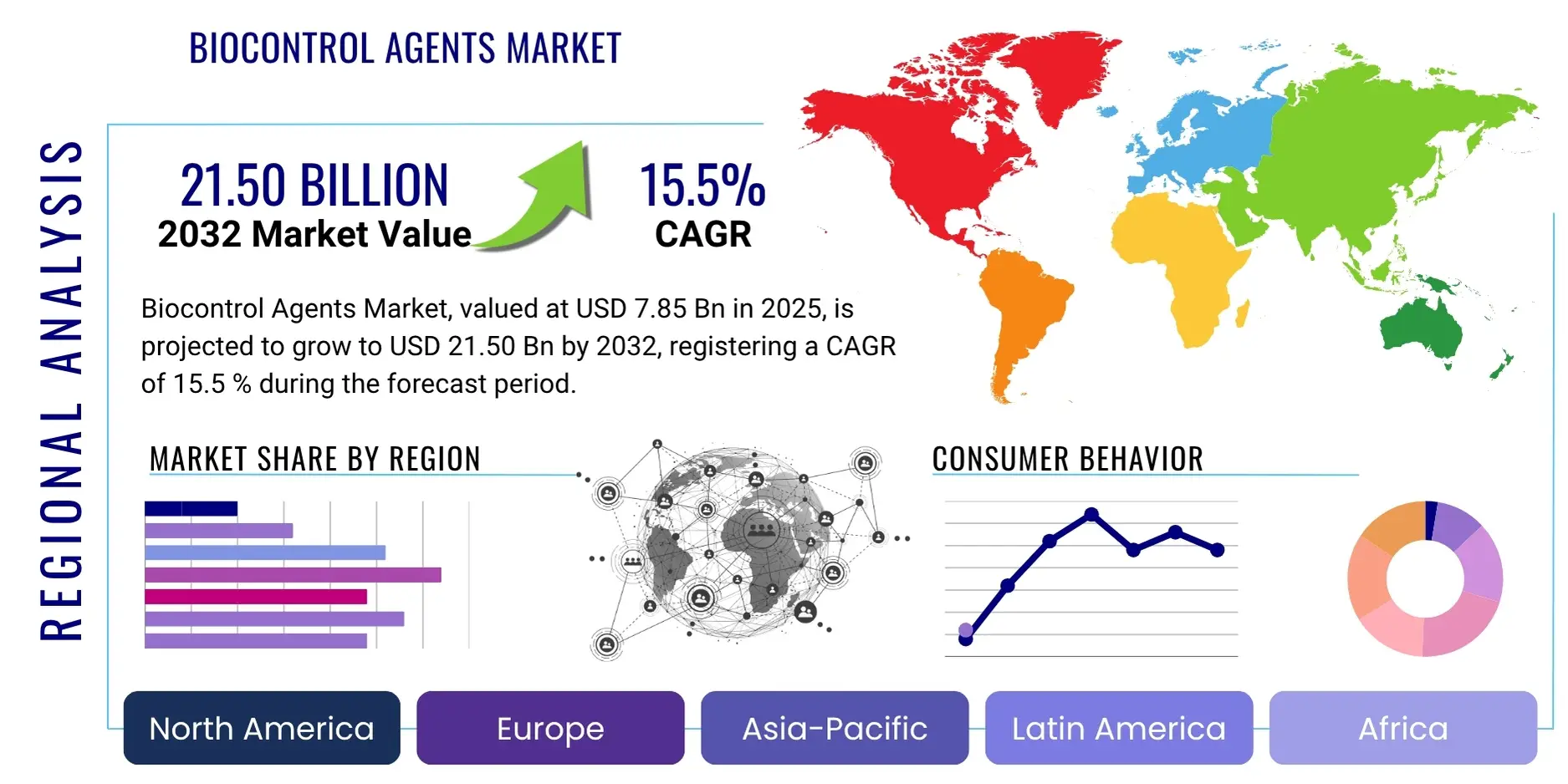

The Biocontrol Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2025 and 2032. The market is estimated at USD 7.85 Billion in 2025 and is projected to reach USD 21.50 Billion by the end of the forecast period in 2032. This substantial growth underscores the increasing global shift towards sustainable agricultural practices and the escalating demand for environmentally friendly crop protection solutions. The market expansion is primarily driven by heightened awareness regarding the adverse effects of synthetic pesticides, coupled with supportive regulatory frameworks promoting biological alternatives.

Biocontrol Agents Market introduction

Biocontrol agents encompass a diverse range of natural enemies, antagonists, or competitors used to suppress pest populations, diseases, and weeds in agriculture, forestry, and public health. These agents leverage biological mechanisms, such as predation, parasitism, herbivory, or competition, to manage pests without relying on synthetic chemicals. The market is broadly categorized into macrobials, which include beneficial insects and mites; microbials, comprising bacteria, fungi, viruses, and nematodes; and biochemicals, derived from naturally occurring substances like plant extracts and pheromones. These products are increasingly being adopted across a wide array of agricultural applications, including field crops, fruits, vegetables, ornamentals, and post-harvest protection.

The primary benefit of biocontrol agents lies in their ability to offer targeted pest management, minimizing harm to non-target organisms and reducing environmental pollution. They contribute significantly to integrated pest management (IPM) strategies by reducing the chemical load in ecosystems and promoting biodiversity. Furthermore, biocontrol agents help in mitigating issues such as pesticide resistance, which has become a growing concern with conventional agrochemicals. The driving forces behind the market's robust growth include the accelerating demand for organic and residue-free food products by health-conscious consumers, stringent environmental regulations restricting the use of chemical pesticides, and the increasing incidence of pest resistance to conventional treatments. Advancements in biological research and formulation technologies are further enhancing the efficacy and commercial viability of these sustainable solutions.

Major applications of biocontrol agents span a multitude of agricultural sectors. In horticulture, they are crucial for protecting high-value crops like fruits and vegetables from pests and diseases, ensuring produce quality and marketability. For field crops such as cereals, oilseeds, and pulses, biocontrol agents are integrated into seed treatments and foliar applications to safeguard yields. Beyond crop protection, these agents also find utility in soil health improvement, nutrient cycling, and enhancing plant resilience to various biotic and abiotic stresses, thereby fostering a holistic approach to sustainable agriculture. The rising investment in research and development, coupled with strategic collaborations between biotechnology firms and agrochemical giants, is paving the way for novel and more effective biocontrol solutions, solidifying their role in modern farming practices.

Biocontrol Agents Market Executive Summary

The Biocontrol Agents Market is experiencing a period of significant growth and transformation, driven by a confluence of evolving business trends, distinct regional dynamics, and emerging segment-specific developments. Business trends highlight a strong emphasis on innovation, with substantial investments flowing into research and development to discover and commercialize new biological strains and advanced formulation techniques. Strategic partnerships and acquisitions are becoming increasingly common, as larger agrochemical companies seek to integrate biological solutions into their portfolios and smaller innovative biopesticide firms look for broader market access and scaling capabilities. Furthermore, there's a growing focus on digital agriculture, where data analytics and precision application technologies are enhancing the efficacy and adoption of biocontrol agents, improving their competitiveness against synthetic alternatives.

Regional trends reveal varied adoption rates and market maturity across different geographies. North America and Europe currently represent leading markets, characterized by stringent regulations on chemical pesticides, strong consumer demand for organic products, and robust research infrastructure. These regions are at the forefront of implementing integrated pest management (IPM) strategies that heavily incorporate biocontrol solutions. The Asia Pacific region, particularly countries like China, India, and Australia, is poised for rapid growth due to expanding agricultural land, increasing awareness among farmers, and supportive government initiatives promoting sustainable farming. Latin America also presents significant opportunities, driven by its vast agricultural acreage dedicated to export-oriented crops and a growing inclination towards sustainable practices to meet international market standards.

Segment trends indicate dynamic shifts within the biocontrol agents market. The microbial segment, especially bacteria and fungi, continues to dominate due to their broad-spectrum activity and adaptability to various application methods. However, the macrobial segment, including beneficial insects and mites, is also experiencing steady growth, particularly in protected agriculture environments like greenhouses. Biochemicals, such as pheromones and plant extracts, are gaining traction due to their high specificity and minimal environmental impact, offering precise solutions for certain pest challenges. Moreover, advancements in genetically engineered biocontrol agents, though controversial in some regions, are emerging as a frontier, promising enhanced efficacy and novel modes of action. The integration of different biocontrol agent types into comprehensive pest management programs is a key strategy driving market evolution.

AI Impact Analysis on Biocontrol Agents Market

Common user questions regarding AI's impact on the Biocontrol Agents Market frequently revolve around how artificial intelligence can enhance the discovery of new agents, optimize their application for greater efficacy, predict pest outbreaks with higher accuracy, and ultimately reduce the reliance on human intervention in complex agricultural systems. Users are keen to understand if AI can accelerate the development pipeline for biocontrol solutions, making them more competitive with faster-acting chemical alternatives. There is also significant interest in AI's role in precision agriculture, enabling the targeted deployment of biocontrol agents to minimize waste and maximize their impact. Concerns often touch upon the initial investment costs, the complexity of implementing AI-driven systems, and the need for robust data infrastructure to support these advanced technologies, alongside the potential for job displacement in traditional agricultural roles due to automation.

- AI-driven discovery and identification of novel biocontrol agents and targets.

- Predictive analytics for early detection of pest and disease outbreaks, enabling proactive biocontrol application.

- Optimization of biocontrol agent formulation, dosage, and timing through machine learning algorithms.

- Precision agriculture integration for targeted application of biocontrols using drones and robotics.

- Automated monitoring and assessment of biocontrol efficacy in real-time.

- Development of smart decision-support systems for farmers to select appropriate biocontrol strategies.

- Enhanced understanding of pest-host-agent interactions through advanced data analysis.

- Streamlined supply chain management and inventory optimization for biological products.

- Facilitation of digital platforms for knowledge sharing and farmer education on biocontrol best practices.

- Accelerated research and development cycles for new biological crop protection solutions.

DRO & Impact Forces Of Biocontrol Agents Market

The Biocontrol Agents Market is shaped by a critical interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that collectively dictate its trajectory and growth potential. Key drivers include the escalating global demand for organic and residue-free agricultural produce, which inherently favors biological pest management solutions over synthetic pesticides. Concurrently, increasing environmental awareness and stringent governmental regulations worldwide are phasing out many conventional chemical pesticides, creating a regulatory push for sustainable alternatives. Furthermore, the pervasive issue of pest resistance to established chemical treatments necessitates the adoption of novel modes of action offered by biocontrol agents. The integration of biocontrol solutions into comprehensive Integrated Pest Management (IPM) strategies is also a significant driver, promoting a holistic and environmentally sound approach to crop protection. Farmers are increasingly recognizing the long-term benefits of improved soil health and biodiversity that biocontrol agents offer, further propelling adoption.

However, several restraints pose challenges to the market's unbridled expansion. High research and development costs associated with identifying, developing, and commercializing new biocontrol agents often translate into higher product prices compared to some generic chemical alternatives, which can deter price-sensitive farmers. The relatively slower mode of action of many biological agents, especially when compared to the immediate knock-down effect of synthetic pesticides, can be a hurdle for farmers facing acute pest infestations. Furthermore, the limited shelf life and specific storage conditions required for many living biological products present logistical challenges in distribution and application. A lack of widespread awareness and technical knowledge among farmers, particularly in developing regions, regarding the proper application and benefits of biocontrol agents also acts as a significant restraint, limiting broader market penetration. Public perception and regulatory complexities related to novel biological products, including genetically modified organisms used for biocontrol, can also slow market acceptance.

Despite these restraints, substantial opportunities exist for market players to capitalize on. Emerging markets in Asia Pacific, Latin America, and Africa, with their large agricultural bases and increasing focus on sustainable farming, represent untapped potential for growth. The development of novel biocontrol agents targeting a wider range of pests and diseases, including those previously difficult to manage biologically, presents significant innovation opportunities. Furthermore, the integration of biocontrol agents with advanced agricultural technologies such as precision farming, drones, and AI-driven predictive analytics can enhance their efficacy and ease of use, creating new market avenues. Impact forces, such as global climate change leading to shifts in pest distribution and increased incidence of certain diseases, necessitate adaptable and resilient crop protection strategies, further highlighting the relevance of biocontrol. Persistent concerns over food security and quality, coupled with evolving consumer preferences for sustainable food systems, will continue to exert pressure on agricultural practices to adopt more environmentally friendly solutions, fundamentally impacting the long-term trajectory of the biocontrol agents market.

Segmentation Analysis

The Biocontrol Agents Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics, reflecting the varied product types, target applications, and geographical considerations that influence market growth. These segmentations enable stakeholders to identify specific growth drivers, competitive landscapes, and unmet needs within distinct market niches. The primary segmentation dimensions typically include the type of biocontrol agent, the crop type it is applied to, the mode of application, and the specific pest target, each revealing unique market characteristics and growth trajectories. Understanding these segments is crucial for strategic planning, product development, and market entry decisions, allowing companies to tailor their offerings to specific agricultural challenges and regional demands.

- By Product Type

- Microbials

- Bacteria (e.g., Bacillus thuringiensis, Pseudomonas)

- Fungi (e.g., Trichoderma, Beauveria bassiana, Metarhizium anisopliae)

- Viruses (e.g., Baculoviruses)

- Nematodes (e.g., Entomopathogenic Nematodes)

- Macrobials

- Insects (e.g., Ladybugs, Parasitic wasps)

- Mites (e.g., Predatory mites)

- Biochemicals

- Pheromones (e.g., Mating disruption, Lure and Kill)

- Plant Extracts (e.g., Neem oil, Pyrethrum)

- Growth Regulators

- Microbials

- By Crop Type

- Fruits and Vegetables

- Grains and Cereals

- Pulses and Oilseeds

- Ornamentals and Turf

- Forestry

- Others (e.g., Cotton, Sugarcane)

- By Application

- Seed Treatment

- Soil Treatment

- Foliar Spray

- Post-Harvest

- Greenhouse Applications

- Field Applications

- By Target Pest

- Insect Pests

- Plant Pathogens (Fungal, Bacterial, Viral)

- Weeds

- Nematodes

- By Formulation

- Liquid Formulations

- Solid Formulations (e.g., Granules, Wettable Powders)

Value Chain Analysis For Biocontrol Agents Market

The value chain for the Biocontrol Agents Market is a multi-layered ecosystem, commencing with upstream activities focused on the discovery and production of active biological ingredients, extending through formulation, distribution, and ultimately reaching the end-users. Upstream analysis involves research and development efforts to identify new microbial strains, beneficial insects, or natural compounds with pest control capabilities. This stage also includes the mass production of these biological entities, often requiring specialized fermentation processes for microorganisms or rearing facilities for macroorganisms, alongside the sourcing of raw materials for biochemicals. Key players at this stage include research institutions, biotech startups, and specialized ingredient manufacturers. Efficiency in R&D and scalable production methods are critical for cost-effectiveness and market competitiveness.

Midstream activities primarily focus on the formulation and manufacturing of the final biocontrol products. This involves stabilizing the active biological ingredients, enhancing their shelf life, and developing user-friendly formulations (e.g., wettable powders, liquid concentrates, granules) suitable for various application methods. Companies at this stage also conduct extensive trials to ensure product efficacy, safety, and regulatory compliance. Packaging and branding are also significant elements here, influencing market acceptance and differentiation. Robust quality control and adherence to regulatory standards are paramount to maintain product integrity and build grower trust.

Downstream analysis encompasses the intricate distribution channels that deliver biocontrol agents from manufacturers to end-users, predominantly farmers and agricultural operations. Distribution can occur through various routes: direct sales channels involve manufacturers selling directly to large agricultural enterprises or through their own sales force; indirect channels rely on a network of distributors, retailers, and cooperatives. Specialized agricultural input retailers, extension services, and agronomy consultants play a crucial role in disseminating information and providing technical support to farmers regarding the proper selection and application of biocontrol products. The choice of distribution channel significantly impacts market reach, logistical efficiency, and responsiveness to regional demands. Effective collaboration between manufacturers and distributors is essential for cold chain management and ensuring product viability until it reaches the field.

Biocontrol Agents Market Potential Customers

The potential customers for biocontrol agents span a broad spectrum of agricultural stakeholders and entities increasingly focused on sustainable and environmentally responsible practices. At the forefront are commercial farmers, including large-scale conventional farms and a rapidly growing segment of organic farmers, who are under pressure to reduce chemical inputs, comply with stricter regulations, and meet consumer demand for residue-free produce. These growers utilize biocontrol agents for pest, disease, and weed management across diverse crop types such as fruits, vegetables, grains, cereals, and oilseeds, seeking solutions that maintain yields while enhancing environmental stewardship. Greenhouse operators and nurseries represent another significant customer base, where controlled environments often favor biological controls for their safety profile and ability to prevent resistance development in confined spaces.

Beyond traditional crop agriculture, the forestry sector represents a valuable customer segment, employing biocontrol agents for managing insect pests and diseases that threaten timber resources and forest health. Public and private pest control services also leverage biocontrol solutions for managing pests in urban environments, parks, and landscapes, offering sustainable alternatives to chemical sprays in sensitive areas. Additionally, companies involved in post-harvest protection, aiming to extend the shelf life of produce without chemical residues, are emerging as key end-users. The trend towards integrated pest management (IPM) further expands the customer base to any grower or entity looking for a holistic approach to pest management, combining various methods, including biological, cultural, and chemical tactics, in a balanced and sustainable manner. As awareness of sustainable agriculture grows, educational institutions and governmental agricultural bodies also act as influential customers, driving research and adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.85 Billion |

| Market Forecast in 2032 | USD 21.50 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, Certis Biologicals, Koppert Biological Systems, Novozymes A/S, Andermatt Biocontrol AG, Biobest Group NV, Nufarm Ltd, Sumitomo Chemical Co., Ltd., Valent BioSciences LLC, Adama Agricultural Solutions Ltd., Lallemand Plant Care, Futureco Bioscience, Aphea.Bio, Chr. Hansen Holding A/S, Marrone Bio Innovations (now Bioceres Crop Solutions), FMC Corporation, Gowan Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biocontrol Agents Market Key Technology Landscape

The Biocontrol Agents Market is characterized by a rapidly evolving technological landscape, driven by innovation aimed at enhancing efficacy, stability, and commercial viability of biological solutions. A cornerstone of this landscape is advanced fermentation technology, crucial for the large-scale, cost-effective production of microbial biocontrol agents such as bacteria, fungi, and viruses. breakthroughs in bioreactor design and media optimization are leading to higher yields and lower production costs. Similarly, sophisticated mass rearing techniques are continuously being refined for macrobial agents, ensuring a consistent supply of healthy, effective beneficial insects and mites. These production technologies are critical for meeting the growing global demand and achieving economies of scale.

Formulation science represents another vital technological domain. Biocontrol agents, particularly living organisms, are inherently sensitive to environmental stresses like UV radiation, temperature fluctuations, and desiccation. Advanced formulation technologies, including microencapsulation, oil dispersions, and specialized granular formulations, are employed to protect the active ingredients, extend their shelf life, and improve their viability and performance under field conditions. These innovations are crucial for overcoming traditional limitations of biological products, making them more robust and user-friendly for farmers. Furthermore, research into novel delivery systems, such as seed treatments that ensure prolonged protection from germination, and drone-based application systems for precision spraying, are revolutionizing how biocontrol agents are applied.

Emerging technologies like genetic engineering and synthetic biology are opening new frontiers in biocontrol. While subject to stringent regulatory review and public acceptance, techniques such as CRISPR-Cas9 are being explored to enhance the virulence of microbial agents, improve the pest-targeting capabilities of beneficial insects, or engineer plants for increased resistance to pests and diseases. Beyond the organisms themselves, the integration of digital technologies, including Artificial Intelligence (AI) and Machine Learning (ML), is profoundly impacting the market. AI-powered platforms aid in the discovery of new biological agents by analyzing vast datasets, predict pest outbreaks with greater accuracy, and optimize application strategies for maximum effect. Robotics and autonomous vehicles equipped with sensors are also facilitating precision application, ensuring that biocontrol agents are deployed exactly where and when they are needed, enhancing efficiency and reducing waste, thus transforming the overall efficacy and adoption potential of biocontrol solutions.

Regional Highlights

- North America: This region stands as a dominant force in the biocontrol agents market, driven by a strong emphasis on sustainable agriculture, high consumer demand for organic produce, and a well-established regulatory framework that supports biological solutions. The U.S. and Canada are leaders in adopting Integrated Pest Management (IPM) strategies, with significant investments in research and development, and a strong presence of key market players. Growth is particularly robust in the fruit and vegetable sectors, and increasingly in field crops, propelled by pesticide resistance issues and environmental concerns.

- Europe: Europe represents another mature and rapidly expanding market, characterized by some of the world's most stringent regulations on synthetic pesticides, particularly under the European Green Deal. Countries like Spain, France, Italy, and the Netherlands are at the forefront of biocontrol adoption, especially in greenhouse horticulture and high-value crops. Supportive government policies, strong consumer awareness about food safety and environmental impact, and proactive research initiatives are key drivers in this region.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for biocontrol agents, fueled by its vast agricultural land, increasing population, and growing awareness of sustainable farming practices. Countries such as China, India, Australia, and Japan are investing heavily in modernizing their agriculture sectors, and there is a rising demand for biological solutions to address food security concerns and reduce the environmental footprint of farming. Government subsidies and initiatives promoting organic farming and IPM are significant accelerators here, despite challenges related to infrastructure and farmer education.

- Latin America: This region presents immense growth potential due to its large-scale agricultural exports, particularly of fruits, vegetables, and cash crops like coffee and sugarcane. Countries like Brazil, Argentina, and Mexico are increasingly adopting biocontrol agents to meet international market standards for low-residue produce and to combat pesticide resistance. The availability of diverse climates and rich biodiversity also provides opportunities for the discovery and application of native biocontrol solutions, making it a highly dynamic market.

- Middle East and Africa (MEA): The MEA region is an emerging market, with adoption primarily driven by the need for sustainable agricultural practices in arid and semi-arid conditions, food security concerns, and the growing influence of international agricultural standards. While still nascent, increased government investment in modernizing agriculture, particularly in Gulf Cooperation Council (GCC) countries and parts of South Africa, is fostering the adoption of protected agriculture and biocontrol solutions to optimize resource use and improve crop yields.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biocontrol Agents Market.- Bayer AG

- Syngenta AG

- BASF SE

- Corteva Agriscience

- Certis Biologicals

- Koppert Biological Systems

- Novozymes A/S

- Andermatt Biocontrol AG

- Biobest Group NV

- Nufarm Ltd

- Sumitomo Chemical Co., Ltd.

- Valent BioSciences LLC

- Adama Agricultural Solutions Ltd.

- Lallemand Plant Care

- Futureco Bioscience

- Aphea.Bio

- Chr. Hansen Holding A/S

- Bioceres Crop Solutions (Marrone Bio Innovations)

- FMC Corporation

- Gowan Company

Frequently Asked Questions

Analyze common user questions about the Biocontrol Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are biocontrol agents and how do they work?

Biocontrol agents are natural enemies or competitors of pests, diseases, and weeds. They work by various biological mechanisms such as predation, parasitism, competition, or pathogenicity to suppress pest populations, offering a sustainable alternative to chemical pesticides.

What are the main types of biocontrol agents available in the market?

The primary types include microbials (e.g., bacteria, fungi, viruses, nematodes), macrobials (e.g., beneficial insects, mites), and biochemicals (e.g., pheromones, plant extracts). Each type offers distinct modes of action for targeted pest management.

What are the key benefits of using biocontrol agents in agriculture?

Key benefits include reduced environmental impact, minimized chemical residues on crops, mitigation of pesticide resistance, enhanced biodiversity, improved soil health, and safer conditions for farm workers. They support sustainable and organic farming practices.

What challenges does the biocontrol agents market face?

Challenges include high research and development costs, the slower action of some agents compared to chemicals, limited shelf life and specific storage requirements, and a lack of widespread farmer awareness or technical knowledge about optimal application.

How is AI impacting the future of biocontrol agents?

AI is transforming biocontrol by aiding in the discovery of new agents, optimizing application strategies for precision farming, providing predictive analytics for pest outbreaks, and enhancing the overall efficiency and effectiveness of biological pest management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager