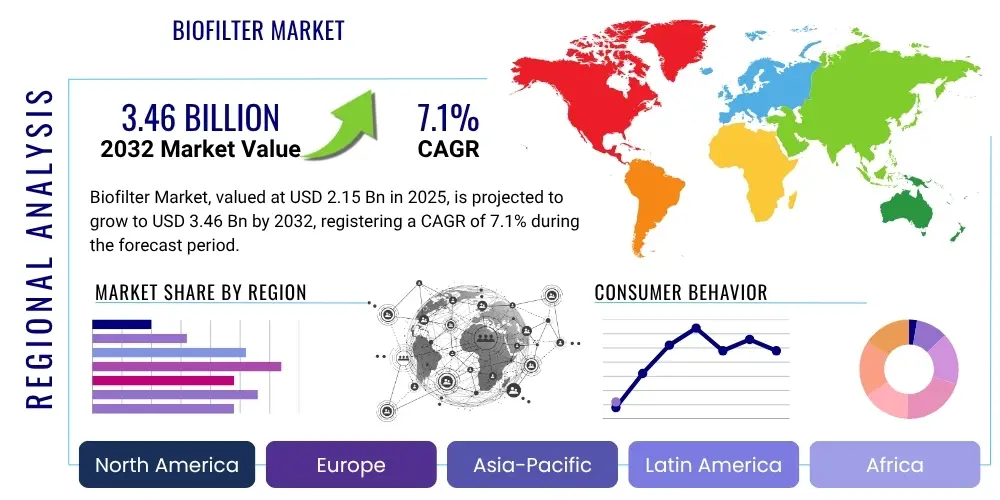

Biofilter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430870 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Biofilter Market Size

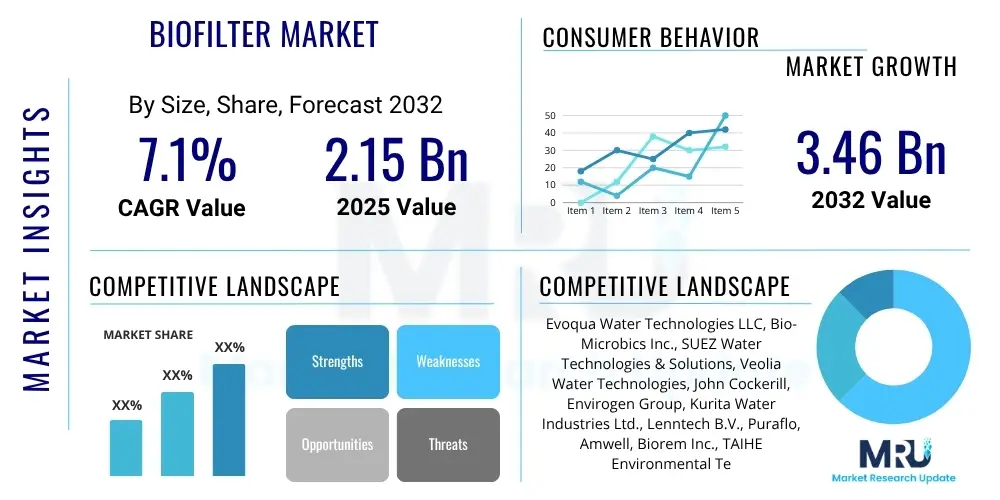

The Biofilter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2025 and 2032. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 3.46 Billion by the end of the forecast period in 2032.

Biofilter Market introduction

Biofilters represent an advanced and environmentally responsible technology crucial for the purification of contaminated air and water streams. Their fundamental operation relies on biological processes, where specialized microorganisms are cultivated on a porous packing material, forming a biofilm. As polluted gases or liquids pass through this media, the microorganisms metabolize and degrade a wide array of organic and inorganic pollutants, transforming them into harmless byproducts like carbon dioxide and water. This natural remediation method distinguishes biofilters from traditional physicochemical treatment systems by offering a sustainable and often more cost-effective solution for pollution control. Their efficacy in removing volatile organic compounds (VOCs), hydrogen sulfide (H2S), ammonia, and other odorous or toxic substances makes them indispensable across various industrial and municipal applications.

The product description encompasses a range of designs including open-bed biofilters, biotrickling filters, and bioscrubbers, each tailored for specific pollutant loads and operational requirements. Key components typically include a robust housing, a packing media (such as peat, wood chips, compost, or synthetic materials), a humidification system to maintain microbial activity, and a drainage system. Major applications span municipal wastewater treatment, industrial exhaust air treatment, odor control in landfills and composting facilities, and purification of air in the chemical, pharmaceutical, food and beverage, and petrochemical industries. These systems are adept at handling large volumes of gas or liquid with low to moderate pollutant concentrations, providing consistent and reliable performance.

The benefits of biofilters are multifaceted, extending beyond mere pollution abatement to include significant environmental and economic advantages. Environmentally, they offer a green technology solution by avoiding the use of hazardous chemicals, minimizing secondary waste production, and contributing to a circular economy through natural degradation processes. Economically, their operational costs are typically lower than those of conventional treatment methods, primarily due to reduced energy consumption and lower sludge disposal expenses, despite potentially higher initial capital outlays. Driving factors for market growth include increasingly stringent environmental regulations worldwide that mandate lower emission limits for industrial and municipal sources, a heightened global awareness regarding air and water quality and its impact on public health, and the continuous industrial expansion in emerging economies which generates a greater volume of pollutants requiring effective treatment solutions. Furthermore, advancements in biofilter media and process control systems are enhancing their efficiency and applicability, fueling market adoption.

Biofilter Market Executive Summary

The Biofilter Market is currently experiencing robust growth driven by a confluence of evolving business trends, significant regional developments, and dynamic shifts within its core segments. Business trends indicate a strong emphasis on sustainability and cost-efficiency, compelling industries to adopt biological treatment methods over chemical or physical alternatives. There is a growing inclination towards integrated pollution control systems, where biofilters form a crucial component of a multi-stage treatment process, enhancing overall efficiency and compliance. Furthermore, digital transformation is permeating the biofilter sector, with increased adoption of automation and real-time monitoring technologies to optimize performance and reduce manual intervention. Companies are investing in research and development to create advanced biofilter media with higher pollutant removal efficiencies and longer lifespans, alongside developing modular and scalable biofilter solutions to cater to diverse industrial needs. The market is also witnessing a rise in strategic partnerships and collaborations aimed at innovation and expanding geographical reach, particularly in nascent markets.

Regional trends highlight distinct growth patterns and regulatory environments. North America and Europe continue to be dominant markets, primarily due to strict environmental regulations, well-established industrial infrastructure, and a high level of environmental consciousness. These regions are characterized by a strong demand for advanced and efficient biofilter systems for both municipal and industrial applications. Asia Pacific is emerging as the fastest-growing market, propelled by rapid industrialization, urbanization, increasing environmental pollution levels, and the gradual strengthening of environmental policies in countries like China, India, and Southeast Asian nations. Latin America and the Middle East and Africa regions are also showing promising growth, albeit from a smaller base, driven by infrastructure development projects and rising awareness of environmental protection. Local governments and industries in these regions are increasingly seeking cost-effective and sustainable solutions for air and water pollution control.

Segment trends reveal a continued dominance of wastewater treatment applications, although air purification and odor control are rapidly gaining traction. Within wastewater, municipal sewage treatment plants constitute a major demand source, alongside industrial wastewater from sectors such as food and beverage, pulp and paper, and chemical manufacturing. The air purification segment is experiencing accelerated growth due to escalating concerns over industrial emissions of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs), as well as odor nuisance from various sources. The demand for biofilters based on organic media remains significant due to their cost-effectiveness and natural origin, but there is an increasing shift towards synthetic and composite media which offer advantages in terms of durability, porosity, and specific surface area, leading to enhanced performance and reduced footprint. The market is also seeing innovation in biotrickling filters and bioscrubbers, which offer better control over operating conditions and are suitable for higher pollutant concentrations.

AI Impact Analysis on Biofilter Market

Users frequently inquire about how artificial intelligence (AI) can revolutionize the operational efficiency and performance of biofilter systems, expressing expectations for enhanced monitoring, predictive maintenance, and optimized pollutant removal. Common questions revolve around AI's capacity to analyze complex sensor data for real-time adjustments, identify potential system failures before they occur, and improve the overall sustainability of biological treatment processes. There is a keen interest in understanding the tangible benefits AI integration could bring, such as reduced energy consumption, lower operational costs, and extended media lifespan. However, users also voice concerns regarding the initial investment required for AI implementation, the complexity of integrating AI with existing infrastructure, and the need for specialized expertise to manage and interpret AI-driven insights. Data privacy and security, particularly when dealing with critical infrastructure, are also emerging as significant themes, alongside the desire for clear return on investment (ROI) metrics and case studies demonstrating successful AI applications in this domain. Overall, there is a strong optimistic outlook tempered by practical implementation challenges and the need for robust, user-friendly solutions.

- AI-driven real-time monitoring and control for optimal microbial activity.

- Predictive maintenance analytics for early detection of operational anomalies and equipment failure.

- Optimization of nutrient dosing and humidification for enhanced pollutant degradation efficiency.

- Automated data analysis from sensors for dynamic adjustment of airflow and media conditions.

- Improved energy efficiency through intelligent fan speed and pump control based on load.

- Enhanced process stability and resilience against fluctuating pollutant concentrations.

- Development of smart biofilter systems with self-learning capabilities for continuous improvement.

- Forecasting of media replacement schedules to minimize downtime and operational costs.

- Remote diagnostic capabilities, enabling off-site troubleshooting and expert support.

DRO & Impact Forces Of Biofilter Market

The Biofilter Market is profoundly shaped by a dynamic interplay of drivers, restraints, opportunities, and powerful external forces that collectively influence its growth trajectory and adoption rates. Key drivers propelling market expansion include the increasingly stringent environmental regulations imposed by governmental bodies worldwide, which mandate industries and municipalities to significantly reduce their emissions of air pollutants such as volatile organic compounds (VOCs), hydrogen sulfide (H2S), and ammonia, as well as ensure the purity of discharged wastewater. Alongside regulatory pressure, the accelerating pace of industrialization and urbanization, particularly in developing economies, generates a greater volume of diverse pollutants, thereby creating an inherent demand for effective and sustainable treatment solutions. Furthermore, heightened public awareness concerning air and water quality and its direct impact on human health and ecosystems is fostering a proactive approach towards pollution control, driving both corporate responsibility and municipal initiatives in adopting advanced biofiltration technologies. The inherent advantages of biofilters, such as their low operational costs, minimal secondary waste production, and use of environmentally benign processes, further contribute to their appeal.

Despite these strong drivers, the market faces several significant restraints that could impede its growth. A primary challenge is the relatively high initial capital expenditure associated with the design, installation, and media procurement for biofilter systems, which can be a barrier for smaller enterprises or municipalities with limited budgets. The requirement for a substantial land footprint, especially for large-scale biofilter installations, poses another constraint, particularly in urbanized or land-scarce regions where space is at a premium. Additionally, the operational complexities involved in maintaining optimal conditions for microbial activity, such as precise control over temperature, humidity, pH, and nutrient supply, necessitate skilled personnel and continuous monitoring, adding to the overall cost and potential for operational issues. While biofilters are highly effective for low to moderate pollutant concentrations, their efficiency can decrease with very high or rapidly fluctuating pollutant loads, limiting their applicability in certain niche industrial processes. The perceived lack of awareness or understanding about the full capabilities and long-term benefits of biofilters among some potential end-users also acts as a market restraint, hindering broader adoption.

Opportunities for growth are abundant and strategically important for market participants. Emerging economies, undergoing rapid industrial and infrastructural development, present vast untapped potential for biofilter deployment as they grapple with escalating pollution challenges and begin to implement more robust environmental policies. Continuous technological advancements, including the development of novel packing media with enhanced surface area and improved microbial colonization properties, as well as the integration of smart sensors and IoT for real-time monitoring and control, are set to significantly improve biofilter efficiency and expand their application scope. The increasing global focus on sustainability, circular economy principles, and green technologies provides a strong impetus for investment and innovation in biofiltration. Companies can leverage these trends by offering customizable, modular, and scalable biofilter solutions that cater to specific industry needs, thereby addressing the existing challenges of capital expenditure and land requirements. Furthermore, educating end-users about the long-term economic and environmental benefits, coupled with robust after-sales support and performance guarantees, can unlock new market segments and accelerate adoption. Impact forces, such as global climate change initiatives, the push for cleaner manufacturing processes, and evolving public health standards, will continue to exert significant pressure on industries to adopt more sustainable and effective pollution control technologies like biofilters.

Segmentation Analysis

The Biofilter Market is extensively segmented to reflect the diverse applications, technological variations, and operational needs across various industries and environmental contexts. This segmentation provides a granular view of market dynamics, allowing stakeholders to identify key growth areas, understand competitive landscapes, and tailor product development and marketing strategies effectively. The primary segmentation typically includes classifications by type of biofilter, the nature of the filter media utilized, the specific application areas, and the end-use industries. Each segment exhibits unique characteristics and growth drivers, influenced by regulatory frameworks, technological advancements, and regional industrial development. Understanding these distinct segments is crucial for a comprehensive market analysis and for developing targeted solutions that meet the specific requirements of different market niches. The market's overall trajectory is significantly influenced by the performance and evolution of its constituent segments, with some experiencing more rapid growth due to emerging environmental challenges and technological innovations.

- By Type:

- Biofilters (open-bed, covered)

- Biotrickling Filters

- Bioscrubbers

- Membrane Biofilters

- Activated Carbon Biofilters

- By Media Type:

- Organic Media (e.g., peat, wood chips, compost, soil)

- Inorganic Media (e.g., lava rock, activated alumina, expanded clay)

- Synthetic Media (e.g., plastic, polyurethane, ceramic)

- Hybrid Media

- By Application:

- Air Treatment

- Odor Control (e.g., H2S, NH3)

- VOC Removal (e.g., toluene, xylene)

- HAP Removal (e.g., formaldehyde)

- Particulate Matter Removal

- Wastewater Treatment

- BOD/COD Removal

- Nitrogen Removal (nitrification/denitrification)

- Phosphorus Removal

- Suspended Solids Removal

- Air Treatment

- By End-Use Industry:

- Municipal Wastewater Treatment Plants

- Chemical and Petrochemical Industry

- Food and Beverage Industry

- Pharmaceutical Industry

- Pulp and Paper Industry

- Agricultural Sector (e.g., livestock facilities)

- Waste Management (e.g., landfills, composting)

- Textile Industry

- Mining Industry

- Semiconductor and Electronics Industry

Value Chain Analysis For Biofilter Market

The value chain for the Biofilter Market encompasses a series of interconnected activities, beginning with the sourcing of raw materials and extending through the design, manufacturing, installation, and ongoing maintenance of biofiltration systems, ultimately reaching the end-users. Upstream analysis focuses on the procurement and processing of essential components. This includes suppliers of various biofilter media, such as organic materials (compost, peat, wood chips), inorganic materials (lava rock, expanded clay), and synthetic media (plastics, ceramics). Beyond the media, upstream activities involve manufacturers of pumps, blowers, humidification systems, structural materials for reactor vessels, and control instrumentation. The quality and availability of these raw materials significantly influence the cost, performance, and sustainability of the final biofilter product. Establishing strong relationships with reliable suppliers is critical for ensuring consistent quality and managing supply chain risks, particularly for specialized or proprietary media. Innovation at this stage, such as the development of more efficient and durable media, can provide a competitive edge.

Midstream activities involve the design, engineering, and manufacturing of the biofilter systems. This stage requires specialized expertise in environmental engineering, microbiology, and process control. Companies in this segment often provide customized solutions tailored to specific pollutant types, concentrations, and flow rates of the client. Manufacturing processes include fabricating the structural components, assembling the internal media supports, integrating the humidification and drainage systems, and installing the necessary instrumentation for monitoring and control. Quality assurance and compliance with industry standards are paramount at this stage to ensure the long-term effectiveness and safety of the biofilter. Research and development efforts are also concentrated here to improve system efficiency, reduce footprint, and enhance automation, often incorporating advanced materials and smart technologies to optimize performance parameters.

Downstream analysis covers the distribution channels, installation, commissioning, and post-sales support that deliver the biofilter solution to the end-user. Distribution channels can be both direct and indirect. Direct distribution often involves the biofilter manufacturer selling directly to large industrial clients or municipal authorities, frequently through tender processes or long-term contracts that include design, build, and operational services. This approach allows for direct client engagement and customization. Indirect distribution involves working with independent distributors, engineering procurement and construction (EPC) firms, environmental consulting firms, or specialized contractors who integrate biofilter systems into broader pollution control projects. These intermediaries play a crucial role in market penetration, especially in diverse geographical regions and for smaller projects. Post-sales services, including installation supervision, system commissioning, operator training, routine maintenance, media replacement, and performance monitoring, are vital for ensuring customer satisfaction and the long-term efficacy of the biofilter system. A robust service network enhances brand reputation and fosters repeat business, thereby strengthening the overall value proposition in a competitive market.

Biofilter Market Potential Customers

The Biofilter Market serves a broad spectrum of end-users and buyers who are driven by the necessity of environmental compliance, operational efficiency, and a commitment to sustainability in managing air and water quality. These customers are typically organizations and entities that generate significant volumes of pollutants, whether gaseous emissions or contaminated wastewater, and are legally mandated or ethically motivated to treat these streams before discharge. The diversity of pollutant types and the scale of treatment required mean that potential customers span multiple industrial sectors and public service domains, each presenting unique challenges and demands for biofiltration solutions. Understanding the specific needs, regulatory pressures, and operational constraints of these varied end-users is paramount for market players to effectively position their products and services. The growth of these industries and their increasing focus on environmental stewardship directly translates into expansion opportunities for the biofilter market, making them the primary drivers of demand. Furthermore, as environmental standards become progressively stricter globally, the pool of potential customers is expected to continue widening, encompassing even those sectors that historically had less stringent pollution control requirements.

One of the largest segments of potential customers comprises municipal bodies and public utilities, specifically municipal wastewater treatment plants and solid waste management facilities such as landfills and composting sites. These entities are consistently seeking cost-effective and environmentally sound solutions for treating sewage, controlling odors from waste decomposition, and managing emissions. Their buying decisions are often influenced by public health concerns, regulatory mandates from local and national environmental agencies, and long-term operational costs. Industrial sectors form another critical customer base, particularly those involved in processes that generate significant air pollutants or industrial effluent. This includes the chemical and petrochemical industry, which faces challenges with VOCs and hazardous air pollutants; the food and beverage industry, grappling with odors, BOD/COD in wastewater; the pharmaceutical industry, requiring controlled environments and emission treatment; and the pulp and paper industry, which needs to manage odors and organic loads in its discharges. These industrial customers are primarily driven by compliance with emission standards, employee health and safety regulations, and corporate social responsibility initiatives, often seeking integrated solutions that can handle complex pollutant mixtures.

Beyond these major segments, the agricultural sector, particularly large-scale livestock operations and intensive farming facilities, represents a growing customer segment due to increasing concerns over ammonia and methane emissions, as well as odor nuisance affecting surrounding communities. The mining industry also utilizes biofilters for treating air streams contaminated with sulfur compounds and other volatile substances. Additionally, certain commercial and institutional facilities, such as laboratories, hospitals, and specialized manufacturing plants, may also require biofiltration for localized air purification or specific process effluent treatment. The trend towards sustainable development and green building practices further broadens the customer base, as developers and operators seek energy-efficient and low-impact solutions for air quality management. For all these potential customers, key considerations in selecting a biofilter system include its demonstrated efficacy, reliability, scalability, ease of operation, maintenance requirements, and overall life cycle cost, highlighting the importance of comprehensive solutions that offer both performance and value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2032 | USD 3.46 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evoqua Water Technologies LLC, Bio-Microbics Inc., SUEZ Water Technologies & Solutions, Veolia Water Technologies, John Cockerill, Envirogen Group, Kurita Water Industries Ltd., Lenntech B.V., Puraflo, Amwell, Biorem Inc., TAIHE Environmental Technology Co. Ltd., CETCO, Odorox, Earth Air Industries, Waterleau, Anguil Environmental Systems, Monroe Environmental, Pacific Ozone Technology, Cirmac International B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biofilter Market Key Technology Landscape

The technological landscape of the Biofilter Market is continuously evolving, driven by the demand for more efficient, compact, and cost-effective pollution control solutions. At the core of biofiltration technology is the development and optimization of filter media. Traditional organic media such as compost, peat, and wood chips remain widely used due to their low cost and excellent buffering capacity, but research is focused on enhancing their longevity and performance through pre-treatment methods or combining them with inorganic materials. Newer inorganic media, including lava rock, expanded clay, and activated alumina, offer advantages in terms of structural stability, resistance to compaction, and higher specific surface area, which translates to better microbial growth and removal efficiencies, especially for high-load applications. Synthetic media, often made from plastics or specialized polymers, provide a highly controlled environment for biofilm development, ensuring consistent porosity and reduced pressure drop, and are increasingly favored for their durability and ease of maintenance. Hybrid media, combining the benefits of organic and inorganic or synthetic components, are also gaining traction for their balanced performance characteristics.

Beyond the media, significant advancements are being made in the engineering and design of biofilter systems. This includes the development of multi-stage biofilters that can sequentially treat complex pollutant mixtures, where each stage is optimized for different microbial communities and degradation pathways. Biotrickling filters, which continuously irrigate the media to provide nutrients and remove metabolic byproducts, are particularly advanced, offering superior control over operating conditions such as pH and moisture content, making them suitable for higher pollutant concentrations and more challenging industrial applications. Bioscrubbers, combining gas absorption with biological degradation in a liquid phase, represent another sophisticated solution, offering very high removal efficiencies and robust operation. Innovations in reactor design, such as modular and compact units, are addressing the challenge of limited land availability, making biofilters more adaptable to urban and space-constrained industrial sites. The development of specialized microbial cultures, tailored to degrade specific recalcitrant pollutants, is also a key area of biotechnological innovation within the biofilter market, enhancing treatment specificity and efficiency.

The integration of advanced monitoring and control technologies is revolutionizing biofilter operation and management. Real-time sensor technologies for parameters like pH, temperature, humidity, gas flow rates, and pollutant concentrations enable continuous process optimization and rapid response to fluctuating inlet conditions. The advent of Internet of Things (IoT) platforms allows for remote monitoring, data logging, and predictive analytics, providing operators with actionable insights to maintain optimal performance and prevent system upsets. Artificial intelligence (AI) and machine learning algorithms are increasingly being employed to analyze vast datasets from sensors, predict maintenance needs, optimize operational parameters, and enhance the overall efficiency and stability of biofiltration processes. These smart technologies reduce operational costs, minimize energy consumption, and extend the lifespan of biofilter media, thus maximizing the return on investment for end-users. Further research is ongoing in membrane bioreactor technology integrated with biofiltration, offering potential for even higher efficiency in water treatment applications by combining biological degradation with physical separation.

Regional Highlights

- North America: This region stands as a mature yet robust market for biofilters, characterized by stringent environmental regulations from agencies like the EPA, driving continuous demand for advanced air and water purification solutions. The United States and Canada are key contributors, with significant investments in municipal wastewater treatment infrastructure upgrades and industrial pollution control, particularly in the chemical, oil and gas, and food processing sectors. The focus here is often on efficiency, automation, and long-term cost-effectiveness.

- Europe: Europe is a leader in environmental technology adoption and sustainability, with countries such as Germany, the UK, France, and the Netherlands demonstrating a strong commitment to reducing industrial emissions and improving water quality. The European Union's directives on industrial emissions and wastewater treatment are major market drivers. There is a high demand for innovative biofilter media and highly efficient systems, often with a preference for compact and integrated solutions suitable for densely populated industrial zones.

- Asia Pacific (APAC): The APAC region represents the fastest-growing market for biofilters, fueled by rapid industrialization, urbanization, and escalating environmental concerns in countries like China, India, Japan, South Korea, and Southeast Asian nations. While environmental regulations are still developing in some areas, the increasing public awareness of pollution and the implementation of stricter policies are significantly boosting market demand. Opportunities are abundant for both municipal and industrial applications, including odor control from agricultural and waste management facilities.

- Latin America: This region is experiencing a gradual but steady growth in the biofilter market. Countries like Brazil, Mexico, and Argentina are investing in infrastructure development and implementing more robust environmental protection policies. The demand primarily stems from municipal wastewater treatment projects and pollution control in the mining, food processing, and chemical industries. Economic development and increasing foreign investment are key growth catalysts, pushing for more sustainable industrial practices.

- Middle East and Africa (MEA): The MEA region is an emerging market for biofilters, driven by significant infrastructure development, particularly in wastewater treatment and industrial expansion in sectors like oil and gas, petrochemicals, and manufacturing. Countries such as Saudi Arabia, UAE, and South Africa are focusing on sustainable solutions to manage their water resources and control industrial emissions. Growing environmental awareness and the adoption of international best practices are creating new market opportunities, albeit with challenges related to investment and technological expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biofilter Market.- Evoqua Water Technologies LLC

- Bio-Microbics Inc.

- SUEZ Water Technologies & Solutions

- Veolia Water Technologies

- John Cockerill

- Envirogen Group

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Puraflo

- Amwell

- Biorem Inc.

- TAIHE Environmental Technology Co. Ltd.

- CETCO

- Odorox

- Earth Air Industries

- Waterleau

- Anguil Environmental Systems

- Monroe Environmental

- Pacific Ozone Technology

- Cirmac International B.V.

Frequently Asked Questions

What is a biofilter and how does it work?

A biofilter is an environmental technology that uses microorganisms to break down pollutants in air or water. It works by passing contaminated gas or liquid through a bed of porous media (like compost or synthetic material) where a biofilm of bacteria and other microbes metabolizes and degrades harmful compounds into less toxic substances, such as carbon dioxide and water.

What are the primary applications of biofilters?

Biofilters are primarily used for air treatment, including odor control (e.g., hydrogen sulfide, ammonia) and the removal of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) from industrial emissions. They are also widely applied in wastewater treatment for reducing biochemical oxygen demand (BOD), chemical oxygen demand (COD), and removing nitrogen and phosphorus from municipal and industrial effluents.

What are the main advantages of using biofilters compared to other pollution control methods?

The key advantages of biofilters include lower operational costs due to reduced energy consumption and minimal chemical use, environmental sustainability as they rely on natural biological processes and produce less secondary waste, and high efficiency in treating large volumes of air or water with low to moderate pollutant concentrations. They are also effective for a wide range of organic and inorganic contaminants.

What factors drive the growth of the Biofilter Market?

The growth of the Biofilter Market is predominantly driven by increasingly stringent environmental regulations globally, which mandate lower emission limits for industrial and municipal discharges. Rapid industrialization and urbanization, leading to higher pollution levels, also create a significant demand. Growing public awareness about air and water quality and the push for sustainable, green technologies further propel market expansion.

What are the challenges associated with biofilter implementation and operation?

Challenges include the relatively high initial capital expenditure for system installation, the requirement for a substantial land footprint for larger systems, and the operational complexities involved in maintaining optimal conditions (e.g., humidity, temperature, pH, nutrient supply) for microbial activity. Biofilters may also have limitations when treating very high or rapidly fluctuating pollutant concentrations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager