Biometric Payment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431096 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Biometric Payment Market Size

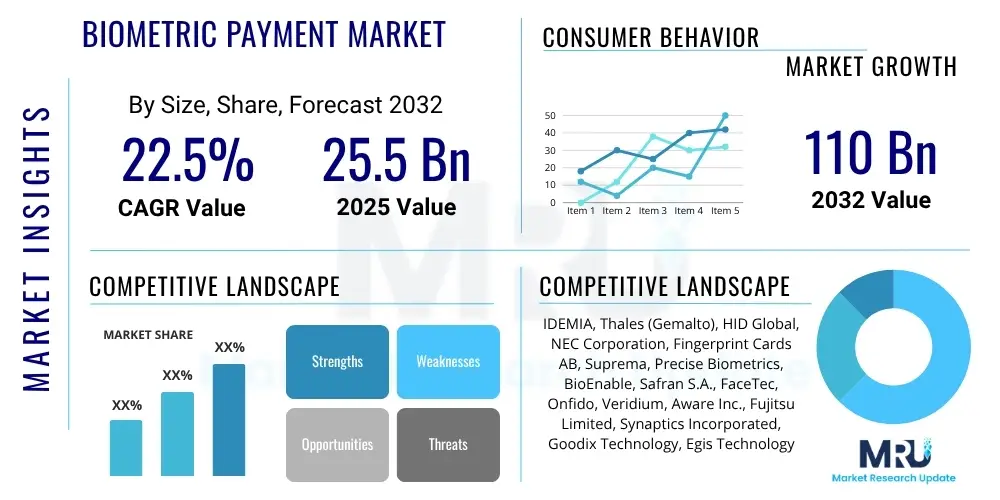

The Biometric Payment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2025 and 2032. The market is estimated at USD 25.5 Billion in 2025 and is projected to reach USD 110 Billion by the end of the forecast period in 2032.

Biometric Payment Market introduction

The Biometric Payment Market represents a rapidly evolving sector focused on authenticating financial transactions using unique biological characteristics of individuals. This innovative approach enhances security, streamlines payment processes, and improves overall user convenience by replacing traditional methods like PINs, passwords, and physical cards with identifiers such as fingerprints, facial scans, iris recognition, or vein patterns. The market encompasses a broad range of technologies and applications, from integrated biometric sensors in point-of-sale terminals to mobile payment solutions and online authentication platforms, addressing the growing global demand for faster, safer, and more seamless transaction experiences.

The core product in this market involves biometric authentication systems integrated into payment infrastructures. These systems leverage advanced sensors and sophisticated algorithms to capture and verify a user's biometric data against a stored template, granting authorization for a transaction. Major applications span across retail, e-commerce, banking, public transport, and various other sectors where efficient and secure payment processing is paramount. The primary benefits include a significant reduction in payment fraud, enhanced transaction speeds, elimination of the need to carry multiple cards or cash, and a greatly improved customer experience.

Several key factors are driving the expansion of the biometric payment market. These include the escalating adoption of digital payment methods worldwide, increasing consumer awareness and preference for contactless and secure transactions, and a continuous rise in concerns over payment card fraud. Furthermore, technological advancements in biometric recognition accuracy, coupled with the widespread integration of biometric sensors in smartphones and other consumer devices, are significantly propelling market growth. Government initiatives supporting digital transformation and financial inclusion also play a crucial role in fostering a conducive environment for biometric payment solutions.

Biometric Payment Market Executive Summary

The Biometric Payment Market is experiencing robust growth driven by a confluence of technological advancements, evolving consumer behaviors, and a heightened global emphasis on payment security and convenience. Current business trends indicate a strong shift towards contactless and mobile biometric solutions, with significant investments in research and development to enhance the accuracy, speed, and reliability of authentication processes. Financial institutions and retail giants are leading the charge in adopting these technologies, recognizing their potential to reduce fraud, improve operational efficiency, and differentiate their services in a competitive landscape. There is a notable trend towards integrating multi-modal biometrics to offer layered security, addressing various user preferences and environmental challenges.

Regionally, the market exhibits diverse growth patterns and adoption rates. Asia Pacific, particularly countries like China and India, stands out as a dominant region due to its large consumer base, rapid smartphone penetration, and government-backed initiatives promoting digital and cashless economies. North America and Europe, while having more mature payment infrastructures, are experiencing steady growth driven by the demand for enhanced security features and seamless transaction experiences, particularly in urban centers. Latin America, the Middle East, and Africa are emerging as high-potential markets, characterized by increasing financial inclusion efforts and a growing embrace of mobile-first payment strategies that can easily incorporate biometric authentication.

Segmentation analysis reveals key trends within the market. By technology, fingerprint recognition remains the most widely adopted method due to its maturity and cost-effectiveness, though facial recognition is rapidly gaining traction owing to advancements in imaging and AI. Iris and vein recognition are preferred for higher security applications, particularly in corporate or specialized retail environments. In terms of application, the retail and e-commerce sectors continue to be the largest adopters, leveraging biometrics for point-of-sale transactions and online purchases. The banking, financial services, and insurance (BFSI) sector is also a critical segment, utilizing biometrics for secure access, transaction authorization, and customer verification, highlighting the diverse utility and broad applicability of biometric payment solutions.

AI Impact Analysis on Biometric Payment Market

Users frequently inquire about how artificial intelligence will fundamentally transform the security landscape and transactional efficiency within the Biometric Payment Market. Common questions revolve around AI's capability to detect sophisticated fraud attempts, its role in accelerating and refining biometric authentication accuracy, and the crucial implications for user privacy and data security when AI algorithms process sensitive biometric information. There is also a keen interest in whether AI can facilitate more personalized payment experiences and adapt to emerging threats in real-time, essentially making biometric payments smarter and more resilient against evolving cyber risks.

Based on these user inquiries, the key themes, concerns, and expectations users hold about AI's influence in this domain can be summarized. Users expect AI to act as a powerful guardian against fraud, leveraging advanced pattern recognition to identify anomalous transaction behavior and sophisticated spoofing attempts that traditional systems might miss. They anticipate that AI will significantly enhance the precision and speed of biometric authentication, leading to virtually instantaneous and infallible verification. However, a significant concern remains regarding the ethical use of biometric data, with users seeking assurances that AI processing maintains the highest standards of privacy and prevents unauthorized access or misuse of their unique biological identifiers. Overall, there is an optimistic expectation that AI will usher in a new era of secure, efficient, and user-centric biometric payment solutions, provided privacy and data governance are adequately addressed.

- AI significantly enhances fraud detection capabilities by analyzing complex transactional patterns and behavioral biometrics, identifying anomalies that indicate fraudulent activity in real time.

- The integration of AI algorithms dramatically improves the accuracy and speed of biometric authentication systems, reducing false positives and false negatives for fingerprint, facial, and iris recognition.

- AI enables advanced liveness detection techniques, making it significantly harder for fraudsters to use spoofed biometrics like masks or printed images to bypass security measures.

- Personalized payment experiences are facilitated by AI, which can learn user preferences and habits, offering tailored authentication methods or expedited processes for trusted transactions.

- AI-driven systems continuously learn and adapt to new threats and vulnerabilities, strengthening security protocols dynamically against evolving cyberattacks and sophisticated hacking attempts.

- Optimizes resource allocation and processing power within biometric systems, leading to more energy-efficient and scalable payment infrastructures.

DRO & Impact Forces Of Biometric Payment Market

The Biometric Payment Market is influenced by a dynamic interplay of various drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. A primary driver is the accelerating global adoption of digital payment methods, fueled by the convenience they offer and the decreasing reliance on physical cash. This trend is further bolstered by increasing consumer expectations for frictionless and swift transaction experiences. Moreover, the escalating concerns over traditional payment fraud, such as credit card skimming and identity theft, are compelling financial institutions and retailers to seek more secure authentication methods, positioning biometrics as a highly effective solution. Government initiatives in various countries promoting cashless economies and digital transformation also provide significant impetus for market expansion.

Despite these strong drivers, the market faces notable restraints that could impede its rapid growth. High implementation costs associated with upgrading existing point-of-sale infrastructure and integrating new biometric systems can be a deterrent for smaller businesses. Furthermore, profound data privacy concerns, particularly regarding the secure storage and processing of highly sensitive biometric data, remain a significant hurdle for consumer adoption and regulatory compliance. The lack of standardized protocols across different biometric technologies and regions can also create interoperability challenges. Technical glitches, such as false rejections or failures in sensor performance, and inherent consumer resistance to adopting new technologies due to perceived inconvenience or security fears, also contribute to market restraints.

Looking forward, the biometric payment market is rich with opportunities that could unlock substantial growth. Emerging markets, characterized by a large unbanked population and rapid smartphone adoption, present fertile ground for leapfrogging traditional payment systems directly to biometric solutions. The ongoing integration of biometric capabilities with wearable technology, such as smartwatches and fitness trackers, expands the potential touchpoints for secure payments. The continuous growth of contactless payment technologies, accelerated by public health concerns, naturally aligns with and supports the adoption of biometric authentication. Lastly, the advent of advanced artificial intelligence and machine learning algorithms promises to further enhance the accuracy, security, and user-friendliness of biometric payment systems, mitigating existing technical challenges and opening new avenues for innovation.

Segmentation Analysis

The Biometric Payment Market is broadly segmented across several key dimensions including technology, component, application, and end-user. This multifaceted segmentation provides a comprehensive understanding of the market's structure, identifying the diverse approaches and widespread adoption of biometric authentication solutions across various industries and consumer touchpoints. Each segment reflects distinct technological preferences, operational requirements, and user demographics, contributing to a granular view of market dynamics and growth opportunities. The granular understanding provided by these segments is crucial for stakeholders to tailor products, services, and market strategies effectively.

The segmentation by technology delineates the primary methods used for biometric authentication, with fingerprint recognition historically dominating due to its widespread adoption in smartphones and established reliability. However, facial and iris recognition are rapidly gaining prominence driven by advancements in camera technology and AI-powered algorithms, offering enhanced convenience and security. Vein recognition, known for its high accuracy and resistance to spoofing, finds niche applications in high-security environments. By component, the market is divided into hardware, software, and services, reflecting the entire ecosystem required for deploying and maintaining biometric payment systems. Hardware includes the physical sensors and terminals, software encompasses the authentication platforms and algorithms, while services cover critical aspects like installation, maintenance, and consulting, ensuring the smooth operation and continued evolution of these systems.

Application-wise, the retail and e-commerce sectors are pivotal, utilizing biometrics for secure point-of-sale transactions and streamlined online purchasing experiences. The banking, financial services, and insurance (BFSI) sector is a cornerstone of biometric adoption, integrating these technologies for secure mobile banking, ATM access, and robust customer verification processes. Healthcare and government sectors are increasingly leveraging biometrics for secure patient identification and citizen services, respectively. Finally, end-user segmentation differentiates between individual consumers who directly use biometric payment methods and commercial entities that deploy and manage these systems for their customers and operations, highlighting the dual-fronted demand driving market expansion.

- By Technology:

- Fingerprint Recognition: Most common, integrated into smartphones and POS terminals.

- Facial Recognition: Gaining traction, contactless, convenient for mobile payments and smart stores.

- Iris Recognition: High security, used in specialized applications and ATMs.

- Vein Recognition: Highly accurate, difficult to spoof, preferred for high-security environments.

- Others: Voice recognition, palm print, behavioral biometrics.

- By Component:

- Hardware: Biometric sensors, point-of-sale (POS) terminals, mobile devices, kiosks.

- Software: Authentication platforms, biometric APIs, middleware, security frameworks.

- Services: Installation, integration, maintenance, consulting, managed services.

- By Application:

- Retail and Consumer Goods: In-store payments, loyalty programs.

- E-commerce and Online Services: Secure online transactions, digital wallet authentication.

- BFSI (Banking, Financial Services, and Insurance): ATM access, mobile banking, branch services, cardless transactions.

- Healthcare: Patient identification, secure payment for medical services.

- Government and Public Sector: Identity verification for benefits, public transport payments.

- Automotive: In-car payments, secure vehicle access.

- Hospitality: Hotel check-ins, restaurant payments.

- By End-User:

- Consumer: Individual users utilizing biometric features for personal payments.

- Commercial: Businesses and organizations implementing biometric payment systems for their operations and customers.

Value Chain Analysis For Biometric Payment Market

The value chain for the Biometric Payment Market is intricate, involving multiple stages and diverse stakeholders, each contributing to the development, deployment, and operation of these advanced payment solutions. The upstream segment primarily focuses on the foundational elements, beginning with research and development of core biometric technologies. This includes the manufacturing of specialized biometric sensors, such as capacitive, optical, and ultrasonic fingerprint sensors, or advanced cameras for facial and iris recognition. It also encompasses the creation of high-performance microprocessors and secure element chips that process and store biometric data. Furthermore, the development of sophisticated biometric algorithms and software platforms, which are critical for accurate recognition and secure data handling, forms a significant part of this upstream activity.

Moving downstream, the value chain progresses to the integration and deployment phases. This involves system integrators who customize and install biometric hardware and software into existing payment infrastructures, such as point-of-sale terminals, ATMs, and mobile applications. Payment processors play a pivotal role in handling the actual financial transactions once authentication is complete, ensuring secure routing and settlement. Financial institutions, including banks and credit card networks, are key intermediaries, offering biometric payment services to their customers and facilitating the underlying payment rails. Merchants across various sectors, from retail to hospitality, represent the final point of deployment, where biometric payment systems are made available to end-users, driving direct adoption and usage.

Distribution channels in this market are varied, reflecting the diverse customer base and technological complexity. Direct sales are common for large-scale enterprise deployments, where biometric solution providers work closely with major financial institutions or large retail chains to implement tailored systems. Partnerships with established payment solution providers, such as terminal manufacturers and payment gateway companies, are also crucial for integrating biometrics into broader payment ecosystems. Indirect sales channels often involve value-added resellers (VARs) and system integrators who provide specialized expertise and localized support, particularly to small and medium-sized enterprises. This multi-channel approach ensures broad market reach and caters to specific client needs, from direct technology provision to comprehensive solution integration.

Biometric Payment Market Potential Customers

The Biometric Payment Market caters to a wide array of potential customers, spanning both the commercial and consumer sectors, driven by the universal need for enhanced security and convenience in financial transactions. Financial institutions stand as a primary and highly critical customer segment, including traditional banks, credit unions, and digital-only challenger banks. These entities seek to leverage biometrics to secure online and mobile banking applications, authenticate ATM transactions, prevent fraud, and offer innovative, frictionless payment options to their account holders, thereby improving customer loyalty and operational efficiency. The robust security features of biometrics are particularly appealing for safeguarding sensitive financial data and complying with stringent regulatory requirements.

Beyond the BFSI sector, the retail industry represents another significant customer base. This includes large multinational retail chains, supermarkets, department stores, and even small and medium-sized enterprises (SMEs). Retailers are motivated by the desire to accelerate checkout processes, reduce queues, and enhance the overall customer shopping experience, leading to increased sales and customer satisfaction. The integration of biometric payment options at the point-of-sale (POS) streamlines transactions, making them faster and more secure than traditional card-based payments. E-commerce platforms and online service providers also represent a growing segment, adopting biometrics to secure online purchases, verify user identities, and combat digital fraud, ensuring a safer and more trusted online shopping environment for their users.

Additionally, various other sectors present significant opportunities for biometric payment solutions. Government agencies are potential buyers for applications in public transport ticketing, identity verification for citizen services, and secure disbursement of benefits. The healthcare industry is exploring biometrics for secure patient identification and streamlined payment for medical services, enhancing both privacy and operational efficiency. Furthermore, individual consumers form the ultimate end-user segment, adopting smartphones, smartwatches, and other devices equipped with biometric sensors to make personal payments. Their increasing preference for secure, fast, and convenient payment methods is a fundamental driver for the entire market, compelling businesses and financial institutions to invest in biometric payment infrastructures to meet evolving consumer demands and expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 25.5 Billion |

| Market Forecast in 2032 | USD 110 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IDEMIA, Thales (Gemalto), HID Global, NEC Corporation, Fingerprint Cards AB, Suprema, Precise Biometrics, BioEnable, Safran S.A., FaceTec, Onfido, Veridium, Aware Inc., Fujitsu Limited, Synaptics Incorporated, Goodix Technology, Egis Technology Inc., Visa Inc., Mastercard Incorporated, FPC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biometric Payment Market Key Technology Landscape

The Biometric Payment Market is underpinned by a sophisticated array of technologies that enable secure, accurate, and rapid authentication for financial transactions. At its core are various biometric sensor technologies, including capacitive, optical, and ultrasonic sensors for fingerprint recognition, which are widely integrated into smartphones and point-of-sale terminals. For facial recognition, advanced 2D and 3D cameras, often augmented with infrared capabilities, capture detailed facial metrics. Iris and vein recognition systems utilize specialized near-infrared cameras to map unique patterns within the iris or beneath the skin, offering high levels of security due to their complexity and difficulty to spoof. These sensors form the critical interface between the user and the payment system, capturing the unique biological data required for authentication.

Beyond the hardware, the market heavily relies on cutting-edge software and algorithms, particularly artificial intelligence (AI) and machine learning (ML), for processing and verifying biometric data. AI-driven algorithms are essential for pattern recognition, enabling systems to accurately match live biometric scans against stored templates. They also play a crucial role in liveness detection, distinguishing between genuine biological features and spoofing attempts, such as printed images or masks. Secure element chips and trusted execution environments (TEEs) are critical for safeguarding biometric templates and cryptographic keys, ensuring that sensitive data is stored and processed in an isolated and highly protected manner, mitigating risks of data breaches and unauthorized access. These software and hardware security components work in concert to establish a robust and trustworthy authentication framework.

Further technological advancements contributing to the biometric payment landscape include tokenization, which replaces sensitive payment card data with a unique, cryptographically generated token, enhancing security during transaction transmission. Public Key Infrastructure (PKI) is often employed for secure communication and digital signatures. Near-Field Communication (NFC) technology facilitates contactless payments, allowing users to simply tap their biometric-enabled device or card at a compatible terminal. Emerging technologies like blockchain are also being explored for their potential to provide an immutable and distributed ledger for transaction records and identity management, promising even greater levels of security and transparency. The continuous evolution and integration of these diverse technologies are paramount to the ongoing growth and innovation within the biometric payment market, addressing both security demands and consumer expectations for seamless transactions.

Regional Highlights

- North America: This region is a significant market for biometric payments, characterized by advanced technological infrastructure, high consumer adoption of digital payment methods, and a strong presence of key technology developers and financial institutions. The United States and Canada are particularly prominent, driven by robust investments in cybersecurity, demand for enhanced fraud protection, and a culture of early adoption of innovative payment solutions. Regulatory frameworks, while complex, generally support the integration of secure digital identities into financial transactions, further boosting market expansion.

- Europe: The European market for biometric payments is expanding rapidly, spurred by stringent data privacy regulations like GDPR, which drive the need for highly secure authentication methods. Countries such as the UK, Germany, and France are leading the charge, with increasing penetration of contactless payments and mobile wallets. Banks and retailers are actively investing in biometric solutions to comply with evolving payment services directives (e.g., PSD2) and to cater to a technologically aware consumer base seeking both security and convenience in their daily transactions.

- Asia Pacific (APAC): APAC is undeniably the fastest-growing and largest market for biometric payments globally. This growth is propelled by rapid urbanization, high mobile penetration rates, and significant government initiatives promoting cashless economies, especially in countries like China, India, and Southeast Asian nations. The region benefits from a vast consumer base that is highly receptive to new technologies, alongside a dynamic ecosystem of fintech innovators and early adopters of advanced biometric solutions in both retail and public services.

- Latin America: This region represents an emerging market with substantial growth potential for biometric payments. Factors such as increasing smartphone adoption, a growing middle class, and efforts towards financial inclusion are driving the demand for secure and accessible payment methods. Countries like Brazil and Mexico are witnessing pilots and gradual rollouts of biometric solutions, particularly in the banking sector and public transport, as they seek to modernize their payment infrastructure and combat high rates of payment fraud.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the biometric payment market, primarily driven by smart city initiatives, economic diversification away from oil, and increasing e-commerce penetration. Governments and financial institutions in the UAE, Saudi Arabia, and South Africa are investing heavily in digital infrastructure, including biometric authentication, to enhance security, improve efficiency, and support the broader digitalization of their economies. Mobile-first strategies are prevalent, making biometric integration into mobile payments a key focus.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biometric Payment Market.- IDEMIA

- Thales (Gemalto)

- HID Global

- NEC Corporation

- Fingerprint Cards AB

- Suprema Inc.

- Precise Biometrics AB

- BioEnable Technologies Pvt. Ltd.

- Safran S.A.

- FaceTec, Inc.

- Onfido

- Veridium Inc.

- Aware Inc.

- Fujitsu Limited

- Synaptics Incorporated

- Goodix Technology Co. Ltd.

- Egis Technology Inc.

- Visa Inc.

- Mastercard Incorporated

- FPC (Fingerprint Cards AB)

Frequently Asked Questions

What is biometric payment and how does it work?

Biometric payment involves authenticating financial transactions using unique biological characteristics such as fingerprints, facial scans, or iris patterns. It works by capturing a user's biometric data through a sensor, converting it into a digital template, and then matching it against a stored template to authorize a payment securely and conveniently, eliminating the need for cards or PINs.

What are the main security benefits of biometric payments?

The primary security benefits of biometric payments include a significant reduction in fraud, as biometric data is extremely difficult to replicate or steal compared to traditional methods. Advanced liveness detection technologies prevent spoofing, and the inherent uniqueness of biometric identifiers provides a stronger, non-transferable form of authentication, enhancing overall transaction security.

What are the primary challenges hindering the adoption of biometric payments?

Key challenges include high initial implementation and integration costs for businesses, significant data privacy concerns regarding the storage and processing of sensitive biometric information, a lack of standardized protocols across different technologies and regions, and potential consumer resistance due to perceived invasiveness or unfamiliarity with the technology.

Which biometric technologies are most commonly used for payments?

Fingerprint recognition is currently the most widespread biometric technology for payments, largely due to its integration into smartphones and POS terminals. Facial recognition is rapidly gaining popularity for its convenience in mobile and contactless transactions, while iris and vein recognition are utilized in higher security applications due to their exceptional accuracy.

How is AI impacting the future of biometric payment systems?

AI is profoundly impacting biometric payment systems by enhancing fraud detection through sophisticated pattern analysis, improving the accuracy and speed of authentication algorithms, and enabling advanced liveness detection to prevent spoofing. AI also facilitates personalized payment experiences and allows systems to adapt dynamically to new threats, making future biometric payments more intelligent, secure, and user-friendly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager