Biopharmaceutical Fermentation Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427860 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Biopharmaceutical Fermentation Systems Market Size

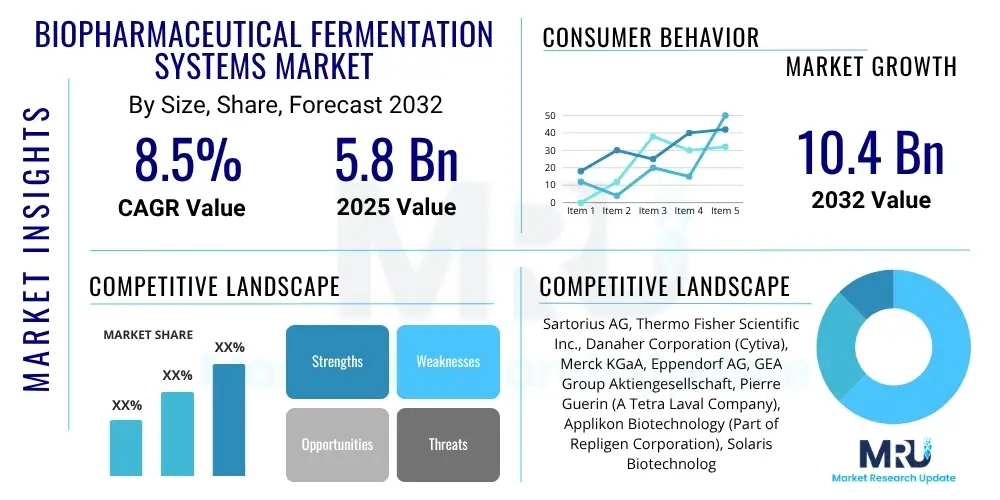

The Biopharmaceutical Fermentation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2032.

Biopharmaceutical Fermentation Systems Market introduction

The biopharmaceutical fermentation systems market encompasses the essential equipment and integrated processes utilized for the controlled cultivation of microorganisms and cells to produce a diverse range of biological products. These systems are fundamental to the modern biopharmaceutical industry, enabling the large-scale manufacturing of therapeutic proteins, vaccines, monoclonal antibodies, enzymes, and other complex biologics. The core components typically include bioreactors or fermenters, advanced control units, filtration modules, and purification apparatus, all designed to maintain optimal environmental conditions for cellular growth and product expression.

Key applications of these systems span drug discovery, clinical trials, and commercial manufacturing, playing a crucial role in developing treatments for chronic diseases, infectious diseases, and rare genetic disorders. The benefits derived from sophisticated fermentation systems include enhanced productivity, improved product purity, precise scalability from laboratory to industrial volumes, and stringent quality control. These advantages are paramount in meeting regulatory requirements and ensuring patient safety. The market's growth is predominantly driven by the escalating global demand for biologics, fueled by an aging population and the rising prevalence of chronic illnesses that require advanced therapeutic solutions.

Furthermore, significant investments in biopharmaceutical research and development, coupled with continuous technological advancements in bioreactor design, process automation, and analytical tools, are propelling market expansion. The increasing focus on personalized medicine and gene therapies also necessitates robust and flexible fermentation platforms capable of producing complex biological entities efficiently. As the industry strives for greater operational efficiency and cost-effectiveness, the adoption of innovative fermentation technologies becomes even more critical for sustainable growth and addressing unmet medical needs worldwide.

Biopharmaceutical Fermentation Systems Market Executive Summary

The Biopharmaceutical Fermentation Systems Market is experiencing robust growth, primarily driven by the expanding biopharmaceutical pipeline and the increasing global demand for advanced biologics. Key business trends indicate a strong shift towards single-use bioreactors, which offer significant advantages in terms of reduced cleaning validation, faster turnaround times, and lower capital expenditure compared to traditional stainless-steel systems. This trend is particularly evident in early-stage R&D and clinical manufacturing. Furthermore, there is a growing emphasis on process intensification and continuous bioprocessing, aiming to enhance productivity and reduce manufacturing costs, leading to innovative system designs and integrated solutions.

Regionally, North America and Europe continue to dominate the market due to well-established pharmaceutical and biotechnology industries, substantial R&D investments, and supportive regulatory frameworks. However, the Asia Pacific region is rapidly emerging as a significant growth hub, propelled by increasing healthcare expenditure, a growing number of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs), and supportive government initiatives for local biopharmaceutical manufacturing. These regions are witnessing a surge in new facility constructions and expansions, contributing to the overall market acceleration.

In terms of segmentation, the market for bioreactors, particularly single-use types, is a prominent segment, alongside advanced control systems and ancillary equipment. Applications in monoclonal antibody production, vaccine manufacturing, and recombinant protein synthesis remain dominant. The end-user landscape is primarily composed of pharmaceutical and biotechnology companies, alongside a significant contribution from CMOs/CDMOs and academic research institutions. The evolution of these segments is profoundly influenced by technological innovation, regulatory dynamics, and the constant pursuit of more efficient and cost-effective bioproduction methods, ensuring sustained market expansion over the forecast period.

AI Impact Analysis on Biopharmaceutical Fermentation Systems Market

User inquiries regarding the influence of Artificial Intelligence (AI) on biopharmaceutical fermentation systems frequently revolve around its capacity to optimize processes, reduce operational costs, and accelerate drug development timelines. Key themes emerging from these questions include how AI can enhance efficiency in fermentation, particularly in complex microbial or cell culture systems, and its potential to improve product yield and quality while minimizing human error. There is also significant interest in AI's role in predictive maintenance for fermentation equipment, data analysis from vast sensor networks, and the integration of machine learning for real-time process control and troubleshooting, ultimately aiming for more robust and reliable biomanufacturing operations.

Users are keen to understand how AI can address the inherent variability and complexity of biological systems, enabling more precise control over critical process parameters (CPPs) and critical quality attributes (CQAs). Expectations are high for AI to facilitate data-driven decision-making, moving beyond traditional empirical approaches to a more predictive and optimized manufacturing paradigm. This includes inquiries into AI's ability to interpret multi-omics data for cell line development and media optimization, thereby shortening the upstream development cycle. The overarching concern is how AI can deliver tangible benefits in terms of operational excellence and strategic competitive advantage within the highly regulated biopharmaceutical landscape.

The integration of AI is perceived as a transformative force, capable of unlocking new efficiencies and driving innovation in biopharmaceutical fermentation. Questions often highlight the need for AI solutions that are user-friendly, scalable, and compliant with regulatory standards. Users anticipate that AI will not only streamline existing processes but also enable the development of novel fermentation strategies, such as adaptive control systems and automated experimental design, leading to faster market entry for new biotherapeutics. This collective interest underscores the industry’s readiness to leverage AI for a significant leap forward in biomanufacturing capabilities.

- AI-driven optimization of fermentation parameters (temperature, pH, dissolved oxygen) for maximal yield and quality.

- Predictive maintenance of bioreactors and associated equipment, reducing downtime and operational costs.

- Real-time monitoring and advanced analytics for early detection of process deviations and rapid troubleshooting.

- Accelerated media formulation and cell line development through machine learning algorithms.

- Enhanced quality control and assurance by correlating process data with product attributes using AI.

- Automated experimental design (DoE) and process modeling for faster scale-up and process transfer.

- Improved data integration and interpretation from diverse sources, fostering holistic process understanding.

DRO & Impact Forces Of Biopharmaceutical Fermentation Systems Market

The biopharmaceutical fermentation systems market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by various impact forces. The primary drivers include the escalating global demand for biologics, such as monoclonal antibodies, recombinant proteins, and vaccines, fueled by the rising prevalence of chronic and infectious diseases and an aging population. Concurrently, substantial investments in biopharmaceutical research and development, particularly in gene and cell therapies, are necessitating advanced and scalable fermentation solutions. Technological advancements in bioreactor design, automation, and process analytical technology (PAT) further propel market growth by enhancing efficiency and productivity in biomanufacturing processes.

However, the market also faces considerable restraints, notably the high capital investment required for establishing and maintaining state-of-the-art fermentation facilities. This includes the cost of advanced bioreactors, control systems, and sterile infrastructure, which can be a significant barrier for smaller companies and emerging markets. Stringent regulatory guidelines from bodies like the FDA and EMA for biopharmaceutical manufacturing, especially concerning product quality, safety, and process validation, add complexity and cost. Furthermore, challenges related to scalability from laboratory to commercial production, coupled with the need for highly specialized technical expertise to operate and maintain these sophisticated systems, pose additional hurdles.

Despite these restraints, numerous opportunities are emerging. The growing focus on personalized medicine and advanced therapeutic medicinal products (ATMPs), including gene and cell therapies, is creating new niches for specialized fermentation systems. The expansion into emerging markets, particularly in Asia Pacific, offers lucrative growth prospects due to increasing healthcare infrastructure and outsourcing trends. Additionally, the development of continuous bioprocessing and integrated modular systems promises to revolutionize manufacturing efficiency and cost-effectiveness. Impact forces such as the strong bargaining power of buyers (large biopharmaceutical companies) demanding cost-effective and high-quality solutions, and the high threat of new entrants due to technological advancements and investment, shape the competitive landscape, while the threat of substitute technologies remains relatively low given the unique nature of biologics production.

Segmentation Analysis

The biopharmaceutical fermentation systems market is broadly segmented to reflect the diverse range of products, scales, operational modes, applications, and end-users within the biomanufacturing landscape. This segmentation provides a granular view of market dynamics, enabling stakeholders to identify key growth areas and strategic opportunities. The market's complexity necessitates clear categorization to understand specific demands and technological preferences across various industry participants.

Understanding these segments is critical for manufacturers to tailor their product offerings, for investors to identify lucrative ventures, and for biopharmaceutical companies to select the most appropriate fermentation solutions for their specific needs, from research and development to full-scale commercial production. Each segment is influenced by unique technological drivers, regulatory considerations, and economic factors, contributing to the overall market structure and evolution.

- By Product Type

- Bioreactors/Fermenters

- Stainless Steel Bioreactors

- Single-Use Bioreactors

- Control Systems

- Automated Control Systems

- Manual Control Systems

- Filtration Systems

- Microfiltration

- Ultrafiltration

- Bioprocess Containers and Media Preparators

- Accessories and Consumables

- Bioreactors/Fermenters

- By Scale

- Laboratory-Scale (Up to 50L)

- Pilot-Scale (50L - 500L)

- Commercial-Scale (Above 500L)

- By Mode of Operation

- Batch Fermentation

- Fed-Batch Fermentation

- Continuous Fermentation

- By Application

- Monoclonal Antibodies (mAbs) Production

- Vaccines Production

- Recombinant Proteins Production

- Gene and Cell Therapy Production

- Antibiotics Production

- Biofuel Production

- Industrial Enzymes Production

- Other Biopharmaceuticals

- By End-User

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs) / Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutions

- Food & Beverage Industry (for certain bioproducts)

Value Chain Analysis For Biopharmaceutical Fermentation Systems Market

The value chain for the biopharmaceutical fermentation systems market begins with upstream activities, primarily involving the sourcing and manufacturing of critical raw materials and components. This includes suppliers of high-quality cell culture media, buffers, growth factors, and other reagents essential for optimal cell growth and product expression. Additionally, specialized manufacturers provide core equipment such as stainless steel and single-use bioreactor vessels, agitation systems, pumps, sensors, and advanced control modules. These upstream providers play a pivotal role in ensuring the quality and consistency of inputs that directly influence the performance and reliability of the overall fermentation process. Relationships with these suppliers are often long-term and strategic, focused on quality assurance and supply chain resilience.

Further along the chain, the main activities involve the integration, assembly, and testing of complete fermentation systems by specialized equipment manufacturers and system integrators. These companies often collaborate with biopharmaceutical firms to design custom solutions tailored to specific process requirements, ensuring scalability, compliance, and efficiency. Once the fermentation process is complete, the downstream activities commence. This phase includes product recovery, clarification, purification (e.g., chromatography, ultrafiltration), and final formulation and fill-finish operations. The efficiency and yield of downstream processing are heavily dependent on the quality and characteristics of the product obtained from the fermentation step, highlighting the integrated nature of the biomanufacturing process.

Distribution channels for fermentation systems and related consumables typically involve both direct and indirect sales. Direct sales are common for large-scale, customized bioreactors and complex integrated systems, where manufacturers work closely with end-users for installation, validation, and ongoing support. Indirect channels involve a network of distributors and resellers who handle standard equipment, consumables, and accessories, particularly in regions where manufacturers may not have a direct presence. These distribution partners provide essential logistical support, local market knowledge, and technical services. Effective management of these channels is crucial for market penetration, customer service, and ensuring the timely delivery of essential components and systems to biopharmaceutical manufacturers globally.

Biopharmaceutical Fermentation Systems Market Potential Customers

The primary potential customers for biopharmaceutical fermentation systems are a diverse group of entities within the life sciences and healthcare sectors, all engaged in the research, development, and manufacturing of biological products. At the forefront are large pharmaceutical and biotechnology companies, which constitute a significant segment due to their extensive pipelines of biologics, robust R&D spending, and established manufacturing capabilities. These companies require fermentation systems for producing monoclonal antibodies, recombinant proteins, vaccines, and advanced therapies, often needing systems capable of both clinical and commercial scale production with high throughput and stringent quality standards.

Another crucial customer segment consists of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations provide specialized services to pharmaceutical and biotech firms, including process development, scale-up, and commercial manufacturing. As the outsourcing trend continues to grow in the biopharmaceutical industry, CMOs and CDMOs are increasingly investing in state-of-the-art fermentation systems to meet the diverse needs of their clients, offering flexibility, specialized expertise, and capacity expansion. Their demand often spans a wide range of scales and technologies, from single-use to traditional stainless steel bioreactors, catering to various therapeutic modalities.

Academic and research institutions also represent a vital customer base, albeit typically for smaller-scale, laboratory-level fermentation systems. These institutions utilize fermentation equipment for basic research, drug discovery, cell line development, and early-stage process optimization. While their individual purchasing volumes may be lower than commercial entities, their collective demand for research-grade systems is consistent and critical for fostering innovation in the biopharmaceutical space. Additionally, emerging segments include companies focused on gene and cell therapies, where specialized, often smaller-volume, high-precision fermentation solutions are required for viral vector production and cell expansion, reflecting the evolving landscape of biotherapeutic development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartorius AG, Thermo Fisher Scientific Inc., Danaher Corporation (Cytiva), Merck KGaA, Eppendorf AG, GEA Group Aktiengesellschaft, Pierre Guerin (A Tetra Laval Company), Applikon Biotechnology (Part of Repligen Corporation), Solaris Biotechnology Srl, Infors HT, Bioengineering AG, Bionet, Cellexus International Ltd., Finesse Solutions Inc. (Part of Thermo Fisher Scientific Inc.), Kuhner AG, Able Corporation & Biott Corporation, OmniBRx Biotechnologies, ZETA Biopharma, Praj Industries, Getinge AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biopharmaceutical Fermentation Systems Market Key Technology Landscape

The biopharmaceutical fermentation systems market is characterized by a rapidly evolving technological landscape, driven by the continuous need for higher efficiency, flexibility, and regulatory compliance in biomanufacturing. A pivotal advancement is the widespread adoption of single-use (disposable) bioreactors and fermenters. These systems eliminate the need for costly and time-consuming cleaning-in-place (CIP) and sterilization-in-place (SIP) processes, significantly reducing turnaround times, mitigating cross-contamination risks, and lowering overall capital expenditure. Their modularity and scalability make them highly attractive for various production scales, from R&D to commercial manufacturing, particularly for multiproduct facilities and contract manufacturing organizations.

Another significant technological trend involves the integration of advanced automation and digitalization across fermentation processes. This includes sophisticated process control software, real-time data analytics, and the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms for predictive maintenance, process optimization, and enhanced quality control. Process Analytical Technology (PAT) is also gaining prominence, employing inline or online sensors to monitor critical process parameters (CPPs) and critical quality attributes (CQAs) in real-time. This provides immediate feedback, allowing for proactive adjustments to maintain optimal conditions and ensure product consistency, thereby moving towards a more robust and data-driven manufacturing paradigm.

Furthermore, there is a strong focus on process intensification and continuous bioprocessing technologies. Unlike traditional batch or fed-batch operations, continuous fermentation systems aim to run uninterrupted for extended periods, potentially leading to smaller footprints, higher volumetric productivity, and reduced costs. This includes perfusion bioreactors for mammalian cell cultures and continuous microbial fermentation setups. Innovations in cell line development, media optimization techniques, and advanced sensor technologies for monitoring cell viability and metabolite concentrations are also crucial. These combined technological advancements are collectively pushing the boundaries of what is achievable in biopharmaceutical production, enhancing throughput, reducing manufacturing costs, and ultimately improving access to life-saving biologics.

Regional Highlights

- North America: Dominates the market due to a robust biopharmaceutical industry, extensive R&D activities, significant investments in advanced manufacturing technologies, and a strong presence of key market players and numerous biotech startups.

- Europe: A leading region with well-established pharmaceutical giants, strong academic research institutions, supportive government funding for bioprocessing innovation, and a high adoption rate of single-use technologies.

- Asia Pacific (APAC): The fastest-growing region, driven by increasing healthcare expenditure, a rising number of contract manufacturing organizations (CMOs) in countries like China and India, government initiatives to boost local biomanufacturing capabilities, and expanding patient populations.

- Latin America: Emerging market with increasing investments in healthcare infrastructure and biotechnology, particularly in countries such as Brazil and Mexico, leading to a growing demand for advanced fermentation systems.

- Middle East and Africa (MEA): Shows gradual growth due to developing healthcare sectors, rising prevalence of chronic diseases, and increasing focus on local pharmaceutical production, though adoption rates for advanced systems are still lower compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biopharmaceutical Fermentation Systems Market.- Sartorius AG

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Cytiva)

- Merck KGaA

- Eppendorf AG

- GEA Group Aktiengesellschaft

- Pierre Guerin (A Tetra Laval Company)

- Applikon Biotechnology (Part of Repligen Corporation)

- Solaris Biotechnology Srl

- Infors HT

- Bioengineering AG

- Bionet

- Cellexus International Ltd.

- Finesse Solutions Inc. (Part of Thermo Fisher Scientific Inc.)

- Kuhner AG

- Able Corporation & Biott Corporation

- OmniBRx Biotechnologies

- ZETA Biopharma

- Praj Industries

- Getinge AB

Frequently Asked Questions

What are biopharmaceutical fermentation systems and why are they crucial?

Biopharmaceutical fermentation systems are specialized equipment and processes used to cultivate microorganisms or cells under controlled conditions to produce biological products like therapeutic proteins, vaccines, and monoclonal antibodies. They are crucial for scalable, efficient, and reproducible biomanufacturing, enabling the development and mass production of life-saving biologics for various medical applications.

How is AI transforming biopharmaceutical fermentation?

AI is transforming biopharmaceutical fermentation by enabling real-time process optimization, predictive maintenance of equipment, and advanced data analytics. It helps in precise control of critical process parameters, accelerating media formulation and cell line development, enhancing quality control, and automating experimental design, ultimately leading to higher yields, improved product quality, and reduced operational costs.

What are the key drivers of market growth for these systems?

The market growth is primarily driven by the surging global demand for biologics due to rising chronic disease prevalence, significant investments in biopharmaceutical R&D, and continuous technological advancements in bioreactor design and process automation. The increasing focus on personalized medicine and gene therapies also contributes significantly to market expansion.

What challenges does the biopharmaceutical fermentation systems market face?

The market faces challenges such as high initial capital expenditure for advanced equipment, stringent regulatory requirements for biopharmaceutical manufacturing, inherent complexities in scaling up fermentation processes from lab to commercial scale, and the persistent demand for specialized technical expertise to operate and maintain sophisticated systems effectively.

What is the role of single-use systems in fermentation?

Single-use (disposable) systems play a vital role by eliminating the need for time-consuming cleaning and sterilization, significantly reducing turnaround times and cross-contamination risks. They offer modularity, flexibility, and lower capital investment, making them highly attractive for early-stage R&D, clinical manufacturing, and multi-product facilities within the biopharmaceutical industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager