Biopharmaceutical Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429944 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Biopharmaceutical Packaging Market Size

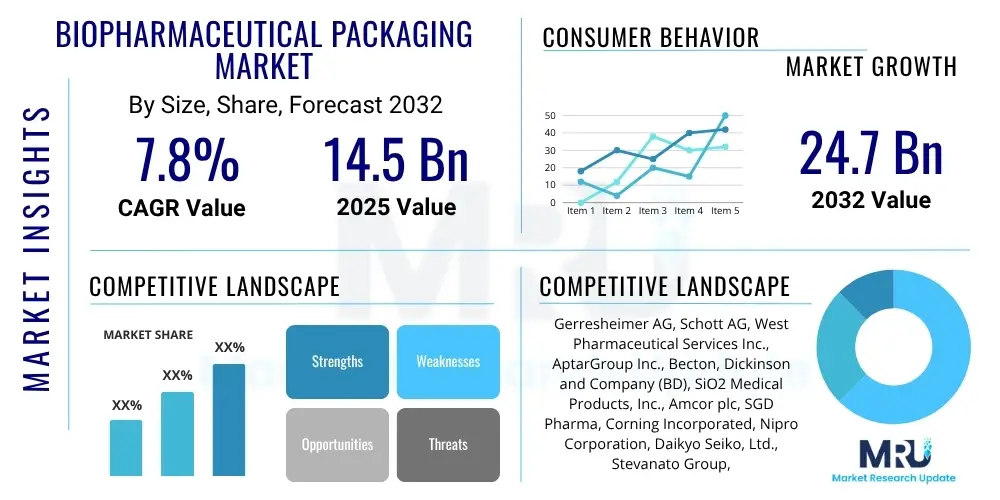

The Biopharmaceutical Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 14.5 Billion in 2025 and is projected to reach USD 24.7 Billion by the end of the forecast period in 2032.

Biopharmaceutical Packaging Market introduction

The biopharmaceutical packaging market encompasses the design, development, and manufacturing of specialized containers and delivery systems tailored for sensitive biological drugs, vaccines, and advanced therapies. These products, due to their complex molecular structures and susceptibility to degradation, require robust primary and secondary packaging solutions that ensure product integrity, sterility, and efficacy throughout their shelf life. Packaging in this sector goes beyond mere containment; it is a critical component in drug stability, patient safety, and successful drug delivery.

Major applications for biopharmaceutical packaging span a wide range of therapeutic areas, including oncology, autoimmune diseases, infectious diseases, and rare genetic disorders. Products requiring specialized packaging include monoclonal antibodies, recombinant proteins, gene and cell therapies, and various vaccines. The primary benefits of advanced biopharmaceutical packaging include enhanced product protection against environmental factors like light, oxygen, and temperature fluctuations, prevention of contamination, extended shelf-life, and improved patient convenience and adherence through user-friendly designs such as pre-filled syringes and auto-injectors.

Key driving factors for market expansion include the significant growth in the global biopharmaceutical industry, marked by a robust pipeline of new biologic drug approvals and an increasing prevalence of chronic and complex diseases. Furthermore, the rising demand for sterile and safe drug delivery systems, coupled with stringent regulatory guidelines for drug packaging and labeling, continues to propel innovation and adoption within this specialized market segment, underscoring its indispensable role in modern healthcare.

Biopharmaceutical Packaging Market Executive Summary

The biopharmaceutical packaging market is currently experiencing dynamic business trends, driven by the escalating demand for biologics, gene therapies, and personalized medicine. A notable trend involves the shift towards sustainable packaging materials and processes, as companies strive to meet environmental mandates and consumer preferences for eco-friendly solutions. Furthermore, the market is witnessing increased adoption of smart packaging technologies that offer enhanced traceability, temperature monitoring, and anti-counterfeiting measures, reflecting a broader industry focus on supply chain integrity and patient safety.

From a regional perspective, North America and Europe continue to dominate the biopharmaceutical packaging market due to their well-established pharmaceutical industries, robust R&D infrastructure, and stringent regulatory frameworks that necessitate advanced packaging solutions. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by expanding biopharmaceutical manufacturing capabilities, rising healthcare expenditures, and increasing access to advanced medical treatments in countries like China, India, and Japan. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, driven by improving healthcare access and government initiatives.

Segmentation trends highlight a strong demand for injectable packaging formats, particularly pre-filled syringes and cartridges, owing to their convenience, reduced medication errors, and suitability for self-administration. Glass remains a predominant material due to its inertness and barrier properties, while advanced plastics and specialized rubber components are gaining traction for specific applications requiring lightweight, shatter-resistant, or high-barrier solutions. The vaccine and monoclonal antibody segments are significant application areas, underscoring the critical need for reliable and safe packaging in these high-value therapeutic categories.

AI Impact Analysis on Biopharmaceutical Packaging Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the biopharmaceutical packaging market, focusing on themes such as enhanced efficiency, improved quality control, and optimized supply chain operations. There is significant interest in AI's potential to drive predictive maintenance for packaging machinery, detect subtle defects with greater accuracy, and forecast demand to minimize waste and inventory costs. Concerns also surface regarding the initial investment required for AI integration, data privacy in smart packaging applications, and the need for a skilled workforce to manage AI-driven systems. Overall, expectations are high for AI to usher in a new era of precision, safety, and cost-effectiveness in biopharmaceutical packaging.

- Predictive maintenance for packaging lines, minimizing downtime and increasing operational efficiency.

- Enhanced quality inspection through AI-powered vision systems, detecting microscopic defects in vials, syringes, and labels.

- Optimized supply chain management by predicting demand, managing inventory, and improving logistics for sensitive biopharmaceuticals.

- Development of smart packaging solutions with embedded sensors and AI algorithms for real-time temperature and integrity monitoring.

- Personalized packaging design and manufacturing processes tailored to specific drug formulations and patient needs.

- Accelerated material science research for novel packaging solutions by analyzing vast datasets of material properties and drug interactions.

- Improved regulatory compliance and data management through AI-driven analytics, streamlining documentation and audit processes.

DRO & Impact Forces Of Biopharmaceutical Packaging Market

The biopharmaceutical packaging market is significantly influenced by a confluence of drivers, restraints, opportunities, and broader impact forces. A primary driver is the robust growth of the global biopharmaceutical sector, characterized by a burgeoning pipeline of complex biologic drugs and gene therapies that necessitate specialized, high-integrity packaging. The increasing prevalence of chronic diseases, coupled with a rising demand for self-administration and home healthcare, further fuels the need for convenient and safe packaging solutions such as pre-filled syringes and auto-injectors. Moreover, continuous technological advancements in barrier materials, aseptic filling, and smart packaging are pushing the market forward, offering enhanced product protection and traceability.

Conversely, several restraints impede market growth. The high cost associated with manufacturing specialized biopharmaceutical packaging, especially for sterile and high-barrier formats, presents a significant challenge for smaller pharmaceutical companies. Material compatibility issues, where packaging components interact negatively with sensitive biological formulations, require extensive R&D and testing, adding to development timelines and expenses. Additionally, growing environmental concerns related to plastic waste and single-use packaging solutions are prompting regulatory scrutiny and consumer demand for more sustainable alternatives, pushing manufacturers to innovate but also navigate complex material science challenges.

Despite these restraints, the market is rife with opportunities. The increasing focus on sustainable packaging materials, including recycled content, bio-based plastics, and lightweight designs, offers a promising avenue for innovation and market differentiation. The advent of smart packaging technologies that integrate sensors, RFID, and NFC for real-time monitoring and anti-counterfeiting provides new value propositions. Furthermore, the expansion into emerging markets, coupled with the rising adoption of personalized medicine, which often requires unique packaging formats for small batch production, presents significant growth prospects. These impact forces collectively shape the competitive landscape, driving innovation while demanding strict adherence to evolving regulatory standards and patient safety protocols.

Segmentation Analysis

The biopharmaceutical packaging market is meticulously segmented to cater to the diverse needs of the global biopharmaceutical industry, reflecting variations in product characteristics, material science, therapeutic applications, and end-user requirements. This detailed segmentation allows for a precise understanding of market dynamics, growth drivers, and emerging opportunities across different facets of the industry, guiding strategic decisions for manufacturers and suppliers alike. Understanding these segments is crucial for identifying key growth areas and developing tailored packaging solutions that meet stringent regulatory and functional demands.

- By Product Type:

- Vials (Glass, Plastic)

- Syringes (Pre-filled, Cartridges)

- Bottles

- Bags (IV Bags, Blood Bags)

- Ampoules

- Blister Packs

- Other Product Types

- By Material:

- Glass (Borosilicate, Soda-lime)

- Plastic (PET, PP, PVC, HDPE, LDPE, COC/COP)

- Rubber (Butyl Rubber, Silicone Rubber, Bromobutyl Rubber, Chlorobutyl Rubber)

- Paper & Paperboard

- Metal

- Other Materials

- By Application:

- Vaccines

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Blood Products

- Cell & Gene Therapies

- Hormones

- Other Applications

- By End-use:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Research Laboratories & Academic Institutes

- Hospitals & Clinics

- Other End-uses

Value Chain Analysis For Biopharmaceutical Packaging Market

The value chain for the biopharmaceutical packaging market begins with upstream activities involving the sourcing and processing of raw materials. This includes specialized glass manufacturers providing borosilicate glass for vials and syringes, polymer resin producers supplying high-grade plastics such as COC/COP and PP, and rubber component manufacturers developing stoppers, plungers, and seals. These suppliers must adhere to strict quality standards and provide materials that are chemically inert, biologically safe, and compliant with pharmaceutical regulations, forming the foundational layer of the packaging ecosystem. Innovation at this stage, particularly in barrier properties and material purity, directly impacts the quality and safety of the final packaging.

Moving downstream, these raw materials and primary components are then transformed by specialized packaging manufacturers into finished products like sterile vials, pre-filled syringes, infusion bags, and blow-fill-seal containers. This manufacturing process often involves complex aseptic filling, sterilization, and assembly technologies. The packaged products are then supplied to biopharmaceutical companies, contract manufacturing organizations (CMOs), and other end-users who fill them with drug substances, perform final assembly, and distribute them to healthcare providers and patients. The distribution channel primarily involves direct sales from packaging manufacturers to large pharmaceutical clients, but also includes specialized distributors who cater to smaller companies or niche product lines, ensuring a broad reach across the market.

The distribution of biopharmaceutical packaging is predominantly direct, where major packaging suppliers establish direct relationships with pharmaceutical and biopharmaceutical companies to provide customized solutions and ensure seamless supply chain integration. Indirect channels, through a network of specialized distributors, serve to broaden market access, especially for standardized components or to reach smaller clients and regional markets. Both direct and indirect models emphasize robust logistics and cold chain management, particularly for pre-sterilized and ready-to-fill components, to maintain product integrity and meet the just-in-time delivery requirements of pharmaceutical production cycles, highlighting the critical role of efficient and compliant distribution networks.

Biopharmaceutical Packaging Market Potential Customers

The primary potential customers and end-users of biopharmaceutical packaging are the global pharmaceutical and biopharmaceutical companies that develop, manufacture, and distribute biological drugs, vaccines, and advanced therapies. These entities represent the largest segment due to their direct need for packaging solutions that ensure the stability, sterility, and safe delivery of their sensitive products. As the pipeline for biologics continues to expand, so does the demand from these companies for innovative and compliant packaging. Their requirements are highly specific, ranging from standard vials and syringes to complex multi-chamber systems for combination products.

Another significant customer segment includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). As pharmaceutical companies increasingly outsource drug development and manufacturing, CMOs/CDMOs become crucial buyers of biopharmaceutical packaging. They require a wide array of packaging types to serve their diverse client base, often seeking flexible and scalable solutions. Research laboratories, academic institutions, and government research bodies also constitute potential customers, albeit on a smaller scale, as they require specialized packaging for R&D phases and clinical trials, often prioritizing custom designs and material compatibility for novel drug candidates.

Additionally, hospitals and clinics, particularly those involved in compounding or specialized drug preparation, may indirectly influence demand or directly purchase certain packaging components for in-house use. The increasing trend of home healthcare and patient self-administration also places greater emphasis on user-friendly packaging, influencing purchase decisions across the entire customer spectrum. Ultimately, any entity involved in the development, manufacturing, distribution, or administration of biological medicines serves as a potential customer, driving the market towards greater specialization and adherence to stringent quality and safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2032 | USD 24.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerresheimer AG, Schott AG, West Pharmaceutical Services Inc., AptarGroup Inc., Becton, Dickinson and Company (BD), SiO2 Medical Products, Inc., Amcor plc, SGD Pharma, Corning Incorporated, Nipro Corporation, Daikyo Seiko, Ltd., Stevanato Group, Catalent Inc., DWK Life Sciences, Comar, Inc., Vetter Pharma, Berry Global Inc., Lonza Group, RPC Group, K.G. International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biopharmaceutical Packaging Market Key Technology Landscape

The biopharmaceutical packaging market is characterized by a sophisticated technology landscape focused on ensuring product integrity, patient safety, and regulatory compliance for sensitive biological drugs. Advanced barrier technologies are paramount, utilizing specialized coatings, laminated films, and multi-layer plastics to protect against moisture, oxygen, and light degradation. Aseptic filling and blow-fill-seal (BFS) technologies are crucial for maintaining sterility during the packaging process, minimizing contamination risks for injectables and ophthalmic solutions. These technologies leverage highly controlled environments and automated systems to ensure the highest levels of purity and safety.

The development of pre-filled syringe (PFS) and auto-injector systems represents a significant technological advancement, enhancing patient convenience, reducing medication errors, and facilitating self-administration. These systems often integrate advanced materials like cyclic olefin copolymers (COCs) and improved rubber formulations for stoppers and plungers to ensure drug stability and compatibility. Furthermore, smart packaging solutions are gaining traction, incorporating technologies such as RFID tags, QR codes, temperature sensors, and near-field communication (NFC) chips. These innovations enable real-time tracking, temperature monitoring across the cold chain, anti-counterfeiting measures, and enhanced patient adherence through interactive features.

Sustainability-driven innovations are also shaping the technology landscape, with a growing focus on developing lightweight materials, recycled plastics, bio-based polymers, and designing for recyclability. Technologies for sterilization, such as gamma irradiation, electron beam, and ethylene oxide, are continuously refined to ensure effective microbial control without compromising packaging material integrity or drug stability. The integration of advanced manufacturing techniques, including robotics and automation, further optimizes production efficiency and consistency, solidifying the market's reliance on cutting-edge technologies to meet evolving industry demands and regulatory expectations.

Regional Highlights

- North America: This region holds a dominant share in the biopharmaceutical packaging market, primarily due to the presence of a well-established pharmaceutical and biotechnology industry, significant R&D investments, and stringent regulatory standards. The United States is a key contributor, driven by a large number of drug approvals and a high demand for advanced healthcare solutions.

- Europe: Europe represents another substantial market, fueled by robust biopharmaceutical manufacturing, a strong focus on advanced therapies, and an increasing aging population requiring specialized drug delivery. Germany, France, and the United Kingdom are leading countries, demonstrating strong innovation in packaging materials and technologies.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is driven by expanding healthcare infrastructure, rising pharmaceutical production (particularly in generics and biosimilars), increasing chronic disease prevalence, and growing R&D activities in countries like China, India, and Japan. The large patient pool and improving access to advanced treatments contribute significantly to market expansion.

- Latin America: This region shows promising growth, with countries such as Brazil and Mexico leading the adoption of modern biopharmaceutical packaging solutions. Factors like increasing healthcare expenditure, improving regulatory frameworks, and growing demand for high-quality pharmaceutical products are key drivers.

- Middle East and Africa (MEA): While currently a smaller market, MEA is anticipated to witness steady growth due to governmental initiatives to improve healthcare access, increasing investments in pharmaceutical manufacturing, and the rising prevalence of chronic diseases. Countries in the GCC region and South Africa are at the forefront of this development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biopharmaceutical Packaging Market.- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services Inc.

- AptarGroup Inc.

- Becton, Dickinson and Company (BD)

- SiO2 Medical Products, Inc.

- Amcor plc

- SGD Pharma

- Corning Incorporated

- Nipro Corporation

- Daikyo Seiko, Ltd.

- Stevanato Group

- Catalent Inc.

- DWK Life Sciences

- Comar, Inc.

- Vetter Pharma

- Berry Global Inc.

- Lonza Group

Frequently Asked Questions

What are the primary types of biopharmaceutical packaging?

The primary types include vials (glass and plastic), pre-filled syringes, bottles, bags (such as IV bags and blood bags), and ampoules, all designed to maintain the sterility and integrity of sensitive biological drugs.

How do regulatory bodies influence biopharmaceutical packaging?

Regulatory bodies such as the FDA and EMA set stringent guidelines for material compatibility, container closure integrity, sterility, and labeling, ensuring patient safety and product efficacy, thereby driving innovation and compliance in packaging design and manufacturing.

What are the key trends shaping the biopharmaceutical packaging market?

Key trends include the increasing demand for sustainable packaging materials, the integration of smart packaging technologies for traceability and monitoring, and the growing adoption of pre-filled systems for enhanced patient convenience and safety.

What role does sustainability play in biopharmaceutical packaging?

Sustainability is increasingly vital, driving the development of lightweight, recyclable, and bio-based packaging materials, as well as optimizing manufacturing processes to reduce environmental impact and meet corporate social responsibility goals.

What are the main challenges faced by the biopharmaceutical packaging industry?

Major challenges include ensuring material compatibility with sensitive biologics, managing the high costs associated with specialized sterile packaging, and addressing environmental concerns related to single-use plastics while maintaining regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager