Bioprocess Validation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427956 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bioprocess Validation Market Size

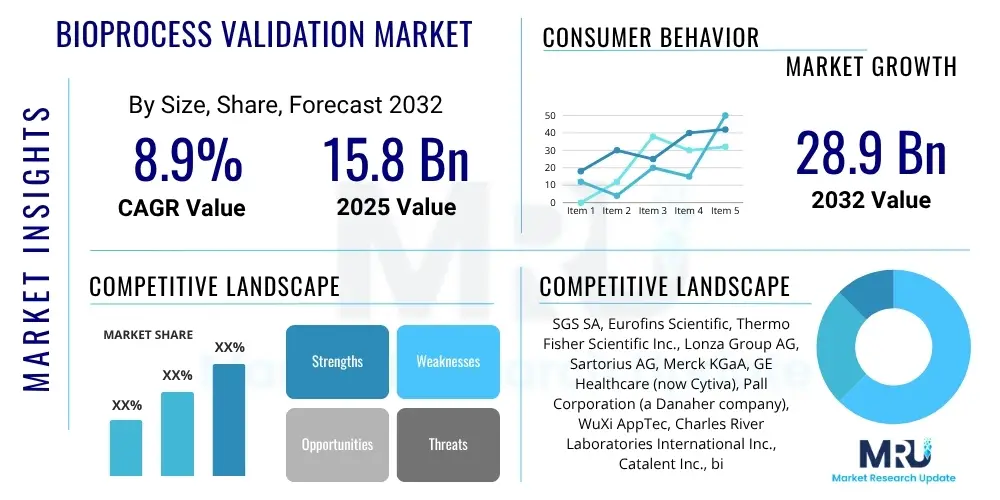

The Bioprocess Validation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at USD 15.8 Billion in 2025 and is projected to reach USD 28.9 Billion by the end of the forecast period in 2032.

Bioprocess Validation Market introduction

The Bioprocess Validation Market encompasses the essential services, products, and technologies required to demonstrate that biopharmaceutical manufacturing processes consistently yield products meeting predetermined quality attributes and regulatory standards. This critical field ensures the safety, efficacy, and purity of biologics, vaccines, and advanced therapies, which are becoming increasingly prevalent in modern medicine. Bioprocess validation involves a systematic approach to establishing documented evidence providing a high degree of assurance that a specific process will consistently produce a product meeting its pre-defined specifications and quality characteristics. The increasing complexity of biopharmaceutical products, coupled with stringent global regulatory frameworks, makes validation an indispensable part of the drug development and manufacturing lifecycle, minimizing risks and ensuring patient safety.

The core product description within this market includes a wide array of validation activities. These range from the validation of upstream processes like cell culture and fermentation to downstream purification, sterile filtration, aseptic filling, and final product packaging. It also covers the qualification of equipment, facilities, utilities (such as purified water and clean steam systems), analytical methods used for in-process testing and finished product release, and cleaning procedures to prevent cross-contamination. Major applications span the entire biopharmaceutical industry, including large pharmaceutical companies, biotechnology firms, contract manufacturing organizations (CMOs), and contract research organizations (CROs) that provide specialized services. Academic and research institutions also contribute to the market through method development and early-stage process validation studies, fostering innovation and refinement of techniques.

The significant benefits derived from robust bioprocess validation are manifold. Foremost among these is regulatory compliance with bodies such as the FDA, EMA, and other global health authorities, which mandate comprehensive validation for market approval and continued operation. This ensures product quality and patient safety, reduces the risk of costly product recalls, and mitigates operational failures. Furthermore, effective validation leads to improved process efficiency, reduced batch failures, and enhanced overall operational reliability, thereby lowering manufacturing costs in the long run. Key driving factors fueling market growth include the burgeoning pipeline of biologics and biosimilars, the increasing trend of outsourcing manufacturing and validation activities to specialized third-party providers, and continuous technological advancements in bioprocessing and analytical instrumentation. The global emphasis on quality assurance and risk-based approaches also significantly contributes to the sustained demand for bioprocess validation solutions.

Bioprocess Validation Market Executive Summary

The Bioprocess Validation Market is experiencing robust growth driven by several key business, regional, and segment trends. Globally, the biopharmaceutical industry is undergoing a significant transformation, characterized by an accelerated pace of drug development for complex biologics, gene therapies, and cell therapies. This surge directly translates into a heightened demand for specialized validation services and products, as manufacturers strive to meet stringent regulatory requirements and ensure product quality and safety. Business trends are increasingly leaning towards digitalization and automation of validation processes, moving away from traditional paper-based systems to integrated electronic validation management systems. Furthermore, a growing number of biopharmaceutical companies are opting to outsource their validation needs to expert contract service providers, seeking to leverage specialized knowledge, reduce operational overheads, and expedite time-to-market. The industry is also witnessing a shift towards continuous processing and real-time monitoring, which necessitate more dynamic and adaptable validation strategies, driving innovation in validation methodologies and technologies.

From a regional perspective, North America and Europe continue to dominate the bioprocess validation market, primarily due to the presence of a well-established biopharmaceutical industry, significant research and development investments, and a mature regulatory environment that strictly enforces validation mandates. These regions are home to numerous large pharmaceutical corporations and biotech innovators, creating a constant demand for high-quality validation services. However, the Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This growth is attributable to expanding biopharmaceutical manufacturing capabilities, increasing healthcare expenditure, a growing number of contract manufacturing and research organizations, and favorable government initiatives to promote biotechnology and pharmaceutical production in countries like China, India, and South Korea. Latin America and the Middle East & Africa (MEA) are also emerging as promising markets, driven by improving healthcare infrastructure, rising prevalence of chronic diseases, and increasing foreign investments in the healthcare sector, albeit from a smaller base.

Segment-wise, the market exhibits dynamic growth across various categories. The services segment, particularly testing and consulting services, is anticipated to hold a dominant share and demonstrate rapid expansion. This is due to the specialized expertise required for complex validation protocols and the growing trend of outsourcing. Within validation types, process validation and cleaning validation remain critical, with increasing emphasis on ensuring the sterility and purity of manufacturing lines. End-users such as pharmaceutical and biopharmaceutical companies represent the largest segment, as they directly engage in the production of biologics and require comprehensive validation for regulatory approval and ongoing compliance. The increasing adoption of advanced analytical techniques and single-use technologies is also shaping segment trends, pushing demand for validation services tailored to these innovative platforms. The confluence of these trends underscores a robust and expanding market, poised for continuous evolution in response to industry demands and regulatory landscapes.

AI Impact Analysis on Bioprocess Validation Market

Common user questions regarding the impact of AI on the Bioprocess Validation Market often revolve around how artificial intelligence can streamline traditionally labor-intensive and time-consuming validation processes, enhance data integrity, and provide predictive insights into process performance and potential failures. Users frequently inquire about AI's role in automating documentation, reducing human error, and ensuring compliance in an increasingly complex regulatory landscape. Concerns are often raised about the regulatory acceptance of AI-driven validation methods, the infrastructure required for AI implementation, the cost-benefit ratio, and the potential impact on job roles within the validation field. There is a strong expectation that AI will bring about a paradigm shift, moving validation from a reactive, periodic activity to a more proactive, continuous, and data-driven approach, fundamentally altering how quality assurance is managed in biopharmaceutical manufacturing. Users are keen to understand how AI can ensure robust, auditable data trails and contribute to a deeper understanding of process dynamics, ultimately leading to faster market entry for new biologics.

Based on this analysis, the key themes, concerns, and expectations users have about AI's influence in the bioprocess validation domain center on efficiency gains, enhanced predictive capabilities, improved data management, and the challenge of regulatory alignment. Users anticipate that AI will significantly shorten validation cycles by automating routine tasks, analyzing vast datasets for deviations, and optimizing process parameters. The ability of AI to provide real-time monitoring and predictive analytics for potential failures or out-of-spec conditions is highly valued, as it can prevent costly batch losses and ensure consistent quality. However, there is a clear concern regarding the validation of AI systems themselves – how does one validate an algorithm that is constantly learning and adapting? The need for robust, explainable AI (XAI) and clear regulatory guidelines for AI adoption in GxP environments is a paramount expectation. The impact on the workforce, requiring new skill sets for data scientists and AI specialists in validation teams, is also a frequently discussed topic. Ultimately, the market expects AI to drive a new era of 'smart' validation, characterized by higher accuracy, reduced manual effort, and a more comprehensive understanding of bioprocesses.

- Predictive Process Monitoring: AI algorithms analyze real-time and historical data from various sensors to predict potential process deviations or failures before they occur, enabling proactive intervention and reducing batch losses, thus moving towards predictive validation.

- Automated Data Analysis and Reporting: AI tools can automatically aggregate, analyze, and interpret vast amounts of validation data from different systems, generating comprehensive reports and identifying trends or anomalies much faster than manual methods, significantly streamlining documentation and audit preparation.

- Enhanced Risk Assessment: Machine learning models can assess risks associated with specific process parameters, equipment functionality, or raw material variations with greater precision, allowing for more targeted and efficient risk-based validation strategies.

- Optimization of Validation Protocols: AI can simulate various process conditions and optimize experimental designs for validation studies, leading to more efficient protocols that require fewer resources and less time while still providing robust evidence.

- Digital Twin Technology Integration: Coupling AI with digital twin technology allows for the creation of virtual models of bioprocesses, where validation scenarios can be tested and optimized in a simulated environment before physical implementation, accelerating process development and validation.

- Real-time Quality Assurance: AI-powered systems can enable continuous, real-time quality assurance by constantly monitoring critical process parameters and instantly flagging any excursions, moving validation from a batch-centric to a continuous verification model.

- Reduced Human Error: By automating repetitive tasks and providing data-driven insights, AI significantly minimizes the potential for human error in data collection, analysis, and decision-making within the validation lifecycle.

DRO & Impact Forces Of Bioprocess Validation Market

The Bioprocess Validation Market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces that collectively dictate its growth trajectory and evolutionary path. A primary driver is the continually increasing global demand for biologics, biosimilars, and advanced therapeutic medicinal products (ATMPs), which necessitate rigorous validation to ensure their safety and efficacy. This is further amplified by the escalating stringency of regulatory guidelines from agencies such as the FDA, EMA, and other national bodies, mandating comprehensive validation across all stages of biopharmaceutical manufacturing. The growing trend of outsourcing biopharmaceutical manufacturing to Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs) also serves as a strong driver, as these specialized entities often require their own robust validation frameworks and offer validation services to clients. Furthermore, continuous technological advancements in bioprocessing, analytical techniques, and automation systems themselves create a need for updated and specialized validation approaches, pushing market innovation.

However, the market also faces notable restraints. The inherently high cost associated with conducting comprehensive bioprocess validation studies, including investment in specialized equipment, trained personnel, and extensive testing, can be a significant barrier, particularly for smaller biotechnology firms. The complexity of biopharmaceutical processes, especially for novel advanced therapies, makes validation a challenging and resource-intensive endeavor, often requiring highly specialized expertise that is in short supply. Another restraint is the time-consuming nature of validation activities, which can delay product launches and increase overall development costs. Despite these challenges, ample opportunities exist for market expansion. The growing focus on personalized medicine and gene therapy presents new validation frontiers, requiring tailored and highly specialized approaches. Emerging markets, particularly in Asia Pacific and Latin America, offer untapped potential as their biopharmaceutical manufacturing capabilities expand. Moreover, the adoption of advanced analytics, artificial intelligence, and machine learning in optimizing validation protocols represents a significant opportunity for increasing efficiency, reducing costs, and accelerating validation cycles, transforming the traditional validation paradigm.

Impact forces on the Bioprocess Validation Market extend beyond direct DRO elements, influencing its foundational dynamics. Global economic pressures, including fluctuating R&D budgets and pharmaceutical pricing constraints, can impact investment in validation technologies and services. The globalization of biopharmaceutical manufacturing and supply chains necessitates harmonized validation standards and practices across different regions, posing complex challenges and opportunities for service providers. Furthermore, the rapid pace of scientific discovery and the introduction of novel bioprocessing technologies continually require the adaptation and evolution of validation methodologies, keeping the market in a state of constant flux. Public health crises, like pandemics, can dramatically accelerate the development and manufacturing of vaccines and therapeutics, placing unprecedented demands on the speed and efficiency of validation processes. Regulatory shifts, such as the increasing emphasis on real-time release testing and continuous process verification, are compelling manufacturers to adopt more dynamic and integrated validation strategies. These overarching forces underscore the critical and evolving role of bioprocess validation in ensuring the integrity of the global biopharmaceutical industry.

Segmentation Analysis

The Bioprocess Validation Market is extensively segmented to provide a detailed understanding of its diverse components and growth dynamics, reflecting the multifaceted nature of biopharmaceutical manufacturing and regulatory requirements. This segmentation allows for targeted analysis of market trends, identification of key growth areas, and strategic planning for stakeholders across the value chain. The market can be broadly categorized by the type of validation performed, the services offered, and the end-user industries that utilize these validation solutions. Each segment is critical to ensuring the quality, safety, and efficacy of biological products, from initial raw material assessment through final product release. The increasing complexity of biologics and the continuous evolution of manufacturing technologies further necessitate this granular level of market analysis to cater to specific industry needs and challenges. The comprehensive segmentation helps to map the intricate ecosystem of bioprocess validation, identifying both established and nascent areas of demand.

The segmentation by type focuses on the specific aspects of the bioprocess that undergo validation, each requiring distinct methodologies and expertise. Process validation, for instance, is foundational, ensuring the overall manufacturing process consistently delivers a product meeting quality standards. Cleaning validation is crucial for preventing cross-contamination between different products or batches, especially in multi-product facilities. Analytical method validation ensures that the testing procedures used to assess product quality are accurate, precise, and reliable. Equipment and utility validation verify that critical systems function as intended and meet predetermined specifications. Within the services segment, testing services, encompassing a wide range of analytical and microbiological tests, form a significant portion, followed by consulting services that provide expert guidance on validation strategies, regulatory compliance, and protocol development. Documentation and training services are also vital, ensuring proper record-keeping and knowledgeable personnel. End-user segmentation highlights the primary consumers of validation solutions, with pharmaceutical and biopharmaceutical companies being the largest, followed by contract manufacturing and research organizations that serve as key outsourced partners in the biopharmaceutical ecosystem, and academic institutions contributing to foundational research and method development.

- By Type:

- Process Validation

- Cleaning Validation

- Method Validation

- Equipment Validation

- Utility Validation

- Facility Validation

- Computer System Validation

- By Service:

- Testing Services

- Extractables & Leachables Testing

- Sterility Testing

- Bioburden Testing

- Endotoxin Testing

- Microbiological Identification

- Container Closure Integrity Testing (CCIT)

- Viral Clearance Studies

- Filter Validation

- Consulting Services

- Regulatory Compliance Consulting

- Validation Master Planning

- Risk Assessment & Mitigation

- Process Optimization Consulting

- Documentation & Training Services

- SOP Development

- Validation Protocol & Report Writing

- Personnel Training

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Medical Device Companies

Value Chain Analysis For Bioprocess Validation Market

A comprehensive value chain analysis of the Bioprocess Validation Market reveals a complex network of activities and stakeholders, extending from the initial development of bioprocess technologies to their final application in drug manufacturing. Upstream activities in this value chain primarily involve the research and development of novel bioprocessing technologies, including advanced bioreactors, purification systems, analytical instruments, and specialized consumables. This stage also includes the development of validation methodologies and standards by regulatory bodies and industry consortia. Key players at this stage are technology providers, equipment manufacturers, and specialized raw material suppliers who innovate to create more efficient and robust bioprocess components. These upstream innovations directly influence the complexity and scope of subsequent validation efforts. Furthermore, academic institutions and research organizations play a vital role in foundational research that informs new process development and subsequently, the need for new validation approaches, contributing intellectual capital and emerging scientific principles to the market's upstream.

As the value chain progresses to downstream activities, the focus shifts to the implementation and execution of validation protocols. This phase primarily involves biopharmaceutical companies, contract manufacturing organizations (CMOs), and contract research organizations (CROs) that conduct actual validation studies on their manufacturing processes, facilities, equipment, and analytical methods. Specialized validation service providers also form a critical part of this downstream segment, offering expertise in testing, documentation, and regulatory compliance. These entities leverage the technologies and methodologies developed upstream to ensure that biopharmaceutical products meet stringent quality and regulatory standards before reaching patients. The interaction between biopharmaceutical manufacturers and these service providers is often characterized by long-term partnerships, given the highly specialized nature of validation work and the need for continuity and consistency. Regulatory bodies are also intrinsically linked to the downstream, providing oversight and auditing validation efforts, thereby influencing best practices and compliance requirements.

The distribution channel for bioprocess validation services and products operates through both direct and indirect models. Direct channels often involve in-house validation teams within large pharmaceutical and biopharmaceutical companies that procure equipment, software, and sometimes raw materials directly from vendors. For specialized validation services, these large entities might engage directly with major global CROs or specialized validation consulting firms. This direct engagement allows for tailored solutions and deeper integration into the client's quality management system. Indirect channels, on the other hand, are typically utilized by smaller biotech companies or those seeking highly specific expertise that they lack internally. These companies might rely on intermediaries, distributors, or a network of smaller, niche validation consultancies that specialize in particular types of validation (e.g., cell & gene therapy validation) or specific regions. The distribution of validation-related software and hardware is often handled through a mix of direct sales forces and authorized distributors, ensuring widespread access to necessary tools. Both direct and indirect models are essential for facilitating the efficient flow of validation solutions across the diverse landscape of the biopharmaceutical industry, reflecting varied needs for expertise, scale, and geographic coverage.

Bioprocess Validation Market Potential Customers

The Bioprocess Validation Market serves a broad spectrum of critical stakeholders within the life sciences and healthcare sectors, all of whom share a common imperative: ensuring the quality, safety, and efficacy of their biological products and processes. Foremost among these are pharmaceutical and biopharmaceutical companies, which represent the largest segment of end-users. These organizations, ranging from multinational giants to emerging biotech startups, are engaged in the research, development, and manufacturing of biologics, vaccines, gene therapies, and cell therapies. Their need for bioprocess validation is constant and extensive, driven by regulatory mandates for new product approvals, continuous process improvement, and ongoing compliance. They require validation for every stage of their manufacturing lifecycle, from raw material qualification and cell bank characterization to final product release testing. The increasing complexity and diversity of their product pipelines amplify their demand for sophisticated and specialized validation services and technologies, making them the cornerstone of the bioprocess validation customer base.

Another significant category of potential customers includes Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). As the biopharmaceutical industry increasingly outsources various stages of drug development and manufacturing, CMOs and CROs have become indispensable partners. These organizations provide specialized services such as process development, analytical testing, clinical trial material production, and commercial manufacturing for their biopharma clients. Consequently, they must maintain robust bioprocess validation capabilities and highly qualified personnel to meet both their clients' requirements and global regulatory standards. Their business model often necessitates flexible and adaptable validation solutions, as they work with a diverse range of products and processes from multiple clients. Furthermore, academic and research institutes, particularly those engaged in translational research and early-stage bioprocess development, also constitute potential customers. While their validation needs might be less stringent than commercial manufacturers, they still require method validation and process qualification to ensure the reliability and reproducibility of their research findings and to facilitate technology transfer to commercial partners. This includes institutions involved in developing novel cell lines, fermentation processes, or purification techniques that will eventually require full-scale validation for therapeutic application. Additionally, ancillary industries such as medical device manufacturers, especially those producing combination products or sterile biological components, also require elements of bioprocess validation to ensure product quality and regulatory compliance, further broadening the customer base.

Report Attributes Report Details Market Size in 2025 USD 15.8 Billion Market Forecast in 2032 USD 28.9 Billion Growth Rate 8.9% CAGR Historical Year 2019 to 2023 Base Year 2024 Forecast Year 2025 - 2032 DRO & Impact Forces - Drivers: Increasing demand for biologics, stringent regulatory requirements, outsourcing trend in biopharma, technological advancements.

- Restraints: High cost of validation, complexity of bioprocesses, lack of skilled personnel.

- Opportunities: Emerging markets, personalized medicine, AI & advanced analytics integration.

Segments Covered - By Type: Process Validation, Cleaning Validation, Method Validation, Equipment Validation, Utility Validation, Facility Validation, Computer System Validation

- By Service: Testing Services (Extractables & Leachables, Sterility, Bioburden, Endotoxin, Microbial ID, CCIT, Viral Clearance, Filter Validation), Consulting Services (Regulatory Compliance, VMP, Risk Assessment), Documentation & Training Services (SOPs, Protocol/Report Writing, Personnel Training)

- By End-User: Pharmaceutical & Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Contract Research Organizations (CROs), Academic & Research Institutes, Medical Device Companies

Key Companies Covered SGS SA, Eurofins Scientific, Thermo Fisher Scientific Inc., Lonza Group AG, Sartorius AG, Merck KGaA, GE Healthcare (now Cytiva), Pall Corporation (a Danaher company), WuXi AppTec, Charles River Laboratories International Inc., Catalent Inc., bioMérieux SA, Labcorp, Agilent Technologies Inc., Shimadzu Corporation, Cytiva, Maravai LifeSciences, Avantor Inc., Bio-Rad Laboratories Inc., Aldevron Regions Covered North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) Enquiry Before Buy Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy Bioprocess Validation Market Key Technology Landscape

The Bioprocess Validation Market is characterized by a rapidly evolving technology landscape, driven by the need for greater efficiency, accuracy, and compliance in biopharmaceutical manufacturing. At its core, the technology employed spans advanced analytical instruments, specialized software, and innovative automation solutions designed to streamline and enhance validation processes. High-performance liquid chromatography (HPLC), mass spectrometry (MS), and gas chromatography (GC) are foundational analytical technologies used for method validation, impurity profiling, and product characterization, ensuring the identity, purity, and potency of biological products. Advanced microbiological testing methods, including rapid microbial detection systems and molecular identification techniques, have become crucial for sterility and bioburden validation, significantly reducing testing times and improving reliability. These analytical advancements enable a more precise and comprehensive assessment of process robustness and product quality attributes, moving beyond traditional, time-intensive assays to more data-rich and accelerated evaluations.

Beyond analytical tools, the market heavily relies on automation and digital solutions. Process analytical technology (PAT) and quality by design (QbD) principles are increasingly integrated into bioprocess validation, leveraging real-time monitoring and control systems to collect continuous data on critical process parameters. This allows for a more dynamic and continuous validation approach, moving away from discrete, periodic validation cycles. Specialized validation management software, including electronic batch record systems and enterprise quality management systems (EQMS), are pivotal for managing documentation, tracking deviations, and ensuring audit readiness, replacing cumbersome paper-based systems. The adoption of single-use technologies (SUTs) in bioreactors, mixers, and purification systems has also introduced new validation challenges and opportunities, requiring specific extractables and leachables testing, as well as integrity testing. Furthermore, the burgeoning field of artificial intelligence (AI) and machine learning (ML) is transforming the technology landscape by enabling predictive maintenance for equipment, advanced data analytics for process understanding, and even automated protocol generation, promising to further revolutionize the efficiency and effectiveness of bioprocess validation in the coming years. These technologies collectively drive the market towards more integrated, data-driven, and proactive validation strategies.

Regional Highlights

- North America: This region holds a dominant share in the Bioprocess Validation Market, primarily driven by the presence of a robust biopharmaceutical industry, significant investments in research and development, and a stringent regulatory environment. The United States, in particular, boasts numerous large pharmaceutical companies, biotechnology firms, and a highly advanced healthcare infrastructure, which collectively create a high demand for advanced validation services and technologies. Early adoption of novel bioprocessing technologies and a strong focus on regulatory compliance further bolster market growth.

- Europe: Europe represents another key market, characterized by a well-established biopharmaceutical sector, strong regulatory frameworks (e.g., EMA guidelines), and a strong emphasis on quality assurance. Countries like Germany, the UK, France, and Switzerland are major contributors due to their significant R&D spending, a high concentration of pharmaceutical and biotech companies, and growing contract manufacturing activities. The region's commitment to innovation and the rising pipeline of biologics support sustained market expansion.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market during the forecast period. This rapid growth is attributed to the expanding biopharmaceutical manufacturing capabilities in countries such as China, India, Japan, and South Korea, coupled with increasing healthcare expenditure and a growing trend of outsourcing manufacturing and research activities to this region. Favorable government initiatives, rising patient populations, and increasing R&D investments by both domestic and international players are fueling the demand for bioprocess validation.

- Latin America: This emerging market shows promising growth, driven by improving healthcare infrastructure, increasing investment in pharmaceutical manufacturing, and rising awareness of regulatory compliance. Countries like Brazil and Mexico are leading the adoption of bioprocess validation solutions as their local biopharmaceutical industries mature and seek to meet international quality standards.

- Middle East and Africa (MEA): While currently a smaller market, the MEA region is experiencing gradual growth due to increasing healthcare investments, a rising prevalence of chronic diseases, and efforts to establish local pharmaceutical manufacturing capabilities. Enhanced regulatory frameworks and growing partnerships with international biopharmaceutical companies are slowly but steadily contributing to the demand for bioprocess validation services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioprocess Validation Market.- SGS SA

- Eurofins Scientific

- Thermo Fisher Scientific Inc.

- Lonza Group AG

- Sartorius AG

- Merck KGaA

- Cytiva (formerly GE Healthcare Life Sciences)

- Pall Corporation (a Danaher company)

- WuXi AppTec

- Charles River Laboratories International Inc.

- Catalent Inc.

- bioMérieux SA

- Labcorp

- Agilent Technologies Inc.

- Shimadzu Corporation

- Maravai LifeSciences

- Avantor Inc.

- Bio-Rad Laboratories Inc.

- Aldevron

- Waters Corporation

Frequently Asked Questions

What is bioprocess validation and why is it essential?

Bioprocess validation is the documented assurance that a biopharmaceutical manufacturing process consistently yields a product meeting predetermined quality attributes and regulatory standards. It is essential for ensuring product safety, efficacy, purity, and for achieving and maintaining regulatory compliance with health authorities like the FDA and EMA. It minimizes risks, reduces batch failures, and supports faster market entry for new biologics.

How does AI impact the Bioprocess Validation Market?

AI significantly impacts bioprocess validation by enabling predictive process monitoring, automating complex data analysis and reporting, and enhancing risk assessment. It facilitates real-time quality assurance, optimizes validation protocols, and can integrate with digital twin technology, ultimately streamlining validation cycles, reducing human error, and fostering more proactive quality management in biomanufacturing.

What are the primary drivers and restraints for market growth?

Key drivers include the surging global demand for biologics and advanced therapies, increasingly stringent regulatory requirements, the growing trend of outsourcing manufacturing and validation activities, and continuous technological advancements in bioprocessing. Restraints typically involve the high costs associated with comprehensive validation, the inherent complexity of biopharmaceutical processes, and the shortage of highly skilled personnel.

Which regions are leading in the Bioprocess Validation Market, and why?

North America and Europe are currently leading due to their well-established biopharmaceutical industries, significant R&D investments, and mature, stringent regulatory environments. The Asia Pacific region, particularly countries like China and India, is projected to be the fastest-growing market, driven by expanding manufacturing capabilities, increasing healthcare expenditure, and favorable government support for biotechnology.

Who are the major end-users of bioprocess validation services and technologies?

The major end-users are pharmaceutical and biopharmaceutical companies, which directly engage in the development and manufacturing of biologics. Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) also represent a significant segment, providing outsourced validation expertise. Additionally, academic and research institutes, as well as some medical device companies, utilize specific aspects of bioprocess validation for their operations.

- Testing Services

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager