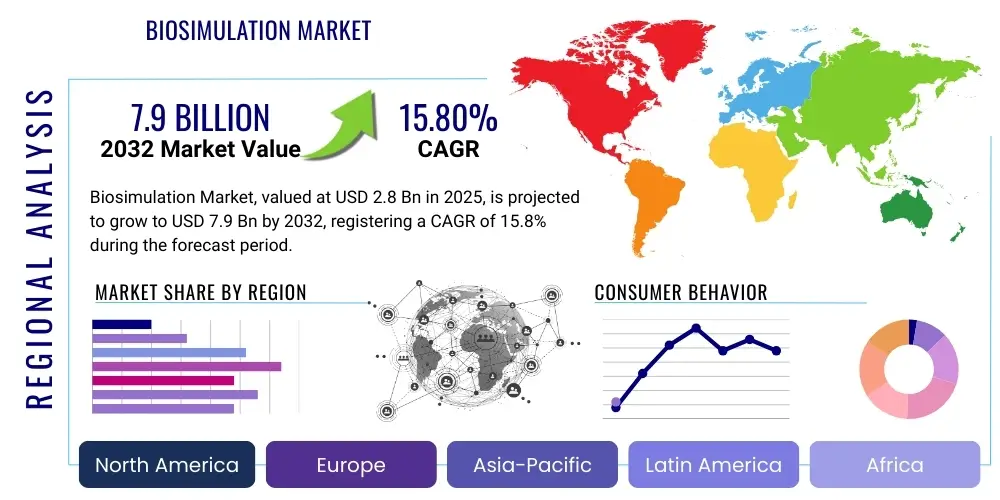

Biosimulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427327 | Date : Oct, 2025 | Pages : 244 | Region : Global | Publisher : MRU

Biosimulation Market Size

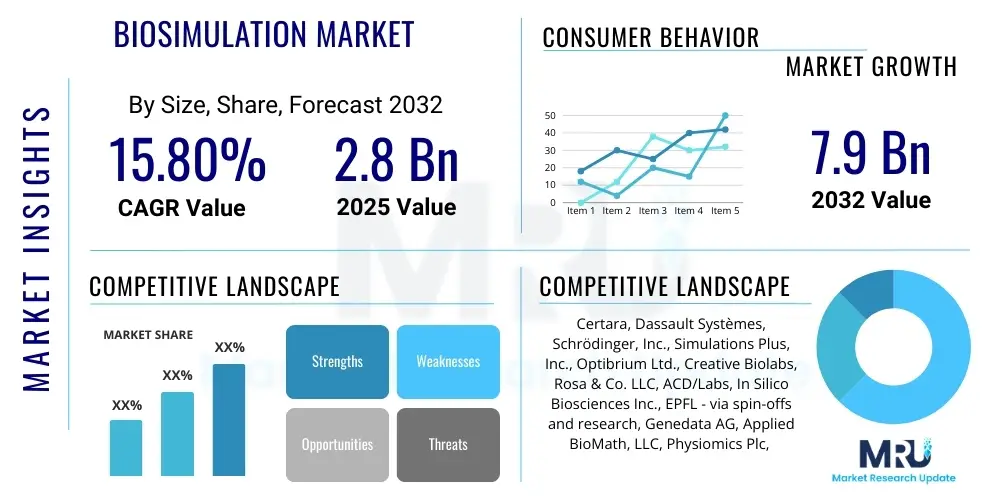

The Biosimulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2025 and 2032. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2032.

Biosimulation Market introduction

The Biosimulation Market encompasses the development and application of computer models and simulations to predict and analyze biological processes and drug behavior. This sophisticated field integrates computational biology, biophysics, and pharmacology to create virtual representations of biological systems, ranging from subcellular mechanisms to entire organisms. Products within this market include advanced software platforms, specialized databases, and consulting services that support drug discovery, development, and regulatory approval. Major applications span pharmacokinetics (PK), pharmacodynamics (PD), quantitative systems pharmacology (QSP), and physiologically based pharmacokinetic (PBPK) modeling, facilitating a deeper understanding of drug-target interactions and disease progression.

The primary benefits derived from biosimulation include accelerated drug development timelines, significant reductions in R&D costs by minimizing the need for extensive in vitro and in vivo experimentation, and enhanced decision-making throughout the drug lifecycle. By providing predictive insights into drug efficacy and safety, biosimulation tools enable researchers to optimize clinical trial designs, personalize therapeutic approaches, and identify potential adverse effects earlier in the development process. These capabilities are crucial for pharmaceutical companies aiming to bring novel therapies to market more efficiently and with greater confidence in their clinical outcomes.

Key driving factors for the expansion of the biosimulation market include the increasing complexity of drug discovery, the rising demand for personalized medicine, and the growing regulatory acceptance of modeling and simulation data in drug submissions. Pharmaceutical and biotechnology companies are increasingly leveraging biosimulation to address the challenges of high attrition rates in clinical trials and to manage the escalating costs associated with bringing new drugs to market. Furthermore, advancements in computational power, artificial intelligence, and machine learning are continuously enhancing the capabilities and predictive accuracy of biosimulation platforms, making them indispensable tools in modern medical research and development.

Biosimulation Market Executive Summary

The biosimulation market is experiencing robust growth, primarily driven by the pharmaceutical industrys escalating demand for more efficient and cost-effective drug development strategies. Business trends highlight a strong focus on strategic collaborations and partnerships between technology providers and pharmaceutical companies, fostering the integration of advanced computational tools into various stages of drug discovery and development. Furthermore, there is a clear shift towards cloud-based biosimulation platforms, offering enhanced accessibility, scalability, and collaborative capabilities, which are particularly appealing to smaller biotech firms and academic research institutions. The market also observes an increasing investment in research and development aimed at improving the predictive accuracy and scope of biosimulation models, encompassing a wider range of biological complexities and therapeutic areas.

Regionally, North America continues to dominate the biosimulation market, primarily due to the presence of a well-established pharmaceutical and biotechnology industry, substantial R&D investments, and a favorable regulatory environment that actively encourages the use of advanced computational methods. Europe follows, with significant contributions from countries like the UK, Germany, and Switzerland, driven by strong academic research and government funding for innovative drug development. The Asia Pacific region is emerging as a high-growth market, propelled by increasing healthcare expenditures, a burgeoning contract research organization (CRO) sector, and a growing emphasis on biopharmaceutical R&D in countries such as China, India, and Japan. Latin America and the Middle East and Africa are also showing nascent growth, driven by expanding healthcare infrastructure and rising awareness of advanced drug development technologies.

In terms of segment trends, software solutions maintain the largest market share, with a growing emphasis on user-friendly interfaces, integrated functionalities, and interoperability with other R&D tools. Services, including consulting, training, and custom model development, are experiencing rapid expansion as companies seek specialized expertise to optimize their biosimulation strategies and interpret complex data. Therapeutic area-wise, oncology and central nervous system (CNS) disorders represent significant application areas due to the high unmet medical needs and the complexity of these diseases, requiring sophisticated predictive modeling. The adoption of biosimulation is also accelerating in areas like immunology, infectious diseases, and metabolic disorders, underscoring its versatility across a broad spectrum of medical conditions.

AI Impact Analysis on Biosimulation Market

The integration of Artificial Intelligence (AI) is profoundly transforming the biosimulation market, addressing a range of user questions regarding the future capabilities and efficiencies of drug development. Users frequently inquire about how AI can enhance the accuracy and speed of biosimulation models, automate complex data analysis, and improve the prediction of drug efficacy and toxicity. There is significant interest in AIs potential to handle vast, multi-omics datasets, identify novel drug targets, and personalize treatment regimens by simulating individual patient responses. Concerns often revolve around the interpretability of AI-driven models, the validation of AI-generated insights, and the ethical implications of autonomous decision-making in drug research. Expectations are high for AI to reduce development costs, accelerate market entry for new drugs, and unlock insights that were previously unattainable through traditional biosimulation methods alone, thereby revolutionizing the entire biopharmaceutical R&D landscape.

AIs primary impact on biosimulation lies in its ability to process and interpret massive datasets from genomic, proteomic, and clinical sources, which would be intractable for human analysis. Machine learning algorithms can identify subtle patterns and correlations that inform more robust and predictive models, leading to a significant enhancement in the accuracy of drug-target binding predictions, ADME (absorption, distribution, metabolism, excretion) properties, and potential toxicity profiles. This not only streamlines the lead optimization process but also enables the exploration of a much wider chemical space, significantly increasing the chances of discovering novel therapeutic compounds. Furthermore, deep learning techniques are being employed to develop more sophisticated quantitative systems pharmacology (QSP) models that can simulate complex biological networks and disease pathways with unprecedented fidelity, providing a holistic view of drug action within the body.

Beyond predictive modeling, AI is automating various aspects of biosimulation, from experimental design to data interpretation. Natural Language Processing (NLP) can extract valuable insights from scientific literature and clinical trial reports, feeding this knowledge directly into simulation models to improve their contextual relevance and realism. The advent of generative AI models is also paving the way for de novo drug design, where AI can propose novel molecular structures with desired pharmacological properties, which can then be rigorously tested through biosimulation. This symbiotic relationship between AI and biosimulation is creating a powerful synergy, pushing the boundaries of what is possible in drug discovery and development, making the process faster, more intelligent, and ultimately more successful in delivering life-saving medications to patients.

- AI significantly enhances predictive accuracy of biosimulation models.

- Automates data analysis, accelerating drug discovery and optimization.

- Enables personalized medicine through individualized patient response simulation.

- Facilitates identification of novel drug targets and pathways.

- Reduces R&D costs and shortens drug development timelines.

- Improves lead optimization and toxicity prediction for compounds.

- Drives the creation of sophisticated QSP models for complex biological systems.

DRO & Impact Forces Of Biosimulation Market

The Biosimulation Market is influenced by a dynamic interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. A significant driver is the persistent pressure on pharmaceutical companies to reduce the exorbitant costs and time associated with traditional drug development, alongside the increasing demand for more precise and effective therapeutic interventions. Regulatory bodies, such as the FDA and EMA, are also increasingly endorsing the use of modeling and simulation data in drug submissions, providing a strong incentive for adoption. Furthermore, the growing adoption of personalized medicine approaches, which necessitate highly predictive models to tailor treatments to individual patients, acts as a powerful catalyst for market expansion. The continuous evolution of computational hardware and software, coupled with advancements in data science, further enhances the capabilities and accessibility of biosimulation tools, making them indispensable in modern R&D.

However, the market also faces notable restraints. The primary challenge remains the high initial investment required for implementing sophisticated biosimulation software and platforms, which can be a barrier for smaller biotechnology firms and academic institutions with limited budgets. A shortage of skilled professionals proficient in both computational biology and pharmacology poses another significant hurdle, as the effective application and interpretation of biosimulation results demand specialized expertise. Additionally, the inherent complexity of biological systems often limits the complete predictability of models, leading to ongoing skepticism among some researchers about the absolute reliability of simulation outcomes compared to empirical experimental data. The need for extensive validation and verification of biosimulation models also adds to the development overhead, impacting the speed of integration.

Despite these challenges, numerous opportunities are poised to propel the market forward. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) with biosimulation promises to unlock unprecedented capabilities in predictive modeling, data interpretation, and de novo drug design. Emerging therapeutic areas, such as cell and gene therapies, offer fertile ground for biosimulation applications, given their complexity and the need for precise mechanistic understanding. The expansion of biosimulation into academic research and contract research organizations (CROs) represents a substantial growth avenue, as these entities increasingly recognize the value of computational tools in accelerating their scientific endeavors. Moreover, advancements in cloud computing are democratizing access to high-performance computing resources, lowering the barrier to entry for many potential users and fostering wider adoption across the global R&D ecosystem.

Segmentation Analysis

The biosimulation market is comprehensively segmented based on various key parameters including product, application, end-user, and therapeutic area, each playing a crucial role in defining market dynamics and growth opportunities. The product segment primarily delineates between software solutions and services, reflecting the dual requirement for advanced computational tools and expert support. Software encompasses a broad array of modeling and simulation platforms, ranging from basic PK/PD tools to highly complex QSP and PBPK models, designed to address specific research questions. Services, on the other hand, include consulting, training, model development, and data analysis support, catering to organizations that may lack internal expertise or resources to fully leverage biosimulation technologies independently. This segmentation helps to understand the diverse offerings available and the preferred modes of engagement by end-users.

Application-based segmentation reveals the primary uses of biosimulation across the drug development pipeline. These applications range from early-stage drug discovery, where models aid in target identification and lead optimization, to preclinical and clinical development, where they support dose selection, trial design, and biomarker identification. Post-market surveillance also increasingly utilizes biosimulation to predict long-term drug effects and patient safety. The end-user segment categorizes the market based on the types of organizations adopting these technologies, predominantly pharmaceutical and biotechnology companies, academic and research institutes, and contract research organizations (CROs). Each end-user group has distinct needs and budgetary considerations that influence their adoption patterns and demand for specific biosimulation products and services.

Finally, the market is also segmented by therapeutic area, highlighting the prevalence and specific requirements of biosimulation across different disease categories. Oncology, with its complex disease mechanisms and high unmet medical needs, stands out as a dominant area, utilizing biosimulation for understanding tumor progression, drug resistance, and optimizing combination therapies. Other significant therapeutic areas include central nervous system (CNS) disorders, metabolic disorders, infectious diseases, and inflammatory diseases, each presenting unique challenges that biosimulation helps address. This detailed segmentation provides a granular view of the market, enabling stakeholders to identify niche opportunities, tailor product development strategies, and forecast growth in specific sectors, ultimately guiding strategic business decisions within the expansive biosimulation landscape.

- By Product: Software, Services

- By Application: Drug Discovery, Drug Development (Preclinical, Clinical), Other Applications

- By End-User: Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations (CROs)

- By Therapeutic Area: Oncology, Central Nervous System Disorders, Metabolic Disorders, Infectious Diseases, Cardiovascular Diseases, Immunological Disorders, Other Therapeutic Areas

Biosimulation Market Value Chain Analysis

The value chain for the biosimulation market is intricate, involving several key stages from foundational research and software development to widespread adoption and ongoing support. It begins with upstream activities focused on basic scientific research in biology, chemistry, and computational sciences, which provides the theoretical underpinnings for biosimulation models. This stage also includes the development of core algorithms and computational frameworks by specialized software providers and academic institutions. The next critical component is the development of robust biosimulation software platforms that integrate complex mathematical models, biological databases, and user-friendly interfaces. These platforms are often built by dedicated biosimulation companies, leveraging expertise in computational biology, pharmacology, and software engineering. The quality and sophistication of these upstream inputs directly influence the accuracy, efficiency, and utility of the final biosimulation products.

Midstream activities involve the refinement, validation, and commercialization of these software solutions and associated services. This includes rigorous testing of models against empirical data, ensuring their predictive capabilities and reliability for various applications. Training and educational programs also form a crucial part of this stage, equipping users with the necessary skills to effectively operate and interpret biosimulation tools. Downstream activities primarily encompass the distribution channels through which these products and services reach the end-users. Direct sales channels are common, where biosimulation companies market and sell their software licenses and service contracts directly to pharmaceutical firms, biotech companies, and research organizations. This allows for direct engagement, customization, and continuous feedback, fostering strong client relationships and tailored solutions.

Indirect distribution channels also play an increasingly important role, particularly through strategic partnerships with larger technology companies, cloud service providers, and contract research organizations (CROs). These partnerships enable broader market reach, integration with other R&D platforms, and the provision of biosimulation as part of a larger service offering. The entire value chain is characterized by a high degree of specialization and collaboration, with each participant contributing unique expertise to deliver comprehensive and effective biosimulation solutions. The success of the market heavily relies on seamless integration across these stages, ensuring that innovative research translates into practical, validated, and accessible tools that support the advanced requirements of modern drug discovery and development.

Biosimulation Market Potential Customers

The potential customer base for the biosimulation market is diverse and primarily concentrated within the life sciences and healthcare sectors, driven by the imperative to accelerate drug development and enhance therapeutic outcomes. Pharmaceutical and biotechnology companies represent the largest segment of end-users, constantly seeking innovative solutions to overcome the challenges of high attrition rates, escalating R&D costs, and extended timelines in bringing new drugs to market. These organizations leverage biosimulation across various stages, from early-stage target identification and lead optimization to preclinical testing, clinical trial design, and post-marketing surveillance. Their demand spans sophisticated software platforms for PK/PD modeling, QSP, and PBPK, as well as specialized consulting services for complex drug development projects and regulatory submissions, aiming to achieve faster approvals and better patient safety profiles.

Academic and research institutes constitute another significant customer group, utilizing biosimulation tools for fundamental scientific discovery, disease modeling, and understanding complex biological mechanisms. These institutions employ biosimulation for teaching purposes, hypothesis testing, and exploring novel therapeutic strategies in a cost-effective and time-efficient manner. While their budgetary constraints may differ from industry players, their demand for robust, flexible, and often open-source compatible biosimulation platforms is growing, driven by an increasing emphasis on computational approaches in biological research. Collaborations between academic institutions and biosimulation providers are also common, fostering innovation and extending the reach of these technologies into emerging research areas, often funded by grants and public sector investments.

Contract Research Organizations (CROs) are rapidly emerging as key potential customers, offering biosimulation services as part of their comprehensive R&D offerings to pharmaceutical and biotech clients. CROs benefit from biosimulation by enhancing their service portfolio, providing advanced data analysis capabilities, and streamlining study designs for their clients. The ability to integrate biosimulation into their service packages allows CROs to offer more competitive and value-added solutions, particularly for complex drug development programs that require extensive modeling and simulation support. Furthermore, regulatory agencies also serve as indirect customers, as they increasingly rely on and require biosimulation data for evaluating drug safety and efficacy profiles, implicitly driving demand for validated and high-quality simulation tools across the industry.

Biosimulation Market Key Technology Landscape

The Biosimulation Market is underpinned by a sophisticated array of technologies that enable the creation, execution, and analysis of complex biological models. At its core, the landscape relies heavily on advanced computational modeling techniques, including physiologically based pharmacokinetic (PBPK) modeling, quantitative systems pharmacology (QSP) modeling, and pharmacokinetics/pharmacodynamics (PK/PD) modeling. PBPK models simulate drug absorption, distribution, metabolism, and excretion within the body, offering insights into how drugs interact with physiological systems. QSP models go a step further, integrating molecular, cellular, and organ-level interactions to predict drug effects on disease pathways. PK/PD models focus on the relationship between drug concentration and its pharmacological effects, crucial for dose optimization. These foundational modeling approaches are continuously evolving, incorporating greater biological detail and mechanistic understanding to improve predictive accuracy and clinical relevance.

Beyond these core modeling methodologies, the technology landscape is significantly shaped by robust software platforms and computational infrastructure. High-performance computing (HPC) environments, including cloud-based solutions, are essential for running computationally intensive simulations and handling large datasets. These platforms provide the necessary processing power and scalability, democratizing access to complex biosimulation capabilities for a wider range of users. Data integration and management tools are also critical, allowing researchers to seamlessly combine diverse data types—such as genomic, proteomic, clinical, and experimental data—to build more comprehensive and accurate models. Furthermore, advanced visualization tools are indispensable for interpreting the intricate outputs of simulations, transforming complex numerical data into intuitive graphical representations that facilitate understanding and decision-making.

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms represents a transformative technological advancement in biosimulation. AI/ML techniques are being deployed to enhance various aspects, including parameter estimation, model calibration, uncertainty quantification, and predictive analytics. For instance, machine learning can identify patterns in vast biological datasets to refine model parameters or predict optimal experimental conditions. Deep learning methods are being used to build more sophisticated and data-driven models, particularly in areas like drug-target interaction prediction and de novo drug design. Furthermore, semantic web technologies and ontologies are being utilized to improve the interoperability and reusability of biosimulation models and data, fostering a more collaborative and efficient research ecosystem. These technological synergies are driving the next generation of biosimulation capabilities, enabling more powerful insights and accelerating the pace of pharmaceutical innovation.

Regional Highlights

Regional dynamics significantly influence the growth and adoption of biosimulation technologies across the globe, with distinct drivers and market maturities in different geographical areas. North America consistently leads the biosimulation market, primarily attributable to its highly developed pharmaceutical and biotechnology industry, which is characterized by substantial investments in research and development and a strong drive for innovation. The presence of numerous key market players, coupled with a supportive regulatory environment that actively promotes the use of modeling and simulation in drug development and approval processes, further solidifies its dominant position. Extensive academic research activities and a robust funding landscape for life sciences also contribute significantly to the regions leadership in adopting and advancing biosimulation technologies, particularly in the United States and Canada.

Europe represents the second-largest market for biosimulation, driven by a strong focus on advanced pharmaceutical research, a well-established healthcare infrastructure, and favorable government initiatives supporting biotechnological innovation. Countries such as the United Kingdom, Germany, France, and Switzerland are at the forefront, boasting a high concentration of pharmaceutical companies and research institutions actively integrating biosimulation into their R&D workflows. The European Medicines Agency (EMA) has also been proactive in encouraging the use of modeling and simulation data, fostering a receptive environment for market growth. Collaborative research programs and a skilled workforce further bolster Europes position as a significant contributor to the global biosimulation market, with continuous advancements in both software and services.

The Asia Pacific region is rapidly emerging as a high-growth market, propelled by increasing healthcare expenditures, expanding pharmaceutical and biotechnology sectors, and a growing emphasis on R&D capabilities in countries like China, India, and Japan. Governments in these nations are investing heavily in scientific research and developing sophisticated healthcare infrastructure, which in turn drives the adoption of advanced technologies like biosimulation. The presence of a large patient population, coupled with a rising number of contract research organizations (CROs) offering biosimulation services, positions Asia Pacific for substantial future growth. Latin America and the Middle East & Africa regions are also demonstrating nascent growth, driven by improving healthcare access, increasing awareness of advanced drug development methods, and gradual investments in R&D infrastructure, signaling potential opportunities for market expansion in the long term.

- North America: Dominates the market due to robust R&D, established pharmaceutical industry, and favorable regulatory support. Key markets include the United States and Canada.

- Europe: Second largest market, driven by strong academic research, pharmaceutical innovation, and proactive regulatory encouragement from EMA. Prominent countries are the UK, Germany, France, and Switzerland.

- Asia Pacific: Fastest-growing region, fueled by increasing healthcare investments, expanding biotech sectors, and R&D emphasis in China, India, and Japan.

- Latin America: Emerging market with increasing healthcare access and growing awareness of advanced drug development tools.

- Middle East & Africa: Showing gradual growth with developing healthcare infrastructure and increasing investments in life sciences R&D.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biosimulation Market.- Certara

- Dassault Systèmes (SIMULIA)

- Schrödinger, Inc.

- Simulations Plus, Inc.

- Optibrium Ltd.

- Creative Biolabs

- Rosa & Co. LLC

- ACD/Labs

- In Silico Biosciences Inc.

- EPFL (École Polytechnique Fédérale de Lausanne) - via spin-offs and research

- Genedata AG

- Applied BioMath, LLC

- Physiomics Plc

- Instem

- Acellera

Frequently Asked Questions

What is biosimulation and how does it benefit drug development?

Biosimulation involves using computer models to simulate biological processes and drug behavior. It benefits drug development by accelerating research, reducing costs through fewer experiments, predicting drug efficacy and safety, optimizing clinical trial designs, and facilitating personalized medicine approaches.

How is AI impacting the biosimulation market?

AI is transforming biosimulation by enhancing predictive accuracy, automating complex data analysis, enabling the handling of vast multi-omics datasets, accelerating drug discovery and optimization, and facilitating the design of novel therapeutic compounds, ultimately making drug development faster and more intelligent.

What are the main applications of biosimulation in the pharmaceutical industry?

The main applications include pharmacokinetics (PK) and pharmacodynamics (PD) modeling, quantitative systems pharmacology (QSP), physiologically based pharmacokinetic (PBPK) modeling, target identification, lead optimization, preclinical testing, clinical trial design, and post-market surveillance for drug safety.

What are the key challenges faced by the biosimulation market?

Key challenges include the high initial investment costs for software and platforms, a shortage of skilled professionals with dual expertise in computational biology and pharmacology, the inherent complexity of biological systems limiting complete model predictability, and the continuous need for extensive model validation.

Which therapeutic areas most significantly utilize biosimulation?

Oncology and Central Nervous System (CNS) disorders are major therapeutic areas leveraging biosimulation due to their complex disease mechanisms and high unmet medical needs. Other significant areas include metabolic disorders, infectious diseases, cardiovascular diseases, and immunological disorders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager