Blast Monitoring Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427989 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Blast Monitoring Equipment Market Size

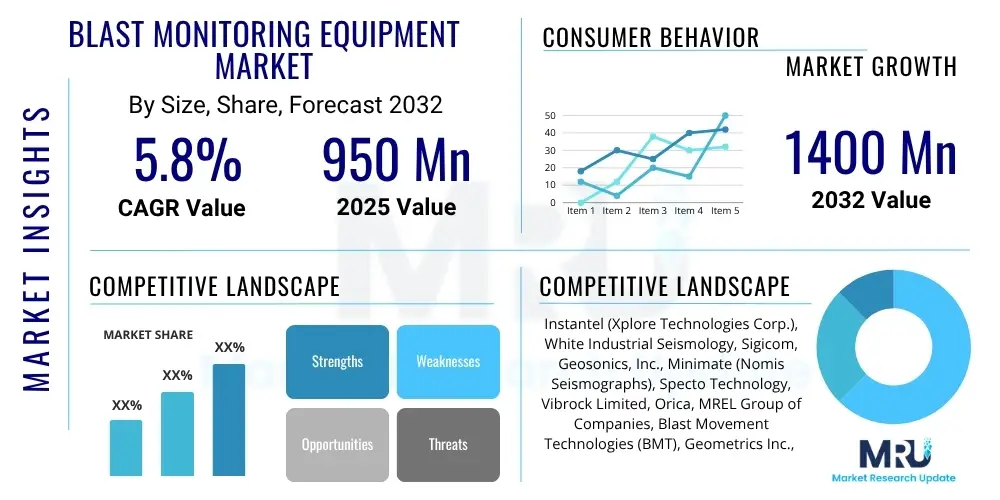

The Blast Monitoring Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 950 million in 2025 and is projected to reach USD 1400 million by the end of the forecast period in 2032.

Blast Monitoring Equipment Market introduction

The Blast Monitoring Equipment Market encompasses a sophisticated array of instruments and systems engineered to accurately measure, record, and analyze ground vibrations and air overpressure generated by controlled explosive events. These specialized devices are indispensable across a multitude of heavy industries, primarily mining, construction, quarrying, and demolition, where precise control over blasting operations is paramount. Products within this market segment include advanced seismographs, highly sensitive geophones, accelerometers, and sophisticated microphones, all integrated with powerful data acquisition hardware and analytical software. The core function of this equipment is to capture critical parameters such such as peak particle velocity (PPV), frequency, and air blast amplitude, providing actionable intelligence for operational optimization and regulatory compliance. The evolution of these systems has shifted towards greater automation, wireless connectivity, and intelligent data processing, reflecting a broader industry trend towards digitalization and enhanced operational oversight.

The primary impetus for the widespread adoption of blast monitoring equipment stems from the imperative to ensure stringent safety standards, uphold environmental responsibility, and achieve operational efficiency. Uncontrolled blasting can lead to significant risks, including structural damage to nearby buildings and infrastructure, potential harm to human populations, and undesirable environmental impacts such as excessive noise and ground heave. Therefore, these monitoring systems serve as critical tools for mitigating these risks by providing real-time and historical data that informs blast design modifications. They enable engineers to fine-tune blast patterns, charge weights, and initiation sequences to achieve optimal rock fragmentation while strictly adhering to permissible vibration and air overpressure limits set by regulatory authorities. The data collected also plays a vital role in post-blast analysis, allowing for continuous improvement in blasting methodologies and contributing to a more predictable and controlled operational environment.

Major applications of blast monitoring equipment are deeply embedded in industries that rely on precise material extraction and earthmoving. In the mining sector, both open-pit and underground operations utilize this equipment extensively for ore body fragmentation, overburden removal, and ensuring the stability of mine structures. The construction and civil engineering industries deploy these systems for site preparation, tunneling, road building, and foundation work, particularly in urban or sensitive ecological areas where minimizing disturbance is crucial. Quarrying operations, focused on producing aggregates and dimension stone, also heavily depend on blast monitoring to manage yield and environmental impact. The benefits derived from implementing these advanced systems are substantial: they include enhanced worker safety by preventing incidents and ensuring compliance with occupational health standards, improved community relations through reduced nuisance complaints, and significant financial savings through optimized blast designs that decrease secondary breakage, improve material handling efficiency, and extend the lifespan of heavy machinery. These compelling advantages, coupled with an increasing global emphasis on sustainable industrial practices and robust infrastructure development, act as powerful driving factors propelling the market forward.

Blast Monitoring Equipment Market Executive Summary

The Blast Monitoring Equipment Market is undergoing a transformative period marked by pervasive technological advancements and an escalating focus on regulatory adherence and operational excellence. Current business trends indicate a decisive pivot towards integrated, smart solutions that leverage the Internet of Things (IoT) for real-time data transmission and cloud-based platforms for comprehensive analytics. This shift is enabling industries to move beyond conventional reactive monitoring towards proactive risk management, facilitated by remote access, centralized data management, and sophisticated reporting capabilities. Companies are vigorously pursuing innovations in wireless technology, enhancing device robustness, extending battery life, and developing more intuitive software interfaces to simplify data interpretation and decision-making. There is a growing emphasis on providing holistic solutions that not only monitor blast effects but also integrate with other site management systems, such as enterprise resource planning (ERP) and geographic information systems (GIS), to create a more interconnected and intelligent operational ecosystem.

Regional dynamics within the market highlight distinct growth patterns and maturity levels. The Asia Pacific (APAC) region stands out as the primary growth engine, propelled by unprecedented levels of infrastructure development, burgeoning mining activities, and rapid urbanization across countries like China, India, Indonesia, and Australia. While price sensitivity remains a factor, the increasing awareness regarding safety and environmental compliance, coupled with foreign investment in large-scale projects, is accelerating the adoption of advanced blast monitoring solutions in this region. Conversely, North America and Europe represent mature markets characterized by stringent and well-enforced environmental and safety regulations. These regions demonstrate a strong preference for highly accurate, reliable, and technologically advanced equipment that ensures absolute compliance and minimizes environmental footprints, driving continuous innovation and the adoption of premium-segment products. Emerging markets in Latin America and the Middle East & Africa are showing promising growth, spurred by significant investments in natural resource extraction and large-scale construction, though market penetration and technological sophistication vary.

Segmentation trends within the market underscore a rising demand for integrated and automated solutions over standalone devices. The product type segment is witnessing a shift towards comprehensive systems that combine seismographs, geophones, and air blast microphones with advanced data loggers and integrated software platforms. Wireless and cloud-based technologies are rapidly gaining market share against traditional wired systems, offering unparalleled flexibility, reduced installation complexity, and enhanced data accessibility, which are critical for remote and dynamic operational environments. The application segment continues to be dominated by the mining industry, which remains the largest consumer, followed closely by the construction and quarrying sectors. However, there is an emerging niche in specialized environmental monitoring and urban demolition where ultra-precise and low-impact solutions are required. Furthermore, the market is observing a trend towards service-centric models, including equipment leasing, managed monitoring services, and subscription-based access to data analytics platforms, providing flexible options for end-users and diversifying revenue streams for manufacturers.

AI Impact Analysis on Blast Monitoring Equipment Market

The integration of Artificial Intelligence (AI) into the Blast Monitoring Equipment Market is profoundly influencing operational methodologies, prompting users to inquire about its potential to revolutionize safety, efficiency, and environmental compliance. Common user questions often revolve around AI's capacity to deliver more accurate predictive analytics, automate the laborious interpretation of extensive datasets, enhance real-time decision-making, and significantly reduce human error. Stakeholders are particularly interested in how AI can transition blast monitoring from a reactive recording process to a proactive, intelligent system capable of forecasting potential impacts before they occur and recommending optimal blast parameters. There is also considerable curiosity about AI's role in processing the vast streams of data generated by modern monitoring devices, converting raw information into actionable insights, and streamlining the complex reporting requirements. Expectations are high that AI will be a game-changer in achieving safer, more sustainable, and economically efficient blasting operations through advanced pattern recognition, autonomous system management, and intelligent risk assessment.

- Enhanced Predictive Analytics: AI algorithms analyze vast historical blast data, geological surveys, and environmental conditions to predict ground vibration and air overpressure levels with unprecedented accuracy. This enables engineers to make preemptive, data-driven adjustments to blast designs, minimizing the risk of exceeding regulatory limits.

- Automated Data Interpretation and Reporting: AI-powered software can automatically process and interpret complex waveform data from multiple sensors, identifying critical events, classifying blast types, and generating comprehensive, compliant reports in a fraction of the time required for manual analysis, significantly reducing human effort and potential for error.

- Optimized Blast Design and Parameter Recommendation: Machine learning models can simulate various blast scenarios and recommend optimal charge weights, timing sequences, and borehole patterns. This optimization aims to achieve desired fragmentation, minimize throw, control dilution, and reduce environmental impact while strictly adhering to safety and regulatory thresholds.

- Real-time Risk Assessment and Proactive Alerting: AI continuously monitors and correlates live data streams from blast monitoring equipment with operational parameters and environmental factors. It can identify potential over-limit events or system anomalies in real time, issuing immediate, context-aware alerts to operators and key stakeholders, enabling rapid response and mitigation.

- Autonomous Monitoring System Management: AI facilitates self-learning and self-regulating monitoring systems that can autonomously adjust sensor sensitivity, filter environmental noise, diagnose system health, and even manage power consumption, thereby improving the reliability and operational longevity of the equipment with minimal human intervention.

- Advanced Post-Blast Analysis and Causal Inference: AI can delve deeper into post-blast data to identify subtle correlations and causal factors between blast designs, site conditions, and observed impacts. This capability offers invaluable insights for continuous improvement of blasting practices and understanding complex ground response mechanisms.

DRO & Impact Forces Of Blast Monitoring Equipment Market

The Blast Monitoring Equipment Market operates within a complex ecosystem of dynamic forces, significantly shaped by compelling drivers, persistent restraints, emerging opportunities, and multifaceted impact forces. A primary driver for market growth is the increasingly stringent global regulatory framework governing blasting activities. Governments and environmental agencies worldwide are enacting and enforcing stricter limits on ground vibration and air overpressure to protect residential areas, sensitive infrastructure, and ecological zones. This regulatory pressure compels mining, construction, and quarrying companies to invest in advanced, highly accurate monitoring solutions to ensure continuous compliance and avoid hefty fines or operational shutdowns. Furthermore, the relentless pace of global infrastructure development, including extensive road networks, tunnels, bridges, and urban construction projects, particularly in rapidly urbanizing economies, generates a consistent demand for controlled blasting and, consequently, robust monitoring equipment. Heightened awareness regarding occupational safety and community well-being also acts as a significant driver, pushing industries to adopt best practices and utilize state-of-the-art monitoring technologies to mitigate risks and foster positive community relations. The overarching industry goal of optimizing operational efficiency and reducing costs through precise blast designs further propels the adoption of equipment that can fine-tune fragmentation, reduce secondary processing, and improve material handling.

Despite these robust drivers, the market faces several notable restraints that can impede its growth trajectory. The substantial initial capital investment required for purchasing advanced blast monitoring equipment, which often includes sophisticated sensors, data loggers, communication modules, and analytical software, can be a significant barrier for smaller enterprises or those operating with limited budgets. Beyond the upfront cost, there are ongoing expenses associated with installation, calibration, maintenance, and regular software updates, contributing to a high total cost of ownership. Another critical restraint is the technical complexity involved in deploying, operating, and accurately interpreting the vast amounts of data generated by these advanced systems. This necessitates a workforce with specialized skills and training in blasting engineering, seismology, and data analytics, which can be scarce in certain regions. Integration challenges with existing legacy systems and diverse operational platforms within client organizations can also pose difficulties, hindering seamless data flow and system adoption. Furthermore, economic downturns, volatility in global commodity prices (especially metals and minerals), and geopolitical uncertainties can lead to reduced capital expenditure in key end-user industries, directly impacting the demand for new equipment.

However, the market is brimming with promising opportunities, primarily fueled by rapid technological advancements. The pervasive integration of the Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML), and cloud computing is revolutionizing the capabilities of blast monitoring equipment. These technologies enable real-time data streaming, advanced predictive analytics, autonomous monitoring, and remote diagnostics, opening new avenues for product innovation and service expansion. The vast untapped potential in emerging markets, particularly in Asia Pacific, Latin America, and Africa, where significant infrastructure projects and resource extraction activities are accelerating, presents substantial growth opportunities as these regions progressively adopt international safety and environmental standards. Developing integrated solutions that combine blast monitoring with other environmental parameters like noise, dust, and weather conditions offers a holistic site management approach, addressing a broader spectrum of client needs. Strategic partnerships and collaborations between equipment manufacturers, software developers, telecommunication providers, and engineering consultants can foster synergistic innovations, enhance market reach, and create comprehensive, value-added solutions that cater to specific industry demands. The growing global emphasis on environmental sustainability and corporate social responsibility also creates opportunities for technologies that demonstrate reduced ecological footprints and improved community engagement.

A variety of external impact forces continuously shape the competitive landscape and strategic direction of the market. The intense competitive intensity, characterized by the presence of numerous well-established global players and innovative niche entrants, drives continuous product development, technological differentiation, and aggressive pricing strategies. Economic forces, including global GDP growth rates, fluctuations in commodity prices, industrial production levels, and interest rates, directly influence investment decisions in the mining and construction sectors, thereby dictating demand for blast monitoring equipment. Rapid technological shifts, such such as the miniaturization of high-fidelity sensors, breakthroughs in low-power wireless communication protocols, and advancements in edge computing, rapidly transform product capabilities, obsolesce older technologies, and reset market expectations. Regulatory changes, whether new safety mandates, stricter environmental protection laws, or updated blasting codes, directly impact compliance requirements and compel industries to upgrade their monitoring capabilities. Moreover, escalating environmental concerns, including climate change impacts, biodiversity protection, and increased public scrutiny of industrial activities, exert pressure on operators to adopt the most environmentally friendly and socially responsible blasting and monitoring practices, thereby accelerating the demand for advanced and highly compliant blast monitoring solutions.

Segmentation Analysis

The Blast Monitoring Equipment Market is meticulously segmented to provide a granular understanding of its diverse components, end-user preferences, and technological adoption patterns. This comprehensive segmentation allows industry participants, investors, and policymakers to accurately identify market niches, assess competitive landscapes, and formulate targeted strategies. The market is typically categorized across several dimensions, including product type, underlying technology, specific application areas, and distinct end-user industries, each reflecting unique drivers, growth rates, and operational considerations. Such a detailed breakdown is crucial for dissecting market dynamics and uncovering opportunities within this specialized industrial equipment sector.

- By Product Type:

- Seismographs: These are the core instruments, capable of measuring and recording ground vibration (peak particle velocity) and air overpressure. They come in various forms, from portable units for short-term monitoring to permanent, networked systems for continuous surveillance.

- Geophones: Specialized sensors designed to detect ground motion and convert it into an electrical signal. They are integral components of seismographs, typically arranged in triaxial configurations to measure motion in three dimensions (vertical, transverse, longitudinal).

- Accelerometers: Used to measure acceleration, these sensors are critical for analyzing structural response to blast events, particularly in civil engineering applications and for assessing the integrity of structures near blast sites.

- Microphones: Specifically calibrated acoustic sensors used to measure air blast overpressure (sound pressure level), providing essential data for environmental compliance and community impact assessment.

- Software and Analytics Platforms: These encompass data acquisition software, cloud-based data storage, processing tools, analytical dashboards, and reporting modules that transform raw sensor data into actionable insights and compliance documentation.

- Accessories and Peripherals: Including cables, tripods, mounting kits, solar power kits, remote communication modules, calibration units, and protective casings designed to ensure equipment longevity and optimal performance in harsh environments.

- By Technology:

- Wired Systems: Traditional monitoring setups that rely on physical cables for power and data transmission. While robust, they are less flexible and more labor-intensive to deploy, often used for fixed, long-term monitoring points.

- Wireless Systems: Employing advanced communication protocols like Wi-Fi, cellular (2G/3G/4G/5G), satellite, or proprietary radio frequencies for data transfer. These offer superior flexibility, ease of deployment, and remote monitoring capabilities, significantly reducing cabling requirements.

- Cloud-based Solutions: Platforms that store, process, and manage blast monitoring data on remote servers accessible via the internet. They provide scalability, enhanced security, remote access, and advanced analytical tools, facilitating collaborative workflows.

- IoT-enabled Devices: Blast monitoring units integrated with the Internet of Things, allowing them to connect, collect, and exchange data with other devices and systems over a network without human-to-computer interaction, enabling real-time insights and autonomous operations.

- By Application:

- Mining (Open-pit and Underground): The largest application segment, covering ore extraction, overburden removal, waste rock management, and ground control in both surface and subterranean mining operations globally.

- Construction and Infrastructure: Encompasses various civil engineering projects such as tunneling, excavation for foundations, road and railway construction, dam building, and urban development where controlled blasting is necessary.

- Quarrying: For the controlled extraction of aggregates, sand, gravel, limestone, and dimension stone from quarries, ensuring efficient material production while adhering to environmental and safety guidelines.

- Demolition: Specialized applications involving the controlled destruction of buildings, bridges, and other structures using explosives, where precise monitoring is critical to prevent collateral damage and ensure public safety.

- Oil and Gas: Utilized in seismic exploration for hydrocarbon reserves and in specialized blasting operations related to well development or pipeline construction.

- Environmental Monitoring: Assessing the impact of blasting on sensitive ecological zones, water bodies, and wildlife habitats, ensuring compliance with environmental protection regulations.

- By End-User:

- Mining Companies: Large multinational corporations and smaller independent operators engaged in the extraction of minerals, metals, and coal globally.

- Construction Firms: General contractors, civil engineering companies, and specialized contractors undertaking large-scale infrastructure and building projects.

- Quarry Operators: Businesses involved in the extraction and processing of aggregates, sand, gravel, and crushed stone for the construction industry.

- Demolition Contractors: Specialist firms providing controlled explosive demolition services for existing structures.

- Government and Regulatory Bodies: Agencies responsible for setting and enforcing safety and environmental regulations, often requiring monitoring data for project approvals and compliance audits.

- Consulting Services: Engineering and environmental consulting firms that provide expertise in blast design, monitoring, and impact assessment to various industries.

Value Chain Analysis For Blast Monitoring Equipment Market

The value chain of the Blast Monitoring Equipment Market is an intricate and multi-layered system, beginning with foundational research and development and extending through to final deployment and post-sales support, creating value at each successive stage. The upstream segment of this value chain is dominated by intense R&D activities and the meticulous sourcing of highly specialized components. Manufacturers invest significantly in advancing sensor technology, developing more robust and precise geophones, accelerometers, and acoustic microphones capable of accurately capturing subtle ground vibrations and air overpressure in harsh environments. This stage also involves the design and integration of high-performance electronic components, including analog-to-digital converters, microprocessors, memory modules, and wireless communication chips (for cellular, Wi-Fi, and satellite connectivity). The selection of durable, weather-resistant materials for equipment housing, capable of withstanding extreme temperatures, dust, and moisture, is also critical. Strategic partnerships with specialized component suppliers and academic research institutions are often forged to ensure access to cutting-edge technologies and materials, which are essential for maintaining a competitive edge and meeting evolving industry standards for accuracy and reliability.

The core manufacturing and assembly stage follows, where these diverse, high-tech components are meticulously integrated into complete, functioning blast monitoring systems. This phase involves precision engineering for hardware assembly, rigorous software integration to ensure seamless data acquisition and processing, and extensive calibration procedures to guarantee the accuracy and sensitivity of each unit. Quality control is paramount at this stage, with multiple layers of testing to ensure that equipment meets or exceeds industry specifications and international standards for blast monitoring. After manufacturing, the distribution channel becomes a critical link in delivering these specialized products to a global customer base. Distribution strategies typically involve a hybrid approach: direct sales channels are often employed for large enterprise clients, particularly major mining companies or government bodies, where manufacturers provide bespoke solutions, direct technical support, and comprehensive training. Complementary to this, an extensive network of indirect distribution channels, comprising authorized distributors, local agents, and value-added resellers, is vital for reaching smaller and medium-sized enterprises (SMEs) and for ensuring market penetration in geographically diverse and often remote operational regions. These intermediaries typically possess intimate local market knowledge, provide localized sales support, and often offer initial installation and training services, effectively extending the manufacturer's reach.

Downstream activities in the value chain are centered around the deployment, ongoing operation, and comprehensive support of the blast monitoring equipment at client sites. This crucial phase includes professional installation services, often requiring specialized expertise to position sensors optimally for data capture, and thorough commissioning to integrate the equipment with existing site infrastructure. Post-sales support is a cornerstone of this segment, encompassing extensive technical assistance, proactive maintenance schedules, calibration services, and timely repairs to ensure continuous, uninterrupted operation and data integrity. Furthermore, providing comprehensive training programs for client personnel on equipment operation, data retrieval, and basic troubleshooting is essential for empowering end-users and maximizing the utility of the monitoring systems. A significant value-add in this downstream segment is the provision of advanced data analysis services, where manufacturers or specialized consulting firms assist clients in interpreting complex blast data, generating regulatory compliance reports, and deriving actionable insights to optimize future blast designs. The rise of cloud-based platforms and subscription models for data management and analytics further enhances this value proposition, offering clients flexible access to advanced tools without significant upfront IT investment. Ultimately, the success of the blast monitoring equipment relies heavily on its effective utilization by end-users, namely mining companies, construction firms, quarry operators, and demolition contractors, who leverage the technology to ensure safety, meet regulatory obligations, and drive operational excellence. Feedback from these end-users is invaluable for continuous product innovation, ensuring that future developments remain aligned with real-world operational needs and evolving industry challenges.

Blast Monitoring Equipment Market Potential Customers

The Blast Monitoring Equipment Market caters to a diverse yet distinct clientele whose operations inherently involve the controlled use of explosives, necessitating precise measurement and management of blast effects to ensure safety, compliance, and efficiency. The most significant and consistent segment of potential customers comprises large-scale and small-scale mining companies globally. These entities, engaged in the extraction of various minerals, metals, and coal through both open-pit and underground methods, rely heavily on blast monitoring equipment to optimize ore fragmentation, control ground movement, ensure the stability of mine infrastructure, and crucially, protect the lives of their workforce. The increasingly stringent regulatory environments within the mining sector, which mandate strict adherence to vibration and air overpressure limits, make blast monitoring equipment an indispensable investment for these companies, driving continuous demand and technological upgrades.

Another substantial customer base is firmly rooted within the expansive construction and infrastructure development sectors. This includes a broad spectrum of civil engineering firms, general contractors, and specialized companies involved in large-scale projects such as tunneling for transportation networks, excavation for building foundations, the construction of dams and bridges, and major urban redevelopment initiatives. In these scenarios, controlled blasting is frequently a necessary technique for earthmoving and site preparation, especially when dealing with hard rock formations or challenging geological conditions. Blast monitoring equipment is essential here to prevent any unintended damage to existing nearby structures, critical utilities, and adjacent residential or commercial properties, while also minimizing noise and vibration disturbance to local communities. The global surge in infrastructure investment, particularly in developing economies and megacities, ensures a robust and sustained demand from this critical segment of end-users.

Quarry operators, responsible for the extraction of aggregates, sand, gravel, and dimension stone for the construction industry, also constitute a vital segment of potential customers. Much like mining, quarrying operations frequently employ blasting techniques to extract raw materials, making blast monitoring equipment crucial for achieving efficient material yields, ensuring worker safety, and meticulously adhering to environmental regulations. Demolition contractors, who specialize in the controlled deconstruction of buildings, bridges, and other structures using explosive methods, represent another key customer group. For these specialists, precise blast monitoring is paramount to ensuring accurate control over explosive charges, minimizing collateral damage, and guaranteeing public safety, especially in often densely populated urban environments. Furthermore, while not direct operational buyers, government agencies and environmental regulatory bodies exert significant influence as indirect customers. They set and enforce the safety and environmental standards that necessitate the use of blast monitoring equipment, often requiring project developers to submit comprehensive monitoring reports and use certified solutions as a prerequisite for obtaining permits and licenses, thereby acting as a powerful market driver.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 950 Million |

| Market Forecast in 2032 | USD 1400 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instantel (Xplore Technologies Corp.), White Industrial Seismology, Sigicom, Geosonics, Inc., Minimate (Nomis Seismographs), Specto Technology, Vibrock Limited, Orica, MREL Group of Companies, Blast Movement Technologies (BMT), Geometrics Inc., Terra Insights, Svantek, Micromate, Syscom Instruments, HBM Test and Measurement, Campbell Scientific, Guralp Systems, Leica Geosystems (Hexagon), Topcon Positioning Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blast Monitoring Equipment Market Key Technology Landscape

The technological landscape of the Blast Monitoring Equipment Market is undergoing rapid and continuous evolution, driven by the persistent demand for enhanced accuracy, reliability, operational efficiency, and real-time data accessibility. At its foundational core, the market relies on highly specialized and sensitive sensor technologies, primarily geophones and accelerometers, which are designed to precisely measure ground vibration, and calibrated microphones for capturing air overpressure. Recent advancements in these sensor components include miniaturization, improved signal-to-noise ratios, extended frequency response, and enhanced robustness, enabling them to operate effectively and reliably in the most demanding and often extreme conditions prevalent in mining and construction sites. These primary data acquisition components are now frequently integrated with sophisticated digital signal processing capabilities directly at the sensor level, allowing for more precise data capture and reducing the amount of raw data that needs to be transmitted, thereby optimizing bandwidth and storage requirements. The development of multi-component sensors that can simultaneously measure various parameters, such as vibration, sound, and even atmospheric conditions, offers a more holistic view of blast impacts.

A transformative shift in the market has been catalyzed by significant advancements in connectivity and data communication technologies. Modern blast monitoring equipment is increasingly leveraging wireless communication protocols to replace traditional, cumbersome wired setups, offering unparalleled flexibility in deployment, significantly reducing installation time and costs, and enabling monitoring in remote or hazardous locations where cabling is impractical. This includes the widespread adoption of cellular networks (ranging from 2G to the latest 5G technologies), robust Wi-Fi capabilities, and satellite communication for truly global coverage in ultra-remote areas. The integration of the Internet of Things (IoT) is a pivotal development, allowing individual monitoring units to become interconnected, forming intelligent networks that can communicate with each other and with centralized command centers. This IoT capability facilitates automated data collection, remote system diagnostics, and even real-time adjustments to monitoring parameters. Furthermore, the ubiquitous integration of Global Positioning System (GPS) technology into monitoring units provides precise geolocation data for each sensor, which is crucial for accurate mapping of blast effects, precise source localization, and comprehensive regulatory compliance reporting, transforming blast monitoring from a static measurement into a dynamic, geospatial data rich process.

The extensive processing, sophisticated analysis, and intelligent interpretation of the vast datasets generated by modern blast monitoring equipment are heavily reliant on advanced software solutions and scalable cloud computing platforms. Cloud-based solutions provide secure, virtually limitless storage for both real-time and historical blast data, making it readily accessible from any location at any time, which is invaluable for remote operations and collaborative analysis. These platforms are equipped with powerful analytical tools capable of performing complex waveform analysis, conducting detailed frequency domain studies, comparing recorded data against predefined regulatory limits, and generating highly detailed, customizable reports automatically. The burgeoning application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing how this data is interpreted, moving beyond simple threshold alerts to predictive and prescriptive analytics. AI models can identify subtle patterns and correlations within historical blast data, site-specific geological conditions, and operational parameters to predict future ground vibration and air overpressure levels with remarkable accuracy. This predictive capability enables proactive optimization of blast designs, including recommendations for optimal charge weights, timing sequences, and borehole patterns, aimed at achieving desired fragmentation while rigorously mitigating risks and ensuring compliance. Moreover, AI is being deployed for anomaly detection, automated event classification, system health monitoring, and even for generating actionable insights that can lead to significant improvements in safety, operational efficiency, and environmental performance, marking a significant leap forward in intelligent blast management.

Regional Highlights

- North America: This region represents a highly mature and technologically advanced market for blast monitoring equipment. Demand is primarily driven by rigorous environmental regulations, stringent safety standards in mining and construction, and a strong emphasis on infrastructure modernization. The United States and Canada are characterized by early adoption of cutting-edge technologies, including wireless, IoT-enabled, and AI-powered monitoring systems, with a significant market for both equipment sales and integrated service solutions. The region's focus on operational efficiency and risk mitigation further propels market growth.

- Europe: Europe also constitutes a mature market with some of the world's most stringent regulatory frameworks for blast-induced vibrations and noise, particularly in countries like Germany, Sweden, and the UK. This regulatory environment fosters a strong demand for high-precision, reliable, and compliant monitoring equipment. The region places a high emphasis on sustainable practices and environmental protection, driving innovation in solutions that minimize ecological footprints. Market growth is further supported by significant civil engineering projects and ongoing quarrying activities, with a trend towards integrated and automated monitoring solutions.

- Asia Pacific (APAC): The APAC region stands as the fastest-growing market globally for blast monitoring equipment. This rapid expansion is fueled by unprecedented levels of infrastructure development, massive urbanization projects, and extensive mining and quarrying activities across key economies such as China, India, Indonesia, and Australia. While price sensitivity can be a factor, increasing awareness of international safety standards and environmental compliance, coupled with substantial foreign investments in industrial projects, is accelerating the adoption of more sophisticated and advanced monitoring technologies. This region is expected to lead global market expansion due to the sheer scale of ongoing and planned industrial and construction activities.

- Latin America: This region presents substantial growth potential, primarily driven by its rich endowment of mineral resources and extensive mining activities in countries like Chile, Peru, Brazil, and Mexico. Increasing foreign investment in large-scale mining projects and infrastructure development, coupled with evolving and strengthening regulatory frameworks, is significantly boosting the demand for blast monitoring equipment. The market in Latin America is characterized by a gradual but discernible shift from basic to more technologically advanced and integrated monitoring solutions, as operators seek to enhance safety and efficiency while meeting local compliance requirements.

- Middle East and Africa (MEA): The MEA region is an emerging market with promising growth prospects, propelled by substantial investments in mega-infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) for new cities and transportation networks, and significant, though often nascent, mining potential across various African nations. While market maturity and adoption rates vary widely across the region, increasing awareness of international safety standards and the imperative for efficient project execution are driving a growing demand for blast monitoring equipment. Challenges include diverse regulatory landscapes, varying levels of technological infrastructure, and a persistent need for local technical expertise and training.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blast Monitoring Equipment Market.- Instantel (Xplore Technologies Corp.)

- White Industrial Seismology

- Sigicom

- Geosonics, Inc.

- Minimate (Nomis Seismographs)

- Specto Technology

- Vibrock Limited

- Orica

- MREL Group of Companies

- Blast Movement Technologies (BMT)

- Geometrics Inc.

- Terra Insights

- Svantek

- Micromate

- Syscom Instruments

- HBM Test and Measurement

- Campbell Scientific

- Guralp Systems

- Leica Geosystems (Hexagon)

- Topcon Positioning Systems

Frequently Asked Questions

What is blast monitoring equipment used for in industrial operations?

Blast monitoring equipment is fundamentally utilized to measure and record ground vibrations and air overpressure resulting from explosive blasting in industries such as mining, construction, and quarrying. Its primary purposes are to ensure safety for personnel and surrounding structures, maintain compliance with stringent environmental and regulatory limits, and enable the optimization of blast designs for greater efficiency and yield.

How is Artificial Intelligence (AI) influencing the Blast Monitoring Equipment Market?

AI is profoundly influencing the market by enabling advanced predictive analytics for blast effects, automating complex data interpretation, optimizing blast designs for enhanced efficiency and safety, providing real-time risk assessment, and enhancing autonomous monitoring and reporting capabilities. It effectively transforms reactive monitoring into a proactive, intelligent risk management system.

What are the main factors driving the growth of the Blast Monitoring Equipment Market?

The key drivers for the Blast Monitoring Equipment Market include increasingly stringent global environmental and safety regulations, rapid global growth in infrastructure development projects, heightened awareness and focus on worker and community safety, and the continuous industry demand for operational efficiency and cost optimization in blasting activities.

Which geographical regions are at the forefront of adopting blast monitoring solutions?

North America and Europe are considered mature markets that lead in the adoption of sophisticated blast monitoring solutions, primarily due to strict regulations and advanced technological infrastructure. The Asia Pacific region, however, is a high-growth market, propelled by extensive infrastructure and mining projects, demonstrating rapidly increasing adoption rates of advanced monitoring technologies.

What are the key technological advancements prevalent in modern blast monitoring equipment?

Modern blast monitoring equipment heavily incorporates wireless communication technologies (such as cellular and Wi-Fi), extensive Internet of Things (IoT) integration for real-time data streaming, cloud computing for scalable data storage and advanced analytics, Global Positioning System (GPS) for precise location tracking, and sophisticated AI/Machine Learning algorithms for predictive analysis, automated data interpretation, and optimization of blast parameters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager