Blind Spot Monitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428445 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Blind Spot Monitor Market Size

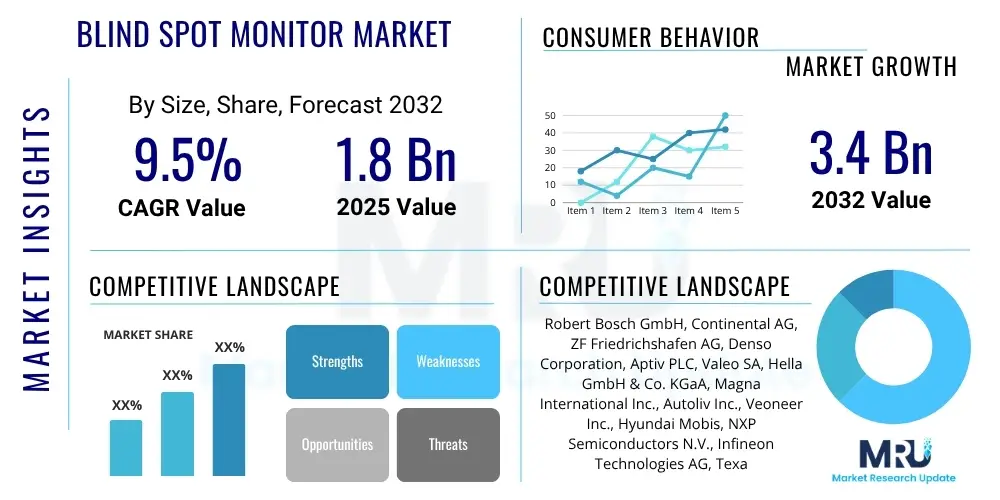

The Blind Spot Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 1.8 billion in 2025 and is projected to reach USD 3.4 billion by the end of the forecast period in 2032.

Blind Spot Monitor Market introduction

The Blind Spot Monitor (BSM) Market is experiencing robust expansion driven by an escalating global focus on automotive safety and the widespread integration of Advanced Driver-Assistance Systems (ADAS) into modern vehicles. Blind Spot Monitors are sophisticated vehicle safety features engineered to detect other vehicles or objects situated within a driver's blind spots, which are areas not adequately visible through conventional rearview or side mirrors. These systems typically employ a combination of advanced sensor technologies, predominantly radar, ultrasonic, or camera-based solutions, to continuously scan the surrounding environment. Upon detecting a potential hazard, BSMs provide timely and intuitive warnings to drivers, commonly through visual indicators illuminated on side mirrors, audible alerts, or haptic feedback, thereby critically minimizing the likelihood of lane change collisions and related accidents. Major applications for BSM technology are pervasive across both passenger vehicles, where they are increasingly becoming standard or premium optional safety enhancements, and commercial vehicles, for which their utility in mitigating the substantial blind zones inherent to larger vehicles is indispensable for operational safety. The paramount benefits of integrating BSM systems encompass significantly enhanced driver situational awareness, proactive accident prevention, and a marked improvement in overall road safety metrics, directly contributing to a substantial reduction in traffic-related fatalities and injuries. Key driving factors propelling market expansion include the implementation of increasingly stringent governmental safety regulations mandating or strongly encouraging the adoption of ADAS features, a growing consumer awareness and demand for advanced vehicle safety technologies, and continuous technological advancements that enhance system accuracy, reliability, and integration capabilities, alongside the broader proliferation of semi-autonomous driving functionalities across vehicle segments.

Blind Spot Monitor Market Executive Summary

The Blind Spot Monitor Market is poised for substantial growth over the forecast period, reflecting a critical intersection of regulatory mandates, technological innovation, and evolving consumer safety expectations. Business trends indicate a consistent shift towards incorporating BSMs as standard equipment in new vehicle models, moving beyond their traditional role as optional premium features. Automotive original equipment manufacturers (OEMs) are investing heavily in research and development to enhance sensor fusion capabilities, integrate AI-driven analytics for predictive warnings, and streamline manufacturing processes to reduce costs, making these systems more accessible across diverse vehicle price points. Strategic partnerships between sensor manufacturers, software developers, and automotive giants are accelerating product innovation and market penetration. Regional trends reveal North America and Europe as mature markets characterized by stringent safety regulations and high consumer adoption rates, exhibiting steady growth fueled by technological upgrades and regulatory compliance. The Asia Pacific region, particularly countries like China, India, and Japan, is emerging as a significant growth engine, driven by rapid urbanization, increasing vehicle parc, rising disposable incomes, and developing safety standards that are increasingly aligning with global benchmarks. Latin America and the Middle East & Africa also show promising growth potential, albeit from a smaller base, as economic development and infrastructure improvements lead to greater vehicle ownership and a nascent demand for advanced safety features. Segmentation trends highlight the dominance of radar-based systems due to their reliability and range, though camera and ultrasonic solutions continue to hold strong positions in specific applications like parking assistance and urban driving. The aftermarket segment, while smaller than OEM, is experiencing consistent expansion as vehicle owners seek to upgrade older models with modern safety functionalities, demonstrating a robust and multifaceted market landscape driven by comprehensive safety imperatives and technological dynamism.

AI Impact Analysis on Blind Spot Monitor Market

User questions regarding the impact of AI on Blind Spot Monitor (BSM) technology frequently revolve around how artificial intelligence can enhance detection accuracy, minimize false positives, and contribute to the broader ecosystem of autonomous driving. Users are keen to understand if AI can make BSMs more intelligent, capable of predicting potential collisions rather than just detecting static objects, and how it might handle complex traffic scenarios or adverse weather conditions. Concerns often include the reliability of AI algorithms in critical safety functions, data privacy implications associated with advanced sensor data processing, and the cost implications of integrating sophisticated AI into existing BSM frameworks. Expectations are high for AI to transform BSMs from reactive warning systems into proactive, intelligent safety co-pilots, offering a more nuanced understanding of the driving environment and seamlessly integrating with other ADAS features for a holistic safety approach.

- Enhanced Object Recognition and Classification: AI algorithms improve the ability of BSM systems to accurately identify and classify different types of objects (e.g., motorcycles, bicycles, pedestrians versus other vehicles) in blind spots, reducing ambiguity and false warnings. Machine learning models, trained on vast datasets of real-world driving scenarios, allow for more robust discrimination between actual threats and benign objects, leading to more reliable alerts for drivers and ultimately increasing trust in the system's efficacy.

- Predictive Analytics and Collision Avoidance: AI enables BSM systems to move beyond simple detection towards predictive capabilities. By analyzing speed, trajectory, and behavioral patterns of surrounding vehicles, AI can anticipate potential collision paths before they fully materialize, providing earlier and more context-aware warnings. This proactive approach supports advanced driver intervention and can be integrated with automatic emergency braking or steering assist systems for active collision mitigation, transforming BSMs into preventative safety components.

- Sensor Fusion Optimization: AI is crucial for effectively fusing data from multiple sensor types, such as radar, ultrasonic, and cameras, that constitute a comprehensive BSM system. Through sophisticated algorithms, AI can process and combine disparate sensor inputs to create a more complete and accurate representation of the vehicle's surroundings. This fusion reduces the limitations of individual sensor technologies, enhancing overall system robustness and performance in challenging environmental conditions like heavy rain or bright sunlight, where one sensor type might be compromised.

- Reduced False Positives and Negatives: One of the primary benefits of AI integration is its capacity to significantly reduce false positive alerts (unnecessary warnings) and false negatives (missed detections). AI-powered filtering and anomaly detection help distinguish between genuine threats and environmental clutter, such as road furniture or benign reflections, thereby improving system credibility. This accuracy boosts driver confidence in BSM warnings, ensuring alerts are received only when truly necessary.

- Integration with Autonomous Driving Systems: As vehicles move towards higher levels of autonomy, AI-enhanced BSMs become an integral component of the overarching autonomous driving stack. The refined situational awareness and predictive capabilities offered by AI-driven BSMs provide critical input for autonomous decision-making algorithms, ensuring that automated lane changes or merges are executed with the highest degree of safety and reliability, acting as a crucial redundancy layer for comprehensive environmental understanding.

DRO & Impact Forces Of Blind Spot Monitor Market

The Blind Spot Monitor (BSM) Market is shaped by a dynamic interplay of driving forces, inherent restraints, promising opportunities, and influential impact forces that collectively dictate its trajectory and evolution. Foremost among the drivers is the increasing emphasis on vehicle safety, propelled by stringent government regulations worldwide, which either mandate the inclusion of ADAS features like BSM in new vehicles or offer incentives for their adoption. This regulatory push, particularly from bodies in North America, Europe, and increasingly Asia, establishes a baseline demand for these systems. Concurrently, a growing consumer awareness regarding road safety and a strong preference for vehicles equipped with advanced protective technologies are significant organic drivers. Technological advancements, including improvements in sensor accuracy, miniaturization, and cost-effectiveness, further fuel market growth by making BSM systems more reliable and widely available. However, several restraints temper this expansion. The relatively high cost of integrating sophisticated BSM systems, especially advanced radar or camera-based solutions, can be a barrier for entry-level vehicle segments and poses a challenge for aftermarket retrofits. Moreover, the complexity of system integration, particularly ensuring seamless operation across diverse vehicle platforms and with other ADAS components, can lead to design and manufacturing hurdles. The potential for false alarms or system malfunctions due though diminishing due to advanced algorithms, can erode driver trust, while increasing cybersecurity concerns surrounding connected vehicle technologies also present a latent restraint. Opportunities for market players abound, especially in emerging economies with rapidly expanding automotive markets and nascent safety infrastructure where awareness is growing. The continuous development of more sophisticated AI and machine learning algorithms promises enhanced predictive capabilities and reduced error rates, opening new avenues for innovation. Furthermore, the integration of BSMs with Vehicle-to-Everything (V2X) communication technologies and their pivotal role in the progression towards fully autonomous vehicles represent substantial future growth opportunities, transforming BSMs from isolated safety features into networked, intelligent components of a broader vehicular ecosystem. The impact forces are predominantly regulatory pressures, which act as a powerful external push for adoption; rapid technological innovation, which constantly redefines system capabilities and cost structures; and the undeniable power of consumer demand for safer driving experiences, which continuously validates and pulls market offerings forward, ensuring sustained investment and development within the Blind Spot Monitor sector.

Segmentation Analysis

The Blind Spot Monitor Market is comprehensively segmented across various critical dimensions, providing a granular view of its structure, dynamics, and growth avenues. These segmentation categories are crucial for understanding market preferences, technological adoption patterns, and strategic positioning of key players. The primary segments typically include classification by the core technology used for detection, the type of vehicle in which the system is installed, and the channel through which the product reaches the end-user. Each segment reflects distinct market characteristics, demand drivers, and competitive landscapes, offering insights into specific niches and overall industry trends. Analyzing these segments helps stakeholders identify high-growth areas, develop targeted product offerings, and formulate effective market penetration strategies, ensuring that innovation and investment are aligned with evolving industry needs and consumer demands across the global automotive sector.

- By Technology Type: This segment categorizes Blind Spot Monitor systems based on the primary sensor technology employed for detection and warning, influencing performance characteristics, cost, and specific application suitability.

- Radar-Based Systems: Utilizing microwave signals to detect objects, radar-based systems offer superior performance in adverse weather conditions like fog, rain, or heavy snow. They are highly effective for detecting fast-moving vehicles at longer ranges, making them ideal for highway driving assistance. Sub-categories include 24 GHz (short to medium range, cost-effective for mid-range vehicles) and 77 GHz (longer range, higher resolution, often integrated into premium ADAS suites for advanced features like Rear Cross Traffic Alert and Lane Change Assist, offering enhanced accuracy and reliability at higher speeds, making them crucial for both passenger and commercial vehicles where precise detection across multiple lanes is critical for preventing high-speed impacts and enhancing driver situational awareness during complex maneuvers).

- Ultrasonic-Based Systems: These systems emit high-frequency sound waves to detect objects in close proximity, typically within a few meters. They are highly effective for low-speed maneuvers, such as parking assistance, parallel parking, and detecting obstacles in urban driving environments where precision at short ranges is paramount. Ultrasonic sensors are generally more cost-effective but have limited range and are sensitive to environmental noise, often used as supplementary sensors or in conjunction with other technologies for comprehensive coverage in applications such as automated parking and slow-speed blind spot detection in city traffic.

- Camera-Based Systems: Employing sophisticated cameras and image processing algorithms, these systems analyze visual data to identify vehicles and objects in blind spots. Advances in computer vision and artificial intelligence allow for complex object recognition and classification, offering visual cues directly to the driver through displays. While sensitive to lighting conditions and weather, camera-based solutions provide rich contextual information and are often integrated into multi-sensor fusion platforms, contributing to enhanced driver awareness and recording capabilities for event reconstruction, thereby providing visual verification alongside warnings in advanced safety systems.

- By Vehicle Type: This segment differentiates the market based on the type of automotive platform where Blind Spot Monitor systems are installed, reflecting varying design requirements, functional priorities, and market volumes.

- Passenger Cars: Encompasses a broad range of vehicles from compact cars and sedans to SUVs and luxury vehicles. BSMs are increasingly becoming a standard safety feature or a highly sought-after option due to rising consumer demand for safety and regulatory mandates. The focus here is on seamless integration with vehicle aesthetics and sophisticated user interfaces, catering to individual drivers for daily commuting and long-distance travel, prioritizing comfort, safety, and a refined driving experience.

- Commercial Vehicles: Includes trucks, buses, vans, and other heavy-duty vehicles. Due to their larger size, extensive blind spots, and higher potential for severe accidents, BSMs are critical for improving operational safety and reducing insurance costs for fleet operators. Robustness, durability, and broad detection ranges are key considerations, crucial for enhancing safety in logistics, public transport, and construction sectors, where the detection of smaller vehicles, cyclists, and pedestrians is paramount in urban and highway environments.

- By Application/End-User: This segment categorizes the market based on whether the BSM system is installed during the vehicle's manufacturing process or added post-purchase.

- Original Equipment Manufacturer (OEM): Refers to BSM systems that are factory-installed in new vehicles directly by automotive manufacturers. This segment accounts for the largest share of the market, driven by integrated design, warranty coverage, and compliance with safety regulations, offering a seamless and fully validated solution as part of the vehicle's original engineering and safety package. OEMs benefit from economies of scale and direct control over system integration.

- Aftermarket: Involves BSM systems purchased and installed by consumers or third-party workshops after the vehicle has left the factory. This segment caters to owners of older vehicles or those wishing to upgrade their existing cars with advanced safety features not present at the time of purchase. Growth in the aftermarket is driven by affordability, ease of installation, and a desire to enhance safety without purchasing a new vehicle, offering a flexible and accessible option for a broader range of vehicle owners seeking enhanced safety.

Value Chain Analysis For Blind Spot Monitor Market

The value chain for the Blind Spot Monitor Market is a complex and highly integrated network, commencing with upstream activities focused on raw material procurement and advanced component manufacturing, extending through sophisticated midstream assembly and software development, and culminating in diverse downstream distribution and installation channels. Upstream analysis involves the sourcing of essential raw materials such as specialized plastics, metals, and semiconductors, which are fundamental for producing sensor components like radar transceivers, ultrasonic transducers, and camera modules. Key players at this stage include semiconductor foundries, specialized material suppliers, and electronic component manufacturers who develop the core technological building blocks. This phase demands high levels of research and development for innovation in sensor technology, miniaturization, and reliability under varying environmental conditions. Midstream activities are dominated by specialized Tier 1 and Tier 2 automotive suppliers who design, develop, and integrate the complex BSM systems, including the electronic control units (ECUs), sophisticated software algorithms for signal processing and object detection, and communication interfaces. These companies often collaborate closely with OEMs to meet stringent performance and integration specifications, focusing on sensor fusion, AI-driven analytics, and real-time processing capabilities. The downstream segment encompasses the distribution and sales of these BSM systems to end-users. This occurs primarily through direct sales to Original Equipment Manufacturers (OEMs), where BSM systems are factory-installed as standard or optional features in new vehicles. The OEM channel represents the largest and most critical part of the downstream market, characterized by long-term contracts and deep technical collaboration. Additionally, the aftermarket distribution channel, involving independent distributors, automotive parts retailers, and specialized installation centers, caters to vehicle owners seeking to retrofit BSM systems onto existing vehicles, offering a broader reach and accessibility for consumers. Direct and indirect channels are both vital; direct sales primarily occur from suppliers to OEMs, while indirect channels leverage dealer networks, online platforms, and third-party installers to reach the vast consumer base, ensuring comprehensive market coverage and product availability across various geographic and demographic segments. The efficiency and synergy across these value chain stages are paramount for delivering cost-effective, high-performance, and reliable Blind Spot Monitor solutions to the global automotive market.

Blind Spot Monitor Market Potential Customers

The Blind Spot Monitor Market caters to a diverse range of potential customers, each driven by unique needs, priorities, and purchasing motivations, broadly encompassing automotive manufacturers, fleet operators, and individual vehicle owners. Automotive Original Equipment Manufacturers (OEMs) represent the most significant segment of potential customers, as they integrate BSM systems directly into their vehicle production lines. Their primary drivers are compliance with increasingly stringent global safety regulations, enhancing vehicle safety ratings (such as those from Euro NCAP or NHTSA), differentiation of their product offerings in a competitive market, and meeting evolving consumer demand for advanced safety features. OEMs seek reliable, cost-effective, and seamlessly integratable BSM solutions that align with their vehicle architecture and brand identity, prioritizing long-term partnerships with sophisticated Tier 1 suppliers. Fleet operators, including logistics companies, public transportation providers, and commercial vehicle rental services, constitute another critical customer group. For these entities, the adoption of BSM technology is motivated by a desire to reduce accident rates, which directly impacts operational costs through lower insurance premiums, minimized vehicle downtime, and improved driver safety. Given the large blind spots inherent in many commercial vehicles, BSMs offer a significant return on investment by preventing costly collisions and protecting valuable assets and personnel. They seek robust, durable systems that can withstand demanding operational environments and often consider aftermarket solutions for their existing fleets. Individual vehicle owners, particularly those with older models without factory-installed BSMs or those seeking enhanced safety features, form a substantial segment within the aftermarket. These consumers are primarily driven by a personal desire for increased safety and peace of mind on the road, often influenced by growing awareness of accident risks and the proven benefits of ADAS technologies. Affordability, ease of installation, and compatibility with their existing vehicles are key purchasing criteria. Additionally, government agencies involved in traffic safety and infrastructure development can be indirect customers, influencing market demand through policy-making, vehicle procurement standards for public fleets, and public awareness campaigns that promote vehicle safety features, collectively fostering a robust and expanding customer base for Blind Spot Monitor technologies across various automotive ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.8 billion |

| Market Forecast in 2032 | USD 3.4 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Aptiv PLC, Valeo SA, Hella GmbH & Co. KGaA, Magna International Inc., Autoliv Inc., Veoneer Inc., Hyundai Mobis, NXP Semiconductors N.V., Infineon Technologies AG, Texas Instruments Incorporated, Mobileye (Intel Corporation), Gentex Corporation, Panasonic Corporation, Hitachi Astemo, Inc., Mitsubishi Electric Corporation, Huawei Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blind Spot Monitor Market Key Technology Landscape

The key technology landscape of the Blind Spot Monitor Market is characterized by a continuous drive towards enhanced sensor capabilities, advanced processing power, and sophisticated software integration, all aimed at improving detection accuracy, reliability, and seamless interaction with the broader ADAS ecosystem. At the core of BSM systems are the diverse sensor technologies employed for object detection. Radar sensors, particularly operating at 24 GHz and 77 GHz frequencies, are foundational, offering robust performance across various weather conditions and excellent long-range detection capabilities for high-speed scenarios. These sensors emit radio waves and measure the time it takes for reflections to return, providing precise data on an object's distance, speed, and angle. Ultrasonic sensors, conversely, utilize high-frequency sound waves for accurate, short-range detection, making them ideal for low-speed maneuvers such as parking assistance and close-proximity warnings in urban environments, often serving as complementary sensors. Camera-based systems, leveraging high-resolution cameras combined with advanced image processing and computer vision algorithms, provide rich contextual data, enabling sophisticated object classification and visual alerts directly to the driver's display. The trend towards sensor fusion is paramount, integrating data from multiple sensor types (radar, ultrasonic, camera) to overcome individual sensor limitations and create a more comprehensive, resilient, and accurate environmental perception. This fusion process is orchestrated by a dedicated Electronic Control Unit (ECU), which serves as the brain of the BSM system. The ECU processes vast amounts of real-time sensor data, runs complex algorithms, and communicates with other vehicle systems. Modern BSM ECUs often incorporate Artificial Intelligence (AI) and Machine Learning (ML) techniques to enhance object recognition, reduce false positives, and introduce predictive capabilities, allowing the system to anticipate potential collision paths. Furthermore, the development of sophisticated communication interfaces, such as CAN (Controller Area Network) bus, is crucial for transmitting data efficiently between the BSM ECU and other vehicle components, including the instrument cluster for visual warnings, haptic feedback systems, and potentially the vehicle's braking or steering systems for active intervention. The evolution towards solid-state radar, enhanced LiDAR integration, and more powerful edge computing for real-time AI processing are defining future advancements, promising even greater precision, faster response times, and deeper integration into higher levels of autonomous driving, continuously pushing the boundaries of vehicular safety technology.

Regional Highlights

- North America: This region stands as a significant market for Blind Spot Monitors, driven by stringent safety regulations imposed by bodies such as the National Highway Traffic Safety Administration (NHTSA) and a high consumer awareness regarding vehicle safety features. The presence of major automotive OEMs and a strong aftermarket demand for retrofitting existing vehicles contribute significantly to market growth. Both the Unit

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager