Blockchain in Power Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430866 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Blockchain in Power Market Size

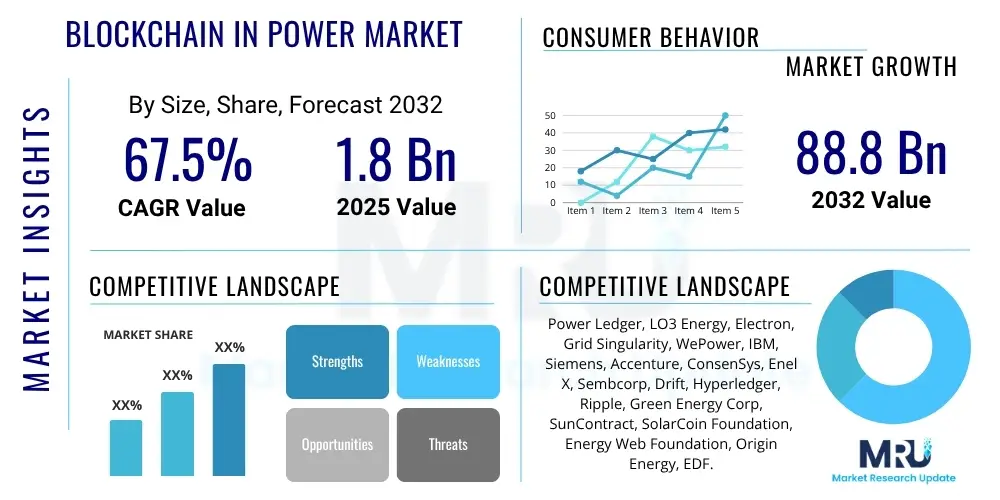

The Blockchain in Power Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 67.5% between 2025 and 2032. The market is estimated at $1.8 Billion in 2025 and is projected to reach $88.8 Billion by the end of the forecast period in 2032.

Blockchain in Power Market introduction

The Blockchain in Power market refers to the application of distributed ledger technology (DLT) and smart contracts across various segments of the energy industry. This innovative approach aims to enhance transparency, security, and efficiency in energy generation, distribution, and consumption by creating an immutable record of transactions and operations. The primary product offerings in this domain include decentralized platforms and software solutions that facilitate peer-to-peer energy trading, optimize grid management, and streamline the tracking of renewable energy credits.

Major applications of blockchain in the power sector encompass enabling prosumers to trade surplus energy directly, enhancing the resilience and management of microgrids, authenticating the provenance of renewable energy, and optimizing electric vehicle charging networks. These applications aim to decentralize control, reduce reliance on intermediaries, and empower individual participants in the energy market. The core benefits include increased operational efficiency, reduced transaction costs, enhanced data security, improved transparency in energy markets, and greater trust among stakeholders due to the immutable nature of blockchain records.

Driving factors for market growth include the global push for renewable energy integration, the increasing adoption of prosumer models where consumers also generate power, the growing need for grid modernization and digitalization, and the rising demand for transparent and auditable energy supply chains. Furthermore, advancements in blockchain technology itself, coupled with supportive regulatory frameworks in several regions, are accelerating its deployment within the power sector, paving the way for more resilient, efficient, and user-centric energy systems.

Blockchain in Power Market Executive Summary

The Blockchain in Power market is poised for significant expansion, driven by transformative business trends, evolving regional dynamics, and increasingly sophisticated segment demands. Key business trends indicate a strong shift towards decentralized energy systems, fostering peer-to-peer energy trading models and the emergence of new market participants, including prosumers and microgrid operators. Strategic partnerships between technology providers, energy utilities, and startups are accelerating pilot projects and commercial deployments. Investment in blockchain-based energy startups continues to rise, signaling confidence in its long-term potential to disrupt traditional energy value chains and introduce novel revenue streams through tokenization and automated transaction systems.

Geographically, North America and Europe are leading the adoption curve, characterized by supportive regulatory environments, high technological readiness, and a strong focus on renewable energy integration and grid modernization. These regions are seeing significant research and development efforts and the implementation of pioneering projects. The Asia Pacific region is rapidly catching up, fueled by massive investments in renewable energy infrastructure, rapid urbanization, and a growing demand for energy security and efficiency. Countries like China, Japan, and Australia are actively exploring blockchain for energy trading, carbon credit management, and smart city initiatives, indicating robust growth prospects.

Segment-wise, the market is primarily driven by the platform and service components, with platforms providing the foundational infrastructure and services encompassing consultation, integration, and maintenance. Application segments such as peer-to-peer energy trading and grid management are experiencing the most pronounced growth, reflecting the immediate benefits of transparency and efficiency. The rising popularity of electric vehicles and the increasing need for reliable and verifiable carbon credit trading mechanisms are further propelling the market for specialized blockchain solutions. This dynamic interplay of trends positions the market for sustained high growth across diverse applications and geographies.

AI Impact Analysis on Blockchain in Power Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Blockchain in Power Market often revolve around how AI complements or potentially clashes with blockchain, the synergistic benefits, and the implications for energy system efficiency, security, and autonomy. Users frequently inquire about AI's role in optimizing blockchain networks, managing energy data, and improving predictive capabilities within a decentralized energy framework. Concerns also surface regarding data privacy in combined AI and blockchain systems, the computational demands of integrating these technologies, and the overall complexity of deployment.

Based on these inquiries, a concise summary reveals that AI is predominantly viewed as a powerful enhancer for blockchain in the power sector rather than a competing technology. The key themes highlight AI's ability to imbue blockchain solutions with intelligence, enabling predictive analytics, optimized resource allocation, and autonomous decision-making in real-time. Users expect AI to significantly improve grid stability, forecast energy demand and supply more accurately, and bolster the cybersecurity of blockchain-managed energy systems. The synergy is anticipated to lead to more responsive, efficient, and resilient smart grids, fostering greater decentralization and empowering prosumers with intelligent energy management tools.

- AI enhances predictive analytics for energy demand and supply forecasting, optimizing grid operations.

- Machine learning algorithms can identify anomalies and potential security threats within blockchain energy networks.

- AI-driven smart contracts automate energy trading and billing processes with greater efficiency and intelligence.

- Optimized resource allocation and load balancing in microgrids are achieved through AI integration.

- Personalized energy management and recommendations for prosumers are enabled by AI analysis of consumption patterns.

- AI can improve the scalability and performance of blockchain networks by intelligently managing data and transactions.

- Enhanced cybersecurity measures leverage AI for real-time threat detection and mitigation in energy systems.

DRO & Impact Forces Of Blockchain in Power Market

The Blockchain in Power Market is profoundly shaped by a unique combination of drivers, restraints, opportunities, and broader impact forces. Key drivers include the escalating global demand for clean energy solutions and renewable integration, which necessitates more transparent and efficient tracking and trading mechanisms. The increasing trend towards energy decentralization and the emergence of the prosumer model, where individuals both consume and produce energy, create a natural fit for blockchain's peer-to-peer capabilities. Furthermore, the imperative for grid modernization, aimed at improving resilience, efficiency, and cybersecurity against evolving threats, strongly advocates for the immutable and secure attributes of distributed ledger technology.

However, the market faces significant restraints that could impede its rapid growth. Regulatory uncertainty across different jurisdictions poses a considerable challenge, as the legal frameworks for decentralized energy trading and tokenization are still evolving. Scalability issues inherent in some blockchain technologies, particularly public blockchains, can limit transaction throughput, making them less suitable for large-scale grid operations. High initial implementation costs, coupled with the complexity of integrating blockchain solutions with legacy energy infrastructure, present substantial barriers to entry for many utilities. Additionally, the nascent stage of the technology implies a lack of standardized protocols and a shortage of skilled technical expertise, which can further complicate adoption.

Despite these challenges, numerous opportunities are emerging that could unlock the full potential of blockchain in the power sector. The development of entirely new energy market models, such as fractional ownership of renewable assets and advanced cross-border energy trading, represents a substantial growth avenue. The integration of blockchain into smart city initiatives, particularly for smart grids and public utility management, offers broad application possibilities. Furthermore, the tokenization of energy assets and the enhanced management of electric vehicle charging infrastructure stand out as key areas for innovation and market expansion. The synergistic impact forces of technological advancements in DLT, supportive government policies promoting renewable energy and smart grids, increasing environmental concerns driving sustainable practices, economic shifts towards decentralized energy, and a competitive landscape pushing for innovation are collectively propelling the market forward.

Segmentation Analysis

The Blockchain in Power market is comprehensively segmented to provide a detailed understanding of its diverse components and application areas. This segmentation allows for targeted analysis of market dynamics, identification of key growth drivers within specific niches, and a clear view of the competitive landscape. The market can be broadly categorized by component (platforms and services), by various applications that address critical needs within the energy sector, and by the end-user types that are adopting these innovative solutions.

Each segment demonstrates unique growth trajectories and adoption patterns influenced by technological maturity, regulatory environments, and specific industry requirements. For instance, the platforms segment is foundational, providing the core blockchain infrastructure, while the services segment focuses on deployment, integration, and ongoing support, indicating a complete ecosystem of offerings. The application-based segmentation highlights how blockchain solves distinct challenges, from optimizing energy transactions to ensuring the provenance of renewable energy credits. End-user segmentation reveals the primary beneficiaries and drivers of demand, ranging from large-scale utilities to individual energy prosumers, underscoring the market's broad appeal and transformative potential across the energy value chain.

- By Component:

- Platforms

- Services

- By Application:

- Peer-to-Peer Energy Trading

- Grid Management

- Electric Vehicle Charging

- Energy & Carbon Credit Trading

- Billing & Payment

- Supply Chain Management

- Others (e.g., Asset Management, Demand Response)

- By End-User:

- Utilities

- Renewable Energy Developers

- Commercial & Industrial

- Residential Prosumers

- Grid Operators

- Energy Retailers

Value Chain Analysis For Blockchain in Power Market

The value chain for the Blockchain in Power Market is characterized by a sequential flow of activities involving technology providers, solution integrators, energy entities, and end-users, increasingly blurring traditional roles through decentralization. Upstream analysis reveals a critical reliance on core blockchain technology developers who build the foundational distributed ledger platforms, smart contract protocols, and cryptographic tools. These technology innovators also include hardware manufacturers producing IoT devices, smart meters, and sensors that act as crucial data inputs for blockchain networks. This initial stage focuses on research, development, and the creation of robust, scalable, and secure blockchain infrastructure tailored for energy applications.

Midstream activities involve solution integrators, software developers, and energy technology companies that customize and deploy these blockchain platforms into specific energy sector applications. This stage encompasses the development of user interfaces, data analytics tools, and APIs that facilitate seamless integration with existing energy management systems. These players often work closely with utilities, grid operators, and renewable energy developers to tailor blockchain solutions for peer-to-peer trading, grid optimization, or renewable energy certificate tracking. The emphasis here is on interoperability, system design, and ensuring the practical application of blockchain within complex energy ecosystems.

Downstream, the value chain extends to the direct utilization of blockchain-powered solutions by end-users in energy generation, distribution, and consumption. This includes traditional energy utilities adopting blockchain for enhanced billing or supply chain transparency, prosumers participating in decentralized energy markets, and commercial and industrial entities managing their energy consumption more efficiently. Distribution channels are primarily direct, through B2B contracts and partnerships between solution providers and energy companies. However, indirect channels are also emerging, such as through energy marketplaces or aggregators that bundle blockchain services with other energy solutions. The evolving nature of the market suggests a future where direct participation and decentralized governance through these channels become increasingly prevalent.

Blockchain in Power Market Potential Customers

The Blockchain in Power Market targets a diverse array of potential customers, spanning the entire energy ecosystem from large-scale utilities to individual residential consumers. Traditional energy utility companies represent a significant customer segment, driven by the need to modernize their aging grid infrastructure, enhance operational efficiency, and meet increasing regulatory demands for transparency and renewable energy integration. These utilities seek blockchain solutions to streamline billing processes, improve grid stability through distributed energy resource management, and secure their data against cyber threats, ultimately aiming to reduce operational costs and improve service reliability.

Another crucial group of potential customers includes renewable energy developers and operators. These entities are increasingly looking to leverage blockchain for the transparent and verifiable tracking and trading of renewable energy certificates (RECs) and carbon credits. Blockchain provides an immutable ledger that can authenticate the origin and attributes of green energy, facilitating compliance and promoting greater trust in green energy claims. This also extends to companies focused on developing and managing microgrids, which benefit from blockchain’s ability to enable autonomous, secure, and efficient energy trading and balancing within a localized network.

Beyond institutional players, individual residential prosumers who generate their own solar or wind power represent a burgeoning customer segment. These prosumers are interested in peer-to-peer energy trading platforms that allow them to sell surplus energy directly to neighbors or other consumers, maximizing their return on investment in renewable energy systems. Commercial and industrial sectors, focused on sustainable operations and energy cost optimization, also emerge as key buyers, seeking blockchain solutions for smart energy management, supply chain traceability of energy inputs, and participation in dynamic energy markets. Furthermore, electric vehicle charging network operators and smart city developers are increasingly recognizing blockchain’s potential for secure payment systems, optimized energy distribution for charging, and integrated smart infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.8 Billion |

| Market Forecast in 2032 | $88.8 Billion |

| Growth Rate | 67.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Power Ledger, LO3 Energy, Electron, Grid Singularity, WePower, IBM, Siemens, Accenture, ConsenSys, Enel X, Sembcorp, Drift, Hyperledger, Ripple, Green Energy Corp, SunContract, SolarCoin Foundation, Energy Web Foundation, Origin Energy, EDF. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blockchain in Power Market Key Technology Landscape

The key technology landscape underpinning the Blockchain in Power market is a sophisticated amalgamation of several cutting-edge digital innovations, primarily centered around distributed ledger technology (DLT). At its core, this landscape relies on robust blockchain platforms, which can be public, private, or consortium-based, designed to provide immutable, transparent, and secure record-keeping for energy transactions and data. Popular frameworks such as Ethereum for smart contract functionality and Hyperledger Fabric for enterprise-grade solutions are commonly adapted, offering developers the tools to build bespoke energy applications. These platforms enable the creation and execution of smart contracts, which are self-executing agreements with the terms directly written into code, automating various processes like energy trading, billing, and grid balancing without the need for intermediaries.

Complementing these DLT platforms is the pervasive integration of Internet of Things (IoT) devices. Smart meters, sensors, and other connected hardware play a crucial role by providing real-time data on energy generation, consumption, and grid conditions directly to the blockchain network. This continuous data feed ensures the accuracy and timeliness of information recorded on the ledger, which is vital for effective grid management, peer-to-peer trading, and demand response mechanisms. The synergy between IoT and blockchain is essential for creating intelligent and responsive energy ecosystems, transforming raw data into actionable insights and verifiable transactions.

Furthermore, artificial intelligence (AI) and machine learning (ML) are increasingly integral to this technology landscape, enhancing the capabilities of blockchain in power. AI algorithms are employed for predictive analytics to forecast energy demand and supply, optimize energy flow across the grid, and identify potential anomalies or inefficiencies. Machine learning can refine smart contract logic, automate complex decision-making processes, and improve the overall resilience and security of the energy infrastructure by detecting cyber threats and optimizing network performance. Cloud computing also provides the scalable and flexible infrastructure required to host and manage these complex, data-intensive blockchain and AI applications, ensuring high availability and robust performance for critical energy operations.

Regional Highlights

- North America: This region is a frontrunner in blockchain in power adoption, characterized by a robust innovation ecosystem, significant R&D investments, and a proactive stance towards grid modernization. States like New York and Texas are actively exploring regulatory sandboxes and pilot projects for peer-to-peer energy trading and blockchain-based renewable energy certificate markets. The presence of major technology firms and a strong venture capital environment further fuels growth.

- Europe: Europe demonstrates strong leadership in integrating renewable energy and developing smart grid infrastructure, making it fertile ground for blockchain in power solutions. Countries such as Germany, the UK, and the Netherlands are home to numerous pilot projects focused on local energy markets, microgrid management, and carbon credit traceability. Supportive policies and a clear commitment to decarbonization are key drivers.

- Asia Pacific (APAC): The APAC region is experiencing rapid growth, driven by substantial investments in renewable energy, burgeoning energy demand, and large-scale smart city initiatives. Countries like China, Japan, and Australia are actively investing in blockchain for energy trading, green certificate issuance, and enhancing the transparency of energy supply chains. Government support and a large consumer base with increasing energy needs contribute to its dynamic expansion.

- Latin America: This emerging market shows considerable potential, particularly for off-grid solutions, microgrids, and addressing energy access challenges. Blockchain can facilitate transparent and efficient management of distributed renewable energy sources in remote areas, offering opportunities for innovative business models and improving energy equity.

- Middle East and Africa (MEA): The MEA region is witnessing growing interest in sustainable energy and smart city developments, especially in the Gulf Cooperation Council (GCC) countries. Blockchain in power solutions are being explored to enhance energy efficiency, manage valuable resources, and support large-scale infrastructure projects aimed at diversifying energy portfolios and reducing carbon footprints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blockchain in Power Market.- Power Ledger

- LO3 Energy

- Electron

- Grid Singularity

- WePower

- IBM

- Siemens

- Accenture

- ConsenSys

- Enel X

- Sembcorp

- Drift

- Hyperledger

- Ripple

- Green Energy Corp

- SunContract

- SolarCoin Foundation

- Energy Web Foundation

- Origin Energy

- EDF

Frequently Asked Questions

What is blockchain in the power market?

Blockchain in the power market refers to the application of distributed ledger technology (DLT) to manage, secure, and optimize energy transactions, grid operations, and data across the energy sector. It facilitates transparent and immutable record-keeping, enabling applications like peer-to-peer energy trading, renewable energy certificate tracking, and efficient grid management.

How does blockchain benefit the energy sector?

Blockchain offers several key benefits to the energy sector, including enhanced transparency and traceability of energy transactions, improved data security and integrity, reduced operational and transaction costs by eliminating intermediaries, increased efficiency through smart contract automation, and greater decentralization which empowers prosumers and optimizes distributed energy resources.

What are the main applications of blockchain in power?

The main applications of blockchain in power include peer-to-peer (P2P) energy trading, where prosumers can directly buy and sell energy; efficient grid management and optimization for microgrids and smart grids; transparent tracking and trading of renewable energy certificates (RECs) and carbon credits; streamlined billing and payment processes; secure management of electric vehicle (EV) charging infrastructure; and supply chain transparency for energy resources.

What are the challenges of adopting blockchain in power?

Key challenges for blockchain adoption in the power market include navigating complex and evolving regulatory frameworks, addressing scalability limitations of current blockchain technologies for large-scale energy grids, managing the high initial implementation costs, ensuring interoperability with existing legacy energy infrastructure, and overcoming a shortage of skilled technical expertise within the energy sector.

Who are the key players in the Blockchain in Power Market?

Leading companies in the Blockchain in Power Market include technology providers like Power Ledger, LO3 Energy, Electron, Grid Singularity, and WePower, alongside major enterprises such as IBM, Siemens, Accenture, and ConsenSys, which are developing and deploying blockchain solutions across various segments of the energy industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager