Blood Culture Tests Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428223 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Blood Culture Tests Market Size

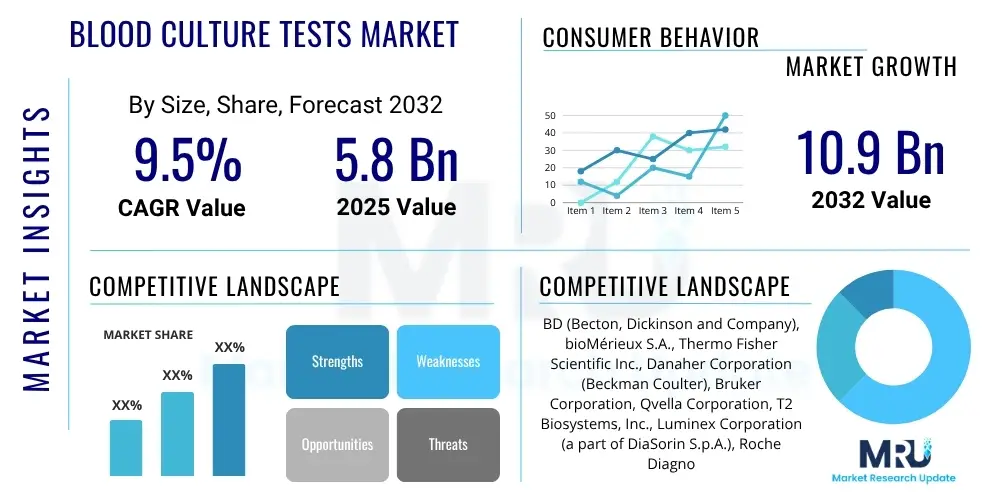

The Blood Culture Tests Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2032.

Blood Culture Tests Market introduction

The Blood Culture Tests Market encompasses the diagnostic procedures and associated products utilized for the detection and identification of microorganisms, primarily bacteria and fungi, in a patient's bloodstream. These tests are crucial for diagnosing bloodstream infections, such as bacteremia, fungemia, and sepsis, which can be life-threatening if not identified and treated promptly. The primary objective is to isolate and identify the causative pathogen, allowing clinicians to administer targeted antimicrobial therapy, thereby improving patient outcomes and combating the rising global threat of antimicrobial resistance. The market includes a wide array of products ranging from blood collection systems and culture media to automated culture instruments and rapid identification systems, each playing a vital role in the diagnostic workflow.

Major applications for blood culture tests span across various healthcare settings, including hospitals, diagnostic laboratories, and research institutions. They are indispensable in emergency rooms for patients presenting with suspected sepsis, in intensive care units for monitoring critically ill individuals, and in microbiology labs for confirming infections and guiding treatment decisions. The benefits of these tests are profound, offering early and accurate diagnosis, which is paramount for initiating appropriate therapy, reducing hospital stays, minimizing complications, and ultimately decreasing mortality rates associated with severe infections. Furthermore, blood cultures provide critical epidemiological data, contributing to public health surveillance and the development of strategies against infectious disease outbreaks.

Driving factors for the expansion of the blood culture tests market are multifaceted. The increasing global incidence of bloodstream infections, coupled with a growing elderly population more susceptible to these conditions, significantly fuels demand. The escalating concern regarding antimicrobial resistance (AMR) is another major catalyst, as rapid and accurate identification of pathogens is essential for guiding appropriate antibiotic selection and avoiding broad-spectrum antibiotic overuse. Technological advancements in diagnostic platforms, including automation, molecular techniques, and mass spectrometry, are enhancing test accuracy, speed, and efficiency, making blood cultures an indispensable tool in modern clinical microbiology. These innovations continue to push the boundaries of early detection and therapeutic guidance.

Blood Culture Tests Market Executive Summary

The Blood Culture Tests Market is experiencing dynamic shifts driven by evolving healthcare landscapes and technological advancements. Business trends indicate a strong emphasis on automation and integration within diagnostic laboratories to improve throughput, reduce manual errors, and enhance turnaround times. Mergers and acquisitions are prevalent as key players seek to expand their product portfolios, geographic reach, and technological capabilities, fostering a competitive yet innovative environment. There is also a notable trend towards developing multiplex assays and rapid diagnostic platforms that can not only detect the presence of pathogens but also identify antibiotic resistance markers directly from blood samples, streamlining treatment protocols and improving patient care pathways.

Regionally, the market exhibits varied growth trajectories. North America and Europe currently dominate due to advanced healthcare infrastructure, significant R&D investments, and high adoption rates of novel diagnostic technologies. However, the Asia Pacific region is poised for substantial growth, propelled by increasing healthcare expenditure, a rising burden of infectious diseases, growing awareness of early diagnosis benefits, and improving access to diagnostic facilities, particularly in emerging economies like China and India. Latin America, the Middle East, and Africa are also showing promising growth, albeit at a slower pace, as healthcare systems in these regions continue to develop and expand their diagnostic capabilities.

Segmentation trends highlight a robust demand for automated blood culture systems and specialized culture media due to their enhanced efficiency and diagnostic accuracy. The consumables segment, including blood collection systems and reagents, continues to hold a significant market share, driven by the recurring need for these components in every test performed. In terms of applications, bacteremia and fungemia diagnoses remain the primary drivers, closely followed by mycobacteremia, especially in regions with high tuberculosis prevalence. End-user segments such as hospitals and diagnostic laboratories are investing heavily in advanced blood culture solutions to meet the increasing diagnostic demands and improve patient outcomes, underpinning sustained market expansion across all segments.

AI Impact Analysis on Blood Culture Tests Market

The integration of Artificial Intelligence (AI) into the Blood Culture Tests Market is poised to revolutionize the diagnostic landscape, addressing critical challenges related to speed, accuracy, and antimicrobial resistance. Common user questions frequently revolve around how AI can accelerate pathogen identification, predict antibiotic susceptibility more effectively, and interpret complex data patterns that might be overlooked by human analysis. Users are particularly interested in AI's potential to minimize the time-to-result, which is crucial for managing sepsis, a rapidly progressing condition. There are also significant expectations for AI to enhance the detection of difficult-to-culture organisms and to provide more sophisticated insights into polymicrobial infections, optimizing treatment strategies. Concerns often include data privacy, the validation of AI algorithms in diverse clinical settings, and ensuring that AI complements rather than replaces the critical judgment of clinical microbiologists.

The collective user sentiment reflects a strong anticipation for AI to transform the efficiency and efficacy of blood culture diagnostics. Stakeholders envision AI tools as invaluable assistants that can sift through vast amounts of phenotypic and genotypic data, correlate clinical findings with microbiological results, and even flag patients at higher risk of bloodstream infections based on predictive analytics. This would enable proactive intervention, a significant leap forward from current reactive diagnostic paradigms. The emphasis is on harnessing AI for precision medicine, where diagnostic pathways are tailored to individual patient profiles, leading to more effective and personalized treatment regimens. The overarching goal is to leverage AI to overcome the limitations of traditional methods, particularly in the context of emerging pathogens and the ever-present challenge of antimicrobial resistance, thereby elevating the standard of care for patients with bloodstream infections.

- Enhanced Sensitivity and Specificity: AI algorithms can analyze complex growth patterns and spectral data more precisely, leading to improved detection of low-titer infections and differentiation of contaminants from true pathogens, thereby reducing false positives and negatives.

- Faster Pathogen Identification and AST: AI-powered platforms can rapidly process raw data from various diagnostic instruments (e.g., mass spectrometry, molecular assays) to identify microorganisms and predict antimicrobial susceptibility patterns in a fraction of the time required by conventional methods, enabling earlier targeted therapy.

- Predictive Analytics for Sepsis Management: AI can integrate patient clinical data, electronic health records, and laboratory results to identify individuals at high risk of developing sepsis, allowing for proactive interventions and improving critical care outcomes by facilitating timely blood culture collection and empirical antibiotic administration.

- Optimization of Laboratory Workflow: AI can automate data interpretation, quality control, and reporting, reducing manual labor, minimizing human error, and streamlining the overall laboratory workflow, leading to increased efficiency and faster diagnostic turnaround times for blood culture tests.

- Antimicrobial Resistance Surveillance and Outbreak Detection: AI tools can analyze large-scale microbiological data to monitor trends in antimicrobial resistance, identify emerging resistance mechanisms, and detect potential infection outbreaks earlier, providing crucial insights for public health initiatives and infection control strategies.

- Decision Support for Clinicians: AI-driven systems can provide clinicians with intelligent recommendations for empirical antibiotic therapy based on local resistance patterns, patient history, and real-time culture results, supporting evidence-based treatment decisions and contributing to antimicrobial stewardship efforts.

DRO & Impact Forces Of Blood Culture Tests Market

The Blood Culture Tests Market is significantly influenced by a complex interplay of driving factors, critical restraints, and promising opportunities, all shaped by various impact forces. A primary driver is the rising global incidence of bloodstream infections, including sepsis, which demands rapid and accurate diagnostic solutions for timely intervention and improved patient outcomes. The escalating concerns surrounding antimicrobial resistance (AMR) further propel market growth, as blood cultures are indispensable for identifying causative pathogens and guiding targeted antibiotic therapy, thereby mitigating the spread of resistant strains. Additionally, the increasing geriatric population, which is more susceptible to infections, and continuous technological advancements in diagnostic platforms contribute substantially to market expansion by offering more efficient and precise testing methodologies. These advancements include automated systems, molecular diagnostics, and mass spectrometry techniques that reduce turnaround times and enhance diagnostic yield.

Conversely, several restraints impede market progression. The high cost associated with advanced automated blood culture systems and molecular diagnostic platforms can be a significant barrier for smaller healthcare facilities or those in developing regions with limited budgets. The inherent complexity of diagnostic procedures, requiring specialized training and infrastructure, also poses a challenge. Furthermore, the potential for false positive or false negative results, often due to sample contamination or low bacterial load, can lead to diagnostic delays or inappropriate treatment, undermining confidence in the tests. Stringent regulatory approval processes for new diagnostic technologies can also prolong market entry, affecting innovation cycles and the availability of advanced solutions to patients.

Despite these challenges, substantial opportunities exist for market growth. The emergence of point-of-care (POC) diagnostics, which offer rapid results at the patient's bedside, represents a significant opportunity, especially for critical conditions like sepsis where time is of the essence. The growing focus on personalized medicine, tailoring treatment based on individual patient and pathogen characteristics, will drive demand for more specific and sensitive diagnostic tools. Furthermore, expansion into untapped emerging markets, particularly in Asia Pacific and Latin America, where healthcare infrastructure is rapidly improving and infectious disease burden is high, presents lucrative avenues for market players. The development of novel biomarkers for earlier detection of infection and sepsis, coupled with enhanced integration of diagnostic data into clinical decision support systems, also promises to unlock new growth potential for the blood culture tests market, facilitating more proactive and effective patient management strategies.

Segmentation Analysis

The Blood Culture Tests Market is extensively segmented across various parameters including product type, method, application, and end-user, providing a granular view of market dynamics and growth opportunities. This detailed segmentation allows for a comprehensive understanding of which components, technologies, and applications are driving the market and where future investments are likely to be concentrated. Each segment addresses specific needs within the diagnostic pathway of bloodstream infections, from initial sample collection to pathogen identification and antimicrobial susceptibility testing. The evolution of these segments reflects the ongoing advancements in diagnostic capabilities, the increasing demand for rapid and accurate results, and the growing complexity of infectious disease management.

The market's product segmentation typically distinguishes between instruments and consumables, reflecting the capital expenditure versus operational expenditure components of blood culture testing. Methodologies are often divided into automated and conventional approaches, highlighting the industry's shift towards higher throughput and reduced manual intervention. Application-based segmentation underscores the specific types of bloodstream infections targeted, while end-user segmentation reveals the primary purchasers and beneficiaries of these diagnostic solutions. This multi-dimensional analysis is critical for stakeholders to identify niche markets, assess competitive landscapes, and formulate effective strategies for product development and market penetration. The continuous innovation across these segments is vital for addressing global health challenges posed by infectious diseases and antimicrobial resistance.

- By Product

- Instruments

- Automated Blood Culture Systems

- Manual Blood Culture Systems

- Consumables

- Blood Culture Media

- Blood Collection Systems

- Assay Kits & Reagents

- Instruments

- By Method

- Automated Blood Culture

- Conventional Blood Culture

- By Application

- Bacteremia

- Fungemia

- Mycobacteremia

- Others (e.g., specific viral or parasitic infections detected via blood culture components)

- By End User

- Hospitals

- Diagnostic Laboratories

- Academic & Research Institutes

Value Chain Analysis For Blood Culture Tests Market

The value chain for the Blood Culture Tests Market begins with upstream activities focused on the research, development, and manufacturing of raw materials and core components. This includes suppliers of purified water, various types of peptones, growth factors, pH indicators, antimicrobial neutralizing agents, resins, and specialized plastics required for blood culture bottles and collection kits. Key upstream players also include manufacturers of optical sensors, electronic components, and intricate mechanical parts essential for automated blood culture instruments. Quality control and stringent regulatory adherence are critical at this stage to ensure the reliability and safety of the final diagnostic products. Innovation in media formulation and bottle design plays a crucial role in optimizing microbial growth and detection efficiency, which directly impacts the accuracy and speed of diagnostic results.

Moving downstream, the value chain encompasses the manufacturing, assembly, and distribution of finished blood culture test products. Large diagnostic companies specialize in producing integrated systems, including automated incubators, optical detection systems, and software for data analysis and interpretation. These manufacturers engage in extensive marketing and sales activities, often directly to major hospitals, reference laboratories, and diagnostic chains, or through a network of distributors. The distribution channels are critical for ensuring timely delivery of temperature-sensitive consumables and high-value instruments. Direct distribution involves manufacturers selling and servicing products directly to end-users, fostering closer relationships and providing specialized support, particularly for complex automated systems requiring installation and ongoing maintenance.

Indirect distribution, conversely, leverages third-party distributors and wholesalers who have established logistics networks and local market presence, particularly beneficial for reaching a broader base of smaller laboratories, clinics, and academic institutions. These distributors often handle warehousing, inventory management, and regional sales, acting as intermediaries between the manufacturers and the diverse end-user base. The final stages of the value chain involve the utilization of these tests by healthcare providers for patient diagnosis, followed by waste management and recycling of spent materials. The efficiency of the entire value chain, from raw material procurement to post-diagnostic support, is paramount for ensuring the rapid and accurate diagnosis of bloodstream infections, which directly impacts patient outcomes and the overall effectiveness of healthcare systems in managing infectious diseases.

Blood Culture Tests Market Potential Customers

The primary potential customers and end-users of blood culture tests are diverse healthcare entities that play critical roles in patient diagnosis, treatment, and public health. Hospitals represent the largest segment of end-users, encompassing a wide range of departments from emergency rooms and intensive care units to general wards and surgical suites. Within hospitals, blood culture tests are essential for managing patients with suspected sepsis, bacteremia, fungemia, and other severe infections, guiding initial empirical antibiotic therapy, and subsequently informing targeted treatment decisions based on culture results. The continuous demand for these tests in hospital settings is driven by the high volume of patients, the critical nature of bloodstream infections, and the need for rapid diagnostic turnaround times to improve patient outcomes and minimize hospital-acquired infections.

Diagnostic laboratories, including independent commercial laboratories and those affiliated with hospitals, constitute another significant customer base. These laboratories often serve multiple healthcare providers, performing blood culture tests on a large scale. They invest in automated blood culture systems and advanced identification platforms to enhance throughput, reduce manual labor, and maintain high standards of accuracy and efficiency. Their role extends beyond simple pathogen detection to include antimicrobial susceptibility testing (AST), providing crucial information for guiding therapeutic choices and monitoring resistance patterns. The increasing outsourcing of diagnostic services by smaller hospitals and clinics further consolidates the position of these large diagnostic labs as key consumers in the market, driving demand for both instruments and consumables.

Academic and research institutes also represent important potential customers. These institutions utilize blood culture tests not only for routine diagnostics within their affiliated teaching hospitals but also for conducting research into new pathogens, evaluating novel diagnostic methodologies, and studying antimicrobial resistance mechanisms. Their demand is often for specialized media, reagents, and advanced molecular platforms that can support complex research protocols and clinical trials. Furthermore, public health organizations and governmental bodies may also be considered indirect customers, as they rely on data generated from blood culture tests for epidemiological surveillance, outbreak investigation, and the formulation of public health policies aimed at controlling infectious diseases. The continuous need for these tests across clinical, research, and public health sectors underscores the broad and sustained demand within the Blood Culture Tests Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 10.9 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), bioMérieux S.A., Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter), Bruker Corporation, Qvella Corporation, T2 Biosystems, Inc., Luminex Corporation (a part of DiaSorin S.p.A.), Roche Diagnostics (a division of F. Hoffmann-La Roche Ltd), Abbott Laboratories, Siemens Healthineers AG, Merck KGaA, Alifax S.p.A., OpGen, Inc., BIOTEC Laboratories, Accelerate Diagnostics, Inc., GenMark Diagnostics (a part of Roche), Molzym GmbH & Co. KG, Microgen Diagnostics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Culture Tests Market Key Technology Landscape

The Blood Culture Tests Market is characterized by a rapidly evolving technological landscape, driven by the imperative for faster, more accurate, and more comprehensive diagnostic solutions for bloodstream infections. Automated blood culture systems form the backbone of modern laboratories, utilizing continuous monitoring through spectrophotometry or CO2 detection to identify microbial growth, significantly reducing manual intervention and improving turnaround times. These systems, such as those offered by BD and bioMérieux, have become standard, providing alerts as soon as microbial growth is detected, which is critical for early sepsis management. Further advancements in these automated platforms include enhanced bottle designs and media formulations that support the growth of a wider range of fastidious organisms and neutralize antimicrobial agents, thereby improving diagnostic yield even in patients already on antibiotics.

Beyond growth-based detection, the market is increasingly adopting molecular diagnostics, including Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) technologies, for direct pathogen identification from positive blood culture bottles or even directly from whole blood. PCR-based assays can rapidly identify specific bacterial or fungal species and detect antimicrobial resistance genes within hours, significantly accelerating targeted therapy decisions compared to traditional phenotypic methods which can take days. For example, multiplex PCR panels can simultaneously test for multiple pathogens and resistance markers, offering a comprehensive diagnostic picture. NGS, while more complex and traditionally used in research, is gaining traction in clinical settings for its ability to provide an unbiased, deep-dive into the entire microbial community and resistome present in a sample, especially useful for complex or polymicrobial infections.

Another transformative technology is mass spectrometry, particularly Matrix-Assisted Laser Desorption/Ionization Time-of-Flight (MALDI-TOF) mass spectrometry. Once a positive blood culture is flagged, a small aliquot of the microbial growth can be rapidly analyzed by MALDI-TOF to identify the pathogen down to the species level within minutes, based on its unique protein fingerprint. This significantly reduces the time from culture positivity to definitive identification, enabling clinicians to refine antibiotic therapy much faster. Furthermore, rapid phenotypic Antimicrobial Susceptibility Testing (AST) systems, often leveraging microfluidics or advanced imaging, are emerging to provide susceptibility results in hours rather than days, directly from positive blood cultures, bridging the gap between identification and tailored treatment, and directly addressing the challenges of antimicrobial resistance. The convergence of these technologies, coupled with the nascent integration of artificial intelligence for data interpretation and predictive analytics, is continually reshaping the diagnostic workflow for blood culture tests.

Regional Highlights

- North America: Dominates the Blood Culture Tests Market due to its robust healthcare infrastructure, high adoption rate of advanced diagnostic technologies, significant R&D investments, and the presence of major market players. The region benefits from increasing awareness of sepsis management and favorable reimbursement policies for diagnostic procedures, alongside a high prevalence of chronic diseases and an aging population, which contribute to a higher incidence of bloodstream infections. The United States, in particular, leads in innovation and market expenditure.

- Europe: Represents a substantial market for blood culture tests, characterized by well-established healthcare systems, stringent regulatory guidelines for diagnostics, and a strong focus on combating antimicrobial resistance. Countries like Germany, the UK, and France are key contributors, driven by government initiatives to improve infection control and diagnostic capabilities. The region also sees high adoption of automated systems and molecular diagnostic techniques, with a growing emphasis on personalized medicine approaches.

- Asia Pacific (APAC): Expected to witness the highest growth rate during the forecast period, primarily due to improving healthcare infrastructure, rising healthcare expenditure, and a large patient pool susceptible to infectious diseases. Economic growth in countries like China, India, and Japan is fostering greater access to advanced diagnostics. Increasing awareness about early disease detection, coupled with a growing prevalence of lifestyle-related diseases and population density, is driving the demand for effective blood culture solutions across the region.

- Latin America: Exhibits a growing market for blood culture tests, albeit at a more moderate pace. Factors contributing to this growth include increasing investments in healthcare infrastructure, rising awareness about infectious diseases, and expanding access to diagnostic services. Countries such as Brazil, Mexico, and Argentina are key markets, focusing on improving their diagnostic capabilities to address local health challenges and infectious disease burdens.

- Middle East and Africa (MEA): This region is experiencing steady growth in the blood culture tests market, driven by increasing government initiatives to modernize healthcare facilities, rising prevalence of infectious diseases, and improving diagnostic infrastructure. Investment in advanced medical technologies and growing health tourism in certain Gulf Cooperation Council (GCC) countries are also contributing factors, leading to a gradual but consistent increase in the adoption of sophisticated blood culture testing methodologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Culture Tests Market.- BD (Becton, Dickinson and Company)

- bioMérieux S.A.

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Beckman Coulter)

- Bruker Corporation

- Qvella Corporation

- T2 Biosystems, Inc.

- Luminex Corporation (a part of DiaSorin S.p.A.)

- Roche Diagnostics (a division of F. Hoffmann-La Roche Ltd)

- Abbott Laboratories

- Siemens Healthineers AG

- Merck KGaA

- Alifax S.p.A.

- OpGen, Inc.

- BIOTEC Laboratories

- Accelerate Diagnostics, Inc.

- GenMark Diagnostics (a part of Roche)

- Molzym GmbH & Co. KG

- Microgen Diagnostics

Frequently Asked Questions

What is a blood culture test and why is it important?

A blood culture test is a laboratory procedure designed to detect and identify microorganisms, such as bacteria or fungi, present in a patient's bloodstream. It is critically important for diagnosing severe infections like sepsis, bacteremia, and fungemia. Early and accurate identification of the causative pathogen allows clinicians to administer targeted antimicrobial therapy promptly, which significantly improves patient outcomes, reduces mortality rates, shortens hospital stays, and helps combat the development of antimicrobial resistance by avoiding broad-spectrum antibiotic overuse.

How long does it typically take to get results from a blood culture test?

The turnaround time for blood culture results can vary significantly. Initial detection of microbial growth in automated systems can occur within 12 to 24 hours, but this depends on the type and concentration of the pathogen. Full identification of the microorganism and its antimicrobial susceptibility profile using traditional methods can take anywhere from 24 to 72 hours, or even longer for slow-growing organisms. However, newer rapid diagnostic technologies, including molecular assays and mass spectrometry, are capable of providing identification and resistance markers within hours once a culture flags positive, thereby significantly reducing the overall diagnostic timeline.

What are the key technological advancements in blood culture testing?

Key technological advancements include highly automated blood culture systems that continuously monitor for microbial growth, reducing manual labor and speeding up detection. Molecular diagnostic techniques, such as PCR and Next-Generation Sequencing (NGS), are rapidly identifying pathogens and resistance genes directly from blood. Additionally, Matrix-Assisted Laser Desorption/Ionization Time-of-Flight (MALDI-TOF) mass spectrometry provides rapid species-level identification from positive cultures, while microfluidics-based systems offer accelerated antimicrobial susceptibility testing. The emerging integration of Artificial Intelligence (AI) promises to further enhance data interpretation, prediction, and workflow optimization, making diagnostics faster and more precise.

What are the main challenges facing the Blood Culture Tests Market?

The Blood Culture Tests Market faces several challenges, including the high cost of advanced automated systems and molecular diagnostic platforms, which can limit adoption in resource-constrained settings. The complexity of these diagnostic procedures often requires specialized training and infrastructure. Furthermore, issues such as sample contamination, which can lead to false positive results, and the potential for false negatives due to low bacterial load or prior antibiotic treatment, remain persistent concerns. Stringent regulatory hurdles for new technologies and the ongoing pressure to reduce diagnostic turnaround times while maintaining accuracy also present significant market challenges.

How is the Blood Culture Tests Market expected to evolve in response to antimicrobial resistance (AMR)?

The Blood Culture Tests Market is evolving rapidly in direct response to the global threat of antimicrobial resistance (AMR). There is an increasing focus on developing rapid diagnostic tests that can not only identify pathogens quickly but also detect specific antimicrobial resistance genes or phenotypic resistance patterns within hours. This enables clinicians to select appropriate antibiotics much earlier, preserving the efficacy of existing drugs and preventing the spread of resistant strains. Innovation is driving the development of integrated platforms that combine pathogen identification with expedited antimicrobial susceptibility testing, providing comprehensive information necessary for effective antimicrobial stewardship programs and personalized medicine approaches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager