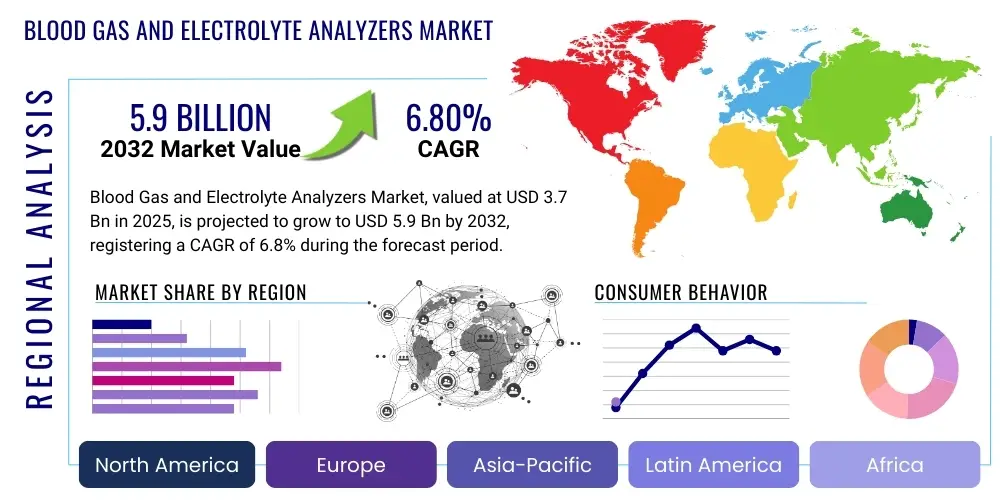

Blood Gas and Electrolyte Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427275 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Blood Gas and Electrolyte Analyzers Market Size

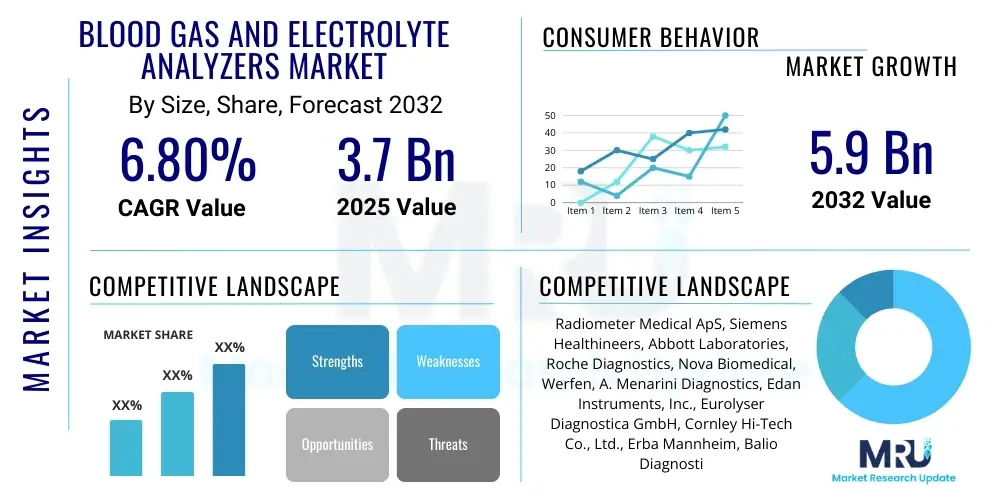

The Blood Gas and Electrolyte Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 3.7 billion in 2025 and is projected to reach USD 5.9 billion by the end of the forecast period in 2032.

Blood Gas and Electrolyte Analyzers Market introduction

The Blood Gas and Electrolyte Analyzers Market encompasses advanced diagnostic devices crucial for measuring various parameters in whole blood samples, including pH, partial pressure of oxygen (pO2), partial pressure of carbon dioxide (pCO2), and electrolytes such as sodium, potassium, and chloride. These analyzers are indispensable in critical care settings, operating rooms, and emergency departments, providing rapid and accurate results essential for timely clinical decision-making and patient management. The primary applications span across monitoring critically ill patients, diagnosing respiratory and metabolic disorders, and assessing electrolyte imbalances, all of which are vital for maintaining physiological homeostasis.

The benefits derived from these analyzers are substantial, offering immediate insights into a patients acid-base balance and oxygenation status, which can be life-saving. Their rapid turnaround time significantly reduces the need for sending samples to central laboratories, thereby improving workflow efficiency and patient outcomes. Key driving factors for market expansion include the escalating global prevalence of chronic diseases such as diabetes, cardiovascular conditions, and chronic obstructive pulmonary disease (COPD), which necessitate frequent blood gas and electrolyte monitoring. Furthermore, the aging global population, increasing number of surgical procedures, and advancements in point-of-care testing (POCT) technologies are propelling market growth by making these sophisticated diagnostic tools more accessible and efficient in diverse healthcare environments.

Blood Gas and Electrolyte Analyzers Market Executive Summary

The Blood Gas and Electrolyte Analyzers Market is poised for robust expansion, primarily driven by evolving healthcare paradigms focused on rapid diagnostics and point-of-care solutions. Business trends indicate a strong emphasis on product innovation, with manufacturers integrating advanced sensor technologies, miniaturization, and connectivity features to enhance analytical precision and operational convenience. Strategic collaborations and mergers and acquisitions are frequently observed as companies seek to consolidate market share, expand product portfolios, and penetrate new geographical regions. Furthermore, the shift towards decentralized testing models is creating significant opportunities for portable and handheld devices, broadening the markets reach beyond traditional hospital settings to include clinics and home care.

Regional trends highlight North America and Europe as dominant markets, primarily due to well-established healthcare infrastructures, high adoption rates of advanced medical technologies, and significant research and development investments. However, the Asia-Pacific region is emerging as the fastest-growing market, propelled by improving healthcare access, increasing healthcare expenditure, and a large patient pool in developing economies like China and India. Latin America and the Middle East and Africa are also expected to exhibit steady growth as healthcare infrastructure improves and awareness regarding advanced diagnostic tools rises. These regions present substantial untapped potential for market players looking to expand their global footprint.

Segmentation trends indicate a strong demand for integrated analyzers that can perform both blood gas and electrolyte measurements simultaneously, offering comprehensive diagnostic panels from a single sample. The point-of-care segment is experiencing particularly rapid growth, driven by the need for immediate results in critical situations, reducing decision-making time and improving patient management. End-user analysis shows hospitals and clinical laboratories remaining the primary consumers, yet the increasing prevalence of critical care units and emergency departments is further solidifying their market dominance. Moreover, the demand for user-friendly interfaces, minimal maintenance, and cost-effective solutions across all segments continues to shape product development and market dynamics.

AI Impact Analysis on Blood Gas and Electrolyte Analyzers Market

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) in enhancing the accuracy, efficiency, and interpretability of blood gas and electrolyte analysis. Common questions revolve around how AI can minimize human error, automate complex data analysis, and provide predictive insights for patient care. There is also significant interest in AIs role in improving quality control, flagging abnormal results, and integrating seamlessly with electronic health records (EHRs). Users are keen to understand if AI can make these analyzers more intelligent, reducing the burden on clinicians and leading to more precise diagnostic and therapeutic interventions. Concerns often surface regarding data privacy, algorithm transparency, and the potential for over-reliance on automated systems.

The key themes emerging from user inquiries include the expectation that AI will optimize operational workflows by reducing manual intervention and streamlining data management. Users anticipate AI-powered systems to offer advanced pattern recognition capabilities, enabling earlier detection of subtle physiological changes that might be missed by human observation. The drive towards personalized medicine also fuels interest in AIs ability to correlate blood gas and electrolyte parameters with other patient data, creating a more holistic view of a patients condition. Furthermore, there is a strong belief that AI can democratize access to sophisticated diagnostic interpretations, making expert-level analysis available even in resource-limited settings.

Overall, users expect AI to elevate the current capabilities of blood gas and electrolyte analyzers from mere measurement devices to intelligent diagnostic platforms. The primary goal is to leverage AI for enhanced diagnostic accuracy, predictive analytics for clinical deterioration, and improved decision support, ultimately contributing to better patient outcomes and more efficient healthcare delivery. The integration of machine learning for calibration, quality assurance, and anomaly detection is seen as a critical next step, promising to revolutionize how these essential diagnostic tools are utilized in clinical practice. This shift is anticipated to reduce variability, improve data integrity, and provide actionable insights directly to clinicians, thereby optimizing patient management strategies.

- Enhanced diagnostic accuracy through advanced pattern recognition in complex blood gas data.

- Predictive analytics for early detection of clinical deterioration based on electrolyte and gas trends.

- Automated quality control and calibration, reducing manual errors and improving reliability.

- Streamlined data integration with Electronic Health Records (EHRs) for comprehensive patient profiles.

- Intelligent decision support systems guiding clinicians on optimal treatment strategies.

- Optimization of laboratory workflows and reduction in turnaround time for critical results.

- Personalized patient monitoring by correlating blood gas data with other physiological parameters.

DRO & Impact Forces Of Blood Gas and Electrolyte Analyzers Market

The Blood Gas and Electrolyte Analyzers Market is significantly shaped by a confluence of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. A primary driver is the increasing prevalence of chronic diseases globally, such as diabetes, chronic kidney disease, and cardiovascular disorders, which necessitate continuous or frequent monitoring of blood gas and electrolyte levels for effective disease management and prevention of acute complications. The growing geriatric population, a demographic particularly susceptible to critical illnesses requiring intensive care and frequent diagnostic tests, also acts as a substantial market impetus. Furthermore, the rising awareness and adoption of point-of-care testing (POCT) solutions, offering rapid results at the patient’s bedside, are transforming clinical workflows and enhancing patient care, thereby fueling demand for compact and efficient analyzers.

Despite these robust drivers, the market faces several restraints. The high cost associated with advanced blood gas and electrolyte analyzers, including the initial capital investment and ongoing maintenance and consumable expenses, poses a significant barrier to adoption, particularly in developing regions with constrained healthcare budgets. Stringent regulatory frameworks and complex approval processes for medical devices can delay product launches and increase development costs for manufacturers. Additionally, the need for skilled professionals to operate and interpret results from these sophisticated instruments, coupled with a potential shortage of such personnel, especially in remote or underserved areas, can limit market penetration and effective utilization. The rapid pace of technological obsolescence also presents a challenge, requiring continuous investment in research and development.

Opportunities within this market are abundant and promising. The ongoing technological advancements, particularly in miniaturization, automation, and the integration of AI and machine learning, are creating new avenues for product innovation and improved analytical capabilities. The expansion of healthcare infrastructure in emerging economies, coupled with increasing healthcare expenditure, represents a vast untapped market for manufacturers. Moreover, the rising demand for home-based care and remote patient monitoring solutions, accelerated by the recent global health crises, is opening up new application areas for portable and user-friendly blood gas and electrolyte analyzers. Developing novel biomarkers and improving connectivity features for seamless data management further augment these opportunities, allowing for more comprehensive diagnostic insights and integrated patient care systems. These dynamics collectively exert a powerful influence on market evolution, pushing innovation while necessitating strategic navigation of existing challenges.

Segmentation Analysis

The Blood Gas and Electrolyte Analyzers Market is extensively segmented to reflect the diverse needs of the healthcare industry, categorized by product type, modality, end-user, and application. This granular segmentation provides a comprehensive understanding of market dynamics, allowing stakeholders to identify key growth areas and tailor strategies accordingly. Product type segmentation typically includes analyzers and consumables, with the latter representing a significant recurring revenue stream due to the continuous need for reagents, electrodes, and calibration solutions. Modality segmentation differentiates between benchtop and portable/handheld analyzers, catering to varying clinical environments from central laboratories to point-of-care settings. Understanding these segments is crucial for manufacturers to align product development with market demand and for healthcare providers to select the most appropriate devices for their operational requirements.

End-user segmentation critically distinguishes between the primary consumers of these devices, predominantly hospitals, clinical laboratories, and other healthcare facilities such as ambulatory surgical centers and emergency medical services. Hospitals, particularly their critical care units, emergency departments, and operating rooms, remain the largest end-users due to the high volume of critical patients requiring immediate monitoring. However, the growth in clinical laboratories, which often serve as central hubs for complex diagnostic testing, is also substantial. Application segmentation further refines market understanding, focusing on the specific clinical uses, including critical care, emergency medicine, operating room monitoring, and general health screenings. This detailed analysis of market segments is vital for precise market sizing, forecasting, and strategic planning, highlighting the distinct drivers and challenges within each niche.

- Product Type:

- Analyzers

- Consumables (reagents, electrodes, quality control solutions, calibration solutions)

- Modality:

- Benchtop Analyzers

- Portable/Handheld Analyzers (Point-of-Care)

- End-User:

- Hospitals (ICUs, EDs, ORs)

- Clinical Laboratories

- Ambulatory Surgical Centers

- Emergency Medical Services

- Other Healthcare Facilities

- Application:

- Critical Care

- Emergency Medicine

- Operating Room Monitoring

- Neonatal and Pediatric Care

- Cardiology

- Pulmonology

- General Health Screenings

Blood Gas and Electrolyte Analyzers Market Value Chain Analysis

The value chain for the Blood Gas and Electrolyte Analyzers Market begins with upstream activities involving research and development, raw material sourcing, and component manufacturing. This initial phase focuses on developing innovative sensor technologies, microfluidic components, and software algorithms that form the core of these diagnostic instruments. Key raw materials include specialized plastics, electrodes, membranes, and chemical reagents, which are procured from a global network of suppliers. Manufacturers then assemble these components, integrating complex analytical systems and ensuring rigorous quality control at every stage. Strategic partnerships with component suppliers are crucial to ensure a stable supply chain and maintain product quality, influencing the overall cost-effectiveness and innovation potential of the final product.

Midstream activities involve the manufacturing, assembly, and initial distribution of the finished blood gas and electrolyte analyzers. This stage also includes crucial aspects of regulatory compliance, obtaining necessary certifications from bodies like the FDA, CE, or national health authorities, which significantly impacts market entry and product commercialization. After manufacturing, products move through various distribution channels to reach end-users. These channels can be broadly categorized as direct and indirect. Direct distribution involves manufacturers selling directly to hospitals, large laboratory networks, or government healthcare systems, often facilitated by their own sales teams and service engineers. This approach allows for greater control over sales and customer relationships, offering tailored support and faster feedback loops for product improvement.

Downstream activities encompass the actual sale, installation, training, and ongoing technical support for the analyzers, including the continuous supply of consumables such as reagents, calibration solutions, and electrodes. Indirect distribution, on the other hand, relies on a network of third-party distributors, wholesalers, and medical device retailers who manage sales, logistics, and localized support within specific regions. These partners play a vital role in market penetration, especially in diverse geographical areas with unique logistical challenges. The after-sales service, including maintenance, troubleshooting, and software updates, is a critical component of the value chain, ensuring device longevity and customer satisfaction. Effective management of the entire value chain, from raw material procurement to post-sales support, is essential for maintaining competitive advantage and ensuring market sustainability in the dynamic healthcare diagnostics sector.

Blood Gas and Electrolyte Analyzers Market Potential Customers

The primary potential customers and end-users of Blood Gas and Electrolyte Analyzers are diverse healthcare institutions and professionals who require rapid and accurate assessment of physiological parameters for critical patient management. Hospitals represent the largest segment of end-users, with a substantial demand driven by their Intensive Care Units (ICUs), Emergency Departments (EDs), Operating Rooms (ORs), and cardiac care units. In these high-acuity settings, immediate and reliable blood gas and electrolyte results are paramount for diagnosing and monitoring conditions such as sepsis, respiratory failure, cardiac arrest, diabetic ketoacidosis, and electrolyte imbalances, directly influencing treatment decisions and patient outcomes. The continuous influx of critically ill patients ensures sustained demand from this sector.

Clinical laboratories, both centralized and decentralized, form another significant customer base. While some highly specialized tests are performed in central labs, the increasing shift towards rapid diagnostics means many clinical laboratories are now incorporating blood gas and electrolyte analyzers for faster turnaround times on critical samples. These labs also often provide services to smaller clinics, outpatient centers, and research institutions, thereby expanding the reach of these analyzers. Beyond traditional hospital and lab settings, emergency medical services (EMS) providers, including ambulances and mobile critical care units, are increasingly adopting portable and handheld analyzers to assess patients at the point of care, prior to hospital arrival, enabling earlier intervention and stabilization.

Furthermore, specialized clinics such as pulmonology clinics, cardiology clinics, and nephrology centers, which manage patients with chronic conditions requiring frequent monitoring, also represent a growing segment of potential customers. The burgeoning market for home healthcare and remote patient monitoring, especially for patients with chronic obstructive pulmonary disease (COPD) or chronic kidney disease, suggests a future expansion into these less traditional settings for ultra-portable and user-friendly devices. Research institutions and pharmaceutical companies conducting clinical trials that involve physiological monitoring also utilize these analyzers. The diverse and evolving landscape of healthcare delivery ensures a broad and expanding customer base for blood gas and electrolyte analyzers, all united by the need for critical diagnostic insights.

Blood Gas and Electrolyte Analyzers Market Key Technology Landscape

The technological landscape of the Blood Gas and Electrolyte Analyzers Market is characterized by continuous innovation aimed at enhancing accuracy, speed, portability, and ease of use. At the core of these devices are sophisticated sensor technologies, primarily based on potentiometric (ion-selective electrodes, ISE) and amperometric principles. Ion-selective electrodes are crucial for measuring electrolytes such as sodium, potassium, chloride, and calcium, providing highly precise and rapid quantification. Amperometric sensors are employed for measuring partial pressures of oxygen (pO2) and carbon dioxide (pCO2), as well as glucose and lactate, by detecting electrical current changes resulting from chemical reactions. These sensor advancements are continuously refined to improve stability, minimize drift, and extend their lifespan, reducing maintenance requirements and improving reliability.

Microfluidics and lab-on-a-chip technologies are revolutionizing the design of modern analyzers, enabling the miniaturization of testing components and the ability to perform multiple tests on very small sample volumes. This not only makes devices more compact and portable, ideal for point-of-care applications, but also reduces reagent consumption and the risk of sample contamination. Integrated systems that combine blood gas, electrolyte, and oximetry measurements into a single platform are becoming standard, offering comprehensive diagnostic panels from one sample analysis. Automation features, including auto-calibration and auto-quality control, significantly reduce manual intervention, enhance accuracy, and minimize operator variability, thereby improving overall workflow efficiency in busy clinical environments.

Connectivity and data management are also critical technological advancements. Modern analyzers are equipped with advanced communication capabilities, including Wi-Fi, Ethernet, and USB, allowing seamless integration with hospital information systems (HIS), laboratory information systems (LIS), and electronic health records (EHRs). This ensures that critical patient data is instantly accessible to healthcare providers, facilitating timely decision-making and improving patient safety. Furthermore, the incorporation of intelligent software and data analytics, including early applications of Artificial Intelligence and machine learning, is poised to offer enhanced interpretative capabilities, predictive insights, and robust quality assurance, transforming raw data into actionable clinical intelligence. These technological strides collectively define the cutting edge of blood gas and electrolyte analysis, driving market growth and improving patient care worldwide.

Regional Highlights

- North America: Dominant market share due to advanced healthcare infrastructure, high prevalence of chronic diseases, significant R&D investments, and rapid adoption of point-of-care testing solutions. The United States and Canada are key contributors.

- Europe: Strong market presence driven by well-established healthcare systems, increasing geriatric population, favorable reimbursement policies, and a focus on advanced medical diagnostics. Germany, the UK, France, and Italy are major markets.

- Asia-Pacific: Fastest-growing region owing to improving healthcare access, rising healthcare expenditure, a large and aging population, and increasing awareness of advanced diagnostics in developing economies like China, India, and Japan.

- Latin America: Emerging market with steady growth attributed to expanding healthcare infrastructure, increasing government initiatives to improve patient care, and a growing medical tourism sector in countries such as Brazil and Mexico.

- Middle East and Africa: Gradual market expansion fueled by increasing investments in healthcare development, rising incidence of lifestyle diseases, and a growing demand for advanced diagnostic tools in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Gas and Electrolyte Analyzers Market.- Radiometer Medical ApS (A Danaher Company)

- Siemens Healthineers

- Abbott Laboratories

- Roche Diagnostics (A Division of F. Hoffmann-La Roche Ltd)

- Nova Biomedical

- Werfen (Instrumentation Laboratory)

- A. Menarini Diagnostics

- Edan Instruments, Inc.

- Eurolyser Diagnostica GmbH

- Cornley Hi-Tech Co., Ltd.

- Erba Mannheim (ERBA Diagnostics Mannheim GmbH)

- Balio Diagnostics, Inc.

- Opti Medical Systems (A part of IDEXX Laboratories)

- Sensa Core Medical Instrumentation Pvt. Ltd.

- I-SENS, Inc.

Frequently Asked Questions

What is the primary function of a blood gas and electrolyte analyzer?

A blood gas and electrolyte analyzer measures critical parameters in whole blood, such as pH, oxygen and carbon dioxide levels, and key electrolytes like sodium, potassium, and chloride, providing rapid insights into a patients respiratory, metabolic, and fluid balance status.

How do point-of-care (POCT) analyzers differ from traditional lab analyzers?

POCT analyzers are typically smaller, portable devices designed for immediate use at the patients bedside or in critical care settings, offering rapid results without the need to send samples to a central laboratory, thus accelerating clinical decision-making compared to larger, less mobile lab instruments.

What are the main applications for blood gas and electrolyte analyzers?

These analyzers are primarily used in critical care units, emergency departments, and operating rooms for monitoring critically ill patients, diagnosing respiratory and metabolic disorders, managing diabetic ketoacidosis, and assessing electrolyte imbalances to guide urgent treatment interventions.

What technological advancements are driving market growth in this sector?

Key technological advancements include miniaturization for enhanced portability, integration of AI and machine learning for improved accuracy and predictive analytics, advanced sensor technologies for greater precision, and seamless connectivity with hospital information systems for efficient data management.

Which geographical region holds the largest market share for these analyzers?

North America currently holds the largest market share for blood gas and electrolyte analyzers, primarily due to its advanced healthcare infrastructure, high prevalence of chronic diseases, significant research investments, and early adoption of innovative diagnostic technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager