Blood Screening Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428670 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Blood Screening Market Size

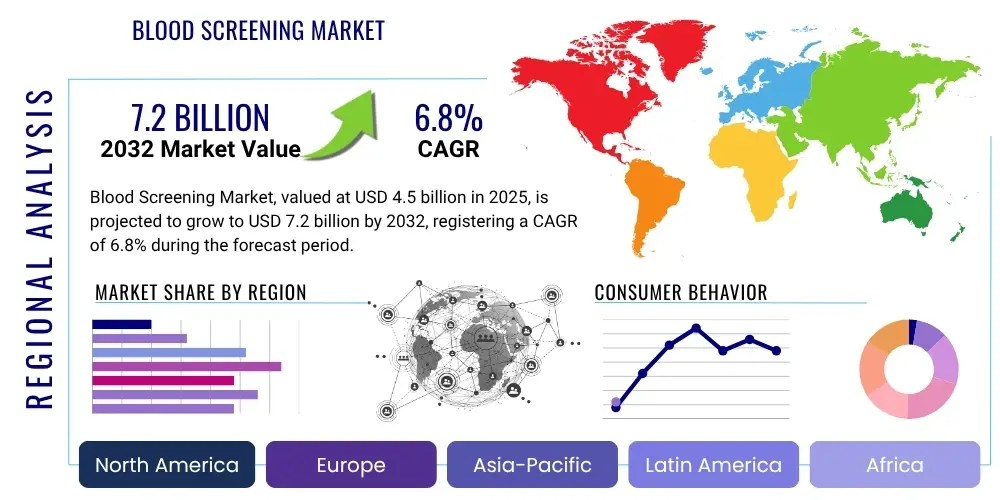

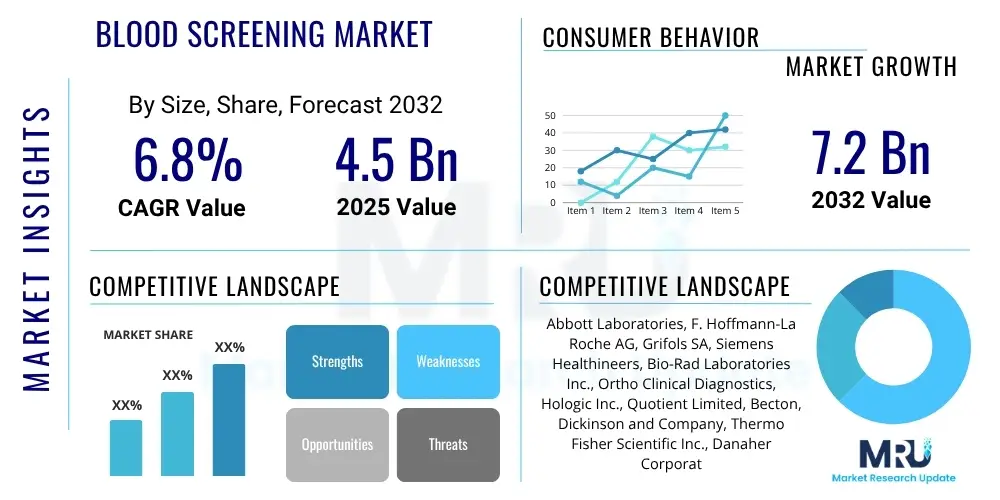

The Blood Screening Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 4.5 billion in 2025 and is projected to reach USD 7.2 billion by the end of the forecast period in 2032.

Blood Screening Market introduction

The Blood Screening Market encompasses a wide array of diagnostic tests and procedures designed to detect infectious diseases, blood grouping incompatibilities, and other conditions in donated blood or patient samples. These critical screenings ensure the safety and compatibility of blood and blood products used in transfusions, organ transplantation, and various medical treatments, thereby safeguarding patient health. The primary objective is to prevent the transmission of bloodborne pathogens from donor to recipient and to ensure accurate blood typing for compatible transfusions.

Products within this market primarily include highly specialized reagents and sophisticated instruments, such as Nucleic Acid Testing (NAT) systems, Enzyme-Linked Immunosorbent Assay (ELISA) kits, and chemiluminescence immunoassay (CLIA) systems. Major applications span pre-transfusion screening for HIV, Hepatitis B and C, Syphilis, and West Nile Virus, as well as blood group typing, cross-matching, and Rh factor determination. The immense benefit of these technologies lies in their ability to significantly reduce transfusion-related infections and adverse reactions, contributing substantially to public health and patient safety globally. The market is propelled by a rising global incidence of infectious diseases, increasing awareness about blood safety, a growing number of blood donations and transfusions, and continuous technological advancements.

Blood Screening Market Executive Summary

The Blood Screening Market is experiencing robust growth driven by an escalating demand for safe blood products and continuous innovation in diagnostic technologies. Key business trends include strategic collaborations among market players, a focus on automation to enhance throughput and reduce manual errors, and the development of multiplex assays capable of detecting multiple pathogens simultaneously. There is also a notable shift towards integrated solutions that streamline the entire screening process, from sample preparation to result interpretation, improving efficiency and cost-effectiveness for blood banks and diagnostic laboratories. Furthermore, companies are investing heavily in research and development to introduce next-generation screening platforms that offer higher sensitivity, specificity, and faster turnaround times, addressing evolving pathogen threats and stringent regulatory requirements.

Regionally, North America and Europe currently dominate the market due to advanced healthcare infrastructure, significant investments in R&D, and established regulatory frameworks. However, the Asia Pacific region is poised for the most rapid growth, fueled by rising healthcare expenditure, a large and growing population base, increasing awareness regarding blood safety, and improving access to modern diagnostic technologies. Latin America, the Middle East, and Africa are also emerging as lucrative markets, primarily due to rising prevalence of infectious diseases, expanding healthcare facilities, and initiatives aimed at improving blood safety standards. These regional dynamics highlight a global commitment to enhancing blood safety, albeit with varying paces of adoption and technological integration.

In terms of segmentation, the molecular diagnostics segment, particularly Nucleic Acid Testing (NAT), continues to lead due to its superior sensitivity and ability to detect viral infections during the window period. The reagents and kits segment holds the largest market share, driven by their recurring demand, while instruments are experiencing steady growth fueled by the need for automation and high-throughput screening. End-user trends indicate that blood banks remain the primary consumers, although hospitals and diagnostic centers are increasingly adopting in-house screening capabilities. The market is also witnessing a trend towards point-of-care (POC) testing, especially in resource-limited settings, promising faster results and decentralized screening capabilities, which could significantly impact market structure in the coming years.

AI Impact Analysis on Blood Screening Market

User questions regarding AI's impact on the Blood Screening Market frequently revolve around its potential to enhance diagnostic accuracy, streamline workflows, and personalize screening approaches. Key themes emerging from these inquiries include the expectation of AI improving the speed and precision of pathogen detection, particularly for rare or emerging threats. There is considerable interest in how AI can aid in the interpretation of complex diagnostic data, minimizing human error and providing more consistent results. Concerns often touch upon the validation of AI algorithms, data privacy issues associated with large datasets, and the integration challenges with existing laboratory information systems, alongside questions about its cost-effectiveness and accessibility for smaller facilities.

The prevailing sentiment suggests a strong belief in AI's transformative power to revolutionize blood screening by moving beyond conventional methods. Users are keen to understand how AI can assist in predictive analytics for outbreaks, optimize donor selection processes, and even contribute to the development of new diagnostic markers. The expectation is that AI will not only improve the detection of known pathogens but also aid in the identification of novel infectious agents, thereby bolstering overall public health safety. However, the need for robust regulatory oversight and clear guidelines for AI deployment in such a critical field is a common underlying concern, highlighting the balance between innovation and patient safety.

- Enhanced diagnostic accuracy and sensitivity through advanced pattern recognition.

- Faster turnaround times for test results by automating data analysis and interpretation.

- Identification of novel biomarkers and emerging infectious agents.

- Optimization of laboratory workflows and resource allocation.

- Reduction of human error in result interpretation and data entry.

- Improved donor risk assessment through predictive analytics on donor health history.

- Development of personalized screening protocols based on individual risk factors.

- Integration with LIS for seamless data management and reporting.

DRO & Impact Forces Of Blood Screening Market

The Blood Screening Market is significantly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its trajectory and impact forces. A primary driver is the escalating global prevalence of infectious diseases such as HIV, Hepatitis B and C, and Zika virus, necessitating stringent screening protocols for blood and blood products to prevent transmission. Concurrently, the increasing number of blood donations and transfusions worldwide, driven by rising surgical procedures, trauma cases, and conditions requiring blood support, directly fuels the demand for advanced and reliable screening solutions. Furthermore, continuous technological advancements, particularly in molecular diagnostics and automation, offer more sensitive, specific, and rapid testing capabilities, pushing market growth.

Conversely, the market faces considerable restraints, including the high cost associated with advanced screening instruments and the recurring expenses of reagents and kits, which can be a barrier for healthcare systems in developing economies. Stringent regulatory frameworks imposed by bodies such as the FDA and EMA, while essential for safety, often lead to lengthy approval processes and increased R&D costs, potentially delaying market entry for innovative products. Additionally, the shortage of skilled professionals required to operate and maintain sophisticated screening equipment, coupled with ethical concerns surrounding donor privacy and genetic information, presents significant challenges to market expansion.

Opportunities for growth are abundant, particularly in emerging markets where healthcare infrastructure is rapidly improving and awareness of blood safety is increasing. The development of point-of-care (POC) testing devices offers a promising avenue for decentralized and rapid screening, especially in remote or resource-limited areas. Moreover, the integration of artificial intelligence and machine learning into diagnostic platforms represents a substantial opportunity to enhance analytical precision, reduce false positives, and optimize laboratory efficiency. The ongoing trend towards personalized medicine and the development of multiplex assays capable of detecting multiple pathogens simultaneously also present lucrative growth prospects, driving innovation and market diversification.

Segmentation Analysis

The Blood Screening Market is comprehensively segmented based on technology, product, application, and end user, providing a detailed understanding of its diverse components and growth dynamics. Each segment plays a crucial role in delivering safe and effective blood screening solutions, addressing specific needs within the healthcare ecosystem. The technological advancements across these segments continually redefine diagnostic capabilities and market accessibility, influencing adoption rates and regional penetration.

- By Technology

- Nucleic Acid Testing (NAT)

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chemiluminescence Immunoassay (CLIA)

- Rapid Tests

- Western Blot

- Next-Generation Sequencing (NGS)

- Microarray Technology

- Other Technologies

- By Product

- Reagents and Kits

- Instruments

- Automated Instruments

- Semi-Automated Instruments

- By Application

- Disease Screening

- HIV

- Hepatitis B

- Hepatitis C

- Syphilis

- Malaria

- Chagas Disease

- Zika Virus

- West Nile Virus

- Other Infectious Diseases

- Blood Grouping

- Donor Screening

- Disease Screening

- By End User

- Blood Banks

- Hospitals

- Diagnostic Laboratories

- Public Health Laboratories

- Research Institutions

Value Chain Analysis For Blood Screening Market

The value chain for the Blood Screening Market begins with extensive upstream activities, primarily involving the research and development of novel diagnostic technologies and the procurement of high-quality raw materials. This includes specialized chemicals, enzymes, antibodies, antigens, and nucleic acid probes essential for developing reagents and kits, alongside precision-engineered components for diagnostic instruments. Key suppliers in this phase are often specialized chemical companies, biotechnology firms, and advanced manufacturing entities, whose innovation and quality directly influence the efficacy and reliability of the final screening products. The initial R&D phase is highly capital-intensive, focusing on identifying new biomarkers, improving detection limits, and ensuring regulatory compliance for new assays.

Midstream activities encompass the manufacturing, assembly, and quality control of blood screening products, including both reagents/kits and sophisticated analytical instruments. Manufacturers integrate the raw materials and technological components to produce validated diagnostic solutions. This stage requires rigorous quality assurance processes to meet international standards and regulatory requirements, such as ISO certifications and FDA approvals. Marketing and sales efforts are also critical here, aimed at educating potential buyers about product benefits, clinical validation, and cost-effectiveness. The distribution channel then bridges manufacturers with end-users, encompassing both direct sales forces for large accounts and indirect distribution through a network of specialized distributors, value-added resellers, and online platforms.

Downstream analysis focuses on the end-users and the consumption of blood screening products, primarily by blood banks, hospitals, diagnostic laboratories, and public health organizations. These entities utilize the products for ensuring blood safety prior to transfusions, diagnosing infectious diseases, and conducting epidemiological surveillance. Post-sales support, including instrument maintenance, technical assistance, and training, forms a vital part of the downstream value chain, ensuring optimal product performance and customer satisfaction. The efficiency of this entire chain, from R&D to end-user support, directly impacts the availability, affordability, and overall effectiveness of blood screening services globally, ultimately contributing to public health outcomes.

Blood Screening Market Potential Customers

The primary potential customers and end-users of blood screening products are institutions and organizations deeply entrenched in healthcare, public health, and research. Blood banks represent the largest segment of buyers, as their core mission revolves around the safe collection, processing, and distribution of blood components for transfusion. They require high-throughput, accurate, and reliable screening systems to test every donated unit for a comprehensive panel of infectious diseases and to ensure proper blood typing. The continuous volume of blood donations necessitates a constant demand for reagents, kits, and automated instruments, making them the most significant recurring revenue source for market players.

Hospitals, particularly those with large trauma centers, surgical departments, or oncology units, also constitute a substantial customer base. While many hospitals rely on external blood banks for screened blood, some larger institutions maintain their own in-house blood processing and screening laboratories. These hospitals seek integrated solutions that can provide rapid results, often in critical care situations, and ensure patient safety from transfusion-transmitted infections. Their purchasing decisions are often influenced by the need for quick turnaround times, integration with existing laboratory information systems, and the ability to handle a diverse range of diagnostic needs beyond routine blood bank operations.

Diagnostic laboratories, both private and public, including reference laboratories and government-run public health organizations, form another critical customer segment. These laboratories often perform specialized or confirmatory tests that may not be available in smaller blood banks or hospital labs. They require advanced, high-precision instruments and highly specific reagents to conduct comprehensive infectious disease surveillance, outbreak investigations, and epidemiological studies. Research institutions and academic centers also procure blood screening technologies for investigative purposes, developing new diagnostic assays, and understanding pathogen dynamics, contributing to the innovation pipeline of the market. These diverse customer segments underscore the broad utility and critical importance of blood screening across the healthcare spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 billion |

| Market Forecast in 2032 | USD 7.2 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, F. Hoffmann-La Roche AG, Grifols SA, Siemens Healthineers, Bio-Rad Laboratories Inc., Ortho Clinical Diagnostics, Hologic Inc., Quotient Limited, Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Danaher Corporation, Sysmex Corporation, FujiRebio, Beckman Coulter (a Danaher Company), bioMérieux SA, DiaSorin S.p.A., GenMark Diagnostics, Inc., Luminex Corporation, Sekisui Diagnostics, Trinity Biotech plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Screening Market Key Technology Landscape

The Blood Screening Market is characterized by a dynamic and evolving technology landscape, with continuous innovation aimed at enhancing diagnostic accuracy, increasing throughput, and reducing turnaround times. One of the cornerstone technologies is Nucleic Acid Testing (NAT), which offers superior sensitivity by directly detecting the genetic material of pathogens (DNA or RNA) during the window period of infection, significantly reducing the risk of transfusion-transmitted diseases like HIV and Hepatitis. NAT systems have largely become the gold standard in developed markets, leveraging real-time PCR or transcription-mediated amplification (TMA) to achieve high levels of detection and specificity.

Another prevalent technology is Enzyme-Linked Immunosorbent Assay (ELISA) and its more sensitive variant, Chemiluminescence Immunoassay (CLIA). These immunoassay techniques are widely used for detecting antibodies or antigens related to various infectious diseases and for blood grouping. While slightly less sensitive than NAT during the early stages of infection, their cost-effectiveness and adaptability make them indispensable, especially in resource-constrained settings or for high-volume initial screening. Recent advancements in these immunoassay platforms focus on automation, multiplexing capabilities, and improved reagent stability, enhancing efficiency and reliability.

Emerging and advanced technologies also play a critical role, including Next-Generation Sequencing (NGS) for comprehensive pathogen detection and resistance profiling, microarrays for simultaneous detection of multiple analytes, and rapid diagnostic tests (RDTs) for point-of-care applications, particularly for diseases like malaria and syphilis in remote areas. The integration of automation and robotics across all these platforms is a major trend, minimizing manual handling, standardizing procedures, and increasing laboratory efficiency. Furthermore, the development of integrated systems that combine multiple testing modalities onto a single platform is simplifying workflows and improving the overall operational efficiency of blood screening laboratories worldwide.

Regional Highlights

Regional dynamics significantly influence the Blood Screening Market, with varying levels of technological adoption, regulatory landscapes, and disease prevalence shaping market growth across different geographies. North America currently dominates the market, primarily due to its advanced healthcare infrastructure, high awareness regarding blood safety, significant investments in research and development, and the presence of major market players. Stringent regulatory guidelines from bodies like the FDA mandate comprehensive screening protocols, further driving market demand for innovative and highly reliable diagnostic solutions. The region also benefits from a high volume of blood donations and transfusions, supported by robust public health campaigns.

Europe represents another significant market, characterized by stringent regulatory standards, a well-established network of blood banks, and a strong emphasis on public health safety. Countries like Germany, the UK, and France are at the forefront of adopting advanced screening technologies and investing in automation for blood testing. The region's focus on research and development, coupled with an aging population and increasing chronic disease burden requiring transfusions, contributes to sustained market growth. However, variations in reimbursement policies and healthcare expenditure across European countries can influence the pace of technology adoption and market penetration.

- North America: Leading market share driven by advanced healthcare infrastructure, high R&D investments, and strict regulatory frameworks. Dominance in adopting Nucleic Acid Testing (NAT) and highly automated systems.

- Europe: Strong market presence with stringent blood safety regulations, well-established blood bank networks, and continuous technological advancements. Focus on automation and multiplex assays.

- Asia Pacific (APAC): Fastest growing market due to increasing healthcare expenditure, a large patient population, rising awareness of bloodborne diseases, and improving access to modern diagnostic technologies, particularly in China and India.

- Latin America: Emerging market with growing healthcare infrastructure, increasing prevalence of infectious diseases, and government initiatives aimed at enhancing blood safety standards. Adoption of cost-effective and efficient screening methods.

- Middle East and Africa (MEA): Rapidly developing market propelled by a high burden of infectious diseases, increasing investments in healthcare infrastructure, and international collaborations to improve blood screening capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Screening Market.- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Grifols SA

- Siemens Healthineers

- Bio-Rad Laboratories Inc.

- Ortho Clinical Diagnostics

- Hologic Inc.

- Quotient Limited

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Sysmex Corporation

- FujiRebio

- Beckman Coulter (a Danaher Company)

- bioMérieux SA

- DiaSorin S.p.A.

- GenMark Diagnostics, Inc.

- Luminex Corporation

- Sekisui Diagnostics

- Trinity Biotech plc.

Frequently Asked Questions

What is blood screening and why is it important?

Blood screening refers to the comprehensive testing of donated blood for infectious agents and accurate blood typing. It is crucial for preventing the transmission of diseases like HIV and hepatitis through transfusions, ensuring patient safety and compatible blood matches.

What are the primary technologies used in blood screening?

Key technologies include Nucleic Acid Testing (NAT) for direct pathogen detection, Enzyme-Linked Immunosorbent Assay (ELISA) and Chemiluminescence Immunoassay (CLIA) for antibody/antigen detection, and rapid tests for quick results.

How is artificial intelligence impacting the blood screening market?

AI enhances diagnostic accuracy, accelerates data analysis, optimizes workflows, and aids in identifying new biomarkers, leading to more efficient and precise pathogen detection while potentially reducing human error.

What are the main challenges faced by the blood screening market?

Major challenges include the high cost of advanced screening technologies, stringent regulatory requirements, the need for skilled laboratory personnel, and ongoing ethical considerations regarding donor privacy and data management.

Which regions are leading in the adoption of advanced blood screening technologies?

North America and Europe currently lead due to their advanced healthcare infrastructures and stringent blood safety regulations, while the Asia Pacific region is experiencing rapid growth fueled by increasing healthcare investments and awareness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager