Blue Hydrogen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428702 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Blue Hydrogen Market Size

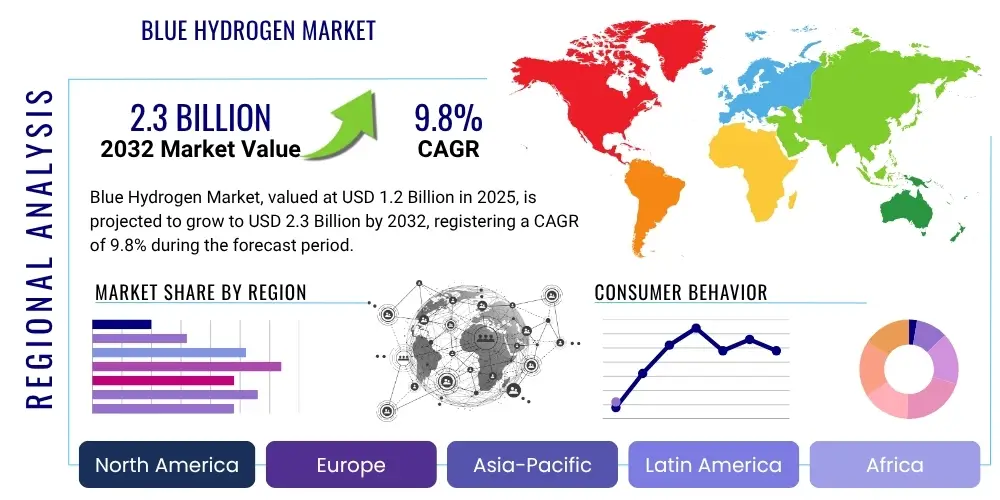

The Blue Hydrogen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2025 and 2032. The market is estimated at $1.2 Billion in 2025 and is projected to reach $2.3 Billion by the end of the forecast period in 2032.

Blue Hydrogen Market introduction

The Blue Hydrogen market represents a pivotal segment in the global energy transition, offering a lower-carbon alternative to traditional grey hydrogen production. Blue hydrogen is typically produced from natural gas through processes like Steam Methane Reforming (SMR) or Autothermal Reforming (ATR), where the resulting carbon dioxide emissions are captured and stored underground (Carbon Capture, Utilization, and Storage - CCUS). This method significantly reduces the carbon footprint compared to hydrogen production without CCUS, positioning it as an essential bridge fuel towards a fully decarbonized energy system. Its primary applications span across industrial feedstock for ammonia and methanol production, oil refining, and increasingly, in power generation, heavy transportation, and as a heating fuel. The benefit of blue hydrogen lies in its ability to leverage existing natural gas infrastructure and proven industrial processes, offering a scalable and relatively cost-effective pathway to decarbonization in sectors where direct electrification is challenging.

Driving factors for the blue hydrogen market include the escalating global pressure to achieve net-zero emissions, supportive government policies and incentives for CCUS projects, and a growing industrial demand for cleaner energy sources and feedstocks. As nations and corporations commit to ambitious climate targets, the adoption of blue hydrogen provides a tangible step towards reducing Scope 1 and Scope 2 emissions, particularly in hard-to-abate sectors. Moreover, the technological maturity of natural gas reforming combined with advancements in carbon capture technologies makes blue hydrogen a commercially viable option, especially in regions with abundant natural gas reserves and suitable geological storage sites for CO2. The market is also benefiting from increased private and public investment aimed at developing comprehensive hydrogen economies, integrating production, infrastructure, and end-use applications.

Blue Hydrogen Market Executive Summary

The Blue Hydrogen Market is experiencing robust growth driven by an accelerating global imperative for decarbonization and the increasing adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies. Business trends indicate significant investment in large-scale blue hydrogen production facilities and associated CCUS infrastructure, particularly from major energy companies diversifying their portfolios. Partnerships between technology providers, energy firms, and industrial end-users are becoming common, aiming to optimize production efficiency and reduce costs. The market is characterized by ongoing innovation in carbon capture methods and efforts to enhance the overall energy efficiency of hydrogen production processes, alongside a growing focus on regulatory frameworks that provide long-term certainty for CCUS projects and hydrogen adoption. This strategic business development is crucial for scaling blue hydrogen capabilities and integrating them into broader energy systems.

Regionally, North America and Europe are at the forefront of blue hydrogen development, propelled by strong governmental support, established natural gas infrastructure, and ambitious climate targets. The United States, with its Inflation Reduction Act offering significant tax credits for CCUS, and European nations, through initiatives like the European Hydrogen Strategy, are fostering an attractive environment for investment. Asia Pacific, particularly countries like China, Japan, and South Korea, is also emerging as a key growth region due to rapidly expanding industrial demand and strategic plans to incorporate hydrogen into their energy mixes, despite a varied approach to CCUS adoption. Segments trends highlight Steam Methane Reforming (SMR) with CCUS as the dominant production technology, while Autothermal Reforming (ATR) with CCUS is gaining traction for its higher efficiency. End-use applications in refineries and the chemical industry remain the largest consumers, but significant growth is anticipated in power generation, heavy-duty transport, and industrial heating as infrastructure develops and costs decrease, broadening the market's impact across diverse sectors.

AI Impact Analysis on Blue Hydrogen Market

Common user questions regarding AI's impact on the Blue Hydrogen Market frequently revolve around how artificial intelligence can enhance operational efficiency, reduce costs, improve safety, and accelerate the development and deployment of blue hydrogen technologies. Users are keen to understand AI's role in optimizing the complex processes of natural gas reforming and carbon capture, predicting equipment failures, managing supply chains, and simulating various production scenarios to identify the most sustainable and economically viable pathways. Concerns often include the data requirements for effective AI implementation, the cybersecurity risks associated with integrated smart systems, and the need for specialized expertise to develop and maintain AI-driven solutions in this niche industrial sector. The overarching expectation is that AI will act as a force multiplier, enabling blue hydrogen to become a more competitive and reliable component of the future energy landscape.

- AI can optimize the Steam Methane Reforming (SMR) and Autothermal Reforming (ATR) processes, enhancing hydrogen yield and energy efficiency by predictive control of reaction parameters.

- Predictive maintenance analytics, powered by AI, can monitor critical equipment in blue hydrogen plants and carbon capture facilities, reducing downtime and operational costs.

- AI-driven supply chain management can optimize the sourcing of natural gas feedstock, transportation logistics, and distribution of blue hydrogen, ensuring reliability and cost-effectiveness.

- Advanced process control systems leveraging AI can improve the efficiency and selectivity of carbon capture technologies, reducing energy penalties associated with CO2 separation.

- AI can model and simulate various CCUS scenarios, aiding in the selection of optimal geological storage sites and predicting CO2 injection performance and long-term storage integrity.

- Enhanced safety protocols through AI-powered monitoring can detect anomalies and potential hazards in real-time, preventing incidents in hydrogen production and handling.

- Data analytics and machine learning can accelerate research and development in new catalytic materials and capture solvents, leading to more efficient and cost-effective blue hydrogen technologies.

DRO & Impact Forces Of Blue Hydrogen Market

The Blue Hydrogen Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by a range of Impact Forces. Key drivers include the intensifying global commitment to decarbonization and net-zero targets, which mandates a shift away from fossil fuels and towards cleaner energy carriers like hydrogen. Significant government support through policies, subsidies, and carbon pricing mechanisms, particularly in regions like North America and Europe, further incentivizes investment in blue hydrogen and associated Carbon Capture, Utilization, and Storage (CCUS) technologies. Additionally, the existing infrastructure for natural gas, coupled with its relative abundance in several key regions, provides a readily available feedstock, making blue hydrogen a more immediate and scalable solution compared to certain other hydrogen production methods in the short to medium term. The growing industrial demand for low-carbon feedstocks in sectors like chemicals, refining, and steel production also strongly propels market expansion.

However, the market faces notable restraints, primarily the high capital expenditure (CAPEX) required for developing large-scale blue hydrogen production facilities and the extensive CCUS infrastructure. The efficiency and cost-effectiveness of carbon capture technologies, while improving, still pose a challenge, particularly in achieving very high capture rates at an economical price. Public perception and acceptance of CCUS technology, including concerns about CO2 storage integrity and potential methane leakage during natural gas extraction, also represent significant hurdles. Furthermore, the market's reliance on natural gas exposes it to price volatility, impacting overall production costs and economic viability. Opportunities for growth are abundant, stemming from advancements in carbon capture technologies that promise increased efficiency and lower costs. The integration of blue hydrogen with existing energy infrastructure, its potential for new end-use applications such as maritime and aviation fuels, and its role as a transitional fuel alongside green hydrogen create compelling avenues for market expansion. The development of a global hydrogen economy and the potential for blue hydrogen exports to energy-importing nations also present substantial opportunities. These market dynamics are heavily influenced by impact forces such as evolving geopolitical landscapes, technological breakthroughs, shifts in regulatory environments, public opinion on climate solutions, and the competitive pressures from other low-carbon energy alternatives.

Segmentation Analysis

The Blue Hydrogen Market is broadly segmented based on several key parameters including technology, end-use application, and geographical region. This segmentation provides a granular view of market dynamics, enabling stakeholders to identify specific growth drivers, competitive landscapes, and emerging trends within each category. Understanding these segments is crucial for strategic planning, investment decisions, and market positioning within the evolving hydrogen economy. The primary technological segments differentiate blue hydrogen production methods, while end-use application segments highlight the diverse industrial and energy sectors that are adopting or projected to adopt blue hydrogen as a clean energy carrier or industrial feedstock. Geographical segmentation offers insights into regional disparities in policy support, resource availability, infrastructure development, and market maturity, outlining areas of strong growth potential and specific challenges. Each segment's growth trajectory is influenced by unique economic, regulatory, and technological factors.

- By Technology

- Steam Methane Reforming (SMR) with Carbon Capture, Utilization, and Storage (CCUS)

- Autothermal Reforming (ATR) with Carbon Capture, Utilization, and Storage (CCUS)

- Gasification with Carbon Capture, Utilization, and Storage (CCUS)

- Plasma Reforming with Carbon Capture, Utilization, and Storage (CCUS)

- Other Production Technologies with CCUS

- By End Use Application

- Refineries

- Chemicals

- Ammonia Production

- Methanol Production

- Other Chemical Synthesis

- Power Generation (e.g., Gas Turbines, Fuel Cells)

- Transportation (e.g., Fuel Cell Electric Vehicles, Heavy-Duty Transport)

- Industrial Feedstock (e.g., Steel Production, Glass Manufacturing, Electronics)

- Industrial Heating

- Other Industrial Applications

- By Region

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Netherlands

- Norway

- Spain

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Australia

- Indonesia

- Rest of APAC

- Latin America

- Brazil

- Argentina

- Chile

- Rest of Latin America

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Egypt

- Rest of MEA

- North America

Value Chain Analysis For Blue Hydrogen Market

The value chain for the Blue Hydrogen Market encompasses several critical stages, beginning with the upstream sourcing of hydrocarbon feedstocks, primarily natural gas, and extending through production, carbon capture, purification, transportation, storage, and ultimately, to downstream distribution and end-use applications. Upstream analysis involves the exploration, extraction, and pipeline transport of natural gas, which forms the primary raw material. Given that blue hydrogen production methods like Steam Methane Reforming (SMR) and Autothermal Reforming (ATR) rely on methane, the availability and cost-efficiency of natural gas heavily influence the economic viability of the entire chain. Efficient carbon capture technologies are integrated into this production stage, adding complexity and significant capital investment. The captured CO2 then requires further infrastructure for transport and geological sequestration or utilization in other industrial processes, such as Enhanced Oil Recovery (EOR) or the production of synthetic fuels and chemicals. This upstream integration requires robust partnerships between natural gas producers, technology providers for reforming and CCUS, and geological storage operators.

Midstream activities involve the processing of hydrogen, its compression, liquefaction (if needed for specific transport methods), and transportation through dedicated hydrogen pipelines, tube trailers, or ships to demand centers. The development of dedicated hydrogen infrastructure is nascent but rapidly expanding, often leveraging or adapting existing natural gas networks. Downstream analysis focuses on the distribution channels and the multitude of end-use applications. Direct distribution occurs when blue hydrogen is supplied directly to large industrial consumers like refineries, ammonia plants, or steel manufacturers via pipeline or dedicated transport. Indirect distribution involves blue hydrogen being supplied to power plants for electricity generation, or to refueling stations for fuel cell vehicles. Both direct and indirect channels are critical for market penetration. Direct sales benefit from large, consistent demand, while indirect channels broaden market access and promote wider adoption across diverse sectors. The entire value chain requires significant capital investment, technological expertise, and collaborative efforts across various industries to ensure efficiency, safety, and environmental integrity, with regulatory support playing a crucial role in enabling infrastructure development and market growth.

Blue Hydrogen Market Potential Customers

Potential customers for blue hydrogen span a broad spectrum of industrial and energy-intensive sectors, driven by their imperative to decarbonize operations and meet sustainability targets without immediately transitioning to entirely new, costly electrification pathways or green hydrogen solutions. Key end-users include refineries, which utilize hydrogen extensively for hydrotreating and hydrocracking processes to produce cleaner fuels. The chemical industry, particularly producers of ammonia for fertilizers and methanol for various industrial applications, represents a significant and established demand segment for hydrogen, now increasingly seeking low-carbon alternatives. These industries often have existing hydrogen infrastructure and can integrate blue hydrogen relatively seamlessly into their operations, offering a clear economic and environmental value proposition. The scalability and consistent supply capability of blue hydrogen make it an attractive option for these large-scale consumers.

Beyond traditional industrial applications, emerging sectors are also poised to become significant buyers of blue hydrogen. The power generation sector is exploring blue hydrogen for blending with natural gas in turbines to reduce emissions or for use in dedicated hydrogen-fired power plants. The transportation sector, especially heavy-duty transport (trucking, shipping, rail), is investigating hydrogen fuel cells as a zero-emission alternative, with blue hydrogen offering a scalable supply solution as infrastructure develops. Furthermore, the steel industry is actively pursuing hydrogen as a reducing agent to replace coking coal, aiming for significant emissions reductions, and other industrial heating applications are considering blue hydrogen for process heat. Geographically, regions with abundant natural gas resources and established industrial bases, along with strong decarbonization mandates, are becoming primary markets, attracting investment and fostering robust demand from a diverse customer base seeking cost-effective and scalable clean energy solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.2 Billion |

| Market Forecast in 2032 | $2.3 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Shell plc, Equinor ASA, BP plc, ExxonMobil Corporation, Chevron Corporation, TotalEnergies SE, Saudi Aramco, Sinopec, Mitsubishi Heavy Industries, Ltd., thyssenkrupp AG, Topsoe A/S, Johnson Matthey plc, Technip Energies N.V., Baker Hughes Company, Chart Industries, Inc., Woodside Energy Group Ltd., ENI S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blue Hydrogen Market Key Technology Landscape

The key technology landscape for the Blue Hydrogen Market is primarily defined by advanced natural gas reforming processes coupled with highly efficient carbon capture, utilization, and storage (CCUS) solutions. Steam Methane Reforming (SMR) with CCUS remains the most established and widely deployed technology. In SMR, methane reacts with steam at high temperatures to produce hydrogen and carbon dioxide; the subsequent capture of CO2, typically via amine-based absorption or other solvent-based methods, is crucial for achieving blue hydrogen status. While SMR is a mature process, continuous improvements focus on enhancing energy efficiency, catalyst performance, and the integration of carbon capture units to reduce the overall energy penalty and operational costs. These advancements are vital for making blue hydrogen more competitive and sustainable. The scale of SMR plants with CCUS can range from smaller industrial applications to very large centralized facilities, serving diverse end-users.

Another prominent technology is Autothermal Reforming (ATR) with CCUS, which combines elements of SMR and partial oxidation. ATR is generally more energy-efficient than SMR as it generates some of its own heat, leading to a higher concentration of CO2 in the flue gas, which can simplify the carbon capture process. This characteristic makes ATR a favored option for larger-scale blue hydrogen projects where high CO2 capture rates are sought. Beyond reforming, gasification of fossil fuels (like coal or petcoke) with CCUS can also produce blue hydrogen, though this is often associated with higher lifecycle emissions concerns if not managed meticulously. Emerging technologies, such as plasma reforming with CCUS, are also being explored for their potential to offer novel ways of producing hydrogen with integrated carbon management. The efficiency, cost, and reliability of the CCUS component, including capture, compression, transport, and secure geological storage, are paramount to the viability and widespread adoption of all blue hydrogen production technologies. Innovations in membrane separation, cryogenic capture, and adsorption technologies are continually being developed to enhance the performance and economic feasibility of the entire blue hydrogen ecosystem.

Regional Highlights

- North America: This region is a leading adopter of blue hydrogen, primarily driven by abundant natural gas resources, robust government incentives such as tax credits for Carbon Capture, Utilization, and Storage (CCUS) projects under the Inflation Reduction Act in the United States, and strong industrial demand for decarbonization. Major investments are directed towards large-scale blue hydrogen production hubs and extensive CO2 pipeline networks, especially in the Gulf Coast region.

- Europe: Europe is demonstrating significant commitment to blue hydrogen as a transitional fuel, supported by the European Hydrogen Strategy and national decarbonization plans. Countries like the Netherlands, Norway, and the UK are actively investing in CCUS infrastructure and projects, leveraging their North Sea gas reserves and industrial clusters. The region focuses on integrating blue hydrogen into industrial feedstocks, power generation, and heating sectors, despite a stronger long-term emphasis on green hydrogen.

- Asia Pacific (APAC): The APAC region is experiencing rapid industrialization and growing energy demand, making blue hydrogen an attractive option for reducing emissions in hard-to-abate sectors. Countries such as China, Japan, South Korea, and Australia are exploring and investing in blue hydrogen projects, often in partnership with international energy companies. While green hydrogen initiatives are also strong, blue hydrogen provides a more immediate, scalable pathway to meet ambitious decarbonization targets, especially given the region's significant industrial base and fossil fuel resources.

- Latin America: Latin America, rich in natural gas reserves, is emerging as a potential hub for blue hydrogen production, with countries like Brazil and Argentina showing interest. While the market is less mature than in North America or Europe, increasing focus on sustainable development and foreign investment opportunities are driving preliminary studies and pilot projects, particularly for industrial applications and export potential.

- Middle East and Africa (MEA): The MEA region, with its vast natural gas reserves and strategic geopolitical importance in energy markets, is positioned to become a major producer and exporter of blue hydrogen. Countries like Saudi Arabia, UAE, and Qatar are making significant investments in CCUS and blue hydrogen projects, aiming to diversify their economies and become global leaders in the clean energy transition. Proximity to European and Asian markets makes MEA a crucial player in future international hydrogen trade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blue Hydrogen Market.- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide S.A.

- Shell plc

- Equinor ASA

- BP plc

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies SE

- Saudi Aramco

- Sinopec

- Mitsubishi Heavy Industries, Ltd.

- thyssenkrupp AG

- Topsoe A/S

- Johnson Matthey plc

- Technip Energies N.V.

- Baker Hughes Company

- Chart Industries, Inc.

- Woodside Energy Group Ltd.

- ENI S.p.A.

Frequently Asked Questions

What is blue hydrogen and how is it produced?

Blue hydrogen is produced from natural gas through steam methane reforming or autothermal reforming, with the carbon dioxide emissions captured and stored underground using Carbon Capture, Utilization, and Storage (CCUS) technology. This process significantly reduces the greenhouse gas footprint compared to conventional grey hydrogen.

What are the primary applications of blue hydrogen?

Blue hydrogen is primarily used as an industrial feedstock in oil refining, ammonia production, and methanol synthesis. It is also gaining traction in power generation, heavy transportation, and as a low-carbon fuel for industrial heating and steel production to aid decarbonization efforts.

What are the main drivers for the growth of the blue hydrogen market?

Key drivers include global decarbonization targets, increasing government support and incentives for CCUS technologies, the abundance and established infrastructure of natural gas, and rising industrial demand for low-carbon energy solutions and feedstocks across various sectors.

What are the key challenges facing the blue hydrogen market?

Major challenges include the high capital expenditure for CCUS infrastructure, public perception concerns regarding CO2 storage, the potential for methane leakage, and the fluctuating prices of natural gas which can impact production costs and overall economic viability.

How does blue hydrogen compare to green hydrogen?

Blue hydrogen, produced from natural gas with carbon capture, offers a lower-carbon solution and is generally more scalable and cost-effective than green hydrogen (produced via electrolysis using renewable electricity) in the short to medium term, leveraging existing infrastructure. Green hydrogen, however, aims for near-zero emissions directly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager