Boat & Yacht Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428535 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Boat & Yacht Insurance Market Size

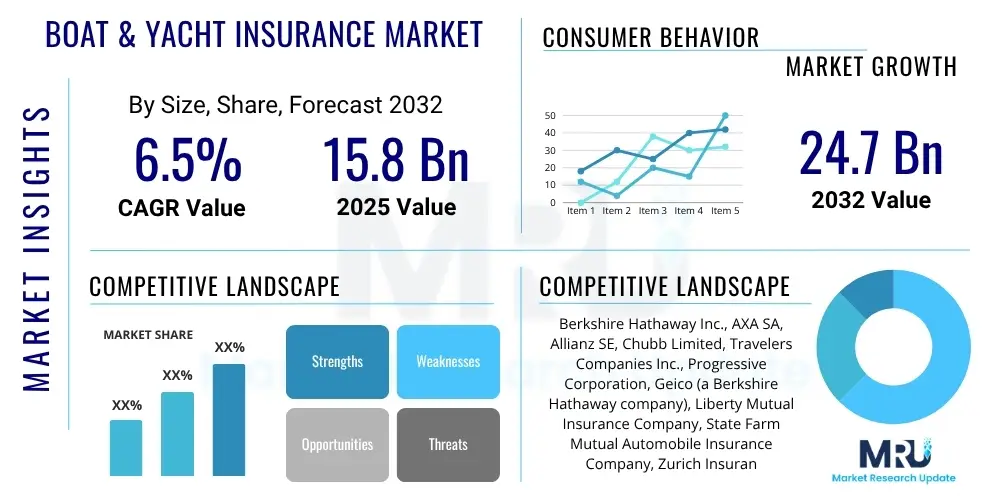

The Boat & Yacht Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 15.8 billion in 2025 and is projected to reach USD 24.7 billion by the end of the forecast period in 2032.

Boat & Yacht Insurance Market introduction

The Boat & Yacht Insurance Market encompasses a specialized segment of the insurance industry dedicated to providing financial protection against risks associated with owning and operating various types of watercraft. This includes everything from small recreational dinghies and personal watercraft to large luxury yachts and smaller commercial vessels. The core product offering provides coverage for potential losses such as physical damage to the vessel, liability for injuries or damage to third parties, theft, and environmental damages. Policies are tailored to the specific needs of boat owners, considering factors like boat type, size, value, usage, and navigation area. This essential service mitigates financial exposure for vessel owners, fostering greater participation in marine leisure activities and commercial operations.

Major applications of boat and yacht insurance extend across individual recreational boating, commercial charter operations, marina businesses, and even vessel manufacturing and dealership activities. For individual owners, it offers peace of mind, protecting their significant investment from perils like collisions, storms, fire, and vandalism. Commercial operators rely on it to cover their fleets, manage passenger liability, and ensure business continuity. The primary benefits include financial security against unforeseen events, legal compliance in many jurisdictions requiring liability coverage, and access to repair services and claims support. The market is primarily driven by the increasing global interest in recreational boating, rising disposable incomes facilitating luxury yacht purchases, expanding maritime tourism, and a heightened awareness of risk management among vessel owners. Additionally, climate change and more frequent extreme weather events are compelling factors for robust insurance coverage.

Boat & Yacht Insurance Market Executive Summary

The Boat & Yacht Insurance Market is experiencing robust growth, propelled by evolving business trends, significant regional expansion, and dynamic shifts within its segments. Business trends indicate a strong move towards digitalization, with insurance providers leveraging online platforms for policy sales, management, and claims processing. There is also an increasing focus on personalized insurance products that utilize telematics and data analytics to offer tailored coverage and premium structures based on individual boat usage patterns and risk profiles. Partnerships between traditional insurers and marine technology companies are becoming more prevalent, enhancing risk assessment capabilities and customer service delivery. Furthermore, sustainability and environmental considerations are influencing policy offerings, with some insurers providing incentives for eco-friendly boating practices.

Regionally, North America and Europe continue to dominate the market due to their mature boating cultures, extensive coastlines, and high disposable incomes. However, the Asia Pacific region, particularly countries like China, Australia, and parts of Southeast Asia, is emerging as a significant growth hub, driven by increasing affluence, expanding leisure marine infrastructure, and a growing interest in water sports and yachting. Latin America and the Middle East & Africa are also showing nascent growth, as tourism industries develop and luxury markets expand. Within segments, there is a noticeable trend towards comprehensive hull and machinery coverage, especially for high-value yachts. The liability insurance segment is also expanding due to increasing regulatory demands and higher awareness of potential third-party damages. Distribution channels are diversifying, with a growing preference for direct-to-consumer online platforms alongside the traditional agent and broker networks, reflecting evolving consumer purchasing habits.

AI Impact Analysis on Boat & Yacht Insurance Market

Users frequently inquire about how Artificial Intelligence (AI) will transform the Boat & Yacht Insurance Market, focusing on its potential to streamline operations, reduce costs, and enhance customer experience. Common questions revolve around the use of AI in risk assessment, how it might personalize premiums, its role in accelerating the claims process, and its capability to detect and prevent fraud. Concerns often touch upon data privacy, the accuracy of AI algorithms in complex marine environments, and the potential for job displacement within the industry. There is a strong expectation that AI will lead to more efficient, transparent, and responsive insurance services, offering tailored coverage that better meets the specific needs of individual boat and yacht owners while optimizing operational efficiencies for insurers.

- Enhanced risk assessment through predictive analytics, analyzing vast datasets including weather patterns, navigation routes, boat specifications, and owner history to accurately price policies.

- Automated claims processing, utilizing AI to quickly evaluate damage reports, photographic evidence, and survey data, significantly reducing resolution times.

- Fraud detection and prevention by identifying unusual patterns and discrepancies in claims data, minimizing losses for insurers.

- Personalized policy offerings based on real-time telematics data from smart boats, monitoring usage, speed, and location to provide dynamic premiums and customized coverage.

- Improved customer service through AI-powered chatbots and virtual assistants, providing instant support, policy information, and claims guidance 24/7.

- Predictive maintenance recommendations for insured vessels, potentially reducing incident rates and insurance costs by anticipating equipment failures.

- Optimization of underwriting processes by automating data extraction and analysis from various sources, leading to quicker policy issuance.

DRO & Impact Forces Of Boat & Yacht Insurance Market

The Boat & Yacht Insurance Market is significantly shaped by a confluence of driving factors, market restraints, and emerging opportunities, all under the influence of various impact forces. Drivers primarily include the sustained growth in recreational boating activities globally, fueled by rising disposable incomes and an increasing desire for leisure and adventure. The expanding luxury yacht market, coupled with the growth of marine tourism and charter services, further boosts demand for comprehensive insurance solutions. Additionally, the increasing incidence of extreme weather events, driven by climate change, elevates awareness among boat owners regarding the necessity of robust insurance coverage against unforeseen perils. Technological advancements in boat manufacturing, leading to more sophisticated and valuable vessels, also necessitate specialized and higher-value insurance policies.

However, the market faces several restraints that temper its growth trajectory. High premium costs, often perceived as prohibitive by smaller boat owners, can deter potential customers. Economic downturns and inflationary pressures can reduce discretionary spending on luxury items like boats and associated services, including insurance. Complex regulatory frameworks and varying insurance laws across different regions can complicate policy sales and claims handling for international operators. A general lack of awareness regarding the importance and scope of boat and yacht insurance among certain demographics also presents a barrier. Furthermore, stringent underwriting processes, driven by the high value and unique risks associated with marine assets, can sometimes make obtaining coverage challenging for certain vessel types or owners with higher risk profiles.

Despite these challenges, significant opportunities exist for market expansion and innovation. The development of personalized insurance products, leveraging advanced data analytics and telematics, allows insurers to offer highly customized policies that better match individual risk profiles and usage patterns, potentially attracting a broader customer base. Expansion into emerging markets, particularly in Asia Pacific and Latin America, where boating culture is growing, presents new avenues for revenue. Strategic partnerships with marine service providers, boat manufacturers, and technology companies can create integrated solutions, enhancing customer value and market reach. The adoption of innovative technologies like AI and blockchain in claims processing and policy management promises to improve efficiency, reduce costs, and enhance transparency, driving customer satisfaction and operational excellence. These impact forces collectively define the market’s dynamism, influencing its direction and the strategies of market participants.

Segmentation Analysis

The Boat & Yacht Insurance Market is meticulously segmented to cater to the diverse needs of various stakeholders and vessel types, ensuring tailored coverage options are available across the spectrum of marine activities. This segmentation allows insurance providers to develop specialized products, refine pricing strategies, and target specific customer demographics more effectively. Understanding these segments is crucial for analyzing market trends, identifying growth opportunities, and assessing competitive landscapes. The segmentation typically considers the nature of coverage required, the type and size of the watercraft, the preferred distribution channels for purchasing policies, and the ultimate end-users of the insurance products, ranging from individual recreational enthusiasts to large commercial entities.

Each segment presents unique risk profiles and insurance requirements, necessitating a flexible and comprehensive approach from insurers. For example, a small sailboat owner might primarily need coverage for basic hull damage and third-party liability, while a luxury yacht owner would typically opt for extensive agreed-value policies that cover a wide array of perils, including advanced navigational equipment and personal belongings, often with worldwide navigation limits. Similarly, the distribution channel impacts how policies are marketed and sold, with digital platforms gaining prominence alongside traditional brokers. This granular segmentation not only aids in effective market analysis but also facilitates the creation of bespoke insurance solutions that accurately reflect the intricate and varied demands of the marine insurance landscape.

- By Coverage Type

- Hull and Machinery Insurance

- Protection and Indemnity (P&I) Insurance

- Liability Insurance

- Personal Accident Insurance

- Agreed Value Policies

- Actual Cash Value Policies

- By Boat Type

- Sailboats

- Motorboats

- Yachts

- Personal Watercraft (PWC)

- Commercial Vessels (small scale)

- Dinghies and Rowboats

- By Distribution Channel

- Insurance Agents and Brokers

- Direct Insurance Companies

- Online Platforms

- Bancassurance

- By End-User

- Individual Boat Owners

- Commercial Operators (charter, rental)

- Marinas and Yacht Clubs

- Manufacturers and Dealers

Value Chain Analysis For Boat & Yacht Insurance Market

The value chain for the Boat & Yacht Insurance Market is a multifaceted ecosystem involving several key stages, from initial risk assessment and policy underwriting to claims management and customer service. It begins with upstream activities focused on data collection and actuarial analysis, where insurers gather information on marine risks, historical claims data, weather patterns, and boat specifications to develop accurate pricing models and policy terms. This involves extensive research and development to understand the evolving landscape of marine technology and environmental factors. Reinsurance companies also play a crucial upstream role by providing coverage to primary insurers, spreading risk and stabilizing the market against catastrophic losses.

Midstream activities primarily involve the distribution and sales of insurance products. This encompasses direct channels where insurers sell policies directly to customers through their websites, call centers, or proprietary agents. Indirect channels, which form a significant part of the market, include independent insurance agents, brokers, and aggregators who connect customers with various insurance providers. These intermediaries offer expert advice, compare policies, and facilitate the purchasing process. Downstream activities are centered on policy administration, customer support, and, most critically, claims management. This includes processing claims, appointing surveyors to assess damages, negotiating settlements, and facilitating repairs or replacements. Effective claims handling is paramount to customer satisfaction and the insurer’s reputation, often involving a network of marine repair shops, surveyors, and legal professionals.

The distribution channel is a critical component, bridging the gap between insurance providers and end-users. Direct sales offer insurers greater control over the customer experience and potentially lower acquisition costs, appealing to tech-savvy consumers seeking convenience and transparency. Indirect channels, through agents and brokers, provide personalized service, expert guidance, and access to a wider range of policy options, which is particularly valued for complex high-value assets like yachts. Bancassurance, a growing channel, leverages bank networks to distribute insurance products, often bundling them with marine financing. The efficiency and effectiveness of these channels significantly influence market penetration, customer loyalty, and overall industry growth. Each stage in this value chain contributes to the delivery of comprehensive and reliable insurance services for boat and yacht owners.

Boat & Yacht Insurance Market Potential Customers

The potential customers for the Boat & Yacht Insurance Market are diverse, encompassing a wide range of individuals and commercial entities with varying needs and risk exposures related to marine vessels. Primarily, these include individual recreational boat owners, who represent a substantial segment. This group ranges from owners of small pleasure crafts such as dinghies, personal watercraft (PWCs), and fishing boats, to those owning medium-sized sailboats, motorboats, and luxury yachts. Their motivation for purchasing insurance stems from a desire to protect their significant investment, mitigate personal liability risks, and comply with marina requirements or financing obligations. Coverage sought often includes hull damage, theft, liability for bodily injury or property damage to third parties, and sometimes even salvage expenses.

Beyond individual owners, commercial operators constitute another significant customer base. This includes businesses involved in charter services, boat rentals, marine tourism, and water taxis, all of whom require specialized commercial marine insurance to cover their fleets, crew liability, passenger liability, and potential business interruptions. Marinas and yacht clubs are also key potential customers, requiring coverage for their infrastructure, vessels under their care, and liability arising from their operations. Furthermore, boat manufacturers and dealers represent potential customers, needing insurance to cover vessels during transit, storage, and demonstration, as well as product liability insurance for their manufactured goods. The overarching need for these diverse customer groups is comprehensive financial protection and risk management tailored to the unique challenges and opportunities presented by marine environments, ensuring peace of mind and operational continuity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 billion |

| Market Forecast in 2032 | USD 24.7 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berkshire Hathaway Inc., AXA SA, Allianz SE, Chubb Limited, Travelers Companies Inc., Progressive Corporation, Geico (a Berkshire Hathaway company), Liberty Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, Zurich Insurance Group, Generali Group, AIG (American International Group Inc.), Marsh & McLennan Companies Inc., Willis Towers Watson, Arthur J. Gallagher & Co., CNA Financial Corporation, RSA Insurance Group (part of Intact Financial Corporation), Pantaenius, Navigators Marine Insurance (a Hartford company), Markel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Boat & Yacht Insurance Market Key Technology Landscape

The Boat & Yacht Insurance Market is increasingly adopting advanced technologies to enhance operational efficiency, improve risk assessment accuracy, and deliver superior customer experiences. Central to this technological transformation is the widespread integration of data analytics and artificial intelligence (AI). Insurers are leveraging big data from various sources, including marine telemetry, weather forecasts, satellite imagery, and historical claims data, to develop sophisticated algorithms for predictive modeling. This allows for more precise underwriting, dynamic premium adjustments based on real-time risk exposure, and proactive identification of fraud patterns. AI-powered chatbots and virtual assistants are also becoming instrumental in streamlining customer service, providing instant policy information and facilitating initial claims submissions, thereby enhancing accessibility and responsiveness for boat owners.

Furthermore, the emergence of the Internet of Things (IoT) and telematics plays a pivotal role in shaping the technology landscape. Smart boating devices equipped with sensors can monitor a vessel's location, speed, engine performance, and even detect early signs of potential issues like leaks or electrical faults. This telematics data provides insurers with granular insights into boat usage and maintenance, enabling personalized policy offerings, usage-based insurance models, and incentives for responsible boating. Blockchain technology is also being explored for its potential to create immutable records of insurance policies and claims, enhancing transparency, reducing disputes, and streamlining cross-border transactions within the complex marine insurance ecosystem. These technological advancements collectively contribute to a more data-driven, efficient, and customer-centric insurance market.

Geospatial intelligence and drone technology are also gaining traction for their application in risk assessment and claims management. Drones can be utilized for remote inspections of vessels and damage assessments, especially in hard-to-reach areas or post-catastrophe scenarios, significantly reducing the time and cost associated with traditional surveying methods. Geospatial analysis allows insurers to map out navigation risks, identify high-risk zones, and assess the impact of environmental factors like sea-level rise or storm surges on insured assets. This integration of diverse technologies not only enhances the accuracy of underwriting and claims processing but also empowers insurers to offer more innovative and competitive products, ultimately benefiting both the providers and the boat and yacht owners they serve.

Regional Highlights

- North America: The largest market share, driven by a well-established boating culture, high disposable incomes, and extensive coastline and inland waterways. The US and Canada are key contributors, with strong demand for recreational boat insurance and a growing market for luxury yachts. Regulatory frameworks are mature, and technological adoption is high.

- Europe: A significant market characterized by a strong maritime heritage and high participation in recreational boating, particularly in countries like the UK, France, Germany, Italy, and Spain. The Mediterranean and Baltic regions are hotspots for yachting. The market benefits from well-developed marine infrastructure and a high concentration of high-net-worth individuals owning luxury vessels.

- Asia Pacific (APAC): The fastest-growing region, propelled by rising disposable incomes, increasing interest in leisure activities, and developing marine tourism infrastructure in countries like Australia, China, Singapore, and parts of Southeast Asia. While starting from a lower base, the expansion of yacht clubs and marinas, coupled with growing affluence, is driving substantial growth.

- Latin America: An emerging market with developing marine tourism and recreational boating sectors, particularly in coastal countries such as Brazil, Mexico, and Argentina. Growth is influenced by economic stability and investment in leisure infrastructure, though market penetration for insurance is still lower compared to mature regions.

- Middle East and Africa (MEA): A nascent but promising market, especially in the GCC countries (UAE, Qatar, Saudi Arabia) due to significant investments in luxury tourism, extensive coastal developments, and a growing segment of affluent individuals. African countries show potential in coastal tourism and small-scale commercial marine activities, but market development for boat insurance is still in early stages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Boat & Yacht Insurance Market.- Berkshire Hathaway Inc.

- AXA SA

- Allianz SE

- Chubb Limited

- Travelers Companies Inc.

- Progressive Corporation

- Geico (a Berkshire Hathaway company)

- Liberty Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Zurich Insurance Group

- Generali Group

- AIG (American International Group Inc.)

- Marsh & McLennan Companies Inc.

- Willis Towers Watson

- Arthur J. Gallagher & Co.

- CNA Financial Corporation

- RSA Insurance Group (part of Intact Financial Corporation)

- Pantaenius

- Navigators Marine Insurance (a Hartford company)

- Markel Corporation

Frequently Asked Questions

What does boat and yacht insurance typically cover?

Boat and yacht insurance typically provides coverage for physical damage to your vessel from perils like collision, fire, theft, and storms. It also includes liability coverage for bodily injury or property damage to third parties, medical payments for injuries aboard your boat, and sometimes uninsured boater coverage or salvage and wreck removal expenses.

How is the premium for boat and yacht insurance determined?

Premiums are determined by several factors, including the type, size, and value of the boat or yacht, its age, the primary navigation area, your boating experience, claims history, and chosen deductible. Additional factors like safety equipment, boat features, and storage methods can also influence the cost.

Is boat insurance legally required?

While boat insurance is not always legally mandated by state or federal law in the same way auto insurance is, it is often required by marinas for dockage, by lenders if you finance your boat, and is highly recommended for financial protection against unforeseen incidents and liabilities. Some states may require proof of liability coverage for certain watercraft types.

What is the difference between an Agreed Value Policy and an Actual Cash Value Policy?

An Agreed Value Policy covers your boat for a predetermined amount that you and the insurer agree upon when the policy is written, regardless of depreciation. An Actual Cash Value Policy, however, covers your boat for its replacement cost minus depreciation at the time of loss, which means it pays out less for older items.

Can I get insurance for my boat if I use it for commercial purposes?

Yes, but you will need a specialized commercial marine insurance policy, not a standard recreational policy. Commercial policies are designed to cover the unique risks associated with chartering, rentals, passenger transport, or other business uses, including higher liability limits and coverage for crew members and business interruptions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager