Bone Graft Substitutes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429996 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Bone Graft Substitutes Market Size

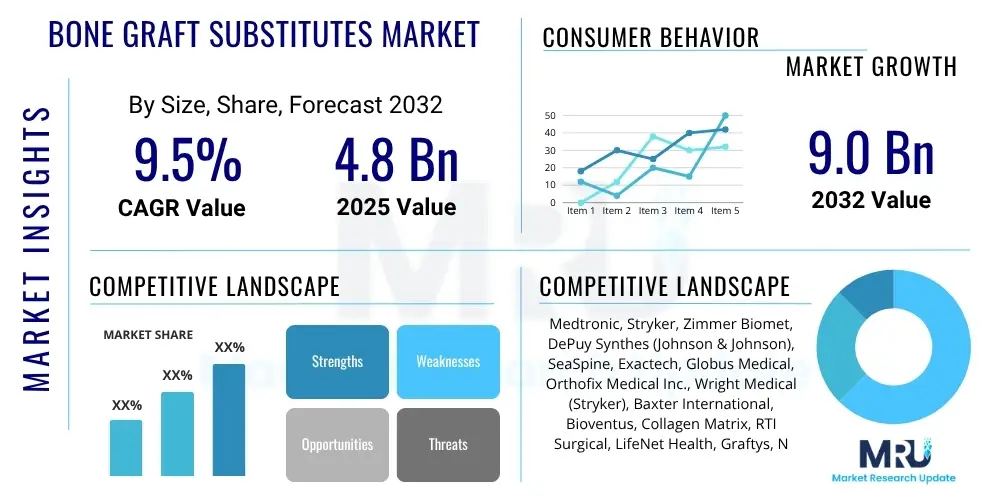

The Bone Graft Substitutes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2032.

Bone Graft Substitutes Market introduction

The Bone Graft Substitutes Market encompasses a diverse range of materials designed to promote bone healing and regeneration in orthopedic, dental, and spinal fusion procedures. These substitutes address the critical need for effective solutions in repairing bone defects, fractures, and promoting arthrodesis, serving as alternatives or enhancements to autografts, which involve harvesting bone from the patient's own body. The evolution of these materials, from allografts derived from human donors to xenografts from animal sources, and increasingly, sophisticated synthetic and alloplast materials, reflects continuous innovation aimed at improving biocompatibility, osteoconductivity, osteoinductivity, and osteogenesis.

Product descriptions within this market vary widely by type. Allografts (demineralized bone matrix, cancellous chips) provide osteoconductive and osteoinductive properties, while xenografts (bovine, porcine) offer a scaffold for new bone growth. Synthetic bone graft substitutes, including calcium phosphates (hydroxyapatite, beta-tricalcium phosphate), bioactive glasses, and polymer-based materials, are engineered for specific mechanical and biological properties, often offering advantages in terms of supply, safety, and tunability. Major applications span reconstructive surgery, trauma care, periodontal reconstruction, and spinal fusion procedures, where strong and durable bone integration is paramount for patient recovery and functional outcomes.

The benefits of utilizing bone graft substitutes are significant, including reduced donor site morbidity associated with autografts, availability in various forms and sizes, and the potential for enhanced bone regeneration and faster recovery times. Key driving factors propelling market growth include the global aging population, which leads to a higher incidence of degenerative bone diseases and fractures, coupled with an increasing prevalence of orthopedic conditions such and trauma injuries. Furthermore, ongoing advancements in biomaterials science and surgical techniques are continuously expanding the efficacy and applicability of these substitutes, making them a cornerstone of modern regenerative medicine.

Bone Graft Substitutes Market Executive Summary

The Bone Graft Substitutes Market is experiencing robust expansion, driven by demographic shifts, advancements in medical technology, and a growing demand for effective musculoskeletal repair solutions. Business trends indicate a strong focus on research and development, particularly in the realm of synthetic and composite materials that offer superior biocompatibility, controlled degradation rates, and enhanced bone regeneration capabilities. Strategic alliances, mergers, and acquisitions are common as companies seek to expand their product portfolios, gain market share, and leverage technological synergies. The emphasis on minimally invasive surgical techniques is also shaping product development, favoring injectable or malleable graft forms that can be delivered with less patient trauma.

Regional trends highlight North America as a dominant market, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players. Europe also holds a significant share, driven by favorable reimbursement policies and increasing adoption of innovative bone graft technologies. However, the Asia Pacific region is anticipated to exhibit the fastest growth over the forecast period, attributed to a rapidly expanding geriatric population, increasing incidence of orthopedic and dental procedures, improving healthcare access, and rising medical tourism. Latin America and the Middle East & Africa are also showing promising growth, albeit from a smaller base, as healthcare systems develop and awareness of advanced treatment options increases.

Segment trends reveal a continued shift towards synthetic grafts due to their consistent composition, reduced risk of disease transmission, and customizable properties. Demineralized Bone Matrix (DBM) products remain popular for their osteoinductive capabilities, while the integration of biologics, such as growth factors and stem cells, into graft substitutes represents a significant area of innovation. Applications in spinal fusion continue to represent a major revenue stream, alongside substantial contributions from dental and orthopedic trauma segments. The market is increasingly characterized by a demand for personalized and procedure-specific solutions, driving manufacturers to offer a broader range of products tailored to diverse clinical needs.

AI Impact Analysis on Bone Graft Substitutes Market

User questions related to the impact of AI on the Bone Graft Substitutes Market frequently revolve around how artificial intelligence can enhance diagnostic precision, optimize surgical planning, personalize treatment approaches, and accelerate the discovery and development of novel biomaterials. There is a keen interest in whether AI can predict graft success rates, identify suitable candidates for specific graft types, or even design bespoke grafts. Key themes include the potential for improved clinical outcomes, reduced procedural risks, and the optimization of resource allocation within healthcare systems. Concerns often surface regarding data privacy, the ethical implications of AI-driven decisions, and the need for robust validation of AI algorithms in clinical settings, alongside the requirement for integration with existing healthcare IT infrastructure.

AI's influence is anticipated to revolutionize several facets of the Bone Graft Substitutes market. In diagnostics, AI algorithms can analyze medical images (X-rays, CT scans, MRIs) with unprecedented speed and accuracy, identifying bone defects and degeneration patterns that might inform the choice of graft substitute. For surgical planning, AI can simulate surgical procedures, predict the biomechanical stability of different graft placements, and assist surgeons in achieving optimal anatomical reconstruction. This leads to more precise pre-operative planning and potentially better post-operative results.

Furthermore, AI is poised to accelerate biomaterial research and development. Machine learning models can analyze vast datasets of material properties, biological responses, and clinical outcomes to identify optimal material compositions or predict the performance of new synthetic grafts. This drastically reduces the time and cost associated with traditional iterative experimental approaches. The ability to personalize treatment by matching specific patient characteristics with the most effective graft substitute based on AI-driven predictive analytics represents a paradigm shift towards truly individualized regenerative medicine, enhancing patient safety and efficacy.

- Enhanced Diagnostic Accuracy: AI analyzes imaging data for precise defect identification.

- Optimized Surgical Planning: AI simulates procedures, predicting graft placement stability.

- Personalized Graft Selection: AI matches patient profiles to optimal graft types for improved outcomes.

- Accelerated Material Discovery: Machine learning identifies novel biomaterial compositions and properties.

- Predictive Analytics: AI forecasts graft integration success and potential complications.

- Robotics Integration: AI-powered robots assist in precise graft implantation.

- Improved Clinical Trial Design: AI streamlines participant selection and data analysis.

- Supply Chain Optimization: AI predicts demand and manages inventory for grafts.

DRO & Impact Forces Of Bone Graft Substitutes Market

The Bone Graft Substitutes Market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that influence its trajectory and growth potential. Key drivers include the escalating global prevalence of orthopedic conditions such as osteoporosis, osteoarthritis, and spinal disorders, which necessitate surgical interventions for bone repair and regeneration. The aging demographic worldwide contributes substantially, as elderly populations are more susceptible to fractures and degenerative bone diseases. Additionally, advancements in biomaterials science, particularly the development of synthetic and composite grafts with improved biocompatibility and osteoinductive properties, are expanding treatment options and driving market adoption. The rising number of sports injuries and trauma cases further fuels the demand for effective bone graft solutions, as does the increasing awareness and acceptance of advanced surgical techniques among both patients and healthcare providers.

However, several restraints challenge market growth. The high cost associated with advanced bone graft substitutes, especially those incorporating biologics or complex engineering, can limit their accessibility, particularly in price-sensitive markets. Stringent regulatory approval processes, often lengthy and costly, pose a significant barrier to market entry for new products and innovations. Ethical concerns surrounding the use of allografts (from human donors) and xenografts (from animal sources), including the risk of disease transmission or immune rejection, necessitate rigorous screening and processing, adding to costs and complexity. Limited or inconsistent reimbursement policies across different healthcare systems can also impede broader adoption, making it difficult for some patients to afford these advanced treatments. Post-operative complications such as infection, non-union, or graft failure, although infrequent, represent a clinical risk that can impact patient and surgeon confidence.

Despite these challenges, substantial opportunities exist for market expansion. The continuous innovation in biomaterials, including the development of 3D-printable grafts, injectable formulations, and grafts incorporating stem cells or growth factors, promises to deliver more effective and personalized treatments. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped potential due to improving healthcare infrastructure, rising disposable incomes, and increasing medical tourism. The growing demand for minimally invasive surgical procedures, which often require specific types of graft delivery systems, also creates new avenues for product development. Finally, strategic collaborations between academic institutions, biotechnology firms, and medical device companies are fostering a rich environment for research and development, accelerating the translation of scientific discoveries into clinically viable products. These dynamic forces collectively dictate the competitive landscape and future direction of the bone graft substitutes market.

Segmentation Analysis

The Bone Graft Substitutes Market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics, adoption patterns, and growth opportunities. These segmentations typically include classifications by product type, material, application, and end-user, each revealing unique market characteristics and competitive landscapes. Analyzing these segments helps stakeholders understand specific niches, identify high-growth areas, and tailor strategies to meet diverse clinical and commercial demands. The market's complexity and the broad spectrum of bone repair needs necessitate this granular approach to segmentation, reflecting the diverse technologies and patient populations involved.

- By Type:

- Allografts

- Demineralized Bone Matrix (DBM)

- Cancellous Chips

- Cortical Grafts

- Other Allografts (e.g., bone putty, structural allografts)

- Xenografts

- Bovine

- Porcine

- Other Xenografts

- Synthetic Bone Grafts

- Calcium Phosphate (e.g., Hydroxyapatite, Beta-Tricalcium Phosphate)

- Bioactive Glass

- Ceramics

- Polymers (e.g., PLGA, PCL)

- Composite Grafts

- Bone Morphogenetic Proteins (BMPs)

- Cell-Based Matrices

- Allografts

- By Application:

- Spinal Fusion

- Dental Bone Grafts

- Orthopedic Trauma

- Joint Reconstruction

- Craniomaxillofacial Surgery

- Foot & Ankle Surgery

- Other Orthopedic Applications (e.g., filling bone voids, non-union repair)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics (e.g., Orthopedic Clinics, Dental Clinics)

- Research & Academic Institutes

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Bone Graft Substitutes Market

The value chain for the Bone Graft Substitutes Market is intricate, involving multiple stages from raw material procurement to end-user application, highlighting the collaborative efforts required to bring these advanced medical products to market. Upstream analysis begins with the suppliers of fundamental biomaterials, which can range from tissue banks providing allograft and xenograft tissues to specialized chemical manufacturers supplying calcium phosphate powders, bioactive glasses, and polymers for synthetic grafts. This stage is critical for ensuring the quality, safety, and consistent supply of raw components, often subject to rigorous regulatory standards and sourcing protocols.

Following material sourcing, the manufacturing process involves advanced processing, sterilization, and formulation into various graft forms (e.g., granules, putty, blocks, injectables). This stage also includes research and development activities, where novel materials are designed and tested, and existing products are refined for improved performance. The distribution channel plays a pivotal role in reaching the end-users. This can involve direct sales forces from major manufacturers who establish relationships with hospitals and surgeons, or through a network of distributors and Group Purchasing Organizations (GPOs) that facilitate broader market access, especially for smaller players or in diverse geographical regions.

Downstream analysis focuses on the end-users, primarily hospitals, ambulatory surgical centers, and specialized clinics (orthopedic, dental), where surgeons and medical professionals evaluate and utilize these bone graft substitutes in patient care. The effectiveness of the supply chain depends on efficient logistics, inventory management, and robust customer support to ensure timely delivery and appropriate clinical application. Both direct sales, where manufacturers engage directly with healthcare institutions, and indirect sales, leveraging third-party distributors, are crucial for comprehensive market penetration, each presenting distinct advantages in terms of cost control, market reach, and technical support.

Bone Graft Substitutes Market Potential Customers

The primary potential customers and end-users of bone graft substitutes are diverse healthcare providers and specialists who regularly perform procedures requiring bone regeneration or fusion. This broad category includes professionals and institutions across orthopedics, dentistry, neurosurgery, and trauma care. These purchasers are driven by the need for effective, safe, and reliable solutions to improve patient outcomes, reduce recovery times, and address a wide range of bone defects and degenerative conditions. Their buying decisions are influenced by factors such as product efficacy, safety profiles, ease of use, regulatory approvals, cost-effectiveness, and compatibility with current surgical techniques.

Within orthopedics, orthopedic surgeons represent a significant customer base, requiring bone graft substitutes for spinal fusion surgeries, joint reconstruction (e.g., hip, knee), repair of complex fractures, and filling bone voids caused by tumors or trauma. Neurosurgeons also frequently utilize these products for spinal fusions and other neurosurgical procedures involving the skeletal system. In the dental field, periodontists, oral and maxillofacial surgeons, and general dentists are key customers, using bone grafts for ridge augmentation, sinus lifts, periodontal defect repair, and implant placement to restore oral function and aesthetics.

Furthermore, hospitals and ambulatory surgical centers (ASCs) are major institutional buyers, procuring these products for their surgical departments. ASCs, in particular, are growing in prominence due to their cost-efficiency and convenience for certain procedures. Trauma specialists and sports medicine practitioners also routinely require bone graft substitutes for critical repairs resulting from injuries. Ultimately, the demand is driven by the imperative to restore mobility, alleviate pain, and enhance the quality of life for patients suffering from various musculoskeletal and dental conditions, making these specialists and facilities central to the bone graft substitutes market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Stryker, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), SeaSpine, Exactech, Globus Medical, Orthofix Medical Inc., Wright Medical (Stryker), Baxter International, Bioventus, Collagen Matrix, RTI Surgical, LifeNet Health, Graftys, NuVasive, Integra LifeSciences, OSTEOFIX, Smith & Nephew, Xtant Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bone Graft Substitutes Market Key Technology Landscape

The technological landscape of the Bone Graft Substitutes Market is characterized by continuous innovation aimed at enhancing material properties, biological efficacy, and surgical applicability. A significant area of focus is advanced biomaterial synthesis, which involves creating synthetic grafts with precise control over composition, porosity, and degradation rates. This includes the development of sophisticated calcium phosphate ceramics (such as hydroxyapatite and beta-tricalcium phosphate) and bioactive glasses that can actively bond with living bone and stimulate regeneration. Furthermore, the incorporation of polymers (e.g., PLGA, PCL) allows for composite grafts that offer both structural support and sustained release of therapeutic agents, mimicking the natural bone extracellular matrix more closely.

Another transformative technology is 3D printing (additive manufacturing), which enables the fabrication of customized bone graft scaffolds with intricate geometries tailored to individual patient anatomy and defect morphology. This personalized approach can significantly improve integration and functional outcomes. Alongside structural advancements, there is a strong emphasis on integrating biologics, such as growth factors (e.g., BMPs) and stem cells, into graft substitutes to enhance osteoinductivity and accelerate bone healing. These biologically active grafts aim to provide not just a scaffold but also signals that actively promote cellular differentiation and new bone formation. Efforts are also concentrated on improving processing techniques for allografts and xenografts to enhance safety, reduce immunogenicity, and optimize their osteoconductive and osteoinductive potential.

Minimally invasive delivery systems are gaining prominence, allowing surgeons to implant graft materials with less surgical trauma, often through injectable putties, pastes, or flexible forms. These systems are crucial for reducing patient morbidity and accelerating recovery. Surface modification techniques, such as plasma treatment or biomimetic coatings, are also being employed to improve graft-host tissue interaction, prevent infection, and enhance integration. The confluence of these advanced material sciences, fabrication technologies, and biological engineering approaches defines a rapidly evolving and highly sophisticated technological landscape, continuously pushing the boundaries of regenerative orthopedics and dentistry.

Regional Highlights

- North America: This region consistently dominates the Bone Graft Substitutes Market, driven by a well-established healthcare infrastructure, high healthcare expenditure, a significant aging population, and a high incidence of orthopedic and spinal disorders. The presence of major market players, coupled with advanced research and development activities and favorable reimbursement policies, contributes to strong market penetration and product adoption. The U.S. remains the largest market within this region, spearheading technological advancements and clinical trials.

- Europe: The European market for bone graft substitutes is substantial, fueled by increasing awareness of advanced treatment options, rising prevalence of musculoskeletal conditions, and governmental initiatives supporting healthcare innovation. Countries like Germany, France, and the UK are key contributors, characterized by robust medical device industries and high adoption rates of sophisticated bone regeneration products. Stringent regulatory frameworks ensure product safety and efficacy, while an aging population continues to drive demand.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market, primarily due to a vast and rapidly aging population, improving healthcare facilities, increasing disposable incomes, and a rising awareness of advanced surgical treatments. Countries such as China, India, and Japan are experiencing a surge in orthopedic and dental procedures. The expanding medical tourism sector and growing investment in healthcare infrastructure further bolster market growth, making it a highly attractive region for market expansion and new product launches.

- Latin America: The Latin American market is experiencing steady growth, driven by increasing healthcare access, growing medical infrastructure, and a rising prevalence of sports injuries and degenerative diseases. Economic development and increasing healthcare spending in countries like Brazil and Mexico are opening new avenues for market players, though price sensitivity and varying regulatory landscapes can present challenges.

- Middle East & Africa (MEA): This region is characterized by emerging markets with increasing investments in healthcare infrastructure, particularly in countries like Saudi Arabia and UAE. The rising incidence of road accidents and related trauma, combined with a growing demand for advanced medical treatments, is driving the adoption of bone graft substitutes. However, market growth can be influenced by political stability and varying levels of healthcare development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bone Graft Substitutes Market.- Medtronic

- Stryker

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson)

- SeaSpine

- Exactech

- Globus Medical

- Orthofix Medical Inc.

- Wright Medical (Stryker)

- Baxter International

- Bioventus

- Collagen Matrix

- RTI Surgical

- LifeNet Health

- Graftys

- NuVasive

- Integra LifeSciences

- OSTEOFIX

- Smith & Nephew

- Xtant Medical

Frequently Asked Questions

What are bone graft substitutes?

Bone graft substitutes are biocompatible materials, natural or synthetic, used to fill bone defects, promote bone regeneration, and provide structural support during orthopedic, dental, and spinal surgeries.

What is the projected growth rate of the Bone Graft Substitutes Market?

The Bone Graft Substitutes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032.

What are the main types of bone graft substitutes?

The main types include allografts (human donor bone), xenografts (animal origin bone), and synthetic grafts (e.g., calcium phosphates, bioactive glasses, polymers).

Which applications drive the demand for bone graft substitutes?

Key applications driving demand include spinal fusion, dental bone grafting for implants, orthopedic trauma repair, and joint reconstruction surgeries.

How does AI impact the Bone Graft Substitutes Market?

AI enhances diagnostics, optimizes surgical planning, personalizes graft selection, and accelerates the discovery and development of novel biomaterials for improved outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dental Bone Graft Substitutes Market Size Report By Type (Natural (Xenograft), Synthetic, Composites, Others), By Application (Hospital, Dental Clinic), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bone Graft Substitutes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Autograft, Demineralized Bone Matrix, Synthetic Bone Grafts, Bone Morphogenetic Protein, Others), By Application (Spinal Fusion, Joint Reconstruction, Long Bone, Dental, Foot & Ankle, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Dental Bone Graft Substitutes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Demineralized Bone Matrix (DBM), Autograft, Allograft, Xenograft, Synthetic Bone Graft Substitute), By Application (Sinus Lift, Ridge Augmentation, Socket Preservation, Periodontal Defect Regeneration, Implant Bone Regeneration), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager