Bottled Water Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430645 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Bottled Water Packaging Market Size

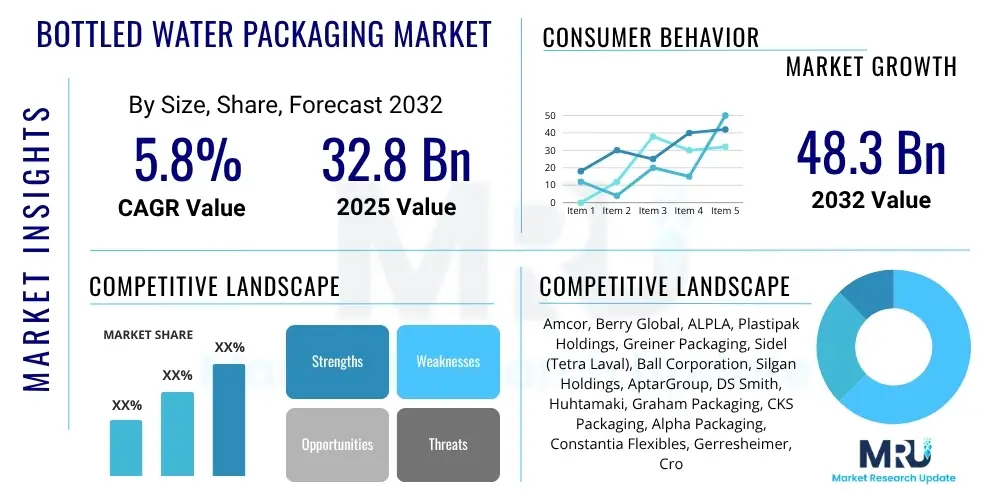

The Bottled Water Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 32.8 Billion in 2025 and is projected to reach USD 48.3 Billion by the end of the forecast period in 2032.

Bottled Water Packaging Market introduction

The Bottled Water Packaging Market encompasses the global industry involved in designing, manufacturing, and distributing containers specifically used for packaging various types of bottled water products. This includes a wide array of materials, forms, and sizes tailored to meet diverse consumer preferences and regulatory standards. The market primarily revolves around providing solutions that ensure the safety, purity, and shelf-life of bottled water, while also addressing critical concerns related to sustainability and consumer convenience. Innovations in packaging materials and production processes are consistently driving market evolution, focusing on reducing environmental impact and enhancing product appeal.

Product descriptions within this market vary significantly, ranging from rigid plastic bottles predominantly made of PET (Polyethylene Terephthalate) and HDPE (High-Density Polyethylene), to glass bottles, aluminum cans, and flexible pouches. Each material offers distinct advantages in terms of cost, durability, weight, and recyclability, influencing manufacturer choices. The primary function of this packaging is to protect the water from external contaminants, maintain its taste profile, and provide a portable, ready-to-consume format for consumers worldwide. Furthermore, advancements in cap and closure technologies, labeling, and ergonomic designs contribute to the overall value proposition of these packaging solutions.

Major applications for bottled water packaging span across an extensive range of consumer scenarios, including individual on-the-go consumption, household use, corporate and institutional hydration programs, and emergency relief efforts. The benefits of effective bottled water packaging include extended shelf life, enhanced portability, brand differentiation through unique designs, and compliance with stringent food safety regulations. Key driving factors propelling market growth include increasing global population, rising awareness regarding health and wellness leading to higher bottled water consumption, rapid urbanization, growing disposable incomes in emerging economies, and the increasing demand for convenient and safe drinking water alternatives in areas with unreliable tap water infrastructure. Additionally, marketing strategies that emphasize purity, health benefits, and sustainability further stimulate consumer demand for packaged water products, directly impacting the packaging market.

Bottled Water Packaging Market Executive Summary

The Bottled Water Packaging Market is experiencing robust growth driven by shifting consumer preferences towards healthier beverage choices and the persistent demand for convenience. Current business trends highlight a significant focus on sustainable packaging solutions, with an increasing number of manufacturers investing in recycled content, lightweight designs, and biodegradable materials to address environmental concerns. Companies are actively exploring innovative material science and circular economy models to reduce their carbon footprint and appeal to environmentally conscious consumers. The competitive landscape is characterized by continuous product differentiation, driven by unique bottle designs, advanced closures, and marketing narratives centered on purity and origin, aiming to capture distinct market segments.

Regional trends reveal varied dynamics across different geographies. North America and Europe, while mature markets, are leading the charge in sustainable packaging innovation, driven by stringent regulations and high consumer awareness regarding environmental impact. The Asia Pacific region, particularly countries like China and India, represents a high-growth market due to rapid urbanization, increasing disposable incomes, and a large population base that increasingly relies on bottled water for safety and convenience. Latin America and the Middle East and Africa regions are also witnessing substantial growth, fueled by improving economic conditions and insufficient potable water infrastructure in many areas, creating a strong demand for packaged water and its associated packaging solutions.

Segment trends underscore the dominance of PET bottles due to their cost-effectiveness, versatility, and recyclability, though alternatives like aluminum cans and glass bottles are gaining traction, especially in premium and sparkling water categories. The market for smaller, single-serve bottles continues to thrive, aligning with on-the-go consumption habits, while larger bulk packaging also sees steady demand for household and office use. Furthermore, advancements in closure systems, such as sports caps and tamper-evident seals, are improving product safety and consumer experience. The functional and flavored water segments are also influencing packaging innovation, requiring specific barrier properties and aesthetic designs that communicate the product's value proposition effectively. Overall, the market remains dynamic, adapting to technological advancements, evolving consumer demands, and increasing regulatory pressure for environmental responsibility.

AI Impact Analysis on Bottled Water Packaging Market

Users frequently inquire about how artificial intelligence (AI) can revolutionize the efficiency, sustainability, and quality control within the bottled water packaging sector. Common questions revolve around AI's capacity to optimize production lines, enhance predictive maintenance, improve packaging design for reduced material usage, and aid in the sorting and recycling of post-consumer waste. There is a palpable expectation that AI can address the industry's critical need for greater operational precision, cost reduction, and environmental responsibility, moving beyond traditional automation to truly intelligent manufacturing and supply chain management. The key themes underscore a desire for AI to drive smarter, more resilient, and eco-friendlier packaging solutions, while ensuring product integrity and consumer trust.

The integration of AI in the bottled water packaging market is poised to introduce transformative changes across various operational facets, significantly enhancing efficiency and sustainability. AI algorithms can analyze vast datasets from production lines to predict equipment failures, allowing for proactive maintenance and minimizing costly downtime. This predictive capability ensures higher operational uptime and consistent product output, crucial for meeting fluctuating consumer demand. Furthermore, AI-powered vision systems are revolutionizing quality control, detecting minute defects in bottles, labels, and caps with unparalleled accuracy and speed, far surpassing human capabilities, thereby reducing waste from flawed products and upholding brand reputation for quality.

Beyond the manufacturing floor, AI is extending its influence into supply chain optimization and material innovation. AI-driven logistics systems can optimize routing and inventory management, reducing transportation costs and carbon emissions. In the realm of sustainable packaging, AI assists in the design phase by simulating material performance and identifying optimal designs that minimize material usage without compromising structural integrity or product protection. It can also play a vital role in advancing recycling efforts by improving the identification and sorting of different plastic types in waste streams, making the recycling process more efficient and increasing the availability of high-quality recycled content for new packaging, thereby fostering a more circular economy.

- AI-powered predictive maintenance reduces equipment downtime and optimizes production schedules by anticipating potential failures.

- Enhanced quality control through AI vision systems accurately detects defects in packaging components, minimizing waste and ensuring product integrity.

- Optimized supply chain and logistics management via AI algorithms, leading to reduced transportation costs and lower carbon emissions.

- AI-driven packaging design innovation facilitates the creation of lighter, stronger, and more sustainable containers by simulating material properties and performance.

- Improved waste sorting and recycling efficiency using AI for better identification and separation of different packaging materials in post-consumer waste streams.

- Real-time data analytics from production processes provided by AI for continuous process improvement and operational transparency.

- Personalized packaging insights based on AI analysis of consumer behavior and preferences, enabling targeted product offerings.

DRO & Impact Forces Of Bottled Water Packaging Market

The Bottled Water Packaging Market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. A primary driver is the accelerating global demand for safe and convenient drinking water, particularly in regions with limited access to clean tap water and among increasingly health-conscious consumers who prefer bottled options over sugary beverages. Rapid urbanization, rising disposable incomes in emerging markets, and the expanding tourism sector further fuel this demand, creating a sustained need for efficient and innovative packaging solutions. The convenience offered by single-serve bottled water formats for on-the-go consumption also serves as a robust growth catalyst, aligning with modern lifestyles and active routines.

However, the market faces notable restraints, predominantly stemming from escalating environmental concerns related to plastic waste and its impact on ecosystems. Public scrutiny and regulatory pressures around single-use plastics are pushing manufacturers to invest heavily in sustainable alternatives, which often come with higher production costs and technological complexities. The fluctuating prices of raw materials, particularly petrochemicals used in plastic production, also pose a significant challenge, impacting profit margins and forcing companies to seek more cost-effective or alternative materials. Additionally, the availability and improving quality of tap water in developed regions could subtly dampen growth for certain bottled water segments, encouraging consumers to opt for reusable bottles.

Despite these challenges, substantial opportunities exist for market players willing to innovate and adapt. The growing consumer demand for eco-friendly packaging presents a lucrative avenue for companies developing biodegradable plastics, plant-based materials, and packaging made from 100% recycled content. Technological advancements in lightweighting, aseptic packaging, and smart packaging solutions offer pathways for improved product protection, extended shelf life, and enhanced consumer interaction. Furthermore, expanding into untapped geographical markets, particularly those undergoing rapid economic development and urbanization, provides significant growth potential. Strategic partnerships for recycling infrastructure development and educational campaigns promoting responsible disposal can also enhance brand image and foster market acceptance for new, sustainable packaging formats, turning environmental concerns into competitive advantages and ensuring long-term market vitality.

Segmentation Analysis

The Bottled Water Packaging Market is extensively segmented to reflect the diverse material choices, product types, applications, and regional consumption patterns that characterize this dynamic industry. Understanding these segments is crucial for stakeholders to identify growth pockets, tailor product offerings, and formulate effective market penetration strategies. The market's segmentation highlights the interplay between technological advancements in packaging materials, evolving consumer preferences for convenience and sustainability, and the varying demands across different end-use sectors, ensuring that a broad spectrum of needs is met by specialized packaging solutions.

These segmentations enable a granular analysis of market trends, allowing businesses to discern which materials are gaining traction, which bottle types are preferred for specific applications, and how consumer habits influence packaging capacities. For instance, the ongoing shift towards more sustainable options impacts material choices, while the rise of health-conscious lifestyles fuels demand for functional water packaging. Furthermore, geographic segmentation reveals regional specificities in consumption patterns and regulatory environments, necessitating localized approaches to packaging design and distribution. This detailed market breakdown is essential for strategic planning, product development, and competitive positioning within the global bottled water packaging landscape, offering a comprehensive view of market dynamics and future growth prospects.

- By Material:

- PET (Polyethylene Terephthalate): Dominant due to clarity, strength, and recyclability.

- HDPE (High-Density Polyethylene): Used for larger containers, milk jugs, and certain water bottles.

- PP (Polypropylene): Known for heat resistance and flexibility, used for caps and some bottles.

- Glass: Premium and highly recyclable, preferred for still and sparkling water in upscale markets.

- Aluminum: Gaining traction for its recyclability and premium perception, especially for sparkling and flavored waters.

- Bioplastics: Emerging segment including PLA (Polylactic Acid) and other plant-based polymers, driven by sustainability initiatives.

- By Type:

- Bottles: The most common type, ranging from small single-serve to large bulk sizes.

- Pouches: Flexible, lightweight, and cost-effective, particularly in developing markets and for specialty waters.

- Cartons: Increasingly used for still water, often made from renewable resources and recyclable materials.

- Cans: Growing in popularity for sparkling and flavored waters, offering high recyclability.

- By Application:

- Still Water: The largest segment, encompassing purified, spring, and mineral waters.

- Sparkling Water: Growing segment, often packaged in glass or aluminum for a premium feel.

- Flavored Water: Requires packaging that maintains flavor integrity and often features vibrant branding.

- Functional Water: Special packaging to protect added vitamins, minerals, or other functional ingredients.

- By Capacity:

- Less than 500 ml: Single-serve, on-the-go convenience.

- 500 ml to 1 liter: Common individual size for daily consumption.

- 1 liter to 2 liters: Family-size, often for home or office use.

- More than 2 liters: Bulk water for dispensers and large household consumption.

Value Chain Analysis For Bottled Water Packaging Market

The value chain for the Bottled Water Packaging Market is a complex network involving several stages, starting from raw material sourcing and extending through manufacturing, distribution, and ultimately to the end-consumer. Upstream analysis focuses on the extraction and processing of fundamental raw materials, primarily petrochemicals for plastics like PET and HDPE, silica for glass, and bauxite for aluminum. These raw materials are then converted into resins, sheets, or ingots by specialized suppliers. The efficiency and environmental impact at this initial stage significantly influence the overall cost and sustainability profile of the final packaging product. Companies are increasingly seeking suppliers that adhere to sustainable sourcing practices and offer recycled content to mitigate environmental concerns.

Midstream activities involve the conversion of these raw materials into various packaging formats. This includes processes such as blow molding for plastic bottles, glass manufacturing, aluminum can fabrication, and carton assembly. Packaging manufacturers invest heavily in advanced machinery and technology to achieve high production efficiency, consistent quality, and innovative designs. This stage is crucial for differentiating products through unique shapes, sizes, and functionalities (e.g., sports caps, ergonomic designs). Strategic partnerships between material suppliers and packaging manufacturers are common to ensure a steady supply chain and foster collaborative innovation in material science and processing techniques.

Downstream analysis encompasses the distribution channels, which are vital for getting packaged water products from manufacturers to consumers. This involves direct sales to large bottling companies, as well as indirect distribution through wholesalers, retailers (supermarkets, convenience stores, online platforms), and institutional buyers (restaurants, hotels, offices). The bottled water packaging itself also moves through a similar distribution network, supplied to bottlers who then fill and distribute the final product. Effective logistics and supply chain management are critical at this stage to ensure timely delivery, reduce transportation costs, and maintain product integrity across diverse geographical markets. The rise of e-commerce has also opened new distribution avenues, requiring packaging solutions that are robust enough for individual parcel delivery.

Bottled Water Packaging Market Potential Customers

The primary potential customers, or end-users and buyers, within the Bottled Water Packaging Market are diverse and span various sectors, reflecting the ubiquitous demand for bottled water globally. Large-scale beverage companies and bottled water brands represent the most significant customer segment. These companies require vast quantities of packaging materials to bottle their diverse product lines, ranging from still spring water to sparkling, flavored, and functional water offerings. Their purchasing decisions are heavily influenced by factors such as cost-effectiveness, scalability of supply, brand differentiation through unique designs, compliance with food safety standards, and increasingly, the sustainability credentials of the packaging.

Beyond the major beverage conglomerates, smaller, regional bottled water producers and private label brands also constitute a substantial customer base. These entities often seek flexible and cost-efficient packaging solutions that allow them to compete in local markets or cater to niche consumer segments. Their needs might include specialized short-run production, custom branding opportunities, and agile supply chains that can respond quickly to local market demands. The growth of artisan and premium water brands further expands this customer group, as they frequently seek high-quality, aesthetically pleasing, and often environmentally friendly packaging to convey exclusivity and a sophisticated brand image.

Furthermore, the packaging industry itself, specifically contract packaging and co-packing service providers, acts as an indirect customer. These companies purchase packaging materials from manufacturers to provide integrated bottling and packaging services to various beverage brands, effectively acting as intermediaries. Additionally, industries such as hospitality (hotels, restaurants), healthcare facilities, educational institutions, and corporate offices represent significant end-users of bottled water, indirectly driving demand for its packaging. Ultimately, the end-consumer's preferences for convenience, health, and sustainability are the ultimate determinants, compelling all players in the value chain to innovate and adapt their packaging solutions to meet evolving expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 32.8 Billion |

| Market Forecast in 2032 | USD 48.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor, Berry Global, ALPLA, Plastipak Holdings, Greiner Packaging, Sidel (Tetra Laval), Ball Corporation, Silgan Holdings, AptarGroup, DS Smith, Huhtamaki, Graham Packaging, CKS Packaging, Alpha Packaging, Constantia Flexibles, Gerresheimer, Crown Holdings, Uflex, Printpack, RPC Group (now Berry Global) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bottled Water Packaging Market Key Technology Landscape

The Bottled Water Packaging Market is continuously evolving through significant technological advancements aimed at enhancing efficiency, sustainability, and product integrity. A pivotal technology is advanced blow molding, particularly for PET and HDPE bottles, which has seen innovations like stretch blow molding techniques that allow for precise control over wall thickness, leading to lightweighting without compromising strength. This not only reduces material consumption and cost but also lowers transportation emissions. Additionally, aseptic packaging technologies are gaining traction, enabling bottled water to be filled and sealed under sterile conditions, extending shelf life without the need for preservatives and supporting broader distribution to various climates.

Another critical area of technological innovation lies in material science and recycling processes. The development of high-performance recycled PET (rPET) and post-consumer recycled (PCR) content integration is crucial for manufacturers striving to meet sustainability targets and consumer demand for eco-friendly products. Innovations in chemical recycling offer a promising future for breaking down mixed plastics into their original monomers, allowing for infinite recycling loops. Furthermore, the advent of bioplastics, derived from renewable resources like corn starch or sugarcane, is providing alternatives to traditional petroleum-based plastics, although their scalability and end-of-life management are still areas of ongoing research and development.

Beyond materials, smart packaging technologies are beginning to make inroads into the bottled water market. This includes the integration of QR codes, NFC tags, and RFID chips that can provide consumers with information about the water's source, purity, and environmental footprint, as well as enabling supply chain traceability. Advanced labeling techniques, such as shrink sleeves and direct-to-container printing, offer greater design flexibility and brand storytelling opportunities. Cap and closure technologies are also evolving, with innovations in tamper-evident features, sports caps, and tethered caps designed to remain attached to the bottle post-opening, addressing littering concerns and enhancing convenience. These technological advancements collectively contribute to a more efficient, sustainable, and consumer-friendly bottled water packaging ecosystem.

Regional Highlights

- North America: A mature market characterized by high consumption of bottled water and strong emphasis on sustainable packaging. Innovations in rPET and lightweighting are prevalent, driven by environmental regulations and consumer demand. The region shows robust growth in premium and functional water segments.

- Europe: Leading in eco-friendly packaging initiatives, with stringent regulations on plastic usage and a high adoption rate of recycled and plant-based materials. Germany, France, and the UK are key markets pushing for circular economy models in packaging, also witnessing a rise in glass and aluminum usage.

- Asia Pacific (APAC): The fastest-growing region due to rapid urbanization, increasing disposable incomes, and insufficient potable tap water infrastructure in many areas. Countries like China, India, and Southeast Asian nations are massive consumers, leading to high demand for cost-effective and convenient PET packaging, with a rising focus on recycling infrastructure development.

- Latin America: Experiencing significant growth, particularly in countries like Brazil and Mexico, driven by improving economic conditions and a preference for bottled water for health and safety reasons. The market is characterized by a mix of traditional plastic packaging and a gradual shift towards more sustainable options.

- Middle East and Africa (MEA): A high-potential market propelled by arid climates, population growth, and increasing tourism. Demand for bottled water packaging is strong, with significant investments in bottling plants and growing awareness for sustainable solutions, though traditional plastic still dominates due to cost efficiency.

- United States: Dominant in North America, with a diverse market that embraces both single-serve convenience and bulk water solutions. A significant driver for packaging innovation, particularly in sustainable materials and smart packaging.

- China: The largest market in APAC for bottled water consumption, offering immense opportunities for packaging manufacturers. Focus on mass-market plastic bottles, but with increasing government initiatives and consumer awareness pushing for better recycling and eco-friendly alternatives.

- India: Rapidly expanding market influenced by population growth and concerns over tap water quality. Price-sensitive, driving demand for economical packaging solutions, but also showing nascent growth in premium and sustainable segments.

- Germany: A leader in Europe for advanced recycling systems and strict environmental policies, promoting high use of reusable and recycled content in bottled water packaging. Innovation in material reduction and closed-loop systems is a key trend.

- Brazil: The largest market in Latin America, characterized by strong consumer demand for bottled water due to perceived safety and convenience. Packaging trends include lightweight PET bottles and growing interest in alternative materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bottled Water Packaging Market.- Amcor

- Berry Global

- ALPLA

- Plastipak Holdings

- Greiner Packaging

- Sidel (Tetra Laval)

- Ball Corporation

- Silgan Holdings

- AptarGroup

- DS Smith

- Huhtamaki

- Graham Packaging

- CKS Packaging

- Alpha Packaging

- Constantia Flexibles

- Gerresheimer

- Crown Holdings

- Uflex

- Printpack

- RPC Group (now Berry Global)

Frequently Asked Questions

What are the primary materials used for bottled water packaging?

The primary materials include Polyethylene Terephthalate (PET) and High-Density Polyethylene (HDPE) for plastic bottles, glass for premium and sparkling water, and aluminum for cans. Bioplastics and carton-based packaging are also emerging as sustainable alternatives, driven by environmental concerns and technological advancements in material science.

How is sustainability impacting the Bottled Water Packaging Market?

Sustainability is profoundly impacting the market by driving demand for eco-friendly solutions. Manufacturers are increasingly adopting recycled content (rPET), lightweight designs, and exploring biodegradable or plant-based plastics. Regulations on single-use plastics and growing consumer environmental awareness are compelling companies to invest in circular economy models and improve recycling infrastructure, making sustainability a core competitive differentiator.

Which regions are driving the growth of the Bottled Water Packaging Market?

The Asia Pacific region, particularly countries like China and India, is a major growth driver due to rapid urbanization, increasing disposable incomes, and rising demand for safe drinking water. North America and Europe, while mature, contribute significantly through innovations in sustainable packaging and high consumption of premium and functional bottled water products.

What technological innovations are shaping bottled water packaging?

Key technological innovations include advanced lightweighting techniques for PET bottles, aseptic filling for extended shelf life, and the integration of recycled and bio-based materials. Additionally, smart packaging features like QR codes for traceability and improved cap and closure designs for enhanced convenience and reduced litter are transforming the market.

What are the main challenges faced by the Bottled Water Packaging Market?

The main challenges include escalating environmental concerns regarding plastic waste and pollution, volatile raw material prices, and stringent governmental regulations on single-use plastics. These factors compel manufacturers to continuously innovate and invest in sustainable yet cost-effective packaging solutions, balancing consumer expectations with ecological responsibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager