Bus Transmission System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429575 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Bus Transmission System Market Size

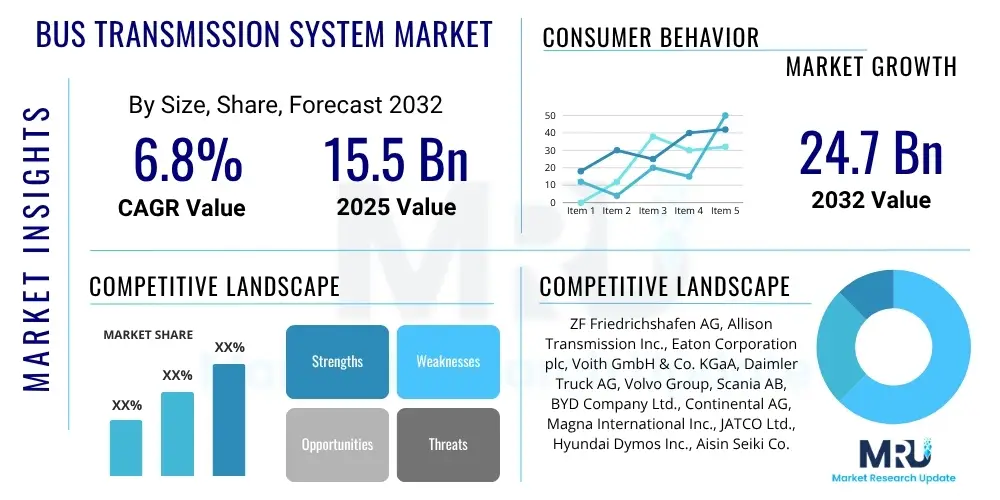

The Bus Transmission System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 24.7 Billion by the end of the forecast period in 2032.

Bus Transmission System Market introduction

The Bus Transmission System Market encompasses the design, manufacturing, and integration of various components responsible for transmitting power from the engine or electric motor to the drive wheels of a bus. These systems are pivotal in ensuring optimal operational efficiency, fuel economy, passenger comfort, and vehicle performance across diverse bus applications. From traditional manual and automatic transmissions to advanced automated manual transmissions (AMT) and specialized electric vehicle (EV) transmissions, the market is continually evolving to meet the demands of a global public transport landscape characterized by urbanization, increasing passenger volumes, and a strong push towards sustainable mobility solutions.

Key products within this market include sophisticated mechanical and hydraulic systems, electronic control units, and increasingly, integrated electric drivetrain components designed for hybrid and fully electric buses. Major applications span city buses, long-distance coaches, school buses, and various specialized transport vehicles, each requiring tailored transmission solutions to maximize efficiency and reliability. The inherent benefits of advanced transmission systems involve significant improvements in fuel efficiency, reduced emissions, smoother acceleration and braking, enhanced driver ergonomics, and prolonged vehicle lifespan. These advantages are crucial for fleet operators facing escalating fuel costs, stringent environmental regulations, and the need to deliver superior passenger experiences.

The primary driving factors propelling this market include rapid global urbanization leading to higher demand for public transportation, governmental initiatives promoting sustainable transport and electric vehicle adoption, and the continuous innovation in transmission technologies aimed at improving performance, efficiency, and reducing environmental impact. The global shift towards electric and hybrid buses is profoundly reshaping the market, necessitating the development of entirely new transmission architectures optimized for electric powertrains, which often involve single-speed or multi-speed gearboxes designed to handle high torque output and integrate with regenerative braking systems, further driving technological advancements and market growth.

Bus Transmission System Market Executive Summary

The Bus Transmission System Market is currently undergoing a significant transformation, driven by a confluence of technological advancements, evolving regulatory landscapes, and changing urban mobility paradigms. Business trends highlight a pronounced shift towards electrification, with manufacturers investing heavily in research and development for transmissions optimized for electric and hybrid buses. This involves lightweight designs, improved power density, and sophisticated control algorithms. Additionally, there is a growing emphasis on smart transmission systems that integrate with telematics and predictive maintenance platforms, aiming to enhance operational uptime and reduce total cost of ownership for fleet operators. The competitive landscape is characterized by both established automotive component suppliers and emerging players specializing in electric driveline solutions, leading to intense innovation and diversification of product offerings.

Regionally, the market exhibits diverse growth dynamics. Asia Pacific stands out as the largest and fastest-growing region, fueled by rapid urbanization, extensive government investments in public transport infrastructure, and the mass adoption of electric buses, particularly in countries like China and India. Europe is experiencing robust growth driven by stringent emission norms, strong policy support for green public transport, and the widespread implementation of advanced driver assistance systems that often integrate with transmission controls. North America is witnessing steady expansion, primarily due to fleet modernization efforts, increasing demand for automatic transmissions, and a growing emphasis on safety and efficiency across its extensive bus networks. Latin America, the Middle East, and Africa are showing promising potential, albeit at a slower pace, as infrastructure development and public transport initiatives gain momentum.

Segment wise, automatic transmissions continue to dominate the conventional bus market due to their ease of operation and comfort, though automated manual transmissions (AMT) are gaining traction in cost-sensitive markets for their balance of efficiency and affordability. The most significant trend is within the electric and hybrid bus segments, where specialized electric vehicle transmissions are seeing exponential growth. These transmissions, often simpler in design but highly sophisticated in their integration with electric motors and battery management systems, are becoming a critical differentiator. The demand for robust and efficient transmission solutions across various bus applications, including city, coach, and school buses, remains strong, with a clear trajectory towards more intelligent, sustainable, and high-performance systems.

AI Impact Analysis on Bus Transmission System Market

Common user questions regarding AI's impact on the Bus Transmission System Market often revolve around how artificial intelligence can enhance efficiency, predict maintenance needs, optimize vehicle performance, and contribute to the development of autonomous buses. Users are keen to understand the practical applications of AI in real-time operation, its role in improving fuel economy or energy consumption for electric buses, and the potential for AI-driven insights to extend the lifespan of transmission components. There is also significant interest in how AI can facilitate safer and more reliable public transport systems, particularly in the context of integrating transmissions with broader vehicle control units and fleet management systems. Users frequently inquire about the feasibility and benefits of predictive diagnostics, adaptive shift strategies, and the overall impact on operational costs and environmental footprint.

The integration of Artificial Intelligence (AI) is set to revolutionize the Bus Transmission System Market by introducing unprecedented levels of efficiency, reliability, and intelligence into vehicle operations. AI algorithms can analyze vast amounts of telematics data, including route topography, traffic conditions, driver behavior, and historical performance, to dynamically optimize gear shifting strategies in real-time. This adaptive optimization directly translates to significant improvements in fuel efficiency for conventional buses and enhanced energy recovery for hybrid and electric buses, maximizing the operational range and reducing energy consumption. Furthermore, AI powered predictive maintenance systems can monitor the health of transmission components, anticipating potential failures before they occur. By identifying subtle anomalies in vibration patterns, temperature, or fluid pressure, AI can trigger timely maintenance alerts, thereby preventing costly breakdowns, extending the service life of transmissions, and minimizing vehicle downtime, which is a critical factor for public transport operators.

Beyond operational efficiency and maintenance, AI is also a cornerstone for the advancement of autonomous bus technologies. Transmissions in future autonomous buses will require seamless integration with AI-driven control systems that dictate acceleration, deceleration, and speed based on environmental data from sensors, cameras, and lidar. AI will enable these transmissions to execute precise and smooth shifts, contributing to a comfortable and safe passenger experience without human intervention. The ability of AI to learn from diverse driving scenarios and continuously refine its control strategies will be instrumental in developing highly reliable and adaptable transmission systems for various autonomous applications. This capability will unlock new possibilities for urban mobility, potentially leading to fully automated bus routes that operate with superior precision and responsiveness, further solidifying AI's transformative role in the bus transmission ecosystem.

- Predictive maintenance and fault detection for transmission components.

- Real-time adaptive shift strategy optimization for fuel/energy efficiency.

- Integration with autonomous driving systems for precise power delivery.

- Enhanced fleet management through data-driven performance insights.

- Improved vehicle safety and passenger comfort via optimized gear changes.

- Development of smart diagnostics for quicker troubleshooting and repairs.

- Personalized driving profiles and transmission behavior based on routes.

DRO & Impact Forces Of Bus Transmission System Market

The Bus Transmission System Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces that shape its growth trajectory and competitive landscape. A primary driver is the accelerating demand for public transportation globally, spurred by rapid urbanization, population growth in metropolitan areas, and persistent traffic congestion. Governments worldwide are investing heavily in expanding and modernizing public transport networks, particularly in emerging economies, which directly fuels the demand for new buses and, consequently, their advanced transmission systems. Coupled with this, the urgent need for sustainable mobility solutions has led to increasingly stringent emission regulations, pushing manufacturers towards electric and hybrid bus technologies that require specialized and highly efficient transmission systems. Furthermore, ongoing technological advancements in materials science, mechatronics, and electronic control units are continuously improving the performance, durability, and efficiency of transmissions, making them more attractive to fleet operators seeking lower operational costs and enhanced reliability.

However, the market also faces considerable restraints. The high initial investment cost associated with advanced transmission systems, particularly for electric and hybrid buses, can be a significant barrier for smaller fleet operators or those in developing regions with limited budgets. The inherent technological complexity of these systems, involving sophisticated electronics and intricate mechanical components, demands specialized maintenance expertise and often results in higher repair costs, posing a challenge for widespread adoption. Additionally, the nascent stage of charging infrastructure development for electric buses in many parts of the world creates operational anxieties for potential buyers, impacting the uptake of electric buses and, by extension, their dedicated transmission systems. Geopolitical uncertainties, fluctuating raw material prices, and supply chain disruptions can also create headwinds, affecting production costs and market stability.

Despite these challenges, numerous opportunities exist for market expansion and innovation. The burgeoning markets in Asia Pacific, Latin America, and Africa present substantial growth avenues as these regions continue to invest in improving their public transport infrastructure and transitioning towards cleaner vehicles. The ongoing development of smart city initiatives worldwide, which often prioritize efficient and connected public transport, opens doors for highly integrated transmission systems that can communicate with broader urban traffic management systems. Moreover, there is a significant opportunity in the retrofitting market, where older conventional buses can be upgraded with more efficient and environmentally friendly transmission systems, extending their operational life and improving performance. The convergence of transmission technology with autonomous driving systems also represents a long-term growth opportunity, requiring new levels of precision and responsiveness. These factors, alongside the pervasive impact forces of regulatory pressures for green vehicles, technological disruption, and competitive dynamics among key players, collectively dictate the future direction and innovation within the bus transmission system market.

- Growing public transport demand due to urbanization.

- Government initiatives promoting electric and hybrid bus adoption.

- Strict global emission regulations (e.g., Euro VI, Bharat Stage VI, EPA).

- Technological advancements in transmission efficiency and durability.

- Increasing passenger comfort and safety expectations.

- High initial cost of advanced transmission systems.

- Complexity of integrating electric powertrains with transmissions.

- Lack of widespread standardized charging infrastructure for EVs.

- High maintenance and repair costs for sophisticated units.

- Emerging markets' investment in modernizing public transport.

- Development of smart, connected, and predictive maintenance systems.

- Opportunities in retrofitting existing bus fleets with advanced transmissions.

- Integration with future autonomous driving technologies.

Segmentation Analysis

The Bus Transmission System Market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, and end-user adoption patterns. This granular analysis allows for a precise evaluation of market dynamics across various technological types, operational applications, specific bus categories, and key customer groups. Understanding these segments is crucial for manufacturers to tailor their product offerings, for operators to make informed purchasing decisions, and for market analysts to accurately forecast growth trajectories and identify emerging trends. The segmentation highlights the evolution from traditional mechanical systems to advanced electronic and electric driveline solutions, reflecting the industry's response to demands for greater efficiency, lower emissions, and enhanced operational performance.

The market is primarily segmented by transmission type, distinguishing between conventional manual systems, which offer simplicity and cost-effectiveness; automatic transmissions (AT), valued for their ease of driving and passenger comfort; automated manual transmissions (AMT), which combine the efficiency of manuals with automated shifting; and specialized electric vehicle (EV) transmissions, designed for the unique power delivery characteristics of electric powertrains. Further segmentation by application differentiates between the rigorous demands of city buses, the high-speed and efficiency requirements of coach buses, the safety-critical nature of school buses, and other specialized commercial bus uses. The market is also analyzed by bus type, categorizing vehicles as conventional, hybrid, or electric buses, each requiring distinct transmission characteristics. Lastly, end-user segmentation examines the purchasing behaviors and needs of public transport operators, private fleet owners, governmental agencies, and educational institutions, among others.

- By Transmission Type:

- Manual Transmission

- Automatic Transmission (AT)

- Automated Manual Transmission (AMT)

- Electric Vehicle (EV) Transmission

- Hybrid Electric Vehicle (HEV) Transmission

- By Bus Type:

- Conventional Buses (Diesel/CNG/LPG)

- Hybrid Buses

- Electric Buses (Battery Electric, Fuel Cell Electric)

- By Application:

- City Bus

- Coach Bus (Intercity/Tour)

- School Bus

- Articulated Bus

- Special Purpose Bus (e.g., Airport Shuttle, BRT)

- By End User:

- Public Transport Authorities/Operators

- Private Fleet Operators

- Educational Institutions

- Tourism and Travel Agencies

- Government and Municipal Services

- By Technology:

- Hydrodynamic (Torque Converter)

- Hydromechanical

- Continuously Variable Transmission (CVT)

- Dual Clutch Transmission (DCT)

- E-Axle Systems

Value Chain Analysis For Bus Transmission System Market

The value chain for the Bus Transmission System Market is a complex network of interconnected activities, starting from the sourcing of raw materials to the final distribution and aftermarket services. This chain involves multiple stakeholders, each adding value at different stages to produce and deliver sophisticated transmission systems. Upstream activities are critical and involve the extraction and processing of raw materials such as steel, aluminum, cast iron, and various composites and plastics that form the core structural and functional components of a transmission. Beyond basic materials, this stage also includes the manufacturing of specialized components like gears, shafts, bearings, clutches, torque converters, hydraulic pumps, and advanced electronic sensors and control units, often supplied by highly specialized component manufacturers to the transmission system integrators.

The midstream of the value chain primarily focuses on the assembly and integration of these diverse components into complete transmission systems by leading manufacturers. This stage involves intricate engineering, precision machining, software development for electronic controls, and rigorous testing to ensure optimal performance, durability, and compliance with industry standards. Downstream activities involve the distribution and sales of these finished transmission systems. This largely occurs through direct sales channels to major bus manufacturers (Original Equipment Manufacturers or OEMs), who then integrate the transmissions into their complete bus chassis. For electric buses, this also includes the integration of e-axles and electric drive units into the overall electric powertrain architecture. Distribution also extends to the aftermarket, serving repair shops, independent service providers, and fleet operators who require replacement parts and service solutions for existing bus fleets, often through a network of authorized distributors and service centers.

Distribution channels are predominantly direct for OEM sales, where transmission manufacturers work closely with bus builders from the initial design phase to ensure seamless integration and optimized performance. This direct relationship fosters innovation and custom solutions. Indirect channels become more prominent in the aftermarket segment, where a network of distributors, wholesalers, and authorized service centers plays a crucial role in supplying spare parts, offering maintenance services, and providing technical support to end-users. This dual channel approach ensures that both new vehicle production and the vast existing fleet of operational buses are adequately supported throughout their lifecycle. The interplay between direct sales to OEMs and robust aftermarket support through indirect channels is vital for maintaining market presence and fostering long-term customer relationships in this specialized industry.

Bus Transmission System Market Potential Customers

The Bus Transmission System Market caters to a diverse range of potential customers, all of whom operate and manage bus fleets for various transportation needs. These end-users are primarily driven by factors such as operational efficiency, passenger comfort, vehicle reliability, total cost of ownership, and adherence to environmental regulations. Public transport authorities and municipal corporations represent a significant segment of potential customers. These entities are responsible for providing essential urban and regional public transport services and typically operate large fleets of city buses, often under strict performance metrics and public scrutiny regarding emissions and passenger experience. Their purchasing decisions are heavily influenced by government mandates for green transport, long-term operational costs, and the need for robust, durable systems that can withstand continuous heavy usage.

Another crucial customer segment comprises private bus operators, including those running intercity coaches, long-haul services, tour buses, and private charters. These operators prioritize fuel efficiency, passenger comfort, and vehicle uptime to maintain profitability and competitiveness in often highly competitive markets. Their choices in transmission systems directly impact their operational expenses and their ability to attract and retain passengers. Furthermore, school districts and private educational institutions that operate school bus fleets are key buyers. For this segment, safety, reliability, and ease of operation are paramount, along with considerations for durability and simplified maintenance to ensure the safe and consistent transport of students. The emphasis here is often on robust and low-maintenance automatic transmission systems that enhance driver focus and safety.

Beyond these primary groups, other potential customers include various governmental agencies requiring specialized bus services, such as airport shuttle operators, corporate employee transport services, and specialized event transportation providers. These diverse end-users collectively contribute to the demand for a broad spectrum of bus transmission systems, each seeking tailored solutions that align with their specific operational profiles, passenger requirements, and budgetary constraints. The market's ability to offer a range of transmission technologies, from conventional to electric and hybrid solutions, allows it to serve the varied needs of this extensive customer base, thereby ensuring sustained growth and innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 24.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Allison Transmission Inc., Eaton Corporation plc, Voith GmbH & Co. KGaA, Daimler Truck AG, Volvo Group, Scania AB, BYD Company Ltd., Continental AG, Magna International Inc., JATCO Ltd., Hyundai Dymos Inc., Aisin Seiki Co. Ltd., AVL List GmbH, Oerlikon Graziano SpA, Dana Limited, GKN Driveline, BorgWarner Inc., FPT Industrial (CNH Industrial N.V.), Wabco Holdings (ZF). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bus Transmission System Market Key Technology Landscape

The Bus Transmission System Market is characterized by a dynamic and evolving technology landscape, driven by the relentless pursuit of greater efficiency, reduced emissions, and enhanced performance across diverse bus applications. A significant technological trend is the adoption of advanced materials such as lightweight alloys and composites in transmission components, which contributes to overall vehicle weight reduction, thereby improving fuel economy and increasing payload capacity. Mechatronics, the synergistic integration of mechanical engineering, electronics, computer engineering, and control engineering, plays a pivotal role in modern transmissions, enabling precise electronic control over gear shifting, clutch engagement, and power transfer. This allows for optimized performance across varying driving conditions and contributes to smoother, more comfortable rides for passengers. Furthermore, the development of sophisticated electronic control units (ECUs) with advanced software algorithms is central to managing complex transmission operations, including predictive shifting, adaptive learning, and fault diagnostics, significantly enhancing both reliability and efficiency.

Another transformative aspect of the technology landscape is the widespread integration of telematics and connectivity features into transmission systems. These smart transmissions can communicate real-time operational data, allowing fleet managers to monitor performance, predict maintenance needs, and optimize route planning. This data-driven approach not only improves operational uptime by enabling proactive servicing but also contributes to better fuel management and reduced operating costs over the vehicle's lifespan. For hybrid and electric buses, the technological focus has shifted dramatically towards specialized electric drive units, which often integrate the electric motor, power electronics, and a single or multi-speed gearbox into a compact e-axle system. These systems are designed to handle high torque characteristics of electric motors, facilitate regenerative braking for energy recovery, and manage power flow between the battery and the drive wheels with exceptional efficiency, representing a significant departure from conventional hydraulic or mechanical systems.

Innovations also extend to continuously variable transmissions (CVTs) and dual-clutch transmissions (DCTs), which, while more common in passenger cars, are seeing specialized applications in certain bus segments for their ability to deliver seamless acceleration and optimal engine RPMs. Moreover, energy recovery systems, particularly in hybrid buses, are becoming more sophisticated, with transmissions playing a crucial role in converting kinetic energy into electrical energy during braking, which is then stored for later use. This emphasis on energy conservation and emission reduction is propelling the research and development into highly integrated and intelligent powertrain solutions, where the transmission is not merely a power transfer mechanism but an integral, smart component of a cohesive and efficient vehicle system. This continuous technological evolution underscores the industry's commitment to meeting stringent environmental targets and growing demands for sustainable public transportation solutions.

Regional Highlights

- Asia Pacific: This region stands as the dominant and fastest-growing market for bus transmission systems, primarily driven by rapid urbanization, significant government investments in expanding public transportation networks, and the large-scale adoption of electric buses, especially in countries like China and India. China leads in manufacturing and deployment of electric buses, creating immense demand for EV transmissions and related technologies. India, with its ambitious FAME India scheme, is also a burgeoning market. The need for efficient, durable, and cost-effective transmission solutions for a vast and growing fleet ensures robust market expansion.

- Europe: The European market is characterized by stringent emission regulations (e.g., Euro VI) and strong governmental support for sustainable public transport, leading to high demand for advanced, low-emission, and electric bus transmission systems. Countries like Germany, France, and the UK are at the forefront of adopting hybrid and electric buses, fueling innovation in e-axles and integrated electric drivetrains. Focus on smart cities and connected vehicles further drives the demand for intelligent transmission systems that offer enhanced efficiency and connectivity.

- North America: North America presents a mature market with steady growth, primarily propelled by fleet modernization initiatives, increasing demand for automatic transmissions for operational ease and driver comfort, and a growing emphasis on safety and fuel efficiency standards. The adoption of electric and hybrid school buses is a notable trend, creating a specific niche for robust and reliable electric vehicle transmission solutions. Investments in public transport infrastructure in major urban centers also contribute to market expansion.

- Latin America: This region is an emerging market for bus transmission systems, driven by ongoing infrastructure development, increasing urbanization, and the modernization of public transport fleets in countries like Brazil, Mexico, and Colombia. While conventional transmissions still hold a significant share, there is a growing interest in more fuel-efficient and lower-emission options, including automatic transmissions and early adoption of hybrid buses in major cities, reflecting a gradual shift towards cleaner solutions.

- Middle East and Africa (MEA): The MEA region is witnessing gradual growth, particularly in the Middle East due to significant infrastructure projects and the expansion of smart city initiatives requiring modern public transport. Countries in the GCC are investing in new bus fleets. In Africa, growth is more fragmented but is supported by urbanization and improving public transport infrastructure in key economic hubs. The demand here is primarily for robust and reliable transmission systems that can withstand harsh operating conditions, with increasing interest in fuel-efficient and potentially electric options in the longer term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bus Transmission System Market.- ZF Friedrichshafen AG

- Allison Transmission Inc.

- Eaton Corporation plc

- Voith GmbH & Co. KGaA

- Daimler Truck AG

- Volvo Group

- Scania AB

- BYD Company Ltd.

- Continental AG

- Magna International Inc.

- JATCO Ltd.

- Hyundai Dymos Inc.

- Aisin Seiki Co. Ltd.

- AVL List GmbH

- Oerlikon Graziano SpA

- Dana Limited

- GKN Driveline

- BorgWarner Inc.

- FPT Industrial (CNH Industrial N.V.)

- Wabco Holdings (ZF)

Frequently Asked Questions

What is the projected growth rate of the Bus Transmission System Market?

The Bus Transmission System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032.

How is AI impacting bus transmission systems?

AI is significantly impacting bus transmission systems by enabling predictive maintenance, optimizing real-time gear shifting for improved fuel/energy efficiency, facilitating integration with autonomous driving technologies, and enhancing overall fleet management through data analytics.

What are the key drivers for the Bus Transmission System Market?

Key drivers include rapid urbanization, increasing demand for public transportation, stringent emission regulations, government initiatives promoting electric bus adoption, and continuous technological advancements in transmission efficiency and durability.

Which region dominates the Bus Transmission System Market?

Asia Pacific currently dominates the Bus Transmission System Market, driven by extensive public transport infrastructure development, rapid urbanization, and significant adoption of electric buses, particularly in China and India.

What are the main types of transmission systems used in buses?

The main types include Manual Transmission, Automatic Transmission (AT), Automated Manual Transmission (AMT), Electric Vehicle (EV) Transmissions, and Hybrid Electric Vehicle (HEV) Transmissions, each optimized for different bus types and operational requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager