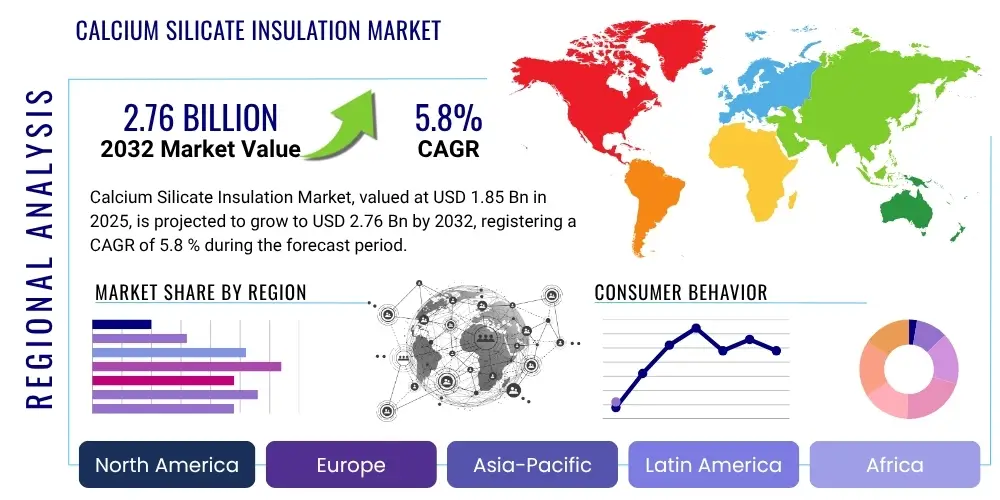

Calcium Silicate Insulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428064 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Calcium Silicate Insulation Market Size

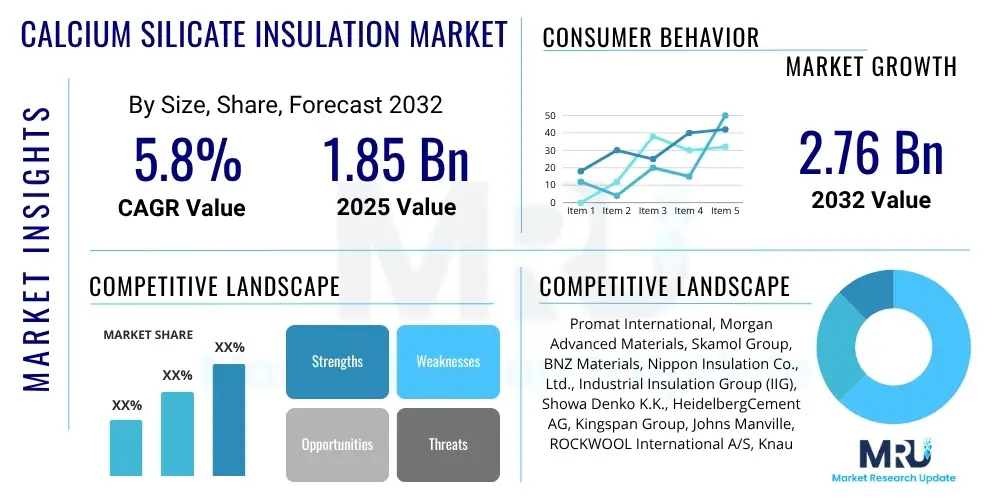

The Calcium Silicate Insulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2032. This robust growth trajectory is primarily driven by escalating demand from industrial sectors requiring high-performance insulation solutions, stringent energy efficiency regulations across various geographies, and increasing investments in industrial infrastructure and retrofitting projects globally. The material's inherent properties, such as superior thermal stability, excellent fire resistance, and mechanical strength, make it an indispensable component in critical high-temperature applications. Furthermore, the rising awareness regarding sustainable practices and the long-term cost benefits associated with reduced energy consumption are significantly contributing to the market's expansion, solidifying its position as a preferred insulation material in demanding environments.

Calcium Silicate Insulation Market introduction

The Calcium Silicate Insulation Market encompasses the production, distribution, and application of a versatile insulation material known for its exceptional thermal and fire-resistant properties. Calcium silicate, a mineral composite formed from lime, silica, and reinforcing fibers, is processed into various forms such as boards, blocks, pipe sections, and molded shapes. These products are engineered to withstand high temperatures, typically ranging from 650°C to over 1000°C, while providing excellent thermal insulation. The material's low thermal conductivity ensures minimal heat transfer, significantly reducing energy losses and enhancing operational efficiency in industrial processes. Its non-combustible nature offers critical fire protection, making it a vital safety component in high-risk environments.

The primary applications for calcium silicate insulation span a wide array of heavy industries, including power generation plants (coal-fired, gas-fired, nuclear), chemical and petrochemical facilities, cement and glass manufacturing plants, and various metals & mining operations. It is also extensively utilized in industrial furnaces, kilns, ovens, and boilers, where extreme temperatures necessitate reliable and durable insulation. Beyond industrial uses, it finds applications in commercial and residential buildings for fireproofing structural elements, ductwork, and marine vessels for thermal and fire insulation. The inherent benefits of calcium silicate insulation, such as its high compressive strength, moisture resistance, and asbestos-free composition, further enhance its appeal and drive its adoption across diverse sectors.

Several key factors are propelling the growth of the calcium silicate insulation market. Foremost among these are the global mandates and incentives promoting energy conservation and reducing carbon emissions, which compel industries to upgrade their insulation systems. The ongoing expansion of industrial capacities, particularly in emerging economies, coupled with significant investments in infrastructure development, fuels the demand for high-performance insulation materials. Moreover, the increasing emphasis on industrial safety and fire protection regulations globally underscores the critical role of calcium silicate in safeguarding assets and personnel. The material's long service life and ability to maintain structural integrity under severe conditions also contribute to its growing market share, as industries seek robust and cost-effective solutions for long-term operational efficiency.

Calcium Silicate Insulation Market Executive Summary

The executive summary highlights the dynamic landscape of the Calcium Silicate Insulation Market, underscoring prominent business trends, evolving regional demands, and significant segmentation shifts. Currently, the market is characterized by a strong emphasis on sustainability and product innovation, with manufacturers investing in research and development to enhance material performance, reduce environmental footprint, and offer tailored solutions. The adoption of advanced manufacturing techniques and the integration of digital technologies in production processes are emerging as key business differentiators. Furthermore, strategic partnerships and collaborations across the value chain, from raw material suppliers to end-users, are becoming more prevalent to streamline supply chains and optimize market penetration. Companies are increasingly focusing on providing comprehensive service packages, including installation and maintenance, to capture greater market value and strengthen customer loyalty in a competitive environment.

From a regional perspective, the Asia Pacific (APAC) region continues to dominate the market, primarily driven by rapid industrialization, burgeoning infrastructure development, and substantial investments in power generation and heavy industries in countries like China and India. This robust economic growth, coupled with increasing energy consumption and a rising focus on energy efficiency, provides a fertile ground for market expansion. North America and Europe, while more mature markets, exhibit stable demand propelled by stringent regulatory frameworks concerning energy conservation and fire safety, as well as significant investments in retrofitting aging industrial facilities. These regions are also witnessing a shift towards higher-performance and environmentally friendly insulation products. Latin America, the Middle East, and Africa are experiencing steady growth, fueled by urbanization, industrial expansion, and diversifying economies, indicating significant future potential for calcium silicate insulation products as infrastructure projects gather momentum.

Segmentation trends within the calcium silicate insulation market reveal a nuanced demand pattern. The industrial application segment, particularly power generation, chemical & petrochemical, and metals & mining, remains the largest revenue contributor due to the critical need for high-temperature insulation in these sectors. Within product forms, calcium silicate boards and pipe sections command substantial market share, driven by their versatility and ease of installation in various industrial settings. There is also a growing demand for customized molded shapes designed for specific equipment and applications, reflecting a market trend towards bespoke solutions. Furthermore, the market is observing increased interest in calcium silicate products that offer enhanced mechanical properties and improved resistance to chemical attacks, catering to more specialized and challenging operating environments. These segmentation insights are crucial for manufacturers and suppliers to strategically align their product portfolios and market approaches to capitalize on specific growth opportunities.

AI Impact Analysis on Calcium Silicate Insulation Market

The integration of Artificial intelligence (AI) is poised to bring transformative changes to the Calcium Silicate Insulation Market, addressing common user questions about operational efficiency, quality control, and material innovation. Users frequently inquire about how AI can optimize the complex manufacturing processes of calcium silicate products, predict and enhance material performance, streamline supply chain logistics, and even accelerate research and development for next-generation insulation solutions. Concerns often revolve around the practical implementation challenges, data security, and the initial investment required for AI technologies, alongside expectations of significant long-term benefits such as cost reduction, improved product consistency, and faster time-to-market for novel materials. The overarching theme is a desire for smart, data-driven solutions that can elevate the industry beyond traditional manufacturing paradigms, ensuring higher quality, greater efficiency, and more predictive maintenance capabilities across the entire product lifecycle.

- AI-driven process optimization in manufacturing for enhanced consistency and reduced waste.

- Predictive maintenance for manufacturing equipment, minimizing downtime and increasing operational efficiency.

- Supply chain optimization through AI algorithms, improving logistics, inventory management, and raw material procurement.

- Quality control and defect detection using computer vision and machine learning during production.

- Accelerated R&D for new calcium silicate formulations and composite materials with AI-powered simulations and data analysis.

- Improved energy management and process heating efficiency in production facilities using AI.

- Enhanced market forecasting and demand prediction for strategic production planning.

- Development of smart insulation systems with embedded sensors for real-time performance monitoring and predictive maintenance in end-use applications.

DRO & Impact Forces Of Calcium Silicate Insulation Market

The Calcium Silicate Insulation Market is significantly shaped by a confluence of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and competitive landscape. Key drivers include the stringent global regulations mandating energy efficiency and reduced carbon footprints across industrial and commercial sectors, which compel industries to adopt advanced insulation solutions to minimize heat loss and optimize energy consumption. The robust growth in industrialization, particularly in emerging economies, coupled with heavy investments in infrastructure development, power generation, and process industries, further fuels the demand for high-performance thermal insulation. Additionally, the increasing focus on fire safety in both industrial facilities and building constructions, driven by stricter building codes and insurance requirements, positions calcium silicate as a preferred choice due to its non-combustible properties and structural integrity at high temperatures. These factors collectively create a strong impetus for market expansion, particularly where operational safety and efficiency are paramount concerns for businesses and regulatory bodies.

Despite these significant drivers, the market faces several notable restraints. The relatively high initial cost of calcium silicate insulation materials compared to some conventional alternatives can be a barrier to adoption, especially for projects with tight budget constraints or in less industrialized regions. Furthermore, intense competition from alternative insulation materials such as mineral wool, ceramic fibers, and aerogels, each offering specific advantages for different applications, can fragment market share and exert downward pressure on pricing. The market is also susceptible to volatility in the prices of key raw materials like lime, silica, and reinforcing fibers, which can impact production costs and profit margins for manufacturers. Economic downturns or slowdowns in industrial investment can also temporarily curb demand, creating uncertainty for market players. Addressing these restraints often involves demonstrating the long-term cost savings and superior performance of calcium silicate, coupled with strategic supply chain management to mitigate raw material price fluctuations.

Opportunities within the calcium silicate insulation market are abundant and varied, presenting avenues for sustained growth and innovation. Significant potential lies in continuous research and development aimed at enhancing material properties, such as improving mechanical strength, reducing weight, and increasing temperature resistance, thereby expanding its application scope into more specialized and demanding environments. The burgeoning market in emerging economies, driven by rapid industrial expansion and urbanization, offers vast untapped potential for new installations and upgrading existing facilities. Additionally, the growing trend of retrofitting aging industrial infrastructure across developed regions provides a substantial market for calcium silicate insulation as industries seek to modernize their operations and comply with updated energy efficiency standards. The development of innovative installation techniques and prefabricated solutions that reduce labor costs and installation time could further unlock market potential. Moreover, niche applications requiring specific properties, such as insulation for concentrated solar power (CSP) plants or advanced battery manufacturing, present specialized growth opportunities for products with tailored characteristics. These opportunities require strategic investment in innovation, market penetration, and customer education to fully realize their value.

The market is also influenced by broader impact forces that shape its operating environment. Regulatory pressures, particularly those related to environmental protection and workplace safety, directly influence product specifications and manufacturing processes. Evolving technological advancements in material science and manufacturing processes offer continuous avenues for product improvement and cost reduction. Economic cycles, including global GDP growth, industrial output, and investment trends, have a direct bearing on demand from core end-use industries. Furthermore, increasing environmental concerns and the global push towards decarbonization significantly impact material selection, favoring products with lower embodied energy and longer service life. Geopolitical stability and trade policies can also affect the availability and pricing of raw materials, as well as market access for finished products. Staying abreast of these overarching impact forces is crucial for market players to adapt strategies, manage risks, and capitalize on emerging trends for sustainable growth in the calcium silicate insulation sector.

Segmentation Analysis

The Calcium Silicate Insulation Market is comprehensively segmented based on various critical attributes, including form, application, end-use industry, and temperature range. This detailed segmentation provides a granular view of market dynamics, enabling stakeholders to understand specific demand patterns, identify key growth areas, and tailor product offerings to diverse customer needs. Each segment reflects unique requirements and operational environments, driving differentiated product specifications and market strategies. Understanding these distinctions is paramount for effective market penetration and competitive positioning. For instance, the demand for boards might be higher in fire protection applications within buildings, while pipe sections are indispensable in process industries for insulating pipelines. The evolution of industrial processes and increasing complexity of thermal management challenges continue to drive innovation and diversification across these segments, catering to an ever-widening array of specialized applications and performance criteria.

- By Form

- Boards

- Blocks

- Pipe Sections

- Powder

- Molded Shapes

- By Application

- Power Generation (e.g., Coal-fired, Gas-fired, Nuclear)

- Chemical & Petrochemical Industry

- Cement & Glass Manufacturing

- Metals & Mining

- Industrial Furnaces & Kilns

- Fire Protection

- Marine

- Commercial & Residential Buildings (e.g., HVAC, fireproofing)

- By End-Use Industry

- Industrial

- Commercial

- Residential

- By Temperature Range

- High Temperature (650°C to 1000°C)

- Medium Temperature (300°C to 650°C)

Value Chain Analysis For Calcium Silicate Insulation Market

The value chain for the Calcium Silicate Insulation Market is intricate, encompassing various stages from raw material sourcing to end-use application, each adding significant value. The upstream segment involves the extraction and processing of primary raw materials such as lime, silica (typically diatomaceous earth or quartz), and various reinforcing fibers (e.g., cellulose or synthetic fibers). Suppliers in this stage focus on ensuring consistent quality and availability of these foundational components, as their properties directly impact the final product's performance. Efficient procurement and quality control at this initial stage are crucial for maintaining manufacturing standards and cost competitiveness. Innovations in sustainable sourcing and alternative raw material development also play a growing role in this part of the value chain, driven by environmental considerations and supply chain resilience.

Midstream activities involve the manufacturing process where these raw materials are chemically reacted and formed into calcium silicate products through processes like hydrothermal synthesis or slurry molding. Manufacturers focus on optimizing production efficiency, ensuring product quality, and developing a diverse range of product forms such as boards, blocks, and pipe sections. This stage also includes quality assurance, testing, and packaging. Downstream activities involve the distribution, sales, and installation of calcium silicate insulation products. Distribution channels can be direct, where manufacturers sell directly to large industrial clients or major construction projects, or indirect, involving a network of distributors, wholesalers, and retailers who cater to smaller projects, contractors, and specialized applications. This dual approach allows manufacturers to reach a broad customer base, balancing direct relationships with large volume buyers against the extensive reach of third-party networks.

The distribution channels are critical for market penetration and customer accessibility. Direct sales channels are typically employed for large-scale industrial projects, offering specialized technical support, customized solutions, and direct negotiation with end-users like power plants or petrochemical complexes. This approach fosters strong client relationships and ensures precise alignment with specific project requirements. Conversely, indirect channels, comprising independent distributors, construction material suppliers, and specialized insulation contractors, are vital for reaching a fragmented market of commercial and residential projects, as well as smaller industrial applications. These partners often provide localized inventory, logistical support, and installation services, making products readily available to a wider range of customers. The effectiveness of the overall value chain relies heavily on seamless collaboration and communication between all participants, from raw material suppliers to installers, to ensure product quality, timely delivery, and customer satisfaction. The efficiency of these channels directly impacts market reach and the overall profitability of the calcium silicate insulation industry, requiring continuous optimization and adaptation to evolving market demands.

Calcium Silicate Insulation Market Potential Customers

The Calcium Silicate Insulation Market caters to a diverse range of potential customers across various industries and applications, all requiring high-performance thermal insulation and fire protection. The primary end-users and buyers are predominantly large industrial entities with operations characterized by high temperatures and demanding environmental conditions. This includes power generation companies, spanning conventional thermal power plants, nuclear facilities, and increasingly, concentrated solar power (CSP) plants, which rely heavily on calcium silicate for insulating boilers, turbines, and associated piping systems to optimize energy conversion efficiency and ensure operational safety. The chemical and petrochemical industries are also significant consumers, utilizing calcium silicate to insulate reactors, distillation columns, pipelines, and storage tanks, where precise temperature control and resistance to corrosive environments are crucial for process integrity and safety. Furthermore, companies involved in the production of cement, glass, and ceramics constitute a substantial customer base, as these industries operate large kilns and furnaces that require robust, high-temperature insulation to minimize heat loss and prolong equipment life.

Beyond these heavy industrial sectors, the metals and mining industry, particularly steel mills and aluminum smelters, are key buyers for insulating furnaces, ladles, and hot gas ducts, where the material's ability to withstand extreme heat and mechanical stress is invaluable. The increasing focus on energy efficiency and emissions reduction in these energy-intensive industries further solidifies their demand for advanced insulation solutions like calcium silicate. Moreover, the commercial and institutional construction sector represents a growing segment of potential customers, particularly for fire protection applications. Building developers, architects, and contractors often specify calcium silicate boards for fireproofing structural steel, ventilation ducts, and firewalls in commercial buildings, hospitals, schools, and transportation hubs to comply with stringent fire safety regulations and enhance occupant safety. This expands the customer base beyond traditional industrial applications, reflecting the material's versatility.

Another significant customer segment includes shipbuilders and marine outfitters, who utilize calcium silicate insulation for thermal and fire protection in marine vessels, offshore platforms, and naval applications, where space constraints and harsh operating conditions demand compact yet highly effective insulation materials. Specialized industrial furnace manufacturers, original equipment manufacturers (OEMs), and industrial contractors also serve as indirect customers, integrating calcium silicate components into their larger systems or offering installation services to end-users. These diverse customer profiles underscore the broad utility and critical importance of calcium silicate insulation across a spectrum of industries, driven by the universal need for energy conservation, operational efficiency, and enhanced safety in high-temperature environments. Understanding the specific needs and procurement processes of each customer type is vital for manufacturers and suppliers to effectively market and distribute their calcium silicate products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 2.76 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Promat International, Morgan Advanced Materials, Skamol Group, BNZ Materials, Nippon Insulation Co., Ltd., Industrial Insulation Group (IIG), Showa Denko K.K., HeidelbergCement AG, Kingspan Group, Johns Manville, ROCKWOOL International A/S, Knauf Insulation, Saint-Gobain S.A., Isolite GmbH, Etex Group, Trelleborg AB, KCC Corporation, Zircar Ceramics Inc., Unifrax I LLC, Pyrotek Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Silicate Insulation Market Key Technology Landscape

The Calcium Silicate Insulation Market is characterized by a dynamic technology landscape that continuously evolves to meet increasing demands for performance, sustainability, and cost-effectiveness. The core manufacturing technologies primarily involve hydrothermal synthesis and slurry molding processes, which are critical for forming the porous, lightweight structure of calcium silicate products. Hydrothermal synthesis is a chemical reaction under elevated temperature and pressure, allowing for precise control over the crystal structure and resulting in materials with high thermal stability and low density. Slurry molding, on the other hand, involves mixing raw materials with water to create a slurry that is then dewatered and pressed into the desired shapes, followed by curing and drying processes. Innovations in these fundamental processes focus on optimizing parameters to enhance product uniformity, reduce energy consumption during manufacturing, and improve overall production efficiency, leading to higher quality and more consistent insulation materials. Advanced mixing and forming techniques are also continuously being refined to achieve intricate geometries and tighter dimensional tolerances for specialized applications.

Beyond the core manufacturing methods, significant technological advancements are being made in several complementary areas. One key area is the development of novel binder technologies that enhance the mechanical strength and durability of calcium silicate products without compromising their thermal performance or fire resistance. Researchers are exploring inorganic binders that can withstand even higher temperatures and offer superior moisture resistance, extending the service life of the insulation in harsh environments. Another significant trend is the integration of advanced fiber reinforcement technologies, moving beyond traditional cellulose or glass fibers to incorporate synthetic or bio-based fibers that impart improved crack resistance, higher flexural strength, and reduced friability. These innovations are crucial for developing next-generation calcium silicate composites that can withstand more severe operational stresses and offer superior long-term performance, making them suitable for a wider range of high-performance applications.

Furthermore, the technology landscape also encompasses advancements in surface treatments and protective coatings, which can enhance the chemical resistance, dust suppression, and aesthetic appeal of calcium silicate products. These treatments can also improve handling characteristics and ease of installation, thereby adding value for end-users. The industry is also witnessing a growing focus on sustainable manufacturing practices, including the utilization of recycled raw materials, energy-efficient curing methods, and waste reduction strategies, aligning with global environmental objectives. The adoption of automation and digital control systems in production facilities is another critical technological development, leading to greater precision, reduced labor costs, and enhanced process monitoring. These technological strides collectively enable manufacturers to produce calcium silicate insulation materials that are not only high-performing and durable but also more environmentally friendly and cost-competitive, thus reinforcing their position as a premium insulation solution in demanding industrial and commercial applications.

Regional Highlights

- Asia Pacific (APAC): This region is projected to be the largest and fastest-growing market for calcium silicate insulation, driven by rapid industrialization, massive infrastructure development, and significant investments in power generation (including coal, gas, and nuclear) and process industries (chemical, petrochemical, cement, glass) in countries like China, India, Japan, and South Korea. Government initiatives promoting energy efficiency and sustainable development also fuel demand.

- North America: A mature market characterized by stringent energy efficiency regulations and a strong emphasis on industrial safety. Demand is robust from the oil & gas, chemical processing, and power generation sectors, alongside substantial activity in retrofitting aging industrial infrastructure. The U.S. and Canada are key contributors, driven by a focus on reducing operational costs and meeting environmental compliance.

- Europe: This region exhibits a steady demand, primarily driven by strict environmental policies, energy conservation mandates, and a robust manufacturing base in countries such as Germany, the UK, France, and Italy. The market benefits from ongoing upgrades in industrial facilities and a strong focus on fire protection in commercial and residential construction. Innovations in sustainable production are also a key trend.

- Latin America: Expected to show considerable growth, spurred by urbanization, industrial expansion, and investments in energy and mining sectors in countries like Brazil, Mexico, and Argentina. The region's developing infrastructure and increasing industrial output contribute to rising demand for effective thermal insulation solutions.

- Middle East and Africa (MEA): This region is experiencing significant market expansion, particularly driven by large-scale investments in the oil & gas, petrochemical, and power generation sectors, especially in Saudi Arabia, UAE, and Qatar. Diversification efforts away from oil economies also lead to new industrial developments requiring high-performance insulation. Growing construction activities in urban centers further bolster demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Silicate Insulation Market.- Promat International

- Morgan Advanced Materials

- Skamol Group

- BNZ Materials

- Nippon Insulation Co., Ltd.

- Industrial Insulation Group (IIG)

- Showa Denko K.K.

- HeidelbergCement AG

- Kingspan Group

- Johns Manville

- ROCKWOOL International A/S

- Knauf Insulation

- Saint-Gobain S.A.

- Isolite GmbH

- Etex Group

- Trelleborg AB

- KCC Corporation

- Zircar Ceramics Inc.

- Unifrax I LLC

- Pyrotek Inc.

Frequently Asked Questions

Analyze common user questions about the Calcium Silicate Insulation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is calcium silicate insulation and what are its main properties?

Calcium silicate insulation is a lightweight, rigid material made from lime, silica, and reinforcing fibers. It offers excellent thermal stability, very low thermal conductivity, high compressive strength, and superior fire resistance, making it ideal for high-temperature industrial applications and fireproofing.

Why is calcium silicate insulation preferred over other materials in high-temperature industrial settings?

It is preferred for its ability to withstand extreme temperatures (up to 1000°C), non-combustibility, durability, and resistance to moisture and chemicals. These properties ensure long-term energy efficiency and enhanced safety in demanding industrial environments where other materials might fail.

What are the primary applications of calcium silicate insulation?

Its primary applications include insulation for industrial furnaces, kilns, ovens, boilers, and piping in power generation, chemical, petrochemical, cement, glass, and metals & mining industries. It's also widely used for fire protection in commercial and residential buildings, and marine vessels.

How does calcium silicate insulation contribute to energy efficiency and sustainability?

By significantly reducing heat loss from high-temperature equipment, it minimizes energy consumption, lowers operational costs, and decreases greenhouse gas emissions. Its long service life and ability to maintain performance contribute to resource efficiency and sustainable industrial practices.

What is the market outlook for calcium silicate insulation?

The market is projected for robust growth, driven by stringent energy efficiency regulations, increasing industrial expansion, and a growing emphasis on fire safety worldwide. Emerging economies, infrastructure development, and ongoing R&D into enhanced material properties are key factors shaping its positive future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager