Caramel Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430408 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Caramel Ingredients Market Size

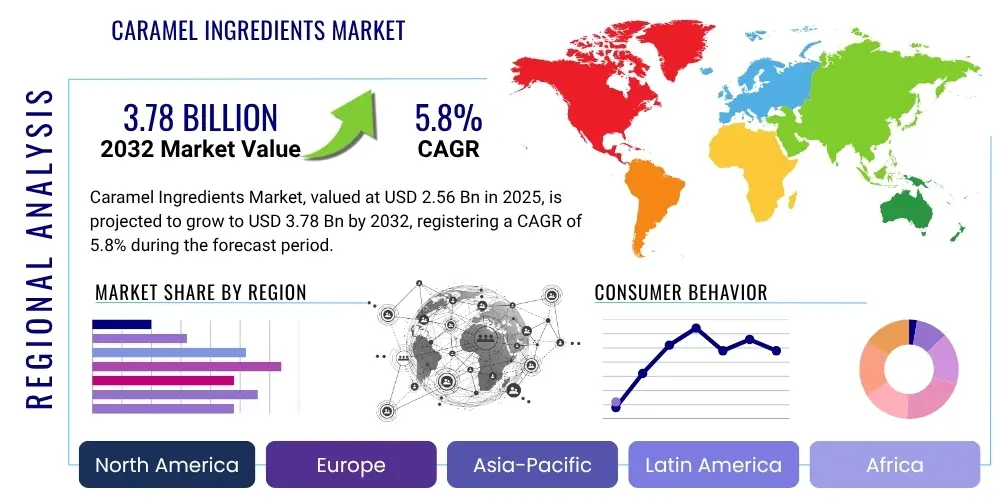

The Caramel Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $2.56 Billion in 2025 and is projected to reach $3.78 Billion by the end of the forecast period in 2032.

Caramel Ingredients Market introduction

The Caramel Ingredients Market encompasses a diverse and essential range of products derived from the controlled thermal processing of various sugars, predominantly sucrose, glucose syrup, or corn syrup. This intricate process of caramelization leads to the formation of a complex mixture of compounds that impart characteristic brown hues, ranging from light amber to deep brown, along with distinctive flavor profiles that can vary from sweet and buttery to slightly bitter and toasted notes. These ingredients are indispensable across the global food and beverage industry, serving as both natural colorants and powerful flavor enhancers. The market includes a wide array of forms such as liquid syrups, solid pieces, and finely ground powders, each engineered to fulfill specific functional and sensory requirements within industrial formulations.

Major applications for caramel ingredients are remarkably broad, spanning nearly every segment of the food and beverage industry. In the confectionery sector, they are fundamental to producing an extensive range of candies, chocolates, nougats, and coatings, contributing essential flavor, color, and textural properties. The bakery industry heavily relies on caramel for enriching cakes, cookies, pastries, bread, and various fillings and glazes. Within the dairy sector, caramel transforms ice creams, yogurts, flavored milks, and desserts into indulgent experiences. Furthermore, beverage manufacturers integrate caramel into specialty coffees, teas, soft drinks, and alcoholic beverages to create unique and appealing flavor dimensions. Their versatility extends to savory applications as well, adding depth and richness to sauces, marinades, and meat glazes, demonstrating their universal appeal.

The core benefits of incorporating caramel ingredients are multi-faceted, driving their sustained demand. Beyond imparting a globally cherished taste and appealing visual aesthetics, they also offer crucial functional properties such as texturization, moisture retention, and improved product stability. Caramel is increasingly favored as a natural alternative to artificial colors and flavors, aligning with contemporary consumer preferences for clean label products. Key market drivers include the consistent global demand for indulgent and comfort food items, the rising consumer awareness and preference for natural and wholesome ingredients, and continuous innovation in food and beverage product development. The adaptability of caramel to various formulations and its perceived authenticity contribute significantly to its market expansion, especially as manufacturers seek to differentiate products in a competitive landscape. This ongoing evolution, driven by both tradition and innovation, firmly establishes caramel ingredients as a cornerstone of modern food production.

Caramel Ingredients Market Executive Summary

The Caramel Ingredients Market is poised for substantial expansion, underpinned by several dynamic business trends. Manufacturers are increasingly prioritizing investment in research and development to innovate new caramel formulations, particularly focusing on healthier alternatives such as reduced-sugar or natural sweetener-based caramel, while maintaining desirable sensory attributes. The drive for clean label solutions is paramount, leading to greater transparency in sourcing and production processes and a preference for minimally processed ingredients. Consolidation through strategic mergers, acquisitions, and partnerships is a notable trend, as companies seek to expand their geographical footprint, diversify product portfolios, and achieve economies of scale. Furthermore, the emphasis on sustainable and ethical sourcing of raw materials, coupled with eco-friendly manufacturing practices, is becoming a critical differentiator for businesses aiming to appeal to environmentally conscious consumers and meet evolving regulatory expectations.

Regional trends reveal a vibrant and geographically diverse growth landscape. The Asia Pacific (APAC) region stands out as the primary growth engine, experiencing significant demand acceleration fueled by rapid urbanization, increasing disposable incomes, and the burgeoning adoption of Western dietary habits. This shift is translating into higher consumption rates for confectionery, bakery products, and convenience foods, creating fertile ground for caramel ingredient suppliers. North America and Europe, while representing mature and saturated markets, continue to demonstrate robust and consistent demand, particularly for premium, artisanal, and specialty caramel products. These regions are also leading the charge in developing functional caramel ingredients and novel applications, often driven by sophisticated consumer demands and strict regulatory frameworks concerning food additives. Latin America also presents promising growth trajectories, supported by its youthful demographic and expanding food processing industries seeking to cater to regional tastes.

Segment trends within the caramel ingredients market highlight specific areas of intensified growth and innovation. There is a discernible shift towards natural caramel color, particularly Class I and Class III, largely influenced by tightening regulatory restrictions on synthetic colorants and a strong consumer preference for ingredients perceived as natural. The liquid caramel segment continues to maintain its market dominance due to its ease of handling and seamless integration into various food and beverage formulations. Concurrently, caramel powders are witnessing a rapid increase in demand, driven by their superior stability, extended shelf life, and convenience in dry mix applications and powdered beverage formulations. Moreover, the market is seeing a surge in demand for specialized flavor profiles, such as gourmet salted caramel, coffee caramel, or spiced caramel, which cater to adventurous consumer preferences and support the premiumization trend across various product categories, from high-end desserts to sophisticated beverages.

AI Impact Analysis on Caramel Ingredients Market

Common user questions and industry concerns regarding the impact of Artificial Intelligence on the Caramel Ingredients Market frequently center on themes of operational optimization, enhanced product development, and supply chain resilience. Stakeholders are particularly interested in how AI can be leveraged to achieve greater consistency in caramelization processes, which are notoriously sensitive to precise temperature and time controls, thereby reducing batch-to-batch variability and minimizing waste. There is also significant curiosity about AI's potential in predicting fluctuations in raw material costs, such as sugar or dairy, to inform more strategic procurement decisions. Furthermore, questions arise concerning AI's ability to analyze vast datasets of consumer preferences and market trends, accelerating the development of novel caramel flavors and formulations that cater to evolving dietary needs like low-sugar or allergen-free options. The overarching expectation is that AI will provide data-driven insights to foster efficiency, sustainability, and innovation across the entire value chain.

- AI-driven process control systems can analyze real-time data from caramelization, ensuring optimal temperature and timing parameters, thereby achieving unparalleled consistency in color, flavor, and texture for every batch.

- Predictive analytics, powered by AI algorithms, can accurately forecast raw material price volatility (e.g., sugar, milk), enabling manufacturers to implement proactive procurement strategies and optimize ingredient sourcing costs.

- AI enhances supply chain management by monitoring logistics, predicting demand fluctuations, identifying potential bottlenecks, and optimizing inventory levels, leading to more resilient and cost-effective operations.

- Accelerated new product development is facilitated by AI through rapid analysis of extensive consumer preference data, ingredient interactions, and market trends, generating insights for innovative caramel flavor profiles and application concepts.

- AI-enabled quality control systems utilize machine vision and sensor technology to detect subtle deviations in caramel attributes (e.g., color, viscosity) with high precision, surpassing human capabilities and ensuring superior product integrity.

- Sustainability initiatives are bolstered by AI through the optimization of energy consumption in manufacturing processes, reduction of food waste, and identification of opportunities for more resource-efficient caramel ingredient production.

- Personalized product development gains traction with AI, allowing manufacturers to cater to niche markets or individual preferences by recommending specific caramel formulations that meet unique dietary or sensory requirements.

- Market intelligence and competitive analysis are significantly improved as AI can process and interpret vast amounts of market data, providing strategic insights into competitor activities, emerging trends, and untapped market opportunities.

DRO & Impact Forces Of Caramel Ingredients Market

The Caramel Ingredients Market is significantly influenced by a powerful combination of driving forces that continuously propel its growth and expansion. A primary driver is the enduring and widespread global consumer demand for indulgent and sensory-rich food and beverage products, where caramel, with its rich flavor and appealing color, serves as a universal favorite. The robust expansion of the confectionery, bakery, and dairy industries worldwide, particularly in rapidly developing economies, directly translates into increased demand for high-quality caramel ingredients for a myriad of products, from everyday staples to gourmet offerings. Furthermore, a critical impetus stems from the burgeoning consumer preference for natural and clean label ingredients; caramel, when conventionally produced, is often perceived as a natural alternative to synthetic colorants and flavorings, aligning perfectly with this health-conscious trend. The intrinsic versatility of caramel in imparting distinct characteristics across diverse applications, from liquid syrups in beverages to solid inclusions in desserts, consistently encourages innovation and market penetration across various food categories.

Despite robust growth, the market also navigates several notable restraints that pose challenges for manufacturers. A significant constraint arises from the global trend towards healthier eating habits and the intensified focus on sugar reduction initiatives. As caramel is fundamentally a sugar-based product, this shift necessitates substantial investment in research and development to formulate low-sugar, sugar-free, or alternative sweetener-based caramel options that can mimic the sensory attributes of traditional caramel without the high sugar content, a process that is often complex and costly. Another persistent challenge is the inherent volatility in the prices of key raw materials such as sugar, dairy products, and glucose syrups. These price fluctuations can severely impact production costs and subsequently squeeze profit margins for caramel ingredient manufacturers. Additionally, managing increasingly intricate and globalized supply chains, including logistical hurdles and ensuring consistent quality control for natural raw materials, presents considerable operational complexities and compliance burdens.

Notwithstanding these restraints, the Caramel Ingredients Market abounds with promising opportunities that market players can leverage for sustained growth. The burgeoning demand for premium and gourmet food products across developed and emerging markets presents a fertile ground for specialized and artisanal caramel ingredients, such as sophisticated salted caramel varieties, smoked caramel, or those infused with unique botanicals, catering to discerning consumer tastes. Expansion into high-growth emerging economies, particularly across the Asia Pacific and Latin American regions, represents a substantial avenue for market penetration, driven by rising disposable incomes, evolving dietary habits, and increasing urbanization. The continuous development of functional caramel ingredients, designed to offer additional benefits like improved stability, enhanced nutritional profiles, or specific textural functionalities, alongside innovations in clean label and allergen-free formulations, unlocks significant market potential. Moreover, advancements in processing technologies and encapsulation methods can further enhance the shelf life, application versatility, and cost-effectiveness of caramel ingredients, opening new product development possibilities.

Impact forces on the market are broad and dynamic, encompassing socio-economic, regulatory, technological, and environmental factors. Shifting consumer dietary patterns, including preferences for plant-based diets or specific health-related choices, directly influence product development strategies. Increased regulatory scrutiny on food additives, labeling transparency, and nutritional claims, varying significantly by region, mandates continuous adaptation from manufacturers to ensure compliance and consumer trust. Economic fluctuations, geopolitical tensions, and global trade dynamics can disrupt raw material sourcing, impact logistical operations, and influence consumer purchasing power, thereby affecting market stability. Furthermore, rapid technological advancements in food processing, analytical techniques, and digital connectivity continue to redefine product capabilities and production efficiencies, while growing environmental concerns about sustainable sourcing, waste reduction, and carbon footprint are increasingly shaping corporate social responsibility initiatives and consumer brand loyalty within the caramel ingredients sector.

Segmentation Analysis

The Caramel Ingredients Market undergoes comprehensive segmentation to dissect its intricate dynamics, understand consumer preferences, and identify specific growth trajectories across various product categories and applications. This detailed market breakdown is critical for stakeholders to gain a granular view of where demand is concentrated, how different ingredient characteristics are valued, and which segments offer the most lucrative opportunities for investment and expansion. The segmentation reflects the multifaceted utility of caramel across the food and beverage industry, serving not only as a primary coloring agent but also as a versatile flavor enhancer and a key contributor to product texture and mouthfeel. By analyzing these distinct segments, companies can tailor their product offerings, optimize their manufacturing processes, and develop targeted marketing strategies to effectively capture market share and respond to evolving industry needs and consumer demands.

- By Type:

- Caramel Color (Class I Plain Caramel, Class II Caustic Sulfite Caramel, Class III Ammonia Caramel, Class IV Sulfite Ammonia Caramel)

- Caramel Flavor (Derived from natural sources, created through artificial synthesis to mimic caramel notes)

- Caramelized Sugar Syrup (Pure caramelized sugar without additional processing agents, offering a milder flavor and lighter color)

- By Form:

- Liquid (Syrups and pastes, widely used for ease of dispersion in beverages and liquid formulations)

- Solid (Pieces, chips, flakes, or chunks, often used as inclusions in confectionery, bakery, and dairy products for textural contrast)

- Powder (Granulated or finely milled forms, preferred for dry mixes, seasonings, and applications requiring extended shelf life and precise dosing)

- By Application:

- Confectionery (Candies, chocolates, fudge, chews, nougats, and coatings, where caramel provides core flavor and texture)

- Bakery (Cakes, pastries, cookies, bread, muffins, tarts, and various fillings, glazes, and toppings)

- Dairy (Ice cream, yogurt, flavored milk, milkshakes, custards, puddings, and other dessert preparations)

- Beverages (Soft drinks, alcoholic beverages, coffee and tea mixes, specialty drinks, and flavored water)

- Sauces & Dressings (Sweet sauces, dessert toppings, savory sauces, glazes for meats, and salad dressings)

- Snacks & Cereals (Granola bars, snack mixes, breakfast cereals, popcorn, and various coated snack items)

- Other Applications (Pharmaceuticals, animal feed, processed meats, and savory prepared meals)

- By Function:

- Coloring Agent (Providing stable and diverse shades of brown to enhance visual appeal)

- Flavoring Agent (Imparting sweet, buttery, or toasted notes that are highly versatile)

- Topping & Filling (Used as a textural and flavor component in and on various food products)

- Texturizer (Contributing to viscosity, mouthfeel, and body in liquid and semi-solid applications)

- Stabilizer (Offering some degree of emulsion stability and moisture retention in certain formulations)

- By Source:

- Sugar (Derived from conventional sucrose)

- Glucose Syrup (From corn, wheat, or potato starch, providing varied sweetness and functional properties)

- Corn Syrup (A common glucose syrup variant, widely used in North America)

- Alternative Sweeteners (Caramel made from date sugar, coconut sugar, fruit extracts, or sugar alcohols for health-conscious products)

Value Chain Analysis For Caramel Ingredients Market

The value chain for the Caramel Ingredients Market initiates with the crucial upstream supply of foundational raw materials, which are predominantly various forms of sugars such as sucrose (from sugar beet or sugarcane), glucose syrup, and corn syrup. Additionally, for specialized caramel formulations, dairy products like milk and butter, along with other minor ingredients and processing aids, are sourced. Key players at this initial stage include large-scale agricultural producers, sugar refineries, and starch processors responsible for converting raw agricultural produce into refined sugar or glucose solutions. The consistent quality, availability, and stable pricing of these base ingredients are paramount, as they directly influence the final sensory and functional characteristics of the caramel product. Upstream analysis focuses intensely on developing robust supplier relationships, implementing stringent quality assurance protocols, and exploring sustainable sourcing practices to mitigate supply risks and manage cost fluctuations effectively within an often volatile commodity market.

The core manufacturing and processing stage forms the heart of the caramel ingredients value chain, where the transformation of raw sugars into diverse caramel forms takes place. This involves sophisticated thermochemical reactions under precisely controlled conditions of temperature, pressure, and time, which are critical for achieving the desired color intensity, flavor profile, and functional properties (e.g., viscosity, pH stability) specific to each caramel type. Manufacturers employ advanced processing equipment, including specialized reactors and heat exchangers, alongside continuous monitoring systems to ensure batch consistency and product safety. Significant investment in research and development is typical at this stage to innovate new caramel solutions, such as clean label variants, reduced-sugar options, or specialty flavors. This R&D also includes developing new methods for enhanced shelf life, stability, and ease of application. Downstream activities primarily encompass the distribution and integration of these finished caramel ingredients into a vast array of consumer food and beverage products by industrial clients.

The distribution channels for caramel ingredients are strategically structured to ensure efficient delivery to a diverse client base, encompassing both direct and indirect models. For large-volume industrial buyers, such as multinational food and beverage corporations, direct distribution is often favored. This involves dedicated sales teams, technical support specialists, and customized logistics to facilitate bulk orders, provide tailored solutions, and foster strong, long-term client relationships. This direct engagement allows for deep collaboration on product development and application. Conversely, indirect distribution channels utilize a network of specialized food ingredient distributors. These intermediaries play a vital role in serving small to medium-sized enterprises (SMEs) and reaching geographically dispersed markets. Distributors often manage warehousing, logistics, and offer local technical support, enabling manufacturers to extend their market reach without extensive direct infrastructure. The effectiveness of these multi-faceted distribution strategies is crucial for ensuring timely delivery, maintaining ingredient integrity, and achieving broad market penetration, thereby optimizing the overall efficiency of the caramel ingredients value chain.

Caramel Ingredients Market Potential Customers

The potential customer base for the Caramel Ingredients Market is remarkably broad and diverse, extending across nearly all segments of the global food and beverage industry due to caramel's inherent versatility in enhancing flavor, color, and texture. Primarily, these customers are large-scale industrial food manufacturers who incorporate caramel into their extensive product lines to meet a consistent consumer demand for indulgent, aesthetically pleasing, and flavor-rich food items. These manufacturers operate in highly competitive environments and require high-quality, consistent, and often customized caramel solutions to differentiate their products. Understanding the specific functional requirements, regulatory compliance needs, and innovation priorities of each customer segment is paramount for caramel ingredient suppliers to successfully tailor their offerings, build robust commercial relationships, and foster long-term partnerships based on reliability and technical expertise.

Key segments of potential customers include prominent players in the confectionery industry, which utilizes caramel extensively in the production of a wide array of candies, chocolates, caramels (as standalone products), nougats, and various coatings and fillings. The bakery sector represents another substantial customer base, with manufacturers integrating caramel into cakes, pastries, cookies, bread, and an assortment of glazes, frostings, and fillings. Dairy product manufacturers are also significant buyers, leveraging caramel to enhance the appeal and flavor profile of ice creams, yogurts, flavored milks, custards, and other dessert innovations. Furthermore, beverage companies are increasingly incorporating caramel for its coloring and flavoring attributes in soft drinks, alcoholic beverages, ready-to-drink coffee and tea products, and specialty beverages, seeking to create unique and appealing sensory experiences for consumers. The expanding applications in savory food products, such as glazes for meats, marinades, and specialized sauces, further broaden the potential customer landscape.

These diverse customers are not merely seeking bulk ingredients but often require innovative solutions that align with evolving consumer preferences, such as clean label formulations, natural colorants, reduced sugar content, or allergen-free options. Consequently, caramel ingredient suppliers must actively engage with the research and development departments of these food producers, offering technical support, co-creation opportunities, and customized product development. The foodservice sector, encompassing restaurants, cafes, hotels, and catering services, also constitutes a rapidly growing customer segment, particularly for ready-to-use caramel sauces, toppings, and flavorings for desserts and specialty beverages. The dynamic and ever-evolving nature of these end-user industries ensures a continuous and robust demand for high-quality, innovative caramel ingredients, making strategic customer relationship management, ongoing product innovation, and deep market insights crucial competitive advantages for suppliers in this thriving market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.56 Billion |

| Market Forecast in 2032 | $3.78 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., Kerry Group plc, Sethness Products Company, DDW The Color House, Chr Hansen Holding A/S, Sensient Technologies Corporation, Givaudan SA, ADM (Archer Daniels Midland Company), Firmenich International SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Tate & Lyle PLC, Barry Callebaut AG, Roquette Freres, W. R. Grace & Co., Nigay S.A., Döhler GmbH, A.M. Todd Company, Naturex S.A. (part of Givaudan), SVZ International B.V., Diana Food (Symrise AG), Fooding Group Limited, Colorcon Inc., San-Ei Gen F.F.I., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Caramel Ingredients Market Key Technology Landscape

The Caramel Ingredients Market is significantly shaped by an evolving technological landscape that aims to enhance production efficiency, ensure superior product quality, and expand the functional versatility of caramel across diverse applications. Traditional caramelization processes, while foundational, are now augmented by sophisticated automation and sensor technologies. These advancements allow for exceptionally precise control over critical parameters such as temperature, pressure, and reaction time, which are vital for consistently achieving desired color intensities, nuanced flavor profiles, and specific functional properties (e.g., pH stability, viscosity). Modern manufacturing facilities leverage advanced process monitoring systems to minimize batch-to-batch variations, reduce waste, and improve scalability, directly impacting cost-effectiveness and product reliability in a competitive market environment.

Beyond the fundamental caramelization process, cutting-edge technologies like enzyme modification and advanced encapsulation techniques are increasingly being integrated. Enzyme technology, for instance, can be employed to precisely alter sugar substrates, enabling the creation of tailored caramel characteristics such as lower sugar content without compromising on taste or texture, or caramels with enhanced solubility. Encapsulation methods, prominently including spray drying, co-crystallization, and extrusion, are instrumental in producing highly stable caramel powders and encapsulated flavorings. These techniques effectively protect volatile flavor compounds from degradation due to heat, light, or moisture, thereby extending shelf life and improving flavor retention. Such advancements facilitate the incorporation of caramel into dry mixes, snack coatings, and other applications where liquid forms might present stability or processing challenges, significantly broadening application possibilities.

Furthermore, the integration of advanced analytical and data-driven technologies is becoming standard practice throughout the caramel ingredients value chain. High-performance analytical tools such as spectroscopy (e.g., NIR, UV-Vis) and chromatography are deployed for real-time quality control, enabling manufacturers to monitor chemical reactions, detect impurities, and ensure stringent product specifications are met from raw material intake to finished product. The application of artificial intelligence and machine learning is also gaining traction, particularly for predictive analytics related to market trends, consumer preferences, and optimizing production parameters. This data-centric approach supports accelerated new product development, improved supply chain resilience, and enhanced decision-making. Moreover, there is an increasing focus on sustainable manufacturing technologies that reduce energy consumption, minimize water usage, and decrease the overall environmental footprint of caramel ingredient production, aligning with global sustainability goals and consumer expectations for eco-conscious products.

Regional Highlights

- North America: A mature and significant market, characterized by high consumer demand for confectionery, bakery, dairy, and beverage products. The region shows a strong trend towards innovative flavor combinations, with salted caramel being exceptionally popular, and a growing emphasis on natural, clean label, and premium quality caramel ingredients. The presence of major food processing giants drives consistent demand for technologically advanced and customized caramel solutions.

- Europe: A well-established market segment, particularly driven by Western European countries, which exhibit a high demand for premium and artisanal food products. Regulatory frameworks are stringent concerning food additives, thus fostering a robust market for natural caramel colors (especially Class I and Class III) and clean label caramel solutions. Innovation in healthier caramel options, such as those with reduced sugar or natural sourcing, is a key regional trend.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally for caramel ingredients, largely propelled by rapid urbanization, substantial increases in disposable income, and the gradual adoption of Western dietary patterns. Countries like China, India, Japan, and Southeast Asian nations are witnessing explosive growth in their domestic food and beverage manufacturing sectors, leading to a surge in demand for both traditional and innovative caramel ingredients across all applications.

- Latin America: This region demonstrates consistent and promising growth, underpinned by a burgeoning middle class, an expanding domestic food processing industry, and a deep cultural affinity for sweet and indulgent products. Brazil and Mexico stand out as key markets, with increasing consumption of confectionery, dairy, and beverage items that heavily utilize caramel for flavor and color. Localized product development catering to regional taste preferences is a crucial aspect of market expansion here.

- Middle East and Africa (MEA): An emerging market experiencing incremental growth, influenced by rising population densities, ongoing urbanization, and the expanding presence of international food brands. Opportunities in MEA exist primarily through localized product offerings that align with regional culinary traditions and taste preferences. However, market penetration can be nuanced due to varying economic conditions, consumer purchasing powers, and logistical challenges across the diverse countries within this extensive region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Caramel Ingredients Market.- Cargill Inc.

- Kerry Group plc

- Sethness Products Company

- DDW The Color House

- Chr Hansen Holding A/S

- Sensient Technologies Corporation

- Givaudan SA

- ADM (Archer Daniels Midland Company)

- Firmenich International SA

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Tate & Lyle PLC

- Barry Callebaut AG

- Roquette Freres

- W. R. Grace & Co.

- Nigay S.A.

- Döhler GmbH

- A.M. Todd Company

- Naturex S.A. (part of Givaudan)

- SVZ International B.V.

- Diana Food (Symrise AG)

- Fooding Group Limited

- Colorcon Inc.

- San-Ei Gen F.F.I., Inc.

Frequently Asked Questions

What are the primary types of caramel ingredients and their key uses?

The primary types of caramel ingredients include Caramel Color (classified into Class I, II, III, and IV based on their production process and color intensity), Caramel Flavor (available as natural or artificial variants to provide specific taste notes), and Caramelized Sugar Syrup. Caramel Color is predominantly used for its natural brown hues in beverages and savory foods, while Caramel Flavor enhances the taste in confectionery and dairy. Caramelized Sugar Syrup offers a milder flavor and lighter color, used in a broader range of applications.

Which industries are the largest consumers of caramel ingredients and why?

The confectionery, bakery, and dairy industries are consistently the largest consumers of caramel ingredients. These sectors heavily rely on caramel for its ability to provide appealing natural brown colors, versatile sweet and sometimes savory flavor profiles, and textural contributions (such as viscosity and chewiness) that are crucial for product development and consumer acceptance in items like candies, chocolates, cakes, ice creams, and yogurts.

How is the clean label trend impacting the caramel ingredients market and product development?

The clean label trend is profoundly influencing the caramel ingredients market by driving a significant shift towards natural caramel colors (particularly Class I and Class III) and formulations with simple, recognizable ingredient lists. Manufacturers are increasingly focusing on transparent sourcing, minimal processing, and avoiding artificial additives, which directly impacts product development towards natural and wholesome caramel solutions that resonate with health-conscious consumers and comply with evolving regulatory standards.

What are the key drivers for growth in the caramel ingredients market over the forecast period?

Key drivers for market growth include the robust global demand for indulgent and comfort food products, the growing consumer preference for natural flavors and colors as alternatives to synthetic additives, continuous innovation within the food and beverage industry leading to new applications, and the significant expansion of key application sectors like confectionery, bakery, and dairy, especially in fast-growing emerging economies worldwide.

What role does technology play in modern caramel ingredient production and innovation?

Technology plays a critical and transformative role in modern caramel ingredient production and innovation. This encompasses advanced process control systems for precise caramelization (ensuring consistent color and flavor), enzyme technology for modifying sugar substrates to create healthier options, and encapsulation techniques for improving the stability and shelf life of caramel powders. Furthermore, data analytics and AI are increasingly used for predictive modeling, optimizing raw material sourcing, and accelerating new product development based on consumer trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager