Cargo Drones Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430612 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cargo Drones Market Size

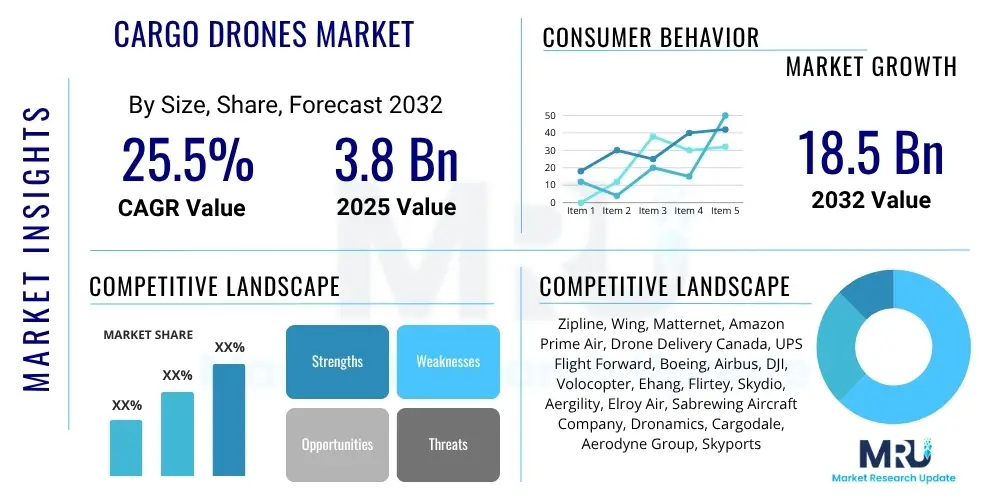

The Cargo Drones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2025 and 2032. The market is estimated at $3.8 billion in 2025 and is projected to reach $18.5 billion by the end of the forecast period in 2032.

Cargo Drones Market introduction

The Cargo Drones Market encompasses the development, manufacturing, and deployment of unmanned aerial vehicles (UAVs) specifically designed for the transportation of goods. These drones vary in size and payload capacity, ranging from small drones for last-mile delivery of lightweight parcels to large, heavy-lift platforms capable of moving significant quantities of cargo across longer distances. The core product offering includes the drone hardware, associated software for flight management, navigation, and logistics integration, as well as ground infrastructure like charging stations and automated loading/unloading systems. These sophisticated aerial vehicles leverage advanced autonomy, navigation, and propulsion technologies to carry out their tasks efficiently and safely.

Major applications for cargo drones span a diverse range of industries, fundamentally transforming traditional logistics and supply chain operations. They are increasingly utilized in e-commerce for rapid last-mile delivery, especially in urban and remote areas where ground transportation is inefficient or challenging. Furthermore, cargo drones are proving invaluable in healthcare for delivering medical supplies, vaccines, and blood samples, particularly in emergencies or to underserved regions. Industrial applications include the transport of critical parts within large facilities or construction sites, while military and defense sectors employ them for tactical resupply and logistics in contested environments. Humanitarian aid organizations also leverage these drones to deliver essentials to disaster-stricken or inaccessible zones, offering a faster and safer alternative to conventional methods.

The benefits derived from adopting cargo drone technology are substantial, driving significant interest and investment in the sector. These benefits include enhanced speed and efficiency in delivery, drastically reducing transit times, especially for urgent shipments. They offer significant cost-effectiveness by minimizing labor costs, fuel expenses associated with traditional transport, and infrastructure requirements. Cargo drones can access remote or difficult-to-reach locations with ease, expanding the reach of logistics networks. Moreover, they contribute to environmental sustainability through electric propulsion, lowering carbon emissions compared to road-based transport. Key driving factors propelling market growth include the explosive growth of e-commerce, increasing demand for rapid and on-demand delivery services, advancements in drone technology (such as improved battery life and autonomous capabilities), and evolving regulatory frameworks that are gradually permitting broader operational scopes, thereby unlocking new opportunities for deployment.

Cargo Drones Market Executive Summary

The Cargo Drones Market is experiencing robust growth driven by significant advancements in automation, artificial intelligence, and battery technology, alongside a burgeoning e-commerce sector that demands increasingly efficient and rapid delivery solutions. Business trends indicate a strong focus on strategic partnerships between drone manufacturers, logistics providers, and technology firms to build integrated delivery ecosystems. There is also a notable shift towards developing specialized heavy-lift drones for industrial and military logistics, complementing the established last-mile delivery segment. Furthermore, the market is characterized by substantial venture capital investments in startups innovating across the drone value chain, from hardware design to sophisticated airspace management software, reflecting confidence in the long-term viability and transformative potential of drone logistics. Companies are actively pursuing regulatory approvals and establishing pilot programs to demonstrate the safety and efficiency of their systems, crucial for widespread adoption.

Regionally, North America and Europe currently dominate the market, propelled by proactive regulatory environments, significant technological R&D, and the presence of major logistics and e-commerce players actively integrating drone solutions into their operations. These regions benefit from established infrastructure for testing and deployment, along with a strong customer base receptive to innovative delivery methods. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by its vast geographical expanse, dense populations, and the aggressive expansion of e-commerce platforms, particularly in countries like China, India, and Australia. Latin America, the Middle East, and Africa are also showing promising potential, especially for addressing logistical challenges in remote areas, humanitarian aid, and specialized industrial applications, although regulatory frameworks and infrastructure development are still in nascent stages, presenting both opportunities and hurdles for market penetration.

Segment trends highlight the increasing importance of both payload capacity and operational range. While lightweight drones for last-mile delivery remain a significant segment, there is a growing demand for medium to heavy-lift cargo drones capable of transporting larger payloads over longer distances, crucial for hub-to-hub logistics and industrial applications. The application segment sees logistics and transportation, along with healthcare and medical deliveries, as primary growth drivers, benefiting from the drones' ability to bypass ground traffic and deliver critical items swiftly. Technological advancements in autonomous navigation, beyond visual line of sight (BVLOS) operations, and robust communication systems are crucial enablers for the expansion of these segments. The integration of cargo drones into existing supply chains, supported by advanced fleet management and unmanned traffic management (UTM) systems, is a key trend shaping future market development, promising a more efficient and resilient global logistics infrastructure.

AI Impact Analysis on Cargo Drones Market

User inquiries about AI's impact on the Cargo Drones Market predominantly revolve around how artificial intelligence can enhance autonomy, safety, and efficiency while also addressing concerns regarding regulatory frameworks, job displacement, and data security. Common questions explore how AI contributes to advanced navigation, obstacle avoidance, and decision-making capabilities, making drone operations more reliable and scalable. There is keen interest in AI's role in optimizing flight paths, managing complex airspace, and enabling sophisticated fleet management for large-scale operations. Users also express curiosity about predictive maintenance powered by AI to ensure drone reliability and extend operational lifespans, alongside the potential for AI-driven data analysis to improve logistics planning and inventory management. Concerns often focus on the ethical implications of autonomous decision-making, the security of AI systems against cyber threats, and the potential impact on human employment within traditional logistics roles.

- Autonomous navigation and intelligent path planning for optimized routes.

- Advanced obstacle detection and avoidance capabilities in complex environments.

- Real-time sensor data analysis for dynamic decision-making during flight.

- Predictive maintenance schedules for drone components, enhancing reliability.

- Enhanced fleet management and coordination for large-scale drone operations.

- Machine learning for optimizing payload distribution and flight performance.

- AI-driven anomaly detection to prevent failures and ensure flight safety.

- Swarm intelligence for collaborative and efficient multi-drone deliveries.

- Automated compliance with evolving air traffic regulations and geo-fencing.

- Improved package identification, loading, and unloading automation.

- Data analytics for demand forecasting and supply chain optimization.

DRO & Impact Forces Of Cargo Drones Market

The Cargo Drones Market is significantly influenced by a dynamic interplay of driving forces, restraining factors, and emerging opportunities. Key drivers include the exponential growth of the e-commerce sector, which necessitates faster and more flexible delivery solutions, particularly in urban and remote areas. The rising demand for rapid, on-demand logistics, coupled with increasing labor costs for traditional delivery services, makes autonomous drone operations an attractive alternative. Furthermore, continuous technological advancements in battery life, propulsion systems, sensor technology, and artificial intelligence are enhancing drone capabilities, making them more efficient, safer, and capable of handling larger payloads and longer distances. Government support through pilot programs, regulatory sandboxes, and investments in drone infrastructure also plays a crucial role in fostering market expansion, encouraging innovation and widespread adoption.

However, several significant restraints challenge the widespread deployment and scalability of cargo drone operations. The most prominent hurdle is the complex and evolving regulatory landscape, particularly regarding Beyond Visual Line of Sight (BVLOS) operations and integration into national airspace. Air traffic management systems require substantial upgrades to safely accommodate a high volume of drone traffic alongside manned aircraft. Public perception and acceptance remain a concern, often influenced by privacy issues, noise pollution, and safety anxieties. Other challenges include limitations in drone payload capacity and battery life for longer routes, the high initial capital investment required for drone fleet acquisition and infrastructure development, and vulnerabilities related to cybersecurity and potential misuse of drones. Addressing these technical, regulatory, and social barriers is critical for the market to realize its full potential.

Despite the challenges, the market presents substantial opportunities that could accelerate its growth trajectory. The integration of cargo drones into existing supply chain logistics offers significant efficiency gains and cost reductions for businesses. Emerging applications in humanitarian aid, emergency response, and medical deliveries (e.g., organ transport, vaccine distribution) highlight the drones' capacity to save lives and improve accessibility in critical situations. The development of urban air mobility (UAM) concepts, where cargo drones could share airspace with passenger drones, points to a future integrated logistics and transportation network. Furthermore, specialized deliveries for niche markets such as offshore oil and gas platforms, mining operations, and construction sites, where traditional logistics are expensive and hazardous, offer lucrative avenues for growth. As regulatory frameworks mature and technological capabilities advance, these opportunities are expected to unlock new market segments and drive substantial investment.

Segmentation Analysis

The Cargo Drones Market is extensively segmented to provide a detailed understanding of its diverse applications, technological specifications, and end-user demands. These segmentations allow for a granular analysis of market trends, competitive landscapes, and growth opportunities across various categories, enabling stakeholders to identify specific niches and tailor strategies effectively. The market is primarily segmented by type, differentiating between the aerodynamic characteristics and operational capabilities of different drone designs. Further segmentation occurs based on the drone's payload capacity, which directly influences its utility for various cargo sizes, and its operational range, defining its suitability for short-distance last-mile deliveries versus longer inter-city transport. Applications and end-use categories highlight the industries and sectors that are the primary adopters of cargo drone technology, reflecting distinct operational requirements and market drivers.

- Type

- Fixed-Wing

- Rotary-Wing

- Hybrid

- Payload Capacity

- Less than 10 kg

- 10 kg to 50 kg

- 50 kg to 100 kg

- More than 100 kg

- Range

- Short-Range (Under 50 km)

- Mid-Range (50 km to 200 km)

- Long-Range (Over 200 km)

- Application

- Logistics and Transportation

- Healthcare and Medical

- Retail and E-commerce

- Military and Defense

- Construction

- Agriculture

- Oil and Gas

- Others (e.g., Mining, Utilities)

- End-Use

- Commercial

- Government and Defense

- Operation Mode

- Beyond Visual Line of Sight (BVLOS)

- Visual Line of Sight (VLOS)

Value Chain Analysis For Cargo Drones Market

The value chain for the Cargo Drones Market is complex and encompasses multiple stages, from raw material sourcing and component manufacturing to drone assembly, software integration, operational deployment, and aftermarket services. Upstream activities involve the procurement of specialized materials such as lightweight composites, advanced alloys, and high-performance plastics for airframes, along with critical electronic components. This stage includes suppliers of specialized sensors (LiDAR, thermal, optical), high-capacity batteries (Li-ion, solid-state), efficient electric motors and propulsion systems, advanced avionics, and communication modules (5G, satellite connectivity). Manufacturers in this segment face intense competition and significant R&D costs to innovate and meet the rigorous demands for performance, reliability, and safety required in aerial logistics.

Midstream activities are dominated by drone manufacturers and system integrators who design, assemble, and test the complete cargo drone platforms. This includes integrating hardware components with sophisticated flight management systems, artificial intelligence algorithms for autonomous navigation and decision-making, and robust cybersecurity protocols. Software developers play a pivotal role in this segment, creating proprietary flight control software, mission planning tools, fleet management platforms, and unmanned traffic management (UTM) solutions that are essential for safe and scalable operations. System integrators often customize standard drone platforms to meet specific customer requirements, such as payload capacity, environmental resilience, or specialized delivery mechanisms, adding significant value by ensuring seamless functionality across all integrated systems.

Downstream in the value chain, the focus shifts to the operational deployment and utilization of cargo drones by end-users. This segment includes logistics service providers, e-commerce giants, healthcare networks, military organizations, and humanitarian aid groups who leverage these drones for their specific delivery needs. Distribution channels are varied, with direct sales to large corporate clients or government entities being common for custom or high-value drone systems. Indirect channels involve partnerships with third-party logistics (3PL) providers who integrate drone services into their broader supply chain offerings, or collaborations with local delivery networks that manage last-mile operations. Post-sales support, including maintenance, repair, overhaul (MRO) services, software updates, and pilot training, forms a crucial part of the downstream value chain, ensuring sustained operational efficiency and safety for the deployed drone fleets.

Cargo Drones Market Potential Customers

The Cargo Drones Market targets a broad spectrum of end-users and buyers across various industries, each seeking to leverage drone technology for enhanced logistical efficiency, cost reduction, or access to challenging locations. E-commerce companies represent a primary customer segment, driven by the imperative to offer faster, more reliable, and often same-day delivery services, especially for lightweight parcels in urban and suburban areas. Their objective is to meet evolving consumer expectations for speed and convenience, thereby gaining a competitive edge in a highly dynamic retail landscape. These companies often invest heavily in pilot programs and infrastructure to integrate drone delivery into their existing fulfillment networks, seeking to optimize their last-mile operations and reduce dependence on traditional ground transportation methods.

Logistics and transportation companies are another significant customer base, including major postal services, express couriers, and freight forwarders. These entities are interested in cargo drones for optimizing hub-to-hub transfers, accessing remote or rural delivery points, and reducing operational costs associated with conventional delivery fleets. Drones offer a viable solution for overcoming traffic congestion, extending delivery windows, and improving service quality in regions where ground infrastructure is insufficient or costly to maintain. Furthermore, specialized logistics providers serving industries like oil and gas, mining, and construction are exploring cargo drones for transporting critical equipment, spare parts, and urgent supplies to isolated sites, minimizing human risk and reducing transit times in hazardous environments.

Healthcare and medical organizations are rapidly emerging as key potential customers due to the critical nature of their deliveries. Hospitals, clinics, pharmaceutical companies, and humanitarian aid agencies utilize cargo drones for the rapid transport of vaccines, blood samples, organs for transplant, diagnostic tests, and essential medical supplies to remote communities, disaster zones, or between medical facilities. This application is particularly impactful in saving lives and improving public health outcomes where traditional transport methods are too slow or impractical. Lastly, government and defense agencies represent a substantial segment, deploying cargo drones for military resupply in tactical operations, disaster relief efforts, border patrol support, and other critical logistical tasks that demand speed, precision, and the ability to operate in challenging or hostile environments, thereby enhancing operational readiness and safety for personnel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $3.8 Billion |

| Market Forecast in 2032 | $18.5 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zipline, Wing, Matternet, Amazon Prime Air, Drone Delivery Canada, UPS Flight Forward, Boeing, Airbus, DJI, Volocopter, Ehang, Flirtey, Skydio, Aergility, Elroy Air, Sabrewing Aircraft Company, Dronamics, Cargodale, Aerodyne Group, Skyports |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cargo Drones Market Key Technology Landscape

The Cargo Drones Market is profoundly shaped by a rapidly advancing technological landscape, with innovations across several critical domains enhancing performance, safety, and scalability. Artificial intelligence and machine learning are central to enabling advanced autonomy, facilitating intelligent path planning, dynamic obstacle avoidance, and real-time decision-making during flight, crucial for complex operational environments. Coupled with advanced navigation systems such as high-precision GPS, Inertial Navigation Systems (INS), and Real-Time Kinematic (RTK) positioning, drones can achieve centimeter-level accuracy, essential for precise delivery and safe landing. Sensor fusion technology, integrating data from various sensors like LiDAR, radar, cameras, and ultrasonic sensors, provides comprehensive environmental awareness, enabling drones to operate safely in diverse weather conditions and cluttered airspaces, significantly improving reliability and mission success rates.

Power and propulsion systems represent another vital area of innovation. Advances in battery technology, including higher energy density lithium-ion batteries and emerging solid-state battery solutions, are extending flight duration and increasing payload capacities, addressing a major limitation for widespread adoption. The development of efficient electric and hybrid propulsion systems not only contributes to longer ranges and heavier lifts but also aligns with environmental sustainability goals by reducing carbon emissions and noise pollution. Communication systems are equally critical, with the integration of 5G cellular connectivity and satellite communication ensuring reliable, low-latency data exchange for Beyond Visual Line of Sight (BVLOS) operations, enabling real-time monitoring and control of drones over vast distances, which is fundamental for large-scale commercial deployments.

Furthermore, the development of sophisticated Unmanned Traffic Management (UTM) systems is paramount for integrating cargo drones safely into national airspace alongside manned aircraft. These systems leverage advanced algorithms for airspace deconfliction, flight authorization, and real-time traffic monitoring, ensuring operational safety and efficiency for a growing number of drone flights. Cybersecurity measures are also a core component of the technology landscape, protecting drones from hacking, data breaches, and unauthorized access, which is critical for maintaining the integrity of sensitive cargo and operational data. The adoption of blockchain technology for supply chain transparency and traceability is also gaining traction, offering secure and verifiable records for cargo movement, enhancing trust and efficiency in drone-based logistics networks.

Regional Highlights

- North America: This region stands as a leader in cargo drone adoption, driven by significant investments in R&D, a strong presence of key technology players, and a relatively progressive regulatory environment, particularly in the United States and Canada. Pilot programs and commercial operations for last-mile delivery and specialized cargo transport are expanding rapidly, supported by favorable government initiatives and private sector funding. The region benefits from robust e-commerce growth and a demand for innovative logistics solutions, pushing the boundaries of BVLOS operations and urban air mobility concepts.

- Europe: Europe is characterized by a cautious yet determined approach to cargo drone integration, with a strong emphasis on safety and stringent regulatory frameworks from EASA. Countries like the UK, Germany, and France are actively engaged in urban air mobility projects and testing drone delivery services, focusing on medical logistics, industrial applications, and intra-city parcel delivery. Research and development in advanced drone technology and UTM systems are robust, aiming for seamless integration into European airspace, though public acceptance and noise concerns remain key considerations.

- Asia Pacific (APAC): The APAC region is poised for explosive growth, fueled by its vast geographical expanse, burgeoning e-commerce markets, and increasing demand for efficient logistics in densely populated and remote areas. Countries such as China, India, Australia, and Japan are investing heavily in drone technology, infrastructure, and regulatory frameworks. China, in particular, is a global leader in drone manufacturing and is rapidly scaling drone delivery networks. The region presents immense opportunities for both last-mile and heavy-lift cargo drone applications, especially for connecting underserved communities and optimizing complex supply chains.

- Latin America: This region is an emerging market for cargo drones, primarily driven by applications in agriculture, mining, and humanitarian aid. Drones offer a cost-effective solution for reaching remote areas with limited infrastructure, delivering essential goods and medical supplies. Brazil, Chile, and Mexico are showing increasing interest and developing pilot projects, though regulatory clarity and investment in supporting infrastructure are still in nascent stages, representing both challenges and significant untapped potential.

- Middle East and Africa (MEA): The MEA region is witnessing growing interest in cargo drones, particularly for defense logistics, oil and gas industry support, and humanitarian efforts in challenging terrains. Countries in the GCC are investing in smart city initiatives and advanced logistics, providing a conducive environment for drone technology adoption. Africa presents unique opportunities for medical deliveries and connecting remote communities, leveraging drones to overcome logistical bottlenecks caused by inadequate infrastructure, with several successful pilot programs already underway in nations like Rwanda and Ghana.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cargo Drones Market.- Zipline

- Wing Aviation LLC (Alphabet Inc.)

- Matternet Inc.

- Amazon Prime Air (Amazon.com Inc.)

- Drone Delivery Canada Corp.

- UPS Flight Forward Inc. (United Parcel Service)

- The Boeing Company

- Airbus SE

- DJI (SZ DJI Technology Co. Ltd.)

- Volocopter GmbH

- Ehang Holdings Ltd.

- Flirtey Inc.

- Skydio Inc.

- Aergility

- Elroy Air

- Sabrewing Aircraft Company, Inc.

- Dronamics

- Cargodale

- Aerodyne Group

- Skyports Ltd.

Frequently Asked Questions

What are the primary applications of cargo drones?

Cargo drones are primarily used for last-mile delivery in e-commerce, urgent medical supply transportation, industrial logistics for critical parts, humanitarian aid deliveries to remote or disaster-stricken areas, and military resupply operations. They offer rapid, efficient, and often safer alternatives to traditional ground or air transport.

What are the main challenges hindering market growth?

Key challenges include complex and evolving regulatory frameworks, particularly for Beyond Visual Line of Sight (BVLOS) operations, public acceptance concerns regarding noise and privacy, limitations in payload capacity and battery life, high initial investment costs, and the need for robust air traffic management systems to integrate drones safely into existing airspace.

How does AI enhance cargo drone operations?

AI significantly enhances cargo drone operations by enabling autonomous navigation, intelligent path planning, real-time obstacle detection and avoidance, predictive maintenance for drone components, and efficient fleet management. It also supports dynamic decision-making during flights and helps optimize logistics planning, improving overall safety, reliability, and efficiency.

Which regions are leading the cargo drone market?

North America and Europe are currently leading the cargo drone market due to advanced technological infrastructure, significant R&D investments, and more progressive regulatory environments. The Asia Pacific region is rapidly emerging as a high-growth market, driven by its vast e-commerce sector and increasing demand for innovative logistics solutions in countries like China and India.

What is the future outlook for cargo drone deliveries?

The future outlook for cargo drone deliveries is highly promising, with expectations of significant market expansion. Continued technological advancements, particularly in AI, battery life, and propulsion systems, alongside the gradual maturation of regulatory frameworks, will enable wider commercial adoption. Drones are anticipated to become an integral part of global logistics, revolutionizing last-mile delivery, specialized transport, and humanitarian aid, ultimately leading to faster, more efficient, and sustainable supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager