Cargo Inspection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430819 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cargo Inspection Market Size

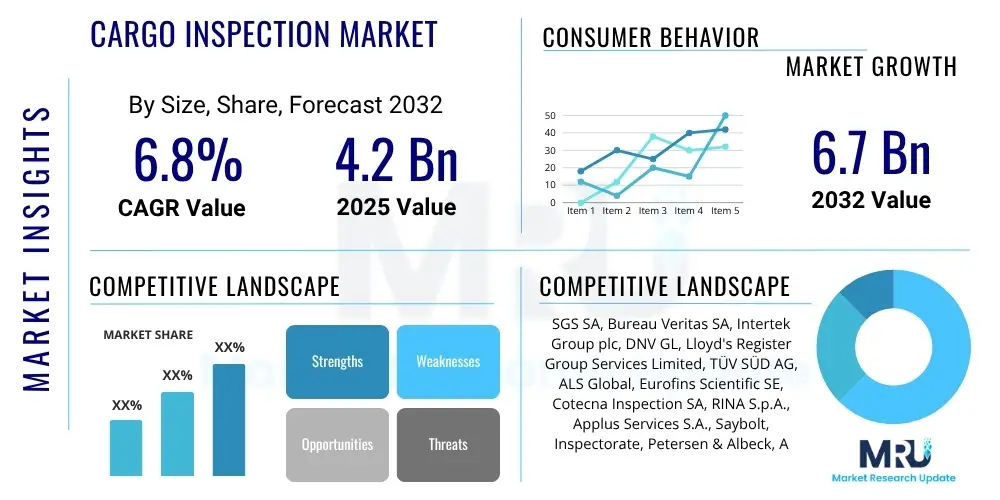

The Cargo Inspection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $4.2 Billion in 2025 and is projected to reach $6.7 Billion by the end of the forecast period in 2032.

Cargo Inspection Market introduction

The cargo inspection market encompasses a critical suite of services designed to verify the quantity, quality, and condition of goods transported across various modes of freight, playing an indispensable role in global trade and supply chain integrity. This sector provides vital assurance to stakeholders, including shippers, consignees, insurance providers, and financial institutions, by minimizing risks such as fraud, damage, or non-compliance with contractual and regulatory standards. Products in this market are primarily the diverse inspection services themselves, which can range from detailed pre-shipment quality checks to comprehensive post-delivery damage assessments, often leveraging sophisticated methodologies and advanced equipment to ensure thoroughness and accuracy.

Major applications of cargo inspection span the entire lifecycle of a shipment, from the point of origin to the final destination. These services are instrumental in pre-shipment verification, ensuring that goods meet specified standards and quantities before loading, thereby preventing costly disputes and returns. During transit, inspections involve monitoring loading and discharge operations, conducting draft surveys for bulk cargo, and inspecting containers for suitability and integrity. Upon arrival, destination inspections validate the cargo's condition and quantity, crucial for insurance claims and final settlement. The pervasive need for these services is highlighted across industries handling high-value or sensitive commodities, including petroleum, petrochemicals, agricultural products, metals, minerals, and a wide array of consumer goods, ensuring that trade is conducted smoothly and transparently.

The benefits derived from robust cargo inspection services are extensive, contributing significantly to operational efficiency, risk mitigation, and brand reputation. Businesses gain enhanced supply chain transparency, reduced financial losses from damaged or non-compliant shipments, and improved trust among trading partners. Adherence to increasingly stringent international trade regulations, quality benchmarks, and safety protocols is facilitated through independent verification, which is particularly vital in today's complex global marketplace. Key driving factors propelling market growth include the relentless globalization of trade, which inherently increases the volume and complexity of cross-border shipments, coupled with a heightened demand for risk management and quality assurance across all logistical stages. Moreover, the escalating value of traded goods and the persistent threat of cargo theft or damage underscore the critical importance of these services, further stimulating market expansion as companies seek to protect their investments and uphold their brand integrity.

Cargo Inspection Market Executive Summary

The Cargo Inspection Market is poised for substantial expansion, underpinned by dynamic business trends that emphasize comprehensive quality assurance and digital transformation within global logistics. Market participants are increasingly focusing on delivering integrated Testing, Inspection, and Certification (TIC) solutions, offering a holistic approach to risk management and compliance across diverse industries. There is a discernible shift towards specialized inspection services tailored for high-value and technically complex cargo, such as LNG, advanced electronics, and specialty chemicals, driving demand for advanced technical expertise and state-of-the-art equipment. Strategic imperatives include fostering innovation in inspection methodologies, expanding geographical footprints, and forging partnerships or executing mergers and acquisitions to enhance service capabilities and broaden market reach, thereby creating a more consolidated and technologically advanced competitive landscape.

Regionally, the market exhibits varied growth dynamics, with Asia Pacific emerging as a primary growth engine due to its unparalleled manufacturing output, booming export-import activities, and burgeoning intra-regional trade lanes. Nations like China, India, and Vietnam are at the forefront of this growth, driven by rapid industrialization and increasing foreign direct investment in manufacturing and infrastructure. Conversely, mature markets in North America and Europe, while growing at a more steady pace, continue to demonstrate robust demand for high-value and technologically sophisticated inspection services, primarily fueled by stringent regulatory frameworks and a strong focus on quality in their advanced industrial sectors. Emerging economies in Latin America, the Middle East, and Africa are also witnessing significant market penetration, propelled by investments in natural resources extraction, burgeoning trade routes, and efforts to diversify their economies, necessitating dependable cargo inspection services for their evolving trade portfolios.

Segmentation trends within the Cargo Inspection Market highlight particular areas of robust demand and technological evolution. The petroleum, petrochemicals, and gas segment remains a cornerstone, given the high value, volatility, and regulatory sensitivity of these commodities, requiring meticulous quantity and quality verification. Simultaneously, the agricultural sector, driven by global food security concerns and extensive international trade of grains and foodstuffs, presents consistent demand for quality and contamination checks. Technology adoption is increasingly influencing service delivery, with digital platforms, remote inspection tools, and advanced data analytics becoming integral to enhancing efficiency, accuracy, and reporting capabilities. This technological integration is not merely an efficiency driver but a critical enabler for managing the increasing complexity of international trade regulations and supply chain transparency demands, positioning specialized, technologically-driven expertise as a key differentiator in the market.

AI Impact Analysis on Cargo Inspection Market

User queries regarding the integration of Artificial Intelligence into the Cargo Inspection Market consistently reveal a strong interest in how AI can fundamentally transform operational efficiencies, enhance inspection accuracy, and reduce overall costs. Common themes explore the potential of AI-powered computer vision for rapid, automated defect detection, the application of machine learning for predictive analysis of shipping risks, and the optimization of logistics through intelligent scheduling of inspections. Users frequently express expectations for AI to minimize human error, accelerate reporting, and enable more proactive risk management across complex supply chains. However, concerns are also prevalent, centering on data security and privacy, the reliability of AI systems in diverse and challenging environmental conditions, the significant initial capital investment required for AI infrastructure, and the necessity for reskilling the existing workforce to adapt to AI-driven processes, highlighting a desire for balanced, human-augmented AI solutions rather than complete automation.

- Enhanced Anomaly Detection: AI-driven computer vision systems rapidly and consistently identify inconsistencies, defects, and non-conformities in cargo, packaging, or documents, often surpassing human capabilities in speed and precision across large volumes.

- Predictive Risk Analytics: Machine learning algorithms analyze vast datasets, including historical inspection data, weather patterns, geopolitical risks, and transport routes, to predict potential cargo issues, enabling proactive interventions and optimized inspection scheduling.

- Automated Data Processing and Reporting: AI significantly streamlines the collection, organization, and analysis of inspection data, automating the generation of comprehensive reports and certifications, thereby reducing manual effort and improving turnaround times.

- Optimized Resource Allocation: AI tools leverage real-time information to efficiently deploy inspection personnel and equipment, optimizing routes, minimizing travel time, and maximizing operational productivity for inspection firms.

- Remote and Autonomous Inspection: Drones and robotic platforms integrated with AI enable inspections in hazardous, confined, or remote environments, improving safety for human inspectors and allowing for continuous, objective monitoring of cargo and infrastructure.

- Improved Supply Chain Visibility: AI-powered analytics provide deeper insights into supply chain performance by correlating inspection data with logistical information, revealing bottlenecks, quality trends, and areas for strategic improvement.

- Fraud Detection and Prevention: AI algorithms can detect suspicious patterns, inconsistencies, or deviations in shipping documents and cargo characteristics that might indicate fraudulent activities, enhancing security and reducing financial losses.

DRO & Impact Forces Of Cargo Inspection Market

The Cargo Inspection Market is dynamically shaped by a robust set of drivers, confronting persistent restraints, and presenting significant opportunities that influence its growth trajectory. Among the primary drivers is the unrelenting expansion of global trade, which necessitates standardized quality and quantity verification across diverse international borders and customs jurisdictions. The increasing complexity of modern supply chains, characterized by multiple transit points, diverse modes of transportation, and numerous intermediaries, significantly amplifies the demand for independent inspection to mitigate inherent risks such as product damage, contamination, or misrepresentation. Furthermore, the tightening global regulatory framework, particularly concerning environmental, social, and governance (ESG) standards, alongside strict product safety and health regulations, compels businesses to adopt rigorous inspection protocols, thereby creating sustained demand for professional assurance services across various industrial sectors.

Conversely, the market grapples with several formidable restraints that can impede its expansion and operational efficiency. The substantial operational costs associated with maintaining a highly skilled and certified workforce, investing in advanced inspection equipment, and operating extensive laboratory facilities can create significant barriers to entry and operational scalability, especially for smaller market players. A prevalent challenge is the global shortage of adequately trained and certified inspectors, coupled with the often hazardous and physically demanding nature of on-site inspection work, which strains workforce capacity. Moreover, the lack of universally harmonized inspection standards and regulatory divergence across different countries can lead to complexities, inconsistencies, and potential delays in international trade, while economic downturns or geopolitical instabilities frequently disrupt global trade volumes, directly impacting the demand for cargo inspection services and creating market volatility.

Despite these challenges, the Cargo Inspection Market is ripe with transformative opportunities. The rapid advancements and increasing adoption of cutting-edge technologies, including Artificial Intelligence, machine learning, robotics, drones, and the Internet of Things (IoT), offer unprecedented avenues for enhancing the accuracy, efficiency, and safety of inspection processes, particularly in challenging environments. The burgeoning global emphasis on sustainable supply chains and ethical sourcing practices presents a specialized niche for "green" inspection services and compliance audits, catering to environmentally conscious businesses. Emerging economies, characterized by their rapid industrialization, expanding trade capacities, and increasing integration into global value chains, represent vast untapped potential for market penetration and growth. The rising demand for integrated Testing, Inspection, and Certification (TIC) services, offering comprehensive quality assurance solutions from a single provider, also presents a strategic opportunity for market players to diversify their service portfolios and deliver greater value to their clients, while leveraging data analytics derived from inspection results can provide actionable insights for optimizing entire supply chain operations.

Segmentation Analysis

The Cargo Inspection Market is meticulously segmented to reflect the diverse operational contexts and specific requirements across a vast range of global trade activities. These segmentations are critical for understanding market dynamics, identifying specific growth opportunities, and tailoring service offerings to meet specialized client needs. Categorization is typically performed based on the nature of the cargo being inspected, the specific type of inspection service required, the mode of transport utilized, and the ultimate end-use industry that is leveraging these services. This granular analytical approach allows for a precise evaluation of market demand drivers, competitive landscapes, and technological integration across different facets of the inspection ecosystem, ensuring that comprehensive and relevant insights can be derived for strategic market positioning and development. Each segment presents unique challenges and opportunities, driven by distinct regulatory environments, commodity values, and logistical complexities inherent to global commerce.

- By Cargo Type:

- Petroleum, Petrochemicals, and Gas: Encompassing crude oil, refined petroleum products (gasoline, diesel), liquefied natural gas (LNG), liquid petroleum gas (LPG), and various petrochemical raw materials.

- Agriculture: Including grains (wheat, corn, rice), oilseeds (soybeans, canola), fertilizers, animal feed ingredients, sugar, coffee, and other foodstuffs, often requiring stringent phytosanitary inspections.

- Metals and Minerals: Covering iron ore, coal, bauxite, precious metals (gold, silver), base metals (copper, aluminum), industrial minerals, ferroalloys, and scrap metal shipments.

- Consumer Goods and Retail: Pertaining to finished products such as electronics, apparel, textiles, footwear, furniture, toys, and general merchandise, requiring quality and safety compliance.

- Machinery and Equipment: Involving inspections for industrial machinery, heavy construction equipment, automotive parts, aerospace components, and other specialized apparatus.

- Chemicals: Focused on industrial chemicals, specialty chemicals, pharmaceutical ingredients, and dangerous goods, necessitating careful handling and regulatory adherence.

- By Service Type:

- Pre-shipment Inspection (PSI): Comprehensive checks on quantity, quality, packing, labeling, and marking specifications before goods depart the origin.

- Loading/Discharge Supervision: On-site monitoring of cargo handling operations to prevent damage, verify quantities, and ensure proper stowage or segregation during transit.

- Damage Survey: Expert assessment of cargo damage, determination of its cause, extent, and responsibility, typically for insurance claims and dispute resolution.

- Draft Survey: A precise method for determining the weight of bulk cargo loaded or discharged from a vessel by measuring changes in its displacement before and after loading/unloading.

- Laboratory Testing: Analytical services performed in accredited laboratories to verify chemical composition, physical properties, purity, and identify contaminants according to international standards.

- Container Inspection: Examination of shipping containers for structural integrity, cleanliness, suitability for specific cargo, and proper sealing to prevent loss or damage.

- Hold Inspection: Verification of ship holds for cleanliness, dryness, and structural soundness to ensure they are suitable for loading specific types of cargo, especially sensitive bulk commodities.

- Sampling and Analysis: Systematic collection of representative samples from cargo lots for subsequent laboratory testing to determine quality, composition, and compliance.

- By Mode of Transport:

- Marine/Sea Freight: Inspections related to cargo transported by bulk carriers, oil tankers, container ships, general cargo vessels, and other maritime transport.

- Road Freight: Covering inspections for goods moved via trucks, trailers, and vans, primarily for domestic or intra-regional distribution.

- Rail Freight: Inspections for cargo transported on freight trains, often involving bulk commodities or intermodal containers over long distances.

- Air Freight: Focusing on high-value, time-sensitive, or perishable goods transported by cargo planes, requiring quick and efficient inspection processes.

- By End-Use Industry:

- Oil and Gas: Encompassing upstream (exploration, production), midstream (transportation, storage), and downstream (refining, distribution) sectors, with focus on crude, refined products, and gas.

- Manufacturing: Serving industries such as automotive, electronics, heavy machinery, and textiles, ensuring quality of raw materials, components, and finished products.

- Mining: Focused on the inspection of extracted ores, concentrates, and processed minerals, verifying quantity and quality for trade.

- Agriculture and Food: Supporting agricultural producers, processors, and distributors in maintaining quality, safety, and compliance of food and agricultural products.

- Retail and E-commerce: Ensuring product quality, safety, and compliance for goods sold through traditional retail channels and rapidly expanding online platforms.

- Logistics and Shipping: Providing services to freight forwarders, port operators, shipping lines, and warehousing companies to optimize operations and minimize risks.

Value Chain Analysis For Cargo Inspection Market

The value chain within the Cargo Inspection Market is characterized by a series of interconnected activities that collectively deliver comprehensive assurance services, beginning with critical upstream investments. Upstream analysis primarily focuses on the foundational resources and capabilities required to perform effective inspections. This includes the strategic procurement and continuous maintenance of highly specialized equipment, such as advanced laboratory instruments for chemical and physical analysis, sophisticated non-destructive testing (NDT) tools, modern drone technology for aerial inspections, and cutting-edge sensor arrays for real-time monitoring. Equally vital is the intensive recruitment, extensive training, and certification of a diverse workforce, comprising expert marine surveyors, industrial chemists, qualified engineers, and highly experienced field inspectors, whose specialized knowledge and meticulous attention to detail are paramount to the quality and reliability of services provided. Furthermore, the development and ongoing enhancement of robust digital infrastructure, including Laboratory Information Management Systems (LIMS) and secure data management platforms, are crucial for efficient operation and client communication.

Moving through the value chain, the core activities revolve around the execution and delivery of inspection services, which form the primary value proposition. This involves the on-site physical inspection of cargo at various points, including manufacturing plants, warehouses, ports, and directly on vessels or transport vehicles. Following the physical inspection, the process extends to detailed laboratory analysis of samples, meticulous data compilation, and the generation of comprehensive, often legally binding, inspection reports and certifications. These downstream activities are critical for providing transparent and verifiable evidence of cargo status. The distribution channel in this market is predominantly direct, with inspection service providers engaging directly with a wide array of clients. These direct relationships are established with cargo owners, commodity traders, international shipping lines, freight forwarders, insurance companies, and financial institutions, allowing for highly customized service agreements and direct communication regarding specific requirements, findings, and compliance issues, ensuring a client-centric approach to service delivery.

Indirect channels, though less prevalent for core inspection services, may emerge through strategic alliances or subcontracting arrangements where a larger logistics provider or a general TIC (Testing, Inspection, and Certification) firm integrates specialized cargo inspection as part of a broader service package. The overall efficacy and competitiveness within the cargo inspection value chain are significantly influenced by a firm's accreditations, adherence to international standards (like ISO/IEC 17020 and 17025), technological prowess, geographical reach, and the depth of its industry-specific expertise. Firms aim to differentiate by offering end-to-end solutions, leveraging digital platforms for real-time data access and reporting, and consistently demonstrating reliability and impartiality. Continuous investment in technological upgrades and human capital development, coupled with strategic market expansion and efficient internal quality control processes, are pivotal for sustaining a strong competitive advantage and enhancing value delivery across this essential global trade facilitator.

Cargo Inspection Market Potential Customers

The Cargo Inspection Market serves an extensive and diverse range of potential customers, comprising virtually every entity involved in the buying, selling, transporting, or insuring of goods across local and international boundaries. These end-users and buyers are fundamentally driven by the imperative to safeguard their investments, mitigate operational and financial risks, ensure unwavering compliance with an increasingly complex web of global and national regulations, and uphold their reputation for quality and reliability. Their purchasing decisions are primarily influenced by the need for independent, unbiased verification of cargo attributes, which provides a critical layer of assurance against discrepancies, damages, and non-conformities. The diverse nature of global trade dictates that these customers span multiple industries, each with unique inspection requirements and risk profiles that demand tailored service solutions from expert providers.

Among the primary customer segments are large-scale commodity traders and producers, especially those dealing in high-value bulk goods such as crude oil, refined petroleum products, natural gas, a variety of agricultural products (e.g., grains, sugar, coffee), and base or precious metals and minerals. For these entities, even marginal variations in quantity or quality can translate into substantial financial gains or losses, making the comprehensive and accurate services of cargo inspection firms absolutely indispensable for contractual fulfillment and financial settlements. Manufacturers across sectors like automotive, electronics, machinery, and consumer goods also constitute a significant customer base. They frequently commission pre-shipment inspections to verify the quality and specifications of raw materials, components, and finished products from their global suppliers, thereby preventing costly defects, rejections, or product recalls further down their supply chains.

Furthermore, the logistics and transportation ecosystem, encompassing shipping lines, port authorities, freight forwarders, and warehousing companies, routinely utilizes cargo inspection services to verify cargo manifest integrity, prevent damage claims, and ensure the safe and compliant handling and transit of goods. Insurance companies and financial institutions, particularly those engaged in trade finance and cargo insurance, are crucial consumers of inspection reports, as these documents provide independent validation essential for risk assessment, collateral verification, and the efficient processing of claims. Additionally, governmental bodies and regulatory agencies, though often indirect customers, significantly influence market demand through their mandates for product safety, environmental protection, and trade compliance, thereby creating a pervasive and non-negotiable need for verifiable quality and quantity assurance throughout the entire global trade and supply chain network, impacting nearly all businesses involved in commerce.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.2 Billion |

| Market Forecast in 2032 | $6.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Bureau Veritas SA, Intertek Group plc, DNV GL, Lloyd's Register Group Services Limited, TÜV SÜD AG, ALS Global, Eurofins Scientific SE, Cotecna Inspection SA, RINA S.p.A., Applus Services S.A., Saybolt, Inspectorate, Petersen & Albeck, Alex Stewart International, Geochem Group, Alfred H Knight, CEERISK International, CIS Commodity Inspection Services, Control Union Certifications |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cargo Inspection Market Key Technology Landscape

The Cargo Inspection Market is undergoing a profound technological transformation, with the integration of advanced solutions revolutionizing traditional inspection methodologies to enhance efficiency, accuracy, and safety across the entire supply chain. A significant shift is observed towards remote inspection capabilities, leveraging sophisticated tools such as Unmanned Aerial Vehicles (UAVs or drones) and robotic systems. These devices are equipped with high-resolution cameras, thermal imaging sensors, and gas detectors, enabling inspections in hazardous, inaccessible, or expansive environments like ship hulls, tall storage tanks, and large warehouses. This not only mitigates risks to human inspectors but also significantly accelerates inspection turnaround times, providing real-time data capture that can be immediately processed and analyzed, thereby optimizing operational workflows and ensuring more consistent data collection across diverse sites.

Furthermore, the Internet of Things (IoT) plays a pivotal role in augmenting cargo inspection by facilitating continuous, real-time monitoring of cargo conditions during transit and storage. IoT sensors embedded within containers or directly with the cargo can track critical environmental parameters such as temperature, humidity, vibration, and precise geographical location. This constant stream of data offers unparalleled visibility into the cargo's integrity throughout its journey, allowing for immediate alerts and proactive interventions if any deviations from optimal conditions are detected. This capability is particularly crucial for perishable goods, sensitive electronics, and high-value commodities, preventing spoilage or damage before it escalates. The data aggregated from these IoT devices is increasingly fed into advanced analytics platforms, providing deeper insights into supply chain performance, identifying recurring issues, and informing predictive maintenance strategies.

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is also reshaping the technological landscape, moving beyond mere data collection to intelligent data interpretation and decision support. AI-powered computer vision systems can automatically detect visual defects, identify discrepancies in packaging, and verify labeling compliance with a speed and accuracy that surpasses human capabilities, especially when processing vast amounts of visual data. Blockchain technology is emerging as a critical tool for enhancing transparency and security in documentation, creating immutable and verifiable records of inspection certificates, ownership transfers, and compliance data, which significantly reduces the potential for fraud and disputes. Complementary technologies like advanced Non-Destructive Testing (NDT) techniques, including ultrasonic testing and radiographic inspection, continue to evolve, offering detailed internal assessments of materials without causing damage, all contributing to a more intelligent, integrated, and reliable cargo inspection ecosystem.

Regional Highlights

- North America: A highly mature and technologically advanced market, North America exhibits robust demand for cargo inspection services, driven by stringent regulatory frameworks, a high volume of intra-continental and international trade, and a strong emphasis on quality and safety. The United States and Canada are key players, with significant activity in the oil and gas sector, agricultural exports, and complex manufacturing industries. Adoption of cutting-edge technologies like AI, drones, and IoT for enhanced efficiency and accuracy is particularly prevalent here, catering to a sophisticated client base that prioritizes speed, reliability, and comprehensive compliance. The region's focus on supply chain resilience also propels demand for advanced inspection protocols.

- Europe: Characterized by established trade routes and strict adherence to EU regulations, Europe represents a significant market for cargo inspection. Countries such as Germany, the UK, France, and the Netherlands lead the demand, particularly for inspections of food products, chemicals, pharmaceuticals, and diverse industrial goods. The emphasis on sustainability, ethical sourcing, and detailed product safety standards within the European Union drives the need for rigorous inspection and certification services. The ongoing digital transformation across European industries is also accelerating the adoption of digital inspection tools and integrated TIC services, enhancing traceability and operational efficiency across complex pan-European supply chains.

- Asia Pacific (APAC): Recognized as the fastest-growing region, APAC's market expansion is fueled by its burgeoning manufacturing capabilities, escalating export volumes, and dynamic intra-regional trade, with powerhouses like China, India, Japan, and Southeast Asian nations at the forefront. Rapid urbanization, extensive infrastructure development, and increasing foreign direct investment contribute significantly to the demand for raw material and finished goods inspections across diverse sectors. The region's competitive landscape is vibrant, featuring both global inspection giants and strong local players who are increasingly investing in digital solutions to manage scale, improve cost-effectiveness, and meet evolving global trade standards.

- Latin America: This emerging market offers considerable growth potential, primarily driven by its rich reserves of natural resources, including minerals, agricultural commodities, and oil and gas. Major countries like Brazil, Mexico, Argentina, and Chile are critical for raw material exports and increasingly diversified trade relationships. Demand for cargo inspection services is concentrated on verifying the quality and quantity of these primary commodities, as well as pre-shipment checks for agricultural exports. While facing challenges related to varying regulatory environments and infrastructure limitations, the region benefits from growing foreign investment and efforts to enhance trade logistics, providing opportunities for specialized inspection firms.

- Middle East and Africa (MEA): This region is experiencing substantial growth in the cargo inspection market, largely influenced by its pivotal role in global oil and gas exports, ambitious infrastructure projects, and the development of new trade routes. Countries such as the UAE, Saudi Arabia, Qatar, and South Africa are key drivers, demanding extensive inspection services for energy commodities, construction materials, and a wide range of imported consumer goods. Significant investments in port infrastructure and logistics hubs are further fueling the need for reliable cargo verification services to ensure security, quality, and compliance with increasingly complex international trade regulations and geopolitical considerations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cargo Inspection Market.- SGS SA

- Bureau Veritas SA

- Intertek Group plc

- DNV GL

- Lloyd's Register Group Services Limited

- TÜV SÜD AG

- ALS Global

- Eurofins Scientific SE

- Cotecna Inspection SA

- RINA S.p.A.

- Applus Services S.A.

- Saybolt

- Inspectorate

- Petersen & Albeck

- Alex Stewart International

- Geochem Group

- Alfred H Knight

- CEERISK International

- CIS Commodity Inspection Services

- Control Union Certifications

Frequently Asked Questions

What is the primary purpose of cargo inspection in international trade?

The primary purpose of cargo inspection is to provide independent, unbiased verification of the quantity, quality, and condition of goods being traded. This ensures compliance with contractual terms, international regulations, and safety standards, critically minimizing financial risks, preventing disputes, and facilitating smooth, trustworthy global logistics operations for all stakeholders.

How do cargo inspection services contribute to overall supply chain efficiency?

Cargo inspection services significantly enhance supply chain efficiency by proactively identifying and preventing issues like product damage or non-compliance before they cause costly delays or rejections. They provide critical data for better logistical planning, risk management, and dispute resolution, ultimately leading to faster transit times, reduced operational costs, and improved overall reliability across the supply chain.

Which types of cargo most frequently require specialized inspection services?

High-value and sensitive commodities most frequently require specialized inspection services. This includes bulk goods such as petroleum products, natural gas, diverse agricultural commodities (grains, foodstuffs), various metals and minerals, and complex manufactured items like industrial machinery and electronics, all of which carry significant financial and regulatory implications.

In what ways is advanced technology transforming the cargo inspection industry?

Advanced technology is profoundly transforming the cargo inspection industry by introducing AI-powered computer vision for automated defect detection, drones for safe and efficient remote inspections, IoT sensors for real-time cargo monitoring, and blockchain for secure, transparent documentation. These innovations collectively improve accuracy, enhance safety, reduce human error, and accelerate reporting and data analysis.

What are the key benefits for businesses that consistently utilize cargo inspection services?

Businesses that consistently utilize cargo inspection services gain multiple key benefits, including substantial reduction in financial losses from damaged or non-compliant goods, enhanced brand reputation through consistent product quality, assurance of compliance with complex global trade regulations, improved risk management across their supply chains, increased transparency, and validated product integrity, fostering greater operational trust and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager