Cargo Vans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430205 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cargo Vans Market Size

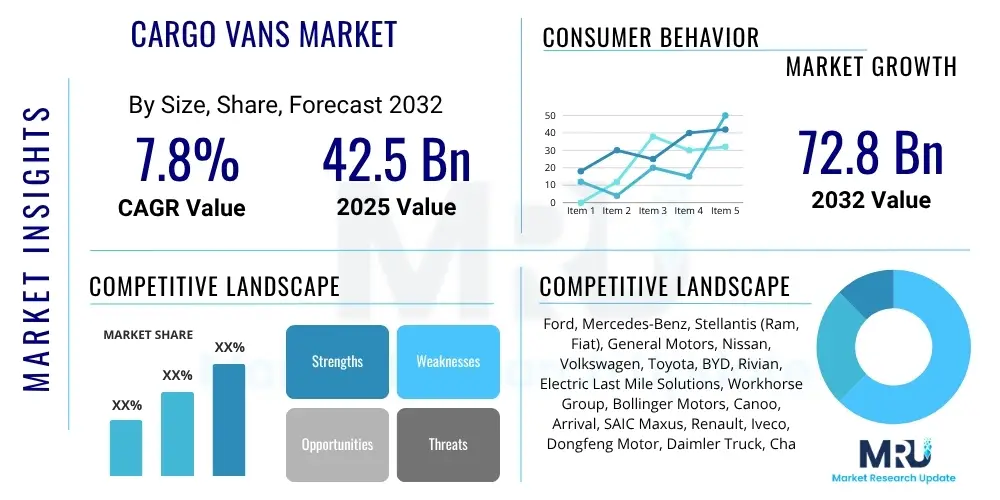

The Cargo Vans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 42.5 billion in 2025 and is projected to reach USD 72.8 billion by the end of the forecast period in 2032.

Cargo Vans Market introduction

The Cargo Vans Market represents a critical segment within the broader automotive industry, primarily driven by the escalating demands of last-mile delivery, e-commerce proliferation, and the expansion of various service-oriented businesses. These versatile commercial vehicles are designed to transport goods, equipment, and personnel efficiently, serving as indispensable assets for businesses ranging from logistics and transportation to construction, utilities, and field services. The market's growth is fundamentally underpinned by global economic development, increasing urbanization, and the continuous need for robust and reliable delivery solutions across diverse industrial sectors.

Cargo vans typically feature a spacious, enclosed rear compartment for secure storage, offering a variety of sizes and configurations to meet specific operational requirements. Product descriptions often highlight their customizable interior designs, robust chassis for heavy payloads, fuel efficiency, and technological integration aimed at enhancing driver comfort, safety, and fleet management capabilities. Their major applications span across urban logistics, delivering packages from distribution centers to end consumers, acting as mobile workshops for tradespeople, and facilitating the movement of supplies for construction projects or utility maintenance. This broad applicability underscores their foundational role in modern commercial operations.

The inherent benefits of cargo vans, such as their maneuverability in congested urban environments, cost-effectiveness compared to larger trucks, and capacity to handle diverse cargo types, make them a preferred choice for numerous enterprises. Key driving factors propelling market expansion include the exponential growth of online retail, which necessitates efficient and scalable delivery networks; the increasing number of small and medium-sized businesses relying on their own transport fleets; and continuous advancements in vehicle technology, including electrification and connectivity, which enhance operational efficiency and reduce environmental impact. These combined forces are shaping a dynamic and evolving market landscape.

Cargo Vans Market Executive Summary

The Cargo Vans Market is experiencing significant transformation, characterized by robust business trends focused on fleet modernization, the integration of advanced telematics, and a pronounced shift towards electric propulsion. Enterprises are increasingly investing in newer, more efficient models to reduce operational costs, comply with evolving environmental regulations, and enhance their logistical capabilities. This modernization often includes vehicles equipped with sophisticated driver assistance systems, improved fuel economy for internal combustion engine (ICE) variants, and the growing adoption of zero-emission electric cargo vans, driven by both corporate sustainability goals and government incentives. The leasing and rental segments are also expanding, offering flexible fleet solutions to businesses of all sizes, mitigating initial capital expenditure requirements.

Regionally, the market exhibits diverse growth patterns. North America and Europe continue to be mature markets, yet they are at the forefront of electric cargo van adoption, spurred by stringent emission standards and robust charging infrastructure development. These regions also demonstrate a high demand for advanced fleet management solutions. The Asia Pacific (APAC) region, conversely, is emerging as a high-growth market, propelled by rapid urbanization, booming e-commerce sectors, and expanding manufacturing industries, particularly in countries like China and India. Latin America, the Middle East, and Africa are showing nascent but steady growth, largely driven by infrastructure development projects and increasing economic activities that necessitate reliable commercial transport.

Segmentation trends reveal a strong inclination towards electric cargo vans as a burgeoning segment, despite higher initial costs, due to long-term operational savings and environmental benefits. The last-mile delivery application segment remains a dominant force, intrinsically linked to the e-commerce boom. Furthermore, there is an increasing demand for specialized and customized cargo van configurations, catering to specific industry needs such as refrigerated transport, mobile service workshops, or passenger shuttles. Payload capacity segmentation highlights a balanced demand across small, medium, and large vans, reflecting the varied requirements of different businesses, from compact urban deliveries to heavy-duty equipment transport.

AI Impact Analysis on Cargo Vans Market

Common user questions regarding AI's impact on the Cargo Vans Market frequently revolve around how artificial intelligence will enhance operational efficiencies, reduce costs, improve safety, and potentially revolutionize last-mile delivery. Users are keen to understand the practical applications of AI in areas such as route optimization, predictive maintenance, and autonomous driving capabilities, while also considering challenges related to data privacy, ethical implications, and the integration of complex AI systems into existing fleet infrastructure. There is a general expectation that AI will lead to smarter, more sustainable, and ultimately more profitable cargo van operations, fostering a new era of logistics and delivery services.

- Route Optimization: AI-powered algorithms analyze real-time traffic, weather conditions, delivery schedules, and vehicle capacities to determine the most efficient routes, significantly reducing fuel consumption, delivery times, and operational costs. This leads to higher productivity and faster service.

- Predictive Maintenance: AI systems monitor vehicle performance data, identifying potential mechanical failures before they occur. This proactive approach minimizes unexpected breakdowns, reduces maintenance expenses, extends vehicle lifespan, and ensures higher fleet availability for critical operations.

- Autonomous Delivery and Driver Assistance: While fully autonomous cargo vans are still in development, AI enhances existing Advanced Driver-Assistance Systems (ADAS) like adaptive cruise control, lane-keeping assist, and automatic emergency braking, improving driver safety and reducing accidents. Future applications could see partial or full autonomous last-mile delivery.

- Inventory and Cargo Management: AI can optimize cargo loading patterns, manage inventory within the van, and track individual packages in real time, ensuring efficient space utilization, reducing loading/unloading times, and minimizing losses or misplacements during transit.

- Supply Chain Integration and Data Analytics: AI facilitates seamless integration of cargo vans into broader supply chain ecosystems, providing valuable data insights for demand forecasting, logistics planning, and performance benchmarking. This leads to more informed decision-making and overall supply chain resilience.

DRO & Impact Forces Of Cargo Vans Market

The Cargo Vans Market is dynamically shaped by a confluence of driving forces, prominent among which is the relentless expansion of the global e-commerce industry, necessitating robust last-mile delivery solutions capable of handling ever-increasing parcel volumes and consumer expectations for rapid fulfillment. Alongside this, burgeoning urbanization continues to concentrate populations in metropolitan areas, intensifying demand for agile commercial vehicles that can navigate congested city streets efficiently. Furthermore, the rising proliferation of field service businesses, from HVAC technicians to mobile repair services, fundamentally relies on cargo vans to transport tools, parts, and personnel, directly contributing to market growth. Fleet modernization initiatives by large corporations and small enterprises alike, aimed at improving fuel efficiency, reducing emissions, and adopting advanced safety features, also serve as a significant driver. Government incentives promoting the adoption of electric vehicles (EVs) are increasingly influencing purchasing decisions, especially in developed economies seeking to achieve sustainability targets.

Despite these powerful drivers, several restraints challenge market expansion. The relatively high acquisition cost of new cargo vans, particularly electric variants, presents a notable barrier for small and medium-sized businesses with limited capital budgets. This financial hurdle is exacerbated by the still-developing charging infrastructure for EVs in many regions, creating range anxiety and logistical complexities for fleet operators considering electrification. Regulatory hurdles, including varied emissions standards across different jurisdictions and evolving safety mandates, necessitate continuous adaptation from manufacturers, adding to production costs and market entry complexities. Moreover, a persistent shortage of skilled drivers and maintenance technicians capable of operating and servicing modern, technologically advanced cargo vans remains a significant operational constraint for fleet managers.

Opportunities for growth are abundant within this evolving landscape. The accelerated adoption of electric cargo vans represents a substantial avenue for market expansion, driven by decreasing battery costs, improving range, and increasing public and private investments in charging infrastructure. Innovations in last-mile delivery, such as specialized vehicle designs, drone integration for specific deliveries, and locker systems, offer new operational models that could leverage advanced cargo van capabilities. The increasing integration of telematics and connectivity solutions provides opportunities for enhanced fleet management, predictive maintenance, and route optimization, significantly improving efficiency and reducing downtime. Furthermore, the demand for highly customizable cargo van solutions, tailored to specific industry requirements for features like refrigeration, shelving, or mobile workspace setups, allows manufacturers to cater to niche markets and foster product differentiation.

Segmentation Analysis

The Cargo Vans Market is extensively segmented to provide a granular understanding of its diverse components, allowing stakeholders to identify specific growth drivers, market dynamics, and opportunities across various product characteristics, applications, and end-user demographics. This segmentation facilitates targeted strategic planning and product development, reflecting the broad utility of cargo vans in the modern commercial landscape.

- Propulsion Type

- Internal Combustion Engine (ICE): Represents the traditional and currently dominant segment, driven by established infrastructure and lower upfront costs.

- Electric: The fastest-growing segment, propelled by environmental regulations, government incentives, and increasing corporate sustainability commitments, despite higher initial investment.

- Vehicle Type

- Small Cargo Vans: Characterized by compact dimensions and agility, ideal for urban deliveries and navigating confined spaces.

- Medium Cargo Vans: Offering a balance of payload capacity and maneuverability, suitable for a wide range of general-purpose commercial applications.

- Large Cargo Vans: Designed for maximum cargo volume and heavier payloads, preferred for longer routes, large-scale logistics, and specialized equipment transport.

- Application

- Last-Mile Delivery: The largest and most dynamic segment, driven by the exponential growth of e-commerce and rapid urban parcel delivery.

- Field Service: Includes mobile repair, maintenance, and installation services across various industries, utilizing vans as mobile workshops.

- Construction: Transporting tools, materials, and small equipment to and from construction sites.

- Utilities: Used by gas, water, electricity, and telecommunication companies for maintenance and infrastructure work.

- Rental and Leasing: Fleets provided for temporary use to businesses and individuals, offering flexible solutions without significant capital outlay.

- Others: Encompassing applications like food and beverage delivery, catering, mobile showrooms, and general transportation for small businesses.

- Payload Capacity

- Less than 1 Ton: Typically small vans, suitable for light packages and urban agility.

- 1-2 Tons: Predominantly medium vans, offering a versatile balance for various commercial loads.

- More than 2 Tons: Primarily large vans, designed for heavy-duty hauling and specialized equipment.

- End-User

- Logistics and Transportation: Major users for inter-city and intra-city cargo movement, including courier services and freight forwarding.

- E-commerce: Directly tied to online retail giants and smaller e-tailers for product distribution.

- Food and Beverage: Utilized for cold chain logistics, catering, and delivery of perishable goods.

- Manufacturing: Transporting components, finished goods, and for internal logistics within industrial complexes.

- Retail: Supporting store-to-store transfers, local customer deliveries, and mobile vending.

- Others: Includes government entities, healthcare services, educational institutions, and various independent contractors.

Value Chain Analysis For Cargo Vans Market

The value chain of the Cargo Vans Market is an intricate network spanning from raw material sourcing to the final end-user, highlighting the sequence of activities that add value to the product. At the upstream end, the market relies heavily on a robust supply chain for raw materials such as steel, aluminum, various plastics, and advanced composites, which are fundamental for vehicle body construction and structural integrity. Critical components like internal combustion engines, electric motors, battery packs for EVs, transmissions, axles, braking systems, and sophisticated electronic control units (ECUs) are sourced from a global network of specialized component manufacturers. This phase also includes the development and supply of advanced materials for interior finishes, safety systems, and connectivity features, all contributing to the vehicle's functionality and market appeal. The efficiency and reliability of these upstream suppliers directly impact the quality, cost, and lead time of the final product.

Moving downstream, the value chain involves the complex manufacturing and assembly processes undertaken by Original Equipment Manufacturers (OEMs). This stage includes design, engineering, body stamping, painting, assembly, and rigorous quality testing. Following production, the vehicles enter the distribution phase, which is segmented into direct and indirect channels. Direct distribution typically involves OEMs selling large fleets directly to major corporate clients, government agencies, and large logistics companies, often through bespoke contract negotiations and customized orders. This channel emphasizes long-term relationships, volume discounts, and specialized service agreements, allowing for tailored solutions that meet specific operational demands of large-scale buyers.

Indirect distribution primarily operates through a comprehensive network of authorized dealerships, which serve individual businesses, small and medium-sized enterprises (SMEs), and smaller fleet operators. Dealerships play a crucial role in sales, after-sales service, parts supply, and financing options, acting as a crucial intermediary between manufacturers and a diverse customer base. Additionally, rental and leasing companies form another significant distribution channel, providing flexible access to cargo vans for businesses that prefer operational leasing over outright purchase, thereby reducing capital expenditure and allowing for fleet scalability. Online platforms and digital sales channels are also gaining prominence, offering a more streamlined purchasing experience. Each step in this value chain contributes to the final delivered value, with continuous efforts focused on optimizing efficiency, reducing costs, and enhancing product innovation to maintain competitive advantage.

Cargo Vans Market Potential Customers

The Cargo Vans Market serves a vast and diverse customer base, primarily comprising businesses and organizations across numerous sectors that require reliable and efficient transportation of goods, equipment, or personnel. These potential customers, often categorized as end-users or buyers, share a common need for vehicles that combine cargo capacity with operational agility. E-commerce companies, for instance, stand as a colossal segment of potential customers. With the exponential rise in online shopping, these businesses, ranging from global retail giants to local online storefronts, are in constant need of cargo vans to facilitate the crucial last-mile delivery of packages directly to consumers. Their demand is driven by the necessity for rapid, cost-effective, and scalable delivery solutions to meet escalating customer expectations.

Beyond e-commerce, the logistics and transportation sector represents another fundamental customer base. This includes traditional courier services, parcel delivery companies, and third-party logistics (3PL) providers who utilize cargo vans for efficient hub-to-door deliveries, inter-city parcel transfers, and specialized freight services. Their purchasing decisions are heavily influenced by factors such as payload capacity, fuel efficiency, vehicle reliability, and the integration of fleet management technologies. Similarly, a broad spectrum of field service businesses, encompassing plumbers, electricians, HVAC technicians, mobile repair services, and landscapers, constitute significant buyers. For these professionals, cargo vans function as essential mobile workshops, providing organized storage for tools, materials, and equipment, thereby enabling them to deliver services directly at customer locations.

Furthermore, businesses in the construction industry, utility companies (such as telecommunications, electricity, and water providers), and various segments of the food and beverage industry (including catering services and perishable goods delivery) represent substantial segments of potential customers. Rental and leasing companies also act as major buyers, acquiring large fleets of cargo vans to then offer flexible rental options to other businesses and individuals, serving as an indirect channel to a wide array of temporary users. Small and medium-sized enterprises (SMEs) across almost all sectors, from florists to dry cleaners, also frequently purchase or lease cargo vans for their daily operational needs, highlighting the ubiquitous and indispensable nature of these vehicles in the modern commercial economy. Each customer segment evaluates cargo vans based on specific operational requirements, total cost of ownership, and suitability for their specialized tasks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 42.5 billion |

| Market Forecast in 2032 | USD 72.8 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ford, Mercedes-Benz, Stellantis (Ram, Fiat), General Motors, Nissan, Volkswagen, Toyota, BYD, Rivian, Electric Last Mile Solutions, Workhorse Group, Bollinger Motors, Canoo, Arrival, SAIC Maxus, Renault, Iveco, Dongfeng Motor, Daimler Truck, Changan Auto |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cargo Vans Market Key Technology Landscape

The Cargo Vans Market is increasingly shaped by a dynamic technological landscape, focusing on enhancing operational efficiency, improving safety, and reducing environmental impact. A primary technological area is the advancement in electric vehicle (EV) powertrain systems. This includes innovations in battery chemistry, energy density, and charging speeds, which are crucial for extending range and minimizing downtime for electric cargo vans. Alongside this, the development of more compact and powerful electric motors, integrated power electronics, and efficient thermal management systems are critical for optimizing performance and ensuring the longevity of EV components. The integration of regenerative braking systems further enhances energy recovery, contributing to overall vehicle efficiency and reducing wear on traditional braking components, thereby lowering maintenance costs.

Another significant technological advancement lies in the realm of telematics and connectivity. Modern cargo vans are increasingly equipped with sophisticated telematics systems that offer real-time GPS tracking, remote diagnostics, and comprehensive fleet management capabilities. These systems provide invaluable data on driver behavior, fuel consumption (or energy usage for EVs), route efficiency, and vehicle health, enabling fleet managers to optimize operations, reduce operational costs, and improve safety. Furthermore, advanced driver-assistance systems (ADAS) are becoming standard, incorporating features such as adaptive cruise control, lane-keeping assist, blind-spot monitoring, automatic emergency braking, and surround-view cameras. These technologies significantly enhance driver safety, reduce the likelihood of accidents, and alleviate driver fatigue during long shifts, particularly in congested urban environments.

Beyond powertrain and connectivity, the market is also seeing innovations in lightweight material science and modular vehicle design. Manufacturers are increasingly utilizing high-strength steel, aluminum alloys, and advanced composites to reduce vehicle weight without compromising structural integrity or payload capacity. Lighter vehicles translate directly into improved fuel economy for ICE vans and extended range for EVs. Modular design principles allow for greater customization and flexibility in configuring the cargo area, catering to diverse industry-specific needs, such as refrigeration units, specialized shelving, or mobile workstation setups. Furthermore, advancements in digital integration, including sophisticated infotainment systems, over-the-air (OTA) software updates, and seamless smartphone connectivity, enhance driver comfort and productivity, making the cargo van a more integrated and smarter tool for businesses. These technological strides collectively redefine the capabilities and value proposition of modern cargo vans.

Regional Highlights

- North America: This region stands as a dominant force in the Cargo Vans Market, characterized by a robust e-commerce sector and a strong demand for fleet renewal. The extensive network of logistics companies and the increasing adoption of electric cargo vans, supported by government incentives and expanding charging infrastructure, contribute significantly to its market share. Key players like Ford and General Motors continue to invest heavily in electric commercial vehicle offerings, catering to both large enterprises and small businesses.

- Europe: Europe exhibits a mature yet highly dynamic market for cargo vans, driven by stringent emission regulations and a strong emphasis on urban logistics. The push towards zero-emission vehicles is particularly strong, leading to rapid adoption of electric cargo vans, especially for last-mile delivery within city centers. Countries like Germany, France, and the UK are witnessing significant investments in EV charging networks and smart city logistics solutions, fostering innovation in this segment.

- Asia Pacific (APAC): The APAC region is recognized as the fastest-growing market for cargo vans, fueled by rapid urbanization, an explosive growth in e-commerce, and expanding industrial and service sectors, particularly in China, India, and Southeast Asian countries. Increasing disposable incomes and infrastructural development are creating immense opportunities. Local manufacturers, alongside international players, are expanding their product portfolios to meet the escalating demand, with a growing focus on cost-effective and efficient solutions.

- Latin America: This region presents an emerging market for cargo vans, characterized by ongoing economic development and increasing investments in infrastructure. As businesses expand and logistics networks evolve, the demand for versatile commercial vehicles is steadily rising. While electrification is still in nascent stages compared to developed markets, there is growing interest and pilot programs for electric cargo vans, particularly in larger urban centers aiming to address pollution concerns.

- Middle East and Africa (MEA): The MEA region represents a market with significant untapped potential, driven by diversified economic initiatives, large-scale construction projects, and the development of modern logistics hubs. While the market is currently smaller in scale, increasing foreign investment and a growing focus on urban development and efficient transportation solutions are expected to propel growth. The adoption of advanced fleet management technologies is also gaining traction, particularly among large corporate fleets and government entities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cargo Vans Market.- Ford

- Mercedes-Benz

- Stellantis (Ram, Fiat)

- General Motors

- Nissan

- Volkswagen

- Toyota

- BYD

- Rivian

- Electric Last Mile Solutions

- Workhorse Group

- Bollinger Motors

- Canoo

- Arrival

- SAIC Maxus

- Renault

- Iveco

- Dongfeng Motor

- Daimler Truck

- Changan Auto

Frequently Asked Questions

What are the primary growth drivers for the Cargo Vans Market?

The Cargo Vans Market is primarily propelled by the exponential growth of the global e-commerce sector, which necessitates efficient and reliable last-mile delivery solutions to meet increasing consumer demand for rapid fulfillment. Additionally, ongoing urbanization trends concentrate populations and businesses in metropolitan areas, driving the need for agile commercial vehicles capable of navigating dense city environments. The expansion of field service industries, requiring mobile transport for tools and personnel, alongside corporate initiatives for fleet modernization to enhance efficiency and reduce emissions, further stimulate market growth. Government incentives promoting electric vehicle adoption also play a crucial role, particularly in developed economies aiming for sustainability targets.

How is electrification impacting the cargo van industry?

Electrification is profoundly transforming the cargo van industry by shifting focus towards zero-emission vehicles, driven by stricter environmental regulations and increasing corporate sustainability commitments. While electric cargo vans (ECVs) currently have higher upfront costs, their lower operational expenses due to reduced fuel consumption and maintenance, coupled with various government subsidies and incentives, make them increasingly attractive for long-term fleet investments. This shift is leading to significant research and development in battery technology, charging infrastructure, and EV-specific vehicle designs. Electrification is enabling cleaner urban deliveries, reducing noise pollution, and offering a sustainable pathway for businesses to manage their logistical operations in an environmentally responsible manner.

What role does last-mile delivery play in market expansion?

Last-mile delivery is a fundamental and rapidly expanding application segment, playing a pivotal role in the Cargo Vans Market's expansion. It represents the final leg of the delivery process, moving goods from a transportation hub to their final destination, typically the customer's doorstep. The dramatic increase in online shopping has created an insatiable demand for efficient, rapid, and cost-effective last-mile solutions. Cargo vans are ideally suited for this role due to their versatility, maneuverability in urban areas, capacity to carry diverse parcel sizes, and ability to be equipped with telematics for optimized routing and tracking. This segment drives innovation in vehicle design, delivery strategies, and technological integration to meet evolving consumer expectations.

Which regions exhibit the most significant growth potential?

The Asia Pacific (APAC) region currently exhibits the most significant growth potential for the Cargo Vans Market. This surge is attributed to rapid urbanization, a booming e-commerce industry, and robust economic development across countries like China, India, and Southeast Asia. The expanding middle class, coupled with increasing infrastructure investments, is fueling a heightened demand for commercial vehicles to support growing logistics and service sectors. While North America and Europe remain strong markets, particularly in electric vehicle adoption and fleet modernization, the sheer scale of population and economic expansion in APAC provides unparalleled opportunities for market acceleration in the forecast period.

What are the key technological advancements in cargo vans?

Key technological advancements in cargo vans are focused on enhancing efficiency, safety, and connectivity. These include sophisticated electric powertrain systems with improved battery range and faster charging capabilities, which are critical for sustainable operations. Telematics and advanced fleet management solutions offer real-time tracking, remote diagnostics, and data-driven insights for route optimization and predictive maintenance, significantly reducing operational costs and downtime. Additionally, Advanced Driver-Assistance Systems (ADAS) such as adaptive cruise control, lane-keeping assist, and automatic emergency braking are becoming standard, improving driver safety and reducing accident risks. Innovations in lightweight materials and modular designs further contribute to enhanced payload capacity and customization options, catering to diverse business needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager