Carmine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428151 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Carmine Market Size

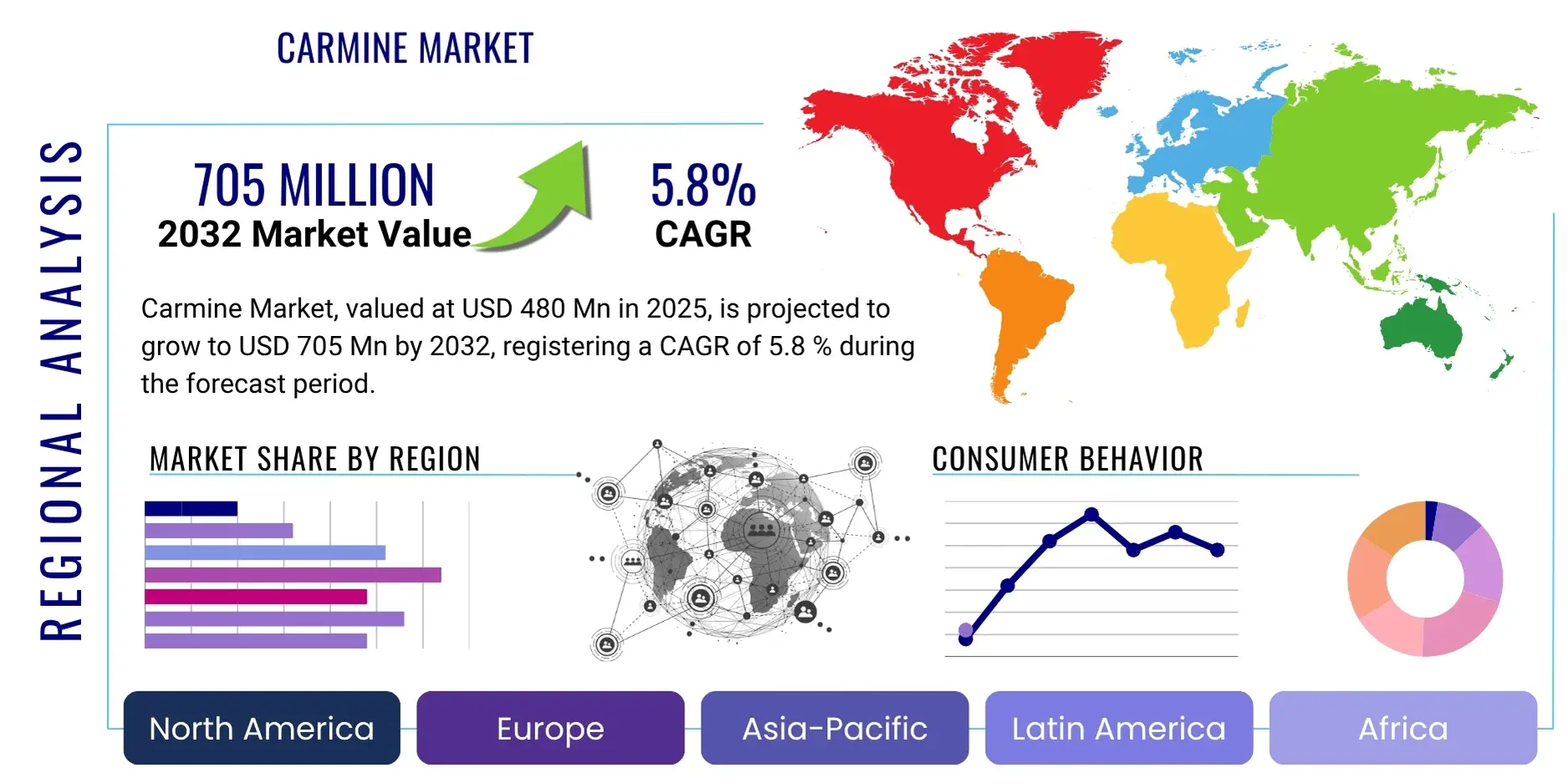

The Carmine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 480 million in 2025 and is projected to reach USD 705 million by the end of the forecast period in 2032.

Carmine Market introduction

The Carmine market, centered around the production and distribution of a highly prized natural red pigment, is experiencing a period of dynamic evolution driven by both consumer demand and regulatory shifts. Derived from carminic acid, extracted meticulously from the female cochineal insect (Dactylopius coccus) found primarily on prickly pear cacti in regions like Latin America, Carmine is revered for its exceptional intensity and stability of color. Unlike many synthetic counterparts, it exhibits remarkable resistance to heat, light, and varying pH levels, making it an indispensable colorant across a myriad of applications. Its historical roots as a natural dye extend back centuries, yet its modern industrial significance has surged due to a global pivot towards ingredients perceived as healthier and more environmentally benign. This resurgence is particularly pronounced as consumers increasingly scrutinize product labels for artificial additives, fostering a robust demand for natural pigments and propelling market expansion.

This versatile natural colorant is not a monolithic product; it is commercially available in several distinct forms, including highly concentrated powders, readily dispersible liquids, and lake pigments, each engineered to cater to specific manufacturing processes and solubility requirements. The adaptability of Carmine allows its widespread integration into the food and beverage sector, where it imparts vibrant red hues to confectionery, dairy products, beverages, and meat alternatives. Beyond ingestible applications, Carmine is a staple in the cosmetics industry, providing rich color to lipsticks, blushes, and eyeshadows, aligning perfectly with the burgeoning clean beauty movement. Furthermore, its application extends into pharmaceuticals, where it serves as a safe and effective coloring agent for tablet coatings and liquid medications, aiding in product differentiation and patient compliance. The inherent benefits, such as its vivid, non-fading red color and its robust performance across a diverse range of matrices, underscore its invaluable contribution to product aesthetics and consumer appeal.

Several powerful macro and micro-economic factors are currently driving the sustained expansion of the Carmine market. Paramount among these is the escalating global consumer preference for natural, clean-label ingredients, directly stemming from increased health consciousness and a desire for transparency in food and product sourcing. This trend is further bolstered by increasingly stringent regulatory environments in key markets like North America and Europe, which are actively restricting or phasing out synthetic food colors, compelling manufacturers to invest in natural alternatives. The burgeoning growth of the processed food and beverage industry in rapidly developing economies, coupled with rising disposable incomes in these regions, also contributes significantly to market demand. Continuous advancements in extraction technologies and formulation techniques, which improve the cost-effectiveness and functional properties of Carmine, are additional catalysts ensuring its continued relevance and growth in the global marketplace.

Carmine Market Executive Summary

The Carmine market is undergoing a period of robust expansion, significantly influenced by prevailing business trends that underscore a global shift towards natural and sustainable ingredients. Across diverse sectors such as food and beverage, cosmetics, and pharmaceuticals, companies are strategically reformulating their product portfolios to align with evolving consumer preferences for clean labels and natural sourcing. This imperative is driven not only by market demand but also by an increasingly stringent global regulatory landscape that favors natural colorants over synthetic alternatives. Consequently, businesses are investing in advanced research and development to optimize Carmine’s functional properties and ensure ethical sourcing, thereby driving innovation in both supply chain management and product application within the industry. The competitive environment is also dynamic, characterized by strategic partnerships, mergers, and acquisitions aimed at consolidating market share and enhancing global distribution capabilities among key players.

Regional trends reveal a heterogeneous yet uniformly upward trajectory for the Carmine market. North America and Europe stand out as mature markets, where a combination of high consumer awareness, robust purchasing power, and stringent regulatory frameworks has cemented the demand for natural colorants. These regions are at the forefront of the clean-label movement, continuously pushing for innovation in natural pigment solutions. Conversely, the Asia Pacific (APAC) region is emerging as a critical growth engine, propelled by rapid industrialization, burgeoning populations, and a significant expansion of the middle class with increasing disposable incomes. This demographic shift, coupled with an escalating demand for processed foods and personal care products, positions APAC as a high-potential market. Latin America maintains its pivotal role as the primary source of raw cochineal, while simultaneously developing its internal market for natural ingredients. The Middle East and Africa (MEA) are also showing promising signs of growth, influenced by evolving dietary preferences and increasing urbanization.

Segment-wise, the Carmine market exhibits clear dominance within specific application areas. The food and beverage sector remains the largest consumer, with extensive use in categories such as confectionery, dairy products, and various beverages, where Carmine’s vibrant red hue and stability are highly valued. This segment is constantly seeking new applications, particularly in meat and seafood alternatives, driven by plant-based food trends. Following closely, the cosmetics industry represents a rapidly growing segment, primarily fueled by the ‘clean beauty’ movement. Manufacturers are increasingly incorporating Carmine into lipsticks, blushes, and other makeup products to offer natural and visually appealing formulations. The pharmaceutical sector also contributes significantly, utilizing Carmine for tablet coatings and liquid medications where color consistency and safety are paramount. These segmented trends highlight the broad utility and irreplaceable value of Carmine across a diverse range of industries.

AI Impact Analysis on Carmine Market

The integration of Artificial Intelligence (AI) across various industrial sectors is beginning to reshape traditional market dynamics, and the Carmine market is poised for significant transformation. Users frequently inquire about how AI can enhance efficiency in cochineal farming, optimize extraction processes for higher yield and purity, and improve supply chain transparency and predictability for this natural colorant. Furthermore, there is considerable interest in AI's role in consumer trend forecasting, helping manufacturers anticipate shifts in color preferences and clean-label demands, and its potential to accelerate research and development for new Carmine applications or more sustainable alternatives. Users are keen to understand if AI can mitigate the inherent supply volatility often associated with natural ingredients, offering solutions that enhance resilience and reduce costs throughout the value chain.

AI’s analytical capabilities offer transformative potential for the Carmine market, addressing challenges from raw material sourcing to final product delivery with unprecedented precision. By leveraging machine learning algorithms, producers can optimize cochineal insect cultivation practices, predicting environmental factors that impact yield, such as climate variability and pest infestations, thereby enhancing agricultural productivity and stability. In the processing stage, AI-driven systems can monitor and control complex extraction parameters in real-time, ensuring consistent quality, maximizing pigment yield, and minimizing waste, which in turn reduces operational costs and environmental footprint. The ability of AI to analyze vast datasets also allows for the early detection of quality deviations and the precise formulation of Carmine to meet specific color specifications, improving overall product consistency and reliability for industrial clients.

Across the entire supply chain, AI-driven predictive analytics can revolutionize inventory management and logistics by accurately forecasting demand fluctuations and identifying potential disruptions, such as shipping delays or raw material shortages. This leads to a more agile and responsive supply chain, ensuring timely delivery and reducing stockout risks. Moreover, AI can significantly contribute to the R&D of novel encapsulation techniques for Carmine, improving its stability against light, heat, and pH changes, and thereby expanding its application scope in more challenging product matrices. By simulating various molecular interactions and material properties, AI can accelerate the discovery of new stabilization methods and even assist in the identification of alternative, plant-based natural red pigments with similar functional characteristics, fostering long-term innovation and sustainability within the market.

- Supply Chain Optimization: AI-driven predictive analytics for demand forecasting, inventory management, and logistics, reducing lead times, minimizing waste, and enhancing overall supply chain resilience.

- Process Efficiency & Quality Control: AI algorithms optimize extraction parameters, monitor pigment purity, and ensure batch consistency in real-time, leading to enhanced yield, reduced errors, and superior product quality.

- Sustainable Sourcing & Farming: AI models predict optimal cochineal farming conditions, assess environmental impacts, and improve resource utilization, supporting ethical and sustainable raw material procurement.

- Market Trend Prediction: Machine learning analyzes vast consumer data, social media trends, and regulatory changes, helping manufacturers anticipate shifts in demand for specific colors and natural ingredients.

- Research & Development Acceleration: AI tools assist in the discovery of new applications, formulation optimization, and the expedited development of novel encapsulation technologies or alternative natural red pigments.

DRO & Impact Forces Of Carmine Market

The Carmine market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces that shape its growth trajectory and competitive landscape. A primary driver is the accelerating global consumer shift towards natural and clean-label ingredients, fueled by increasing health consciousness, growing skepticism towards synthetic additives, and a desire for transparency in product composition. The inherent properties of Carmine, such as its superior color stability, exceptional heat resistance, and broad pH tolerance, make it an ideal and often irreplaceable natural pigment, further solidifying its market position across diverse applications. The robust expansion of the processed food and beverage industry, particularly in rapidly urbanizing developing economies, coupled with expanding applications in the cosmetics and pharmaceutical sectors, also serves as a significant impetus, creating consistent and growing demand.

However, the market faces several notable restraints that necessitate strategic navigation by industry players. The relatively high cost of Carmine compared to many synthetic dyes presents a considerable barrier, particularly for price-sensitive segments or emerging markets, often leading manufacturers to seek more economical alternatives. Ethical and religious concerns associated with its insect origin, though diminishing with increased awareness of sustainable farming, still pose challenges for widespread adoption among certain consumer demographics, including vegans and specific religious groups. Supply chain volatility, influenced by environmental factors affecting cochineal populations (e.g., climate change, disease) and geopolitical instabilities in key sourcing regions, can lead to unpredictable price fluctuations and availability issues, impacting production planning and market stability. Additionally, the continuous development of innovative synthetic red dyes that mimic natural properties, or the emergence of other plant-based natural red colorants, poses competitive threats that require ongoing product differentiation and value proposition reinforcement.

Despite these restraints, significant opportunities exist within the Carmine market that promise future expansion and innovation. These include the potential for broadening Carmine’s application base into new product categories, particularly within the rapidly evolving plant-based food sector, functional beverages, and premium natural cosmetic lines, where natural aesthetics and ingredient integrity are paramount. Innovations in sustainable cochineal farming practices and advanced, environmentally friendly extraction technologies that improve yield, purity, and reduce environmental footprint represent significant growth avenues, aligning with global sustainability goals. Developing new encapsulation and stabilization techniques could further enhance Carmine's performance, extend its shelf life, and overcome formulation challenges in highly complex or harsh application matrices. The market is also propelled by powerful impact forces such as evolving food safety regulations that increasingly favor natural ingredients, shifting consumer dietary preferences towards organic and ethically sourced products, and continuous technological advancements in ingredient processing and analysis, all of which necessitate continuous adaptation and innovation from market participants to maintain relevance and competitiveness.

Segmentation Analysis

The Carmine market is comprehensively segmented across various dimensions to provide a granular understanding of its diverse applications, product forms, and end-user types. This detailed segmentation is crucial for market analysts and stakeholders to accurately identify specific growth drivers, pinpoint high-potential segments, and formulate targeted business strategies. By dissecting the market along these distinct criteria, it becomes possible to observe the nuanced demand patterns, competitive dynamics, and regulatory influences that impact different facets of the Carmine industry. Such an intricate breakdown allows for a precise evaluation of market opportunities and challenges, enabling companies to optimize their product offerings and market penetration strategies effectively, ultimately contributing to a more robust and responsive market ecosystem.

The primary segmentation criteria often include the physical form in which Carmine is supplied, as this directly dictates its ease of integration into various manufacturing processes and its functional characteristics. Equally important is the application segment, which categorizes Carmine’s end-use across major industrial sectors, highlighting its versatility and indispensable role in adding aesthetic and functional value to diverse products. Furthermore, the market can be meticulously analyzed based on the specific end-user types, differentiating between large-scale industrial buyers (B2B) who procure Carmine as a raw ingredient for their own product formulations, and the indirect retail consumption (B2C) embedded within finished consumer goods. Understanding these interconnected segments is fundamental for mapping the entire value chain, from raw material sourcing to final product consumption, thereby identifying the intricate network of supply and demand that characterizes this specialized market.

- By Form:

- Powder: Highly concentrated form, widely used for its cost-effectiveness and versatility in dry mixes and applications requiring minimal moisture.

- Liquid: Pre-dissolved form, favored for ease of dispersion and consistent coloring in liquid formulations like beverages, dairy, and syrups.

- Lake Pigment: Insoluble form, ideal for applications requiring color stability in fatty or oily bases, such as confectionery coatings, cosmetics, and certain pharmaceutical tablets.

- By Application:

- Food & Beverage: The largest application segment, driven by the clean-label trend and demand for vibrant natural colors.

- Confectionery: Candies, jellies, gums, and other sugary treats.

- Dairy Products: Yogurts, ice creams, milkshakes, and flavored milks.

- Beverages: Juices, soft drinks, energy drinks, and alcoholic beverages.

- Meat & Seafood Products: Processed meats, sausages, and seafood analogues, often for color consistency.

- Baked Goods: Cakes, pastries, and biscuits.

- Desserts: Puddings, custards, and gelatins.

- Cosmetics: Growing segment due to clean beauty movement and demand for natural pigments.

- Lipsticks & Lip Glosses: For intense red and pink shades.

- Blushes & Rouges: Providing natural-looking color for cheeks.

- Eyeshadows: Used in various palette formulations.

- Nail Polishes: Contributing to vibrant nail color ranges.

- Hair Colorants: In natural and organic hair dye formulations.

- Pharmaceuticals: Used for product differentiation and patient compliance.

- Tablet Coatings: For identification and aesthetic appeal.

- Syrups & Liquid Medications: For coloring liquid pharmaceutical preparations.

- Capsules: As an excipient to color capsule shells.

- Textiles: Traditional application for natural dyeing of fabrics and yarns.

- Others (e.g., Inks, Art Supplies): Niche applications in specialized inks, paints, and art materials.

- Food & Beverage: The largest application segment, driven by the clean-label trend and demand for vibrant natural colors.

- By End-Use:

- B2B (Industrial): Predominant segment, where Carmine is sold as a raw ingredient to manufacturers for inclusion in their finished products.

- B2C (Retail - indirect through finished products): Carmine is consumed indirectly as an ingredient within final consumer products purchased at retail.

Value Chain Analysis For Carmine Market

A thorough value chain analysis of the Carmine market reveals the intricate stages involved in transforming the raw cochineal insect into a high-value industrial pigment, spanning from upstream sourcing and raw material processing to downstream manufacturing and distribution. The upstream segment is fundamentally anchored in the cultivation and harvesting of cochineal insects, predominantly in Latin American countries such as Peru, Bolivia, and Mexico, which possess the ideal climatic conditions and native host plants (Opuntia cacti). This initial stage involves either traditional manual collection by local farmers or more structured semi-cultivation on large cactus plantations, followed by the meticulous drying and initial processing of the insects to prepare them for carminic acid extraction. This foundational step is critical as it directly determines the quality, quantity, and ethical footprint of the raw material, significantly influencing the cost and purity of the final Carmine product. Suppliers in this segment increasingly focus on sustainable practices, fair trade, and ensuring the socio-economic well-being of local farming communities, which are becoming key differentiators in the global market.

The midstream of the value chain encompasses the complex process of extracting carminic acid from the dried cochineal insects and its subsequent conversion into various forms of Carmine pigment. This involves a series of sophisticated chemical and physical processes, including boiling the dried insects in water to release the carminic acid, followed by filtration, precipitation with aluminum and calcium salts to form Carmine lake, and rigorous purification steps. These processes are often highly specialized and tailored to achieve specific color shades, intensities, and functional properties (e.g., solubility, heat stability) required by diverse end-user industries. Ingredient manufacturers and specialized pigment producers play a pivotal role here, investing heavily in technological advancements to improve extraction efficiency, ensure product stability, and meet the stringent regulatory standards for food-grade, cosmetic-grade, and pharmaceutical-grade applications. These players are also at the forefront of developing innovative formulations, such as liquid carmine concentrates or encapsulated forms, that offer enhanced functionality and ease of integration for their industrial clients, continuously pushing the boundaries of pigment technology.

Downstream activities involve the comprehensive distribution and sales of the finished Carmine pigment to a diverse range of industries globally. This segment includes direct sales relationships with large-scale food and beverage corporations, major cosmetic manufacturers, and pharmaceutical companies, where bespoke solutions and direct technical support are often provided. Concurrently, an extensive network of specialized distributors and agents plays a crucial role in reaching smaller businesses or specific regional markets, offering local market expertise, logistical support, and tailored customer service. These distribution channels are critical for ensuring broad market reach and accessibility, bridging the geographical and logistical gaps between producers and a multitude of end-users. The efficiency and reliability of these direct and indirect channels directly impact market penetration, customer satisfaction, and the overall responsiveness of the Carmine supply chain, solidifying its position as an essential ingredient in countless consumer products worldwide.

Carmine Market Potential Customers

The Carmine market primarily targets a broad spectrum of industrial end-users seeking high-quality natural red colorants for their product formulations. The largest and most diverse segment of potential customers includes manufacturers within the food and beverage industry, who utilize Carmine extensively across numerous product categories. These encompass dairy products such as yogurts, ice creams, and flavored milks; confectionery items like candies, jellies, and chewing gums; various beverages including juices, soft drinks, and sports drinks; and processed meat and seafood products, where Carmine is often used to ensure color consistency and enhance visual appeal. These companies prioritize Carmine for its vibrant and stable red color, its alignment with the burgeoning clean-label and natural ingredient trends, and its superior performance in maintaining color integrity under various processing conditions, catering to an increasingly health-conscious and discerning consumer base.

Another highly significant and rapidly growing customer base resides within the global cosmetics industry, particularly manufacturers of makeup and personal care products. Carmine is exceptionally valued for its intense pigmentation, excellent stability, and its natural origin in a wide array of cosmetic formulations. It is a preferred ingredient for products such as lipsticks, lip glosses, blushes, rouges, eyeshadows, and hair colorants, offering a broad spectrum of rich red, pink, and purple shades. The clean beauty movement has profoundly influenced cosmetic companies, prompting them to replace synthetic dyes with natural alternatives like Carmine to meet consumer demands for transparent ingredient lists and naturally derived products. These customers frequently seek high-purity Carmine and specific shade variations to perfectly match their product lines and brand aesthetics, driving continuous innovation in pigment refinement and formulation within the Carmine market to meet precise color requirements.

Furthermore, pharmaceutical companies represent a crucial and consistent segment of potential customers, employing Carmine as a safe and effective coloring agent in various medicinal applications. It is widely used in tablet coatings for product identification and aesthetic appeal, in liquid medications and syrups to enhance palatability and differentiation, and in capsules as an excipient to color the shell. In the highly regulated pharmaceutical sector, the consistency, safety profile, and regulatory compliance of excipients are paramount, and Carmine provides a natural, stable, and approved option that meets these stringent requirements. Beyond these primary sectors, the textile industry also constitutes a niche market, utilizing Carmine for natural dyeing applications of fabrics and yarns, while it also finds specialized uses in high-quality inks, paints, and art supplies. Essentially, any industry requiring a stable, vibrant, and natural red pigment, with an emphasis on natural sourcing, safety profiles, and superior performance characteristics, constitutes a valuable potential customer for Carmine suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 480 Million |

| Market Forecast in 2032 | USD 705 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chr. Hansen Holding A/S, Sensient Technologies Corporation, DDW The Color House (Archer Daniels Midland Company), GNT Group B.V., Kalsec Inc., Naturex S.A. (Givaudan), Roha Dyechem Pvt. Ltd., Fiorio Colori S.p.A., ColorMaker Inc., Extraco S.A., Allied Biotech Corporation, Food Ingredient Solutions LLC, D.D. Williamson & Co., Inc. (DDW), Prova S.A., BioconColors, Sethness Caramel Color, Wild Flavors and Specialty Ingredients (ADM), Vinayak Ingredients Pvt. Ltd., BASF SE, DSM N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Carmine Market Key Technology Landscape

The Carmine market's technological landscape is continuously evolving, driven by the persistent need for enhanced extraction efficiency, improved product stability, and broader application versatility, all while adhering to increasingly stringent quality and safety standards. At the core of these advancements are sophisticated methods for extracting carminic acid from cochineal insects. While traditional boiling and precipitation techniques remain foundational, they are being significantly refined with modern separation and purification processes, such as membrane filtration, ultrafiltration, and various forms of chromatography (e.g., ion-exchange, reverse-phase). These advancements are crucial for yielding higher purity pigments, effectively reducing impurities, minimizing potential off-flavors, and ensuring consistent color strength and shade batch after batch, which is vital for high-grade food, cosmetic, and pharmaceutical applications.

Furthermore, innovative formulation technologies play a critical role in enhancing Carmine's functional performance and applicability in diverse end-products. Advanced encapsulation techniques, including micro-encapsulation and nano-encapsulation, are increasingly utilized to protect the delicate pigment from premature degradation caused by environmental factors such as light, heat, oxygen, or extreme pH variations. This protective layering extends its shelf life, maintains color intensity, and prevents undesirable pigment migration or uneven dispersion within complex food, beverage, and cosmetic matrices. The development of highly stable and soluble liquid Carmine formulations, often involving specialized emulsifiers, stabilizers, and solubilizing agents, simplifies its integration into water-based systems and offers manufacturers greater flexibility in product development, allowing for a wider range of applications without compromising color integrity or visual appeal.

Beyond extraction and formulation, cutting-edge analytical technologies are paramount for ensuring rigorous quality control, regulatory compliance, and product consistency throughout the entire Carmine production process. Techniques such as High-Performance Liquid Chromatography (HPLC), spectrophotometry, and mass spectrometry are routinely employed to precisely identify and quantify carminic acid content, detect potential impurities or contaminants, and ensure precise batch-to-batch color consistency. Additionally, the adoption of sustainable processing technologies, including solvent-free extraction methods, enzymatic treatments, and processes that recycle waste streams, is gaining significant traction, driven by escalating environmental concerns and a global push for greener manufacturing practices. The integration of automation, process control systems, and data analytics in production lines further contributes to operational optimization, enabling real-time monitoring, predictive maintenance, and enhanced traceability, thereby streamlining the manufacturing of Carmine and significantly improving overall product reliability and market confidence.

Regional Highlights

- North America: A mature and highly influential market characterized by some of the most stringent food and drug regulations globally, driving a strong consumer preference for natural ingredients. The region is at the forefront of the clean-label movement, resulting in high demand for high-quality, ethically sourced Carmine in processed foods, beverages, and premium natural cosmetics. Innovation in product application and sustainable sourcing practices are key trends here.

- Europe: Similar to North America, Europe maintains strict and evolving regulations regarding food additives and cosmetic ingredients, which significantly drives the adoption of natural colorants. Western European countries are primary consumers, propelled by an established natural and organic food sector, a strong emphasis on ethical consumerism, and a sophisticated market for natural personal care products. Regional players heavily focus on formulation innovations and transparency in sourcing.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally for Carmine, fueled by rapid urbanization, increasing disposable incomes, and the extensive expansion of the food and beverage processing and cosmetics industries, particularly in economic powerhouses like China, India, Japan, and Southeast Asian nations. Regulatory frameworks across APAC are continually evolving, progressively pushing towards greater adoption of natural ingredients, creating substantial and diverse opportunities for Carmine suppliers.

- Latin America: This region holds a critical dual role as the predominant global source of cochineal insects, with countries like Peru, Bolivia, and Mexico being major producers of raw material. While also serving as a significant supplier to global markets, domestic demand for natural colors is steadily growing, driven by a rising middle class, increasing health and wellness awareness, and an expanding local food and beverage manufacturing sector. There is also a growing emphasis on enhancing local processing capabilities.

- Middle East & Africa (MEA): An emerging market for Carmine, with growth influenced by increasing investments in food processing and manufacturing infrastructure, coupled with evolving consumer preferences for natural and premium products in urban centers. Regulatory harmonization efforts across the region and a rising health consciousness among consumers are gradually but surely creating a discernible demand for natural colorants, presenting new market entry points for Carmine suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Carmine Market.- Chr. Hansen Holding A/S

- Sensient Technologies Corporation

- DDW The Color House (Archer Daniels Midland Company)

- GNT Group B.V.

- Kalsec Inc.

- Naturex S.A. (Givaudan)

- Roha Dyechem Pvt. Ltd.

- Fiorio Colori S.p.A.

- ColorMaker Inc.

- Extraco S.A.

- Allied Biotech Corporation

- Food Ingredient Solutions LLC

- D.D. Williamson & Co., Inc. (DDW)

- Prova S.A.

- BioconColors

- Sethness Caramel Color

- Wild Flavors and Specialty Ingredients (ADM)

- Vinayak Ingredients Pvt. Ltd.

- BASF SE

- DSM N.V.

Frequently Asked Questions

What is Carmine and where does it come from?

Carmine is a highly valued natural red pigment derived from carminic acid, which is primarily produced by the female cochineal insect (Dactylopius coccus). These insects are cultivated on prickly pear cacti, predominantly in Latin American countries such as Peru, Bolivia, and Mexico, where they are harvested and processed to extract the pigment.

Is Carmine safe for consumption and use in products?

Yes, Carmine is generally recognized as safe (GRAS) by major international regulatory bodies, including the U.S. FDA and the European Food Safety Authority (EFSA), for use as a colorant in food, cosmetics, and pharmaceuticals. While extremely rare, some individuals with pre-existing allergies may experience allergic reactions, though it is considered a safe ingredient for the vast majority of consumers.

What are the primary applications of Carmine in various industries?

Carmine is extensively utilized across multiple industries due to its vibrant color and exceptional stability. Its primary applications include the food and beverage sector (e.g., yogurts, confectionery, beverages), the cosmetics industry (e.g., lipsticks, blushes, eyeshadows), and pharmaceuticals (e.g., tablet coatings, liquid medications). It is also used in textiles and specialized inks.

Are there any ethical or environmental concerns associated with Carmine's production?

Ethical concerns sometimes arise due to Carmine's insect origin, leading some consumers (vegetarians, vegans) to seek alternatives. Environmentally, the market is addressing concerns through improved sustainable farming practices for cochineal, focusing on minimizing habitat impact and ensuring the ecological balance of cultivation regions.

What are the natural alternatives to Carmine for achieving red hues?

Several natural alternatives can provide red hues, though their shades, stability, and functional properties vary by application. Common alternatives include beet red (from beetroot), anthocyanins (derived from fruits like grapes and berries), lycopene (extracted from tomatoes), and paprika extract. The choice depends on the specific product requirements and desired color profile.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager